Enerpac Tool Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerpac Tool Group Bundle

Navigate the complex external forces impacting Enerpac Tool Group's market position with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the industrial tools sector. Gain a strategic advantage by leveraging these critical insights to refine your business planning and investment decisions. Download the full PESTLE analysis now to unlock actionable intelligence and secure your competitive edge.

Political factors

Enerpac Tool Group's performance is closely tied to government infrastructure spending. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in late 2021, allocated over $1 trillion towards improving roads, bridges, public transit, and energy grids. This significant investment is expected to fuel demand for Enerpac's specialized tools used in heavy construction and maintenance throughout 2024 and 2025.

Enerpac Tool Group, as a global entity with operations in over 100 countries, is significantly influenced by international trade policies and tariffs. Shifts in import/export duties and trade agreements directly impact the cost of raw materials, manufacturing expenses, and the overall market competitiveness of Enerpac's product lines.

In its Q3 2025 earnings call, the company highlighted a substantial estimated annualized tariff impact of $18 million under the prevailing trade framework, underscoring the financial sensitivity to these political factors.

Geopolitical stability is a critical consideration for Enerpac Tool Group, given its global operational footprint. Events like regional conflicts or trade disputes can significantly disrupt supply chains, affecting the availability and cost of raw materials and components. For instance, ongoing tensions in Eastern Europe in 2024 continued to pose risks to global logistics and energy markets, indirectly impacting industries like construction and oil and gas that rely on Enerpac's specialized tools.

Operating in over 100 countries exposes Enerpac to a wide array of political risks, from regulatory changes to social unrest. The company's 2023 annual report highlighted its ongoing efforts to build resilience through diversified sourcing and robust risk management frameworks. This proactive approach is essential to mitigate potential impacts on market access and customer demand, particularly in sectors sensitive to political climates.

Regulatory Environment for Industrial Safety

The stringent safety regulations prevalent across key sectors such as construction, manufacturing, and energy directly bolster demand for Enerpac's specialized tools. These regulations often mandate the use of equipment that ensures worker safety and operational efficiency, areas where Enerpac's engineered solutions excel. For instance, in 2024, the global industrial safety market was valued at approximately $55 billion, with a projected compound annual growth rate (CAGR) of over 6% through 2030, indicating a strong and expanding market driven by regulatory compliance.

Evolving safety standards present significant opportunities for Enerpac to innovate and solidify its market position. As new or updated regulations are introduced, companies like Enerpac that can quickly adapt and offer compliant solutions gain a competitive edge. This proactive approach to safety compliance is a cornerstone of Enerpac's strategy, as evidenced by their consistent development of products designed to mitigate risks in hazardous work environments.

- Increased Demand: Stricter safety regulations in construction and manufacturing, valued at a combined $1.2 trillion in global output in 2024, directly increase the need for Enerpac's safety-focused tools.

- Innovation Driver: New safety standards, such as updated OSHA guidelines in the US that came into effect in early 2025, encourage Enerpac to develop advanced, compliant products.

- Market Leadership: By aligning with and anticipating regulatory shifts, Enerpac reinforces its reputation as a provider of safe and reliable industrial solutions.

- Hazard Mitigation: Enerpac's product portfolio is strategically positioned to address the core need for safe execution of critical tasks, a priority for businesses operating under evolving safety mandates.

Government Support for Green Initiatives

Government support for green initiatives presents a significant tailwind for Enerpac Tool Group. As nations worldwide intensify their focus on renewable energy and sustainable infrastructure, demand for specialized heavy lifting and hydraulic technologies, areas where Enerpac excels, is set to grow. For instance, the U.S. Inflation Reduction Act of 2022, with its substantial investments in clean energy, signals a long-term commitment that will likely spur projects requiring Enerpac's robust equipment.

Enerpac's tools are well-positioned to support the construction and maintenance of critical green infrastructure. This includes everything from wind turbine installation and offshore platform maintenance to the development of new solar farms and electric vehicle charging networks. The global renewable energy sector is projected to see substantial growth, with the International Energy Agency (IEA) forecasting that clean energy investments could reach $2 trillion annually by 2030, directly benefiting companies like Enerpac that provide essential equipment for these projects.

- Increased demand for heavy lifting solutions in wind energy projects.

- Opportunities in the maintenance and expansion of hydroelectric power facilities.

- Support for infrastructure development in emerging green technologies.

- Alignment with national and international climate action goals.

Government infrastructure spending, particularly initiatives like the United States' Infrastructure Investment and Jobs Act, directly fuels demand for Enerpac's heavy construction tools. This legislation, allocating over $1 trillion, is expected to drive significant project activity through 2025, benefiting Enerpac's core markets.

Trade policies and tariffs significantly impact Enerpac's global operations, affecting raw material costs and market competitiveness. The company reported an estimated annualized tariff impact of $18 million in Q3 2025, highlighting the financial sensitivity to these political shifts.

Geopolitical stability remains a key concern for Enerpac due to its extensive international presence, with regional conflicts potentially disrupting supply chains and increasing operational costs. Enerpac's 2023 annual report emphasized its focus on risk management to navigate these global uncertainties.

Stringent safety regulations across industries like construction and manufacturing are a major driver for Enerpac's specialized equipment, as compliance necessitates advanced safety solutions. The global industrial safety market, valued at approximately $55 billion in 2024, demonstrates the scale of this regulatory-driven demand.

What is included in the product

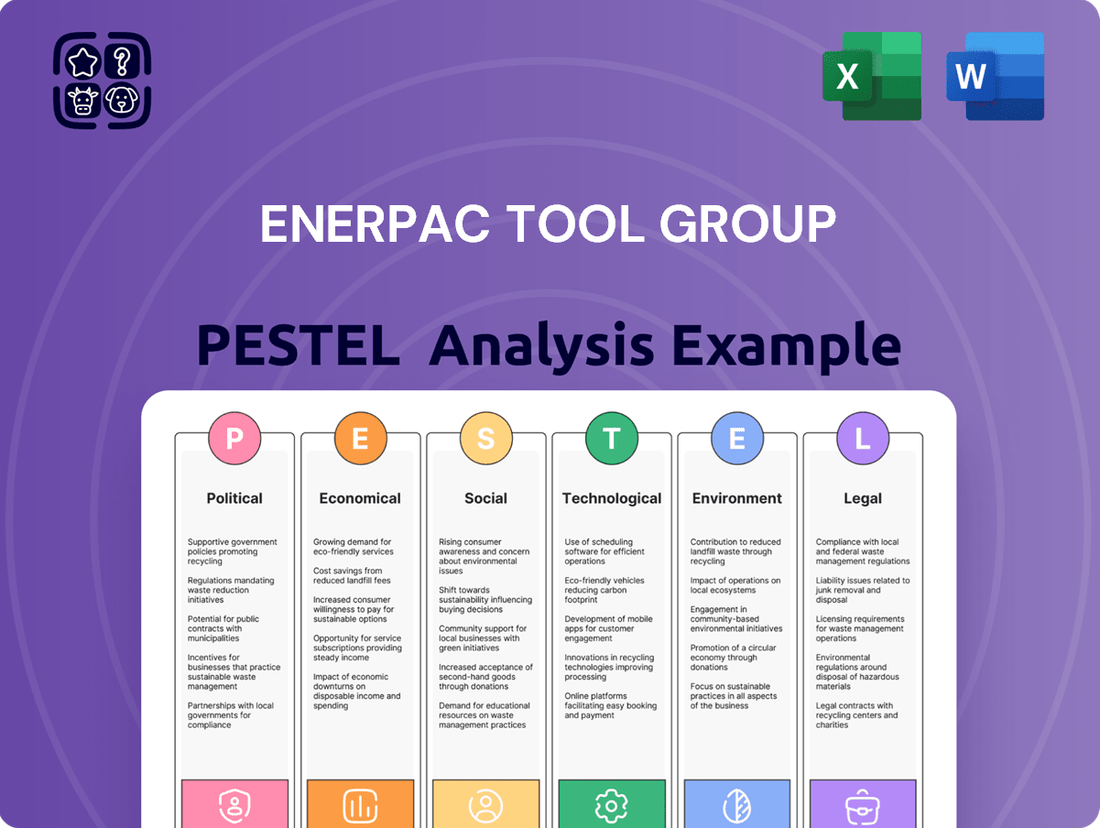

This PESTLE analysis examines the external macro-environmental forces impacting Enerpac Tool Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors to identify strategic opportunities and threats.

A concise PESTLE analysis of Enerpac Tool Group provides a clear, actionable framework to navigate complex external factors, acting as a pain point reliever for strategic decision-making.

Economic factors

Enerpac Tool Group's financial health is intrinsically linked to the global industrial market's performance. A sustained downturn in manufacturing, reflected in indicators like the Purchasing Managers' Index (PMI), directly impacts Enerpac's sales. For instance, if global manufacturing PMIs hover below 50, signaling contraction, Enerpac often experiences a dip in organic sales.

Conversely, an upswing in industrial production and related economic activity provides a strong tailwind for Enerpac. As of early 2024, while some regions show signs of recovery, others continue to grapple with slower growth, creating a mixed global industrial landscape. This variability means Enerpac's revenue streams are sensitive to regional industrial output trends.

Fluctuations in raw material costs, particularly for steel and other metals, directly affect Enerpac Tool Group's profitability. For instance, in the first quarter of 2024, steel prices saw a notable increase, impacting manufacturing expenses. This volatility requires Enerpac to consider strategic pricing adjustments to protect its gross profit margins on hydraulic tools and equipment.

Enerpac Tool Group, with its extensive global operations, is significantly exposed to the impact of fluctuating exchange rates on its financial performance. When the U.S. dollar strengthens, it can diminish the reported value of revenues and profits earned in foreign currencies.

For instance, in the first quarter of 2024, a stronger dollar versus key international currencies like the Euro and British Pound likely presented a headwind to Enerpac's reported international sales, even if local currency sales remained robust. This currency translation effect is a critical consideration for investors analyzing the company's top-line growth and profitability trends.

Interest Rate Environment

The prevailing interest rate environment significantly impacts Enerpac Tool Group by affecting borrowing costs for both the company and its clientele. Higher interest rates can make it more expensive for Enerpac to finance its operations and strategic initiatives, potentially slowing down expansion or R&D.

For its customers, particularly those in industrial sectors reliant on capital investment, rising interest rates can deter purchases of new equipment and machinery. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25% to 5.50% through 2024 and into early 2025, as anticipated by many economists, this elevated cost of capital could lead to delayed capital expenditures.

- Increased Borrowing Costs: Higher benchmark rates, such as the Federal Funds Rate which was 5.25%-5.50% as of early 2024, directly increase the cost of debt for Enerpac.

- Customer Investment Hesitation: Industrial clients facing higher financing costs may postpone or reduce investments in new equipment, impacting Enerpac's sales volume.

- Impact on Project Viability: Projects requiring significant financing become less attractive to customers when interest rates rise, potentially reducing demand for Enerpac's specialized tools and solutions.

- Currency Exchange Rates: Fluctuations in interest rates can also influence currency exchange rates, affecting the profitability of Enerpac's international sales and operations.

Capital Allocation and Shareholder Returns

Enerpac Tool Group's capital allocation strategy significantly impacts its financial health and investor confidence. The company balances investments in organic growth initiatives with potential strategic mergers and acquisitions (M&A). A key focus is returning value to shareholders through share repurchases and dividend payments, demonstrating financial stability and commitment.

For the fiscal year ended September 30, 2023, Enerpac reported a net cash provided by operating activities of $214.6 million. The company's approach to capital allocation directly influences its ability to fund future growth while simultaneously rewarding its investors. This strategic deployment of capital is crucial for maintaining a strong market position.

- Capital Allocation Balance: Enerpac aims to balance investments in R&D and operational improvements with strategic M&A opportunities to drive long-term growth.

- Shareholder Returns: The company actively manages its capital structure to support share repurchases and dividend payouts, enhancing shareholder value.

- Financial Health Indicator: A consistent and well-communicated capital allocation plan is vital for maintaining investor confidence and a healthy stock price.

- Fiscal Year 2023 Performance: Enerpac's operating cash flow of $214.6 million in FY23 provides a solid foundation for its capital deployment strategies.

Global economic conditions directly influence Enerpac Tool Group's performance, with industrial production levels being a key driver. A slowdown in manufacturing, as indicated by Purchasing Managers' Index (PMI) figures falling below 50, typically correlates with reduced demand for Enerpac's products. For example, in early 2024, mixed regional industrial growth presented a variable demand environment.

Fluctuations in raw material costs, particularly steel, directly impact Enerpac's profitability. Increased costs in Q1 2024 for materials like steel necessitated strategic pricing reviews to maintain gross margins. Similarly, interest rate environments affect both Enerpac's borrowing costs and its customers' capital expenditure decisions; the Federal Reserve's target rate of 5.25%-5.50% through 2024-2025 impacts the affordability of equipment purchases.

Currency exchange rates also play a significant role, with a stronger U.S. dollar in Q1 2024 potentially reducing the reported value of international earnings. Enerpac's capital allocation strategy, including its $214.6 million net cash from operations in FY23, balances growth investments with shareholder returns like dividends and buybacks, crucial for investor confidence.

| Economic Factor | Impact on Enerpac | Data Point/Trend (2024/2025) |

|---|---|---|

| Global Industrial Production | Drives demand for tools and equipment. | Mixed regional growth observed early 2024; PMI trends critical. |

| Raw Material Costs | Affects cost of goods sold and profitability. | Steel price increases noted in Q1 2024. |

| Interest Rates | Impacts borrowing costs and customer investment. | Federal Funds Rate target 5.25%-5.50% (2024-2025) increases financing costs. |

| Currency Exchange Rates | Affects reported international revenue and profit. | Stronger USD in Q1 2024 pressured international sales value. |

Preview Before You Purchase

Enerpac Tool Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Enerpac Tool Group PESTLE analysis covers all key external factors influencing the company's operations and strategy. You'll gain immediate access to detailed insights into political, economic, social, technological, legal, and environmental aspects.

Sociological factors

Heightened scrutiny on workplace safety, especially in sectors like construction and manufacturing where Enerpac operates, directly fuels demand for their safety-enhancing hydraulic tools. For instance, the U.S. Bureau of Labor Statistics reported a 4.1% decrease in nonfatal workplace injuries in 2023 compared to 2022, suggesting a proactive safety environment that values advanced equipment.

The specialized nature of high-pressure hydraulic systems necessitates rigorous training. This creates a significant market for Enerpac's service and support offerings, as companies prioritize skilled operation to prevent accidents and ensure equipment longevity. Many industrial safety certifications now mandate specific training protocols for handling such equipment.

The world's infrastructure is getting older, creating a constant need for upkeep. This means more work for sectors like construction and energy, which directly benefits companies like Enerpac that provide essential tools for these jobs. For instance, the American Society of Civil Engineers (ASCE) reported in 2021 that the U.S. infrastructure received a C- grade, highlighting the significant investment needed for repairs and upgrades, a trend mirrored globally.

This ongoing demand for maintenance, repair, and overhaul (MRO) activities translates into a stable market for specialized equipment. Enerpac's hydraulic tools are well-suited for these demanding tasks, from bridge repairs to offshore oil platform maintenance, ensuring a consistent revenue stream as aging systems require attention.

The availability of skilled labor directly impacts industries like construction and manufacturing, key markets for Enerpac. A tight labor market, particularly for those with specialized skills, can slow down projects and increase the appeal of tools that enhance productivity or require less specialized training. For instance, a 2024 report noted a persistent shortage of skilled tradespeople in North America, with some sectors experiencing a deficit of over 500,000 workers.

This scarcity can drive demand for Enerpac's more automated or user-friendly hydraulic tools. As companies seek to overcome labor gaps, they are more likely to invest in equipment that allows fewer, less experienced workers to accomplish tasks efficiently and safely. The trend towards digitalization and advanced manufacturing further emphasizes the need for workers proficient with sophisticated equipment, potentially creating a dual challenge and opportunity for tool providers.

Shifting Industry Demographics

The industrial workforce is undergoing significant demographic shifts, impacting companies like Enerpac. Generational changes, with a growing presence of Millennials and Gen Z, are reshaping workplace expectations regarding technology integration and company culture. For instance, a 2024 report indicated that over 60% of Gen Z workers prioritize companies with strong sustainability and diversity initiatives, a trend that influences product development and marketing for industrial equipment manufacturers.

Diversity and inclusion efforts are also a major factor. As industries strive for greater representation, Enerpac must consider how its product designs and training programs cater to a broader range of users. This includes ensuring ergonomic designs and accessible training materials. By 2025, it’s projected that women will hold an increased percentage of skilled trade positions, necessitating a more inclusive approach to product usability and marketing campaigns.

These evolving workforce demographics directly influence Enerpac's strategies:

- Product Design: Innovations may focus on user-friendliness and digital integration to appeal to tech-savvy younger generations.

- Training Methods: A shift towards digital, on-demand training solutions will be crucial for onboarding a diverse and geographically dispersed workforce.

- Recruitment and Retention: Companies that embrace diversity and offer modern work environments will have a competitive edge in attracting talent.

- Market Penetration: Understanding and adapting to the needs of a changing workforce ensures Enerpac remains relevant and continues to capture market share across different user segments.

Corporate Social Responsibility (CSR) Expectations

Societal pressure for companies to act responsibly is increasing, impacting how Enerpac Tool Group is perceived and how it interacts with stakeholders. This includes expectations around ethical operations and involvement in local communities.

Enerpac's commitment to these areas is highlighted through its Corporate Responsibility Report. For instance, in their 2023 report, they detailed progress on environmental, social, and governance (ESG) goals, noting a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2020 baseline.

These evolving expectations influence consumer choices and investor decisions, pushing companies like Enerpac to integrate sustainability and ethical practices into their core business strategies. This focus is crucial for maintaining a positive brand image and strong relationships with all parties involved.

- Growing CSR Demands: Consumers and investors increasingly scrutinize companies' social and environmental impact.

- Brand Reputation: Positive CSR engagement enhances Enerpac's brand, attracting talent and customers.

- Stakeholder Relations: Demonstrating ethical practices and community support strengthens relationships with employees, customers, and investors.

- Reporting Transparency: Publishing Corporate Responsibility Reports, like Enerpac's 2023 update detailing a 15% GHG emission reduction, showcases accountability.

Societal expectations are shifting towards greater emphasis on workplace safety and skilled labor, directly influencing demand for Enerpac's advanced hydraulic tools. The U.S. Bureau of Labor Statistics reported a 4.1% decrease in nonfatal workplace injuries in 2023, indicating a trend towards safer practices that often involve specialized equipment. Furthermore, a 2024 report highlighted a persistent shortage of skilled tradespeople in North America, with some sectors experiencing a deficit of over 500,000 workers, which can drive demand for more user-friendly or automated tools.

Demographic shifts within the industrial workforce, with younger generations like Gen Z entering the workforce, are reshaping expectations regarding technology and company culture. A 2024 report indicated that over 60% of Gen Z workers prioritize companies with strong sustainability and diversity initiatives. By 2025, it’s projected that women will hold an increased percentage of skilled trade positions, necessitating inclusive product design and training.

Societal pressure for corporate responsibility is growing, with consumers and investors increasingly scrutinizing companies' social and environmental impact. Enerpac's 2023 Corporate Responsibility Report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2020 baseline, demonstrating a commitment to ESG goals.

Technological factors

Enerpac's market position hinges on ongoing innovation in high-pressure hydraulics and controlled force. For instance, their recent advancements in electric torque wrenches offer users up to 20% greater accuracy compared to previous models, a direct benefit of improved controlled force technology.

The development of more efficient, precise, and powerful tools directly strengthens Enerpac's product portfolio. In 2024, the introduction of their new lightweight, battery-powered hydraulic pumps, which deliver 15% more power per charge, exemplifies this commitment to enhancing performance and user experience.

The increasing adoption of digital and smart technologies is a key technological factor influencing Enerpac Tool Group. This includes the integration of wireless connectivity into their product lines, allowing for enhanced data collection and remote operation. For instance, Enerpac has been actively incorporating wireless capabilities into its latest hydraulic tools, enabling real-time performance monitoring and diagnostics.

Furthermore, the growth of e-commerce platforms presents a significant channel for sales and customer engagement. Enerpac has experienced substantial revenue growth through its e-commerce initiatives, reflecting a broader industry trend towards digital purchasing. This digital transformation allows for greater market reach and more efficient customer service, a trend expected to continue through 2024 and 2025.

The industrial sector's embrace of automation and robotics presents a significant growth avenue for Enerpac. As companies increasingly adopt automated systems for maintenance and operations, there's a rising demand for tools that can integrate with these advanced technologies. This trend is evident in the global industrial robotics market, which was projected to reach over $50 billion in 2024, showcasing the scale of this shift.

Enerpac's strategic acquisition of DTA, a specialist in automated on-site horizontal movement products, directly addresses this technological evolution. This move positions Enerpac to offer solutions that complement and enhance automated industrial processes, potentially expanding their market share in sectors heavily reliant on robotic integration and efficiency gains.

Battery-Powered Tool Development

The increasing demand for cordless and portable equipment is a significant technological driver. Battery-powered tools offer enhanced maneuverability and reduced environmental impact compared to their hydraulic or pneumatic counterparts. This shift is reshaping the industrial tool landscape, prioritizing user convenience and sustainability.

Enerpac Tool Group has actively responded to this trend with innovations like their battery-powered handheld torque wrench. This product launch signifies Enerpac's commitment to integrating advanced battery technology into their professional-grade tool offerings, directly addressing market demand for efficient, emission-free solutions.

The global market for power tools, including battery-operated segments, is experiencing robust growth. For instance, the cordless power tool market was valued at approximately $35.1 billion in 2023 and is projected to reach $55.6 billion by 2030, exhibiting a compound annual growth rate of 6.8%. This expansion underscores the substantial opportunity for companies like Enerpac to leverage battery technology.

- Market Growth: The cordless power tool market is projected for significant expansion, indicating strong consumer and industrial adoption of battery-powered solutions.

- Environmental Benefits: Battery-powered tools contribute to reduced emissions and noise pollution, aligning with increasing environmental regulations and corporate sustainability goals.

- Enerpac's Strategy: Enerpac's development of battery-powered handheld torque wrenches demonstrates a strategic adaptation to technological advancements and evolving market needs.

- Technological Advancement: Continued improvements in battery density and charging efficiency are further enhancing the performance and viability of battery-powered industrial tools.

Materials Science Innovations

Innovations in materials science are directly impacting Enerpac Tool Group's product development. The creation of advanced composites and high-strength alloys allows for the manufacturing of tools that are not only lighter but also significantly more robust. This translates to improved performance and extended operational life for their hydraulic equipment, a critical factor in demanding industrial applications.

These material advancements offer Enerpac a distinct competitive edge. For instance, the adoption of specialized steel alloys in their cylinders can reduce weight by up to 15% while maintaining or even increasing tensile strength, leading to easier handling and reduced operator fatigue. Such improvements directly contribute to enhanced product performance and can ultimately lower manufacturing costs through more efficient material utilization and reduced warranty claims.

- Lighter Materials: Development of advanced alloys and composites for reduced tool weight.

- Stronger Materials: Utilization of high-strength steels and alloys for increased durability.

- Enhanced Performance: Improved tool efficiency and operational lifespan due to material properties.

- Cost Reduction: Potential for lower manufacturing costs through material innovation and reduced wear.

Technological advancements are reshaping the industrial tool landscape, with Enerpac Tool Group at the forefront of innovation. The company's focus on developing more precise, efficient, and powerful tools is evident in their recent product launches, such as the new lightweight, battery-powered hydraulic pumps that offer 15% more power per charge, a key development for 2024.

The integration of digital technologies, including wireless connectivity, is enhancing Enerpac's product lines by enabling real-time performance monitoring and remote operation. This digital transformation is also reflected in their e-commerce growth, which saw substantial revenue increases in 2024, indicating a strong market shift towards digital purchasing channels.

Furthermore, the increasing adoption of automation and robotics in the industrial sector presents a significant growth opportunity for Enerpac. Their acquisition of DTA, a specialist in automated movement products, strategically positions them to integrate with advanced industrial processes, tapping into a global industrial robotics market projected to exceed $50 billion in 2024.

The demand for cordless and portable equipment continues to rise, driven by the need for enhanced maneuverability and reduced environmental impact. Enerpac's response includes innovations like their battery-powered handheld torque wrench, aligning with a global cordless power tool market valued at approximately $35.1 billion in 2023 and expected to reach $55.6 billion by 2030.

| Technological Factor | Description | Enerpac's Response/Impact | Relevant Data (2024/2025 Focus) |

| Precision & Power | Advancements in hydraulic technology | Improved accuracy in electric torque wrenches (up to 20% greater), 15% more power per charge in new pumps | Continued R&D investment in controlled force technology |

| Digital Integration | Wireless connectivity and data analytics | Enhanced remote operation and real-time diagnostics in hydraulic tools | Growth in e-commerce sales, increasing digital customer engagement |

| Automation & Robotics | Integration with automated systems | Acquisition of DTA to offer complementary solutions for automated processes | Global industrial robotics market projected >$50 billion in 2024 |

| Cordless & Portable | Battery-powered tool development | Launch of battery-powered handheld torque wrenches | Cordless power tool market: ~$35.1B (2023), projected growth |

Legal factors

Enerpac Tool Group operates under stringent product liability and safety regulations due to the high-pressure and heavy-duty nature of its hydraulic tools. Failure to comply can lead to significant legal repercussions and damage to its reputation. For instance, in 2023, the Consumer Product Safety Commission (CPSC) reported over 200,000 emergency room visits related to power tool injuries, underscoring the critical importance of robust safety features and adherence to industry standards for companies like Enerpac.

Adherence to regulations like OSHA's standards for workplace safety, which govern the safe operation and maintenance of heavy equipment, is crucial for Enerpac. The company's commitment to safety directly impacts its ability to avoid costly lawsuits and maintain customer confidence in its reliable and durable product offerings. In 2024, product liability claims in the industrial equipment sector saw an average settlement of $1.5 million, highlighting the financial risks associated with non-compliance.

Enerpac Tool Group's global business is heavily influenced by international trade laws and sanctions, requiring careful navigation to maintain market access. For instance, in 2024, companies operating internationally must stay abreast of evolving trade policies and potential restrictions impacting supply chains and customer bases, especially concerning geopolitical hotspots.

Compliance with these intricate legal frameworks, including export controls and sanctions lists, is paramount for Enerpac's operational integrity and its ability to conduct business seamlessly across borders. Failure to comply can result in significant penalties, impacting financial performance and market reputation, underscoring the critical need for robust legal and compliance teams.

Enerpac Tool Group heavily relies on intellectual property rights and patents to protect its advanced hydraulic tools and integrated systems. The company invests significantly in research and development, making the safeguarding of these innovations crucial for maintaining its market position.

In 2023, Enerpac reported spending $55 million on research and development, a key area where patent protection is paramount. The legal framework surrounding patents allows Enerpac to prevent competitors from replicating its unique product designs and proprietary technologies, thereby securing its revenue streams and market share.

Globally enforcing these intellectual property rights presents ongoing legal challenges for Enerpac, requiring constant vigilance and strategic legal action against potential infringements. This legal diligence is essential to prevent unauthorized use and maintain the exclusivity of its engineered solutions.

Environmental Regulations and Compliance

Environmental regulations are becoming more rigorous, affecting how Enerpac Tool Group designs its products and manages its manufacturing. This includes stricter rules on emissions and waste disposal, which are critical legal and operational challenges for the company.

Compliance with these evolving environmental laws, particularly concerning greenhouse gas (GHG) emissions, is a significant factor for Enerpac. For instance, the company must navigate regulations like the EU's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, impacting imported goods based on their embodied carbon.

- Increased Scrutiny on Emissions: Governments worldwide, including the US with its Inflation Reduction Act (IRA) incentives for clean energy, are intensifying focus on reducing industrial carbon footprints.

- Waste Management Compliance: Regulations such as the EU's Waste Framework Directive mandate higher recycling rates and producer responsibility, influencing Enerpac's supply chain and product lifecycle management.

- Product Design Standards: Emerging eco-design directives, like those proposed for batteries and sustainable products in the EU, can necessitate changes in materials and product longevity for companies like Enerpac.

Data Privacy and Cybersecurity Laws

Enerpac Tool Group, like all global businesses, must navigate a complex web of data privacy and cybersecurity laws. The increasing reliance on digital platforms and e-commerce necessitates strict adherence to regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. Failure to comply can result in significant financial penalties and reputational damage.

These legal mandates require companies to implement robust cybersecurity measures to safeguard sensitive customer and proprietary data from breaches. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, highlighting the substantial financial risk associated with inadequate security. Enerpac must invest in advanced security protocols and ongoing employee training to mitigate these risks and ensure legal compliance.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA Impact: The CCPA grants consumers rights regarding their personal data, requiring businesses to be transparent about data collection and usage practices.

- Cybersecurity Investment: Global spending on cybersecurity is projected to reach $215 billion in 2024, reflecting the critical importance of these measures.

- Data Breach Costs: The average cost of a data breach in 2023 was $4.45 million, underscoring the financial imperative for strong data protection.

Enerpac Tool Group must navigate evolving product liability and safety regulations, as demonstrated by the over 200,000 emergency room visits related to power tool injuries reported by the CPSC in 2023. Adherence to OSHA standards is vital, especially considering average settlement costs for product liability claims in the industrial equipment sector reached $1.5 million in 2024.

The company's global operations are shaped by international trade laws and sanctions, with companies in 2024 needing to monitor evolving policies impacting supply chains. Compliance with export controls and sanctions lists is critical for operational integrity and market access.

Intellectual property protection is key, with Enerpac investing $55 million in R&D in 2023, necessitating robust patent strategies to safeguard innovations against infringement.

Environmental regulations are increasingly stringent, impacting product design and manufacturing processes, with directives like the EU's CBAM, which began its transitional phase in October 2023, influencing carbon footprint management.

Data privacy and cybersecurity laws, such as GDPR and CCPA, are paramount, with global data breach costs averaging $4.45 million in 2023, underscoring the need for significant investment in security measures.

| Legal Factor | Impact on Enerpac Tool Group | Relevant Data/Statistics |

| Product Liability & Safety | Ensuring safe product design and operation to avoid lawsuits. | Over 200,000 ER visits for power tool injuries (2023); Avg. $1.5M product liability settlement (2024). |

| Workplace Safety | Compliance with OSHA standards for equipment use and maintenance. | N/A |

| International Trade & Sanctions | Navigating global trade policies and restrictions. | Evolving trade policies impacting supply chains (2024). |

| Intellectual Property | Protecting R&D investments and proprietary technologies. | $55M R&D spending (2023); Patent protection vital for market share. |

| Environmental Regulations | Adhering to emission and waste disposal rules. | EU's CBAM transitional phase began Oct 2023. |

| Data Privacy & Cybersecurity | Safeguarding customer and company data. | Avg. $4.45M data breach cost (2023); Global cybersecurity spending projected $215B (2024). |

Environmental factors

Enerpac Tool Group is actively pursuing a reduction in its carbon footprint and enhanced energy efficiency across its global operations. This commitment is demonstrated through targeted initiatives like implementing energy-saving projects within its facilities, optimizing its vehicle fleet management for better fuel economy, and investigating opportunities for fuel switching to cleaner alternatives.

In line with these efforts, Enerpac reported a reduction in its Scope 1 and Scope 2 GHG emissions by 7% in fiscal year 2023 compared to its 2021 baseline, a key step towards its sustainability goals. The company is also investing in upgrading its manufacturing equipment to more energy-efficient models, aiming for a further 15% improvement in energy intensity by 2025.

Enerpac Tool Group's commitment to waste reduction and responsible waste management directly supports circular economy principles. This involves actively minimizing waste generated during their manufacturing operations and strategically planning for the end-of-life phase of their robust hydraulic tools, aiming for greater resource efficiency.

In 2023, Enerpac reported a 5% reduction in manufacturing waste compared to the previous year, a tangible step towards more sustainable operations. This focus on minimizing waste aligns with the broader industrial trend of embracing circular economy models, which seek to keep resources in use for as long as possible, extracting maximum value from them before recovering and regenerating products and materials at the end of each service life.

Enerpac Tool Group is increasingly prioritizing sustainable product design and manufacturing, a trend driven by growing consumer and regulatory demand. This involves considering a product's environmental footprint from raw material sourcing to end-of-life disposal, encouraging the use of recycled content and bio-based materials in their hydraulic tools and systems.

The company's focus on durability and repairability directly combats the "throwaway" culture, extending product lifespans and reducing waste. For instance, advancements in their hydraulic cylinder technology aim for greater longevity, meaning fewer replacements and less material consumption over time. This aligns with broader industry shifts, where companies like Caterpillar, a major customer for many industrial equipment manufacturers, are setting ambitious sustainability targets for their supply chains, impacting companies like Enerpac.

Climate Change Impact and Adaptation

Enerpac Tool Group actively acknowledges the growing significance of reporting on climate-related metrics and understanding the multifaceted impacts of climate change on its operations and the communities it serves. This commitment involves a proactive assessment of potential climate risks, ranging from extreme weather events affecting supply chains to evolving regulatory landscapes, and the concurrent development of robust adaptation strategies to mitigate these challenges.

The company's approach to climate change adaptation is crucial for ensuring business resilience and long-term sustainability. This includes evaluating how physical risks, such as increased frequency of severe weather events impacting manufacturing facilities or transportation routes, could disrupt operations. Furthermore, Enerpac is focused on the transition risks associated with shifting to a lower-carbon economy, which may influence product demand and operational efficiency.

- Climate Risk Assessment: Enerpac is engaged in assessing both physical and transition risks stemming from climate change.

- Adaptation Strategies: The company is developing strategies to adapt to the impacts of climate change, aiming to enhance operational resilience.

- Metric Reporting: There's a focus on improving the reporting of climate-related metrics to provide greater transparency to stakeholders.

- Community Impact: Enerpac recognizes the importance of understanding and addressing the impact of climate change on the communities where it operates.

Resource Scarcity and Material Sourcing

Enerpac Tool Group's operations are directly impacted by the availability and sustainable sourcing of raw materials crucial for high-pressure hydraulic tools, such as specialized steel alloys and hydraulic fluids. The increasing global demand for these materials, coupled with geopolitical factors influencing supply chains, presents a significant environmental challenge.

Resource scarcity can lead to price volatility and supply disruptions, affecting Enerpac's production costs and delivery timelines. For instance, fluctuations in the price of specialty steel, a key component in their cylinders and pumps, can directly impact profitability. Ensuring responsible sourcing practices, including ethical mining and manufacturing, is vital for maintaining brand reputation and long-term operational resilience.

- Steel Price Volatility: Global steel prices experienced significant fluctuations in 2023 and early 2024, with some benchmarks showing increases of over 15% in certain periods due to supply chain constraints and demand shifts.

- Hydraulic Fluid Regulations: Evolving environmental regulations concerning the biodegradability and toxicity of hydraulic fluids are prompting manufacturers like Enerpac to invest in research and development for more sustainable alternatives.

- Rare Earth Mineral Dependence: While not a primary component in all hydraulic tools, the broader industrial trend towards electrification in some sectors may increase reliance on materials like rare earth minerals, which have complex sourcing and environmental footprints.

- Circular Economy Initiatives: Companies are increasingly exploring circular economy principles, such as material recycling and remanufacturing of hydraulic components, to mitigate resource scarcity and reduce environmental impact.

Enerpac Tool Group is actively addressing environmental concerns by focusing on reducing its carbon footprint and enhancing energy efficiency across its global operations. Initiatives include energy-saving projects, optimizing vehicle fleets, and exploring cleaner fuel alternatives, as evidenced by a 7% reduction in Scope 1 and 2 GHG emissions in fiscal year 2023 compared to a 2021 baseline.

The company is also committed to waste reduction and responsible management, aligning with circular economy principles by minimizing manufacturing waste and planning for product end-of-life. In 2023, Enerpac achieved a 5% reduction in manufacturing waste year-over-year, demonstrating progress towards resource efficiency.

Furthermore, Enerpac prioritizes sustainable product design, incorporating recycled content and bio-based materials, while emphasizing durability and repairability to extend product lifespans. This approach is crucial given the impact of climate change and the need for resilient operations, with the company actively assessing climate risks and developing adaptation strategies.

The availability and sustainable sourcing of raw materials like specialty steel alloys and hydraulic fluids present ongoing environmental challenges, exacerbated by global demand and supply chain complexities. Price volatility for key components like specialty steel, which saw increases of over 15% in certain periods of 2023-2024, directly affects production costs and necessitates responsible sourcing practices.

PESTLE Analysis Data Sources

Our Enerpac Tool Group PESTLE Analysis is meticulously constructed using data from reputable sources like Statista, government economic reports, and leading industry publications. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the business.