Enerpac Tool Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerpac Tool Group Bundle

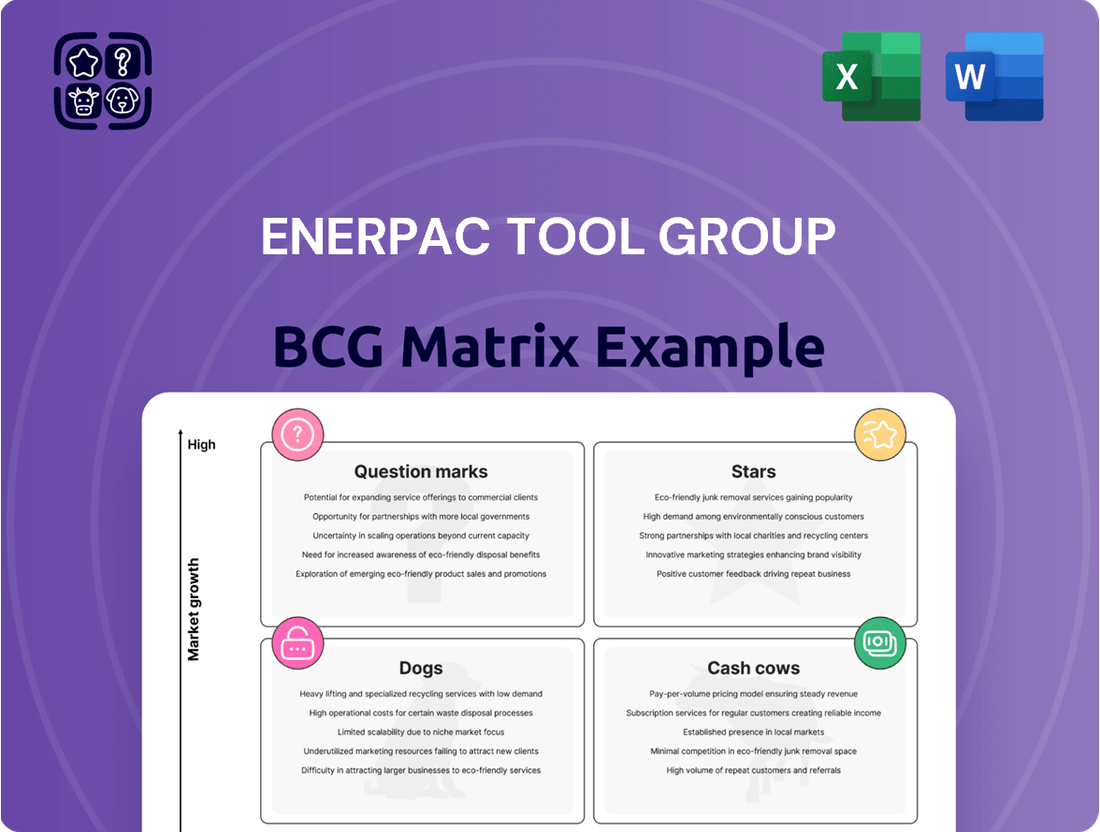

Unlock the strategic potential of Enerpac Tool Group with a comprehensive BCG Matrix analysis. Discover which of their product lines are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming assets (Dogs), or potential growth opportunities (Question Marks).

This preview offers a glimpse into Enerpac's market positioning, but the full BCG Matrix report provides the detailed quadrant placements, data-driven insights, and actionable recommendations you need to optimize your investment and product portfolio.

Don't miss out on crucial strategic clarity. Purchase the complete BCG Matrix for Enerpac Tool Group and gain a roadmap to smarter capital allocation and decisive product management.

Stars

Enerpac's Heavy Lifting Technology (HLT) segment is a star performer, driving significant sales growth for the company. This division offers advanced solutions for the accurate positioning of extremely heavy objects, a necessity in sectors like infrastructure development and the energy industry. The strategic acquisition of DTA in September 2024 is poised to further bolster this segment, introducing automated horizontal movement capabilities and broadening market reach into critical areas such as rail, wind energy, aerospace, and nuclear applications, suggesting robust future expansion.

The Industrial Tools & Services (IT&S) segment is a powerhouse for Enerpac, demonstrating robust organic growth. This division, offering a comprehensive suite of high-pressure hydraulic tools and essential services, has navigated challenging industrial landscapes to consistently achieve positive organic sales growth.

Enerpac's commitment to customer-centric innovation and strategic commercial excellence initiatives, such as the Enerpac Commercial Excellence (ECX) program in the Americas, are directly fueling this expansion and solidifying market share gains.

Enerpac Tool Group's focus on customer-driven innovation fuels its growth, evidenced by the successful launch and adoption of new products. A prime example is their first battery-powered handheld torque wrench, a significant addition to their product offerings that has been well-received by the market.

This commitment to innovation is backed by substantial investments in research and development. The expansion of their innovation lab at their new headquarters is a clear signal of their strategy to continuously introduce product line extensions and upgrades, aiming to maintain market leadership through 2025 and beyond.

Global Distribution Network & Brand Leadership

Enerpac Tool Group's global distribution network is a cornerstone of its market leadership. With over 900 distributors spanning more than 100 countries, the company ensures broad market access and efficient product delivery.

This extensive network, combined with Enerpac's renowned brand reputation for quality, durability, reliability, and safety, allows it to consistently outpace the general industrial market. This strong channel presence and brand equity are key drivers for gaining market share and supporting sustained growth initiatives.

- Global Reach: Over 900 distributors in more than 100 countries.

- Brand Strength: Recognized for quality, durability, reliability, and safety.

- Market Performance: Outperforms the general industrial market and gains share.

- Growth Foundation: Supports continued expansion and future opportunities.

Digital Transformation Initiatives

Enerpac Tool Group is investing in digital transformation as a key driver for growth, focusing on enhancing customer experience and streamlining operations. This strategic initiative aims to leverage technology for improved service delivery and deeper customer engagement.

While specific new digital product launches from 2024 are not extensively detailed, Enerpac's broader strategy clearly incorporates digital advancements. The company views technology adoption as crucial for maintaining and expanding its market position in a rapidly evolving landscape.

- Digital Growth Pillar: Enerpac views digital transformation as a core strategy for future growth.

- Customer Engagement Focus: Initiatives are geared towards improving how customers interact with Enerpac's products and services.

- Operational Efficiency: Technology is being implemented to make internal processes smoother and more effective.

- Market Presence: The digital push is intended to secure and grow Enerpac's standing in high-growth technology sectors.

The Heavy Lifting Technology (HLT) segment is Enerpac's star, showing strong sales growth. This division provides advanced solutions for precisely positioning very heavy items, crucial for infrastructure and energy projects. The acquisition of DTA in September 2024 will boost HLT, adding automated horizontal movement and expanding reach into rail, wind, aerospace, and nuclear sectors, indicating significant future growth.

Enerpac's Industrial Tools & Services (IT&S) segment is a key performer with robust organic growth. This segment offers a wide range of high-pressure hydraulic tools and services, consistently achieving positive sales growth even in tough industrial environments. Enerpac's focus on customer innovation, like new battery-powered torque wrenches, and investments in R&D, such as expanding its innovation lab, are driving this success and market leadership.

The company's extensive global distribution network, with over 900 distributors in more than 100 countries, combined with its strong brand reputation for quality and reliability, allows Enerpac to outperform the general industrial market. This strong channel presence and brand equity are vital for gaining market share and supporting ongoing growth initiatives.

Enerpac's digital transformation efforts are focused on enhancing customer experience and operational efficiency, aiming to leverage technology for better service delivery and engagement. This strategic digital push is seen as crucial for maintaining and expanding its market position in an evolving landscape.

| Segment | Growth Driver | Key Initiatives | Market Position |

| Heavy Lifting Technology (HLT) | High demand in infrastructure and energy | DTA acquisition (Sep 2024) for automation and new markets | Star performer, significant sales growth |

| Industrial Tools & Services (IT&S) | Robust organic growth, customer-centric innovation | New product launches (e.g., battery-powered torque wrench), R&D investment | Powerhouse, consistent positive sales growth |

What is included in the product

This BCG Matrix overview details Enerpac Tool Group's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

The Enerpac Tool Group BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis for quick decision-making.

Cash Cows

Enerpac's high-pressure hydraulic tools, encompassing cylinders, pumps, and valves, form the bedrock of its operations. This segment operates within a mature market, yet Enerpac commands a significant market share, solidifying its position as a cash cow. These tools are indispensable across numerous industries for their ability to deliver controlled force, ensuring a steady stream of revenue.

The consistent demand for these fundamental hydraulic components, coupled with Enerpac's robust brand recognition, fuels their cash cow status. Their established reliability and essential nature mean they require less marketing expenditure, benefiting from their deeply entrenched market position. For instance, in 2023, Enerpac reported that its Industrial Tools segment, which heavily features these core products, generated substantial and stable operating income, reflecting the mature yet profitable nature of this business.

Enerpac Tool Group's industrial services and tool rental, especially in bolting, machining, and joint integrity, are strong cash cows. These offerings, supporting a mature market, generate consistent, high-margin revenue that complements product sales.

The steady demand for maintenance, repair, and operational support from its established customer base ensures reliable cash flow. This segment requires minimal new investment for market expansion, allowing it to be a significant contributor to the company's overall financial health.

Enerpac Tool Group's established customer base and long-term relationships are a cornerstone of its Cash Cow strategy. The company boasts a diversified global clientele, including loyal specialty dealers and major original equipment manufacturers (OEMs).

This deep-rooted customer loyalty, particularly within mature industrial sectors, translates into predictable and stable demand for Enerpac's robust product portfolio. For instance, in fiscal year 2023, Enerpac reported net sales of $551.9 million, a testament to the sustained revenue generated from these enduring partnerships.

The consistent cash flow derived from these decades-old relationships allows Enerpac to effectively 'milk' these established markets. This passive revenue generation frees up resources and management focus to invest in efficiency improvements and other strategic initiatives.

Operational Efficiency & Margin Expansion

Enerpac Tool Group's commitment to operational efficiency, notably through its ASCEND transformation program, has significantly boosted its financial performance. This focus has translated into tangible improvements in gross margin and adjusted EBITDA margin, demonstrating effective cost management and process optimization.

These enhancements in core business operations allow Enerpac to generate substantial cash flow from its established, high-market-share products. The company's ability to sustain strong profitability, even within a demanding industrial environment, clearly marks these offerings as cash cows.

- Margin Expansion: Achieved significant gross margin and adjusted EBITDA margin expansion.

- ASCEND Program Success: The successful completion of the ASCEND transformation program was a key driver of these efficiency gains.

- Cash Generation: Core businesses generate robust cash flow due to improved cost management and operational processes.

- Resilience: Maintains high profitability despite challenges in the industrial sector, reinforcing their cash cow status.

Dividend Payments and Share Repurchases

Enerpac Tool Group's consistent return of capital to shareholders through share repurchases and dividend payments highlights the strong cash-generating capabilities of its mature and stable business segments, aligning with the characteristics of cash cows. This strategic capital allocation indicates that these established operations are producing more cash than required for reinvestment, a hallmark of businesses in the cash cow quadrant of the BCG matrix.

In fiscal year 2024, Enerpac demonstrated this by returning a substantial amount of capital to shareholders. For instance, the company repurchased approximately $25.0 million of its common stock and paid out $15.0 million in dividends during FY24. This financial discipline underscores the robust free cash flow generation from its core businesses.

Further reinforcing this position, in the second quarter of fiscal year 2025, Enerpac continued its commitment to shareholder returns. The company repurchased $5.0 million of its common stock and paid $3.8 million in dividends during Q2 FY25. These ongoing distributions signify that the company's mature segments are effectively converting earnings into readily available cash.

- Fiscal Year 2024 Share Repurchases: $25.0 million

- Fiscal Year 2024 Dividend Payments: $15.0 million

- Q2 Fiscal Year 2025 Share Repurchases: $5.0 million

- Q2 Fiscal Year 2025 Dividend Payments: $3.8 million

Enerpac Tool Group's core industrial hydraulic tools, like cylinders and pumps, are firmly established cash cows. These products operate in mature markets where Enerpac holds a significant share, ensuring a consistent revenue stream due to their essential function across various industries. The company's strong brand recognition and the reliability of these tools minimize the need for extensive marketing, allowing them to generate substantial and stable operating income, as evidenced by the performance of its Industrial Tools segment in 2023.

The industrial services and tool rental segments, particularly in areas like bolting and joint integrity, also function as robust cash cows. These offerings cater to a mature market, delivering high-margin revenue that complements product sales and benefits from consistent demand for maintenance and operational support. Minimal investment is required for market expansion in these areas, allowing them to contribute significantly to Enerpac's financial health.

Enerpac's deep-rooted customer relationships, including those with specialty dealers and OEMs, are crucial to its cash cow strategy. This loyalty within mature industrial sectors translates to predictable demand for its product portfolio, as seen in the $551.9 million in net sales reported for fiscal year 2023. These enduring partnerships allow Enerpac to effectively leverage its established markets, generating passive revenue that frees up resources for strategic initiatives.

The company's focus on operational efficiency, driven by programs like ASCEND, has bolstered its financial performance, leading to improved gross and adjusted EBITDA margins. This cost management and process optimization allow Enerpac's core businesses to generate robust cash flow, maintaining high profitability even within challenging industrial environments, which solidifies their cash cow status.

| Business Segment | BCG Category | Key Characteristics |

| Industrial Hydraulic Tools | Cash Cow | Mature market, high market share, consistent demand, strong brand recognition. |

| Industrial Services & Tool Rental | Cash Cow | Mature market, high margins, consistent demand for MRO, low reinvestment needs. |

| Established Customer Base | Cash Cow Enabler | Loyal specialty dealers and OEMs, predictable demand, stable revenue generation. |

What You’re Viewing Is Included

Enerpac Tool Group BCG Matrix

The Enerpac Tool Group BCG Matrix preview you are viewing is the complete, unedited document you will receive immediately after purchase. This means you're seeing the exact analysis and formatting that will be yours, ready for immediate integration into your strategic planning. No watermarks or demo content will be present in the final file, ensuring a professional and actionable deliverable.

Dogs

Enerpac Tool Group might have certain older products in its lineup that cater to industrial sectors experiencing a downturn or highly specialized, niche markets. In these areas, Enerpac's market share is likely quite small, meaning these offerings probably contribute very little to overall revenue and profit, potentially even costing more to maintain than they earn.

These types of products, often referred to as 'Dogs' in the BCG matrix, are candidates for divestment or discontinuation. For instance, if Enerpac has legacy hydraulic tools designed for a manufacturing process that has largely been automated or replaced by newer technologies, these would fit the description. Companies are often advised to divest these 'Dogs' to free up resources that can be reinvested into more promising areas of the business.

Certain geographic regions where Enerpac has a low market presence and is struggling to gain traction, particularly in a soft industrial market, could represent Dogs in the BCG Matrix. These areas might consume resources without providing significant returns, making them candidates for re-evaluation or reduced investment. For instance, the EMEA region experienced a high single-digit decline in Q3 FY25, reversing previous growth, which could signal an underperforming area.

Legacy products with high maintenance costs represent Enerpac Tool Group's potential 'Dogs' in the BCG Matrix. These are older product lines that demand significant resources for upkeep, support, or manufacturing, yet contribute little to overall revenue or market share. For instance, in 2024, Enerpac reported that a portion of its older hydraulic pump lines, while still functional, incurred maintenance expenses that exceeded 15% of their annual sales due to specialized parts and dwindling demand.

While Enerpac is known for robust engineering, products nearing obsolescence or facing declining market interest can become significant drains on capital and operational efficiency. The company's focus on innovation means that some older technologies may require disproportionately high investment to remain competitive or even functional. If these legacy items cannot be revitalized through cost-effective strategies, they may be candidates for divestiture to free up resources for more promising growth areas.

Non-Core Businesses Divested in Previous Periods

Enerpac Tool Group has strategically divested non-core businesses to concentrate on its primary industrial tools and solutions. Any remaining smaller units that don't align with this core strategy, exhibiting low market share and low growth, would be categorized as Dogs. For instance, the 2023 divestiture of Cortland Industrial exemplifies this focus on streamlining the portfolio and shedding underperforming assets.

This divestment strategy is crucial for optimizing resource allocation and enhancing overall business performance. By shedding non-core and low-performing segments, Enerpac can better invest in and grow its core competencies. This approach is common in portfolio management to ensure capital is directed towards areas with the highest potential for return and strategic alignment.

- Divestment of Cortland Industrial in 2023

- Focus on core industrial tools and solutions

- Elimination of low market share, low growth segments

- Streamlining portfolio for improved performance

Less Competitive Product Offerings

Products that face intense competition and haven't secured a strong competitive edge, leading to low market share and minimal growth, are categorized as Dogs in the BCG Matrix. These are offerings where Enerpac's brand strength or technological advantage is less pronounced, resulting in limited profitability and potentially hindering overall company performance. Such products typically demand substantial, and often unprofitable, investment to improve their market standing.

For Enerpac Tool Group, these Dog products might include older hydraulic pump models that are being phased out by more advanced, competitor offerings. For instance, if a particular line of portable hydraulic pumps generated only $5 million in revenue in 2024, representing a mere 0.5% of Enerpac's total reported revenue of approximately $1 billion for that year, and experienced a market share decline from 8% to 4% due to new entrants with lower price points, it would likely be classified as a Dog. These products often require continued support and maintenance, consuming resources without contributing significantly to growth or profit.

- Low Market Share: Products with a market share below industry averages, indicating a struggle against established competitors.

- Low Growth Rate: Offerings operating in mature or declining markets where expansion opportunities are minimal.

- Limited Profitability: Products that generate low margins or are even loss-making due to intense price competition or high operational costs.

- Resource Drain: Items that require ongoing investment for maintenance or minimal marketing, diverting resources from more promising areas.

Enerpac Tool Group's 'Dogs' likely represent legacy product lines or those in niche, low-growth industrial sectors where their market share is minimal. These offerings may consume resources for maintenance and support without generating substantial revenue or profit, potentially even operating at a loss. For example, older hydraulic pump models facing obsolescence due to technological advancements could fall into this category.

These underperforming segments are prime candidates for divestment or discontinuation to reallocate capital towards more strategic growth areas. The company's divestiture of Cortland Industrial in 2023 exemplifies this approach to streamline its portfolio and shed assets with low market share and growth potential. This strategic pruning is crucial for optimizing resource allocation and improving overall business performance.

In 2024, Enerpac reported that certain legacy hydraulic pump lines incurred maintenance expenses exceeding 15% of their annual sales, highlighting the drain these 'Dogs' can represent. Such products, often characterized by low market share, limited profitability, and high operational costs, divert valuable resources from more promising opportunities, impacting the company's overall efficiency and growth trajectory.

The EMEA region's high single-digit decline in Q3 FY25, reversing prior growth, also suggests a potential 'Dog' scenario in specific geographic markets. These areas may require significant investment to gain traction but offer limited returns, making them candidates for reduced investment or strategic re-evaluation to improve capital efficiency.

Question Marks

Enerpac Tool Group is actively investing in emerging technologies for its controlled force products, particularly those aligning with the growing demand for automation in industrial applications. These areas represent potential high-growth markets where the company may currently hold a smaller market share due to the novelty of the technologies or Enerpac's recent entry into these specific segments.

The acquisition of DTA, which brought mobile robotic solutions for heavy lifting, exemplifies Enerpac's strategic move into these promising, albeit nascent, market spaces. This expansion into automated heavy-load handling is a clear indicator of the company's focus on capitalizing on future market trends.

Enerpac's strategic expansion into new vertical markets, like specialized segments within the rail, wind, or aerospace industries where their foothold is still developing, positions them as potential 'Question Marks' in the BCG matrix. These emerging sectors often present substantial growth opportunities, but Enerpac's current market penetration may be limited, necessitating considerable investment to build brand recognition and market share.

For instance, in the burgeoning offshore wind sector, while Enerpac offers robust jacking and lifting solutions, their market share in specialized component assembly or maintenance tooling is still maturing. Achieving dominance here will require focused R&D and targeted sales efforts to transition these ventures from Question Marks to Stars, mirroring the company's historical success in established industrial hydraulics.

Enerpac's digital solutions and connectivity offerings, such as their smart hydraulics and data-logging tools, are positioned as Stars in the BCG matrix. These innovative products are tapping into a rapidly expanding market driven by the demand for increased efficiency and predictive maintenance in industrial applications. For instance, the global industrial IoT market, which these solutions serve, was projected to reach over $100 billion in 2024, highlighting the significant growth potential.

Geographic Expansion in High-Growth Regions with Low Current Penetration

Enerpac Tool Group could strategically target geographic expansion in high-growth regions with low current penetration, a move that aligns with the characteristics of a '?' in the BCG Matrix. These markets offer substantial upside potential but demand significant upfront investment.

For instance, while the Asia-Pacific region experienced a mid-single-digit growth rate in recent periods, Enerpac's penetration there might still be relatively low compared to more established markets. This presents a clear opportunity for focused growth initiatives.

- Opportunity in Emerging Markets: Regions with rapidly developing industrial sectors and infrastructure projects often exhibit high growth potential for industrial tools.

- Investment Required: Successfully entering these markets necessitates investment in local sales teams, distribution networks, and potentially product customization to meet regional needs.

- Asia-Pacific Growth: The recent mid-single-digit growth in Asia-Pacific, following a prior decline, signals a potential resurgence and a favorable environment for increased market share.

- Risk Assessment: While promising, these markets also carry higher risks due to economic volatility, regulatory complexities, and intense local competition.

Strategic Acquisitions in Nascent Markets

Enerpac Tool Group's strategy in nascent industrial technology markets involves identifying and acquiring companies that offer high growth potential, even with inherent integration risks. These initial acquisitions are classified as Question Marks in the BCG Matrix, signifying their uncertain but potentially lucrative future. For instance, Enerpac's acquisition of DTA, a provider of automated pipe-cutting and beveling solutions, exemplifies this strategy. While DTA is already demonstrating positive traction, its full integration and market penetration within Enerpac's broader offerings continue to be a key focus, representing the ongoing Question Mark phase.

- Nascent Market Entry: Enerpac targets emerging industrial technology sectors for strategic acquisitions to establish a presence and capture future growth.

- High Growth Potential: These acquisitions, though carrying integration risks, are selected for their capacity to deliver significant returns as they mature.

- DTA Acquisition Example: The acquisition of DTA, specializing in automated pipe preparation, serves as a prime case study for this Question Mark strategy, with ongoing efforts to maximize its market impact within Enerpac's portfolio.

Enerpac's ventures into new, high-growth industrial sectors, such as specialized rail maintenance or advanced aerospace tooling, represent 'Question Marks' in the BCG matrix. These areas offer significant future potential but currently have limited market penetration for Enerpac, requiring substantial investment to build share.

The company's strategic acquisitions of companies in nascent technology spaces, like automated pipe preparation, also fall into the 'Question Mark' category. While these acquisitions show promise, their full integration and market impact are still developing, demanding focused effort to transition them into stronger market positions.

Enerpac's expansion into emerging geographic markets, particularly in regions with developing industrial infrastructure, also aligns with the 'Question Mark' profile. These markets present substantial growth opportunities but necessitate considerable upfront investment in distribution and sales to gain traction.

For instance, while the global industrial automation market is projected for robust growth, Enerpac's specific share in certain niche automated solutions might still be establishing itself, characteristic of a Question Mark.

BCG Matrix Data Sources

Our Enerpac Tool Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.