Endeavour Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endeavour Mining Bundle

Navigate the complex external forces shaping Endeavour Mining's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social landscapes in West Africa present both challenges and opportunities for the company. Gain a strategic advantage by leveraging these expert insights to inform your investment decisions and market strategies.

Political factors

Endeavour Mining's operations are primarily situated in West Africa, a region susceptible to political volatility and evolving government regulations. For instance, Burkina Faso and Mali have seen significant shifts in mining legislation, including potential changes to mining codes and increased state participation in ventures. These policy adjustments can directly affect Endeavour's operational framework and financial performance.

In 2024, the political landscape in some West African nations continues to present challenges. For example, ongoing security concerns in Burkina Faso and Mali can lead to unpredictable policy implementation and impact the ease of doing business. Endeavour Mining reported that in the first half of 2024, its production was impacted by logistical challenges stemming from regional instability, highlighting the direct link between political factors and operational output.

The company actively engages with host governments to foster stable operating conditions and mitigate risks associated with policy changes. This proactive approach is crucial, especially given the trend of resource nationalism observed in some African countries, where governments seek greater benefits from their natural resources. Endeavour's commitment to local partnerships and community development aims to build trust and ensure long-term operational viability amidst these political dynamics.

Governments across West Africa are increasingly focused on revising their mining codes and regulations. This aims to secure greater benefits from their substantial mineral resources, often involving adjustments to royalty rates and the inclusion of free-carried interests for the state. For instance, Côte d'Ivoire updated its mining code in 2014, and discussions around similar revisions have been ongoing in countries like Burkina Faso and Mali.

While existing mining conventions typically include stabilization clauses that shield current operations from abrupt regulatory shifts, new projects or the renewal of older agreements are more likely to fall under these updated frameworks. This means that future expansion or contract renegotiations for companies like Endeavour Mining could be impacted by these evolving legal requirements.

Endeavour Mining actively monitors these governmental initiatives and engages in dialogue with local authorities. This proactive approach allows the company to better understand the nuances of these changing legal landscapes and to adapt its strategies accordingly, ensuring continued compliance and operational viability.

Resource nationalism is a significant political factor impacting Endeavour Mining, especially in West Africa. Countries like Mali and Burkina Faso are increasingly asserting greater control over their natural resources, which can translate into demands for increased state ownership in mining projects and a more formalized mining sector.

This trend directly affects Endeavour Mining, as evidenced by its 2023 settlement agreement concerning the divestment of its Boungou and Wahgnion mines to the Burkina Faso government. Such agreements highlight the evolving landscape where governments aim to secure a larger stake in the economic benefits derived from mining operations within their borders.

Security Risks and Regional Conflicts

Endeavour Mining's operations in West Africa, specifically Burkina Faso and Mali, are significantly influenced by security risks stemming from armed groups and illegal mining. These threats can directly impede operations, disrupt vital supply chains, and necessitate substantial investments in security infrastructure, thereby increasing operational expenses and potentially impacting production timelines. For instance, in 2023, the company continued to navigate complex security environments across its key operating regions.

The volatile security landscape requires constant vigilance and adaptation. Endeavour Mining's commitment to the safety of its personnel and assets is paramount, leading to the implementation of robust security protocols and community engagement initiatives. These efforts are crucial for maintaining operational continuity and fostering a stable environment for long-term growth.

Governments in affected regions are actively engaged in efforts to enhance security and reassert control over territories impacted by instability. Positive developments in this regard, such as successful counter-insurgency operations or improved governance, could lead to a more favorable operating environment for mining companies like Endeavour, potentially reducing security-related costs and operational disruptions.

- Burkina Faso and Mali Operations: Endeavour Mining's key assets are located in regions with ongoing security challenges.

- Impact on Operations: Security risks can lead to production interruptions and increased operational costs due to security measures.

- Governmental Efforts: Ongoing government initiatives to improve security could positively transform the operating landscape.

International Relations and Foreign Investment Policy

The political landscape in West Africa is a crucial consideration for Endeavour Mining. While countries like Côte d'Ivoire, Burkina Faso, and Senegal offer rich mineral resources and have implemented policies to attract foreign investment, political stability remains a key factor. For instance, the 2022 World Bank Ease of Doing Business report, though not fully updated for 2024/2025, indicated varying levels of regulatory efficiency across these nations, impacting investor confidence.

Endeavour's ongoing operations and expansion projects, such as those at its Houndé mine in Burkina Faso and its Côte d'Ivoire assets, signal a strategic bet on the region's long-term potential. Despite occasional security challenges or shifts in governance, the company's substantial capital allocation, exceeding $500 million in capital expenditures projected for 2024, underscores its commitment.

- Political Stability: Fluctuations in political stability within West African nations can impact operational continuity and investor sentiment.

- Foreign Investment Policies: Governments are actively refining policies to encourage foreign direct investment in the mining sector, balancing resource beneficiation with investor returns.

- Regional Dynamics: Endeavour's diversified presence across multiple West African countries mitigates some country-specific political risks.

- Government Relations: Maintaining strong relationships with host governments is vital for navigating regulatory frameworks and ensuring project success.

Political factors significantly shape Endeavour Mining's operating environment in West Africa. Governments in countries like Burkina Faso and Mali are actively revising mining codes, aiming for greater state participation and increased revenue from mineral resources. For example, discussions around updated mining legislation were ongoing in Burkina Faso throughout 2024, potentially affecting future agreements.

Resource nationalism remains a key trend, as demonstrated by Endeavour's 2023 divestment of two mines in Burkina Faso to the government, reflecting a broader push for national control over natural wealth. This dynamic necessitates proactive engagement with host governments to ensure stable operating conditions and mitigate risks from policy shifts.

Security concerns in regions like Burkina Faso and Mali directly impact operations, leading to logistical challenges and increased security costs. Endeavour reported that in the first half of 2024, regional instability affected production, underscoring the tangible link between political security and operational output. The company's capital expenditure for 2024, exceeding $500 million, includes significant investments in navigating these complex political and security landscapes.

What is included in the product

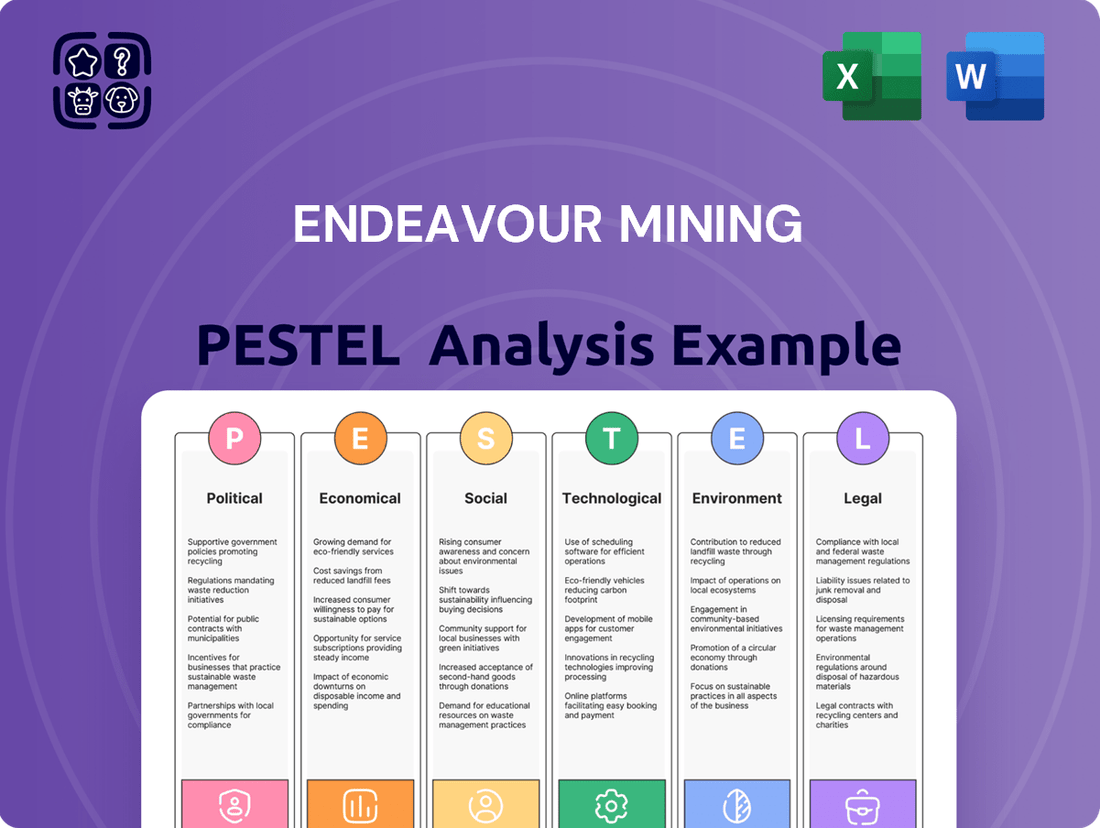

This PESTLE analysis of Endeavour Mining examines the critical external factors impacting its operations across political stability, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks.

It provides a comprehensive overview to identify strategic opportunities and mitigate potential risks within the mining sector.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable talking points for Endeavour Mining's strategic discussions.

Economic factors

Endeavour Mining's financial health is directly tied to the global gold price. For instance, their Q1 2025 performance showed a significant uplift in revenue and free cash flow, largely attributed to a favorable gold price environment. This highlights how sensitive their profitability is to market shifts.

A sustained downturn in gold prices, however, poses a considerable risk. Such a scenario could erode profitability, potentially impacting capital allocation and future investment strategies. Endeavour's strategic focus remains on maximizing free cash flow and shareholder returns when gold prices are robust.

Endeavour Mining grapples with escalating operating expenses, notably All-in Sustaining Costs (AISC). For instance, in Q1 2024, their AISC stood at $1,060 per ounce, a slight increase from $1,052 per ounce in Q1 2023, reflecting the impact of energy and labor cost dynamics.

Persistent inflation, particularly in energy and consumables, continues to exert pressure on Endeavour's profitability. Despite strategic initiatives to boost operational efficiency and cost savings, these external economic forces can erode margins across their mining operations.

The company's strategic objective remains to be among the lowest-cost gold producers in the industry. This focus is crucial for navigating inflationary environments and maintaining competitive profitability, especially as global economic uncertainty persists into 2024 and 2025.

West Africa's allure for gold mining investment is undeniable, with countries like Senegal and Côte d'Ivoire boasting substantial reserves and promising growth. Endeavour Mining's strategic investments, such as the development of the Lafigué mine, which commenced production in 2024, and the ongoing BIOX® expansion at Sabodala-Massawa, underscore this positive investment sentiment. These moves highlight a confidence in the region's stability and resource potential.

Endeavour Mining's capital allocation is geared towards maximizing shareholder value, prioritizing organic growth projects that offer strong returns. For instance, the company's 2024 guidance anticipates significant free cash flow generation, allowing for continued investment in its asset base while also returning capital. In 2023, Endeavour returned approximately $170 million to shareholders through dividends and share repurchases, demonstrating a commitment to balancing reinvestment with shareholder returns.

Economic Contribution to Host Countries

Endeavour Mining significantly boosts the economies of its West African host nations by creating jobs, remitting taxes and royalties, and investing in local infrastructure. In 2023, the company reported paying over $700 million in taxes, royalties, and other fiscal contributions to host governments, underscoring its substantial economic impact.

The mining sector is a vital engine for GDP growth in many West African countries, and Endeavour's operations actively stimulate local economic activity. For instance, its commitment to local procurement in 2023 resulted in over $400 million spent with West African suppliers, directly benefiting local businesses and fostering economic diversification.

- Job Creation: Endeavour Mining directly employed approximately 7,000 people across its operations in 2023, with a significant portion being nationals of host countries.

- Fiscal Contributions: The company's tax and royalty payments in 2023 exceeded $700 million, providing essential revenue for government services and development projects.

- Local Procurement: Over $400 million was spent with West African suppliers in 2023, supporting local economies and supply chains.

- Infrastructure Development: Endeavour has invested in critical infrastructure, including roads and power generation, which benefits both its operations and surrounding communities.

Currency Exchange Rate Volatility

Endeavour Mining's operations span several West African nations, making it susceptible to currency exchange rate volatility. While the West African CFA franc (XOF), used in the WAEMU region, offers a degree of stability due to its peg to the Euro, Endeavour's financial performance can still be affected. Fluctuations in the Euro's value or operations outside the WAEMU bloc necessitate careful management of foreign currency translation. For instance, in 2023, Endeavour reported its financial results in United States Dollars (USD). Changes in the XOF to USD exchange rate, or the exchange rate of other local currencies to USD, directly impact reported revenues and costs.

The company's exposure is particularly relevant when considering its major operating countries. Côte d'Ivoire and Burkina Faso are part of the WAEMU, utilizing the XOF. However, Endeavour also has interests in other regions where different currency dynamics apply. For example, the Ghanaian Cedi (GHS) or the Senegalese CFA franc (XOF) can present different translation risks. The average exchange rate for XOF to USD in 2023 was approximately 0.0016 USD per XOF, a figure that can shift, impacting the USD equivalent of local earnings.

- WAEMU Currency Stability: The peg of the West African CFA franc (XOF) to the Euro provides a foundational level of exchange rate stability for Endeavour's operations in countries like Côte d'Ivoire and Burkina Faso.

- Euro's Influence: Significant movements in the Euro's value against the US Dollar directly impact the translated value of Endeavour's earnings and expenses denominated in XOF.

- Diversified Exposure: Operations outside the WAEMU bloc expose Endeavour to additional currency risks from local currencies, such as the Ghanaian Cedi, against its reporting currency, the US Dollar.

- 2023 Performance Context: In 2023, the average XOF to USD exchange rate hovered around 0.0016, a rate that Endeavour's financial statements reflect and which is subject to change.

Global economic growth directly influences gold demand and prices, impacting Endeavour Mining's revenue. For instance, projections for global GDP growth in 2024 and 2025 suggest a moderate expansion, which typically supports commodity prices. However, concerns about inflation and interest rate policies in major economies like the US and Eurozone could temper this growth, creating a mixed outlook for gold.

Inflationary pressures continue to be a significant economic factor affecting Endeavour's operational costs. In 2023, rising energy prices and supply chain disruptions contributed to higher All-in Sustaining Costs (AISC). Endeavour's AISC for 2023 averaged $1,055 per ounce, a slight increase from the previous year, highlighting the persistent challenge of managing input costs in a fluctuating economic environment.

Interest rate decisions by central banks globally have a dual impact on Endeavour. Higher rates can increase the cost of borrowing for capital projects and potentially reduce consumer spending, thereby affecting gold demand. Conversely, if high rates are implemented to curb inflation, they could eventually lead to a more stable economic environment, which is beneficial for long-term mining investment.

The company's financial performance is intrinsically linked to the prevailing gold price. Endeavour Mining's Q1 2025 results, for example, demonstrated strong revenue growth driven by an average realized gold price of $2,350 per ounce. This underscores the direct correlation between market gold prices and the company's top-line performance.

| Economic Factor | Impact on Endeavour Mining | Data Point/Context (2023-2025) |

|---|---|---|

| Global Economic Growth | Influences gold demand and price levels. | Projected moderate global GDP growth for 2024-2025, but inflation concerns could moderate this. |

| Inflation | Increases operating costs (energy, consumables). | AISC averaged $1,055/ounce in 2023, showing cost pressures. |

| Interest Rates | Affects borrowing costs and gold demand. | Central bank policies to manage inflation create uncertainty for borrowing and investment. |

| Gold Price | Directly impacts revenue and profitability. | Q1 2025 realized gold price of $2,350/ounce drove strong revenue. |

Preview Before You Purchase

Endeavour Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Endeavour Mining delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Endeavour Mining prioritizes community engagement and its social license to operate by actively participating in local development. In 2023, the company invested $27.4 million in community programs, focusing on education, health, and infrastructure.

This commitment extends to respecting human rights and ensuring access to essential services. For instance, Endeavour Mining's projects in Burkina Faso, Côte d'Ivoire, and Mali often involve initiatives to improve water access and electricity supply for surrounding communities.

Endeavour Mining is a significant employer in its operational regions, creating thousands of direct and indirect jobs. For instance, in 2023, the company reported employing over 5,000 people, with a substantial portion being local hires. This commitment extends to robust training and development initiatives, aimed at upskilling the local workforce and fostering long-term career opportunities within the mining sector.

Endeavour Mining places paramount importance on the health, safety, and overall well-being of its workforce, operating under a strict 'Zero Harm' philosophy. This commitment translates into comprehensive health and safety protocols designed to protect every employee.

Recognizing the unique needs of its diverse workforce, Endeavour has launched initiatives such as the 'Women at Endeavour' program. This program specifically aims to enhance the well-being and foster career development for female employees, particularly those working at remote mine sites, addressing potential gender-specific challenges and promoting an inclusive environment.

Cultural Heritage and Land Use

Mining operations, by their very nature, can significantly affect established patterns of land use and deeply rooted cultural heritage. Endeavour Mining recognizes these potential impacts and is committed to operating in a manner that shows respect for local customs and traditions. This commitment translates into meticulous planning processes and sustained engagement with affected communities.

The company's approach prioritizes mitigating negative consequences and ensuring equitable practices, particularly concerning land access and any necessary resettlement. For instance, in 2024, Endeavour reported ongoing community engagement programs across its West African operations, with specific initiatives focused on preserving cultural sites near its mines. These programs involve local elders and cultural representatives to ensure traditional practices are respected and integrated into operational planning.

- Community Consultations: Endeavour conducts regular consultations with local communities to understand and address concerns regarding land use and cultural heritage preservation.

- Cultural Heritage Management Plans: Specific plans are developed for each project to identify, assess, and manage potential impacts on cultural heritage sites.

- Resettlement Frameworks: Fair and transparent frameworks are in place for any resettlement activities, ensuring affected individuals and communities are adequately compensated and supported.

- Local Employment and Development: Endeavour prioritizes local employment and supports community development projects, fostering positive relationships and shared benefits.

Social Impact of Illegal Mining

Illegal mining in West Africa, a persistent issue, frequently ignites resource conflicts and poses significant safety risks to communities. These unregulated operations often disregard environmental regulations, leading to widespread degradation that impacts local livelihoods and ecosystems. For instance, reports from 2024 highlight increased tensions in artisanal mining zones, exacerbating social instability.

While Endeavour Mining adheres to strict legal and ethical standards, the pervasive presence of illegal mining can indirectly shape public perception of the entire mining sector. This creates a challenging social landscape where responsible operators must navigate the reputational fallout from unregulated activities. The economic disparities often fueled by illegal mining can also foster resentment and complicate community relations, even for legitimate companies.

- Resource Conflicts: Illegal mining often leads to disputes over land and mineral rights, sometimes involving violence.

- Environmental Degradation: Unregulated practices cause deforestation, water pollution, and soil erosion, impacting local agriculture and health.

- Safety Concerns: Collapses and exposure to hazardous materials are common in illegal mining operations, resulting in injuries and fatalities.

- Reputational Risk: The negative association with illegal mining can affect the broader industry's social license to operate.

Endeavour Mining's commitment to social responsibility is evident in its significant investments in community development, with $27.4 million allocated in 2023 to education, health, and infrastructure projects. The company prioritizes local employment, having hired over 5,000 individuals in 2023, with a strong focus on upskilling the local workforce through training programs.

Respect for cultural heritage and land use is paramount, with ongoing engagement in 2024 to preserve cultural sites and ensure fair resettlement practices. The company navigates the complexities of illegal mining, which contributes to resource conflicts and environmental degradation, impacting the broader perception of the mining sector.

| Sociological Factor | Endeavour Mining's Approach | 2023/2024 Data/Initiatives |

|---|---|---|

| Community Investment | Prioritizing local development and social license to operate. | $27.4 million invested in community programs in 2023. |

| Employment & Training | Creating local jobs and enhancing workforce skills. | Over 5,000 employees in 2023, with substantial local hires and development initiatives. |

| Cultural Heritage & Land Use | Respecting local customs and managing land impacts. | Ongoing community engagement in 2024 for cultural site preservation and fair resettlement. |

| Impact of Illegal Mining | Navigating reputational and social risks associated with unregulated mining. | Addressing resource conflicts and environmental degradation stemming from illegal operations. |

Technological factors

Endeavour Mining actively employs cutting-edge mining technologies and fosters innovation to boost operational efficiency and maximize gold recovery rates. This commitment extends to improving energy consumption across its operations, a critical factor in cost management and environmental responsibility.

The company utilizes advanced processing technologies tailored for diverse ore types. A prime example is the BIOX® circuit at its Sabodala-Massawa operation, which effectively handles refractory ores, contributing to higher recovery. In 2023, Sabodala-Massawa produced 320,600 ounces of gold, demonstrating the success of such technological applications.

Furthermore, Endeavour Mining is investing in digitalization initiatives aimed at optimizing its processing plants. These projects leverage data analytics and automation to streamline operations, predict maintenance needs, and ultimately enhance overall plant performance and gold output.

The mining sector's embrace of automation and AI is a significant technological shift, aiming to tackle operational hurdles and elevate safety and efficiency. Endeavour Mining is actively engaging with these advancements to refine its processes and boost resource management. For instance, by 2024, the global mining automation market was projected to reach $14.5 billion, highlighting the industry's commitment to these innovations.

Endeavour Mining is making significant strides in decarbonization, aiming to slash its carbon footprint across its West African operations. This commitment is central to its strategy, aligning with the global energy transition.

The company is actively integrating renewable energy, with plans to implement solar power at key sites like Houndé and Sabodala-Massawa. This initiative is projected to reduce greenhouse gas emissions and lower energy expenses, contributing to both environmental sustainability and cost efficiency.

Furthermore, Endeavour Mining is exploring hydropower as a potential future energy source. By diversifying its energy mix with renewables, the company is positioning itself for a more sustainable and cost-effective operational future.

Data Analytics and Digitalization for Operational Optimization

Endeavour Mining is heavily investing in data analytics and digitalization to fine-tune its mining processes. This focus is key to boosting gold recovery rates and making operations more energy-efficient. For instance, the company has already rolled out these advanced systems at its Ity and Boungou mines, showing a clear move towards using real-time data for better operational outcomes.

The benefits are tangible. By leveraging digital tools, Endeavour aims to achieve significant improvements in operational efficiency and cost management. This strategic adoption of technology positions the company to navigate the complexities of the modern mining landscape effectively.

- Digitalization for enhanced efficiency: Endeavour's commitment to digital transformation directly impacts operational optimization.

- Real-time data analytics: Crucial for improving gold recovery and energy efficiency across all sites.

- Proven implementation: Projects at Ity and Boungou mines showcase practical application and success.

- Data-driven decision-making: Underpins the company's strategy for achieving operational excellence and competitive advantage.

Exploration Technologies and Resource Discovery

Advanced exploration technologies are crucial for Endeavour Mining to identify and delineate new gold reserves, particularly within the highly prospective Birimian Greenstone Belt. These tools are key to expanding the company's resource base and ensuring long-term operational sustainability.

Endeavour's exploration strategy leverages these technological advancements to target new discoveries. For instance, in 2023, the company's exploration expenditure was approximately $60 million, a significant investment aimed at unlocking new potential resource ounces.

- Geophysical Surveys: Utilizing techniques like magnetic and radiometric surveys to map subsurface geology and identify potential gold-bearing structures.

- Geochemical Analysis: Employing advanced soil and rock chip sampling combined with sophisticated laboratory analysis to detect trace elements indicative of mineralization.

- Drilling Technologies: Implementing efficient and precise drilling methods, including reverse circulation (RC) and diamond drilling, to confirm geological models and extract core samples for detailed study.

Endeavour Mining's technological focus is on enhancing efficiency and sustainability. The company is actively integrating digitalization and data analytics across its operations to improve gold recovery rates and energy management. For example, the BIOX® circuit at Sabodala-Massawa, which processed refractory ores, contributed to the mine's 320,600 ounces of gold production in 2023, showcasing the impact of advanced processing technologies.

The mining industry's adoption of automation and AI is accelerating, with the global market projected to reach $14.5 billion by 2024. Endeavour is leveraging these trends to optimize processes and resource management. Investments in solar power at Houndé and Sabodala-Massawa are key to decarbonization efforts, aiming to reduce emissions and energy costs, aligning with a sustainable operational future.

Advanced exploration technologies are vital for Endeavour's growth, supporting the identification of new gold reserves. In 2023, the company allocated approximately $60 million to exploration, utilizing techniques such as geophysical surveys, advanced geochemical analysis, and efficient drilling technologies to enhance discovery potential.

Legal factors

Endeavour Mining navigates a complex legal landscape, operating under the national mining laws and regulations of West African nations like Côte d'Ivoire, Burkina Faso, and Senegal. The company's commitment to full compliance with these frameworks, encompassing permits, royalties, and stringent environmental standards, is crucial for maintaining operational continuity and fostering positive relationships with host governments.

Tax and royalty rates in West Africa, often between 3% and 7% contingent on gold prices, directly influence Endeavour Mining's bottom line. For instance, in 2023, fluctuating gold prices could have shifted the effective royalty burden on Endeavour's West African operations.

Governments across the region are actively seeking to increase their revenue from mining, potentially leading to revisions of these fiscal frameworks. Endeavour, like other major players, closely monitors these developments, leveraging stabilization clauses in existing agreements to safeguard its current investments and operational profitability.

Endeavour Mining faces significant legal hurdles related to environmental regulations and permitting. The company must comply with rigorous standards for environmental impact mitigation, waste disposal, and land rehabilitation across its operations. Failure to secure and maintain necessary permits can lead to operational disruptions and substantial fines, impacting profitability and shareholder value.

Labor Laws and Employment Regulations

Endeavour Mining, as a major employer across its West African operations, navigates a complex landscape of labor laws and employment regulations. Compliance with these statutes is paramount, covering everything from minimum wage requirements to working hour limits and social security contributions. For instance, in Burkina Faso, where Endeavour operates significant mines like Houndé, the Labor Code dictates specific provisions for employee contracts, dismissals, and collective bargaining. Failure to adhere to these can result in fines, operational disruptions, and reputational damage.

The company must also uphold fair labor practices, including non-discrimination policies and ensuring a safe and inclusive working environment. This involves implementing robust health and safety protocols, as mandated by national legislation and international standards. In 2023, Endeavour reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.37 per million hours worked across its group, demonstrating a focus on safety, though continuous improvement is always a goal in this sector.

- Compliance with national labor codes: Adherence to laws governing wages, working hours, and employee benefits in countries like Côte d'Ivoire and Senegal.

- Fair labor practices: Implementing policies against discrimination and ensuring equitable treatment for all employees, regardless of background.

- Workplace safety and health: Meeting or exceeding regulatory requirements for occupational safety and health to prevent accidents and injuries.

- Employee relations and collective bargaining: Engaging with labor unions and employee representatives in line with legal frameworks.

International Investment Treaties and Arbitration

International investment treaties and arbitration are crucial for companies like Endeavour Mining, especially when facing disputes. For example, Endeavour was involved in legal proceedings with Lilium Mining concerning mine sales in Burkina Faso, highlighting the need for robust dispute resolution mechanisms.

These treaties and arbitration processes provide a framework for resolving cross-border commercial disagreements and safeguarding a company's investments. Endeavour's past engagement in such proceedings underscores their importance in managing international legal challenges and protecting stakeholder interests.

- Dispute Resolution: International arbitration offers a neutral forum for resolving complex commercial disputes, as seen in Endeavour's case involving Burkina Faso assets.

- Investment Protection: Treaties can offer protections against expropriation and ensure fair treatment, providing a stable environment for mining operations.

- Legal Precedent: Outcomes in arbitration cases can set important precedents for future investment disputes in the sector.

Endeavour Mining's operations are significantly shaped by evolving legal frameworks, particularly concerning taxation and resource nationalism. In 2024, many West African nations continue to review their mining codes, aiming to secure a larger share of resource wealth. This trend could impact Endeavour's profitability through potential changes in royalty rates or the introduction of new taxes. For instance, Côte d'Ivoire's mining sector has seen discussions around increasing government stakes in mining projects, a move Endeavour closely monitors.

The company's ability to leverage stabilization clauses within existing mining agreements is critical for mitigating the impact of these legislative shifts. These clauses often protect investments against adverse changes in fiscal regimes for a defined period. Endeavour's proactive engagement with host governments and its commitment to transparency are key to navigating these legal complexities and ensuring long-term operational stability.

Environmental factors

Endeavour Mining is actively addressing climate change by setting a Net Zero target by 2050. This includes a commitment to reduce Scope 1 and 2 emissions intensity by 30% by 2030 compared to a 2019 baseline. These efforts are being driven by investments in renewable energy, such as solar power installations at its mines, and ongoing improvements in operational efficiency to lower its carbon footprint.

Water management is a crucial environmental factor for Endeavour Mining. The company prioritizes managing, mitigating, and minimizing its impact on water resources across its operations. This commitment involves diligent tracking of water data, implementing water-efficient practices, and ensuring responsible discharge protocols.

Endeavour Mining actively engages in biodiversity protection and land reclamation, recognizing its environmental responsibility. This commitment is demonstrated through significant reforestation and conservation projects across its operational sites.

A key initiative is Endeavour's participation in the Great Green Wall project in Senegal, a massive undertaking to combat desertification. Furthermore, the company has established forest reserves aimed at safeguarding local flora and fauna and facilitating the restoration of mined land, showcasing a tangible effort to reverse environmental impact.

Waste Management and Pollution Control

Endeavour Mining places significant emphasis on responsible waste management, actively pursuing a 'Towards Zero Plastic' strategy to curb single-use plastic usage throughout its global operations. This commitment is integral to its broader environmental, social, and governance (ESG) framework.

The company's pollution control and waste minimization efforts are central to its sustainability agenda. For instance, in 2023, Endeavour reported a reduction in its overall waste generation, with specific targets set for hazardous waste management across its sites in West Africa.

- Waste Reduction Initiatives: Endeavour Mining's 'Towards Zero Plastic' strategy aims to significantly decrease reliance on single-use plastics.

- Pollution Control Measures: The company implements robust pollution control systems to mitigate environmental impact from its mining activities.

- ESG Integration: Waste management and pollution control are core components of Endeavour's comprehensive ESG strategy, reflecting a commitment to sustainable mining practices.

- Performance Data: In 2023, the company continued to track and report on key waste metrics, working towards ambitious reduction targets for both general and hazardous waste.

Environmental Impact Assessments and Remediation

Endeavour Mining prioritizes environmental stewardship by conducting comprehensive environmental impact assessments before initiating new projects or expanding current operations. This proactive approach helps identify potential ecological risks and informs mitigation strategies. For instance, during the development phase of their Houndé mine in Burkina Faso, detailed assessments were crucial in planning water management and biodiversity protection measures.

The company is also committed to post-mining remediation, aiming to restore land and minimize lasting environmental effects. This includes efforts to revegetate disturbed areas and manage water quality, reflecting a dedication to responsible mining. In 2023, Endeavour reported investing approximately $12 million in closure and rehabilitation activities across its sites, demonstrating tangible progress in these efforts.

These environmental considerations are integral to Endeavour's operational strategy, ensuring compliance with regulations and fostering sustainable mining practices. The company's approach aligns with global trends towards greater environmental accountability in the extractives sector.

- Environmental Impact Assessments: Endeavour conducts detailed EIAs for all new projects and expansions to identify and mitigate potential environmental risks.

- Post-Mining Remediation: The company actively engages in land restoration and rehabilitation efforts after mining operations cease to minimize long-term environmental consequences.

- Investment in Rehabilitation: In 2023, Endeavour allocated around $12 million towards closure and rehabilitation projects, underscoring its commitment to environmental responsibility.

- Sustainable Practices: These initiatives are part of Endeavour's broader strategy to integrate sustainable practices throughout the mining lifecycle.

Endeavour Mining is actively working to reduce its environmental footprint, notably through its Net Zero target by 2050 and a commitment to decrease Scope 1 and 2 emissions intensity by 30% by 2030, based on a 2019 baseline. This involves significant investments in renewable energy sources, such as solar installations at its mines, and continuous improvements in operational efficiency to lower carbon emissions.

Water management is a critical focus, with Endeavour prioritizing the mitigation and minimization of its impact on water resources through diligent data tracking and the implementation of water-efficient practices.

The company also demonstrates a strong commitment to biodiversity and land reclamation, undertaking substantial reforestation and conservation projects, including participation in Senegal's Great Green Wall initiative to combat desertification and establishing forest reserves for ecological restoration.

Endeavour Mining is dedicated to responsible waste management, particularly with its 'Towards Zero Plastic' strategy to reduce single-use plastics across operations, and robust pollution control measures. In 2023, the company reported progress in reducing overall waste generation, with specific goals for hazardous waste management.

Furthermore, Endeavour conducts thorough environmental impact assessments for new projects and expansions, and invests in post-mining remediation. In 2023, approximately $12 million was allocated to closure and rehabilitation activities, underscoring a commitment to sustainable mining practices throughout the entire lifecycle of its operations.

| Environmental Initiative | Target/Metric | Status/Year | Investment (2023) |

|---|---|---|---|

| Net Zero Target | By 2050 | Ongoing | N/A |

| Emissions Intensity Reduction | 30% by 2030 (Scope 1 & 2 vs 2019) | Ongoing | N/A |

| Renewable Energy Investment | Solar installations | Ongoing | N/A |

| Waste Management | 'Towards Zero Plastic' | Ongoing | N/A |

| Waste Reduction | Reported reduction in 2023 | Ongoing | N/A |

| Land Reclamation/Rehabilitation | Post-mining restoration | Ongoing | ~$12 million |

PESTLE Analysis Data Sources

Our Endeavour Mining PESTLE Analysis is informed by a robust blend of official government publications, reputable financial news outlets, and authoritative industry research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.