Endeavour Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endeavour Mining Bundle

Unlock the strategic core of Endeavour Mining's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and revenue streams, offering a clear blueprint for success in the mining sector. Discover how they forge key partnerships and manage their cost structure to drive profitability.

Ready to gain a competitive edge? Download the full Endeavour Mining Business Model Canvas to see their entire strategic framework, from key resources to channels and customer relationships. This actionable document is perfect for anyone looking to understand and adapt proven mining industry strategies.

Partnerships

Endeavour Mining's operations in West Africa, specifically in countries like Côte d'Ivoire, Burkina Faso, and Senegal, necessitate robust engagement with government agencies and regulators. These entities are critical for granting and renewing mining licenses, issuing environmental permits, and ensuring compliance with national mining codes and fiscal regimes. For instance, in 2023, Endeavour continued to work closely with these bodies to maintain its social license to operate and secure approvals for ongoing projects.

Strong relationships with governments are fundamental for Endeavour's business continuity, enabling smooth operations and preventing disruptions. Adherence to regulatory frameworks, including environmental, social, and governance (ESG) standards, is paramount. In 2023, the company reported significant progress in its sustainability initiatives, often in collaboration with government partners, underscoring the importance of these ties for long-term operational stability and expansion plans.

Endeavour Mining actively partners with local communities to secure and maintain its social license to operate. In 2024, the company continued its commitment to community development, investing significantly in initiatives aimed at job creation and skills training for local residents, a cornerstone of fostering positive relationships and ensuring smooth operations.

These collaborations extend to vital infrastructure projects and educational programs designed to uplift community well-being. For instance, Endeavour's focus on local procurement in 2024 aimed to boost the regional economy, with a target of sourcing a substantial portion of its supplies and services from local businesses, thereby directly contributing to socio-economic progress.

Endeavour Mining relies on a robust network of suppliers and contractors for everything from essential raw materials and explosives to specialized drilling and maintenance services. These partnerships are critical for maintaining operational efficiency and cost control across its diverse asset base. In 2023, Endeavour reported that its cost of sales was approximately $1.14 billion, a significant portion of which is directly attributable to supplier and contractor expenses.

Financial Institutions and Investors

Endeavour Mining's key partnerships with financial institutions and investors are foundational for its capital-intensive operations. These include banks providing credit facilities and investment firms that underwrite equity and debt offerings, crucial for funding exploration, project development, and day-to-day activities. For instance, as of early 2024, Endeavour maintained significant credit facilities with major financial institutions, demonstrating their reliance on these partnerships to manage liquidity and fund growth initiatives.

Maintaining strong relationships with shareholders and the broader investment community is paramount. This involves consistent and transparent financial reporting, investor roadshows, and presenting a compelling case for the company's strategic direction and financial health. Endeavour's commitment to clear communication and a robust balance sheet aims to attract and retain capital, thereby supporting its expansion plans and delivering value to its investors. In 2023, the company reported strong operational performance and a healthy cash flow, which are vital for investor confidence and continued access to capital markets.

- Banks: Provide essential credit facilities and project financing.

- Investment Firms: Facilitate capital raising through equity and debt markets.

- Shareholders: Supply equity capital and represent ownership stakes, requiring consistent value delivery.

- Financial Reporting: Transparent and timely disclosure is critical for maintaining investor trust and access to funding.

Technology and Research Partners

Endeavour Mining actively collaborates with technology and research partners to drive innovation in its operations. These alliances are crucial for integrating cutting-edge extraction techniques and advanced data analytics, aiming to boost efficiency and safety. For instance, partnerships in 2024 are focused on piloting autonomous drilling systems and optimizing ore processing through AI-driven insights.

These collaborations directly contribute to operational improvements and a more sustainable mining footprint. By adopting new technologies, Endeavour Mining seeks to enhance resource recovery and minimize environmental impact, aligning with global best practices. A key focus for 2024 has been the exploration of novel water management solutions and energy-efficient processing technologies.

- Partnerships for Enhanced Efficiency: Collaborations with technology providers to implement AI for predictive maintenance and autonomous vehicle deployment, aiming to reduce downtime and operational costs.

- Research into Sustainable Technologies: Engaging with research institutions to develop and pilot greener extraction methods and advanced tailings management systems, reducing environmental impact.

- Data Analytics and Digitalization: Working with data science firms to leverage big data for optimizing mine planning and resource estimation, improving decision-making accuracy.

Endeavour Mining's robust supplier and contractor network is essential for its operational efficiency, covering everything from raw materials to specialized services. In 2023, the company's cost of sales, approximately $1.14 billion, highlights the significant financial reliance on these partnerships for maintaining its diverse asset base.

These relationships are crucial for cost control and ensuring the availability of critical inputs, directly impacting Endeavour's profitability and project timelines. The company's strategic sourcing and vendor management are key to mitigating supply chain risks and optimizing expenditures across its West African operations.

| Key Supplier Categories | Importance to Endeavour Mining | 2023 Financial Impact (Illustrative) |

|---|---|---|

| Mining consumables (explosives, chemicals) | Essential for extraction processes | Significant portion of cost of sales |

| Equipment and machinery suppliers | Crucial for operational uptime and productivity | Major capital expenditure and maintenance costs |

| Specialized services (drilling, maintenance, logistics) | Enables efficient operations and project execution | Contributes to operational expenses |

What is included in the product

Endeavour Mining's Business Model Canvas focuses on efficient, low-cost gold production from a portfolio of high-quality assets in West Africa, targeting a diverse range of investors and stakeholders.

It details their value proposition of delivering shareholder returns through operational excellence, responsible mining practices, and strategic growth, supported by key partners and a robust cost structure.

Endeavour Mining's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operational strategy, allowing for rapid identification of potential bottlenecks and inefficiencies in their complex mining operations.

Activities

Endeavour Mining's core activity is identifying and defining new gold deposits and extending current ones, focusing on the rich Birimian Greenstone Belt in West Africa. This is crucial for maintaining a steady supply of gold for future operations.

Their exploration efforts involve detailed geological mapping, extensive drilling programs, and sophisticated resource modeling. These steps are vital for accurately assessing the quantity and quality of gold reserves, ensuring a sustainable production pipeline.

In 2023, Endeavour reported a total attributable gold mineral reserve of 13.3 million ounces (Moz), a testament to their successful exploration and resource delineation. This robust reserve base underpins their long-term production strategy.

Endeavour Mining's key activity involves the meticulous planning, design, and construction of new mining operations and the expansion of current ones. This phase is crucial for bringing new resources into production and increasing overall output.

Significant capital is allocated to this stage, covering essential infrastructure, advanced processing plants, and supporting facilities. For instance, the company brought the Lafigué project online and is undertaking the BIOX Expansion at Sabodala-Massawa, demonstrating its commitment to growth through development.

Endeavour Mining's primary activity is the efficient and safe extraction of gold ore from its mines in West Africa, employing both open-pit and underground techniques. The company prioritizes maximizing production volumes while rigorously controlling all-in sustaining costs to ensure profitability.

In 2023, Endeavour Mining produced 1,096,000 ounces of gold, demonstrating its operational capacity. The company maintained a focus on cost management, with all-in sustaining costs reported at $1,056 per ounce for the same period, highlighting their commitment to operational efficiency.

Gold Processing and Production

Gold processing and production are core to Endeavour Mining's operations, involving the transformation of mined ore into sellable gold. This crucial stage encompasses crushing and grinding the ore to liberate gold particles, followed by metallurgical extraction. Processes like Carbon-in-Leach (CIL) or BIOX are employed to efficiently recover gold, aiming for the highest possible yield.

The primary objective of these activities is to maximize gold recovery rates, ensuring that as much of the valuable metal as possible is extracted from the ore. This directly impacts the company's profitability by increasing the volume of gold produced. The output of this process is high-quality doré bars, which are then sold, forming a significant portion of Endeavour Mining's revenue.

In 2024, Endeavour Mining's strategic focus on operational efficiency and optimization within its processing plants is expected to yield positive results. For instance, the company has consistently reported strong production figures, with its mines achieving impressive recovery rates. Endeavour reported producing 1,374,000 ounces of gold in 2023, a testament to its effective processing capabilities.

- Maximizing Gold Recovery: Endeavour employs advanced metallurgical techniques to ensure efficient extraction of gold from ore.

- Production of Doré Bars: The processed gold is refined into high-purity doré bars, ready for sale on the international market.

- Revenue Generation: Successful gold processing and production are direct drivers of Endeavour Mining's financial performance and revenue streams.

- Operational Efficiency: Continuous improvement in processing technologies and methodologies is key to maintaining competitive production costs and high recovery rates.

Environmental, Social, and Governance (ESG) Management

Endeavour Mining's key activities in ESG management focus on embedding responsible practices across its mining lifecycle. This includes rigorous adherence to international standards and proactive management of environmental impacts, such as water stewardship and biodiversity preservation. For instance, in 2023, Endeavour reported a 20% reduction in water intensity at its Sabodala-Massawa mine compared to 2022.

The company actively engages in social development initiatives to support local communities, fostering positive relationships and contributing to their socio-economic well-being. This commitment extends to maintaining robust corporate governance structures and ethical business conduct throughout its operations. Endeavour's 2023 sustainability report highlighted over $15 million invested in community development programs across its operating regions.

- Responsible Mining Practices: Integrating environmental protection and social development into all operational facets.

- International Standards Adherence: Complying with global benchmarks for environmental and social performance.

- Environmental Impact Management: Focused efforts on water conservation and biodiversity protection, with a 20% water intensity reduction at Sabodala-Massawa in 2023.

- Community Support and Governance: Investing in local communities and upholding strong ethical business practices, with over $15 million allocated to community development in 2023.

Endeavour Mining's key activities revolve around the entire gold mining value chain, from initial exploration and resource definition to the efficient extraction and processing of gold. The company also places significant emphasis on environmental, social, and governance (ESG) practices to ensure sustainable operations. These integrated activities are designed to maximize shareholder value while adhering to responsible mining principles.

| Activity | Description | Key 2023/2024 Data Points |

| Exploration & Resource Definition | Identifying and delineating new gold deposits and extending existing ones. | Attributable gold mineral reserves of 13.3 million ounces (Moz) as of year-end 2023. |

| Mine Development & Construction | Planning, designing, and building new mining operations and expanding current ones. | Brought Lafigué project online; undertaking BIOX Expansion at Sabodala-Massawa. |

| Mining Operations | Efficient and safe extraction of gold ore using open-pit and underground methods. | Produced 1,096,000 ounces of gold in 2023; maintained all-in sustaining costs of $1,056 per ounce. |

| Processing & Production | Transforming mined ore into sellable gold doré bars through metallurgical extraction. | Achieved strong recovery rates; produced 1,374,000 ounces of gold in 2023. |

| ESG Management | Embedding responsible practices, managing environmental impacts, and supporting communities. | 20% water intensity reduction at Sabodala-Massawa (2023 vs. 2022); over $15 million invested in community programs (2023). |

Preview Before You Purchase

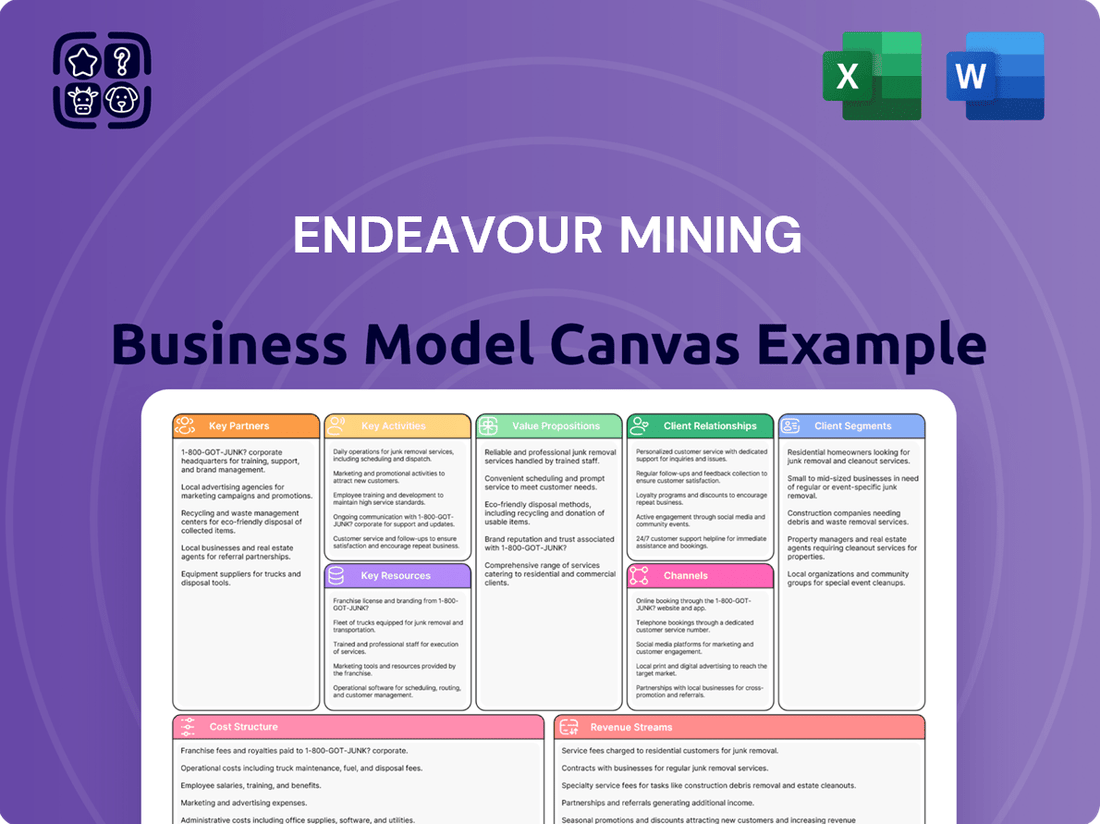

Business Model Canvas

The Endeavour Mining Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this precisely structured and formatted canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Endeavour Mining's most vital resource is its substantial portfolio of proven and probable gold reserves, primarily located within West Africa's Birimian Greenstone Belt. These deposits are the bedrock of the company's current and future gold production capabilities.

In 2024, Endeavour Mining reported a robust total attributable gold reserves of 10.1 million ounces (Moz) and 5.5 Moz of gold resources. This extensive mineral deposit base is continually expanded through aggressive and successful exploration programs, ensuring a long-term supply pipeline.

Endeavour Mining's mining infrastructure and equipment represent a significant capital investment, crucial for its operations. This includes large mining fleets and advanced processing plants like CIL and BIOX, essential for extracting and refining valuable minerals. In 2024, the company continued to focus on optimizing these assets to enhance efficiency and production capacity across its West African portfolio.

Endeavour Mining relies heavily on its highly skilled workforce, comprising experienced geologists, engineers, and operators. This expertise is fundamental to their success in exploration, development, and day-to-day mining operations. In 2023, Endeavour reported a total workforce of approximately 10,000 employees and contractors, underscoring the scale of their human capital.

The company's robust management team provides the strategic direction and oversight necessary for efficient and safe operations. Their leadership ensures effective decision-making across all facets of the business, from resource exploration to financial management. This experienced leadership is a core asset in navigating the complexities of the mining industry.

Financial Capital

Endeavour Mining's access to significant financial capital is a cornerstone of its business model. This includes a robust mix of equity, debt, and internally generated cash flow, crucial for financing its extensive operations. For instance, in 2024, the company continued to leverage its strong balance sheet to support major capital expenditures, including ongoing development projects and exploration initiatives across its West African portfolio.

The company's financial health directly fuels its ability to undertake large-scale mining projects, manage day-to-day operations efficiently, and invest in future growth through exploration. This financial resilience also enables Endeavour to provide consistent shareholder returns, a key aspect of its value proposition. In the first half of 2024, Endeavour reported strong operational performance and cash generation, reinforcing its capacity for strategic investments and dividend payouts.

- Equity Financing: Access to capital markets for raising funds through share offerings.

- Debt Financing: Utilizing credit facilities and loans to fund operational needs and expansion.

- Internally Generated Cash Flow: Profits from mining operations are reinvested into the business.

- Shareholder Returns: Ability to pay dividends and buy back shares, demonstrating financial strength.

Licenses, Permits, and Social License to Operate

Endeavour Mining’s ability to operate hinges on securing and maintaining both legal and social permissions. This encompasses obtaining essential government-issued mining licenses and environmental permits, which are critical for lawful operations. For instance, in 2024, Endeavour continued its focus on regulatory compliance across its West African operations, ensuring all permits were up-to-date.

Beyond formal approvals, a social license to operate is paramount. This is earned through consistent, responsible practices and proactive community engagement. Endeavour actively invests in local development initiatives, aiming to foster trust and long-term acceptance from the communities surrounding its mines. This commitment is vital for uninterrupted operations and sustainable growth.

- Mining Licenses: Formal government authorization to extract mineral resources.

- Environmental Permits: Approvals required to conduct operations in an environmentally responsible manner.

- Social License to Operate: Community acceptance and support, built on trust and responsible engagement.

- Community Investment: Endeavour’s 2024 initiatives included projects focused on education and infrastructure, demonstrating commitment to local well-being.

Endeavour Mining's key resources include its extensive gold reserves, skilled workforce, and robust financial backing. These elements are fundamental to its operational success and strategic growth in the West African mining sector.

In 2024, the company reported 10.1 million ounces of gold reserves, underscoring its significant mineral asset base. This is supported by a workforce of approximately 10,000 employees and contractors as of 2023, highlighting substantial human capital. Furthermore, Endeavour's access to capital markets and internally generated cash flow in 2024 enabled continued investment in exploration and development.

The company's operational infrastructure, including advanced processing plants, and its strong management team are also critical resources. These are complemented by the essential legal and social licenses to operate, which Endeavour actively maintains through regulatory compliance and community engagement initiatives.

Value Propositions

Endeavour Mining's value proposition centers on delivering consistent and growing gold production from its robust portfolio of West African assets. This operational excellence translates into reliability for investors and partners, underpinned by a clear path for expansion.

The company's strategic focus on developing new projects and expanding existing operations, such as the Houndé mine in Burkina Faso which produced approximately 274,000 ounces of gold in 2023, highlights its commitment to a strong growth trajectory.

This consistent output and forward-looking development strategy offer stakeholders both immediate returns and significant future potential, solidifying Endeavour Mining's position as a dependable producer in the gold sector.

Endeavour Mining is focused on keeping its all-in sustaining costs (AISC) remarkably low, positioning itself as a leader in cost-efficient gold production. This commitment to a lean operational structure is a key value proposition, directly impacting profitability.

Achieving class-leading low AISC means Endeavour can generate higher profit margins on every ounce of gold produced. For instance, in the first quarter of 2024, Endeavour reported an AISC of $1,014 per ounce, a figure that stands favorably against industry averages.

This cost advantage translates into stronger financial performance, making the company an attractive prospect for investors who prioritize robust returns and financial stability in the mining sector.

Endeavour Mining is dedicated to generating substantial shareholder returns, primarily through consistent dividend payments and strategic share repurchase programs. This approach directly rewards investors and boosts the attractiveness of holding Endeavour’s stock.

In 2023, Endeavour Mining declared a total dividend of $1.00 per share, reflecting its commitment to returning capital to shareholders. The company also actively engaged in share buybacks, further enhancing shareholder value.

Strong Exploration Upside

Endeavour Mining's value proposition of Strong Exploration Upside is built on its commitment to discovering and developing new mineral resources. The company actively invests in exploration across its highly prospective landholdings in West Africa, aiming for significant organic growth. This strategy is crucial for extending the life of existing mines and creating new ones, thereby ensuring long-term value for shareholders.

The company's exploration efforts are focused on identifying high-grade gold deposits. In 2023, Endeavour reported a significant increase in its mineral reserves and resources, demonstrating the success of its ongoing programs. For instance, exploration at its flagship Houndé mine in Burkina Faso continued to yield positive results, adding to its resource base.

- Aggressive Exploration Programs: Endeavour maintains a robust exploration budget, targeting areas with proven geological potential in countries like Côte d'Ivoire, Burkina Faso, and Mali. This proactive approach fuels the discovery pipeline.

- Resource Growth: The company consistently aims to grow its gold reserves and resources year-over-year. In 2023, Endeavour reported a consolidated attributable gold reserve of 15.5 million ounces, a testament to successful exploration and mine life extensions.

- Discovery of High-Quality Deposits: Success in exploration translates to the identification of economically viable gold deposits, which are key to future production and profitability.

- Long-Term Value Creation: By extending mine lives and discovering new deposits, Endeavour secures its operational future and enhances shareholder value through sustainable growth.

Responsible and Sustainable Mining Practices

Endeavour Mining's commitment to responsible and sustainable mining practices is a core value proposition. This focus on environmental, social, and governance (ESG) principles resonates deeply with stakeholders increasingly prioritizing ethical investments. By integrating ESG into its operations, Endeavour aims to ensure long-term viability and foster positive relationships within the communities where it operates.

This dedication translates into tangible benefits for various stakeholders. Investors seeking to align their portfolios with sustainable values find Endeavour an attractive option. Furthermore, the company’s proactive approach to environmental stewardship and community engagement helps mitigate operational risks and build social license to operate, contributing to overall business resilience. For instance, in 2023, Endeavour reported significant progress in reducing its greenhouse gas emissions intensity by 10% compared to 2022, demonstrating a concrete step towards environmental responsibility.

- Environmental Stewardship: Endeavour actively works to minimize its environmental footprint through responsible water management, biodiversity protection, and progressive rehabilitation of mining sites.

- Social Impact: The company prioritizes community development, investing in local employment, education, and healthcare initiatives, fostering shared value and positive social outcomes.

- Governance Excellence: Strong corporate governance, ethical conduct, and transparent reporting are fundamental to Endeavour's operations, building trust and accountability with all stakeholders.

- Operational Sustainability: By embedding ESG principles, Endeavour enhances operational efficiency, reduces risks, and secures its long-term social and economic license to operate.

Endeavour Mining's value proposition is built on delivering consistent, low-cost gold production from its high-quality West African assets, ensuring reliable returns for investors. The company's strategic focus on operational efficiency, exemplified by its industry-leading all-in sustaining costs (AISC), directly translates into enhanced profitability and financial stability.

Furthermore, Endeavour is committed to substantial shareholder returns through dividends and share buybacks, alongside a strong exploration pipeline aimed at growing reserves and resources. This dual approach of operational excellence and strategic growth, underpinned by a dedication to ESG principles, solidifies its position as a preferred investment in the gold mining sector.

The company's commitment to sustainable practices and community engagement further strengthens its value proposition, mitigating risks and fostering long-term operational viability. This holistic approach ensures Endeavour Mining is not only a producer of gold but also a responsible corporate citizen.

Here's a snapshot of Endeavour Mining's performance and strategic highlights:

| Metric | 2023 Performance | Q1 2024 Performance | Strategic Focus |

|---|---|---|---|

| Gold Production (Attributable) | ~1,350,000 ounces | ~310,000 ounces | Consistent output from core assets |

| All-in Sustaining Costs (AISC) | ~$1,077 per ounce | $1,014 per ounce | Industry-leading cost efficiency |

| Dividends Declared | $1.00 per share (total for 2023) | (To be declared based on H1 2024 results) | Shareholder returns |

| Gold Reserves (Attributable) | 15.5 million ounces | (Updates pending Q2/Q3 2024) | Resource growth through exploration |

| ESG Progress | 10% reduction in GHG emissions intensity (vs. 2022) | Ongoing ESG initiatives | Responsible mining and community impact |

Customer Relationships

Endeavour Mining prioritizes transparent investor communication, fostering trust through detailed financial reports and quarterly presentations. This open dialogue ensures shareholders are consistently updated on performance and strategic initiatives.

In 2024, Endeavour continued this commitment by releasing comprehensive quarterly results and timely news updates, reinforcing its dedication to keeping stakeholders fully informed about operational progress and financial health.

Endeavour Mining actively cultivates robust relationships with its host communities by engaging in dialogue and implementing tailored social development initiatives. In 2023, the company invested $23.7 million in these community programs, demonstrating a tangible commitment to local well-being.

These programs, spanning critical areas like healthcare, education, and infrastructure development, are fundamental to securing and maintaining a positive social license to operate. For instance, Endeavour supported the construction and renovation of 14 schools and 10 health facilities across its operational areas in 2023, directly impacting thousands of lives.

Endeavour Mining actively cultivates and sustains positive interactions with host governments and regulatory authorities. This is achieved through ongoing, transparent communication and strict compliance with all applicable laws and regulations.

This proactive approach is crucial for ensuring uninterrupted operations and streamlining the often complex permitting and licensing procedures. For instance, in 2024, Endeavour reported successful engagement with regulatory bodies across its West African operations, contributing to the timely progress of key development projects.

By fostering these strong relationships, Endeavour solidifies its position for long-term sustainability and responsible resource development within its host countries, demonstrating a commitment to being a trusted partner.

Supplier and Partner Collaboration

Endeavour Mining cultivates strong partnerships with its suppliers and contractors to guarantee consistent material and service availability, crucial for uninterrupted operations. These relationships are founded on transparency, ethical dealings, and shared objectives, aiming for optimal project delivery and cost-effectiveness.

These collaborations are vital for maintaining operational efficiency and driving innovation. For instance, in 2024, Endeavour Mining continued to focus on robust supplier agreements to mitigate supply chain risks, a critical factor given the global economic landscape. Their approach emphasizes long-term agreements that offer price stability and preferential access to essential mining inputs.

- Supplier Reliability: Ensuring a steady flow of critical consumables and equipment, such as explosives and heavy machinery parts, directly impacts production targets.

- Contractor Performance: Engaging specialized contractors for services like mine development and maintenance requires performance-based contracts that align incentives.

- Innovation and Efficiency: Collaborative efforts with key partners can lead to the adoption of new technologies and more efficient operational methods, reducing costs and environmental impact.

- Risk Mitigation: Diversifying the supplier base and establishing strong relationships helps mitigate risks associated with single-source dependencies and geopolitical instability.

Employee Well-being and Development

Endeavour Mining cultivates robust employee relationships by prioritizing health and safety, evident in their commitment to reducing lost-time injury frequency rates. In 2023, the company reported a lost-time injury frequency rate of 0.77 per million hours worked, underscoring their dedication to a safe working environment.

The company invests significantly in employee growth through comprehensive training and development programs, aiming to enhance skills and foster career progression. This focus on human capital is crucial for maintaining operational efficiency and a highly motivated workforce.

Endeavour actively promotes an inclusive workplace culture, believing that diversity drives innovation and strengthens team cohesion. This approach is key to attracting and retaining top talent in the competitive mining sector.

- Health and Safety Focus: Endeavour's commitment to employee well-being is demonstrated by their pursuit of industry-leading safety performance, aiming for zero harm.

- Training and Development: The company offers various programs, including technical skills training and leadership development, to support employee career advancement.

- Inclusive Culture: Endeavour fosters an environment where all employees feel valued and respected, contributing to higher engagement and retention rates.

- Talent Attraction and Retention: These initiatives collectively position Endeavour as an employer of choice, ensuring a skilled and dedicated workforce essential for achieving business objectives.

Endeavour Mining's customer relationships are multifaceted, encompassing investors, host communities, governments, suppliers, and employees. The company prioritizes transparent communication with investors, delivering detailed financial reports and quarterly updates to build trust. For its host communities, Endeavour invests in social development programs, exemplified by its $23.7 million investment in 2023 for initiatives in healthcare, education, and infrastructure. Strong government relations are maintained through consistent, transparent dialogue and regulatory compliance, crucial for operational continuity. Furthermore, Endeavour fosters reliable supplier partnerships through ethical dealings and long-term agreements, ensuring access to essential materials and mitigating supply chain risks.

| Stakeholder Group | Key Relationship Strategy | 2023/2024 Data/Example |

|---|---|---|

| Investors | Transparent Communication | Comprehensive quarterly results and timely news updates in 2024. |

| Host Communities | Social Development Investment | $23.7 million invested in community programs in 2023; supported 14 schools and 10 health facilities. |

| Governments/Regulators | Proactive Engagement & Compliance | Successful engagement with regulatory bodies across West African operations in 2024. |

| Suppliers/Contractors | Partnership & Reliability | Focus on robust supplier agreements in 2024 for price stability and risk mitigation. |

| Employees | Health, Safety & Development | Lost-time injury frequency rate of 0.77 per million hours worked in 2023; investment in training programs. |

Channels

Endeavour Mining's primary revenue stream flows from the direct sale of its refined gold, specifically doré bars, to a select group of accredited gold refineries and established bullion dealers operating within the global market. This focused approach guarantees the secure and efficient conversion of its mined gold into liquid assets, crucial for maintaining operational liquidity and funding future exploration and development.

In 2024, Endeavour Mining reported a significant year for production and sales. The company achieved a total gold production of 1,099,541 ounces, with 1,089,713 ounces sold. This robust sales performance directly to its established partners underscores the effectiveness of its direct sales channel.

Endeavour Mining's corporate website and investor relations portal are crucial for sharing financial results, presentations, and ESG reports worldwide. This direct access ensures investors and analysts receive comprehensive company information, including their 2024 performance highlights.

Endeavour Mining strategically utilizes financial news and media outlets to communicate its progress. By distributing press releases, quarterly earnings, and operational updates through major agencies like Reuters and Bloomberg, and specialized mining publications, the company ensures its information reaches a wide array of investors and industry professionals. This channel is crucial for maintaining transparency and informing market sentiment.

Industry Conferences and Investor Roadshows

Endeavour Mining actively participates in key global mining conferences and investor forums. These gatherings are crucial for direct engagement with institutional investors, fund managers, and prospective shareholders. For instance, in 2024, the company presented at the Denver Gold Forum and the BMO Capital Markets Global Mining Conference, highlighting its operational successes and strategic growth initiatives.

Investor roadshows are a cornerstone of Endeavour's communication strategy. These events facilitate in-depth discussions about the company's value proposition, operational efficiency, and future development plans. Such direct dialogue allows for clear articulation of the company's strengths and addresses investor queries effectively.

- Global Reach: Endeavour Mining attends major international mining and investment conferences to connect with a diverse investor base.

- Direct Engagement: Roadshows and forums enable face-to-face interactions with key financial stakeholders, fostering transparency and trust.

- Value Proposition: These platforms are used to showcase Endeavour's robust asset portfolio, operational excellence, and commitment to sustainable mining practices.

- Investor Relations: In 2024, the company conducted multiple investor update calls and participated in analyst site visits, reinforcing its investor relations efforts.

Sustainability Reports and ESG Platforms

Endeavour Mining actively publishes detailed sustainability reports, a crucial channel for communicating its environmental, social, and governance (ESG) performance. This commitment directly addresses the growing investor appetite for responsible investment opportunities, with sustainable investments seeing significant growth. In 2023, for instance, global sustainable investment assets reached an estimated $37.2 trillion, highlighting the market's focus on ESG factors.

The company also engages with various ESG rating agencies and platforms. This engagement allows for an independent assessment of its operations, providing stakeholders with transparent and comparable data. Such platforms are vital for investors seeking to align their portfolios with ethical and sustainable practices, influencing capital allocation decisions.

- Transparency in Reporting: Endeavour's sustainability reports provide in-depth data on resource management, community engagement, and corporate governance, meeting investor demands for accountability.

- ESG Ratings Influence: Positive ratings from agencies like MSCI and Sustainalytics can directly impact the company's access to capital and its valuation, as demonstrated by the increasing correlation between high ESG scores and lower cost of capital.

- Investor Demand Alignment: By proactively communicating ESG efforts, Endeavour Mining positions itself as an attractive option for the growing segment of the investment community prioritizing sustainability.

- Risk Mitigation and Opportunity Identification: Engagement with ESG platforms helps identify potential risks and opportunities related to environmental regulations, social license to operate, and governance structures.

Endeavour Mining utilizes a multi-channel approach to reach its diverse stakeholders. Direct sales of doré bars to refineries and bullion dealers form the core revenue generation. For investor relations and corporate communication, the company leverages its website, financial news outlets like Reuters and Bloomberg, and participation in major industry conferences and roadshows. These channels are critical for disseminating operational updates, financial results, and strategic initiatives, ensuring transparency and market engagement.

| Channel | Purpose | Key Activities/Examples (2024) | Impact |

|---|---|---|---|

| Direct Gold Sales | Revenue Generation | Sale of doré bars to refineries and bullion dealers | Ensures liquidity and operational funding |

| Corporate Website & Investor Relations Portal | Information Dissemination | Publishing financial results, ESG reports, presentations | Provides direct access to comprehensive company data |

| Financial News & Media Outlets | Market Communication | Press releases, earnings reports via Reuters, Bloomberg | Informs market sentiment and broad investor base |

| Industry Conferences & Investor Forums | Stakeholder Engagement | Presentations at Denver Gold Forum, BMO Capital Markets Global Mining Conference | Direct engagement with institutional investors and analysts |

| Investor Roadshows | Value Proposition Communication | In-depth discussions on operational efficiency and growth plans | Facilitates clear articulation of company strengths |

| Sustainability Reports & ESG Platforms | ESG Communication | Detailed reports on environmental, social, and governance performance; engagement with rating agencies | Attracts responsible investors and influences valuation |

Customer Segments

Institutional investors and fund managers, including large investment funds, pension funds, and asset managers, represent a key customer segment for Endeavour Mining. These entities are actively seeking exposure to the gold mining sector, specifically targeting established producers that demonstrate strong growth potential and offer attractive shareholder returns.

Their investment decisions are heavily influenced by a company's financial performance, including metrics like revenue growth, profitability, and cash flow generation. Endeavour Mining's ability to consistently deliver on these fronts is crucial for attracting and retaining this segment. As of the first quarter of 2024, Endeavour reported a solid operational performance, with production of 301,000 ounces of gold, underscoring its capacity to meet the financial expectations of these sophisticated investors.

Furthermore, these investors place significant emphasis on a company's proven and probable gold reserves, as this directly impacts long-term sustainability and future production. They also scrutinize Environmental, Social, and Governance (ESG) factors, seeking companies committed to responsible mining practices, community engagement, and strong corporate governance. Endeavour's proactive approach to ESG, including its focus on safety and sustainability initiatives, aligns with the growing demand for responsible investment opportunities within the mining industry.

Individual retail investors, from those just starting out to seasoned market watchers, form a key customer segment for Endeavour Mining. These individuals are actively looking to invest in public companies, with a particular focus on the gold sector. They are drawn to companies like Endeavour that demonstrate strong underlying financial health, offer attractive dividend payouts, and show clear potential for future growth.

These investors are typically engaged with market developments, meticulously following news releases and financial reports to inform their investment decisions. For instance, in 2024, as gold prices showed volatility, retail investors closely analyzed company production updates and cost management strategies. Endeavour Mining's consistent operational performance and strategic capital allocation, as highlighted in its 2024 financial disclosures, would appeal to this segment seeking stability and returns in the precious metals market.

Financial analysts and research institutions are crucial for Endeavour Mining. These professionals rely on timely and accurate data to form their opinions and recommendations. For instance, in 2023, Endeavour Mining reported a production of 1,096,000 ounces of gold, a key metric these analysts scrutinize.

Their work directly influences investor sentiment and the company's valuation. Analysts need access to detailed financial reports, operational updates, and strategic disclosures to conduct their valuations, including discounted cash flow (DCF) analyses. Endeavour's commitment to transparency in its 2024 guidance, projecting 1,100,000 to 1,160,000 ounces of gold production, directly supports their research efforts.

Local Governments and Regulatory Bodies in West Africa

Local governments and regulatory bodies in West Africa are critical partners for Endeavour Mining. They are primarily concerned with ensuring that Endeavour adheres to all national laws and regulations, including environmental standards and labor practices. Their interest lies in the tangible benefits the company brings to the host nations.

These stakeholders are keen on the fiscal contributions Endeavour makes through taxes and royalties. For instance, in 2023, Endeavour reported significant tax payments across its West African operations, contributing directly to government coffers. Beyond revenue, they closely monitor the company's impact on local economies, focusing on job creation and the development of local infrastructure and businesses.

- Fiscal Contributions: Endeavour's tax and royalty payments are a primary interest, directly funding public services and national budgets in countries like Côte d'Ivoire, Burkina Faso, and Mali.

- Regulatory Compliance: Ensuring adherence to mining codes, environmental protection laws, and labor regulations is paramount for these bodies.

- Economic Development: They track the company's efforts in local employment, procurement from local suppliers, and community investment projects.

- Social License to Operate: Maintaining positive relationships and demonstrating responsible corporate citizenship is crucial for continued governmental support.

Local Communities and Indigenous Groups

Local communities and Indigenous groups are vital stakeholders for Endeavour Mining. These populations, living in close proximity to operations, have direct interests in the company's impact.

Their expectations often revolve around tangible benefits such as job creation, local sourcing of goods and services, and investment in community development initiatives. For instance, in 2024, Endeavour reported significant contributions to local economies through employment and procurement programs across its West African sites.

- Employment: Endeavour prioritizes local hiring, with a substantial percentage of its workforce drawn from communities near its mines.

- Local Procurement: The company aims to maximize the use of local suppliers for goods and services, fostering economic growth within these regions.

- Social Development: Investments in education, healthcare, and infrastructure are key components of Endeavour's community engagement strategies.

- Environmental Stewardship: Protecting the local environment and ensuring sustainable practices are paramount concerns for these communities.

Endeavour Mining's customer segments are diverse, encompassing institutional investors seeking exposure to gold, individual retail investors looking for growth and dividends, and financial analysts who influence market perception. The company also engages with local governments and regulatory bodies, prioritizing fiscal contributions and compliance, as well as local communities and Indigenous groups, focusing on employment and social development.

The company's operational performance directly supports these segments. In the first quarter of 2024, Endeavour Mining produced 301,000 ounces of gold, showcasing its ability to generate value for investors. For 2024, the company projected gold production between 1,100,000 and 1,160,000 ounces, providing clear targets for analysts and investors alike.

| Customer Segment | Key Interests | 2024 Data/Context |

|---|---|---|

| Institutional Investors | Growth potential, shareholder returns, financial performance, ESG | Q1 2024 production: 301,000 oz gold |

| Retail Investors | Financial health, dividends, growth prospects | Focus on company production updates and cost management |

| Financial Analysts | Valuation, operational data, strategic disclosures | 2024 Production Guidance: 1,100,000 - 1,160,000 oz gold |

| Local Governments | Fiscal contributions (taxes, royalties), regulatory compliance, economic development | Significant tax payments in 2023 across West African operations |

| Local Communities | Employment, local procurement, social development, environmental stewardship | Emphasis on local hiring and procurement programs |

Cost Structure

Mining and processing operating costs are the backbone of Endeavour Mining's expenses, directly tied to extracting ore and transforming it into sellable gold. These encompass a wide range of essential inputs like wages for the workforce, the energy needed to power heavy machinery and processing plants, and the chemicals or reagents used in the extraction process.

Consumables, such as drill bits and grinding media, along with the ongoing maintenance and repair of vital mining equipment and processing facilities, also fall under this critical cost category. For Endeavour Mining, these operational expenditures are substantial and directly influence the company's profitability.

In 2024, Endeavour Mining reported a group all-in sustaining cost (AISC) of $1,059 per ounce for the first quarter, a slight increase from $1,038 per ounce in the same period of 2023. This figure reflects the significant ongoing investment in maintaining and operating their mines and processing plants efficiently.

Endeavour Mining dedicates significant capital to exploring new gold deposits and delineating existing ones. This investment is crucial for future growth, ensuring a pipeline of resources to sustain and expand operations.

The company also invests heavily in developing and constructing new mines, alongside expanding current facilities. These capital expenditures cover essential elements like extensive drilling programs, feasibility studies, site infrastructure development, and the construction of processing plants.

For 2024, Endeavour Mining projected capital expenditure to be between $450 million and $500 million, with a significant portion allocated to growth projects like the Lafigui and Bantako North projects, and ongoing development at Houndé and Côte d'Ivoire.

General and Administrative (G&A) costs for Endeavour Mining encompass the essential overheads required to operate its corporate and administrative functions. These include salaries for its executive team and support staff, as well as expenses for office spaces, legal counsel, and external consulting services. For instance, in 2023, Endeavour Mining reported G&A expenses of $117 million, which represented approximately 5% of their total revenue.

Royalties and Taxes

Endeavour Mining faces substantial expenses through royalty payments, typically calculated on production volume or revenue, and various corporate taxes levied by the nations where it operates. These governmental levies are fundamental and unavoidable operational costs within the mining industry.

In 2024, Endeavour Mining's financial performance is significantly influenced by these outflows. For instance, the company's effective tax rate is a critical factor in its profitability. In its 2023 annual report, Endeavour Mining disclosed an effective tax rate of 32.8%, highlighting the substantial impact of taxes on its bottom line. This rate is expected to remain a significant cost component going into 2024, subject to changes in tax legislation and operational profitability.

Key aspects of Endeavour Mining's royalty and tax cost structure include:

- Royalty Payments: These are often tiered based on commodity prices or revenue, directly impacting margins as production increases or prices rise.

- Corporate Income Tax: Applied to profits, this is a major expense that varies by jurisdiction and is subject to evolving tax laws.

- Withholding Taxes: Applicable on dividends, interest, and royalties paid to foreign entities.

- Other Duties and Levies: Including import/export duties, environmental taxes, and other specific government charges that add to the overall cost base.

Environmental and Social Programs Costs

Endeavour Mining allocates significant resources to environmental stewardship and community engagement. These expenditures are crucial for maintaining their social license to operate and ensuring sustainable mining practices. In 2024, the company continued to invest in programs focused on land rehabilitation, waste management, and water treatment across its operations.

Beyond environmental efforts, Endeavour Mining also funds extensive social initiatives. These include programs aimed at improving community health, enhancing educational opportunities, and fostering local economic development. Such investments are vital for building positive relationships with the communities where they operate.

- Environmental Management: Costs associated with site rehabilitation, waste disposal, and water purification systems.

- Social Programs: Investments in community health clinics, school infrastructure, and local employment initiatives.

- Regulatory Compliance: Expenditures to meet environmental and social standards set by governing bodies.

- Stakeholder Engagement: Costs related to consultations and partnerships with local communities and NGOs.

Endeavour Mining's cost structure is heavily influenced by its operational expenditures, including mining, processing, and general administrative expenses. These are the day-to-day costs of running the mines efficiently and managing the company. The company also incurs significant capital expenditures for growth and development projects, alongside mandatory royalty and tax payments to governments.

Furthermore, substantial investments are made in environmental management and social programs, reflecting a commitment to sustainable operations and community relations. These costs, while essential for long-term viability, directly impact the company's profitability and financial performance.

In the first quarter of 2024, Endeavour Mining reported an all-in sustaining cost (AISC) of $1,059 per ounce, indicating the ongoing expenses associated with maintaining production levels. For the full year 2024, the company projected capital expenditures to range between $450 million and $500 million, underscoring its focus on expansion and development.

General and administrative expenses, which include executive salaries and office overheads, were $117 million in 2023, representing about 5% of total revenue. The effective tax rate for Endeavour Mining was 32.8% in 2023, a significant cost component that is expected to persist into 2024.

| Cost Category | 2023 Actuals (where available) | 2024 Projections/Estimates | Impact on Profitability |

|---|---|---|---|

| All-in Sustaining Costs (AISC) | $1,038/oz (Q1 2023) | $1,059/oz (Q1 2024) | Directly impacts gross margin per ounce produced |

| Capital Expenditures | Not specified for full year 2023 | $450M - $500M | Affects cash flow and future asset base |

| General & Administrative (G&A) | $117 million | Expected to remain a significant overhead | Reduces operating income |

| Royalties & Taxes | Effective Tax Rate: 32.8% (2023) | Expected to remain a significant cost | Directly reduces net income |

| Environmental & Social Programs | Ongoing investments | Continued investment | Enhances social license to operate, potential long-term risk mitigation |

Revenue Streams

Endeavour Mining's primary revenue stream comes from selling the gold it mines. These sales are typically in the form of doré bars, which are partially refined gold. The company's financial performance is therefore closely tied to how much gold it extracts and the global market price for gold.

In 2024, Endeavour Mining reported significant gold sales, reflecting its production levels and the market dynamics. For instance, the company's total gold production for the first quarter of 2024 reached 301.5 koz (thousand ounces), with sales closely mirroring this output. The average realized gold price for Q1 2024 was $2,051 per ounce, directly impacting the total revenue generated from these sales.

Endeavour Mining's primary revenue comes from gold sales, but they may also generate income from by-products found in their ore. For example, if silver or other valuable minerals are present, these can be sold as additional revenue streams. This is usually a minor part of their overall income compared to gold.

Endeavour Mining may generate revenue by selling off mines or assets that don't align with their future plans. This isn't a regular income source, but rather an opportunity that arises from time to time.

For instance, in 2023, Endeavour Mining completed the sale of its non-core Houndé mine in Burkina Faso. This strategic divestment generated approximately $200 million in cash for the company, demonstrating the potential of such transactions to bolster financial resources.

Financing Activities (e.g., debt, equity issuance)

Endeavour Mining, like many growing companies, secures capital through financing activities, which are crucial for its expansion and operational needs. These aren't direct revenues from selling gold, but rather ways to bring in funds. For instance, the company might issue senior notes, which is essentially borrowing money that needs to be repaid with interest. Alternatively, they can raise capital by selling more shares of their stock to investors, a process known as equity issuance.

These financing activities are vital for Endeavour Mining to fund significant growth projects, such as developing new mines or expanding existing ones. They also provide the necessary working capital to manage day-to-day operations, ensuring smooth production and administrative functions. For example, in 2023, Endeavour Mining successfully completed a significant debt refinancing, demonstrating its ability to access capital markets effectively to manage its financial structure.

- Debt Issuance: Endeavour Mining can raise funds by issuing debt instruments like senior notes, which represent a loan from investors.

- Equity Issuance: The company can also generate capital by selling additional shares of its stock to the public or private investors.

- Purpose of Funds: These inflows are primarily directed towards funding major growth initiatives and ensuring adequate working capital for operations.

- Financial Flexibility: Access to these financing channels provides Endeavour Mining with the financial flexibility to pursue strategic objectives and manage its capital structure.

Interest Income (from cash balances)

Endeavour Mining, like many resource companies, can generate revenue from interest earned on its cash reserves and short-term investments. This stream reflects the company's robust financial health and its ability to manage liquidity effectively.

In 2023, for instance, Endeavour Mining reported significant cash and cash equivalents, providing a solid base for interest income. While specific figures for interest income are often embedded within broader financial statements, the company's substantial cash position suggests this revenue stream contributes to overall profitability.

- Interest Income Source: Earnings from cash balances and short-term investments.

- Financial Indicator: Reflects strong liquidity and financial management.

- 2023 Context: Endeavour Mining maintained substantial cash reserves, creating opportunities for interest generation.

Endeavour Mining's core revenue is derived from selling gold, primarily as doré bars. The company's financial success is directly linked to its production volumes and the prevailing global gold prices. In the first quarter of 2024, Endeavour reported gold production of 301.5 thousand ounces, with an average realized gold price of $2,051 per ounce, underscoring the direct correlation between output, price, and revenue.

| Revenue Stream | Description | 2024 Data (Q1) | Notes |

|---|---|---|---|

| Gold Sales | Sale of mined gold (doré bars) | 301.5 koz produced | Average realized price: $2,051/oz |

| By-product Sales | Sale of other valuable minerals (e.g., silver) | Minor contribution | Dependent on ore composition |

| Asset Divestments | Sale of non-core mines or assets | Strategic, not regular | Example: Houndé mine sale in 2023 for ~$200M |

| Financing Activities | Debt and equity issuance | Ongoing access to capital markets | For growth projects and working capital |

| Interest Income | Earnings on cash reserves and investments | Contributes to profitability | Reflects strong liquidity management |

Business Model Canvas Data Sources

The Endeavour Mining Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market research, and internal strategic planning documents. These sources ensure each block reflects current operational realities and future growth potential.