Endeavour Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endeavour Mining Bundle

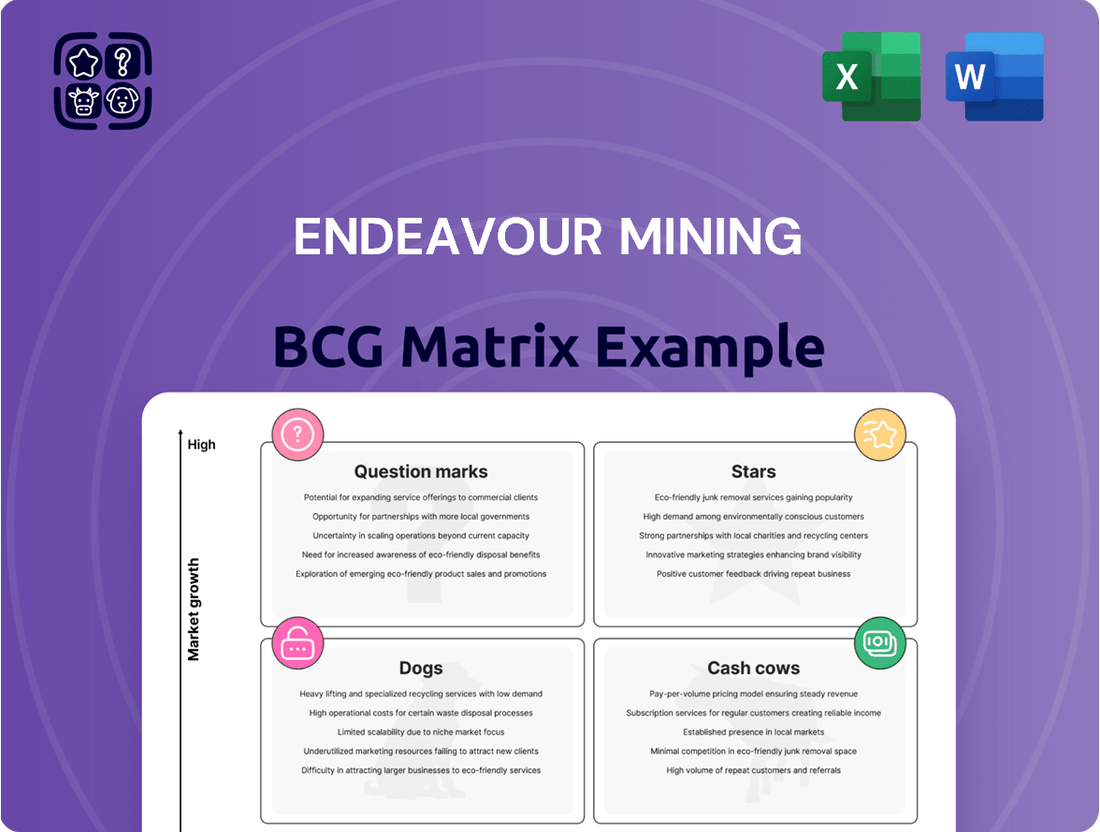

Curious about Endeavour Mining's strategic positioning? This preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. To truly understand where their resources are best allocated and to unlock actionable growth strategies, dive into the complete BCG Matrix.

Gain a comprehensive understanding of Endeavour Mining's market share and growth potential by purchasing the full BCG Matrix. This detailed report will equip you with the insights needed to make informed investment decisions and optimize your product strategy for maximum impact.

Stars

Lafigué, Endeavour's newest mine, began operations in the second quarter of 2024. It is expected to produce between 180,000 and 210,000 ounces in fiscal year 2025. This production comes with a competitive All-in Sustaining Cost (AISC) of $950 to $1,075 per ounce, making it a strong contender in the market.

The swift ramp-up at Lafigué, along with its projected significant output and cost efficiency, marks it as a crucial growth engine for Endeavour. Its position in the expanding West African gold market is further solidified by these impressive early performance indicators.

The Sabodala-Massawa BIOX Expansion, completed in 2024, has transformed the mine into a premier asset for Endeavour Mining. This strategic development targets an annual production exceeding 300,000 ounces, boasting an industry-leading All-In Sustaining Cost (AISC).

This significant capacity increase, particularly in processing refractory ores, highlights Sabodala-Massawa's robust growth potential and solidifies its position as a key player within Endeavour's mining portfolio.

The Houndé mine is demonstrating robust performance, exceeding expectations in Q1 2025 production by prioritizing high-grade ore. This strategic focus has solidified its position as a cornerstone asset for Endeavour Mining.

Houndé is projected to maintain production levels exceeding 250,000 ounces annually for the next decade. This sustained output, coupled with industry-leading All-In Sustaining Costs (AISC), underscores its significant and enduring market share in a dynamically expanding region.

Ity Mine Performance

The Ity mine stands as another foundational asset for Endeavour Mining, demonstrating a history of exceptional production. In 2023, it achieved record output, underscoring its consistent and significant contribution to the company's total production figures.

Its sustained robust performance, coupled with an extended mine life and successful ongoing exploration efforts in the vicinity, solidifies Ity's position as a high-market-share asset within a region poised for growth.

- Ity Mine Production (2023): 360,000 ounces (record performance)

- Contribution to Group Output: A cornerstone asset, consistently exceeding targets.

- Market Position: High market share in a growth-oriented region.

- Exploration Success: Ongoing near-mine exploration continues to extend mine life and enhance resource potential.

Overall Production Growth & Market Leadership

Endeavour Mining stands as West Africa's dominant gold producer, a region anticipated to experience a significant upswing in gold output, with projections exceeding 10% growth by 2025. This positions Endeavour favorably within a burgeoning market.

The company's strategic focus on maximizing free cash flow and improving shareholder returns, coupled with its commitment to advancing a robust organic growth pipeline, underscores its market leadership. This dual approach not only solidifies its current standing but also signals a clear investment in expanding its market share.

- West African Gold Production Growth: Projected to exceed 10% by 2025.

- Endeavour's Market Position: Largest gold producer in West Africa.

- Strategic Priorities: Maximizing free cash flow and enhancing shareholder returns.

- Growth Strategy: Advancing a high-quality organic growth pipeline for continued market share expansion.

The Ity and Houndé mines, along with the recently expanded Sabodala-Massawa, consistently deliver strong production figures and cost efficiencies, positioning them as Endeavour Mining's Stars. Ity achieved a record 360,000 ounces in 2023, while Houndé is projected to exceed 250,000 ounces annually for the next decade. Sabodala-Massawa's BIOX expansion targets over 300,000 ounces annually, solidifying these assets as key drivers of Endeavour's market leadership in West Africa.

| Asset | 2023 Production (oz) | Projected FY25 Production (oz) | AISC ($/oz) | Status |

|---|---|---|---|---|

| Ity | 360,000 (Record) | N/A | Competitive | Star |

| Houndé | N/A | >250,000 annually | Industry-leading | Star |

| Sabodala-Massawa | N/A | >300,000 annually | Industry-leading | Star |

| Lafigué | N/A | 180,000 - 210,000 (FY25) | $950 - $1,075 | Question Mark (Emerging Star) |

What is included in the product

Endeavour Mining's BCG Matrix offers a tailored analysis of its mining assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

The Endeavour Mining BCG Matrix provides a clear, visual roadmap to optimize resource allocation, alleviating the pain of inefficient investment decisions.

Cash Cows

Ity Mine, a foundational asset for Endeavour Mining, exemplifies a Cash Cow. While possessing Star-like qualities due to ongoing exploration, its mature status and consistent, low-cost production profile solidify its role as a reliable cash generator.

Since 1991, Ity has yielded over 3.4 million ounces, underscoring its longevity and contribution. Its stable output and extended projected mine life ensure it continues to be a significant source of free cash flow for the company.

The Houndé mine, operational since 2017, stands as a key asset for Endeavour Mining, consistently delivering robust operational results and achieving a leading All-In Sustaining Cost (AISC). This mature, high-market-share operation significantly bolsters Endeavour's cash flow, demanding comparatively lower growth investments.

Endeavour Mining's Mana Mine, acquired in 2020, has seen significant production improvements in 2024 due to a strategic focus on its underground resources and operational optimization. This enhanced productivity, coupled with efforts to extend the mine's life, solidifies its position as a key cash cow for the company.

In 2024, Mana Mine's optimized operations contributed to a robust cash flow generation, reflecting its mature stage of production. The company's investment in improving efficiency at Mana underscores its value as a reliable income stream, supporting Endeavour Mining's broader strategic objectives.

Sabodala-Massawa (Pre-Expansion Stability)

Before its recent BIOX expansion, the Sabodala-Massawa mine, established in 2009, was a cornerstone for Endeavour Mining. It consistently generated significant gold production and robust cash flow, positioning it as a mature, high-market-share asset.

- Established in 2009

- Consistent gold output and cash flow generation

- Mature asset with high market share

Robust Balance Sheet & Shareholder Returns

Endeavour Mining's financial strength is a key indicator of its Cash Cows. The company demonstrated exceptional performance, generating record free cash flow of $226 million in the first quarter of 2025. This robust cash generation, coupled with a significant reduction in net debt, highlights a business model heavily reliant on mature, high-performing assets that consistently produce strong returns.

This financial prowess directly fuels Endeavour's commitment to shareholder returns. The company consistently rewards its investors through substantial dividends and share buyback programs. For instance, in 2024, Endeavour paid out $250 million in dividends, reflecting the confidence derived from its stable, cash-generative mining operations.

- Record Q1 2025 Free Cash Flow: $226 million generated, underscoring the cash-generating power of its mature assets.

- Significant Debt Reduction: Demonstrates a healthy financial structure and efficient use of cash.

- Robust Shareholder Returns: Evidenced by $250 million in dividends paid in 2024, a direct benefit of strong cash flow.

- Dominance of Cash-Generative Assets: The company's portfolio is characterized by mines that consistently produce substantial cash, supporting its Cash Cow status.

Endeavour Mining's Cash Cows are its mature, high-production assets that consistently generate significant free cash flow with minimal reinvestment needs. These operations, like Ity, Houndé, and Mana, form the backbone of the company's financial stability and ability to fund growth initiatives and shareholder returns.

The company's financial performance in early 2025, including a record $226 million in free cash flow in Q1 2025, directly reflects the strength of these Cash Cow assets. This consistent cash generation allowed Endeavour to pay out $250 million in dividends in 2024, demonstrating the tangible benefits of its well-established mining operations.

| Asset | Operational Status | Cash Flow Contribution | Key Metric |

|---|---|---|---|

| Ity Mine | Mature, consistent production | Significant free cash flow generator | Over 3.4 million ounces produced since 1991 |

| Houndé Mine | Operational since 2017, mature | Robust cash flow, low AISC | Leading All-In Sustaining Cost (AISC) |

| Mana Mine | Acquired 2020, optimized in 2024 | Enhanced cash flow from underground focus | Improved productivity and extended mine life |

Preview = Final Product

Endeavour Mining BCG Matrix

The Endeavour Mining BCG Matrix preview you see is the definitive, final document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for your immediate use. You are viewing the exact report that will be delivered to you, meticulously crafted to provide clear insights into Endeavour Mining's portfolio for informed decision-making.

Dogs

The Boungou and Wahgnion mines, divested by Endeavour Mining on June 30, 2023, represent assets that were likely categorized as Dogs in a BCG matrix analysis. Their sale for a combined $300 million underscores Endeavour's strategic pivot towards optimizing its portfolio and focusing on core, high-growth operations.

Underperforming legacy assets, while not currently a dominant feature for Endeavour Mining, represent a potential category that could emerge. These would be older, smaller mines facing rising operational expenses, lower ore grades, or heightened geopolitical uncertainties without a clear path to improvement. Such assets would likely consume cash without yielding commensurate returns, placing them in the Dogs quadrant of the BCG matrix – characterized by low growth and low market share.

If Endeavour Mining's mines consistently exceed their projected All-in Sustaining Costs (AISC) due to ongoing operational issues or diminishing productivity, they could be classified as Dogs in the BCG Matrix. For instance, if a mine's AISC rose by 15% above its 2024 guidance, pushing it to $1,500 per ounce when the gold price hovers around $2,000, its profitability would be severely impacted.

These underperforming assets would find it challenging to generate consistent profits, particularly in a volatile gold market, diminishing their appeal for further investment. Such a scenario might see a mine's contribution to overall company earnings shrink significantly, making it a drag on performance.

Assets with Limited Exploration Upside (Hypothetical)

Mines that have reached the end of their near-mine exploration potential and lack a clear strategy to extend their operational life or boost reserves are considered assets with limited exploration upside. These mines, by their nature, will see their production gradually decrease over time.

Endeavour Mining makes significant investments in exploration activities specifically to avoid this scenario and ensure the longevity of its assets. However, a hypothetical asset within Endeavour's portfolio that does not possess organic growth potential through exploration would fall into this category.

- Limited Growth Potential: Assets in this category have exhausted near-mine exploration opportunities.

- Production Decline: Without new discoveries or extensions, production naturally tapers off.

- Strategic Focus: Endeavour's exploration efforts aim to prevent assets from entering this stage.

- Hypothetical Classification: An asset lacking organic growth pathways would be classified here.

Projects Facing Prolonged Delays or Cost Overruns (Hypothetical)

Projects facing prolonged delays or significant cost overruns can become cash traps, draining resources without generating anticipated returns. For Endeavour Mining, this scenario would mean a project shifting from a potential Star or Question Mark into a Dog category within the BCG matrix. For instance, if a hypothetical new mine development, initially projected to cost $500 million and come online in 2026, instead faces a two-year delay and a 30% cost increase to $650 million, its viability as a future cash generator diminishes significantly.

Endeavour Mining's strategic approach prioritizes robust planning and execution to mitigate these risks. Their commitment to on-budget and on-schedule project delivery, as demonstrated by the successful completion of the Houndé mine expansion, helps prevent projects from languishing as Dogs. In 2023, Endeavour reported that their capital expenditure for the year was approximately $426 million, with a focus on advancing key growth projects like the Lafigui Phase II expansion and the exploration at their Kalana project.

- Projected Cost Escalation: A hypothetical project delay from 2026 to 2028, coupled with a 30% cost overrun, would transform a potential asset into a financial burden.

- Capital Consumption: Such delayed projects consume capital that could be deployed to more promising ventures or returned to shareholders.

- Endeavour's Mitigation Strategy: The company's historical success in project management aims to prevent the creation of such underperforming assets.

- 2023 Capital Allocation: Endeavour's $426 million capital expenditure in 2023 highlights their investment in growth, underscoring the importance of efficient project execution.

Mines with declining ore grades and increasing operational costs, like a hypothetical asset with AISC rising 15% above its 2024 guidance to $1,500/oz when gold is $2,000/oz, would be classified as Dogs. These assets struggle to generate profits, especially in volatile markets, becoming a drag on overall company performance.

Assets that have exhausted near-mine exploration potential and lack a strategy for life extension are also Dogs. Endeavour Mining actively invests in exploration to prevent this, but an asset without organic growth would naturally see declining production.

Projects facing significant delays and cost overruns, such as a hypothetical $500 million project delayed by two years and facing a 30% cost increase to $650 million, can become cash traps. Endeavour's focus on efficient project execution, exemplified by their 2023 capital expenditure of $426 million on growth projects, aims to prevent such scenarios.

| Asset Type | Market Growth | Relative Market Share | Endeavour Mining Example/Consideration |

|---|---|---|---|

| Dogs | Low | Low | Divested mines (e.g., Boungou, Wahgnion), underperforming legacy assets, projects with severe delays/cost overruns. |

| Hypothetical mine with AISC 15% above 2024 guidance ($1,500/oz vs $2,000/oz gold price). | |||

| Projects with significant capital overruns (e.g., 30% increase on $500M project). |

Question Marks

The Assafou project, a key Tier 1 development for Endeavour Mining, is currently classified as a Question Mark in the BCG Matrix. Its high growth potential is underscored by a Definitive Feasibility Study (DFS) anticipated between late 2025 and early 2026.

With a substantial maiden reserve of 4.1 million ounces, Assafou represents a significant future asset. However, its current status as a cash-consuming development project places it firmly in the Question Mark quadrant, poised for potential transition into a Star performer with successful development and production.

Exploration continues at the Pala Trend 3 target, situated near Assafou. Endeavour Mining anticipates a maiden resource estimate for this area in the second half of 2025.

This development signifies an early-stage exploration success, showcasing high growth potential. However, as it currently has no production and no established market share, it aligns with the characteristics of a 'Question Mark' in the BCG matrix.

Endeavour Mining's Siguiri exploration licenses in Guinea represent classic question marks within the BCG framework. These areas are strategically located near existing mining operations, suggesting a favorable geological setting and potential for resource discovery.

These high-potential exploration properties require substantial capital outlay to define resources and progress through the development pipeline. Consequently, they are categorized as question marks, characterized by uncertain but potentially significant returns on investment.

Other Regional Exploration Targets

Endeavour Mining holds a significant exploration land package throughout West Africa, actively seeking new discoveries to achieve its long-term resource objectives. These numerous early-stage exploration targets are characterized as high-growth opportunities with currently low market share, necessitating substantial cash investment to ascertain their economic viability.

For instance, as of the first quarter of 2024, Endeavour reported a robust exploration program, with over 100,000 meters of drilling completed across its extensive portfolio of greenfield and brownfield targets. This investment is crucial for identifying and delineating new mineral resources, which are essential for future production growth.

- Significant Land Holdings: Endeavour controls a vast exploration land package, providing a broad base for discovering new mineral deposits.

- High Growth Potential: These early-stage targets represent opportunities for substantial resource growth, albeit with higher exploration risk.

- Investment Requirements: Proving the economic viability of these targets demands significant capital expenditure for drilling and technical studies.

- Strategic Importance: These targets are vital for Endeavour's long-term strategy of replenishing its resource base and ensuring future operational sustainability.

Kalana Project

The Kalana project, acquired by Endeavour Mining in 2017, is situated in Mali. Its pre-feasibility study, released in February 2021, presented a positive outlook. This project is considered a question mark in the BCG matrix because, despite its advanced stage and promising study, it requires significant capital for development and is not yet generating revenue.

Key aspects of the Kalana project's question mark status include:

- Advanced Development Stage: The project has completed a pre-feasibility study, indicating substantial progress in technical and economic evaluations.

- Future Potential: The positive PFS suggests strong potential for future profitability and market share growth if development proceeds successfully.

- Investment Requirement: Kalana is not yet in production and necessitates further substantial investment to reach the operational phase, a characteristic of question mark assets.

- Geographical Context: Located in Mali, the project's operational environment presents specific geopolitical and logistical considerations influencing its development trajectory.

Question Marks in Endeavour Mining's portfolio represent high-growth potential assets that currently have low market share, requiring significant investment to determine their future viability. These include early-stage exploration targets and development projects not yet in production.

The Assafou project, with its maiden reserve of 4.1 million ounces, and the Pala Trend 3 exploration area, targeting a maiden resource estimate in H2 2025, exemplify this category. Similarly, Kalana, despite its positive pre-feasibility study, remains a question mark due to its need for substantial development capital.

Endeavour's extensive exploration efforts across West Africa, involving over 100,000 meters of drilling in Q1 2024, are aimed at converting these question marks into future revenue-generating assets.

These investments are critical for Endeavour's long-term strategy of resource replenishment and future growth.

| Project/Area | BCG Category | Key Characteristics | Investment Stage | Potential |

|---|---|---|---|---|

| Assafou | Question Mark | Tier 1 development, 4.1 Moz maiden reserve | Development (DFS expected late 2025/early 2026) | High growth, potential Star |

| Pala Trend 3 | Question Mark | Exploration, near Assafou | Early-stage exploration (Maiden resource H2 2025) | High growth potential |

| Kalana | Question Mark | Acquired 2017, positive PFS (Feb 2021) | Development (requires significant capital) | Future profitability, market share growth |

| Siguiri Exploration | Question Mark | Strategic location near operations | Exploration (resource definition needed) | Potential resource discovery |

| West Africa Exploration Portfolio | Question Mark | Extensive land package, numerous targets | Early-stage (significant cash investment for viability) | Long-term resource objectives |

BCG Matrix Data Sources

Our Endeavour Mining BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.