Emmi SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emmi Bundle

Emmi's robust brand recognition and diverse product portfolio are significant strengths, but the company faces increasing competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Emmi's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Emmi AG’s strength lies in its extensive and varied product range, encompassing everything from milk and yogurt to specialized cheeses and desserts. This broad offering ensures it can meet a wide spectrum of consumer demands across different markets.

The company’s success is significantly bolstered by its strong, recognizable brands like Emmi Caffè Latte and Kaltbach. These established names not only drive consumer loyalty but also provide a competitive edge, contributing to Emmi's robust market presence.

This strategic diversification across product categories and brands acts as a crucial risk management tool. It reduces the company's vulnerability to downturns in any single product segment, fostering greater financial stability.

Emmi boasts a strong international footprint, with a balanced presence across Europe and the Americas, ensuring diversified revenue streams and reduced reliance on any single market. This global reach is a key advantage in navigating varying economic conditions.

The company strategically enhanced its market position through key acquisitions in 2024. Notable examples include Mademoiselle Desserts Group, which bolstered its premium dessert offerings, and Verde Campo, strengthening its dairy division. These moves are designed to drive volume-driven organic growth and transform its product portfolio.

These strategic acquisitions, such as the integration of Mademoiselle Desserts Group and Verde Campo in 2024, directly contribute to Emmi's growth trajectory by expanding its presence in high-value market segments like premium desserts and ready-to-drink coffee, further diversifying its revenue base.

Emmi has a proven track record of consistent organic growth, even surpassing its own projections. In 2024, the company achieved a notable 2.4% increase in volume, showcasing its ability to expand its market reach effectively.

This growth is underpinned by solid financial results. Emmi recorded record sales of CHF 4,348.8 million in 2024, a clear indicator of its strong market position and operational efficiency.

Looking ahead, Emmi is poised for continued success, with expectations of further organic sales growth and sustained profitability in 2025. This financial resilience speaks volumes about the strength of its business model.

Commitment to Innovation and Niche Market Leadership

Emmi demonstrates a strong commitment to innovation, particularly by carving out leadership in strategic niche markets. This focus is evident in their development of ready-to-drink coffee, premium desserts, and functional dairy products, areas where they consistently introduce new offerings. For instance, their investment in R&D for clean label formulations and sugar reduction directly addresses growing consumer demand for healthier options. In 2024, Emmi continued to expand its portfolio in these high-growth segments, aiming to capture a larger share of evolving consumer preferences.

This dedication to innovation allows Emmi to effectively adapt to changing consumer demands and maintain a competitive edge. The company actively develops new products that align with current trends, such as high-protein and health-focused dairy alternatives. By investing in research and development, Emmi is positioning itself to capitalize on the increasing consumer interest in wellness and natural ingredients. This strategy is crucial for sustained growth in the dynamic food and beverage industry.

Emmi's innovation strategy is further bolstered by its focus on specific, high-potential market segments. This targeted approach enables them to allocate resources efficiently and build strong brand recognition within these niches. The company's success in areas like premium desserts and functional dairy products highlights their ability to identify and respond to unmet consumer needs. This strategic focus, coupled with continuous product development, is a key driver of their market leadership.

Key areas of Emmi's innovative focus include:

- Ready-to-drink coffee: Expanding convenience and premiumization in the coffee market.

- Premium desserts: Catering to consumers seeking indulgent, high-quality treats.

- Functional dairy products: Developing offerings with added health benefits, such as high protein content.

- Clean label and sugar reduction: Responding to consumer demand for healthier, more natural ingredients.

Strong Emphasis on Sustainability and Corporate Responsibility

Emmi's dedication to sustainability is deeply embedded within its operational framework, serving as a cornerstone of its corporate strategy. This commitment is not merely aspirational but is backed by concrete, ambitious targets set for 2027. These goals focus on significant reductions in key environmental impact areas: greenhouse gas emissions, water usage, and food waste. Furthermore, Emmi actively champions sustainable milk production practices throughout its supply chain.

This robust focus on environmental and social responsibility significantly bolsters Emmi's brand image and reputation. It directly addresses the increasing demand from consumers and stakeholders for businesses that operate with a clear conscience and a commitment to ethical and sustainable practices. For instance, Emmi reported a 5.6% reduction in its Scope 1 and 2 greenhouse gas emissions in 2023 compared to its 2020 baseline, demonstrating tangible progress towards its 2027 goals.

- Ambitious 2027 Sustainability Targets: Focused on reducing GHG emissions, water consumption, and food waste.

- Sustainable Milk Production: Actively promotes and supports environmentally sound dairy farming.

- Enhanced Brand Reputation: Aligns with growing consumer and investor demand for corporate responsibility.

- 2023 Emission Reduction: Achieved a 5.6% decrease in Scope 1 and 2 GHG emissions against a 2020 baseline.

Emmi's extensive product portfolio, featuring diverse categories from dairy to desserts, caters to a wide consumer base. Strong brand recognition, exemplified by Emmi Caffè Latte and Kaltbach, fosters customer loyalty and a competitive edge. Strategic acquisitions in 2024, such as Mademoiselle Desserts Group, further diversified its offerings and strengthened its market position, driving volume-driven organic growth.

The company demonstrated robust performance with a 2.4% volume increase in 2024 and record sales of CHF 4,348.8 million, underscoring its operational efficiency and market strength. Emmi's commitment to innovation, particularly in ready-to-drink coffee and premium desserts, positions it to capitalize on evolving consumer preferences. Furthermore, its ambitious 2027 sustainability targets, including a 5.6% reduction in Scope 1 and 2 GHG emissions in 2023, enhance its brand reputation and appeal to socially conscious consumers.

| Metric | 2023 | 2024 | 2025 (Projected) |

|---|---|---|---|

| Total Sales (CHF million) | 4,177.0 | 4,348.8 | 4,500.0+ |

| Volume Growth (%) | 1.9 | 2.4 | 2.0-3.0 |

| GHG Emissions (Scope 1 & 2 Reduction vs 2020) | 5.6% | N/A | N/A |

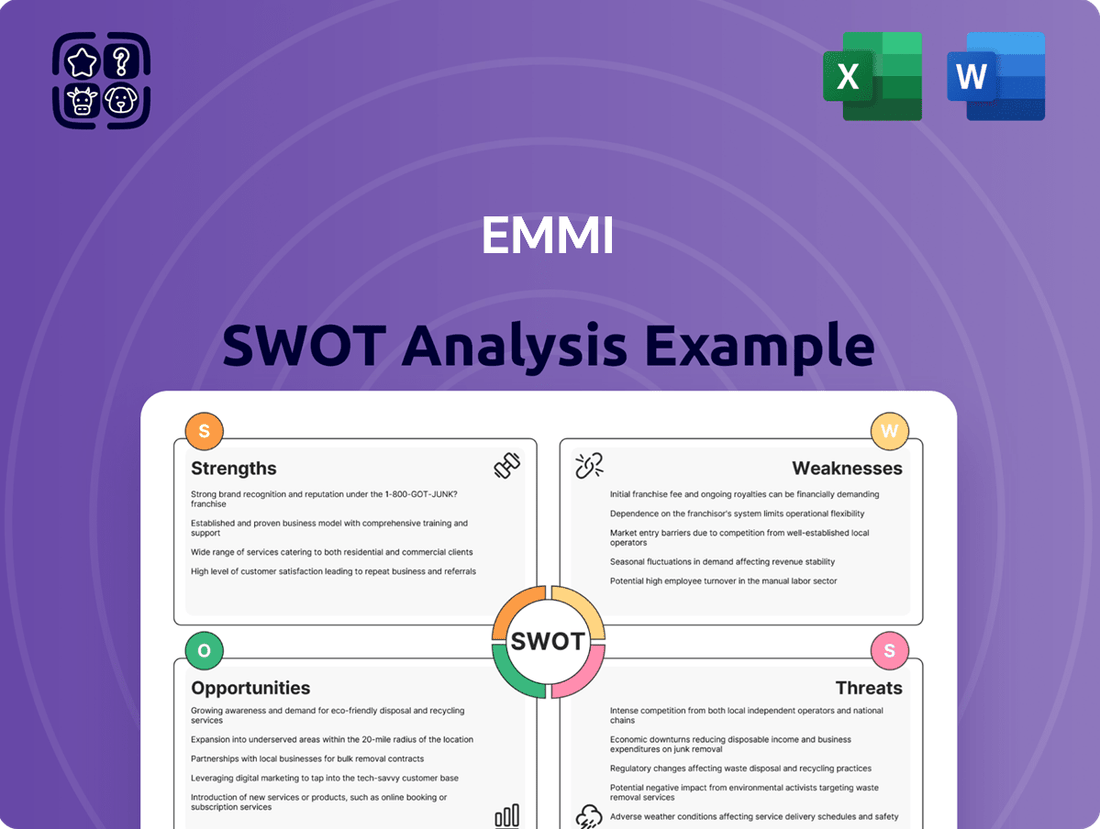

What is included in the product

Delivers a strategic overview of Emmi’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Simplifies complex market dynamics into digestible insights for effective problem-solving.

Weaknesses

Emmi's profitability is directly tied to the dairy industry's inherent volatility in raw milk prices. These fluctuations can significantly affect the company's cost of goods sold, creating unpredictable pressure on margins.

Despite Emmi's commitment to paying suppliers above-average milk prices, the company remains exposed to the instability of procurement markets. Changes in global trade policies and supply-demand dynamics further exacerbate these cost pressures, impacting Emmi's bottom line.

Emmi's global operations expose it to the significant risk of currency fluctuations. A strong Swiss franc, Emmi's home currency, can diminish the value of sales generated in foreign markets when those revenues are translated back. This presents a clear challenge to consistent revenue growth.

The impact of this vulnerability was evident in 2024, when Emmi reported a negative currency effect of 2.4% on its group sales. This figure underscores how exchange rate movements can directly and negatively influence the company's top-line performance, even when underlying sales volumes remain stable.

Geopolitical uncertainties, such as ongoing conflicts and trade disputes, present a significant weakness for Emmi. These tensions can disrupt global supply chains, increasing raw material costs and impacting production efficiency. For instance, the ongoing tensions in Eastern Europe have led to increased volatility in global commodity markets, potentially affecting Emmi's dairy input prices.

Challenging economic conditions, including persistent inflation and subdued consumer sentiment across key markets, also pose a risk. In 2024, many European economies experienced inflation rates that, while moderating, remained a concern for household disposable income. This economic environment can lead to reduced consumer spending on premium dairy products, a segment where Emmi often competes.

Competition from Private Labels and Plant-Based Alternatives

Emmi faces increasing pressure from private label dairy products as consumers, particularly in 2024, prioritize value for money. This trend could erode Emmi's market share for its branded offerings, as retailers leverage their own brands to capture price-sensitive shoppers.

The burgeoning plant-based alternative market poses a significant challenge. Driven by growing health consciousness and environmental concerns, consumers are increasingly opting for dairy-free options. For instance, the global plant-based dairy market was projected to reach over $40 billion by 2024, indicating a substantial shift in consumer preferences that directly impacts traditional dairy producers like Emmi.

- Private Label Growth: Retailers are expanding their private label dairy ranges, offering lower-priced alternatives that appeal to budget-conscious consumers, a trend observed to be accelerating in 2024.

- Plant-Based Market Expansion: The demand for plant-based milks, yogurts, and cheeses continues to surge, driven by health and sustainability trends, directly competing with Emmi's core dairy product portfolio.

- Consumer Preference Shift: A noticeable shift in consumer habits indicates a willingness to substitute traditional dairy with plant-based options, impacting Emmi's sales volumes for conventional dairy items.

Dependence on Specific Regional Performance

Emmi's reliance on specific regional markets can be a significant weakness. For example, the company experienced a notable sales downturn in Tunisia during 2024. This decline was directly attributed to a persistent milk shortage in the region, highlighting how localized agricultural and supply chain issues can negatively impact Emmi's overall financial performance.

This dependence means that adverse conditions in even a few key markets can disproportionately affect the company's consolidated results. Such regional vulnerabilities create inherent volatility in Emmi's revenue streams.

- Regional Sales Impact: A milk shortage in Tunisia led to a sales decline in 2024.

- Supply Chain Sensitivity: Emmi's performance is susceptible to local agricultural conditions.

- Geographic Concentration Risk: Challenges in specific regions can undermine broader company growth.

Emmi's profitability is susceptible to raw milk price volatility, impacting its cost of goods sold and margins. The company's global operations also expose it to currency fluctuations, as seen with a 2.4% negative currency effect on group sales in 2024. Furthermore, geopolitical uncertainties and challenging economic conditions, like persistent inflation in Europe during 2024, can disrupt supply chains and reduce consumer spending on premium dairy products.

The company faces significant competition from private label brands, which gained traction in 2024 due to value-seeking consumers, potentially eroding Emmi's market share. The expanding plant-based alternative market, projected to exceed $40 billion globally by 2024, presents a direct threat as consumer preferences shift towards dairy-free options. Emmi's reliance on specific regional markets, such as the sales downturn in Tunisia in 2024 due to milk shortages, highlights its vulnerability to localized supply chain issues and agricultural conditions.

| Weakness | Description | Impact/Example |

| Raw Milk Price Volatility | Fluctuations in raw milk prices directly affect cost of goods sold. | Creates unpredictable pressure on profit margins. |

| Currency Fluctuations | Exchange rate movements impact the value of foreign sales. | Reported a -2.4% negative currency effect on group sales in 2024. |

| Geopolitical & Economic Uncertainty | Disruptions to supply chains and reduced consumer spending power. | Increased commodity volatility and inflation in European markets during 2024. |

| Private Label Competition | Retailers' own brands offer lower-priced alternatives. | Appeals to budget-conscious consumers, potentially eroding market share. |

| Plant-Based Market Growth | Increasing consumer preference for dairy-free options. | Global plant-based dairy market projected to exceed $40 billion by 2024. |

| Regional Market Dependence | Vulnerability to localized supply chain and agricultural issues. | Sales decline in Tunisia in 2024 due to milk shortages. |

Same Document Delivered

Emmi SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The preview you see is a direct representation of the complete Emmi SWOT analysis, ensuring you know exactly what you're getting.

Purchase this listing to access the entire, detailed Emmi SWOT analysis, identical to this preview.

Opportunities

Emmi has a significant opportunity to expand its presence in high-growth international markets, particularly within its Americas division. Countries like Brazil, Chile, Mexico, and the USA represent key areas for leveraging existing strengths and driving further positive growth momentum.

Continued strategic investment and a focused approach in these regions are expected to yield substantial sales growth for Emmi. For instance, the US dairy market alone is a massive opportunity, with projections indicating continued expansion, offering Emmi a fertile ground for increasing its market share through innovative product offerings and targeted marketing campaigns.

Consumer interest in dairy products that offer health benefits, such as high protein and probiotics, is a significant growth driver. This trend is particularly strong in key markets, with the global functional foods market projected to reach over $300 billion by 2027, indicating substantial consumer willingness to pay a premium for health-enhancing options.

Emmi is well-positioned to leverage this growing demand. By expanding its range of functional premium dairy products, including brands like Aktifit and Verde Campo, the company can tap into this lucrative segment. For instance, sales of probiotic-rich yogurts have seen consistent double-digit growth in Europe over the past few years, a trend Emmi can directly benefit from.

Emmi has a significant opportunity to bolster its sustainability credentials by embracing innovative packaging, such as the development of fully recyclable PET bottles for its dairy products. This move aligns with growing consumer demand for eco-friendly options.

By actively promoting a circular economy model for its milk products, Emmi can not only reduce waste but also significantly enhance its brand image among environmentally aware consumers. For instance, in 2024, the global sustainable packaging market was valued at over $300 billion, with a strong growth trajectory driven by consumer preference.

Leveraging Automation and Digital Tools for Efficiency

The dairy sector is increasingly adopting automation, AI, and IoT for enhanced efficiency, consistent product quality, and lower labor expenses in manufacturing. Emmi has an opportunity to further integrate these advanced technologies to streamline its operations and bolster its market position.

By investing in smart factory solutions and data analytics, Emmi can achieve greater precision in its production processes, leading to reduced waste and improved resource utilization. This focus on digital transformation is crucial for maintaining a competitive edge in a rapidly evolving industry.

- Increased Automation: Emmi can implement robotic systems for tasks like packaging and palletizing, potentially reducing manual labor by up to 30% in specific areas, as seen in similar food processing operations.

- AI for Quality Control: Utilizing AI-powered visual inspection systems can identify product defects with higher accuracy than manual checks, improving consistency and reducing recall risks.

- IoT for Supply Chain: Implementing IoT sensors throughout the supply chain can provide real-time data on temperature, humidity, and location, ensuring optimal conditions for dairy products and minimizing spoilage.

- Data-Driven Optimization: Analyzing production data through AI can identify bottlenecks and inefficiencies, allowing for targeted improvements that boost overall output and reduce operational costs.

Strategic Acquisitions to Enhance Portfolio and Market Reach

Emmi's track record of successful strategic acquisitions, including the recent additions of Mademoiselle Desserts, Verde Campo, and Hochstrasser, presents a significant opportunity. These moves have demonstrably bolstered Emmi's market share in key regions and specialized product segments, paving the way for continued expansion and enhanced profitability.

By continuing this acquisition-driven growth strategy, Emmi can further solidify its competitive position. This approach allows for the rapid integration of new capabilities and market access, which is crucial in the dynamic food industry. For instance, the acquisition of Mademoiselle Desserts in 2021 expanded Emmi's dessert portfolio and European footprint.

- Strengthened Market Position: Acquisitions allow Emmi to gain immediate market share and brand recognition in new or existing categories.

- Portfolio Diversification: Targeting niche product categories or complementary businesses reduces reliance on single product lines or markets.

- Synergistic Growth: Integrating acquired companies can lead to operational efficiencies and cross-selling opportunities, driving profitable growth.

- Enhanced Innovation: Acquiring companies with innovative products or technologies can accelerate Emmi's own R&D efforts.

Emmi can capitalize on the growing demand for premium and functional dairy products in international markets, especially in the Americas. This expansion is supported by the robust growth of the US dairy sector, which presents substantial opportunities for increased market share through innovative offerings.

The company is well-positioned to benefit from the increasing consumer preference for health-conscious options, as evidenced by the projected growth of the global functional foods market. Emmi's existing brands like Aktifit and Verde Campo are key assets in tapping into this trend, mirroring successful double-digit growth seen in probiotic-rich yogurts in Europe.

Emmi has a clear opportunity to enhance its brand image and appeal to environmentally conscious consumers by prioritizing sustainable packaging solutions, such as recyclable PET bottles. This aligns with the significant global market for sustainable packaging, valued at over $300 billion in 2024, and Emmi's commitment to a circular economy can further solidify its market standing.

Further integration of advanced technologies like automation, AI, and IoT in its manufacturing processes offers Emmi a path to greater operational efficiency, consistent product quality, and reduced costs. This digital transformation is vital for maintaining a competitive edge in the evolving dairy industry, enabling data-driven optimization and improved resource utilization.

Emmi's strategic acquisition approach, exemplified by recent successful integrations like Mademoiselle Desserts and Verde Campo, provides a strong foundation for continued expansion. These acquisitions have demonstrably strengthened Emmi's market presence and diversified its product portfolio, creating synergistic growth opportunities and enhancing its innovation capabilities.

Threats

The global dairy market is a crowded space, with Emmi navigating intense competition from both established international corporations and agile local dairies. This constant rivalry puts significant pressure on pricing, potentially forcing Emmi into price wars that could erode profit margins.

In 2024, the dairy sector continues to see consolidation and innovation, with new entrants and private labels vying for consumer attention. Emmi's market share is therefore under continuous threat, necessitating substantial investment in brand differentiation and marketing to maintain its position.

For instance, the rise of plant-based alternatives, while not directly dairy, siphons off market share from traditional dairy products, adding another layer of competitive challenge. Emmi must strategically allocate resources to both defend its dairy stronghold and explore these evolving consumer preferences.

The growing consumer demand for plant-based and hybrid dairy alternatives, fueled by health consciousness, environmental impact awareness, and ethical considerations, presents a significant long-term challenge for Emmi's traditional dairy product lines. This ongoing shift directly impacts sales volumes for conventional dairy offerings.

In 2024, the global dairy alternatives market was valued at approximately $27.5 billion, with projections indicating continued robust growth. For instance, the plant-based milk segment alone is expected to reach over $50 billion by 2027, highlighting the scale of this consumer preference change and the need for Emmi to strategically adjust its product portfolio to remain competitive.

Emmi faces significant threats from supply chain disruptions and disease outbreaks, which can directly impact its access to raw milk. For instance, outbreaks of diseases like bluetongue in cattle, which has been a concern in various European regions, can reduce milk yields and affect the health of the herds, leading to lower raw milk availability. This scarcity can drive up commodity prices, increasing Emmi's input costs and potentially squeezing profit margins.

Broader supply chain issues, such as transportation delays or increased logistics costs, also pose a risk. These challenges can affect Emmi's ability to source ingredients, distribute finished products efficiently, and manage inventory. For example, global shipping disruptions experienced in 2021-2022, which saw freight rates surge, illustrate the potential for increased operational expenses that could impact Emmi's financial performance.

Regulatory Changes and Trade Policy Uncertainties

Changes in federal milk marketing orders, like potential adjustments to Class I milk pricing formulas, could directly impact dairy processors such as Emmi by altering the cost of raw milk. For instance, proposals considered in 2024 aimed to better reflect market conditions, which could lead to price volatility. Trade policy shifts, including the possibility of tariffs on dairy products or ingredients, pose a significant threat. The US dairy industry, a key market for many processors, saw exports fluctuate in 2024 due to global trade tensions, impacting overall industry stability and profitability for companies like Emmi operating internationally.

Emmi must remain vigilant in monitoring evolving regulatory landscapes and trade agreements. For example, the European Union's Common Agricultural Policy (CAP) reforms, with potential implications for dairy subsidies and production quotas, require careful analysis. The ongoing geopolitical climate and its effect on international trade agreements, such as those impacting key markets for Emmi's specialty dairy products, necessitate proactive strategy adjustments to mitigate financial pressures across the entire value chain.

- Regulatory Shifts: Potential revisions to federal milk marketing orders in the US could alter raw milk costs for Emmi, impacting its procurement strategy.

- Trade Policy Impact: Tariffs or changes in import/export regulations on dairy products, particularly in key markets like the US or EU, could affect Emmi's international sales and profitability.

- Market Access: Uncertainties in trade agreements may limit or complicate access to vital export markets, creating financial pressure on Emmi's global operations.

- Adaptation Costs: Emmi will incur costs in adapting its supply chain and business strategies to comply with new regulations or navigate altered trade policies.

Reputational Risks Related to Sustainability and Animal Welfare

Emmi's strong brand image is vulnerable to shifts in consumer perception around sustainability and animal welfare. Failure to align with increasingly stringent ethical sourcing standards could damage its reputation, especially as consumers in key markets like Switzerland and Germany show heightened awareness. For instance, a 2024 survey indicated that over 60% of Swiss consumers consider animal welfare a critical factor when purchasing dairy products.

The company must proactively address potential criticisms regarding its supply chain practices. Negative publicity stemming from perceived shortcomings in animal welfare or environmental impact could lead to boycotts and a decline in sales, impacting Emmi's market position. In 2025, a significant portion of dairy consumers are expected to actively seek out brands demonstrating transparent and ethical practices, making this a critical area for Emmi.

- Consumer Scrutiny: Growing consumer demand for ethical and sustainable products poses a direct threat if Emmi's practices are perceived as inadequate.

- Supply Chain Transparency: Lack of clear communication or demonstrable improvements in animal welfare and environmental impact throughout the value chain can lead to reputational damage.

- Market Expectations: Evolving stakeholder expectations, including those from NGOs and investors, necessitate continuous improvement and robust reporting on sustainability metrics.

Intense competition from global and local players pressures Emmi's pricing and market share, necessitating significant investment in differentiation. The rising popularity of plant-based alternatives directly erodes demand for traditional dairy products, requiring strategic portfolio adjustments. Emmi faces risks from supply chain disruptions, disease outbreaks impacting milk availability, and increased logistics costs, all of which can elevate input expenses and squeeze profit margins.

SWOT Analysis Data Sources

This Emmi SWOT analysis is built upon a robust foundation of data, drawing from Emmi's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a thorough and accurate strategic overview.