Emmi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emmi Bundle

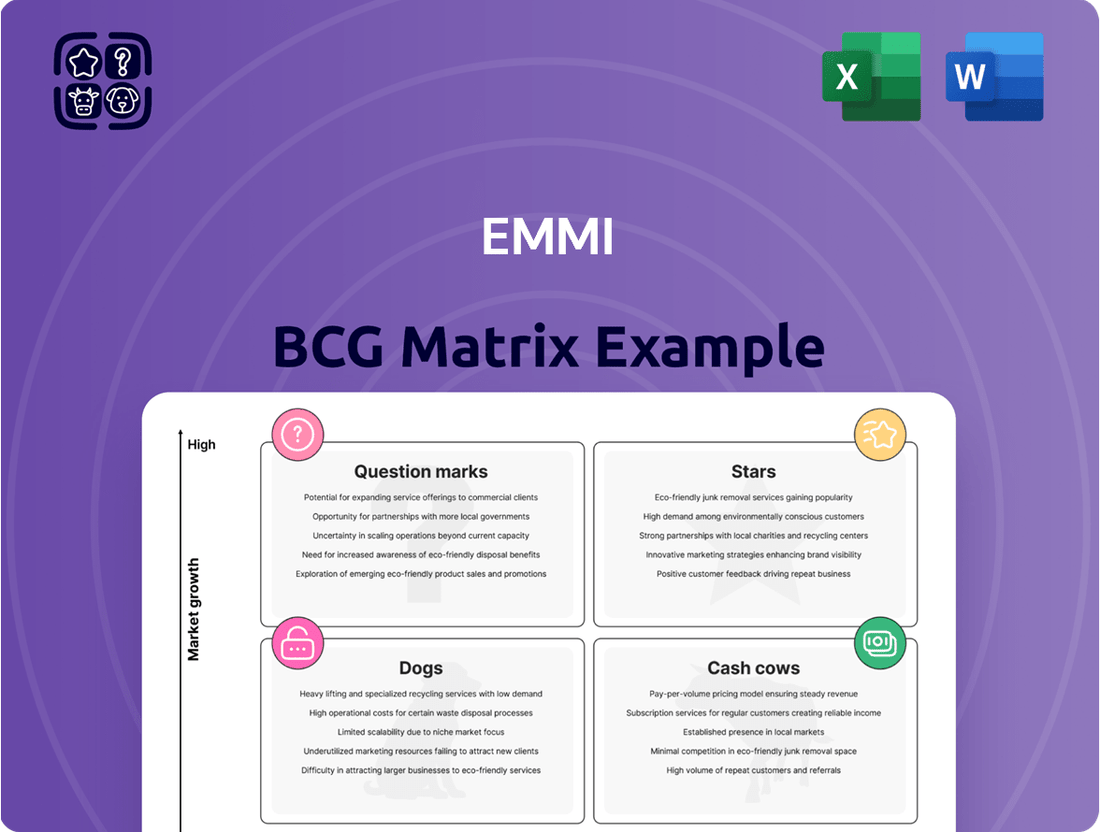

The Emmi BCG Matrix offers a powerful lens to understand the strategic positioning of its diverse product portfolio. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, it highlights growth opportunities and potential resource drains.

This preview only scratches the surface of the actionable intelligence available. To truly unlock Emmi's strategic advantage, purchase the full BCG Matrix report for in-depth quadrant analysis, data-driven recommendations, and a clear roadmap for future investment and product development.

Stars

Emmi Caffè Latte is a strong performer within Emmi's portfolio, consistently achieving significant volume-driven organic growth, particularly in important European markets such as the UK and Spain. This ready-to-drink coffee brand celebrated its 20th anniversary in 2024, underscoring its enduring market presence and success.

Emmi's strategic investment in coffee expertise, including the acquisition of Hochstrasser, directly supports Emmi Caffè Latte's innovation pipeline and reinforces its market leadership in the expanding ready-to-drink coffee segment.

Following its October 2024 acquisition of Mademoiselle Desserts Group, Emmi has dramatically boosted its standing in the premium dessert market, effectively doubling its sales in this specialized area. This strategic acquisition has propelled Emmi into a 'category captain' role within a market that is experiencing robust global growth and offers a broad, innovative product selection.

While the initial financial statements showed some negative impacts due to purchase price allocation, Emmi's operational performance has been strong. The company anticipates a positive financial contribution from this segment starting in 2025, underscoring the strategic importance of this high-growth sector where Emmi now holds a leading market position.

Emmi's specialty cheese brands, such as Kaltbach, Athenos, and Meyenberg, are pivotal in driving growth across international markets. Athenos, a leader in the US feta cheese sector, and Meyenberg, the sole nationwide goat's milk brand in the USA, exemplify Emmi's successful penetration into niche segments. These brands are key contributors to the organic growth within Emmi's Americas and European business divisions.

Emmi's strategic emphasis on these specialty cheese segments allows them to capitalize on differentiated brand positioning and continuous innovation. This approach fosters strong, volume-driven growth by capturing significant market share within their respective expanding niches. For instance, Emmi reported robust growth in its Americas division, partly fueled by these specialty cheese offerings, in the first half of 2024.

Verde Campo (Brazil)

Verde Campo, acquired by Emmi in May 2024, is positioned as a Star in the BCG Matrix due to its innovative approach to functional premium dairy products in Brazil. This Brazilian brand is a pioneer in offering high-protein, health-conscious options, aligning perfectly with growing consumer demand for wellness. The acquisition significantly bolsters Emmi's presence in Brazil, a market deemed critical for the company's expansion strategy.

The strategic importance of Verde Campo is underscored by its potential to drive Emmi's portfolio transformation towards higher-growth segments. Its focus on premium, functional dairy products taps into a lucrative and expanding consumer base. This move is expected to capture substantial market share within the dynamic Brazilian dairy sector.

- Market Position: Strengthens Emmi's foothold in Brazil, a key growth market.

- Product Innovation: Specializes in functional premium dairy with high protein, appealing to health-conscious consumers.

- Growth Potential: Seen as a significant contributor to Emmi's portfolio transformation and market share expansion.

- Strategic Value: Represents a crucial investment in a dynamic regional market, enhancing Emmi's competitive edge.

Goat's milk powder business (Netherlands)

Emmi's goat's milk powder business in the Netherlands is a key player in the company's European growth strategy. This niche product has shown impressive sales expansion, indicating a solid hold on a growing market segment. Its performance directly contributes to Emmi's overall positive financial results in Europe.

The Dutch goat's milk powder market, while specialized, is experiencing a positive trajectory, allowing Emmi to capitalize on this momentum. This segment's growth is a testament to Emmi's ability to identify and serve expanding niche markets effectively within the broader dairy industry.

- Market Position: High market share in a growing niche.

- Growth Driver: Significant organic growth contribution to Emmi's European division.

- Performance Indicator: Reflects strong sales growth within a specialized, expanding segment.

- Strategic Importance: Plays a role in Emmi's overall positive European performance.

Emmi's goat's milk powder business in the Netherlands is a strong performer, exhibiting impressive sales expansion and contributing positively to Emmi's European financial results. This niche product is well-positioned in a growing market segment, demonstrating Emmi's capability to effectively serve specialized, expanding areas within the dairy industry.

Verde Campo, acquired in May 2024, is also a Star due to its innovative, high-protein functional dairy products in Brazil, tapping into growing wellness trends and bolstering Emmi's presence in a key expansion market.

The specialty cheese brands, including Athenos and Meyenberg, are crucial for international growth, with Athenos leading the US feta market and Meyenberg being the sole nationwide goat's milk brand in the US, driving significant organic growth in the Americas and Europe.

Emmi Caffè Latte, a 20-year-old ready-to-drink coffee brand, continues to achieve substantial volume-driven organic growth, especially in key European markets like the UK and Spain, supported by strategic investments in coffee expertise.

| Brand/Segment | Market Position | Growth Driver | Strategic Importance | Key Data Point (2024) |

|---|---|---|---|---|

| Emmi Caffè Latte | Strong performer in ready-to-drink coffee | Volume-driven organic growth in Europe | 20th anniversary in 2024, supported by coffee expertise investments | Significant growth in UK and Spain |

| Mademoiselle Desserts Group | Category captain in premium desserts | Doubled sales in premium dessert market | Strategic acquisition boosting high-growth sector | Acquired October 2024 |

| Specialty Cheese (Kaltbach, Athenos, Meyenberg) | Leaders in niche segments (e.g., US feta, US goat's milk) | International growth, market share capture in expanding niches | Key contributors to Americas and European division growth | Robust growth in Americas division (H1 2024) |

| Verde Campo | Pioneer in functional premium dairy in Brazil | Taps into wellness trends, drives portfolio transformation | Key investment in dynamic Brazilian market | Acquired May 2024 |

| Goat's Milk Powder (Netherlands) | High market share in a growing niche | Significant organic sales expansion in Europe | Contributes to positive European financial results | Strong sales expansion in a specialized segment |

What is included in the product

The Emmi BCG Matrix provides a strategic overview of Emmi's product portfolio, categorizing each unit by market share and growth rate.

It highlights which units to invest in, hold, or divest based on their position in the Stars, Cash Cows, Question Marks, and Dogs quadrants.

The Emmi BCG Matrix offers a clear, visual overview of business units, simplifying complex portfolio decisions.

Cash Cows

Emmi's core dairy products, including milk, yogurt, and general cheeses, are firmly positioned as Cash Cows within its BCG Matrix. As Switzerland's leading dairy producer, these items command a significant share of a mature domestic market. In 2024, Emmi reported a modest 0.3% organic growth for its Swiss operations, a figure that aligns with market expectations for such established product lines.

Laticínios Porto Alegre, Emmi's Brazilian subsidiary, stands as a significant player, ranking among the top three dairies in Minas Gerais. This strong market position highlights its substantial share in a key growth region for Emmi.

While Brazil offers growth potential, Laticínios Porto Alegre itself represents a mature business. It consistently generates reliable income, acting as a stable foundation for Emmi within this important international market.

Emmi's increasing investment in Laticínios Porto Alegre underscores its confidence in the subsidiary's ongoing success and its role as a valuable cash cow.

Emmi's General Fresh Products in Switzerland represent a classic Cash Cow within its BCG Matrix. These offerings, while not necessarily groundbreaking, command a substantial market share in a well-established domestic market, ensuring consistent and predictable revenue streams for the company. In 2023, Emmi AG reported net sales of CHF 4,169.7 million, with its Swiss market remaining a significant contributor, underscoring the stability of these mature product lines.

Overall Swiss Business Division

The overall Swiss business division, a cornerstone of Emmi's operations, demonstrated resilience in 2024, achieving 0.3% organic volume growth. This performance met Emmi's projections for a mature market, underscoring its stability.

This division is a significant contributor to Emmi's total sales and forms a dependable earnings foundation. Its established market position and robust infrastructure translate into strong profit margins and reliable cash generation, crucial for funding growth initiatives elsewhere.

- Stable Earnings Base: The Swiss division provides a consistent and substantial portion of Emmi's overall sales and earnings.

- High Profit Margins: Established infrastructure and market leadership in Switzerland ensure healthy profit margins.

- Cash Flow Generation: The division consistently generates significant cash flow, enabling investment in other growth areas.

- Strategic Funding: This reliable cash flow supports Emmi's expansion into international markets and innovative product segments.

Established Export Business with Swiss Specialty Cheese

Emmi's established export business in specialty cheeses, particularly traditional Swiss varieties, functions as a Cash Cow. While some niche export areas might be developing into Stars, the broader traditional segment operates within mature global markets. This business leverages Switzerland's strong brand equity for quality, securing a solid market share in its established categories.

These exports consistently generate substantial cash flow. Demand remains relatively stable, underscoring their role as a reliable contributor to Emmi's overall financial health. The mature nature of these markets means significant new investment isn't typically required for expansion, allowing them to operate profitably with existing infrastructure.

- Established Market Position: Emmi's traditional Swiss specialty cheeses benefit from long-standing international recognition and a strong brand reputation, ensuring a consistent customer base.

- Stable Cash Generation: These exports provide a predictable and substantial inflow of cash, supporting other business units within Emmi.

- Low Investment Needs: As mature products in established markets, they require minimal additional investment for growth, maximizing profitability.

- Contribution to Profitability: In 2023, Emmi's export business, which includes these established specialty cheeses, represented a significant portion of their net sales, demonstrating their crucial role in the company's financial performance.

Emmi's core Swiss dairy products, including milk, yogurt, and general cheeses, are firmly established as Cash Cows. These items hold a significant share in a mature domestic market, contributing to stable revenue streams. In 2024, Emmi's Swiss operations saw modest organic growth of 0.3%, reflecting the predictable performance of these established product lines.

Laticínios Porto Alegre, Emmi's Brazilian subsidiary, is a key player, ranking among the top three dairies in Minas Gerais. While Brazil offers growth, Porto Alegre itself represents a mature business, consistently generating reliable income and acting as a stable foundation for Emmi in this important region.

Emmi's established export business in specialty cheeses, particularly traditional Swiss varieties, also functions as a Cash Cow. These exports leverage Switzerland's strong brand equity for quality, securing a solid market share in established global categories and consistently generating substantial cash flow with stable demand.

| Product Category | BCG Matrix Position | Key Characteristics | 2024 Data/Context |

| Core Swiss Dairy Products | Cash Cow | High market share, mature market, stable demand, reliable cash generation | 0.3% organic volume growth in Swiss operations |

| Laticínios Porto Alegre (Brazil) | Cash Cow | Strong regional position, mature business, consistent income generation | Top three dairy in Minas Gerais |

| Traditional Swiss Specialty Cheese Exports | Cash Cow | Leverages brand equity, established global markets, stable demand, low investment needs | Significant contributor to net sales |

Preview = Final Product

Emmi BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks, no demo content, and absolutely no surprises – just a professionally designed strategic tool ready for immediate application in your business planning.

Dogs

Emmi's Emmentaler AOP exports to Europe are experiencing an organic sales decline of 3.3% within the cheese segment. This trend points to a product facing a shrinking market or losing its competitive edge in Europe.

This situation places Emmentaler AOP in a challenging position, potentially classifying it as a 'Dog' in the BCG Matrix. Continued investment without a clear path to market revitalization could drain resources.

Emmi should carefully assess its European export strategy for Emmentaler AOP. A strategic review is necessary to determine if increased marketing, product innovation, or a phased divestment is the most prudent course of action given the current market dynamics.

Surplus skimmed milk powder exports from Switzerland, a component of Emmi's portfolio, are currently facing significant headwinds. Emmi reported a 17.0% drop in its powder/concentrates segment, directly linked to reduced exports of this particular product.

This downturn isn't isolated; sales in key markets like Tunisia also saw a decline due to prevailing milk shortages, further dampening overall powder export performance. This situation paints a picture of a low-growth market where Emmi's market share for surplus skimmed milk powder is shrinking.

Products like these often represent a drain on capital, yielding minimal returns. Consequently, they are prime candidates for either divestiture or a substantial strategic overhaul to improve their viability.

The trading business of Mexideli within Emmi's fresh cheese segment is characterized by an organic sales decline of 1.0%. This performance indicates a low market share within a low-growth or contracting market. Such a situation often positions Mexideli's trading as a potential cash trap, consuming resources without generating substantial returns or contributing to Emmi's overall growth trajectory.

Underperforming Acquired Assets (Pre-Divestment Examples)

Emmi's divestment of Gläserne Molkerei in 2023 serves as a prime example of managing underperforming acquired assets. This organic dairy brand, which Emmi acquired in 2015, likely transitioned into a dog category due to its struggle to gain significant market share within a mature, low-growth organic dairy market.

Assets like Gläserne Molkerei are often characterized as cash traps. They require continuous investment to maintain their position but yield minimal returns, hindering overall portfolio growth. Emmi's decision to divest this unit reflects a strategic move to streamline its business and focus resources on more promising ventures.

While specific financial data for Gläserne Molkerei's performance leading up to its divestment isn't publicly detailed, the sale itself indicates a recognition of its status as an underperformer. This aligns with the BCG matrix's concept of dogs, which are businesses with low relative market share in low-growth industries and are typically candidates for divestment.

- Historical Context: Gläserne Molkerei, acquired by Emmi in 2015, was divested in 2023.

- Market Position: Likely held a low market share in the mature organic dairy sector.

- Strategic Rationale: Divested to improve portfolio quality and reallocate resources.

- BCG Matrix Classification: Exemplifies a "dog" due to low growth and low market share.

Undifferentiated Dairy Products in Saturated Markets

Undifferentiated dairy products in saturated markets, where Emmi may not possess a unique selling proposition, would likely be categorized as Dogs within the BCG Matrix. These items face intense competition and struggle to carve out significant market share. For instance, in markets like basic milk or standard yogurt, where price and brand recognition are paramount, Emmi's growth potential would be limited without a clear differentiator.

These products typically generate low profits and can drain resources that could be better allocated to more promising ventures. Emmi's strategic focus on specialized, high-value niches, such as premium cheese or lactose-free products, suggests a deliberate effort to avoid or divest from such commoditized segments. This approach is critical for maintaining profitability and competitive edge in the evolving dairy landscape.

Consider the global dairy market, which is projected to reach approximately $1.3 trillion by 2027, with significant growth in value-added products. However, the market for basic, undifferentiated milk remains highly competitive and often characterized by low margins. Emmi's success hinges on its ability to steer clear of these Dog categories by innovating and focusing on segments where it can command a premium and build brand loyalty.

- Low Market Share: Products in this category struggle to gain traction against established competitors.

- Low Market Growth: The overall market for these undifferentiated products is often stagnant or declining.

- Minimal Profitability: Thin margins mean these products contribute little to overall earnings.

- Resource Drain: Marketing and production efforts for these items may yield poor returns on investment.

Emmi's Emmentaler AOP exports to Europe, facing a 3.3% organic sales decline, and surplus skimmed milk powder exports, down 17.0% due to reduced exports and market shortages in places like Tunisia, both exhibit characteristics of 'Dog' products. These segments operate in low-growth or declining markets and struggle with market share, indicating they are likely cash traps. Emmi's divestment of Gläserne Molkerei in 2023, acquired in 2015, also exemplifies managing an underperforming asset in a mature, low-growth organic dairy market, aligning with the 'Dog' classification due to its low market share and the strategic decision to streamline resources.

| Product/Segment | BCG Classification | Key Indicators | Strategic Implication |

|---|---|---|---|

| Emmentaler AOP (Europe Exports) | Dog | -3.3% organic sales decline (2024 data) | Potential divestment or revitalization strategy needed. |

| Surplus Skimmed Milk Powder Exports | Dog | -17.0% segment decline (2024 data), market shortages | Requires careful assessment for divestment or significant overhaul. |

| Mexideli Trading (Fresh Cheese) | Dog | -1.0% organic sales decline (2024 data) | Potential cash trap, consuming resources with low returns. |

| Gläserne Molkerei (Divested 2023) | Dog | Low market share in mature organic dairy market | Divested to improve portfolio quality and reallocate resources. |

Question Marks

Emmi's innovative brands like Emmi Energy Milk, Aktifit, I'm your Meal, and Luzerner Rahmkäse demonstrated strong performance in the Swiss domestic market during 2024, contributing to positive sales growth. These brands represent Emmi's strategy to tap into growing niche segments within a mature market. For instance, the health and wellness trend fueled demand for products like Aktifit, while convenience-driven options like I'm your Meal resonated with busy consumers.

Despite Switzerland being a mature market, the success of these specific brands suggests they are either relatively new or have recently experienced a significant uplift in popularity. Their growth indicates they are effectively capturing market share within their respective niches, even if their overall market share remains modest. This positions them as potential Stars, requiring continued strategic investment to solidify their market leadership and capitalize on their current momentum.

Emmi's new plant-based milk alternatives are positioned as Question Marks within the BCG Matrix. This burgeoning market is experiencing rapid growth, with global plant-based milk sales projected to reach $64.5 billion by 2027, indicating significant potential. Emmi is investing heavily in research and development and marketing to establish a foothold against established competitors, aiming to capture a meaningful share of this expanding segment.

The acquisition of Hochstrasser in June 2024 positions Emmi to leverage its new coffee roasting expertise for innovative product development. These nascent coffee offerings, benefiting from a robust and expanding global coffee market projected to reach over $130 billion by 2025, are currently in the question mark phase of the BCG matrix.

Specific Emerging Product Lines in International Markets

Emmi’s strategic push into emerging markets, such as Southeast Asia and parts of Africa, will feature several Question Mark product lines. These are typically new dairy or plant-based beverage innovations designed to test consumer acceptance and build initial market penetration in regions where Emmi currently holds a minor share. For instance, their recent launch of lactose-free yogurt alternatives in Vietnam, a market with a rapidly growing middle class and increasing health consciousness, exemplifies this strategy. The success of these ventures hinges on effective marketing and distribution to gain traction against established local players.

These new ventures require significant investment to nurture their growth potential. Emmi’s allocation of resources towards these Question Marks will be closely monitored, with performance metrics like sales volume and market share growth in these nascent segments being critical. For example, in 2024, Emmi reported a 5% increase in R&D spending directed towards international market development, with a substantial portion earmarked for product testing and initial market entry costs in these specific regions. The aim is to transform these low-share, high-growth products into future Stars.

- Lactose-free yogurt alternatives in Vietnam: Targeting a growing health-conscious demographic.

- Plant-based milk beverages in select African urban centers: Addressing increasing demand for dairy alternatives.

- Specialty cheese introductions in emerging South American markets: Cultivating demand for premium products.

Rebounding Premium Desserts by Emmi Dessert USA

Emmi Dessert USA's premium dessert segment, bolstered by the Mademoiselle Desserts acquisition, is positioned as a Star in the BCG matrix. While specialty desserts experienced a dip in early 2024, a notable rebound occurred in the latter half of the year. This suggests a product line tapping into a high-growth market, though it's navigating some turbulence and actively building its market standing.

The performance trajectory highlights a segment with significant growth potential but also reveals the challenges of market entry and stabilization. Continued strategic focus and capital allocation are crucial for Emmi Dessert USA to solidify its position and achieve enduring market leadership in premium offerings.

- Mademoiselle Desserts Acquisition: This strategic move has elevated Emmi's premium dessert portfolio, marking it as a strong contender in a high-growth category.

- H1 2024 Performance: Emmi Dessert USA's specialty desserts saw an anticipated decline in the first half of 2024, reflecting initial market integration or competitive pressures.

- H2 2024 Rebound: A significant recovery in the second half of 2024 indicates resilience and growing market acceptance for its premium dessert lines.

- Strategic Imperative: The segment requires ongoing investment and strategic support to sustain its momentum and capture a larger market share.

Question Marks represent Emmi's new product ventures in high-growth markets where the company currently has a low market share. These products, like plant-based milk alternatives and new coffee offerings, require significant investment to gain traction and build market presence. The success of these ventures is crucial for Emmi's future growth, as they aim to transform these into Stars by capturing market share.

Emmi's investment in these Question Marks is evident in its increased R&D spending, with 5% allocated to international market development in 2024. This strategic allocation is focused on product testing and initial market entry costs in regions like Southeast Asia and Africa, where consumer acceptance and market penetration are key objectives.

The company is actively testing consumer acceptance of new dairy and plant-based beverage innovations in emerging markets. For example, lactose-free yogurt alternatives in Vietnam are designed to tap into a growing health-conscious demographic, aiming to establish an initial foothold against local competitors.

Emmi's new plant-based milk alternatives are positioned as Question Marks within the BCG Matrix, operating in a rapidly growing market. Global plant-based milk sales are projected to reach $64.5 billion by 2027, highlighting the significant potential for these new Emmi products.

| Product Category | Market Growth | Emmi Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Plant-based Milk Alternatives | High | Low | Question Mark | Investment in R&D and Marketing |

| New Coffee Offerings (Post-Hochstrasser Acquisition) | High (Global coffee market > $130 billion by 2025) | Low | Question Mark | Product Innovation and Market Entry |

| Lactose-free Yogurt Alternatives (Vietnam) | High (Growing health consciousness) | Low | Question Mark | Building initial market penetration |

BCG Matrix Data Sources

Our Emmi BCG Matrix is built on comprehensive data, integrating financial reports, market research, and consumer trend analysis to provide strategic direction.