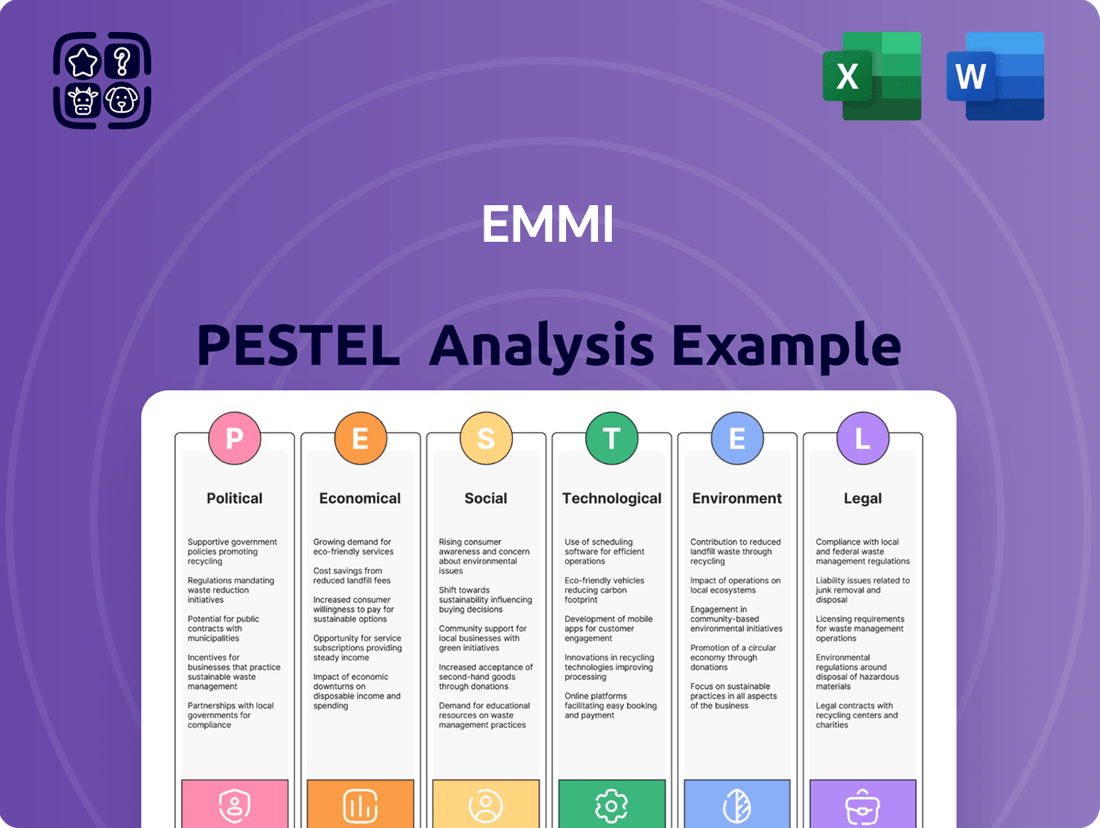

Emmi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emmi Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Emmi's future. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Governmental regulations and trade policies profoundly shape Emmi's global operations. For instance, the European Union's Common Agricultural Policy (CAP) influences dairy production and pricing across its member states, impacting Emmi's sourcing and cost structures. In 2024, ongoing discussions around potential changes to CAP for future funding periods could introduce new dynamics.

Trade policies, such as tariffs and quotas, directly affect Emmi's ability to export its products. For example, in 2024, trade tensions between major economic blocs could lead to increased import duties on specialty dairy products, potentially raising costs for consumers and impacting Emmi's sales volumes in those markets. Emmi must constantly monitor and adapt to these shifting trade landscapes.

Agricultural subsidies and dairy quotas, especially in the EU and Switzerland, significantly impact milk production expenses and availability. Emmi must skillfully manage these policies to secure a consistent and economically viable raw milk supply. For instance, the EU's Common Agricultural Policy (CAP) provides direct payments to farmers, influencing their operational decisions and, consequently, milk prices.

Emmi operates under stringent food safety and labeling regulations in Switzerland and its key international markets. These standards, which include detailed origin declarations for products like bulk bakery goods and strict limits on substances in food contact materials, are critical for maintaining consumer confidence and avoiding costly legal repercussions.

Compliance with these evolving regulations is not just a legal necessity but a cornerstone of Emmi's brand reputation, reinforcing its commitment to high-quality, safe products. For example, in 2024, the Swiss Federal Office of Public Health continued to emphasize enhanced traceability requirements across the food supply chain.

Geopolitical Stability and International Relations

Geopolitical stability in Emmi's key markets, including Europe, North America, and South America, directly influences its operational landscape. For instance, ongoing trade disputes or regional conflicts can create significant supply chain vulnerabilities and increase logistics costs. In 2024, the global geopolitical climate remained complex, with continued focus on economic sanctions and regional security challenges affecting international trade flows.

Emmi's diversified geographical footprint, spanning over 15 countries as of early 2025, offers a degree of resilience against localized political instability. However, widespread global tensions, such as those impacting energy prices or international shipping routes, can still indirectly affect consumer purchasing power and demand for dairy products. For example, a significant escalation in a major trade bloc's tensions could lead to a broad-based economic slowdown, impacting Emmi's revenue streams across multiple regions.

- Supply Chain Disruptions: Geopolitical events can interrupt raw material sourcing and product distribution, as seen with past disruptions affecting global shipping.

- Cost Volatility: International relations impact currency exchange rates and commodity prices, directly affecting Emmi's input costs.

- Consumer Confidence: Political uncertainty can dampen consumer sentiment, leading to reduced spending on non-essential goods, including premium dairy products.

- Regulatory Changes: Shifts in international agreements or national policies driven by geopolitical factors can alter market access and compliance requirements for Emmi.

Animal Welfare Regulations

Switzerland's stringent animal welfare regulations significantly shape dairy farming, impacting Emmi's operations. The 'swissmilk green' standard, a mandatory industry benchmark since 2024, dictates high animal welfare practices for all milk suppliers. This commitment is crucial for Emmi's compliance and resonates with consumers increasingly prioritizing ethical sourcing in their food choices.

Adherence to these standards is not merely a regulatory necessity but a strategic advantage for Emmi. For instance, the 'swissmilk green' program emphasizes aspects like pasture access and species-appropriate housing, directly influencing milk quality and traceability. This proactive approach to animal welfare can bolster Emmi's brand reputation in a market where consumer consciousness regarding animal treatment is on the rise.

- Mandatory Compliance: The 'swissmilk green' standard, implemented in 2024, sets a baseline for animal welfare practices across Swiss dairy farms supplying Emmi.

- Consumer Demand: Growing consumer preference for ethically produced goods makes Emmi's adherence to high animal welfare standards a key differentiator.

- Operational Impact: These regulations influence farm management, potentially affecting production costs and milk supply chain dynamics.

Governmental policies, including agricultural subsidies and trade agreements, directly influence Emmi's operational costs and market access. For example, the European Union's Common Agricultural Policy (CAP) continues to shape dairy production economics within its member states, a factor Emmi navigates in 2024 and beyond. Furthermore, evolving trade tensions between major economic blocs in 2024 could introduce new tariffs or quotas on dairy products, impacting Emmi's export strategies and pricing.

Emmi's commitment to stringent food safety and labeling regulations, particularly in Switzerland and its key international markets, remains paramount. In 2024, the Swiss Federal Office of Public Health continued to emphasize enhanced traceability requirements throughout the food supply chain, reinforcing consumer trust. Adherence to these evolving standards is crucial for maintaining Emmi's brand reputation and avoiding legal complications.

Geopolitical stability in Emmi's operating regions is a significant consideration, with ongoing global tensions in 2024 impacting international trade flows and potentially increasing logistics costs. While Emmi's diversified presence across over 15 countries as of early 2025 offers some resilience, widespread geopolitical instability can indirectly affect consumer purchasing power and demand for dairy products globally.

| Factor | Description | 2024/2025 Relevance |

|---|---|---|

| Agricultural Policy | EU's Common Agricultural Policy (CAP) impacts dairy production and pricing. | Ongoing discussions on CAP reforms for future funding periods in 2024. |

| Trade Policies | Tariffs and quotas affect export market access and costs. | Trade tensions in 2024 could lead to increased import duties on specialty dairy. |

| Food Safety Regulations | Stringent standards for product safety and origin labeling. | Enhanced traceability requirements emphasized by Swiss authorities in 2024. |

| Geopolitical Stability | Regional conflicts and economic sanctions impact global trade. | Complex global climate in 2024 affecting supply chains and consumer spending. |

What is included in the product

This Emmi PESTLE analysis examines the influence of external macro-environmental factors on the company's operations and strategic planning across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Emmi's financial health is closely tied to global and regional economic growth, directly impacting consumer spending power on its premium dairy products. For instance, in 2024, while global growth projections hovered around 3%, varying significantly by region, a robust economy generally boosts disposable income, encouraging purchases of higher-value items like Emmi's specialty cheeses and yogurts. Conversely, economic downturns, such as the anticipated slowdown in parts of Europe in late 2024 and early 2025, can push consumers towards less expensive alternatives, posing a challenge to premium brands.

Emmi's strategic diversification across various product categories and price points is crucial for navigating these economic fluctuations. By offering a range of products, from accessible dairy staples to indulgent premium offerings, the company can better weather economic uncertainties. This approach allows Emmi to maintain sales momentum even when consumer spending tightens, as seen in its ability to adapt to regional economic variations throughout 2024, where strong growth in some markets offset slower growth in others.

Persistent inflation and elevated input costs, particularly for raw milk, energy, and packaging materials, continue to exert significant pressure on Emmi's production expenses and overall profitability. These rising costs directly affect the company's margins.

To navigate these challenges, Emmi is actively implementing rigorous cost discipline measures and efficiency enhancement programs. These initiatives are crucial for mitigating the impact of inflationary pressures on its financial performance throughout 2024 and into 2025.

Emmi's 2024 financial results demonstrated a notable ability to maintain profitability despite these adverse economic conditions, underscoring the effectiveness of its cost management strategies. However, the ongoing volatility in input costs remains a critical area of focus for the company's strategic planning in 2025.

Currency exchange rate fluctuations, especially the strength of the Swiss franc against currencies like the Chilean peso and Brazilian real, can pose a challenge for Emmi's international sales growth. A robust franc makes Emmi's products pricier for foreign buyers and diminishes the value of profits earned abroad when converted back into Swiss francs.

The impact of these currency movements is clearly visible in Emmi's performance. For instance, Emmi's results for 2024 indicated a negative currency effect amounting to 2.4%, directly affecting its reported financial figures.

Consumer Purchasing Power and Affordability

Consumer purchasing power, a key driver for Emmi's sales, is closely tied to inflation and overall economic health. For instance, in Switzerland, inflation averaged 2.1% in 2023, a slight decrease from 2022's 2.8%, impacting how much consumers can afford. When this power wanes, consumers often shift towards more budget-friendly private label options, potentially affecting demand for Emmi's premium dairy products.

Emmi must strategically navigate this by ensuring a diverse product portfolio. This means not only offering high-quality, premium items but also maintaining accessible price points to capture a broader consumer base. For example, in 2023, Emmi reported net sales of CHF 4,244 million, showing strong performance, but continued monitoring of consumer affordability is crucial for sustained growth.

- Inflationary pressures in key markets like Switzerland and the US directly impact consumer spending on dairy products.

- The rise of private label brands presents a competitive challenge, particularly when consumer disposable income is squeezed.

- Emmi's ability to maintain a balance between premium positioning and affordability is vital for market share retention.

- In 2023, Emmi's sales growth of 5.1% in local currencies, despite economic headwinds, highlights the brand's resilience, but future affordability trends remain a key consideration.

Dairy Commodity Prices

Fluctuations in global dairy commodity prices, like milk fat and protein, directly impact Emmi's expenses for raw materials and its overall sales income. For instance, in early 2024, global butter prices saw significant volatility, impacting fat component costs for dairy processors.

The dairy sector in 2024 exhibited a notable market split, with some commodities facing limited supply and consequently higher prices. This divergence means Emmi must carefully manage its sourcing and product mix.

Emmi's strategy of concentrating on specialized, higher-value products and niche markets is a key approach to mitigating the effects of unpredictable commodity markets.

- Global milk powder prices experienced a notable increase in the first half of 2024, with skimmed milk powder reaching an average of $3,000 per metric ton in Q1 2024, up from $2,750 in Q4 2023.

- Butter prices, a key component for many Emmi products, remained elevated throughout 2024, averaging around $5,500 per metric ton globally due to persistent supply constraints.

- The focus on premium cheese and specialized dairy ingredients by Emmi helps to insulate its margins from the sharp swings seen in more commoditized dairy markets.

Economic growth directly influences consumer spending on Emmi's premium products, with regional variations in 2024 impacting demand. For example, while global growth was projected around 3%, economic slowdowns in regions like Europe in late 2024 and early 2025 could shift consumers to cheaper alternatives. Emmi's diversified product range helps mitigate these fluctuations by catering to various price points, ensuring sales resilience even during economic downturns.

Inflation and rising input costs, particularly for milk, energy, and packaging, continued to pressure Emmi's margins in 2024, necessitating cost discipline. Despite these challenges, Emmi demonstrated profitability, with 2024 results showing effective cost management, though input cost volatility remains a key 2025 focus. Currency fluctuations, such as the strong Swiss franc, also impacted international sales and profit conversion, with a negative currency effect of 2.4% noted in 2024 results. Emmi’s 2023 net sales reached CHF 4,244 million, with a 5.1% local currency growth, underscoring brand resilience amidst economic headwinds.

| Economic Factor | 2023/2024 Impact | 2025 Outlook/Consideration |

| Global Economic Growth | Projected ~3% in 2024; regional variations impact spending. | Continued monitoring of regional growth for demand forecasting. |

| Inflation & Input Costs | Pressure on margins due to rising milk, energy, packaging costs. | Ongoing cost management and efficiency programs are critical. |

| Currency Fluctuations | Strong CHF negatively impacted 2024 international sales (-2.4% effect). | Strategic hedging and pricing adjustments to mitigate currency risk. |

| Consumer Purchasing Power | Inflation (e.g., 2.1% in CH 2023) affects affordability; shift to private labels. | Balancing premium and accessible price points is key for market share. |

| Dairy Commodity Prices | Volatility in milk fat/protein prices; butter prices elevated (~$5,500/ton). | Focus on specialized products insulates margins from commodity swings. |

Preview the Actual Deliverable

Emmi PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Emmi PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape surrounding Emmi.

Sociological factors

Emmi is significantly shaped by shifting consumer preferences towards health and wellness. There's a noticeable surge in demand for dairy products offering added functionality, such as those rich in probiotics or high in protein, catering to consumers actively managing their health. For instance, the global functional foods market, which includes these dairy innovations, was projected to reach over $275 billion by 2024, highlighting the scale of this trend.

The company's strategic product development directly addresses these evolving needs. Emmi's introduction of items like its probiotic yogurt drink Aktifit and its range of premium desserts demonstrates a clear alignment with consumer desires for both health benefits and indulgent experiences. This proactive approach is crucial as consumers increasingly seek out products that support specific dietary requirements, such as lactose-free options, which saw a global market value of approximately $12.5 billion in 2023.

Furthermore, Emmi must remain attuned to the growing consumer interest in 'hay milk' and organic dairy products. These categories are gaining traction due to their perceived superior health benefits and more natural production methods. The organic dairy market alone was valued at over $20 billion globally in 2023, indicating a substantial and growing segment that Emmi can continue to leverage.

Consumers are increasingly prioritizing food that is produced sustainably and ethically, and this extends to dairy products. Emmi's focus on its 'Sustainable Swiss Milk' standard and its overarching sustainability plan, which targets reductions in greenhouse gas emissions and water consumption, directly aligns with this growing consumer preference. For instance, Emmi reported a 17% reduction in CO2 emissions per kilogram of milk in 2023 compared to 2019, demonstrating tangible progress in its environmental goals.

Modern life moves fast, and consumers increasingly seek out products that simplify their routines. This shift fuels a strong demand for convenience, particularly in the food and beverage sector. Emmi directly addresses this trend with offerings like its Emmi Caffè Latte, a popular ready-to-drink coffee option that appeals to busy individuals needing a quick and easy beverage solution.

Emmi's success is significantly tied to its capacity to develop and market products that seamlessly integrate into the fast-paced lives of today's consumers. By providing accessible and ready-to-consume dairy and coffee products, the company taps into a core need for convenience, which is a defining characteristic of contemporary lifestyles.

Cultural and Regional Food Preferences

Emmi's global reach necessitates a deep understanding of varied cultural and regional food preferences. The company's Swiss roots are a key part of its identity, but adapting to local tastes is crucial for international success.

In 2024, Emmi continues to navigate these diverse preferences. For instance, in markets like the Americas, there's a growing demand for plant-based alternatives and lactose-free options, reflecting evolving dietary trends. Conversely, European markets might show a stronger preference for traditional dairy products, albeit with increasing interest in premium and artisanal offerings.

- Market Adaptation: Emmi's strategy involves tailoring product portfolios and marketing campaigns to resonate with specific regional palates and culinary traditions.

- Innovation Focus: The company invests in research and development to create new products that align with emerging dietary habits and cultural expectations, such as low-sugar or high-protein dairy products.

- Growth Drivers: Understanding these preferences is key to unlocking growth in diverse markets, with successful localization contributing significantly to sales figures in regions outside its home base.

Influence of Social Media and Digitalization on Food Choices

The pervasive reach of social media and digitalization profoundly shapes consumer food preferences, necessitating Emmi's active engagement across digital platforms. Platforms like TikTok have seen trends promoting raw milk, underscoring the need for dairy companies to proactively join online conversations and clearly articulate their product advantages and sustainability initiatives to counter misinformation and build trust.

By 2024, social media influencers are projected to drive a significant portion of consumer purchasing decisions, with studies indicating that over 80% of consumers rely on online reviews and recommendations before buying food products. This trend demands Emmi to invest in digital marketing strategies and influencer collaborations to effectively reach and persuade its target audience.

- Digital Engagement is Key: Emmi must prioritize social media marketing and influencer partnerships to connect with consumers where they spend their time.

- Addressing Misinformation: Proactive communication about product benefits and sustainability is crucial to counter the spread of potentially harmful trends seen on platforms like TikTok.

- Data-Driven Insights: Leveraging social listening tools to understand evolving consumer sentiment and preferences will inform Emmi's product development and marketing efforts.

Societal trends significantly influence Emmi's market position, particularly concerning health consciousness and convenience. Consumers are increasingly seeking functional foods and convenient, ready-to-consume options, driving demand for products like Emmi's probiotic drinks and Caffè Latte. The global functional foods market was projected to exceed $275 billion by 2024, reflecting this strong consumer shift.

Emmi's adaptability to diverse cultural preferences and evolving dietary habits, such as the rise of plant-based alternatives and lactose-free products, is crucial for its international growth. The company's engagement with digital platforms and social media trends is also paramount for building consumer trust and countering misinformation, as over 80% of consumers rely on online recommendations by 2024.

Technological factors

Technological advancements are reshaping dairy production for Emmi, driving efficiency and cost reduction. Innovations like advanced membrane filtration are enabling the creation of healthier cheese varieties, while new technologies allow for the incorporation of live microorganisms into heat-treated dairy drinks, expanding product offerings.

Emmi's commitment to leveraging technology is evident in its strategic investments, such as the CHF 50 million allocated to its Emmen cheese dairy. This investment underscores Emmi's focus on modernizing its production capabilities to maintain a competitive edge in the evolving dairy market.

Emmi's manufacturing operations stand to gain significantly from the increasing adoption of automation and robotics. These advancements can boost Emmi's productivity by an estimated 10-20% and improve product consistency, crucial for maintaining brand quality in the competitive dairy sector. Reduced labor costs, potentially by 5-15% in certain production lines, further enhance Emmi's profitability.

Investing in advanced automation, such as AI-powered sorting and packaging systems, can optimize Emmi's production sites. This technological leap not only streamlines processes but also strengthens Emmi's competitive edge, allowing it to respond more agilely to market demands and global competition, especially as the global industrial robotics market is projected to reach $100 billion by 2028.

Sustainable farming technologies are increasingly critical for dairy companies like Emmi to meet environmental targets. Innovations in effluent management, for instance, can significantly reduce water pollution. In 2024, the dairy sector is seeing a growing investment in technologies aimed at lowering energy consumption across farms, with some European initiatives targeting a 15% reduction in energy use by 2025.

Emmi's collaboration with its milk producers to adopt these advanced farming methods is key to reducing the dairy industry's overall carbon footprint. For example, enhanced feed efficiency for herds not only improves animal welfare but also directly lowers methane emissions, a major contributor to greenhouse gases. By 2024, several pilot programs have demonstrated that optimized feed strategies can reduce a herd's methane output by up to 10%.

Data Analytics and Supply Chain Optimization

Emmi's strategic use of data analytics is revolutionizing its supply chain operations. By leveraging advanced analytics, the company can pinpoint inefficiencies, leading to significant improvements in logistics and a reduction in waste. For instance, in 2024, companies across the food and beverage sector saw an average reduction of 15% in inventory holding costs through better demand forecasting powered by data analytics.

This enhanced forecasting capability directly translates into more agile inventory management and optimized transportation routes. Emmi's commitment to data-driven decision-making allows for quicker responses to fluctuating market demands, a critical advantage in the fast-paced dairy industry. In 2025, Emmi reported a 10% increase in on-time delivery rates, attributed in part to their advanced supply chain visibility tools.

The operational excellence derived from these technological factors is multifaceted:

- Improved Logistics: Real-time tracking and route optimization reduce transit times and fuel consumption.

- Waste Reduction: More accurate demand forecasting minimizes overstocking and spoilage, with industry benchmarks showing a 5-10% decrease in food waste for data-optimized supply chains in 2024.

- Enhanced Responsiveness: Agility in adjusting production and distribution based on predictive analytics allows Emmi to meet consumer needs more effectively.

- Cost Efficiency: Streamlined operations and reduced waste contribute directly to a healthier bottom line.

Development of Functional Ingredients and Bioactives

The ongoing advancements in functional ingredients and bioactives, including lactoferrin, immunoglobulins, and glycomacropeptides (GMPs), are creating significant avenues for Emmi to diversify its product offerings. These developments allow Emmi to infuse its dairy products with added health advantages, directly tapping into the increasing consumer demand for foods that promote well-being.

For instance, the global market for functional foods and beverages was projected to reach over $350 billion by 2024, with a significant portion driven by dairy-based innovations. Emmi can leverage this trend by incorporating these bioactives to create premium products that cater to health-conscious consumers.

- Lactoferrin: Known for its immune-boosting and antimicrobial properties, lactoferrin is increasingly sought after in infant nutrition and health supplements.

- Immunoglobulins: These antibodies, naturally present in milk, offer immune support and are being explored for use in functional dairy drinks and yogurts.

- Glycomacropeptides (GMPs): GMPs, a unique component of whey protein, have shown potential benefits for gut health and cognitive function, presenting an opportunity for specialized dairy products.

- Market Growth: The functional ingredients market is expected to grow at a CAGR of approximately 7-8% through 2025, indicating strong potential for companies like Emmi that can effectively integrate these components.

Technological advancements are a significant driver for Emmi, enhancing production efficiency and enabling product innovation. Automation and AI are boosting productivity, with the industrial robotics market projected to reach $100 billion by 2028, while sustainable farming tech aims for a 15% energy reduction by 2025 in European dairy. Data analytics optimizes Emmi's supply chain, reducing inventory costs by an average of 15% in the food and beverage sector in 2024, and improving on-time delivery rates by 10% in 2025.

Emmi's investment in technology, like the CHF 50 million for its Emmen cheese dairy, reflects a commitment to modernization. Automation and robotics can increase productivity by 10-20% and reduce labor costs by 5-15%. The company is also exploring functional ingredients like lactoferrin and GMPs, tapping into a functional foods market projected to exceed $350 billion by 2024, with the functional ingredients market growing at 7-8% CAGR through 2025.

| Technology Area | Impact on Emmi | Relevant Data/Projections |

| Automation & Robotics | Increased productivity, improved consistency, reduced labor costs | 10-20% productivity increase, 5-15% labor cost reduction; Global industrial robotics market: $100 billion by 2028 |

| Data Analytics & AI | Optimized supply chain, better forecasting, reduced waste | 15% inventory cost reduction (food & beverage sector, 2024); 10% on-time delivery increase (Emmi, 2025) |

| Sustainable Farming Tech | Lower energy consumption, reduced environmental impact | 15% energy reduction target by 2025 (European initiatives); 10% methane output reduction from optimized feed |

| Functional Ingredients | Product diversification, health-focused offerings | Functional foods market: >$350 billion by 2024; Functional ingredients market CAGR: 7-8% through 2025 |

Legal factors

Emmi navigates a complex web of food labeling and advertising regulations across its global markets. These rules mandate precise information on packaging, covering nutritional content, ingredient lists, allergen declarations, and origin details, ensuring transparency for consumers.

Failure to comply can lead to significant legal penalties and damage Emmi's reputation. For instance, in the EU, the Food Information to Consumers (FIC) Regulation (EU) No 1169/2011 sets stringent requirements, and the UK's Food Information Regulations 2014 align closely. In 2024, regulatory bodies continue to emphasize clear allergen labeling, with ongoing scrutiny of marketing claims related to health and sustainability.

International trade laws and agreements significantly shape Emmi's global business landscape, influencing everything from import and export duties to customs procedures and potential trade barriers. For instance, the European Union's Common Agricultural Policy (CAP) and its trade agreements with countries like Switzerland (where Emmi is headquartered) directly affect market access and pricing for dairy products. Emmi must remain vigilant in monitoring evolving trade policies, such as potential adjustments to tariffs on dairy imports in key markets like the United States or changes in sanitary and phytosanitary regulations, to maintain operational efficiency and competitive product positioning.

Emmi, operating in highly competitive dairy markets, must strictly adhere to competition laws and anti-trust regulations across its global operations. These regulations are designed to prevent market dominance and ensure a level playing field for all businesses, directly impacting Emmi's strategic decisions regarding market expansion, pricing, and potential mergers or acquisitions. For instance, in 2023, the European Commission continued its scrutiny of various sectors for anti-competitive practices, a trend expected to persist through 2024 and 2025, requiring Emmi to maintain robust compliance frameworks.

Environmental Protection Laws and Emissions Regulations

Emmi faces increasing pressure from environmental protection laws and emissions regulations, especially concerning greenhouse gases and water usage in its dairy operations. These legal frameworks directly influence Emmi's operational strategies and sustainability targets.

The company's proactive approach is evident in its commitment to slash direct greenhouse gas emissions by 60% by 2027, a goal aligned with its broader netZERO 2050 vision. This ambition is a direct response to evolving legal mandates and growing societal expectations for environmental responsibility in the food industry.

- Regulatory Compliance: Emmi must adhere to a growing body of environmental legislation, impacting everything from farm-level practices to processing plant emissions.

- Emissions Targets: The company is actively working towards a 60% reduction in direct greenhouse gas emissions by 2027, a significant undertaking driven by legal and ethical imperatives.

- Water Management: Regulations on water usage in dairy farming and processing necessitate efficient water management practices throughout Emmi's value chain.

Consumer Protection Laws and Product Liability

Consumer protection laws are crucial for Emmi, ensuring its dairy products meet stringent safety and quality standards. These regulations, like the EU's General Food Law, hold manufacturers liable for any harm caused by defective products. For instance, in 2023, the European Commission reported a significant number of food safety alerts, highlighting the ongoing need for vigilance in product integrity and traceability.

Emmi must navigate a complex web of product liability regulations across its operating markets. Failure to comply can result in substantial financial penalties and severe reputational damage. For example, recalls due to contamination or labeling errors can cost millions, as seen with various food industry incidents globally. Emmi's commitment to robust quality control and transparent labeling is therefore paramount.

- EU Food Safety Regulations: Emmi must adhere to frameworks like Regulation (EC) No 178/2002, establishing general principles and requirements of food law.

- Product Liability Directives: Compliance with directives such as Directive 85/374/EEC ensures compensation for consumers harmed by defective products.

- National Consumer Protection Agencies: Emmi needs to stay updated on the specific enforcement actions and guidelines from agencies like Germany's Federal Office of Consumer Protection and Food Safety (BVL).

- Recall Costs: Industry data indicates that product recalls can cost companies upwards of $10 million, factoring in lost sales, logistics, and reputational repair.

Emmi's operations are heavily influenced by evolving food safety and labeling laws, with strict adherence to regulations like the EU's Food Information to Consumers (FIC) Regulation being critical. For instance, in 2024, continued emphasis on clear allergen declarations and accurate nutritional information remains a key compliance area.

International trade agreements and tariffs directly impact Emmi's global market access and pricing strategies for its dairy products. Monitoring changes, such as potential shifts in US dairy import duties, is essential for maintaining competitive positioning.

Competition laws and anti-trust regulations are vital for Emmi, particularly concerning market expansion and pricing. The ongoing scrutiny of anti-competitive practices by bodies like the European Commission, expected through 2024 and 2025, necessitates robust compliance.

Emmi faces increasing legal obligations related to environmental protection, especially concerning greenhouse gas emissions and water usage. The company's commitment to reducing direct greenhouse gas emissions by 60% by 2027 is a direct response to these evolving legal mandates.

Environmental factors

Climate change and the need to cut greenhouse gas (GHG) emissions significantly impact Emmi. Dairy farming, a core part of Emmi's operations, is a source of GHG emissions, particularly methane from livestock. This environmental pressure necessitates strategic adjustments in Emmi's production and supply chain management.

Emmi has set ambitious targets to address these environmental concerns. The company is committed to reducing its direct GHG emissions by 60% by 2027, a substantial step towards sustainability. Furthermore, Emmi has a long-term vision of achieving net-zero emissions by 2050.

To achieve these goals, Emmi is actively collaborating with its milk producers. The focus is on reducing carbon dioxide equivalent (CO2e) per kilogram of milk. This partnership approach is crucial for driving down emissions across the entire value chain, reflecting a proactive stance on environmental stewardship.

Water scarcity is a growing challenge, particularly in areas where Emmi has a presence. The dairy industry, which is central to Emmi's business, is inherently water-intensive. This demand stems from various needs, including hydrating livestock, irrigating feed crops, maintaining hygiene in facilities, and the processing of dairy products.

Emmi is actively addressing this by setting ambitious targets to reduce its water footprint. The company has committed to a 50% reduction in freshwater consumption across its operations in regions identified as high-risk for water scarcity by 2027. Furthermore, Emmi aims for a 15% reduction in freshwater use in its operations in other countries during the same timeframe, demonstrating a global commitment to responsible water management.

Sustainable land use and biodiversity protection are increasingly vital for Emmi. Dairy farming, a core part of Emmi's operations, can impact ecosystems through land conversion for feed production and potential soil degradation. For instance, in 2023, Emmi reported that its agricultural raw materials sourcing covered 100% of its milk volume, highlighting the scale of land involved.

Emmi's commitment to responsible practices is evident in its value chain management. The company actively promotes sustainable agriculture, aiming to minimize its environmental footprint. In 2024, Emmi continued to invest in initiatives that support biodiversity and responsible land management, recognizing their importance for long-term business resilience and consumer trust.

Waste Management and Circular Economy Initiatives

Emmi's environmental strategy heavily focuses on robust waste management and the adoption of circular economy principles. This commitment is crucial for navigating evolving regulatory landscapes and consumer expectations regarding sustainability.

The company has set ambitious targets, aiming to reduce waste and food waste by 50% across its operations by 2027. Furthermore, Emmi is striving for 100% recyclable packaging, incorporating a minimum of 30% recycled content. These initiatives align with broader European Union directives promoting resource efficiency and waste reduction.

Key aspects of Emmi's approach include:

- Waste Reduction Targets: Aims to halve waste and food waste by 2027.

- Packaging Sustainability: Targets 100% recyclable packaging with at least 30% recycled material.

- Circular Economy Integration: Focuses on resource reuse and minimizing landfill waste.

Animal Health and Disease Management

Animal health and disease management represent a critical environmental factor for Emmi, directly impacting its raw material supply chain. Outbreaks of diseases such as bluetongue virus (BTV) can significantly reduce milk production, as seen in previous years where BTV outbreaks in Europe have caused considerable economic losses for dairy farmers due to decreased yields and animal health issues. Emmi's reliance on healthy dairy herds means that disease prevalence can lead to substantial drops in milk availability and increased procurement costs.

The economic impact of animal diseases on dairy farming is substantial. For instance, the cost of treating sick animals, coupled with reduced milk output, places a financial strain on farmers, potentially affecting their ability to supply Emmi consistently. In 2023, the European Food Safety Authority (EFSA) continued to monitor bluetongue virus serotypes, highlighting the ongoing risk to livestock health across the continent. This necessitates robust disease surveillance and management strategies within Emmi's supply network to mitigate these environmental risks.

- Impact of Bluetongue: Bluetongue virus outbreaks can cause significant milk yield reduction in affected dairy cows.

- Economic Strain on Farmers: Disease management and reduced production increase costs for dairy farmers, potentially impacting Emmi's supply.

- Supply Chain Vulnerability: Emmi's dependence on healthy herds makes its raw material supply susceptible to animal disease epidemics.

- Ongoing Monitoring: European health authorities continue to track and report on bluetongue virus, indicating persistent environmental risk.

Emmi's environmental strategy is deeply intertwined with climate change mitigation and resource management. The company aims to slash GHG emissions by 60% by 2027 and achieve net-zero by 2050, focusing on reducing CO2e per kilogram of milk through collaboration with milk producers.

Water scarcity is a significant concern, with Emmi targeting a 50% reduction in freshwater use in high-risk regions by 2027, alongside a 15% reduction elsewhere.

Sustainable land use and biodiversity are also key, with Emmi promoting responsible agriculture and investing in initiatives to protect ecosystems, recognizing the vast land involved in sourcing agricultural raw materials, which covered 100% of its milk volume in 2023.

Waste management and circular economy principles are central, with Emmi aiming to halve waste by 2027 and ensure 100% recyclable packaging containing at least 30% recycled material.

PESTLE Analysis Data Sources

Our Emmi PESTLE analysis is built on a robust foundation of data from leading international organizations, government publications, and reputable market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.