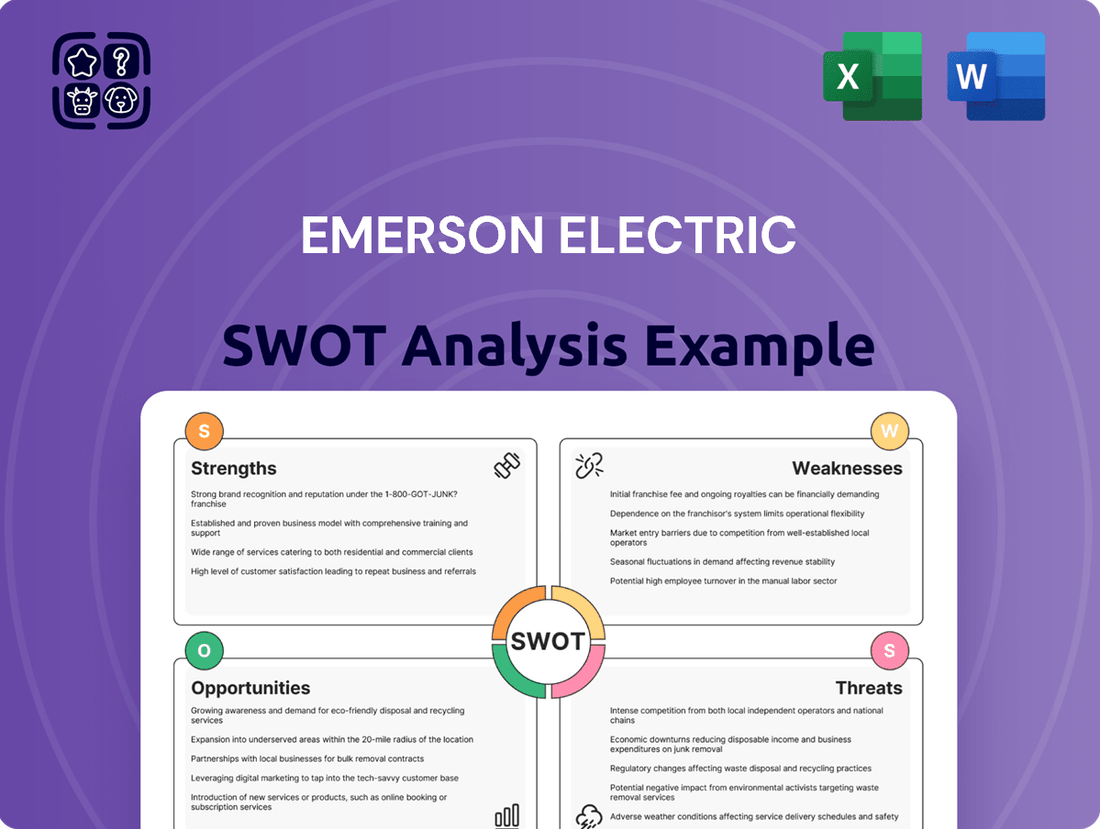

Emerson Electric SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emerson Electric Bundle

Emerson Electric boasts significant strengths in its diversified portfolio and strong brand recognition, offering a stable foundation for growth. However, understanding the nuances of its competitive landscape and potential market shifts is crucial for capitalizing on opportunities and mitigating risks.

Our comprehensive SWOT analysis dives deep into these elements, revealing actionable insights into Emerson's strategic positioning. Discover the full picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Emerson Electric stands as a global powerhouse in technology and software, boasting a remarkably diversified portfolio. Its operations span crucial industrial, commercial, and residential markets, providing a broad base of operations and innovative solutions. This extensive reach, particularly in automation and commercial & residential solutions, equips Emerson with significant resilience against the ebb and flow of various market conditions.

The company's strategic emphasis on high-margin segments, coupled with its proven capacity to deliver cutting-edge solutions across a spectrum of essential industries, firmly establishes its robust market standing. For instance, in fiscal year 2023, Emerson reported net sales of $15.2 billion, with its Automation Solutions segment contributing significantly to this revenue, highlighting the strength of its industrial focus.

Emerson Electric showcased impressive financial strength in its first quarter of 2025, reporting substantial growth in net sales, pretax earnings, and adjusted earnings per share. This robust performance underscores the company's successful strategic shift towards higher-margin industrial technology solutions.

The company's ability to generate strong cash flow, coupled with record profit margins, is a testament to its operational efficiency and the effectiveness of its management systems. This financial resilience positions Emerson favorably for future investments and continued delivery of shareholder value.

Emerson Electric has executed a significant strategic pivot, actively reshaping its business through both divestitures and targeted acquisitions. This transformation is crucial for its future growth and market positioning.

Key divestitures, including Copeland and InSinkErator, have allowed Emerson to shed non-core operations, focusing resources on higher-potential segments. This streamlining is a deliberate move to enhance overall operational efficiency and financial flexibility.

Strategic acquisitions such as AspenTech, National Instruments (NI), Afag, and Flexim are bolstering Emerson’s expertise in critical areas. These moves significantly strengthen its capabilities in industrial software, test and measurement, and factory automation, aligning with market demands for advanced digital solutions.

This portfolio reshaping positions Emerson as a more focused, pure-play automation company. The integration of these acquired technologies and businesses is designed to capitalize on high-growth opportunities within the industrial technology sector, particularly in areas driven by digitalization and automation trends.

Commitment to Innovation and Advanced Technology

Emerson Electric's dedication to innovation is a significant strength. The company consistently channels substantial resources into research and development, with approximately 8% of its sales allocated to innovation in 2024. This robust investment fuels the creation of next-generation technologies, such as intelligent devices, advanced control systems, and sophisticated industrial software. By focusing on these cutting-edge areas, Emerson is strategically positioned to be a frontrunner in rapidly evolving fields like artificial intelligence, the Internet of Things (IoT), and software-defined automation.

This commitment translates into tangible market advantages:

- Technological Leadership: Emerson's R&D spending drives the development of market-leading technologies.

- Future-Proofing: Investment in AI and IoT prepares the company for future industrial demands.

- Competitive Edge: Advanced automation solutions offer a distinct advantage over competitors.

- Enhanced Efficiency: Intelligent devices and software improve operational efficiency for clients.

Strong Sustainability and ESG Performance

Emerson Electric demonstrates a robust commitment to sustainability, evident in its 2024 Sustainability Report. The company has achieved notable reductions in its environmental footprint, including a 30% decrease in energy intensity since 2021 and a significant 48% reduction in Scope 1 and 2 emissions. Furthermore, Emerson has actively pursued renewable energy sources, reaching 57% adoption in 2024.

This strong Environmental, Social, and Governance (ESG) performance serves as a key strength for Emerson. It not only helps in mitigating operational and regulatory risks associated with environmental impact but also significantly bolsters the company's brand reputation. This enhanced image is particularly attractive to the growing segment of environmentally conscious investors, potentially leading to increased capital access and favorable valuations.

- Reduced Energy Intensity: 30% decrease since 2021.

- Lower Emissions: 48% reduction in Scope 1 and 2 emissions.

- Renewable Energy Adoption: 57% utilization in 2024.

- Enhanced Reputation: Attracts environmentally conscious investors and mitigates risks.

Emerson Electric's diversified business model provides significant stability, with its Automation Solutions segment being a major revenue driver. The company's strategic focus on high-margin industrial technology and software, bolstered by recent acquisitions like AspenTech and National Instruments, strengthens its market position and innovation capabilities. Emerson's commitment to R&D, with approximately 8% of sales dedicated to innovation in 2024, fuels the development of cutting-edge solutions in AI and IoT, ensuring future competitiveness.

The company's financial performance in fiscal year 2023, with net sales of $15.2 billion, and its strong start to fiscal year 2025, demonstrating growth in net sales and earnings, highlight its operational efficiency and strategic execution. Emerson's ability to generate robust cash flow and achieve record profit margins further solidifies its financial resilience and capacity for sustained shareholder value creation.

Emerson's proactive portfolio reshaping, including the divestiture of non-core assets like Copeland and InSinkErator, has sharpened its focus on core automation and software segments. This strategic streamlining, combined with key acquisitions, positions Emerson as a more agile and specialized player in the industrial technology landscape, ready to capitalize on digitalization trends.

Emerson Electric's strong ESG performance is a notable strength, with a 30% reduction in energy intensity and a 48% decrease in Scope 1 and 2 emissions since 2021, alongside 57% renewable energy adoption in 2024. This commitment not only mitigates risks but also enhances brand reputation, attracting environmentally conscious investors and potentially improving access to capital.

| Metric | FY23 (Billions USD) | FY24 (Projection) | FY25 (Projection) |

|---|---|---|---|

| Net Sales | $15.2 | $15.5 - $16.0 | $16.3 - $16.8 |

| R&D Investment (% of Sales) | ~8% | ~8% | ~8% |

| Renewable Energy Adoption | 57% (2024) | N/A | N/A |

| Scope 1 & 2 Emissions Reduction | 48% (vs. 2021) | N/A | N/A |

What is included in the product

Delivers a strategic overview of Emerson Electric’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Emerson Electric's SWOT analysis helps identify potential market disruptions and competitive threats, alleviating the pain of unforeseen strategic challenges.

Weaknesses

While Emerson Electric's acquisition strategy is a core strength, integrating major acquisitions like AspenTech and NI presents significant challenges. These can include operational disruptions as systems are merged, cultural clashes between distinct workforces, and unforeseen integration costs that can impact profitability.

There's a tangible risk that the projected synergies from these deals might not be realized as rapidly or as fully as initially anticipated. This could lead to a dilution of short-term earnings per share, a key metric for investor confidence.

Emerson's global footprint, while a strength, also presents a significant weakness: exposure to currency fluctuations. For instance, a strong U.S. dollar can reduce the value of earnings generated in foreign markets when translated back into dollars, potentially impacting reported revenues and profits. This volatility is a constant factor in managing international financial performance.

Beyond currency, geopolitical risks pose another considerable challenge. Trade disputes, shifting regulatory environments, and regional conflicts can disrupt supply chains, increase operational costs, and dampen demand in key markets. For example, ongoing trade tensions between major economies can lead to tariffs and restrictions that directly affect Emerson's ability to operate and compete effectively in those regions.

The company's reliance on international markets means that unforeseen political events or changes in trade policy can have a swift and material impact on its financial results. In 2023, for example, global economic uncertainties and regional political instability continued to create headwinds for multinational corporations, including Emerson, highlighting the need for robust risk management strategies.

Emerson Electric's reliance on cyclical industrial markets, notably oil and gas, presents a significant weakness. Even with diversification efforts, a substantial portion of its revenue is tied to sectors prone to economic swings. For example, during periods of reduced energy demand or price volatility, Emerson's automation solutions and climate technologies business can experience a direct hit.

This exposure means that broader economic downturns or specific industry slumps can disproportionately affect Emerson's financial performance. In 2023, while Emerson showed resilience, the energy sector's fluctuations still presented headwinds, impacting order rates for certain product lines. This inherent cyclicality can lead to unpredictable revenue streams and profitability, making long-term forecasting more challenging.

Competitive and Evolving Industry Landscape

The industrial automation and technology sectors are intensely competitive. Emerson Electric faces formidable rivals such as Siemens, Honeywell, and Rockwell Automation, as well as numerous specialized players. This dynamic environment necessitates constant innovation to stay ahead.

To maintain its market position, Emerson must proactively adapt to swift technological shifts and evolving customer needs. Failing to do so risks losing ground to more agile competitors. For example, the increasing demand for integrated software solutions and advanced data analytics in industrial settings presents both an opportunity and a challenge.

- Intense Rivalry: Emerson competes with major global players in automation and technology.

- Technological Pace: Rapid advancements require continuous investment in R&D to remain competitive.

- Customer Demands: Shifting preferences towards digital solutions and sustainability necessitate strategic adaptation.

- Market Share Pressure: Aggressive competition from both large incumbents and niche providers puts constant pressure on market share.

Operational Costs and Amortization from Strategic Shifts

Emerson Electric's strategic shift towards software and automation, while promising for future growth, has undeniably increased its operational expenses. Integrating these new, often technologically advanced, businesses requires significant investment in systems, talent, and ongoing support. This ramp-up phase naturally leads to higher costs in the short to medium term.

Furthermore, the acquisition of businesses with substantial software intellectual property results in a rise in intangibles on the balance sheet. The amortization of these intangibles, recognized over their useful lives, directly impacts reported earnings. For instance, Emerson's 2024 fiscal year saw continued investments in its automation solutions portfolio, contributing to these amortization expenses.

- Increased Operational Expenses: The integration of acquired software and automation businesses leads to higher costs for IT infrastructure, specialized personnel, and ongoing R&D.

- Amortization of Intangibles: Acquisitions, particularly in the software space, result in significant intangible assets that are amortized, reducing reported net income.

- Impact on Profitability: These short-to-medium term cost increases can temporarily suppress profit margins, necessitating careful financial management and strategic cost control.

- Need for Management Focus: Effectively managing these growing operational costs and amortization is crucial for Emerson to realize the full long-term benefits of its portfolio transformation.

Emerson's reliance on cyclical industrial markets, particularly oil and gas, is a significant vulnerability. Even with diversification, a substantial portion of revenue remains tied to sectors prone to economic swings. For example, fluctuations in energy demand and prices directly impact its automation and climate technologies businesses, leading to unpredictable revenue streams.

The company faces intense competition in the industrial automation and technology sectors from giants like Siemens and Honeywell, as well as specialized firms. This necessitates continuous innovation and adaptation to rapid technological shifts and evolving customer demands for digital solutions.

Integrating major acquisitions, such as AspenTech, presents substantial challenges. These include operational disruptions, cultural clashes, and unforeseen costs that can delay or diminish projected synergies, potentially impacting earnings per share.

Emerson's global presence exposes it to currency fluctuations and geopolitical risks like trade disputes and regulatory changes. These factors can disrupt supply chains, increase costs, and dampen demand in key international markets, affecting reported revenues and profits.

| Weakness | Description | Impact |

|---|---|---|

| Cyclical Market Dependence | Significant revenue tied to volatile sectors like oil and gas. | Unpredictable revenue, vulnerability to economic downturns. |

| Intense Competition | Faces strong rivals in automation and technology. | Requires continuous R&D investment and strategic adaptation. |

| Acquisition Integration Challenges | Merging acquired companies like AspenTech is complex. | Potential for operational disruptions, cost overruns, and delayed synergies. |

| Geopolitical & Currency Risks | Global operations subject to currency fluctuations and political instability. | Reduced value of foreign earnings, supply chain disruptions, and market access issues. |

Full Version Awaits

Emerson Electric SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive look at Emerson Electric's Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis is essential for strategic planning.

Opportunities

The worldwide push for industrial automation and digital transformation, fueled by the Internet of Things (IoT) and Artificial Intelligence (AI), offers substantial growth avenues. Emerson is well-positioned to leverage these trends, aiming to increase its market presence.

Emerson's strategic pivot towards software-defined automation, bolstered by acquisitions such as AspenTech, significantly enhances its software offerings. This move is designed to capitalize on the escalating demand for integrated digital solutions across various industries, driving expansion.

The global industrial automation market is projected to reach approximately $314.9 billion by 2027, with digital transformation initiatives being a key driver. Emerson's investment in these areas, including its expanded software portfolio, directly targets this expanding market segment.

The global drive for decarbonization and the expansion of clean energy infrastructure present a significant growth avenue for Emerson. As of early 2024, the International Energy Agency projects substantial investment in renewable energy sources, a trend Emerson's automation and energy management solutions are well-suited to support.

Emerson's established expertise in areas like liquefied natural gas (LNG) infrastructure, coupled with its focus on energy efficiency and emission reduction technologies, directly aligns with market demands. This strategic positioning allows Emerson to capitalize on the increasing need for smart grid solutions and the integration of renewable energy sources into existing power systems.

Emerging markets present a significant opportunity for Emerson Electric, offering a chance to connect with a broad range of customers and participate in industrial expansion. For instance, in 2024, Emerson highlighted the growing demand for automation solutions in regions like Asia-Pacific, which is expected to be a key driver of its commercial business.

The company is also poised to benefit from anticipated upturns in discrete automation markets, a sector that saw some slowdown but is projected to rebound. This recovery, coupled with ongoing strong demand in process and hybrid industries, creates multiple pathways for Emerson to increase its revenue streams throughout 2024 and into 2025.

Strategic Partnerships and Ecosystem Development

Strategic partnerships offer Emerson significant avenues for growth. Collaborations, such as the one with Zitara Technologies for advanced battery management, are key. This specific partnership, announced in early 2024, aims to bolster Emerson's presence in the burgeoning energy storage market, a sector projected for substantial expansion through 2030.

These alliances are crucial for accelerating innovation and developing comprehensive solutions that address evolving customer demands. By integrating complementary technologies and expertise, Emerson can unlock new market opportunities and enhance its competitive positioning. This approach allows for faster market penetration and the creation of synergistic offerings.

Emerson's strategy involves building a robust ecosystem of technology providers and solution partners.

- Expanding into Energy Storage: The Zitara Technologies partnership targets the rapidly growing energy storage sector, a key growth area.

- Accelerating Innovation: Collaborations speed up the development and deployment of new technologies.

- Market Reach Enhancement: Partnerships provide access to new customer segments and geographic regions.

- Integrated Solutions: Emerson can offer more complete product and service packages to customers.

Government Investments in Infrastructure and Reshoring

Government initiatives like the U.S. Infrastructure Investment and Jobs Act (IIJA) are injecting significant capital into public works, creating a robust demand environment for Emerson's automation and electrical solutions. This act alone allocated $1.2 trillion, with a substantial portion earmarked for grid modernization and transportation networks, areas where Emerson has strong product offerings. Furthermore, the CHIPS and Science Act, with its focus on semiconductor manufacturing, and the Inflation Reduction Act (IRA), which promotes clean energy, directly translate into increased project opportunities for Emerson's industrial technologies as these sectors expand domestically.

The trend of manufacturing reshoring, spurred by geopolitical considerations and supply chain resilience efforts, presents a considerable opportunity for Emerson. As companies bring production back to the United States, there's a heightened need for modernizing and automating these facilities. This domestic expansion can lead to increased sales of Emerson's advanced manufacturing equipment and software, supporting a more efficient and competitive U.S. industrial base. For example, the reshoring trend is expected to drive billions in new manufacturing investments across various sectors in 2024 and 2025.

- Infrastructure Spending Boost: The IIJA's $1.2 trillion commitment is projected to stimulate significant demand for electrical components and automation systems.

- Reshoring Momentum: Companies are investing heavily in bringing manufacturing back to the US, requiring new, often automated, production facilities.

- Clean Energy Transition: The IRA incentivizes renewable energy projects, directly benefiting Emerson's solutions for power generation and distribution.

- Domestic Market Growth: These government policies and reshoring trends create a fertile ground for Emerson to expand its market share within the United States.

Emerson's strategic focus on industrial automation and digital transformation, coupled with its acquisition of AspenTech, positions it to capitalize on the growing demand for integrated digital solutions. This move is expected to drive significant revenue growth as industries increasingly adopt AI and IoT. The global industrial automation market is projected to reach approximately $314.9 billion by 2027, a testament to the sector's expansion.

The global push for decarbonization and clean energy infrastructure represents a substantial opportunity for Emerson. As of early 2024, substantial investments are being made in renewable energy, and Emerson's energy management and automation solutions are well-suited to support this transition. Their expertise in areas like LNG and emission reduction technologies aligns perfectly with market needs.

Emerging markets, particularly in the Asia-Pacific region, are showing strong demand for automation solutions, which Emerson is poised to serve. Furthermore, strategic partnerships, such as the one with Zitara Technologies for battery management, are enhancing Emerson's offerings and market reach in high-growth sectors like energy storage. These collaborations are vital for accelerating innovation and providing comprehensive solutions.

Government initiatives in the US, including the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, are driving significant investment in grid modernization, transportation, and clean energy projects. These policies, alongside the trend of manufacturing reshoring, are creating a robust domestic market for Emerson's automation and electrical solutions throughout 2024 and 2025.

| Opportunity Area | Market Projection/Data | Emerson's Relevance |

|---|---|---|

| Industrial Automation & Digital Transformation | Global market ~$314.9 billion by 2027 | Leveraging IoT, AI, and AspenTech acquisition |

| Clean Energy & Decarbonization | Significant investment in renewables (early 2024) | Energy management & emission reduction technologies |

| Emerging Markets | Strong demand in Asia-Pacific (2024) | Expanding customer base and industrial expansion |

| Strategic Partnerships | Energy storage market growth | Zitara Technologies for battery management |

| Government Initiatives (US) | IIJA ($1.2 trillion), IRA | Demand for grid modernization, clean energy solutions |

| Manufacturing Reshoring | Billions in new manufacturing investments (2024-2025) | Automating modernized domestic facilities |

Threats

The industrial technology and automation landscape is fiercely competitive, with both long-standing corporations and emerging companies aggressively pursuing market share. Emerson Electric faces continuous pressure from global industrial powerhouses, which can lead to price wars, squeezed profit margins, and a potential decline in its market standing if innovation falters.

For instance, in the fiscal year 2023, Emerson reported net sales of $15.1 billion, a testament to its current market position. However, the ongoing battle for dominance, especially in key segments like process automation and climate technologies, means that failing to outpace rivals in product development and service offerings could see this revenue stream challenged. Companies like Siemens and Honeywell are significant players in these same markets, creating a dynamic environment where differentiation is paramount.

Global economic uncertainties, including persistent inflation and the lingering effects of supply chain disruptions, present a significant threat to Emerson's business. These factors can dampen demand for its industrial automation and climate technologies, directly impacting revenue streams.

The inherent cyclicality within key industrial sectors that Emerson serves means that economic downturns can lead to sharp reductions in customer capital expenditures. For instance, a projected slowdown in global manufacturing output for 2024 could translate into lower sales for Emerson's automation solutions.

Market volatility, characterized by fluctuating interest rates and geopolitical instability, further exacerbates these risks. This environment can make customers hesitant to commit to large projects, thereby affecting Emerson's order backlog and near-term profitability.

The automation and software sectors are evolving at breakneck speed. Competitors could launch game-changing innovations that quickly make Emerson's current offerings less relevant. For instance, advancements in AI-driven predictive maintenance, a key area for Emerson, could be leapfrogged by rivals with more integrated or efficient solutions.

Emerson's ability to adapt and invest in research and development is crucial. If competitors introduce superior technologies, particularly in areas like industrial IoT platforms or advanced analytics for process optimization, Emerson risks losing market share. This was highlighted in 2023 when several smaller, agile firms announced significant breakthroughs in edge computing for industrial applications, potentially impacting Emerson's distributed control system market.

Failure to effectively commercialize new technologies can also be a significant threat. Even if Emerson develops innovative solutions, a slow or ineffective go-to-market strategy could allow competitors to capture early adoption. The company's success in the 2024-2025 period will heavily depend on its agility in integrating emerging technologies, such as digital twins and enhanced cybersecurity for operational technology, into its product portfolio and business models.

Cybersecurity Risks and Data Vulnerabilities

Emerson Electric's growing reliance on software and digital solutions, central to industrial automation, exposes it to significant cybersecurity risks. A data breach or system failure could result in substantial financial penalties, damage to its reputation, and severe operational disruptions for both Emerson and its vast customer base. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of this threat.

The company's interconnected systems, handling sensitive operational data, are prime targets. Such vulnerabilities can lead to:

- Disruption of critical infrastructure operations for clients.

- Theft of intellectual property and proprietary algorithms.

- Significant financial losses due to ransomware attacks or system downtime.

- Erosion of customer trust and market confidence.

Regulatory Changes and Trade Policy Instability

Evolving regulatory landscapes in the energy and automation sectors present a significant threat to Emerson Electric. Changes in environmental regulations, particularly concerning emissions and energy efficiency standards, can necessitate costly upgrades to manufacturing processes and product lines. For instance, shifts in climate policy could impact demand for certain traditional energy solutions while accelerating the need for new automation technologies to support renewable energy infrastructure.

Potential shifts in U.S. trade policies, such as the imposition of tariffs or changes in import/export agreements, add another layer of complexity. These policy instabilities can directly affect Emerson's global supply chain and manufacturing operations, potentially increasing the cost of raw materials and finished goods. In 2024, ongoing geopolitical tensions and trade disputes continue to create an unpredictable environment for international business.

These regulatory and trade policy uncertainties can lead to increased compliance challenges and elevated operational costs. Such factors directly impact global manufacturing strategies and export competitiveness, making it difficult to forecast long-term business predictability and potentially hindering international growth. The company's reliance on a global manufacturing footprint means it is particularly exposed to these international policy shifts.

- Regulatory Uncertainty: Emerson faces potential compliance costs from evolving environmental and safety regulations in key markets like the U.S. and Europe.

- Trade Policy Volatility: Tariffs or other trade barriers could increase the cost of components sourced internationally or impact the pricing of exported products.

- Supply Chain Disruption: Changes in trade agreements or geopolitical events can disrupt Emerson's established global supply chains, leading to production delays and increased expenses.

- Reduced Predictability: The dynamic nature of regulatory and trade policies makes long-term strategic planning and investment decisions more challenging.

Intense competition from global industrial players like Siemens and Honeywell poses a significant threat, potentially driving down profit margins and market share, especially in automation and climate technologies. Economic uncertainties, including inflation and supply chain issues, can dampen demand for Emerson's products, while the cyclical nature of industrial sectors means downturns can sharply reduce customer spending on automation solutions.

Rapid technological advancements in areas like AI and edge computing could render Emerson's current offerings obsolete if it fails to innovate quickly or effectively commercialize new technologies. Furthermore, increasing reliance on software and digital solutions exposes Emerson to substantial cybersecurity risks, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, threatening financial losses and reputational damage.

Evolving environmental regulations and trade policy volatility, including potential tariffs and shifts in import/export agreements, create compliance challenges and increase operational costs. These factors can disrupt global supply chains and reduce business predictability, impacting Emerson's international growth strategies and cost competitiveness.

SWOT Analysis Data Sources

This analysis is built on a foundation of robust data, drawing from Emerson Electric's official financial statements, comprehensive market research reports, and expert industry analysis to provide a thorough and accurate assessment.