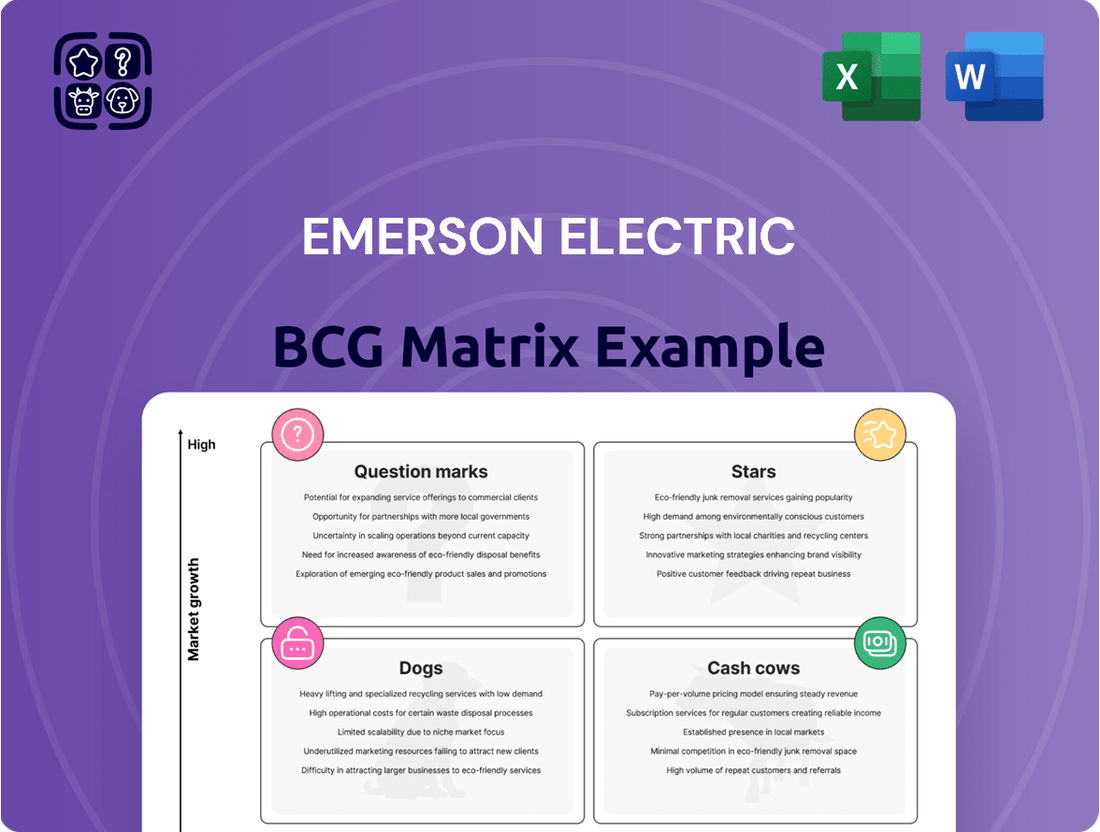

Emerson Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emerson Electric Bundle

Discover how Emerson Electric's diverse product portfolio aligns with the strategic framework of the BCG Matrix. This initial glimpse highlights key areas of strength and potential challenges.

Understand which of Emerson Electric's offerings are generating substantial cash flow and which require careful consideration for future investment. Uncover the nuances of their market position.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Emerson Electric.

The complete BCG Matrix reveals exactly how Emerson Electric is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Purchase now and get instant access to a beautifully designed BCG Matrix for Emerson Electric that’s both easy to understand and powerful in its insights—delivered in Word and Excel formats.

Stars

Emerson Electric's Industrial Software & Control Systems segment is a strong Star, driven by its strategic shift towards software-centric automation. This is significantly amplified by the full acquisition of AspenTech in March 2025, a move that cements its position in a high-growth market focused on industrial digitalization and predictive analytics. Emerson is actively capturing market share and improving its profit margins in this domain.

The synergy created by integrating AspenTech's advanced AI modeling and digital twin capabilities with Emerson's robust hardware offerings results in complete, end-to-end solutions for customers. This integration not only enhances value but also builds substantial recurring revenue streams, further solidifying the segment's Star status. For instance, AspenTech's software is projected to contribute significantly to Emerson's software revenue growth in the coming years, with analysts anticipating a substantial increase in the software portion of Emerson's total sales by 2026.

Emerson's Solutions for Sustainability & Decarbonization represent a strategic focus area, addressing the urgent global need to reduce emissions. This segment includes technologies vital for hydrogen production, carbon capture, and integrating renewable energy sources into industrial processes. The market for these solutions is booming, driven by stricter environmental mandates and corporate climate goals.

Emerson's expertise in advanced measurement and control systems positions it well to capitalize on this growth. For instance, the company's Ovation™ automation platform is key for optimizing complex processes in green hydrogen production, a sector projected to reach hundreds of billions in value by 2030. Emerson's commitment here aligns with the increasing demand for decarbonization technologies, allowing them to secure a strong market position.

Advanced Factory Automation & Robotics is a significant growth area for Emerson, bolstered by the August 2023 acquisition of Afag. This move significantly expanded Emerson's offerings in electric linear motion, feeding, and handling automation, crucial components for modern manufacturing.

This segment operates within the rapidly expanding discrete manufacturing market, fueled by reshoring initiatives and the widespread adoption of automation technologies. Emerson's strategic integration of Afag's advanced electric automation solutions with its own established pneumatic motion expertise positions it for substantial gains in this dynamic sector.

Industrial IoT (IIoT) & Edge Computing Solutions

Emerson Electric's strategic focus on Industrial IoT (IIoT) and edge computing positions it strongly within the evolving industrial landscape. The company's commitment is underscored by achievements like the 2025 IoT Breakthrough Award for its DeltaV Workflow Management software. This highlights Emerson's capability to deliver advanced solutions that drive operational efficiency.

These IIoT and edge computing solutions are crucial for enabling real-time data analysis directly at the point of operation. This capability is fundamental for optimizing industrial processes in a sector experiencing rapid technological advancement and significant growth. The ability to process data locally reduces latency and enhances responsiveness, critical for modern manufacturing and industrial automation.

Emerson's strategic adoption of Software-as-a-Service (SaaS) models for these offerings further solidifies their position. This approach facilitates scalability and recurring revenue streams, aligning with a high-growth business trajectory. The market for industrial software and connected services is projected for continued expansion, making this a key growth driver for Emerson.

- Award Recognition: Emerson's DeltaV Workflow Management software received the 2025 IoT Breakthrough Award, validating its IIoT innovation.

- Edge Computing Focus: The company is actively developing solutions that enable real-time data analysis and optimization at the operational edge.

- Growth Market: IIoT and edge computing represent a high-growth area within the industrial sector, driven by digital transformation initiatives.

- SaaS Strategy: Emerson's emphasis on SaaS models supports a scalable and recurring revenue business, crucial for sustained growth.

Test & Measurement Automation (post-NI acquisition)

Emerson Electric's acquisition of National Instruments (NI) in October 2023 marked a significant expansion into the test and measurement automation sector. This move diversifies Emerson's technology portfolio, targeting industries that demand rigorous, high-precision testing and validation. The global test and measurement market was valued at approximately USD 29.7 billion in 2023 and is projected to grow, driven by increasing complexity in industrial processes and the adoption of data-driven strategies.

This segment is considered a Star within Emerson's business portfolio due to its strong growth potential and strategic importance. The increasing demand for sophisticated testing solutions in sectors like automotive, aerospace, and semiconductor manufacturing, where NI has a strong presence, positions this business for substantial future expansion. Emerson's integration of NI's capabilities is expected to unlock synergies, enhancing its offering in automation and control.

- Market Position: NI is a recognized leader in automated test and measurement solutions, a crucial element for modern industrial innovation.

- Growth Drivers: The increasing complexity of electronics, the rise of 5G, and the expansion of electric vehicle technology are significant tailwinds for this market.

- Strategic Fit: Test and measurement automation aligns with Emerson's broader strategy of providing integrated solutions for industrial efficiency and performance.

- Financial Outlook: While specific post-acquisition financial data is still emerging, NI's historical revenue of over USD 1.6 billion in 2022 indicates a substantial and established market presence.

Emerson Electric's Industrial Software & Control Systems, particularly with the full integration of AspenTech in March 2025, is a prime example of a Star in the BCG matrix. This segment thrives on the industrial digitalization trend, leveraging AI and digital twins to create comprehensive solutions. The acquisition is projected to significantly boost Emerson's software revenue, solidifying its high-growth, high-market-share position.

The Solutions for Sustainability & Decarbonization segment also shines as a Star, addressing the critical global demand for emission reduction technologies. Emerson's expertise in areas like hydrogen production and carbon capture, supported by platforms like Ovation™, places it at the forefront of a rapidly expanding market. This strategic focus aligns with increasing environmental regulations and corporate sustainability goals.

Advanced Factory Automation & Robotics, strengthened by the August 2023 acquisition of Afag, also qualifies as a Star. This segment benefits from the reshoring trend and the widespread adoption of automation in discrete manufacturing. By integrating Afag's electric automation with its pneumatic expertise, Emerson is well-positioned to capture significant growth in this dynamic sector.

Emerson's focus on Industrial IoT (IIoT) and edge computing, validated by awards like the 2025 IoT Breakthrough Award for DeltaV Workflow Management, marks it as a Star. The company's SaaS strategy for these solutions ensures scalability and recurring revenue in a high-growth market. These technologies are crucial for real-time data optimization, a key driver in modern industrial operations.

The Test and Measurement Automation sector, bolstered by the October 2023 acquisition of National Instruments (NI), is another significant Star for Emerson. NI's leadership in high-precision testing, serving industries like automotive and semiconductors, aligns perfectly with Emerson's automation strategy. The market's growth, driven by technological complexity and data-driven approaches, provides a strong foundation for this segment.

| BCG Category | Emerson Electric Segment | Key Growth Drivers | Recent Strategic Moves | Market Position |

|---|---|---|---|---|

| Stars | Industrial Software & Control Systems (incl. AspenTech) | Industrial digitalization, AI, predictive analytics, recurring revenue | Full acquisition of AspenTech (March 2025) | High-growth, high-market share in automation software |

| Stars | Solutions for Sustainability & Decarbonization | Global emission reduction mandates, green hydrogen production, carbon capture | Leveraging Ovation™ platform for optimization | Strong position in growing environmental technology market |

| Stars | Advanced Factory Automation & Robotics | Reshoring, adoption of automation in discrete manufacturing, electric automation | Acquisition of Afag (August 2023) | Expanding offerings in high-demand manufacturing automation |

| Stars | Industrial IoT (IIoT) & Edge Computing | Digital transformation, real-time data analysis, operational efficiency | 2025 IoT Breakthrough Award for DeltaV Workflow Management, SaaS strategy | Leader in connected industrial solutions |

| Stars | Test and Measurement Automation (incl. NI) | Increasing complexity of electronics, 5G, EV technology, data-driven strategies | Acquisition of National Instruments (October 2023) | Leader in automated test and measurement solutions |

What is included in the product

The Emerson Electric BCG Matrix provides a strategic overview of its diverse product portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Emerson Electric BCG Matrix provides a clear visual guide, simplifying complex strategic decisions.

Cash Cows

Emerson Electric's DeltaV and Ovation systems are the bedrock of many industrial operations, including oil and gas, chemicals, and power generation. These mature control systems command a substantial market share, consistently generating strong cash flows with comparatively low reinvestment needs. Their status as essential infrastructure guarantees stable demand, solidifying their position as cash cows.

Emerson's Measurement & Analytical Instrumentation segment, a cornerstone of its portfolio, encompasses critical products such as flow, pressure, and temperature transmitters, alongside sophisticated analytical devices. These instruments are fundamental to nearly every industrial operation, solidifying their position in a mature market.

Within this segment, Emerson commands a significant market share, bolstered by its strong brand reputation and a loyal, established customer base. The predictable replacement cycles for these essential components contribute to consistent revenue streams, underscoring their role as reliable cash cows for the company.

For the fiscal year 2024, Emerson Electric reported that its Automation Solutions segment, which includes Measurement & Analytical Instrumentation, saw robust performance. While specific segment breakdowns vary, the overall segment revenue growth was a key driver for the company's financial results.

Emerson's Fisher brand stands as a cornerstone in the control valves and regulators market, recognized globally for its unwavering reliability and superior performance, especially in challenging industrial environments. This segment represents a mature market where Emerson has cemented a dominant, industry-leading position, consistently generating substantial, high-margin revenue. The focus for Fisher is on maintaining this market leadership through ongoing innovation and efficiency enhancements, ensuring its continued profitability.

Professional Tools (RIDGID, Greenlee)

The RIDGID and Greenlee brands, key components of Emerson's Commercial & Residential Solutions segment, represent strong cash cows within the company's BCG Matrix. These brands are deeply entrenched as leaders in professional tools, serving critical trades like plumbing, electrical, and HVAC.

Operating in stable, mature markets, RIDGID and Greenlee benefit from high brand loyalty and consistent demand from a dedicated base of contractors and skilled tradespeople. This market maturity, combined with established brand strength, allows them to generate reliable and predictable cash flow for Emerson.

- Market Position: Dominant players in plumbing, electrical, and HVAC professional tools.

- Demand Stability: Consistent demand driven by essential trades and contractor needs.

- Financial Contribution: Significant and reliable cash flow generation for Emerson.

- Brand Loyalty: High customer retention due to established reputation and product quality.

Cold Chain & Commercial Refrigeration Solutions

Even after divesting a majority stake in its Climate Technologies business to Copeland, Emerson Electric still holds significant sway in the cold chain and commercial refrigeration sector. This area represents a classic Cash Cow within the BCG Matrix framework for Emerson.

This segment caters to a mature yet indispensable market, crucial for industries like food and pharmaceuticals. The constant need for reliable temperature control ensures a steady and predictable revenue stream, characteristic of a Cash Cow.

- Market Stability: The demand for cold chain and commercial refrigeration is consistently high due to essential services like food preservation and pharmaceutical storage, ensuring stable revenue.

- Brand Recognition: Emerson's long-standing presence and expertise in refrigeration technologies contribute to strong brand recognition and customer loyalty in this established market.

- Profitability: As a mature business, it likely benefits from economies of scale and optimized operational efficiencies, leading to healthy profit margins.

- Cash Generation: The consistent demand and established market position allow this segment to generate substantial cash flow, supporting investments in other business areas or shareholder returns.

Emerson's Automation Solutions segment, particularly its Measurement & Analytical Instrumentation and control systems like DeltaV and Ovation, represent established leaders in mature markets. These offerings consistently generate strong, stable cash flows with limited need for significant reinvestment, a hallmark of cash cows.

Brands like Fisher, a leader in control valves, and those within Commercial & Residential Solutions such as RIDGID and Greenlee, also embody cash cow characteristics. Their dominant market positions, coupled with high brand loyalty in stable sectors, ensure predictable and substantial revenue generation.

Even post-divestiture of its Climate Technologies, Emerson retains strong positions in essential refrigeration markets. This segment, crucial for food and pharmaceuticals, continues to be a steady cash generator due to perpetual demand in a mature industry.

| Emerson Electric Cash Cow Segments | Market Maturity | Market Position | Cash Flow Generation |

|---|---|---|---|

| Automation Solutions (DeltaV, Ovation, Measurement & Analytical) | High | Dominant/Leading | Strong & Stable |

| Fisher Control Valves & Regulators | High | Dominant/Leading | High & Consistent |

| Commercial & Residential Solutions (RIDGID, Greenlee) | High | Strong/Leading | Reliable & Predictable |

| Cold Chain & Commercial Refrigeration (Post-Divestiture) | High | Significant | Steady & Predictable |

What You’re Viewing Is Included

Emerson Electric BCG Matrix

The Emerson Electric BCG Matrix preview you are viewing is the exact, fully-formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional-ready report immediately. You can confidently use this preview as a true representation of the detailed BCG Matrix analysis you'll download, ready for immediate application in your business planning and decision-making processes.

Dogs

Legacy Analog Control Systems & Components are likely positioned as Dogs in Emerson Electric's BCG Matrix. These older systems, often characterized by less integration and a reliance on analog technology, face a declining market as digital and software-driven solutions take over. For example, while specific figures for Emerson's legacy analog segment aren't always broken out individually, the broader trend shows a significant shift in industrial automation towards connected, data-rich digital platforms.

The market for these legacy products is shrinking, reflecting low growth prospects and a diminishing market share. Emerson's strategic focus and substantial investments, exceeding billions of dollars in areas like advanced automation and digital transformation, underscore a clear move away from these older, hardware-centric offerings. This strategic pivot is designed to align with evolving industry demands and future growth opportunities.

Emerson Electric strategically divested non-core businesses like InSinkErator and its majority stake in Climate Technologies (Copeland) to sharpen its focus on automation and software. The sale of InSinkErator was completed in 2022, and the majority of Climate Technologies was divested in 2023, with the remaining interest sold in 2024. These moves allowed Emerson to reallocate resources towards higher-growth, more strategically aligned segments of its business.

Niche, low-volume specialized hardware for declining industries would likely fall into the Dogs category of the BCG Matrix for Emerson Electric. These products typically serve very specific industrial needs within sectors that are experiencing contraction, leading to limited market growth and demand.

Such offerings might struggle with obsolescence as newer technologies emerge, and their specialized nature makes them less compatible with Emerson's strategic focus on broader, integrated automation solutions. For instance, if Emerson has legacy components for an older manufacturing process that is now largely phased out, these would fit the Dog profile.

Their low market share, coupled with minimal growth prospects, means these products are unlikely to generate significant returns and could even become cash traps, consuming resources without yielding substantial benefits. In 2024, companies like Emerson continuously evaluate their portfolios to divest or phase out such underperforming assets to reallocate capital to higher-growth areas.

Outdated Software Versions or Support Services

As Emerson Electric shifts towards newer software and subscription-based revenue streams, older, perpetual license software versions or legacy support services can easily fall into the 'dog' category of the BCG Matrix. These products may still exist but contribute very little to overall revenue. For instance, while Emerson's newer digital transformation initiatives are seeing substantial investment and growth, older system maintenance contracts for discontinued product lines might represent a shrinking portion of their service revenue.

These legacy offerings often have a low market share when compared to Emerson's current, cutting-edge solutions. They can also demand a disproportionate amount of resources for maintenance and customer support, making them inefficient. In 2023, for example, Emerson reported significant growth in its Automation Solutions segment, driven by cloud-based offerings and industrial software. Conversely, revenue from older, non-recurring software licenses for legacy industrial controls likely saw a decline, making them candidates for the 'dog' quadrant.

- Low Revenue Generation: Older software versions contribute minimally to Emerson's top line, especially when contrasted with the growth of its recurring revenue models.

- Shrinking Market Share: As customers migrate to newer, more advanced Emerson platforms, the user base for legacy software diminishes, leading to a smaller market presence.

- Disproportionate Support Costs: Maintaining and supporting outdated software can be resource-intensive, consuming valuable technical expertise and financial investment without significant returns.

- Strategic Divestment Potential: Products in the 'dog' quadrant are often candidates for divestment or phased retirement to reallocate resources to more promising business units.

Underperforming Regional Niche Offerings

Underperforming regional niche offerings within Emerson Electric's portfolio could be categorized as Dogs in the BCG matrix. These might include specific product lines tailored for limited geographic markets that have not achieved substantial adoption or are struggling against strong local competitors, leading to both low market share and sluggish growth. Emerson's ongoing strategy of streamlining its global portfolio is designed to enhance overall performance by divesting or repositioning such underperforming segments.

For instance, historical data might point to certain automation solutions developed exclusively for the Asian market that, despite initial investment, failed to capture significant market share due to unforeseen regulatory hurdles or rapid technological shifts driven by local players. By 2024, Emerson's focus on core, high-growth markets is expected to lead to the divestiture or restructuring of these niche, underperforming assets.

- Niche Product Lines: Specific automation or climate technologies designed for limited regional markets.

- Low Market Share: These offerings typically hold a small percentage of their respective regional market.

- Limited Growth Potential: Facing intense local competition or evolving regional needs hinders expansion.

- Strategic Divestment: Emerson's portfolio optimization aims to exit or reduce focus on such underperforming segments to reallocate resources to stronger SBU's.

Emerson Electric's older, less integrated analog control systems and components are likely classified as Dogs in the BCG Matrix. These products operate in a shrinking market with low growth prospects, contrasting with Emerson's significant investments in digital automation and software. For example, the company's strategic divestments, including Climate Technologies in 2024, highlight a clear redirection of resources away from legacy hardware.

These legacy offerings often have a small market share and can consume resources without generating substantial returns, making them inefficient. While Emerson's Automation Solutions segment saw robust growth driven by cloud and software in 2023, older software licenses for legacy controls likely experienced a decline. This positions them as prime candidates for divestment or phasing out to focus on higher-growth areas.

Question Marks

Emerson Electric is actively pursuing high-growth opportunities in emerging AI/ML applications for industrial optimization. Their investment in areas like advanced battery management software, exemplified by their collaboration with Zitara Technologies, positions them to capitalize on future market trends. While these sectors offer substantial upside, Emerson is still in the initial phases of establishing a strong market presence, indicating a Stars or Question Marks quadrant in a BCG analysis, depending on the current pace of market adoption and competitive landscape.

Emerson Electric's potential ventures into decentralized energy management and microgrids likely position them within the Question Marks quadrant of the BCG Matrix. This market is experiencing significant growth, driven by the increasing demand for grid resilience and renewable energy integration. For instance, the global microgrid market was valued at approximately $28.7 billion in 2023 and is projected to reach $75.4 billion by 2030, exhibiting a compound annual growth rate of around 14.7%.

Emerson possesses strong capabilities in control systems and automation, which are crucial for managing complex decentralized energy resources. However, their current market share in these specialized sub-segments is probably modest. Significant investment in research and development, strategic partnerships, and market penetration efforts will be necessary for Emerson to establish a strong foothold and compete effectively against established players and emerging innovators in this dynamic sector.

Emerson Electric's foray into advanced manufacturing, particularly additive manufacturing, positions it in a high-growth, albeit cash-intensive, segment. These innovative solutions, like industrial 3D printing for complex components, require significant investment in research and development to capture market share. As of early 2024, the global additive manufacturing market was projected to reach over $37 billion by 2030, demonstrating the substantial opportunity.

Expanded Applications of NI's Test & Measurement in New Industries

NI's test and measurement capabilities are finding exciting new homes in rapidly evolving sectors. While NI itself is considered a Star within Emerson Electric's portfolio, these specific applications are emerging as potential Stars. Think about cutting-edge research facilities and the development of novel materials, areas where Emerson is only starting to establish a foothold.

These specialized markets offer significant growth potential, but they also demand strategic and focused investment. To truly capture market leadership, Emerson needs to channel resources into tailoring NI's solutions for these niche yet high-promise industries. For instance, consider the burgeoning field of advanced battery development, where precise and rapid testing is paramount.

In 2024, the demand for sophisticated test and measurement solutions in these emerging sectors is projected to surge. For example, the global market for advanced materials testing is anticipated to grow at a compound annual growth rate (CAGR) of over 8% through 2028, driven by innovations in aerospace, automotive, and renewable energy. NI's flexible platform is well-suited to meet these evolving needs.

- Advanced Materials Testing: Supporting R&D in sectors like composites and nanomaterials, crucial for next-generation aircraft and electric vehicles.

- Cutting-Edge Research Infrastructure: Providing essential tools for university labs and government research institutions pushing scientific boundaries.

- Emerging Energy Technologies: Enabling the testing and validation of new battery chemistries, hydrogen fuel cells, and advanced solar technologies.

- Biotechnology and Pharmaceutical R&D: Facilitating complex experimental setups and data acquisition for drug discovery and medical device innovation.

Early-Stage Digital Twin & Simulation Services for New Verticals

Emerson Electric, through its acquisition of AspenTech, is strategically positioned to expand its digital twin and simulation services into new, high-growth verticals. This move aligns with a BCG Matrix assessment that would likely place these early-stage offerings in the 'Question Marks' category. These services are capitalizing on AspenTech's robust simulation platforms, offering advanced predictive capabilities for industries previously underserved by such sophisticated digital tools.

The challenge for Emerson lies in accelerating market adoption for these nascent services in emerging sectors. Significant investment in targeted marketing and sales initiatives will be crucial to educate potential clients and demonstrate the tangible value proposition. For instance, by early 2024, the industrial digital twin market was projected to reach $15 billion, with significant growth anticipated in sectors like pharmaceuticals and renewable energy, areas where Emerson is actively seeking to penetrate.

- High Growth Potential: The global market for digital twins is experiencing rapid expansion, with projections indicating a compound annual growth rate (CAGR) often exceeding 30% in the coming years.

- Market Penetration Challenges: Entering new verticals requires substantial effort to build awareness, establish trust, and demonstrate ROI, often leading to initially low market share for 'Question Mark' offerings.

- Leveraging AspenTech's Expertise: Emerson benefits from AspenTech's established leadership in process simulation, providing a strong foundation for developing advanced digital twin solutions for complex industrial processes.

- Strategic Expansion: Emerson's focus on these new verticals signals a deliberate strategy to diversify its revenue streams and capture emerging opportunities in the expanding digital transformation landscape.

Emerson Electric's ventures into areas like decentralized energy management and advanced additive manufacturing represent significant growth opportunities. These sectors, while promising, require substantial investment and focused strategies to gain market traction. Emerson's established expertise in automation and control systems provides a strong foundation, but market share in these emerging segments is likely still developing, characteristic of 'Question Marks' in the BCG Matrix.

The company's expansion of digital twin and simulation services, particularly through AspenTech, also falls into this category. While the industrial digital twin market is projected to reach $15 billion by early 2024, with strong growth in pharmaceuticals and renewables, Emerson is in the early stages of penetrating these new verticals. This necessitates significant investment in marketing and sales to build awareness and demonstrate value.

Emerson's strategic focus on these high-potential, but currently nascent, markets highlights a deliberate effort to diversify and capture future growth. Success will depend on effectively navigating competitive landscapes and fostering adoption through targeted initiatives.

These 'Question Mark' ventures are crucial for Emerson's long-term growth strategy, aiming to leverage its core competencies in new and expanding markets.

| Business Area | Market Potential | Current Position (BCG) | Key Challenges | Strategic Focus |

|---|---|---|---|---|

| Decentralized Energy Management | Global microgrid market projected to reach $75.4B by 2030 (14.7% CAGR) | Question Mark | Market penetration, competition against established players | Leverage automation expertise, strategic partnerships |

| Additive Manufacturing | Global additive manufacturing market projected to exceed $37B by 2030 | Question Mark | High R&D investment, market share acquisition | Innovation in industrial 3D printing solutions |

| Digital Twin & Simulation Services | Industrial digital twin market projected to reach $15B (early 2024) | Question Mark | Accelerating market adoption, demonstrating ROI in new verticals | Leverage AspenTech's platform, targeted marketing |

| Advanced Materials Testing (NI Applications) | Advanced materials testing market CAGR >8% through 2028 | Question Mark | Tailoring solutions for niche industries, building market presence | Focus on R&D facilities, emerging energy tech |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.