Emerson Electric PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emerson Electric Bundle

Navigate the complex external forces shaping Emerson Electric's future with our meticulously crafted PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends directly impact their operations and strategic decisions. Discover the technological advancements and environmental regulations that present both challenges and opportunities for this industrial giant. Gain a competitive edge by leveraging these insights to refine your own market strategy.

Unlock a deeper understanding of Emerson Electric's operating environment. Our PESTLE analysis provides expert-level insights into the political, economic, social, technological, legal, and environmental factors influencing their success. This comprehensive report is an invaluable resource for investors, consultants, and strategic planners looking to make informed decisions. Purchase the full version now for immediate access to actionable intelligence.

Political factors

Emerson Electric operates under a stringent regulatory environment, particularly concerning industrial emissions and product safety. For instance, in 2024, the U.S. Environmental Protection Agency continued to enforce stricter standards on greenhouse gas emissions, directly affecting industries that utilize Emerson's automation technologies. Compliance with these evolving rules requires significant investment in research and development to ensure Emerson's offerings help clients meet environmental targets.

Navigating diverse international regulations, such as the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) or specific national safety certifications, presents both challenges and opportunities. Emerson's ability to adapt its product designs and manufacturing processes to meet these varied requirements is crucial for maintaining market access and competitiveness. By 2025, many regions are expected to introduce even more rigorous sustainability reporting mandates, pushing companies like Emerson to highlight the compliance benefits of their solutions.

Changes in government policies, especially those promoting energy efficiency and renewable energy adoption, directly influence the demand for Emerson's climate control and automation solutions. For example, government incentives for building retrofits aimed at reducing energy consumption in 2024 and projected through 2025 create a favorable market for Emerson's intelligent building management systems.

Fluctuations in global trade policies, including tariffs and trade agreements, significantly affect Emerson Electric's international supply chains and market competitiveness. For instance, ongoing trade tensions between the US and China, which saw tariffs imposed on billions of dollars worth of goods in 2023-2024, directly impact the cost of components Emerson sources and the pricing of its products in these key markets.

Increased protectionism or trade disputes can lead to higher costs for raw materials and components, impacting Emerson's profit margins. If tariffs on steel or semiconductors rise, as they have periodically in recent years, Emerson faces increased input costs, potentially forcing price adjustments for its automation and climate technologies.

Trade disputes can also disrupt distribution networks, making it harder for Emerson to move finished goods efficiently across borders. For example, changes in import/export regulations following Brexit or new trade pacts can necessitate adjustments to Emerson's logistics and market access strategies.

Emerson's global footprint, with significant operations in North America, Europe, and Asia, means it must strategically manage the implications of evolving trade relationships between major economic blocs. In 2024, navigating the trade landscape between the US, EU, and China remains a critical strategic imperative for maintaining its competitive edge and ensuring supply chain resilience.

The political stability of countries where Emerson Electric operates, such as the United States, China, and Germany, is paramount. For instance, the ongoing trade policy discussions between the US and China, which intensified in 2024, create uncertainty for Emerson's global supply chains and market access. Any significant geopolitical tensions or civil unrest in these or other key markets, like those experienced in parts of Europe in recent years, could directly impact Emerson's manufacturing facilities and distribution networks, potentially disrupting production and sales.

Sudden policy shifts, such as changes in environmental regulations or trade tariffs, pose direct risks. In 2024, many nations continued to review and implement new climate-related policies, which could affect Emerson's manufacturing costs and product development strategies. Emerson's ability to navigate diverse political landscapes, including assessing and mitigating risks associated with operating in regions with varying degrees of political stability, is crucial for maintaining business continuity and safeguarding its substantial global investments, estimated in the billions of dollars across its various segments.

Government Incentives for Automation and Green Technologies

Government initiatives encouraging industrial automation and green technologies present a significant tailwind for Emerson Electric. For instance, the United States' Inflation Reduction Act of 2022, with its substantial tax credits and incentives for clean energy and manufacturing, directly supports Emerson's focus on energy efficiency and sustainable solutions. This legislation, alongside similar programs globally, is designed to accelerate the adoption of advanced manufacturing and smart infrastructure, areas where Emerson's automation and digital technologies are paramount.

Policies promoting digital transformation and the adoption of green technologies are a direct driver for Emerson's core product and service offerings. These incentives, such as grants for R&D in sustainable manufacturing or tax advantages for upgrading to energy-efficient systems, create a more favorable market environment. For example, European Union directives aimed at reducing carbon emissions and enhancing industrial competitiveness encourage investments in the very automation and control systems that Emerson specializes in, boosting demand for their solutions.

- Growth Opportunities: Government incentives for automation and green tech create significant growth avenues for Emerson.

- Demand Drivers: Policies supporting digital transformation and sustainable manufacturing directly boost demand for Emerson's offerings.

- Investment Catalysts: Tax breaks, subsidies, and favorable regulations encourage industrial upgrades, benefiting Emerson's business.

- Market Expansion: Global focus on energy efficiency and smart infrastructure aligns with Emerson's strategic priorities, fostering market expansion.

Geopolitical Tensions and Supply Chain Resilience

Ongoing geopolitical tensions, particularly those affecting vital trade routes and the availability of critical materials, underscore the need for Emerson Electric to cultivate highly resilient supply chains. For instance, the ongoing Red Sea shipping disruptions, which began in late 2023 and continued into 2024, have significantly increased shipping times and costs, impacting global logistics for many manufacturing firms.

Emerson must prioritize strategies such as diversifying its manufacturing bases across different regions and securing multiple, reliable alternative suppliers for key components. Adapting to potential restrictions on technology transfer, a growing concern in certain bilateral relationships, is also paramount to maintaining its competitive edge.

These geopolitical shifts directly influence Emerson's investment decisions and market entry strategies. Companies are increasingly re-evaluating their global operational footprints to mitigate risks associated with political instability and trade policy changes. For example, many technology-focused companies are exploring nearshoring or friend-shoring options to reduce dependency on politically volatile regions.

- Supply Chain Diversification: Emerson aims to reduce reliance on single sourcing for critical components, a strategy reinforced by the 2024 Semiconductor Supply Chain Resilience Act in the US, encouraging domestic production.

- Geopolitical Risk Assessment: Emerson actively monitors global political landscapes, including trade disputes and regional conflicts, to inform its strategic planning and operational adjustments.

- Technology Transfer Adaptability: The company must navigate evolving export control regulations, such as those implemented by the US and EU regarding advanced technologies, to ensure continued access to necessary innovation.

- Market Entry Strategy: Geopolitical stability is a key criterion in Emerson's evaluation of new markets, potentially leading to phased market penetration or partnerships in higher-risk environments.

Government policies promoting industrial automation and green technologies directly fuel demand for Emerson's solutions. For instance, the US Inflation Reduction Act of 2022, with its significant incentives for clean energy, supports Emerson's focus on energy efficiency and sustainable manufacturing, a trend expected to continue through 2025.

Stricter environmental regulations, such as those enforced by the EPA in 2024 regarding emissions, necessitate Emerson's advanced automation technologies to help clients meet compliance. Similarly, evolving international rules like EU's REACH require product adaptation, presenting ongoing challenges and opportunities for market access.

Geopolitical tensions and trade disputes, exemplified by US-China trade policies in 2023-2024, impact Emerson's supply chains and costs. Diversifying manufacturing and securing alternative suppliers are critical strategies to mitigate risks from trade route disruptions, as seen with Red Sea shipping issues in late 2023 and into 2024.

What is included in the product

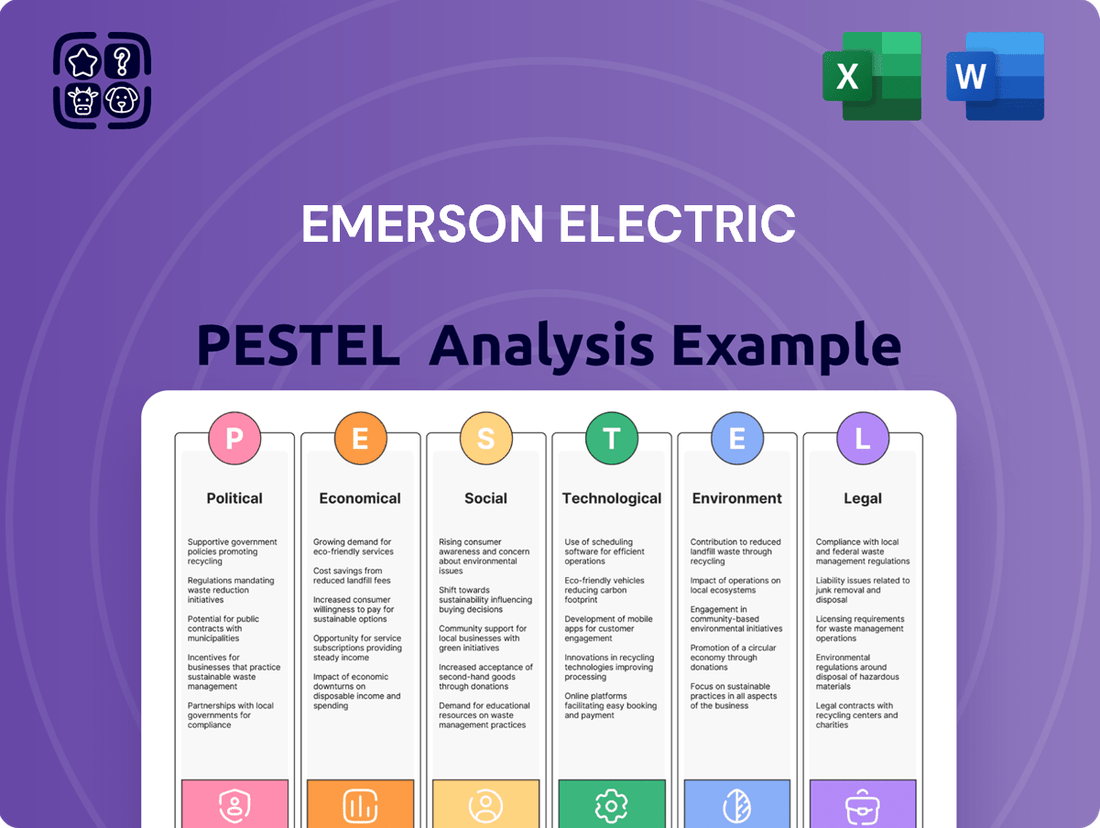

This PESTLE analysis examines the external forces impacting Emerson Electric, dissecting how political shifts, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks create both challenges and avenues for growth.

A concise PESTLE analysis of Emerson Electric's external environment, highlighting key Political, Economic, Social, Technological, Environmental, and Legal factors, serves as a pain point reliever by providing clarity and focus for strategic decision-making.

Economic factors

Emerson Electric's financial health is intrinsically linked to the pulse of global economic growth and the robustness of industrial output. As a provider of automation and climate technologies for industrial, commercial, and residential sectors, Emerson thrives when the global economy is expanding and industries are actively investing. For instance, in the first quarter of fiscal year 2024, Emerson reported a 20% increase in net sales for its Automation Solutions segment, reflecting a favorable market environment and strong demand for its offerings.

A robust global economy often spurs higher capital expenditures from businesses, directly benefiting Emerson. When companies are confident about future demand, they tend to invest more in upgrading or expanding their production facilities, which fuels the need for Emerson's automation and control systems. This trend was evident in early 2024, with many manufacturing sectors seeing renewed investment cycles.

Conversely, economic downturns present significant headwinds for Emerson. A slowdown in global industrial output can lead to reduced business investment, project delays, and a general contraction in demand for capital-intensive solutions. For example, during periods of economic uncertainty, like those experienced in late 2022 and early 2023, companies often postpone large-scale projects, directly impacting Emerson's order pipelines and revenue generation.

The International Monetary Fund (IMF) projected global economic growth to be around 3.1% for 2024, a slight increase from 2023, signaling a somewhat supportive environment for industrial sectors. However, regional variations and potential geopolitical instability remain critical factors to monitor, as these can disproportionately affect industrial output and, consequently, Emerson's performance in specific markets.

Rising inflation presents a significant challenge for Emerson Electric. For instance, the Consumer Price Index (CPI) in the US saw an annual increase of 3.4% as of April 2024, indicating persistent upward pressure on costs for raw materials, components, and labor. This can directly impact Emerson's cost of goods sold and squeeze profit margins if not effectively passed on to customers.

The current interest rate environment, with the Federal Reserve maintaining its target range for the federal funds rate between 5.25% and 5.50% through early 2024, also poses a hurdle. Higher borrowing costs can make it more expensive for Emerson to finance its operations and capital expenditures, and for its industrial and commercial clients to invest in new machinery or system upgrades, potentially slowing demand for Emerson's products and services.

Emerson's ability to navigate these economic headwinds is crucial. Managing inflationary pressures through strategic sourcing and operational efficiencies, alongside careful consideration of its debt structure and customer financing options in a higher interest rate climate, will be key to maintaining profitability and its competitive edge in 2024 and beyond.

As a global powerhouse, Emerson Electric's financial results are inherently sensitive to currency exchange rate fluctuations. When Emerson reports its earnings, revenues and expenses generated in foreign currencies are translated back into its primary reporting currency, typically the US Dollar. This conversion process means that significant movements in exchange rates can directly alter the reported value of these financial items.

For instance, a strengthening US Dollar against other major currencies would generally make Emerson's foreign earnings appear smaller when converted. Conversely, a weaker US Dollar would inflate those reported earnings. This dynamic can impact the perceived profitability of Emerson's international sales and also influence the cost of raw materials or components it imports from other countries.

Consider the impact of the US Dollar's performance in 2024. As of late 2024, the US Dollar has shown resilience against a basket of major currencies, a trend that could present headwinds for companies like Emerson with substantial overseas operations. For example, if the Euro weakens against the Dollar, revenue generated in Euros by Emerson's European subsidiaries will translate into fewer Dollars, potentially dampening reported revenue growth.

Emerson actively manages these currency risks through various hedging strategies. These can include forward contracts and options to lock in exchange rates for future transactions, thereby providing greater predictability and stability to its financial performance. By mitigating the impact of volatile currency markets, Emerson aims to protect its profitability and maintain consistent shareholder value.

Energy Prices and Demand for Efficiency

Energy prices significantly impact Emerson Electric by affecting both their operating expenses and the market demand for their products. For instance, the EIA reported that industrial electricity prices averaged 7.34 cents per kilowatt-hour in the US in 2023, a figure that can fluctuate and directly influence Emerson's manufacturing costs.

When energy becomes more expensive, businesses are more inclined to invest in efficiency. This trend directly benefits Emerson, as industries and commercial sectors look to reduce their energy bills by adopting Emerson's climate technologies and automation solutions. For example, a 10% increase in energy prices could significantly shorten the payback period for investments in energy-efficient HVAC systems, a key Emerson offering.

This creates a dynamic where volatile energy markets present a dual challenge and opportunity for Emerson.

- Rising energy costs incentivize demand for Emerson's energy-saving solutions.

- Industrial electricity prices in the US averaged 7.34 cents per kWh in 2023, highlighting a key operational cost factor.

- Emerson's automation and climate control technologies are designed to address these rising energy expenditures for clients.

- The adoption rate of energy-efficient technologies is directly correlated with energy price volatility.

Capital Expenditure Trends in Key Sectors

Emerson Electric's performance is closely tied to capital expenditure (CapEx) trends across vital sectors. Industries such as oil and gas, chemicals, power generation, life sciences, and manufacturing are key drivers for Emerson's business, as these sectors frequently invest in upgrading and expanding their operational infrastructure.

The demand for Emerson's process control systems, valves, and measurement instrumentation is directly influenced by these investment cycles. For instance, a robust CapEx environment in the oil and gas sector, particularly for projects related to energy transition and efficiency, translates into increased orders for Emerson's automation solutions.

Looking ahead, resilient demand is anticipated in process and hybrid markets, while a recovery is expected in discrete manufacturing markets. This outlook is positive for Emerson, as it signals potential growth opportunities. For example, the global process automation market was projected to reach approximately $60 billion in 2024, with significant contributions from the energy and chemical industries.

- Sectoral Investment: CapEx in oil & gas, chemicals, power, life sciences, and manufacturing directly impacts Emerson's sales.

- Market Dynamics: Resilient demand in process and hybrid markets, coupled with a discrete market recovery, supports Emerson's growth trajectory.

- Product Demand: Increased investment cycles in these industries fuel demand for Emerson's automation and control technologies.

- Market Size: The global process automation market is a substantial area of opportunity, with significant CapEx flowing into key Emerson-served sectors.

The global economic landscape significantly shapes Emerson Electric's revenue streams. A strong economy generally translates to higher capital expenditures from businesses, directly benefiting Emerson's automation and climate technology segments. For instance, Emerson reported a 20% increase in net sales for its Automation Solutions segment in Q1 FY24, highlighting positive market conditions.

However, economic downturns pose considerable risks. Reduced industrial output and delayed investments during periods of uncertainty, as seen in late 2022 and early 2023, can contract demand for Emerson's capital-intensive solutions. The IMF projected global economic growth at 3.1% for 2024, indicating a cautiously optimistic environment, though regional variations remain a factor.

| Economic Indicator | Value/Trend (as of early-mid 2024) | Impact on Emerson Electric |

|---|---|---|

| Global Economic Growth | Projected 3.1% for 2024 (IMF) | Supports higher CapEx and demand for automation/climate solutions. |

| Industrial Output | Varied by region, generally recovering but subject to geopolitical risks. | Directly influences demand for Emerson's core products. |

| Inflation (US CPI) | 3.4% annual increase (April 2024) | Increases operating costs; necessitates efficient pricing strategies. |

| Interest Rates (US Federal Funds Rate) | 5.25%-5.50% range (maintained through early 2024) | Increases borrowing costs for Emerson and its clients, potentially slowing investment. |

| Currency Exchange Rates | Resilient US Dollar against major currencies (late 2024 trend) | Can reduce reported earnings from foreign operations. |

What You See Is What You Get

Emerson Electric PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Emerson Electric delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, competitive landscapes, and strategic opportunities for Emerson. What you're previewing here is the actual file—fully formatted and professionally structured, offering a deep dive into these critical business elements.

Sociological factors

Emerson Electric's success hinges on a skilled workforce adept at advanced automation and digital technologies. The company faces challenges and opportunities from evolving workforce demographics.

Demographic shifts, including an aging industrial workforce in key markets like the United States, present a need for robust talent acquisition and retention strategies. For example, in 2024, the U.S. Bureau of Labor Statistics projects continued demand for skilled trades, a segment critical for Emerson's operational success.

To counter labor shortages and enhance worker safety, Emerson increasingly deploys automation solutions. This not only boosts efficiency but also addresses societal expectations for improved employee well-being and a safer work environment, a trend highlighted by increasing employee satisfaction metrics in companies prioritizing such initiatives.

Societal awareness regarding environmental impact is a significant driver for Emerson Electric. Consumers and businesses alike are increasingly seeking products and operational methods that are sustainable and energy-efficient. This growing demand directly influences Emerson's approach to product innovation and market positioning, pushing for solutions that minimize environmental footprints.

In 2023, Emerson reported that its sustainability-focused solutions, such as those for energy management and emissions reduction, continued to see robust demand across industrial, commercial, and residential sectors. For instance, their advanced building automation systems are helping commercial clients achieve up to 30% energy savings, a key metric for sustainability-conscious customers.

This trend is not just about environmental responsibility; it's also about economic advantage. Emerson's green technologies are directly addressing customer needs for resource efficiency, translating into lower operating costs and enhanced competitiveness for their clients. This creates a clear market opportunity for Emerson's portfolio, particularly in areas like smart grid technologies and efficient HVAC systems.

There's a growing societal and regulatory push for enhanced worker safety, especially in industries with inherent risks. This trend directly fuels the demand for automation technologies that minimize human exposure to hazardous situations. For instance, in 2024, industrial accidents in the manufacturing sector continued to be a significant concern, prompting investments in safety upgrades.

Emerson Electric's portfolio, featuring advanced process control systems and collaborative robots, directly addresses this need. By automating tasks in dangerous environments, Emerson's solutions significantly reduce the risk of injuries and fatalities. This proactive approach to safety strengthens the appeal of their automation offerings to businesses prioritizing employee well-being.

Corporate Social Responsibility (CSR) Expectations

Societal demands for corporate social responsibility (CSR) and ethical operations significantly shape Emerson's public image and its connections with various stakeholders. This involves ensuring responsible sourcing of materials, upholding fair labor standards throughout its supply chain, and actively participating in community development initiatives. Emerson's documented dedication to these principles, as detailed in its sustainability disclosures, can bolster its attractiveness to investors, employees, and consumers who increasingly value conscientious business conduct.

For instance, in its 2023 sustainability report, Emerson highlighted a 15% reduction in greenhouse gas emissions intensity compared to its 2019 baseline, demonstrating tangible progress in environmental stewardship. Furthermore, the company reported investing $5 million in community programs globally in 2023, supporting education and environmental conservation efforts. These actions are crucial for maintaining a positive brand perception in a market where consumers and investors are increasingly scrutinizing corporate behavior.

- Responsible Sourcing: Emerson is committed to ethical sourcing practices, aiming to ensure its supply chain adheres to environmental and human rights standards.

- Fair Labor Practices: The company emphasizes fair wages, safe working conditions, and non-discrimination policies for its employees and those within its partner organizations.

- Community Engagement: Emerson actively invests in and partners with communities where it operates, focusing on areas like STEM education and sustainability initiatives.

- Investor Appeal: Strong CSR performance can attract socially responsible investment (SRI) funds, which saw significant growth in 2024, with assets under management projected to reach new highs.

Urbanization and Infrastructure Development

Global urbanization continues its relentless march, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This demographic shift directly fuels demand for Emerson's commercial and residential solutions. As cities expand, the need for robust and efficient infrastructure, particularly in climate control and building management, escalates. Emerson's expertise in HVAC systems and smart building technologies positions it to capitalize on this sustained market opportunity.

The increasing density of urban populations necessitates upgraded and new infrastructure. For Emerson, this translates into a heightened demand for advanced climate control technologies within both new construction and retrofitting projects. For instance, smart building solutions that optimize energy consumption are becoming paramount in densely populated urban centers seeking sustainability and cost-efficiency. This trend is expected to persist, offering a stable growth avenue for Emerson's residential and commercial business segments.

- Urban Population Growth: United Nations data indicates global urbanization will reach 68% by 2050.

- Infrastructure Demand: Urban expansion drives a critical need for new and upgraded infrastructure, especially HVAC and smart building systems.

- Emerson's Role: The company's climate control and building management solutions are well-positioned to meet this growing urban demand.

- Market Opportunity: Sustained market growth is anticipated for Emerson's residential and commercial segments due to these demographic shifts.

Evolving workforce demographics, particularly an aging industrial base in developed nations like the U.S., present a persistent challenge for Emerson Electric in securing skilled labor. This reality underscores the company's strategic focus on automation to mitigate labor shortages and enhance operational efficiency, aligning with societal expectations for safer workplaces.

Societal emphasis on sustainability and environmental responsibility directly fuels demand for Emerson's energy-efficient solutions, as evidenced by strong sales of its building automation systems that deliver significant energy savings. This trend is not merely about corporate image but also about providing tangible economic benefits to clients through resource efficiency.

Increasing global urbanization, projected to reach 68% by 2050, creates substantial opportunities for Emerson's climate control and building management technologies. This demographic shift necessitates robust infrastructure upgrades, particularly in urban centers, directly boosting demand for Emerson's residential and commercial solutions.

Emerson's commitment to corporate social responsibility, demonstrated through initiatives like reducing its greenhouse gas emissions intensity by 15% (vs. 2019 baseline in 2023) and investing in community programs, enhances its brand appeal. Such actions are critical for attracting socially responsible investment, a sector that saw continued growth throughout 2024.

Technological factors

Emerson Electric is heavily invested in leveraging advancements in Artificial Intelligence (AI), the Internet of Things (IoT), and machine learning. These technologies are fundamental to modern industrial automation and are central to Emerson's strategic direction. For instance, Emerson's Ovation automation system, enhanced with AI capabilities, allows for more sophisticated process control and optimization.

These technological shifts directly translate into tangible benefits for Emerson's customers, such as predictive maintenance and real-time asset monitoring. This means equipment failures can be anticipated and addressed before they cause costly downtime. In 2024, the industrial IoT market, a key area for Emerson, was projected to reach over $1.1 trillion globally, highlighting the immense opportunity for companies integrating these solutions.

Emerson is actively embedding these innovations across its product lines, particularly within its industrial software and automation solutions. This includes enhancing its DeltaV distributed control system with machine learning algorithms for improved operational insights. By integrating AI and IoT, Emerson aims to deliver greater efficiency and reliability, reinforcing its position as a leader in industrial technology.

The ongoing digital transformation is fundamentally reshaping industries, pushing businesses towards smart factories and intelligent operations. This trend directly benefits Emerson Electric, as the company supplies the crucial technologies like advanced sensors, sophisticated control systems, and integrated software that empower customers to enhance connectivity, leverage data analytics, and move towards autonomous processes. For instance, Emerson's Plantweb digital ecosystem is designed to bring together operational technology (OT) and information technology (IT), enabling a more cohesive and efficient operational environment. In 2023, Emerson reported significant growth in its Automation Solutions segment, which heavily features these digital offerings, indicating strong market demand for their smart factory enablers.

The increasing interconnectedness of industrial environments means cybersecurity for operational technology (OT) and industrial control systems (ICS) is a critical concern. Emerson must prioritize investing in strong cybersecurity features for its products and services to safeguard vital infrastructure and client operations from cyber threats.

This growing need for robust security also presents a significant market opportunity for Emerson's specialized cybersecurity solutions and consulting services. For instance, the global industrial cybersecurity market was valued at approximately $14.5 billion in 2023 and is projected to reach over $30 billion by 2028, showing substantial growth potential for companies like Emerson.

Innovation in Climate Control Technologies

Technological advancements in climate control are significantly impacting Emerson Electric. Innovations like energy-efficient HVAC systems and the development of sustainable refrigerants are crucial for Emerson's commercial and residential businesses. These technologies are not just about comfort; they are directly tied to meeting increasingly stringent energy efficiency regulations and growing consumer preferences for eco-friendly solutions.

The push for smarter homes and buildings, integrating intelligent climate management, further highlights the importance of R&D for Emerson. By investing in these areas, Emerson can better align with market demands for intelligent, connected, and sustainable climate solutions, ensuring its products remain competitive and relevant in a rapidly evolving technological landscape.

- Energy Efficiency Standards: Global regulations, such as those from the EU and US EPA, are continually tightening requirements for HVAC system energy consumption, driving demand for Emerson's efficient technologies.

- Refrigerant Transition: The phase-down of high global warming potential (GWP) refrigerants, like HFCs, necessitates Emerson's innovation in developing and adopting lower-GWP alternatives, such as HFOs, for its cooling systems.

- Smart Building Integration: The smart building market, projected to reach over $100 billion by 2025, presents a significant opportunity for Emerson's smart thermostat and building automation solutions, enhancing energy management and occupant comfort.

- IoT in HVAC: The integration of the Internet of Things (IoT) allows for predictive maintenance and remote diagnostics in HVAC systems, a key area of technological focus for Emerson to improve service offerings and operational efficiency.

Additive Manufacturing and Advanced Materials

Additive manufacturing, or 3D printing, coupled with the development of advanced materials, presents evolving opportunities for Emerson Electric. While not a primary driver like automation software, these technologies can influence Emerson's manufacturing efficiency and product design. For instance, the ability to create more intricate components through 3D printing can lead to optimized performance and reduced material waste.

The impact on Emerson's production processes is tangible. These advancements allow for quicker prototyping, enabling faster iteration cycles during product development. Furthermore, additive manufacturing supports localized production, which can significantly enhance supply chain resilience and reduce lead times, a crucial factor in today's dynamic global market. Emerson actively tracks these developments for potential integration into its operations, aiming to boost efficiency and explore new product avenues.

Consider the implications for component design and cost optimization. Advanced materials, such as high-strength composites or specialized alloys, can be leveraged with additive manufacturing to produce lighter, more durable parts. This can translate to lower material costs and improved product performance in sectors like aerospace and industrial equipment, where Emerson has a strong presence. For example, the aerospace industry saw a 10% increase in the use of 3D printed parts in new aircraft models between 2023 and 2024, highlighting the growing adoption of this technology.

- Enhanced Design Complexity: Additive manufacturing allows for geometries previously impossible with traditional methods, potentially improving Emerson's product functionality.

- Faster Prototyping Cycles: Reducing the time from concept to physical model can accelerate innovation and market entry for new Emerson products.

- Supply Chain Flexibility: On-demand, localized production capabilities can mitigate risks associated with global supply chain disruptions.

- Material Innovation: The development of new materials offers opportunities for lighter, stronger, and more cost-effective components in Emerson's offerings.

Emerson Electric's strategic focus on AI, IoT, and machine learning is reshaping industrial automation, as seen in its Ovation system enhancements. The industrial IoT market's projected growth to over $1.1 trillion globally in 2024 underscores the immense opportunity for Emerson's integrated solutions.

These technologies enable predictive maintenance and real-time monitoring for Emerson's clients, preventing costly downtime. The company's DeltaV system, now integrating machine learning, exemplifies this push towards smarter, more efficient operations.

The growing demand for robust cybersecurity in operational technology (OT) presents both a challenge and a significant market opportunity for Emerson, with the industrial cybersecurity market valued at approximately $14.5 billion in 2023.

Emerson's innovation in energy-efficient HVAC systems and sustainable refrigerants is driven by tightening global energy efficiency standards. The smart building market, expected to exceed $100 billion by 2025, further highlights the potential for Emerson's connected climate solutions.

| Technology Focus | Market Opportunity | Emerson's Role | Data Point |

| AI & IoT in Automation | Industrial IoT Market | Enhanced process control, predictive maintenance | Projected >$1.1 trillion globally in 2024 |

| Industrial Cybersecurity | Industrial Cybersecurity Market | Securing OT/ICS, specialized solutions | Valued ~$14.5 billion in 2023 |

| Energy Efficiency (HVAC) | Smart Building Market | Energy-efficient systems, sustainable refrigerants | Smart Building Market projected >$100 billion by 2025 |

Legal factors

Emerson Electric faces a complex web of global product safety and liability regulations, especially critical for its industrial and commercial solutions deployed in high-stakes environments. These regulations mandate rigorous testing, certification, and stringent quality control to ensure products meet demanding safety standards and mitigate potential liability. For instance, in 2024, the global product recall market is projected to see continued activity, with manufacturers allocating significant resources to compliance and risk management, a trend Emerson actively navigates.

Intellectual property laws are a cornerstone for Emerson Electric, safeguarding its vast portfolio of patents, trademarks, and trade secrets. These protections are critical for maintaining its competitive edge in the automation and engineering solutions sectors. For instance, Emerson's significant investment in R&D, which often results in patentable technologies, underpins its market leadership.

Navigating the intricate web of international intellectual property regulations presents a continuous legal challenge. Emerson must actively monitor and defend against potential infringements across various global markets. This proactive legal stance is essential to ensure the company can effectively monetize its innovations and sustain its market share in a highly competitive landscape.

Emerson Electric faces a complex legal landscape regarding data privacy and cybersecurity. As industrial systems become more interconnected and operational data collection grows, stringent regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) demand careful adherence. For instance, in 2024, companies operating globally are increasingly scrutinized for their data handling practices, with potential fines for violations reaching millions or even billions of dollars, as seen in past GDPR penalties against other tech giants.

Compliance necessitates robust measures to protect customer data, secure data transmission channels, and establish clear data governance policies. A failure to implement these safeguards can result in substantial financial penalties and, critically, a significant erosion of customer trust, impacting Emerson's reputation and market position.

Antitrust and Competition Laws

Antitrust and competition laws are critical for Emerson Electric, a global industrial giant. These regulations govern everything from how Emerson can acquire other companies to how it competes in the marketplace, ensuring a level playing field for all. Failure to comply can result in significant fines and damage to its reputation.

Emerson's strategic moves, such as its 2023 divestiture of its Climate Technologies business for $14 billion and its acquisition of NI (National Instruments) for $8.2 billion in 2023, directly fall under the scrutiny of these competition authorities worldwide. Navigating these complex legal frameworks is essential for successful portfolio management and continued growth.

- Merger Control: Emerson must obtain approval from competition authorities for significant acquisitions and mergers, like the NI deal, to prevent undue market concentration.

- Market Conduct: Laws prevent anti-competitive practices such as price-fixing, bid-rigging, or abusing a dominant market position.

- Global Enforcement: Compliance requires adherence to regulations from bodies like the U.S. Federal Trade Commission (FTC), the European Commission, and China's State Administration for Market Regulation (SAMR).

- Regulatory Scrutiny: The increasing global focus on market power means Emerson faces ongoing scrutiny regarding its competitive strategies.

Labor Laws and Employment Regulations

Emerson Electric navigates a complex web of labor laws across the globe, impacting everything from minimum wage requirements to employee termination procedures. For instance, in the United States, federal laws like the Fair Labor Standards Act (FLSA) set standards for overtime pay and minimum wage, which can influence Emerson's operational costs and compensation strategies. Similarly, in Europe, regulations such as the General Data Protection Regulation (GDPR) also have implications for how employee data is handled.

Ensuring compliance with these varying labor statutes presents a significant legal hurdle for Emerson. This includes adherence to collective bargaining agreements, which are prevalent in many of the countries where Emerson operates, such as Germany with its strong co-determination laws. Failure to comply can lead to substantial fines, reputational damage, and operational disruptions. In 2023, companies globally faced an increasing number of labor-related lawsuits, highlighting the critical need for robust compliance frameworks.

Adhering to these diverse employment regulations is fundamental to fostering positive employee relations and mitigating legal risks. These laws dictate aspects like workplace safety, non-discrimination, and the rights of unionized workforces. Emerson's commitment to these legal frameworks directly influences its ability to attract and retain talent, a key factor in its long-term success.

- Global Labor Law Diversity: Emerson must comply with distinct labor laws in each country of operation, covering wages, working conditions, and collective bargaining rights, impacting its global human resources management.

- Compliance Challenges: The sheer volume and variation of international labor regulations, such as those in the EU and Asia, create ongoing legal and administrative challenges for Emerson's compliance efforts.

- Impact on Employee Relations: Strict adherence to labor laws is crucial for maintaining harmonious employee relations, preventing disputes, and ensuring a stable operational environment.

- Financial and Reputational Risks: Non-compliance can result in significant financial penalties and damage Emerson's reputation, potentially affecting its market position and investor confidence.

Emerson Electric operates within a stringent regulatory environment that impacts product development, market access, and operational procedures. Compliance with global standards for safety, emissions, and energy efficiency is paramount, especially for its automation and climate technologies. For instance, in 2024, the European Union's Ecodesign and Energy Labelling regulations continue to evolve, requiring manufacturers to meet increasingly rigorous performance benchmarks.

Environmental factors

Global climate change regulations, including ambitious carbon emission targets and increasingly stringent reporting mandates, are reshaping industries and directly impacting Emerson Electric's operational landscape and innovation pipeline. These evolving environmental policies create a growing market for Emerson's expertise in energy management, process optimization, and decarbonization technologies, which are crucial for businesses aiming to lower their carbon footprints.

The push for reduced emissions is a significant tailwind for Emerson's portfolio, as industries seek solutions to comply with regulations like the EU's Emissions Trading System (ETS) and national net-zero commitments. For instance, many nations are setting targets for significant emissions reductions by 2030 and 2050, driving investment in the very technologies Emerson provides. The International Energy Agency (IEA) has highlighted the massive investment needed in clean energy technologies to meet these goals, many of which align with Emerson's offerings.

Emerson is also actively engaged in its own sustainability journey, setting clear goals for reducing its Scope 1, 2, and 3 emissions. The company has committed to achieving science-based targets, reflecting a proactive approach to corporate environmental responsibility. This internal focus not only aligns with regulatory pressures but also enhances credibility and provides valuable insights into customer needs for decarbonization solutions.

The increasing global focus on sustainability is a significant tailwind for Emerson Electric. This translates directly into a stronger market for their energy-efficient technologies. For instance, the demand for smart grid solutions, crucial for optimizing energy distribution and reducing waste, is projected to grow substantially in the coming years. Emerson's own 'Greening By' initiative highlights their commitment to helping clients reduce their environmental footprint, aligning perfectly with this market trend.

Emerson Electric faces increasing scrutiny and evolving regulations regarding waste management and recycling, directly impacting its global manufacturing footprint. Environmental laws covering hazardous materials and end-of-life product disposal necessitate robust compliance strategies, influencing operational costs and product design.

To navigate these requirements, Emerson must prioritize sustainable manufacturing, focusing on waste reduction initiatives throughout its production cycles. This includes investing in processes that minimize the generation of industrial waste and hazardous byproducts, aligning with stricter environmental standards prevalent in key markets like the EU and North America.

Furthermore, the company is compelled to develop and implement comprehensive take-back and recycling programs for its diverse product portfolio, from industrial automation components to climate technologies. This commitment to circular economy principles requires significant investment in eco-friendly product design and the establishment of efficient reverse logistics networks.

For instance, in 2023, companies in the electronics sector reported increased spending on compliance with waste electrical and electronic equipment (WEEE) directives, with estimates suggesting a 5-10% rise in operational costs related to recycling and disposal. Emerson's proactive approach to these environmental factors is therefore crucial for maintaining its social license to operate and mitigating financial risks associated with non-compliance.

Resource Scarcity and Sustainable Sourcing

Emerson Electric faces increasing pressure due to global resource scarcity, especially concerning raw materials critical for its automation and climate technologies. For instance, the demand for rare earth elements, vital for advanced electronics and motors, continues to surge, with projections indicating a significant supply-demand gap widening in the coming years. This scarcity directly impacts Emerson's production costs and supply chain stability, pushing the company to prioritize sustainable sourcing and build greater resilience.

To address these environmental challenges, Emerson is actively exploring and implementing strategies focused on circular economy principles and responsible procurement. This includes efforts to reduce reliance on virgin materials by incorporating recycled content into its products and packaging. Furthermore, the company is enhancing its supply chain visibility to ensure ethical and environmentally sound sourcing practices, aiming to mitigate risks associated with resource depletion and environmental degradation.

Emerson's commitment to sustainability is also reflected in its innovation pipeline, with a focus on developing products that are more energy-efficient and utilize fewer critical resources. The company is investing in research and development for alternative materials and advanced manufacturing techniques that can reduce waste and environmental impact. These initiatives are crucial for maintaining competitive advantage and meeting the growing expectations of environmentally conscious stakeholders.

- Resource Scarcity Impact: Projections show a growing gap between demand and supply for critical materials like rare earths, impacting manufacturing costs.

- Sustainable Sourcing: Emerson is enhancing supply chain transparency and exploring alternative materials to ensure responsible procurement.

- Circular Economy Focus: The company is integrating recycled content into products and packaging to reduce reliance on virgin resources.

- Innovation in Efficiency: Emerson is developing more energy-efficient technologies and utilizing advanced manufacturing to minimize environmental footprint.

Corporate Environmental Reporting and ESG Pressures

Emerson Electric is navigating a landscape where environmental accountability is paramount, driven by escalating demands from investors, customers, and regulatory bodies for robust environmental reporting and superior Environmental, Social, and Governance (ESG) performance. The company's commitment is evident in its detailed sustainability reports, such as the one published in 2024, which showcases tangible progress in reducing energy intensity and increasing the use of renewable energy sources. For instance, Emerson reported a 6% reduction in Scope 1 and 2 greenhouse gas (GHG) emissions intensity in fiscal year 2023 compared to its 2021 baseline. This focus on sustainability not only aligns with global environmental goals but also directly impacts Emerson's market standing and attractiveness to a growing segment of environmentally conscious investors.

The drive for transparency in environmental impact is reshaping corporate strategies. Emerson's 2024 sustainability report highlighted a 10% increase in renewable energy procurement for its global operations, a key metric for investors assessing climate risk and transition readiness. This proactive approach to environmental reporting and performance enhancement is crucial for maintaining a competitive edge. Moreover, companies demonstrating strong ESG credentials, like Emerson's efforts to improve water efficiency, which saw a 5% decrease in water withdrawal intensity in FY23, are increasingly favored by institutional investors and are better positioned to attract capital in the evolving financial markets.

Key environmental factors influencing Emerson's operations and strategy include:

- Increasing investor scrutiny of ESG metrics: Many large institutional investors now integrate ESG performance into their investment decisions, directly impacting Emerson's cost of capital and valuation.

- Regulatory pressures for emissions reduction: Evolving environmental regulations, particularly concerning carbon emissions and energy efficiency, necessitate continuous adaptation and investment in cleaner technologies.

- Customer demand for sustainable products and supply chains: Customers are increasingly seeking products and services from companies with demonstrable environmental responsibility throughout their value chain.

- Transition to renewable energy: Emerson's own investments in renewable energy sourcing and its development of energy-efficient technologies are critical for both its operational footprint and its market offerings.

Environmental regulations, particularly concerning carbon emissions and energy efficiency, are driving demand for Emerson's technologies. The push for decarbonization aligns with global net-zero commitments, creating market opportunities for Emerson's energy management and process optimization solutions.

Resource scarcity, especially for critical materials like rare earth elements, impacts manufacturing costs and supply chain stability. Emerson is addressing this by focusing on circular economy principles, increasing the use of recycled content, and ensuring responsible sourcing practices.

Investor and customer focus on ESG performance is intensifying. Emerson's commitment to sustainability, as demonstrated by its emissions reduction targets and renewable energy procurement, enhances its market standing and attractiveness to investors.

Emerson Electric's 2023 sustainability report shows a 6% reduction in Scope 1 and 2 GHG emissions intensity compared to a 2021 baseline. The company also increased its renewable energy procurement by 10% in 2024.

| Environmental Factor | Impact on Emerson | Emerson's Response/Data |

|---|---|---|

| Climate Change Regulations | Increased demand for emissions reduction solutions | 6% reduction in Scope 1 & 2 GHG emissions intensity (FY23 vs FY21) |

| Resource Scarcity | Higher raw material costs and supply chain risks | Focus on circular economy, increased recycled content, enhanced supply chain transparency |

| ESG Scrutiny | Investor focus on sustainability performance | 10% increase in renewable energy procurement (2024) |

PESTLE Analysis Data Sources

Our Emerson Electric PESTLE Analysis is built on a robust foundation of data from leading economic institutions like the IMF and World Bank, alongside government policy documents and reputable industry analysis reports. This ensures a comprehensive view of political, economic, and legal factors impacting the company.