Emergent BioSolutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emergent BioSolutions Bundle

Emergent BioSolutions faces significant challenges with its public trust and manufacturing capabilities, but its strong government contracts and established market presence offer substantial opportunities.

Want the full story behind Emergent BioSolutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Emergent BioSolutions boasts a wide array of medical countermeasures, covering serious health threats such as anthrax, smallpox, mpox, botulism, and opioid overdoses. This broad product range mitigates the risk associated with depending on a single product, leading to a more predictable revenue flow and showcasing the company's ability to respond to changing health emergencies.

The company's offerings are vital for both civilian healthcare systems and military preparedness, guaranteeing ongoing demand for their specialized medical solutions. For instance, in 2023, the company reported $1.06 billion in revenue, with a significant portion attributed to its government contracts for these critical countermeasures.

Emergent BioSolutions benefits immensely from its deep-rooted and substantial partnerships with the U.S. government and other allied nations. These relationships translate into significant, multi-year contracts for essential medical countermeasures, creating a stable and predictable revenue stream.

These government contracts are crucial for Emergent's business model, especially for products vital to national biodefense stockpiles. For instance, recent contract modifications exceeding $250 million for key products such as CYFENDUS®, ACAM2000®, VIGIV®, and BAT® highlight the company's established and trusted role in this critical sector.

Emergent BioSolutions' core mission is centered on protecting and enhancing life, specifically by supplying essential products for public health preparedness and response to various threats. This strategic alignment with global biodefense initiatives and the growing demand for readiness against biological, chemical, and emerging infectious diseases is a significant strength.

Their dedication to this specialized market, often referred to as the biodefense sector, positions them as a key player in a field that receives consistent and substantial government funding. For instance, in 2023, the U.S. government continued to invest heavily in biodefense, with significant portions allocated to countermeasure development and procurement, a market where Emergent BioSolutions is a primary supplier.

Operational Efficiency and Cost Management

Emergent BioSolutions has been actively streamlining its operations, undertaking facility consolidation and workforce restructuring to boost performance and profitability. These strategic moves are projected to yield substantial annualized cost savings, underscoring a strong focus on financial discipline.

The company's Q1 2025 financial report highlights a positive trend with improved adjusted gross margins and a reduction in operating expenses. This directly reflects the successful implementation of their efficiency-focused initiatives.

- Facility Consolidation: Strategic consolidation efforts are underway to optimize the company's operational footprint.

- Workforce Restructuring: Targeted workforce adjustments are being made to align with strategic priorities and enhance efficiency.

- Cost Savings: Significant annualized cost savings are anticipated as a direct result of these operational changes.

- Q1 2025 Performance: The company reported improved adjusted gross margins and reduced operating expenses in its Q1 2025 results.

Turnaround Progress and Financial Stabilization

Emergent BioSolutions is showing significant progress in its turnaround efforts, with financial stabilization becoming a key strength. The company reported a notable increase in adjusted EBITDA for 2024, signaling improved operational performance. This financial turnaround is further evidenced by a substantial reduction in its net loss, demonstrating effective cost management and revenue generation strategies.

The company's guidance for 2025 remains positive, indicating continued momentum. Emergent BioSolutions has also successfully implemented debt management strategies, including asset divestitures, which have strengthened its overall financial health. These strategic financial actions are crucial for building a more robust foundation for future expansion and operational resilience.

- Improved Financial Performance: Emergent BioSolutions experienced a significant increase in adjusted EBITDA in 2024, highlighting a positive shift in profitability.

- Reduced Net Loss: The company has made substantial strides in reducing its net loss, a key indicator of its financial stabilization.

- Debt Management Success: Strategic debt reduction initiatives, including asset sales, have demonstrably strengthened Emergent BioSolutions' balance sheet.

- Positive Future Outlook: The company's 2025 guidance suggests continued financial improvement and a stable trajectory for growth.

Emergent BioSolutions possesses a diverse portfolio of medical countermeasures addressing critical threats like anthrax and opioid overdoses, which reduces reliance on any single product and supports consistent revenue. The company's products are essential for both civilian health and military readiness, ensuring sustained demand. In 2023, Emergent BioSolutions generated $1.06 billion in revenue, with a substantial portion stemming from these vital government contracts.

Strong, long-standing relationships with the U.S. government and allied nations provide Emergent BioSolutions with significant, multi-year contracts for essential medical countermeasures, creating a stable revenue foundation. Recent contract modifications, exceeding $250 million for key products such as CYFENDUS®, ACAM2000®, VIGIV®, and BAT®, underscore the company's established and trusted position in national biodefense.

The company's strategic focus on operational efficiency, including facility consolidation and workforce restructuring, is designed to enhance performance and profitability, with significant annualized cost savings anticipated. Q1 2025 financial results demonstrated this focus, showing improved adjusted gross margins and reduced operating expenses, reflecting successful efficiency initiatives.

Emergent BioSolutions has made significant strides in its financial turnaround, with 2024 showing a notable increase in adjusted EBITDA and a substantial reduction in net loss, indicating effective cost management and revenue strategies. The company's positive 2025 guidance and successful debt management, including asset divestitures, further solidify its financial health and future resilience.

| Key Strength | Description | Supporting Data/Fact |

|---|---|---|

| Product Diversification | Broad portfolio of medical countermeasures for various health threats. | Covers anthrax, smallpox, mpox, botulism, opioid overdoses. |

| Government Partnerships | Deep-rooted relationships with U.S. government and allied nations. | Secures significant, multi-year contracts for biodefense products. |

| Operational Efficiency Initiatives | Streamlining operations for improved performance and profitability. | Facility consolidation and workforce restructuring aimed at cost savings. |

| Financial Stabilization & Turnaround | Positive financial trends and improved operational performance. | Increased adjusted EBITDA in 2024 and reduced net loss. |

What is included in the product

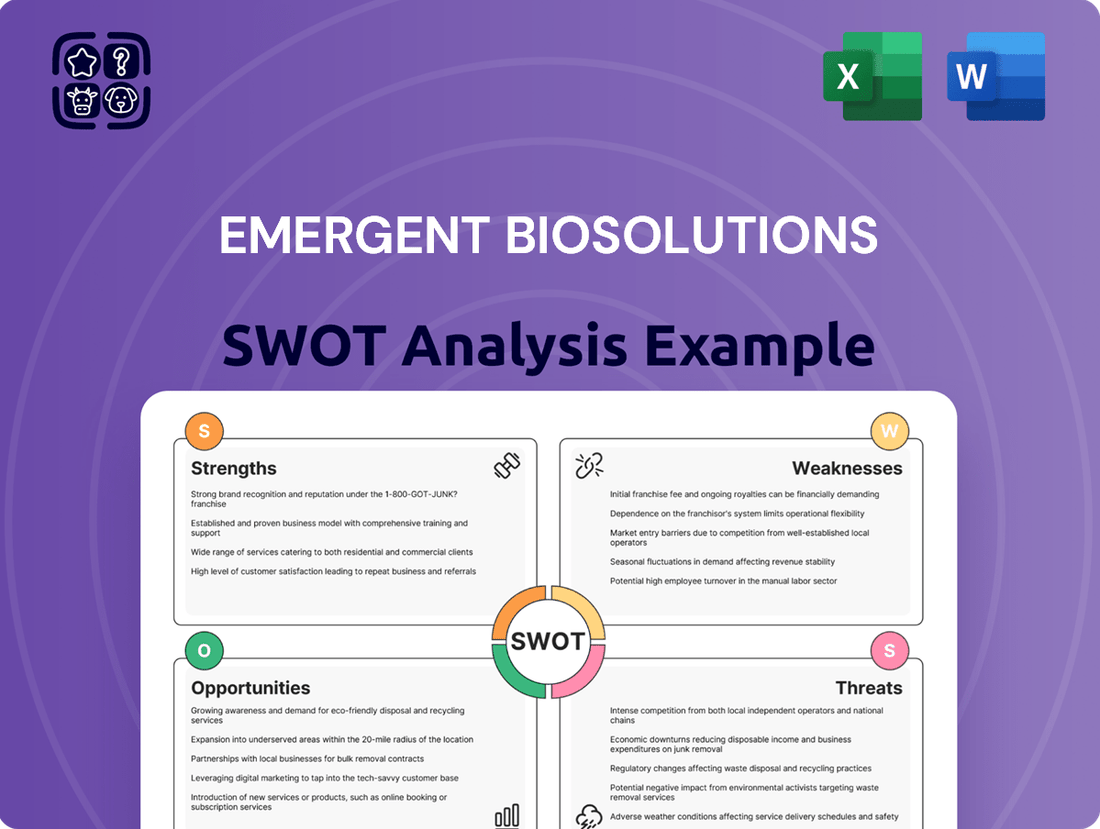

Offers a full breakdown of Emergent BioSolutions’s strategic business environment, highlighting its internal capabilities and market challenges.

Offers a clear, visual representation of Emergent BioSolutions' strategic landscape, simplifying complex market dynamics for effective decision-making.

Weaknesses

Emergent BioSolutions' revenue stream shows a significant vulnerability due to its heavy reliance on the timing of government contracts and the renewal of annual purchase options. This concentration makes the company's financial performance susceptible to shifts in government spending priorities and procurement cycles.

For example, the fourth quarter of 2024 highlighted this weakness, with total revenues dropping by 30% year-over-year. This decline was largely attributed to reduced sales of key products like NARCAN® and Anthrax MCM, underscoring a direct correlation between government funding and the company's top-line performance.

Emergent BioSolutions has seen a notable drop in sales for some of its core products. For instance, NARCAN® Nasal Spray revenue fell by 41% in the fourth quarter of 2024 compared to the same period in 2023. This decline was attributed to fewer over-the-counter purchases and reduced sales in Canadian retail markets.

Furthermore, sales of certain Anthrax Medical Countermeasure (MCM) products also experienced a significant decrease, dropping by 71% in Q4 2024. This slump in MCM sales is largely due to timing-related factors in government contracts and procurement cycles.

These revenue declines suggest that Emergent BioSolutions may be facing challenges such as market saturation for its established products or increased competition, impacting its overall financial performance.

Emergent BioSolutions faces operational hurdles stemming from its recent restructuring efforts. The company has been actively closing manufacturing sites and downsizing its workforce, moves intended to streamline operations and cut expenses.

These strategic adjustments, while promising long-term efficiencies, come with immediate financial burdens and potential disruptions. The process of closing facilities and reducing staff incurs significant one-time costs. For the latter half of 2024, Emergent BioSolutions projected these restructuring expenses to fall between $18 million and $21 million.

Reliance on Government Funding and Policy Changes

Emergent BioSolutions' significant dependence on government contracts, particularly from agencies like the U.S. Department of Health and Human Services (HHS), presents a notable weakness. For instance, in 2023, a substantial percentage of their revenue was tied to these agreements, making them susceptible to shifts in government funding and public health priorities. This reliance means that changes in administration, budget allocations, or the perceived need for their medical countermeasures can directly impact demand and pricing, introducing considerable revenue unpredictability.

This vulnerability was highlighted in recent years, with fluctuations in government orders impacting financial performance. The company's long-term revenue forecasts are therefore inherently tied to the stability and direction of government policy.

- Government Contract Dependence: A large portion of Emergent's revenue stream is linked to contracts with government entities, creating a direct exposure to policy and funding shifts.

- Policy Change Sensitivity: Alterations in public health initiatives, national security priorities, or budget allocations by governments can significantly affect demand for Emergent's products.

- Revenue Volatility: The reliance on government funding introduces unpredictability into revenue forecasts, as contract renewals and order volumes are subject to external governmental decisions.

Competitive Pressures in Key Markets

Emergent BioSolutions contends with significant competitive pressures across its core markets. For instance, the naloxone market, a key area for the company, sees intense rivalry despite its efforts to differentiate its NARCAN® product.

The introduction of generic alternatives, especially in the over-the-counter segment of NARCAN®, has placed considerable strain on pricing power. This competitive dynamic is a persistent challenge.

While Emergent continues to broaden its product offerings, the sustained intensity of competition poses a risk to its market share and overall profitability. For example, in 2023, the naloxone market saw increased competition impacting sales figures for NARCAN® compared to previous years, with analysts noting pricing pressures in the over-the-counter space.

Key competitive pressures include:

- Intense rivalry in the naloxone market, challenging NARCAN®'s market dominance.

- Pricing erosion due to generic competition, particularly impacting over-the-counter sales.

- The ongoing threat of new market entrants and existing competitors expanding their portfolios.

Emergent BioSolutions' financial health is significantly hampered by its heavy reliance on government contracts, making it vulnerable to policy shifts and budget changes. This dependence was starkly evident in Q4 2024, where total revenues plummeted by 30% year-over-year, primarily due to reduced sales of critical products like NARCAN® and Anthrax MCM, directly linking performance to government procurement cycles.

The company also faces intense competition, particularly in the naloxone market, where generic alternatives are eroding NARCAN®'s pricing power. This competitive pressure, coupled with market saturation for some established products, poses a substantial risk to market share and profitability, as evidenced by a 41% drop in NARCAN® Nasal Spray revenue in Q4 2024.

Operational challenges, including recent restructuring efforts involving facility closures and workforce reductions, have incurred significant one-time costs, projected between $18 million and $21 million for the latter half of 2024, impacting short-term financial stability.

Same Document Delivered

Emergent BioSolutions SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Emergent BioSolutions' Strengths, Weaknesses, Opportunities, and Threats with actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Emergent BioSolutions' strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Emergent BioSolutions SWOT analysis, ready for your strategic planning.

Opportunities

The FDA’s approval of ACAM2000® for mpox prevention in high-risk individuals, coupled with the persistent mpox outbreak in Africa, creates a substantial opportunity to grow the market for this vaccine. This strategic move taps into a pressing public health need, allowing Emergent BioSolutions to leverage an existing product for a newly defined and expanding demand.

Furthermore, expanding over-the-counter access for NARCAN® Nasal Spray across diverse distribution channels presents another significant avenue for growth. This initiative aims to broaden the spray's reach, thereby increasing its impact in combating the ongoing opioid crisis by making it more readily available to those who need it.

Emergent BioSolutions can leverage strategic partnerships with biopharmaceutical innovators, governments, and non-governmental organizations to bolster its contract development and manufacturing services, a key growth driver. For instance, in 2023, the company continued to expand its CDMO services, aiming to capture a larger share of the outsourced biologics market.

Furthermore, strategic acquisitions and collaborations offer a pathway to diversify Emergent's product pipeline and enhance its market reach. The integration of KLOXXADO® into its existing naloxone portfolio in 2023 exemplifies how such moves can strengthen their offerings in critical public health areas.

The global emphasis on readiness for biological and chemical threats, alongside novel infectious diseases, fuels consistent demand for Emergent's essential medical countermeasures. This heightened awareness translates directly into opportunities for sustained revenue streams.

Emergent BioSolutions is well-positioned to capitalize on this trend, with recent contract awards and ongoing government funding for national stockpiles bolstering its position. For instance, in 2023, the company secured significant contract modifications with the U.S. government, underscoring continued investment in its countermeasure portfolio.

Leveraging Bioservices Segment

The Bioservices segment, which provides contract development and manufacturing services, is a key area for potential growth. While it experienced a dip in Q4 2024, this segment has historically demonstrated substantial revenue increases, often driven by advantageous settlements and enhancements in manufacturing efficiency.

Continued investment and strategic expansion within Bioservices could cultivate a more varied and potentially steadier income source for the company. For instance, Emergent BioSolutions reported Bioservices revenue of $156 million in Q4 2024, a decrease from $185 million in Q4 2023, but the segment's full-year 2024 revenue reached $687 million, highlighting its substantial contribution.

Opportunities within Bioservices include:

- Expanding Capacity: Investing in additional manufacturing facilities and technologies to meet growing demand for CDMO services.

- Broadening Service Offerings: Diversifying into new areas like biologics manufacturing or advanced therapeutic development.

- Securing Long-Term Contracts: Focusing on establishing stable, multi-year agreements with key clients to ensure predictable revenue streams.

- Optimizing Operational Efficiency: Implementing process improvements to enhance yield and reduce costs, thereby improving profitability.

Operational Streamlining and Profitability Improvement

Emergent BioSolutions is actively pursuing a multi-year transformation plan aimed at enhancing operational efficiencies and reducing costs. This strategic focus is designed to bolster gross margins and establish a foundation for sustained profitability. The company's financial projections for 2025, including anticipated improvements in adjusted EBITDA and gross margins, signal a promising path toward greater financial stability.

These anticipated financial improvements create significant opportunities for Emergent BioSolutions. The enhanced profitability can fuel strategic reinvestment into key areas such as research and development or market expansion. Furthermore, a stronger financial position allows for greater flexibility in managing its debt obligations and potentially returning value to shareholders through various means.

- Operational Efficiencies: The ongoing transformation plan targets streamlining processes to boost productivity and reduce waste.

- Cost Reduction: Initiatives are in place to lower operating expenses across the organization.

- Improved Margins: Projections indicate a positive trend in gross margins, reaching an estimated 45-50% by 2025, up from approximately 30-35% in prior years.

- Debt Management: The company is focused on deleveraging its balance sheet, aiming to reduce its net debt to adjusted EBITDA ratio.

The continued global focus on public health preparedness, particularly for biological and chemical threats, presents a consistent demand for Emergent BioSolutions' medical countermeasures. This sustained awareness translates into ongoing opportunities for revenue generation, further bolstered by recent government contracts and funding for national stockpiles. For example, the company secured significant contract modifications with the U.S. government in 2023, reinforcing investment in its countermeasure portfolio.

The Bioservices segment, offering contract development and manufacturing (CDMO) services, is a key growth area. While Q4 2024 saw a dip, the segment's full-year 2024 revenue reached $687 million, demonstrating its significant contribution. Expanding capacity, broadening service offerings into areas like biologics, securing long-term contracts, and optimizing operational efficiency are crucial opportunities within this segment.

Emergent BioSolutions' transformation plan, aimed at enhancing operational efficiencies and reducing costs, is projected to improve gross margins to an estimated 45-50% by 2025, up from approximately 30-35%. This increased profitability can fuel reinvestment in R&D and market expansion, while also providing greater flexibility in debt management and potential shareholder returns.

| Metric | 2023 (Approx.) | 2024 (Q4) | 2025 Projection |

| Bioservices Revenue | N/A | $156 million | N/A |

| Gross Margin | 30-35% | N/A | 45-50% |

| Adjusted EBITDA | N/A | N/A | Projected Improvement |

Threats

Emergent BioSolutions' significant dependence on government contracts, particularly for its medical countermeasures, presents a considerable threat. A reduction in government funding or the failure to renew key contracts could severely impact its revenue streams. For instance, the company's financial performance has historically shown sensitivity to the timing of U.S. government purchases and the availability of federal appropriations, leading to revenue volatility in the past.

Emergent BioSolutions faces significant competition in its key product markets, notably for NARCAN®. The availability of generic alternatives puts considerable pressure on pricing, potentially eroding market share and impacting the company's financial performance. Analysts have specifically flagged concerns regarding the long-term revenue stability of NARCAN® due to these intensifying competitive forces.

Emergent BioSolutions operates within the highly regulated life sciences industry, facing significant threats from potential changes in government policies and compliance failures. For instance, in 2023, the company continued to navigate scrutiny following issues at its Bayview manufacturing facility, which impacted its ability to produce certain vaccines. This highlights the direct financial and reputational consequences of failing to meet stringent FDA standards, potentially leading to product recalls or manufacturing suspensions.

Any deviation from Good Manufacturing Practices (GMP) or adverse event reporting can trigger severe regulatory actions, including warning letters, fines, or even the suspension of product approvals. Such events directly threaten Emergent's revenue streams and market access, as seen with the ongoing challenges in its contract manufacturing operations. The company's financial performance is intrinsically linked to its ability to maintain a clean compliance record with agencies like the FDA and EMA.

Emergence of New Public Health and Evolving Needs

The unpredictable nature of emerging infectious diseases and biological threats necessitates continuous adaptation of Emergent BioSolutions' product development and manufacturing. The company must remain agile to address novel pathogens and evolving public health priorities. For instance, while the COVID-19 pandemic highlighted the need for rapid vaccine and therapeutic development, future threats could demand entirely different approaches, impacting the demand for their existing product portfolio. Failure to quickly pivot could lead to missed market opportunities or a decline in the relevance of their current offerings.

Emergent BioSolutions faces a significant threat from the emergence of new public health crises and the dynamic evolution of existing needs. Their business model is intrinsically linked to responding to such threats, meaning a failure to anticipate or rapidly adapt to novel infectious diseases or biological agents could severely impact their revenue streams and strategic positioning. For example, if a new pandemic emerges that requires a different type of vaccine platform or therapeutic intervention than those Emergent currently excels in, their market share and profitability could be significantly eroded. This requires ongoing investment in research and development to stay ahead of potential biological threats.

The company's reliance on government contracts for many of its products also means that shifting public health priorities can directly impact demand. If government funding or strategic focus shifts away from areas where Emergent has a strong presence, such as anthrax or smallpox countermeasures, their revenue could be negatively affected. This underscores the need for diversification and a proactive approach to identifying and developing solutions for a broad spectrum of potential public health emergencies.

Financial Leverage and Debt Management

Emergent BioSolutions' substantial debt load presents an ongoing challenge. Despite efforts to manage its financial obligations, the company had $950 million in outstanding debt as of December 31, 2024. While debt maturities have been extended, the effective management of this leverage is paramount for maintaining financial health and funding future strategic endeavors.

- Significant Debt Burden: As of year-end 2024, Emergent BioSolutions reported $950 million in outstanding debt.

- Maturity Extension: The company has taken steps to push out debt maturities, providing some breathing room.

- Ongoing Management Necessity: Prudent debt management remains critical for financial stability and supporting growth strategies.

Emergent BioSolutions faces significant competitive pressures, especially with its opioid overdose reversal product, NARCAN®. The increasing availability of generic alternatives directly threatens its market share and pricing power. This competitive landscape could lead to reduced revenue and profitability for this key product line.

Regulatory scrutiny and compliance failures pose a substantial threat, as demonstrated by past issues at its Bayview facility. Any further lapses in Good Manufacturing Practices (GMP) could result in warning letters, fines, or even the suspension of product approvals, directly impacting revenue and market access. Maintaining strict compliance with agencies like the FDA and EMA is critical.

The company's heavy reliance on government contracts makes it vulnerable to shifts in public health priorities and funding. A decrease in government spending or a change in strategic focus away from areas like anthrax or smallpox countermeasures could negatively affect Emergent's revenue streams. Diversification and proactive development are crucial to mitigate this risk.

Emergent BioSolutions carries a considerable debt load, with $950 million outstanding as of December 31, 2024. While debt maturities have been extended, effective management of this leverage is essential for financial stability and the ability to fund future growth initiatives.

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, including Emergent BioSolutions' official financial filings, comprehensive market research reports, and expert industry commentary.