Emergent BioSolutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emergent BioSolutions Bundle

Emergent BioSolutions' product portfolio is a dynamic landscape, with some offerings poised for growth and others requiring careful management. Understanding their position within the BCG Matrix—whether as Stars, Cash Cows, Dogs, or Question Marks—is crucial for strategic decision-making. Purchase the full BCG Matrix report to gain a comprehensive view of these placements and unlock actionable insights for optimizing your investment and product strategy.

Stars

ACAM2000, a crucial vaccine for Emergent BioSolutions, saw its market potential bolstered by an expanded FDA approval in 2024 for mpox prevention in at-risk populations. This development is particularly timely given the continued mpox outbreaks globally, indicating a growing demand for effective preventative measures.

Emergent BioSolutions' proactive approach, including significant dose donations for deployment in affected regions, underscores its commitment and strengthens its market standing for ACAM2000. This strategic move not only addresses public health needs but also solidifies the vaccine's importance in combating viral threats.

Emergent BioSolutions holds a significant position in the anthrax vaccine market, bolstered by ongoing U.S. government procurement. The U.S. government awarded Emergent BioSolutions a $1.5 billion contract in 2023 for its anthrax vaccine, indicating strong demand. The recent July 2023 approval of CYFENDUS, supported by positive clinical trial outcomes, enhances their offerings in biodefense.

This segment is likely a Cash Cow for Emergent BioSolutions, given its established market share and recurring government revenue streams. The global anthrax vaccine market is projected to grow at a compound annual growth rate (CAGR) of approximately 5% from 2023 to 2028, driven by increased awareness and investment in biosecurity.

Emergent BioSolutions' Medical Countermeasures (MCM) portfolio is a significant component of its business, encompassing treatments for public health threats like smallpox, mpox, botulism, and Ebola. The company holds a substantial market share in this niche sector, driven by its specialized products.

In 2024, Emergent BioSolutions saw robust demand for its MCM products, evidenced by over $500 million in new contract modifications. This highlights the company's strong partnerships with government entities and the ongoing need for its life-saving medical solutions.

The MCM segment is a strategic priority for Emergent, directly supporting its mission to combat a range of public health emergencies, whether they arise accidentally, deliberately, or naturally. This focus underscores the critical role the company plays in national and global health security.

Contract Development and Manufacturing Organization (CDMO) Services

Emergent BioSolutions' Contract Development and Manufacturing Organization (CDMO) services offer comprehensive 'molecule-to-market' solutions, tapping into the burgeoning biopharmaceutical and medical device contract manufacturing sectors. This segment is experiencing robust expansion, with projections indicating significant growth through 2024 and beyond.

These services, while not a distinct product, are crucial for Emergent's strategic positioning. They capitalize on the company's established manufacturing prowess and deep industry expertise, solidifying its role as a vital collaborator for other pharmaceutical and biotech firms. This focus on service provision leverages existing infrastructure and knowledge to generate revenue and market share.

Emergent has actively optimized its manufacturing network to bolster efficiency and competitiveness within its CDMO offerings. This strategic streamlining is key to meeting the increasing demand for specialized manufacturing support in the life sciences industry.

- Market Growth: The medical device contract manufacturing market is anticipated to experience substantial growth, with some reports projecting it to reach over $100 billion globally by 2027.

- Strategic Importance: CDMO services allow Emergent to diversify revenue streams beyond its own product portfolio, utilizing its manufacturing assets effectively.

- Operational Efficiency: The company’s network optimization efforts aim to reduce lead times and improve cost-effectiveness, making its CDMO services more attractive.

- Industry Demand: A growing number of biotech companies, especially smaller ones, are outsourcing development and manufacturing, creating a strong demand for reliable CDMO partners like Emergent.

International Expansion of Medical Countermeasures and Naloxone

Emergent BioSolutions is strategically extending its reach for medical countermeasures and naloxone beyond the United States. This global push into regions like the EU, Middle East, Africa, and Asia Pacific is designed to unlock significant growth potential by accessing new customer bases and reducing reliance on U.S. government contracts.

The company's commitment to bolstering global health security initiatives creates a robust and expanding market for its specialized products. For instance, in 2024, the global market for naloxone was projected to reach several billion dollars, with significant growth expected from international adoption as public health bodies prioritize opioid overdose prevention.

- International Expansion: Targeting EU, Middle East, Africa, and Asia Pacific for medical countermeasures and naloxone.

- Revenue Diversification: Moving beyond primary U.S. government contracts to tap into new revenue streams.

- Global Preparedness Focus: Capitalizing on the growing demand driven by international health security efforts.

- Market Growth: The global naloxone market is a key area of expansion, with significant projected growth in 2024 and beyond.

Emergent BioSolutions' ACAM2000 vaccine is positioned as a potential Star in the BCG matrix. Its expanded FDA approval in 2024 for mpox prevention in at-risk populations, coupled with global outbreaks, indicates high market growth. The company's proactive dose donations further solidify its market leadership and demand for this product.

Emergent BioSolutions' anthrax vaccine, including CYFENDUS, represents a strong Cash Cow. The company benefits from significant U.S. government procurement, evidenced by a $1.5 billion contract in 2023. With a projected 5% CAGR for the anthrax vaccine market through 2028, this segment provides stable, recurring revenue.

| Product/Service | BCG Category | Market Growth | Market Share | Key Drivers |

| ACAM2000 (Mpox Vaccine) | Star | High (Global outbreaks) | Growing | FDA approval, public health demand |

| Anthrax Vaccine (incl. CYFENDUS) | Cash Cow | Moderate (5% CAGR 2023-2028) | High (Govt. contracts) | U.S. government procurement, biosecurity investment |

| Medical Countermeasures (MCM) | Star/Question Mark | High (>$500M new contracts in 2024) | Substantial | National security, diverse public health threats |

| CDMO Services | Question Mark/Star | High (>$100B market by 2027) | Developing | Outsourcing trend, manufacturing expertise |

| Naloxone & Global Expansion | Question Mark | High (Multi-billion dollar market) | Emerging | Opioid crisis, international health initiatives |

What is included in the product

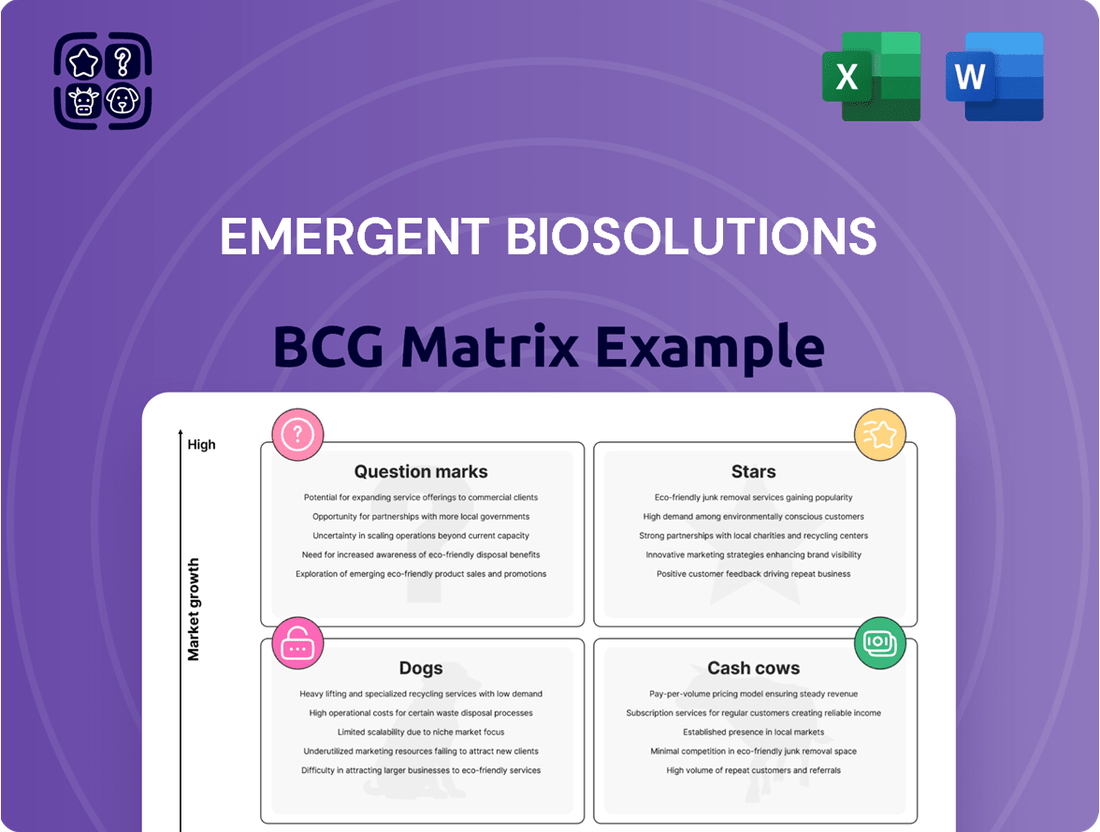

The Emergent BioSolutions BCG Matrix categorizes its products by market share and growth, guiding investment and divestment decisions.

A clear BCG matrix visualizes Emergent BioSolutions' portfolio, easing strategic decision-making pain.

Cash Cows

NARCAN Nasal Spray's public interest channel in the U.S. and Canada has been a cornerstone of Emergent BioSolutions' revenue. This segment has consistently driven significant sales, underscoring its importance to the company's financial performance.

Despite facing some pricing challenges and brief funding interruptions in early 2025, NARCAN's demand remains robust. The persistent opioid crisis fuels a continuous need for this life-saving medication, ensuring its market relevance.

The naloxone market, in general, is expanding, but Emergent's established public interest distribution network offers a dependable, high-volume source of income. This stable channel provides a predictable revenue stream, even amidst market fluctuations.

The U.S. government's ongoing procurement of anthrax vaccines, including BioThrax and Anthrasil, through annual purchase options provides Emergent BioSolutions with a dependable revenue source. These established contracts, bolstered by national biodefense initiatives, secure a significant market share in a mature, government-controlled sector. For instance, in 2024, Emergent reported that the U.S. Strategic National Stockpile (SNS) contract for BioThrax remained a key revenue driver, demonstrating the continued reliance on these products for national security.

ACAM2000, Emergent BioSolutions' smallpox vaccine, serves as a crucial component of the U.S. government's strategic national stockpile, creating a predictable and consistent demand. This ensures a stable revenue stream for the company.

While the overall market for smallpox vaccines might not exhibit rapid expansion, Emergent BioSolutions' position as a key supplier for biodefense purposes guarantees a substantial and enduring market share. This translates into reliable cash flow generation for the company.

Sales of ACAM2000 are typically secured through long-term government contracts and are directly linked to national preparedness initiatives. For instance, in 2023, Emergent BioSolutions reported $307.2 million in revenue from its biologics business unit, which includes ACAM2000, highlighting the significance of government contracts.

BioThrax (Anthrax Vaccine Adsorbed)

BioThrax, Emergent BioSolutions' established anthrax vaccine, has been a bedrock of the company's revenue, largely due to its consistent demand from the U.S. government. Despite the emergence of newer alternatives like CYFENDUS, BioThrax maintains a significant presence in government stockpiles, solidifying its position as a mature product with a stable market share.

This reliable demand from a single, major customer ensures BioThrax continues to be a dependable source of income for Emergent BioSolutions. In 2023, Emergent BioSolutions reported total revenue of $1.08 billion, with their government business segment, which includes BioThrax, being a primary driver.

- Historical Revenue Driver: BioThrax has consistently generated substantial revenue for Emergent BioSolutions.

- Government Contract Stability: Its primary market is the U.S. government, providing a predictable revenue stream.

- Mature Product Status: While newer vaccines exist, BioThrax holds a strong, established market position within government procurement channels.

- Cash Generation: The vaccine's consistent demand makes it a reliable cash cow for the company.

Certain Mature Medical Countermeasures

Emergent BioSolutions' mature medical countermeasures, beyond their well-known anthrax and smallpox vaccines, likely function as cash cows. These products cater to ongoing public health needs and benefit from secure, long-term government contracts. For instance, in 2024, the company continued to supply critical medical supplies to government agencies, reflecting the stable demand for these established countermeasures.

These offerings, while not in high-growth markets, maintain a strong market share within their specific segments. Their established presence means lower investment is needed for promotion and market placement compared to newer or more volatile products. This stability allows them to generate consistent revenue streams for Emergent BioSolutions.

- Established Government Contracts: Secure, recurring revenue from public health preparedness programs.

- Consistent Demand: Addressing ongoing, known public health threats ensures a steady market.

- High Niche Market Share: Dominant position in specific, mature product categories.

- Low Promotional Investment: Reduced marketing spend due to established product recognition and demand.

Emergent BioSolutions' established medical countermeasures, including vaccines like BioThrax and ACAM2000, are key cash cows. These products benefit from long-term government contracts, ensuring consistent demand and revenue. For example, in 2023, their government business segment, driven by these products, was a primary revenue source, contributing significantly to the company's total revenue of $1.08 billion.

NARCAN Nasal Spray also functions as a cash cow due to its robust demand, fueled by the ongoing opioid crisis. Despite some pricing pressures, its public interest channel in the U.S. and Canada provides a stable, high-volume revenue stream, underscoring its importance. In 2024, Emergent BioSolutions continued to leverage these mature products, maintaining their status as reliable income generators.

| Product | Category | Primary Market | Revenue Driver | Status |

|---|---|---|---|---|

| BioThrax | Anthrax Vaccine | U.S. Government (SNS) | National Biodefense Initiatives | Mature, Stable |

| ACAM2000 | Smallpox Vaccine | U.S. Government (SNS) | National Preparedness Initiatives | Mature, Stable |

| NARCAN Nasal Spray | Opioid Overdose Reversal | U.S. & Canada Public Interest | Opioid Crisis Demand | Growing, Stable Demand |

Preview = Final Product

Emergent BioSolutions BCG Matrix

The BCG Matrix report you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis of Emergent BioSolutions' product portfolio, categorized by market growth and relative market share, is ready for immediate strategic application. You can confidently expect the same detailed insights and professional presentation in the final file, ensuring no surprises and full usability for your business planning needs.

Dogs

RSDL, or Reactive Skin Decontamination Lotion, has been categorized as a 'Dog' in Emergent BioSolutions' BCG Matrix. This classification stems from its recent sale to SERB Pharmaceuticals in the third quarter of 2024. The divestiture itself signals that RSDL held a small market share and was likely operating within a market experiencing minimal growth.

The financial impact of this sale is evident in RSDL's sales performance. Following the transaction, sales experienced a notable decline in both the fourth quarter of 2024 and the first quarter of 2025. This downturn directly reflects its reduced role within Emergent BioSolutions' revenue streams, reinforcing its position as a product with limited current contribution and future potential.

Emergent BioSolutions' Botulism Antitoxin Heptavalent (BAT) likely falls into the 'Dog' category of the BCG Matrix. Sales saw a significant dip in the last quarter of 2024 and the first quarter of 2025, attributed to the irregular schedule of deliveries, indicating unpredictable revenue generation.

Despite its critical role in addressing botulism, a serious public health concern, BAT's market share and demand may be relatively low when contrasted with Emergent's more dominant products. This positions it as a product that generates minimal, inconsistent cash flow, necessitating a close review of its ongoing investment viability.

Emergent BioSolutions saw a decline in revenues from contracts and grants in Q4 2024, a direct result of winding down several development initiatives. This strategic move indicates that these particular projects, likely in their early stages, did not achieve the expected market penetration or commercial success. Such underperforming assets, often categorized as 'Dogs' in the BCG Matrix, require careful management to avoid continued resource drain.

Divested Assets (e.g., Camden facility, other asset divestitures)

Emergent BioSolutions has been actively divesting assets as part of a broader strategic stabilization plan. This includes the sale of facilities like the Camden plant. These actions suggest that the divested operations or product lines were not meeting performance expectations, held a small market share, or were deemed non-core to the company's future growth strategy.

Such divestitures align with the characteristics of 'Dogs' in the BCG Matrix, representing businesses with low growth and low market share. For instance, Emergent BioSolutions reported a net loss of $173 million for the full year 2023, highlighting the financial pressures that often accompany underperforming assets. The company's focus has shifted towards stabilizing its core business and optimizing its manufacturing footprint.

- Divestiture Rationale: Assets are divested when they exhibit low market share and low growth potential, fitting the 'Dog' category.

- Strategic Realignment: The sale of the Camden facility and other assets reflects a strategic move to streamline operations and focus on more profitable ventures.

- Financial Performance Impact: Divesting underperforming assets is a common strategy to improve overall financial health and resource allocation.

- BCG Matrix Classification: These divested assets are categorized as 'Dogs' due to their limited contribution to growth and market share.

Older, Less Strategic Bioservices Contracts

Emergent BioSolutions' Bioservices segment may be shedding older, less strategic contracts. A reported decrease in Bioservices revenue for Q4 2024 and Q1 2025, partly attributed to the sale of its Camden facility, points to potential underperformance in some of these older engagements.

These contracts, if they weren't yielding strong profit margins or driving strategic expansion, would be candidates for divestment or discontinuation. For example, if a contract manufacturing agreement for a mature product with low volume and tight pricing was part of the Bioservices portfolio, it might be a prime candidate for this strategic pruning.

- Revenue Decline: Bioservices revenue saw a dip in late 2024 and early 2025.

- Facility Sale Impact: The Camden facility sale contributed to this revenue reduction.

- Contract Evaluation: Older, less profitable contracts are likely being reviewed.

- Strategic Focus: The company appears to be prioritizing higher-margin, growth-oriented engagements.

Emergent BioSolutions' RSDL, sold in late 2024, and its Botulism Antitoxin Heptavalent (BAT), facing delivery inconsistencies, both exemplify 'Dogs' in the BCG Matrix. These products likely possess low market share and operate in slow-growing markets, generating minimal and unpredictable cash flow. The company's strategic divestitures and winding down of development initiatives in 2024 further highlight the identification and management of such underperforming assets.

| Product/Segment | BCG Category | Rationale | Recent Performance Indicator |

| RSDL | Dog | Low market share, low market growth potential; divested in Q3 2024. | Sales decline in Q4 2024 and Q1 2025 post-sale. |

| Botulism Antitoxin Heptavalent (BAT) | Dog | Low market share, inconsistent demand/revenue. | Significant sales dip in Q4 2024 and Q1 2025 due to irregular deliveries. |

| Winding Down Development Initiatives | Dog | Failed to achieve expected market penetration or commercial success. | Revenue decline from contracts and grants in Q4 2024. |

| Camden Plant Operations | Dog | Non-core, underperforming asset divested as part of stabilization. | Sale contributed to Bioservices revenue reduction in Q4 2024/Q1 2025. |

Question Marks

KLOXXADO (naloxone HCl) Nasal Spray 8 mg represents a potential Star within Emergent BioSolutions' portfolio. Its recent inclusion in the NARCANDirect offering, backed by a six-year exclusive commercial rights agreement, positions it in a high-growth market fueled by the ongoing opioid crisis.

While the market for naloxone is expanding, KLOXXADO's market share compared to the established NARCAN 4mg spray is still in its nascent stages. This indicates a need for significant strategic investment in marketing and distribution to solidify its position and drive growth.

Emergent BioSolutions is actively developing a portfolio of product candidates targeting emerging infectious diseases (EIDs). These are in various stages, from pre-clinical to clinical trials, reflecting a commitment to addressing significant public health threats. The company's investment in this area positions it to potentially capitalize on a rapidly growing market driven by the constant emergence of new pathogens.

While these EID candidates represent high-growth potential, they currently hold a minimal market share as they are still undergoing development. Significant research and development (R&D) funding is essential for these candidates to advance through regulatory pathways and eventually achieve market success. For instance, in 2024, Emergent BioSolutions continued to allocate substantial resources to its EID pipeline, underscoring the long-term strategic importance of these programs.

Emergent BioSolutions is actively pursuing geographical expansions for key products like naloxone and its broader medical countermeasures portfolio. The company is targeting significant growth opportunities in the European Union, the Middle East, Africa, and the Asia Pacific regions. These strategic moves are designed to tap into developing markets for public health solutions.

While these emerging markets present substantial growth potential, Emergent BioSolutions anticipates a low initial market share in these nascent territories. This necessitates considerable investment in market penetration strategies and adapting to diverse local regulatory frameworks. For instance, navigating the EU's complex regulatory landscape for pharmaceuticals can be a lengthy process, requiring extensive data and compliance efforts.

Development Work for Ebanga (ansuvimab-zykl)

Emergent BioSolutions' development work on Ebanga (ansuvimab-zykl) positions it as a Question Mark in the BCG matrix. Revenues from contracts and grants saw an increase in Q1 2025, largely driven by this ongoing development for Ebanga, a crucial treatment for Ebola.

Ebanga addresses a significant public health concern, with demand that can fluctuate dramatically based on outbreak occurrences. Although its market presence might be modest during non-outbreak periods, its development signifies high growth potential, especially when responding to emerging health threats, making it a classic Question Mark candidate.

- Ebanga's Role: A critical treatment for Ebola, addressing a vital public health need.

- Q1 2025 Performance: Revenues from contracts and grants increased, primarily due to Ebanga development work.

- Market Dynamics: Experiences sudden surges in demand during outbreaks, but may have low market share otherwise.

- BCG Classification: Considered a Question Mark due to its high growth potential in specific, albeit infrequent, circumstances.

Any New Product Candidates from Strategic Partnerships or Acquisitions

Emergent BioSolutions' strategic focus on profitable growth and innovation means that any new product candidates emerging from partnerships or acquisitions would likely enter the BCG Matrix as Question Marks.

These potential new offerings, while targeting promising markets or addressing unmet medical needs, would begin with a low market share. For instance, if a partnership in 2024 yielded a novel vaccine candidate for a newly identified emerging infectious disease, it would require substantial investment in research, development, clinical trials, and market penetration to gain traction.

This classification highlights the inherent uncertainty and the need for significant capital infusion to nurture these products towards market leadership. The company's 2024 R&D expenditure, which was approximately $242 million, demonstrates its commitment to exploring such avenues, with a portion allocated to pipeline development that could include these nascent product candidates.

- New Product Candidates: Products from strategic partnerships or acquisitions are initially classified as Question Marks.

- Market Position: They target growing markets or unmet needs but start with low market share.

- Investment Needs: Significant investment is required to scale up and establish a strong market position.

- R&D Focus: Emergent BioSolutions' R&D spending, like the $242 million in 2024, supports the development of these early-stage candidates.

Emergent BioSolutions' development of Ebanga (ansuvimab-zykl) for Ebola positions it as a Question Mark. While its revenue from contracts and grants saw an increase in Q1 2025, largely due to this development, Ebanga's market share is modest outside of outbreak periods. This fluctuating demand, coupled with its high growth potential in specific public health crises, makes it a classic Question Mark.

| Product/Area | BCG Category | Market Share | Market Growth | Strategic Consideration |

| Ebanga (ansuvimab-zykl) | Question Mark | Low (outside outbreaks) | High (during outbreaks) | Requires significant investment to capitalize on outbreak-driven demand. |

| Emerging Infectious Diseases (EID) Pipeline | Question Mark | Minimal (in development) | High | Substantial R&D funding needed for advancement and market entry. |

| New Product Candidates (Partnerships/Acquisitions) | Question Mark | Low | Promising | Capital infusion critical for market penetration and leadership. |

BCG Matrix Data Sources

Our Emergent BioSolutions BCG Matrix is constructed using a blend of financial disclosures, market research reports, and internal performance data to provide a comprehensive view of product portfolio health.