Emergent BioSolutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emergent BioSolutions Bundle

Emergent BioSolutions operates in a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate this sector effectively.

The complete report reveals the real forces shaping Emergent BioSolutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The pharmaceutical sector, including biodefense specialists like Emergent BioSolutions, increasingly relies on raw material suppliers located outside of Europe. This geographic concentration can empower these suppliers, giving them greater leverage in price negotiations and supply terms. For instance, disruptions in global shipping or geopolitical instability can exacerbate this dependence, further solidifying supplier bargaining power.

For critical medical countermeasures, suppliers of highly specialized active pharmaceutical ingredients (APIs) or proprietary manufacturing technologies can wield considerable power. This is especially true when alternative sources are scarce, as is often the case with complex biologics and advanced therapies. For instance, the development of novel vaccines or gene therapies relies on a limited number of suppliers capable of producing the intricate biological components or utilizing specialized cell culture techniques.

Suppliers capable of consistently adhering to rigorous regulatory mandates, such as current Good Manufacturing Practices (cGMP) and sophisticated quality control for pharmaceuticals, naturally gain leverage. This ability to meet high standards is not easily replicated.

The significant financial and operational investment required for regulatory compliance acts as a barrier to entry for potential suppliers. For instance, the cost of maintaining cGMP certification can run into millions of dollars annually for a manufacturing facility, thereby concentrating qualified suppliers and amplifying their bargaining power.

Switching Costs for Emergent BioSolutions

Switching suppliers in the biopharmaceutical sector, particularly for a company like Emergent BioSolutions, involves significant hurdles. These include the extensive time and resources required for re-validating new suppliers, securing necessary regulatory approvals, and managing potential disruptions to ongoing production schedules. These complexities inherently elevate the switching costs for Emergent, thereby strengthening the bargaining power of its existing, qualified suppliers.

For Emergent BioSolutions, these high switching costs translate into a greater reliance on its current supplier base. This dependency means suppliers can often dictate terms, including pricing and delivery schedules, with less fear of losing Emergent's business. This dynamic is crucial for understanding Emergent's operational costs and strategic flexibility.

- High Re-validation Costs: The process of qualifying a new supplier in the biopharmaceutical industry can cost millions of dollars and take years to complete.

- Regulatory Hurdles: Any change in a key supplier necessitates extensive review and approval from regulatory bodies like the FDA, adding significant time and uncertainty.

- Production Disruption Risk: A supplier switch can lead to temporary halts or slowdowns in manufacturing, resulting in lost revenue and potential contractual penalties for Emergent.

- Supplier Concentration: In specialized areas of biopharmaceutical manufacturing, the number of qualified suppliers may be limited, further concentrating power in the hands of a few key partners.

Limited Number of CDMO Service Providers

The contract development and manufacturing organization (CDMO) market is indeed expanding, projected to reach over $300 billion by 2027, but the availability of highly specialized providers, especially for complex biologics and novel therapies, remains constrained. This limited pool of expert CDMOs grants them significant bargaining power when negotiating service agreements with companies like Emergent BioSolutions.

- Specialized Expertise: CDMOs with advanced capabilities in areas like viral vector manufacturing or cell therapy development face less competition, allowing them to command higher prices.

- Capacity Constraints: High demand for specific manufacturing slots can lead to longer lead times and increased costs for clients.

- Regulatory Hurdles: The stringent regulatory landscape for biopharmaceutical manufacturing means that only a select few CDMOs possess the necessary approvals and experience, further concentrating power.

- Innovation Dependence: Companies relying on CDMOs for cutting-edge manufacturing processes are particularly vulnerable to supplier leverage.

Suppliers of specialized active pharmaceutical ingredients (APIs) and proprietary manufacturing technologies hold significant sway, especially when alternatives are scarce, as is common with complex biologics. For example, in 2024, the global market for biopharmaceuticals, a key area for Emergent BioSolutions, continued to see high demand for niche components, allowing specialized suppliers to dictate terms. The ability to meet stringent regulatory standards like cGMP further solidifies their position, as compliance requires substantial investment, limiting the number of qualified providers and thus increasing their bargaining power.

The high costs and lengthy timelines associated with re-validating new suppliers in the biopharmaceutical sector mean companies like Emergent BioSolutions face substantial switching costs. These barriers, coupled with the risk of production disruptions and the need for regulatory re-approvals, create a strong dependence on existing, qualified suppliers. This dependency allows suppliers to exert considerable leverage over pricing and delivery, impacting Emergent's operational flexibility and cost structure.

The limited pool of contract development and manufacturing organizations (CDMOs) with advanced capabilities in areas like viral vector manufacturing or cell therapy development grants them significant bargaining power. In 2024, demand for these specialized services outstripped supply, leading to longer lead times and increased costs for clients. This concentration of expertise, combined with stringent regulatory requirements, means that companies relying on these CDMOs are particularly susceptible to supplier leverage.

| Factor | Impact on Emergent BioSolutions | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration (APIs) | High bargaining power for specialized API providers due to limited alternatives. | Continued demand for niche biopharmaceutical components in 2024. |

| Switching Costs | Significant financial and time investment to change suppliers, increasing reliance. | Re-validation processes can take years and cost millions, a persistent challenge. |

| Regulatory Compliance | Suppliers meeting cGMP and quality standards have an advantage. | Ongoing investment in compliance by suppliers reinforces their value and power. |

| CDMO Specialization | Limited number of expert CDMOs allows them to command higher prices and terms. | Growth in specialized biomanufacturing services outpaced capacity in 2024. |

What is included in the product

This analysis dissects Emergent BioSolutions' competitive environment, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Gain immediate insight into competitive pressures on Emergent BioSolutions, allowing for proactive strategy adjustments to mitigate risks and capitalize on opportunities.

Customers Bargaining Power

Emergent BioSolutions' customer base is heavily concentrated among government entities, particularly agencies like the U.S. Department of Health and Human Services (HHS) and the Department of Defense. These organizations represent significant buyers of medical countermeasures, a core part of Emergent's business.

As large, consolidated purchasers, these government agencies wield substantial bargaining power. Their ability to negotiate long-term contracts for critical supplies allows them to influence pricing and contract terms considerably, directly impacting Emergent BioSolutions' revenue and profit margins.

Public health preparedness mandates create a unique dynamic for Emergent BioSolutions. Governments, driven by national security and public health concerns, represent a significant and consistent customer base for products like Narcan and vaccines. For instance, in 2023, the U.S. government continued its strategic national stockpile initiatives, which directly impact companies like Emergent.

However, this government-driven demand also concentrates bargaining power. As the primary procurer, the government can leverage its position to negotiate pricing and terms, ensuring they meet readiness objectives. This centralized purchasing power means Emergent faces a single, powerful entity dictating the conditions of sale for critical public health supplies.

Emergent BioSolutions, through its contract development and manufacturing (CDMO) services, caters to a range of biopharmaceutical companies. While the CDMO sector is expanding, large clients hold considerable sway. For instance, in 2023, the global CDMO market was valued at approximately $16.5 billion, showcasing significant growth potential.

These major pharmaceutical clients, due to the sheer volume of their business, can exert substantial bargaining power. If contract terms are not favorable, these large entities possess the capability to bring manufacturing processes in-house, thereby reducing their reliance on external CDMOs like Emergent.

Price Sensitivity and Budgetary Constraints

Government entities, as significant purchasers of biodefense and public health products, exhibit considerable price sensitivity. Their purchasing decisions are often dictated by fluctuating government budgets and shifting political priorities, directly impacting the pricing leverage they hold over suppliers like Emergent BioSolutions. For instance, during fiscal year 2023, the U.S. Department of Health and Human Services (HHS) allocated approximately $47.6 billion for public health initiatives, a figure that can be influenced by competing budgetary demands.

These budgetary constraints mean that customers, particularly government agencies, can exert substantial pressure on pricing for critical medical countermeasures. This heightened price sensitivity, driven by the need to maximize the impact of limited public funds, directly translates into increased bargaining power for these major clientele. Emergent BioSolutions must therefore navigate these financial realities to secure and maintain contracts.

- Price Sensitivity: Government budgets are subject to political winds and economic conditions, leading to intense scrutiny of expenditures on medical countermeasures.

- Budgetary Constraints: Fiscal limitations compel government buyers to seek the most cost-effective solutions, enhancing their negotiation power.

- Customer Leverage: Major government customers can significantly influence pricing due to their substantial purchasing volume and budget oversight.

- Impact on Suppliers: Companies like Emergent BioSolutions face pressure to offer competitive pricing to secure contracts with these budget-conscious entities.

Existence of Multiple Suppliers for Certain Products

When numerous suppliers can offer comparable medical countermeasures or contract development and manufacturing organization (CDMO) services, clients gain leverage. This abundance of choice empowers customers to negotiate better terms, potentially driving down prices or demanding more favorable contract conditions.

Emergent BioSolutions' ability to command higher prices or more favorable terms is somewhat dependent on the uniqueness of its specialized products. For instance, if Emergent is the sole provider of a critical, novel medical countermeasure, customer bargaining power is significantly diminished. However, for more standardized or commoditized offerings within its portfolio, such as certain CDMO services where multiple players exist, customer power is likely to be more pronounced.

- Market Dynamics: The broader market for medical countermeasures and CDMO services in 2024 features a mix of specialized and more generalized providers.

- Competitive Landscape: For certain product categories, Emergent faces competition from companies like Bavarian Nordic and SIGA Technologies, particularly in areas like smallpox countermeasures.

- Customer Options: Government agencies and other large clients often have multiple options for sourcing critical medical supplies, increasing their negotiation strength for non-exclusive products.

Emergent BioSolutions' customers, primarily government agencies like the U.S. Department of Health and Human Services, possess significant bargaining power due to their large purchase volumes and budget oversight. In 2023, the U.S. government's substantial investments in public health preparedness, such as the approximately $47.6 billion allocated by HHS for health initiatives, highlight their ability to negotiate favorable pricing and terms.

The concentration of demand among a few major government buyers, coupled with their price sensitivity driven by budgetary constraints, amplifies their leverage. This means Emergent must remain competitive to secure contracts for critical medical countermeasures.

Furthermore, the availability of alternative suppliers for certain products and services, particularly in the expanding CDMO market valued at around $16.5 billion in 2023, gives customers options and strengthens their negotiation position.

| Customer Type | Bargaining Power Drivers | Key Considerations for Emergent |

|---|---|---|

| Government Agencies (e.g., HHS, DoD) | Large purchase volume, budget oversight, price sensitivity, national security mandates | Negotiating pricing and terms for critical medical countermeasures, long-term contract stability |

| Biopharmaceutical Companies (CDMO Clients) | Volume of business, potential for in-house manufacturing, alternative CDMO options | Offering competitive pricing and favorable contract terms for specialized manufacturing services |

Preview the Actual Deliverable

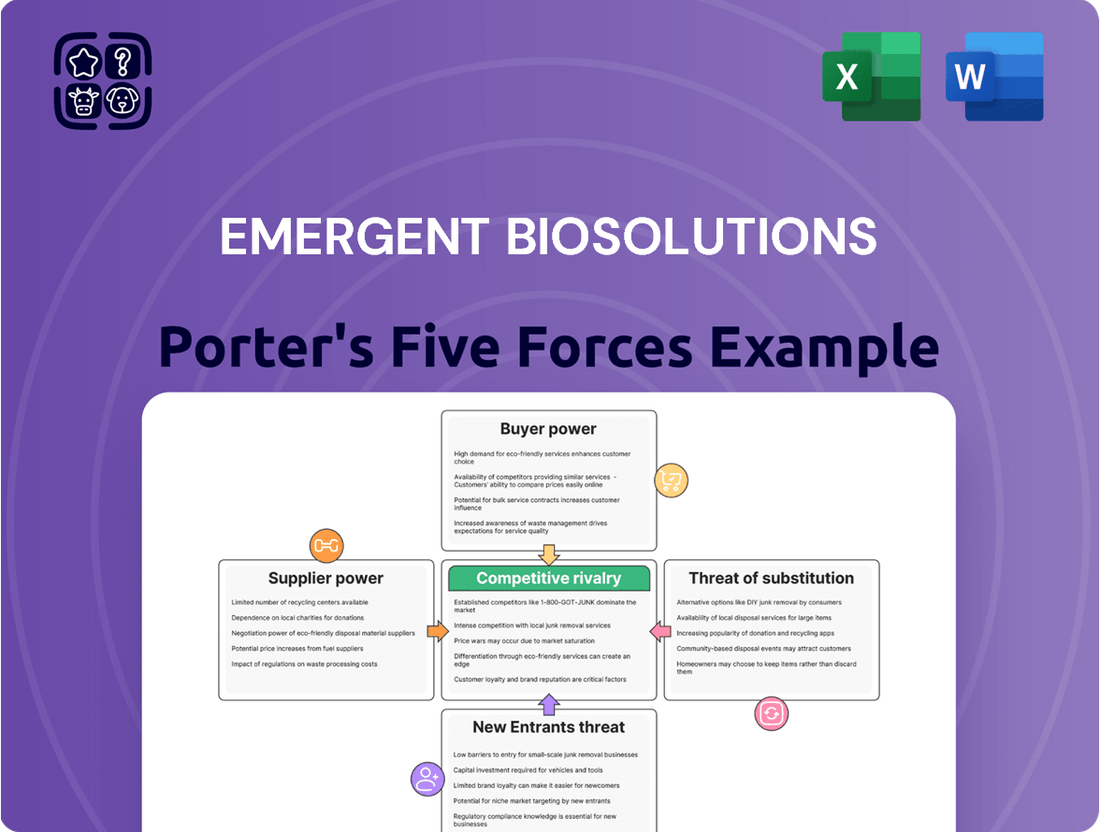

Emergent BioSolutions Porter's Five Forces Analysis

This preview showcases the complete Emergent BioSolutions Porter's Five Forces Analysis, offering a detailed examination of competitive forces impacting the company. You will receive this exact, professionally formatted document immediately upon purchase, providing actionable insights into industry attractiveness and strategic positioning.

Rivalry Among Competitors

Emergent BioSolutions faces a dynamic competitive environment, populated by a wide array of players. This includes established giants like Johnson & Johnson and Teva Pharmaceuticals, which possess significant resources and market share, alongside nimble, specialized biotech firms such as Valneva and SIGA Technologies, each carving out niches in specific therapeutic areas.

The sheer number and varied capabilities of these competitors intensify the rivalry within the markets Emergent operates. For instance, in the vaccine and therapeutics space, companies like GSK and Pfizer are major forces, often competing for government contracts and market penetration.

The biodefense and public health threat markets are characterized by fierce competition, driven by significant national security and public health interests. Companies actively pursue government contracts, which often represent substantial, long-term funding opportunities, intensifying the rivalry among players.

In 2024, the U.S. government continued to be a primary customer for biodefense solutions, with significant investments allocated to programs like Project BioShield and the Biomedical Advanced Research and Development Authority (BARDA). Emergent BioSolutions, a key player, has historically secured large contracts, such as its previous agreements with the Strategic National Stockpile for anthrax vaccines.

This intense competition for government funding means companies must constantly innovate and demonstrate their capabilities to secure and maintain these critical partnerships. The stakes are incredibly high, as these contracts often form the backbone of a company's revenue in this specialized sector.

Emergent BioSolutions' strategy of focusing on specialized medical countermeasures provides a degree of product differentiation. However, this advantage is tempered as other companies in the biopharmaceutical sector actively pursue the development of their own unique vaccines and therapeutics. For instance, in 2023, the global biopharmaceutical market was valued at approximately $1.7 trillion, indicating a highly competitive landscape where innovation is constant.

The intensity of rivalry is directly influenced by how distinct these products are. When competing products are highly similar, the pressure to attract customers through pricing or aggressive marketing intensifies, leading to a more heated competitive environment. In 2024, the market for infectious disease therapeutics alone is projected to see significant growth, further highlighting the need for clear differentiation to stand out.

Regulatory and R&D Costs

The pharmaceutical sector, including companies like Emergent BioSolutions, faces intense rivalry fueled by substantial research and development expenditures and stringent regulatory hurdles. These factors create significant barriers for new entrants, but for established companies, they translate into a competitive race to innovate and capture market share to justify their investments.

For instance, the drug development process can cost billions, with many promising candidates failing before reaching the market. This high-stakes environment forces existing players to constantly push the boundaries of science and navigate complex approval pathways, like those overseen by the FDA, intensifying competition.

- High R&D Investment: Pharmaceutical companies typically invest a significant portion of their revenue in R&D. In 2023, the top pharmaceutical companies often spent between 15-25% of their sales on research and development.

- Regulatory Scrutiny: The lengthy and costly process of gaining regulatory approval from bodies like the FDA acts as both a barrier to entry and a driver of rivalry among existing firms.

- Market Share Competition: Companies compete fiercely to recoup their R&D outlays and secure market dominance for their approved products, leading to aggressive marketing and pricing strategies.

- Innovation Race: The need to develop novel treatments and therapies creates a continuous cycle of innovation, where companies vie to be the first to market with breakthrough drugs.

Competition in CDMO Services

The contract development and manufacturing organization (CDMO) market is experiencing robust growth, driving intense competition. Companies are increasingly focusing on offering comprehensive, end-to-end solutions to attract biopharmaceutical clients, leading to market consolidation. Emergent BioSolutions' CDMO segment contends with numerous other CDMOs, each vying for a share of this expanding market.

The competitive landscape includes established global players and specialized niche providers. Many CDMOs are investing heavily in expanding their capacity and technological capabilities, particularly in areas like biologics and advanced therapies, to capture market share. For instance, the global CDMO market was valued at approximately $150 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 10-12% through 2030, indicating the significant opportunities and the fierce competition to secure these contracts.

- Intensifying Rivalry: The CDMO sector is characterized by a growing number of players, from large, integrated service providers to smaller, specialized firms, all competing for biopharmaceutical outsourcing contracts.

- Focus on Integration: Many CDMOs are enhancing their service offerings to become 'one-stop shops,' covering the entire drug lifecycle from early-stage development to commercial manufacturing, thereby increasing competitive pressure on those with more limited capabilities.

- Capacity Expansion: Significant investments are being made by CDMOs globally to increase manufacturing capacity, particularly for biologics and sterile injectables, creating a supply-side dynamic that fuels competition for client projects.

- Technological Advancements: Competition also hinges on adopting and mastering advanced manufacturing technologies, such as continuous manufacturing and cell and gene therapy platforms, to attract clients seeking cutting-edge production solutions.

Emergent BioSolutions operates in highly competitive markets, facing both large, established pharmaceutical companies and specialized biotech firms. This rivalry is particularly intense in securing government contracts for biodefense and public health threats, a key revenue driver for the company. In 2024, the U.S. government's continued investment in these areas, exemplified by programs like BARDA, means companies like Emergent must constantly innovate and demonstrate value to maintain these crucial partnerships.

The competitive landscape is further shaped by the need for product differentiation in a sector with high R&D costs and stringent regulatory approvals. Companies like GSK and Pfizer are major competitors, often vying for the same government contracts and market share. The global biopharmaceutical market, valued at approximately $1.7 trillion in 2023, underscores the pervasive competition, with companies investing heavily in R&D to bring novel treatments to market.

Within the Contract Development and Manufacturing Organization (CDMO) segment, Emergent BioSolutions faces intense competition from a growing number of players offering integrated services. The global CDMO market, valued at around $150 billion in 2023, is expanding rapidly, with companies investing in capacity and advanced technologies to attract clients, intensifying the rivalry for outsourcing contracts.

| Competitor Type | Examples | Key Competitive Factors |

|---|---|---|

| Large Pharmaceutical Companies | Johnson & Johnson, Pfizer, GSK | Market share, R&D capabilities, established distribution, government contract history |

| Specialized Biotech Firms | Valneva, SIGA Technologies | Niche product focus, agility, specific technological expertise |

| Contract Development & Manufacturing Organizations (CDMOs) | Lonza, Catalent | End-to-end service offerings, manufacturing capacity, technological innovation, regulatory compliance |

SSubstitutes Threaten

For public health threats, alternative medical countermeasures can pose a significant substitute threat to Emergent BioSolutions' products. Even if not direct biological equivalents, different vaccine platforms, antiviral treatments, or even public health strategies can reduce the demand for specific countermeasures. For instance, the development of broad-spectrum antivirals could lessen the reliance on targeted treatments for specific viral outbreaks.

The threat of generic and biosimilar products poses a notable challenge for Emergent BioSolutions, particularly as patents on its key offerings expire. For instance, if a blockbuster drug like Narcan (naloxone HCl) were to face significant generic competition, it could drastically alter Emergent's revenue streams.

These cheaper alternatives directly compete on price, forcing Emergent to consider price adjustments to maintain market share. This pressure can erode profit margins, impacting the company's overall financial health and ability to reinvest in research and development.

Improvements in public health infrastructure and preventative measures, such as widespread rapid diagnostic testing and enhanced hygiene protocols, could significantly lessen the need for Emergent BioSolutions' reactive medical countermeasures. For instance, if a new, highly effective vaccine for anthrax were to become widely available and administered, it would directly reduce the market for Emergent's existing anthrax treatments. The Centers for Disease Control and Prevention (CDC) reported a 15% increase in routine vaccination rates for several key diseases in 2023, indicating a trend towards proactive health management that could impact demand for emergency response products.

Non-Pharmaceutical Interventions

Non-pharmaceutical interventions (NPIs) such as lockdowns and social distancing, while not direct product substitutes for Emergent BioSolutions' offerings, can influence the demand for pharmaceutical countermeasures, especially during emerging infectious disease outbreaks. These measures, implemented to curb disease spread, can sometimes reduce the immediate perceived urgency for vaccines or therapeutics, potentially impacting sales cycles.

However, NPIs are often viewed as complementary tools within a broader public health strategy. For instance, during the COVID-19 pandemic, the effectiveness of NPIs was enhanced by the availability of vaccines and treatments. In 2024, the ongoing global health landscape continues to highlight the symbiotic relationship between NPIs and pharmaceutical solutions, suggesting that their impact is more nuanced than a simple substitution effect.

The perceived effectiveness and duration of NPIs can influence the market's anticipation of pharmaceutical product lifecycles. If NPIs are highly successful in controlling a pathogen, the demand for long-term pharmaceutical interventions might be tempered. Conversely, prolonged or recurring outbreaks that NPIs cannot fully contain often bolster the case for robust pharmaceutical development and procurement.

- NPIs as Demand Modulators: While not direct substitutes, NPIs like mask mandates and travel bans can alter the immediate demand for vaccines and therapeutics by controlling disease transmission.

- Complementary Nature: NPIs and pharmaceutical interventions often work in tandem. For example, the successful rollout of COVID-19 vaccines in 2021, alongside continued NPIs, demonstrated this synergy.

- Impact on Market Cycles: The perceived success of NPIs can influence the perceived urgency and market entry timelines for Emergent BioSolutions' products.

- Public Health Strategy Integration: The integration of NPIs into national and international public health responses shapes the overall market environment for biopharmaceutical companies.

Shifting Government Priorities and Funding

Changes in government focus can significantly impact demand for Emergent BioSolutions' products. For instance, a pivot in national security priorities away from biodefense towards cyber defense could reduce government investment in vaccines or countermeasures for biological threats. This shift effectively substitutes the need for Emergent's specialized offerings with solutions addressing the new priority. In 2024, the U.S. government's budget allocation for public health preparedness saw adjustments, with a notable emphasis on emerging infectious diseases beyond traditional biothreats, potentially impacting funding streams for certain legacy programs.

The threat of substitutes is amplified when government funding priorities change. For example, if a government decides to allocate more resources to rapid response teams for novel pathogens rather than stockpiling specific vaccines, this represents a substitute approach to public health security. This reallocation can diminish the market for pre-developed countermeasures, forcing companies like Emergent to adapt their product development and market strategies. Data from 2024 indicated increased government interest in flexible, platform-based technologies that can be rapidly adapted to new threats, a shift that could substitute demand for single-purpose biodefense products.

- Shifting Government Funding: Government spending priorities can divert funds from biodefense to other areas like cybersecurity or climate resilience, reducing demand for Emergent's products.

- Emergence of Alternative Solutions: New technologies or approaches to public health security, such as advanced diagnostics or broad-spectrum antivirals, can act as substitutes for specific countermeasures.

- Budget Reallocations in 2024: Reports in 2024 highlighted a trend of governments re-evaluating defense budgets, with some nations reducing allocations for traditional biosecurity measures in favor of other national security concerns.

The threat of substitutes for Emergent BioSolutions' products is multifaceted, stemming from alternative medical countermeasures, generic competition, and shifts in public health strategies. For instance, the development of broad-spectrum antivirals can reduce reliance on targeted treatments, while improvements in diagnostics and hygiene protocols can lessen the need for reactive countermeasures. In 2023, the CDC noted a 15% rise in routine vaccination rates, signaling a move towards proactive health management that could impact demand for emergency response products.

Furthermore, changes in government funding priorities can act as a significant substitute threat. A shift away from biodefense towards other national security concerns, such as cybersecurity, can lead to reduced government investment in Emergent's specialized offerings. In 2024, budget allocations for public health preparedness saw adjustments, with increased focus on emerging infectious diseases beyond traditional biothreats, potentially impacting funding for certain legacy programs.

| Category of Substitute | Description | Impact on Emergent BioSolutions | Example/Data Point (2023-2024) |

|---|---|---|---|

| Alternative Medical Countermeasures | Different vaccine platforms, antivirals, or broad-spectrum treatments. | Can reduce demand for specific targeted products. | Broad-spectrum antivirals could lessen reliance on targeted viral outbreak treatments. |

| Generic and Biosimilar Products | Cheaper versions of existing patented drugs. | Erodes profit margins and necessitates price adjustments. | Potential generic competition for Narcan (naloxone HCl). |

| Public Health Infrastructure & Preventative Measures | Enhanced diagnostics, hygiene protocols, and widespread rapid testing. | Decreases the need for reactive medical countermeasures. | CDC reported a 15% increase in routine vaccination rates in 2023. |

| Shifting Government Funding Priorities | Reallocation of government budgets to other security or health areas. | Reduces investment in biodefense and specific countermeasures. | Increased focus on emerging infectious diseases beyond biothreats in 2024 budgets. |

Entrants Threaten

Entering the biopharmaceutical and biodefense sectors, where Emergent BioSolutions operates, demands immense capital. Companies need to invest heavily in cutting-edge research and development, navigate lengthy and expensive clinical trials, and establish sophisticated manufacturing facilities. For instance, the average cost to develop a new drug can exceed $2.6 billion, a significant hurdle for any newcomer.

These substantial upfront costs act as a powerful deterrent, effectively blocking many potential competitors from entering the market. The sheer financial commitment required to even begin operations, let alone compete effectively, creates a high barrier to entry, protecting established players like Emergent BioSolutions.

The pharmaceutical and biopharmaceutical sectors, including companies like Emergent BioSolutions, are characterized by extensive regulatory hurdles. New entrants must navigate complex and lengthy approval processes mandated by agencies such as the U.S. Food and Drug Administration (FDA).

These processes require rigorous demonstration of product safety and efficacy, often involving multi-phase clinical trials that can span many years and demand substantial financial investment, acting as a significant barrier to entry.

For instance, bringing a new drug to market can cost upwards of $2.6 billion and take over a decade, according to some industry estimates, making it exceptionally difficult for smaller or newer companies to compete with established players who have already navigated these challenges and built robust regulatory compliance systems.

Strong intellectual property rights, particularly patents, are a significant barrier for new entrants in the biopharmaceutical industry. For Emergent BioSolutions, these patents protect its existing products and technologies, making it challenging for competitors to develop and market similar offerings without infringing on these exclusive rights. This is a critical factor in maintaining market share and profitability.

Need for Specialized Expertise and Infrastructure

The development and manufacturing of medical countermeasures, alongside Contract Development and Manufacturing Organization (CDMO) services, demand a high level of specialized scientific, technical, and manufacturing expertise. This includes navigating complex regulatory pathways and maintaining stringent quality control standards, which are not easily replicated.

Establishing the necessary infrastructure, such as Good Manufacturing Practice (GMP) compliant facilities and advanced research laboratories, represents a substantial capital investment. For instance, building a state-of-the-art biopharmaceutical manufacturing facility can cost hundreds of millions of dollars, creating a significant hurdle for potential new entrants aiming to compete with established players like Emergent BioSolutions.

- High Capital Investment: Building GMP-compliant facilities and specialized R&D labs requires substantial financial resources, often exceeding hundreds of millions of dollars.

- Regulatory Hurdles: Navigating complex FDA and other global regulatory approvals for medical countermeasures is time-consuming and requires deep expertise.

- Skilled Workforce: Accessing and retaining a highly skilled workforce with expertise in biopharmaceutical development, manufacturing, and quality assurance is critical and challenging.

- Intellectual Property: Existing patents and proprietary technologies in areas like vaccine development and manufacturing processes create barriers for newcomers.

Established Relationships with Government and Public Health Agencies

Emergent BioSolutions benefits significantly from its deeply entrenched relationships with government and public health agencies. These aren't just casual connections; they are multi-year contracts and established partnerships that provide a stable revenue stream and significant barriers to entry for newcomers. For instance, in 2023, Emergent reported $1.1 billion in revenue from its government business, highlighting the scale of these relationships.

New companies would find it incredibly difficult to replicate the trust and proven track record Emergent has built over years of service. Securing the large-scale, consistent contracts that underpin Emergent's government business requires navigating complex procurement processes and demonstrating unwavering reliability, which takes considerable time and effort to establish. This makes it challenging for new entrants to gain a foothold in a market where established trust is paramount.

- Long-standing Government Contracts: Emergent BioSolutions holds significant multi-year contracts with key government entities, providing a predictable revenue base.

- Established Trust and Reliability: Years of successful partnerships have fostered deep trust with public health agencies, a critical factor for new entrants to overcome.

- Barriers to Entry: The time and effort required to build similar relationships and secure large-scale contracts present a substantial hurdle for potential competitors.

- Revenue Dependence: In 2023, government contracts represented a substantial portion of Emergent's $1.1 billion in revenue, underscoring the importance of these established relationships.

The threat of new entrants in Emergent BioSolutions' market is considerably low due to immense capital requirements for research, development, and specialized manufacturing facilities. Navigating stringent regulatory approvals, like those from the FDA, adds significant time and cost, estimated at over $2.6 billion for drug development. Furthermore, securing established government contracts, which accounted for a substantial portion of Emergent's $1.1 billion revenue in 2023, requires years of building trust and proven reliability, presenting a formidable barrier for newcomers.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Investment | High cost for R&D, clinical trials, and GMP facilities | Significant financial hurdle | Drug development cost > $2.6 billion |

| Regulatory Hurdles | Lengthy and complex FDA approval processes | Time-consuming and costly compliance | Multi-phase clinical trials |

| Intellectual Property | Patents on existing products and technologies | Limits ability to replicate offerings | Proprietary vaccine manufacturing |

| Government Relationships | Established multi-year contracts and trust | Difficult to replicate established partnerships | 2023 Government Revenue: $1.1 billion |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Emergent BioSolutions is built upon a foundation of public company filings, including SEC reports and annual statements. This is supplemented by industry-specific market research from reputable firms and insights from trade publications to capture the competitive landscape.