Emergent BioSolutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emergent BioSolutions Bundle

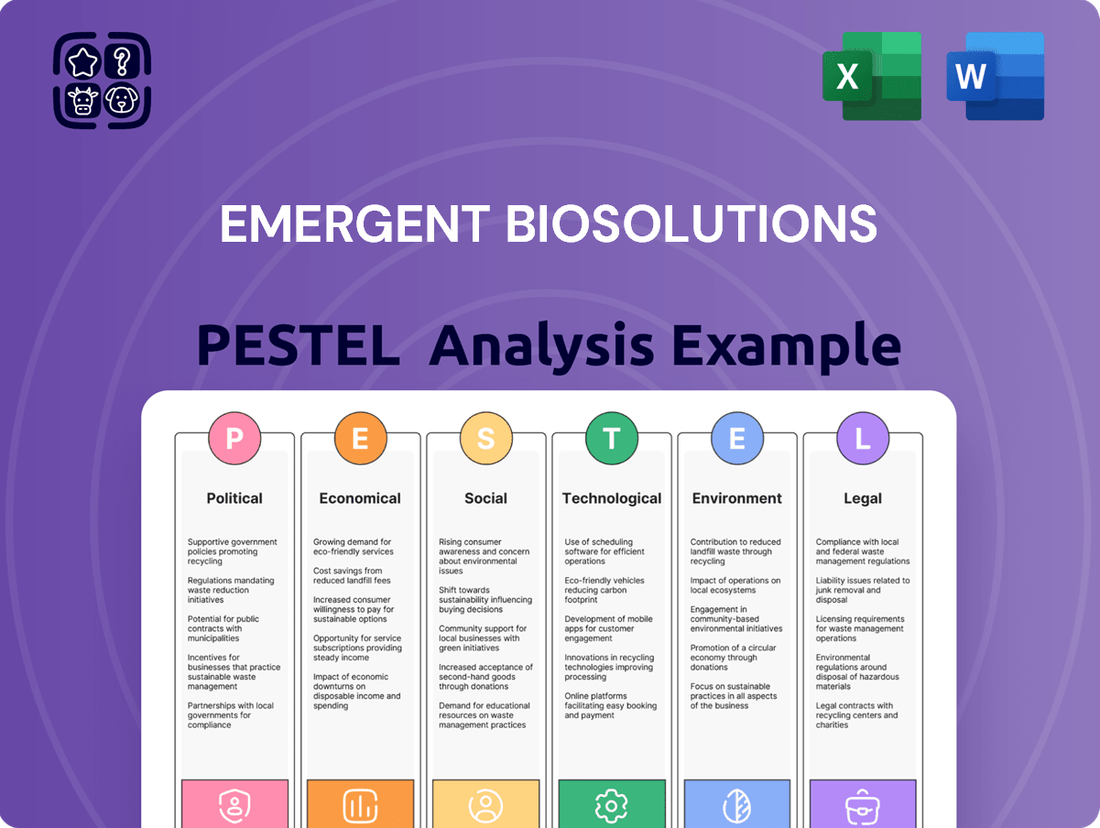

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Emergent BioSolutions's trajectory. Our expert PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence for strategic planning. Gain a competitive edge by understanding the landscape; download the full report now and equip yourself with the insights to navigate the future.

Political factors

Emergent BioSolutions' financial health is closely linked to government contracts and funding, particularly for its medical countermeasures. The company's ability to secure and maintain these agreements directly impacts its stability and growth trajectory.

The ongoing commitment to national preparedness and the allocation of funds for public health threats are critical drivers for Emergent BioSolutions. For instance, recent contract modifications for anthrax and smallpox countermeasures highlight the direct correlation between government initiatives and the company's revenue streams.

Changes in national and international public health policies, especially those related to biodefense and emerging infectious diseases, are a major driver for Emergent BioSolutions. For instance, the ongoing focus on pandemic preparedness following COVID-19 has bolstered demand for certain countermeasures.

The company's reliance on government contracts for products like anthrax vaccines and Narcan means that shifts in funding priorities or policy directives can directly affect its revenue streams. A notable example is the continued government investment in biodefense stockpiles, which directly benefits Emergent's core business.

Geopolitical stability and the evolving landscape of global health threats significantly shape government stockpiling and procurement strategies. Emergent BioSolutions, as a key player in life sciences, finds its demand directly tied to the perceived urgency and scale of international health crises, impacting its product sales.

For instance, the ongoing geopolitical tensions and the potential for novel infectious disease outbreaks in 2024 and 2025 could bolster government investment in biodefense and pandemic preparedness, directly benefiting companies like Emergent that supply countermeasures. The company's 2023 revenue was $1.03 billion, demonstrating its reliance on these large-scale government contracts, which are sensitive to global political climates and health security perceptions.

Regulatory and Approval Processes

Political influence significantly shapes the pace and prioritization of regulatory approvals for vital medical countermeasures. In 2024, the FDA's ability to expedite reviews for products addressing public health emergencies remains a critical factor for companies like Emergent BioSolutions.

Streamlined regulatory pathways are essential for Emergent to effectively deliver its products and meet the demands of government contracts. For instance, the speed at which the FDA grants Emergency Use Authorizations (EUAs) directly impacts Emergent's revenue streams from pandemic preparedness programs.

- FDA Approval Timelines: Delays in FDA review processes can directly impact Emergent's ability to fulfill government contracts for critical medical supplies.

- Government Contract Prioritization: Political decisions can influence which companies and products receive priority for funding and procurement, affecting Emergent's market access.

- Legislative Changes: New legislation or amendments to existing regulations can create new opportunities or impose additional compliance burdens on Emergent's operations.

Trade Policies and Tariffs

Trade policies, including tariffs and international trade agreements, can significantly impact Emergent BioSolutions' global supply chain and manufacturing costs. Fluctuations in these policies can create uncertainty and affect the pricing of raw materials and finished goods. For instance, changes in import duties on specialized pharmaceutical components could directly increase production expenses.

Emergent's strategic decision to concentrate manufacturing within North America is a deliberate move to mitigate the adverse effects of evolving trade landscapes, especially in light of agreements like the United States-Mexico-Canada Agreement (USMCA). This positioning aims to streamline operations and reduce exposure to international trade disputes and associated tariffs.

- USMCA Impact: The USMCA aims to facilitate trade between the three North American countries, potentially reducing some trade barriers for Emergent's operations within the region.

- Tariff Sensitivity: While North American manufacturing reduces direct tariff exposure on finished goods, the sourcing of certain raw materials or components from outside the USMCA bloc could still be subject to tariffs, impacting overall cost structure.

- Supply Chain Resilience: By focusing on North America, Emergent seeks to build a more resilient supply chain, less susceptible to geopolitical trade tensions and customs complexities prevalent in other global regions.

Government funding and contract prioritization are paramount for Emergent BioSolutions, directly influencing its revenue and operational focus. Political decisions on national biodefense and public health initiatives, especially in 2024 and 2025, will continue to shape demand for its medical countermeasures. For example, the company's 2023 revenue of $1.03 billion underscores its dependence on these large-scale government agreements, which are sensitive to shifts in political priorities and global health security perceptions.

Regulatory approval timelines, particularly from the FDA in 2024, are critical. Expedited review pathways for products addressing public health emergencies, such as Emergency Use Authorizations (EUAs), directly impact Emergent's ability to fulfill contracts and generate revenue. Delays in these processes can significantly hinder the company's performance.

Trade policies and legislative changes also play a significant role. While Emergent's North American manufacturing strategy, influenced by agreements like the USMCA, aims to mitigate tariff impacts, the sourcing of components can still be subject to duties, affecting production costs. Legislative shifts can create new opportunities or compliance challenges.

| Factor | Impact on Emergent BioSolutions | Data/Example (2024/2025 Focus) |

|---|---|---|

| Government Funding & Contracts | Directly drives revenue and product demand. | 2023 Revenue: $1.03 billion. Continued government investment in biodefense stockpiles is key. |

| Regulatory Approvals (FDA) | Affects speed to market and contract fulfillment. | Expedited reviews and EUAs for pandemic preparedness are crucial in 2024. |

| Trade Policies & Legislation | Impacts supply chain costs and market access. | USMCA facilitates North American trade; component sourcing tariffs remain a consideration. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Emergent BioSolutions, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support strategic decision-making and identify potential threats and opportunities within the biopharmaceutical landscape.

A concise PESTLE analysis of Emergent BioSolutions provides a clear, summarized version of external factors for easy referencing during strategic discussions and risk assessments.

Economic factors

Emergent BioSolutions' financial health is intrinsically tied to government outlays for public health initiatives and defense. For instance, in the first quarter of 2024, the company reported revenues of $236.7 million, a significant portion of which is derived from contracts with U.S. government agencies.

Changes in budget allocations from key bodies such as the U.S. Department of Health and Human Services (HHS) and the Department of Defense directly influence Emergent's income streams, particularly from its medical countermeasures. The company's reliance on these government contracts underscores the sensitivity of its performance to fiscal policy shifts.

Broader economic trends in healthcare spending significantly impact Emergent BioSolutions' commercial product lines, including its opioid overdose reversal medication, NARCAN. Factors like consumer access, the breadth of insurance coverage, and the effectiveness of public health initiatives directly influence sales volumes and pricing power.

In the United States, total healthcare spending reached an estimated $4.5 trillion in 2023, a figure projected to continue its upward trajectory. This overall economic environment shapes the market dynamics for pharmaceuticals, affecting reimbursement rates and patient affordability for critical treatments.

Economic conditions significantly shape the capital available for research and development in the biopharmaceutical sector. Emergent BioSolutions' capacity to fund new product pipelines and technological progress hinges directly on its financial stability and access to capital, both of which are sensitive to broader economic cycles.

For instance, during periods of economic expansion, companies like Emergent may find it easier to secure favorable financing for R&D initiatives. Conversely, economic downturns can tighten credit markets and reduce investor appetite for risk, potentially limiting investment in long-term R&D projects. In 2023, Emergent BioSolutions reported $287.1 million in R&D expenses, a crucial figure that reflects its commitment to innovation amidst fluctuating economic landscapes.

Contract Development and Manufacturing Organization (CDMO) Market Dynamics

The economic vitality of the global biopharmaceutical sector is a critical driver for Emergent BioSolutions' Contract Development and Manufacturing Organization (CDMO) segment. A robust industry with increasing R&D investment translates to higher demand for outsourced manufacturing and development services.

Specifically, the CDMO market experienced significant growth, with projections for the global market to reach approximately $250 billion by 2027, indicating a strong trend of outsourcing within the biopharma industry. This expansion directly benefits Emergent's CDMO operations, as pharmaceutical companies increasingly rely on external partners for specialized manufacturing needs and capacity. Factors influencing this growth include the rising complexity of drug development, the need for specialized technologies, and the desire for cost efficiencies.

- Biopharmaceutical R&D Spending: Global biopharmaceutical R&D spending was projected to exceed $250 billion in 2024, a key indicator of potential demand for CDMO services.

- CDMO Market Growth: The CDMO market is anticipated to grow at a compound annual growth rate (CAGR) of around 10-12% through 2027, underscoring the outsourcing trend.

- Manufacturing Outsourcing Trends: Approximately 80% of pharmaceutical companies utilize CDMOs for at least some of their manufacturing needs, highlighting the widespread reliance on these services.

- Emergent's CDMO Revenue: While specific segment breakdowns fluctuate, Emergent's overall financial performance is closely tied to the health and demand within its CDMO services.

Inflation and Cost of Goods

Inflationary pressures significantly impact Emergent BioSolutions by increasing the cost of essential inputs. Rising prices for raw materials, labor, and energy directly affect manufacturing expenses. For instance, the Consumer Price Index (CPI) in the US showed a notable increase throughout 2023 and into early 2024, indicating broad-based cost escalation across industries.

These rising costs put pressure on Emergent's profitability. Maintaining healthy gross margins becomes a challenge when the cost of goods sold increases disproportionately to product pricing. The company's ability to pass on these increased costs to customers is a key determinant of its financial performance.

Managing these inflationary impacts is critical for Emergent BioSolutions. The company must focus on cost control measures and strategic sourcing to mitigate the effects on its bottom line.

- Rising Input Costs: Increased prices for raw materials, labor, and energy directly inflate manufacturing expenses.

- Profitability Squeeze: Higher cost of goods sold can erode gross margins if not effectively managed through pricing strategies.

- Operational Efficiency: Focus on supply chain optimization and operational efficiencies is paramount to counter inflationary headwinds.

- Market Dynamics: Emergent's ability to adjust product pricing in response to market demand and competitive pressures is crucial for margin preservation.

Economic factors significantly influence Emergent BioSolutions, particularly through government spending and broader healthcare market dynamics. The company's revenue streams are heavily tied to U.S. government contracts for public health and defense, making fiscal policy shifts a critical consideration. For example, in Q1 2024, Emergent reported $236.7 million in revenue, a substantial portion of which originates from these government agreements.

Inflationary pressures present a direct challenge by increasing the cost of raw materials, labor, and energy, impacting manufacturing expenses and potentially squeezing profit margins. The company's ability to manage these rising costs through operational efficiencies and strategic pricing is paramount for maintaining financial health.

The global economic environment also shapes the demand for Emergent's Contract Development and Manufacturing Organization (CDMO) services. A growing biopharmaceutical sector, with increasing R&D investment projected to exceed $250 billion in 2024, fuels the need for outsourced manufacturing solutions.

| Metric | Value (as of latest available data) | Source/Period |

| Emergent BioSolutions Revenue (Q1 2024) | $236.7 million | Company Financial Reports |

| Global Biopharmaceutical R&D Spending (Projected 2024) | > $250 billion | Industry Analysis |

| US Consumer Price Index (CPI) Trend | Upward trend through 2023-early 2024 | Bureau of Labor Statistics |

Preview Before You Purchase

Emergent BioSolutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Emergent BioSolutions delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. Understand the critical external forces shaping Emergent BioSolutions' present and future landscape.

Sociological factors

Heightened public awareness and concern surrounding biological threats, pandemics, and the ongoing opioid crisis directly fuel the demand for Emergent BioSolutions' diverse product portfolio. This societal focus on health security translates into increased market opportunities for the company's offerings.

The growing emphasis from both the public and governments on preparedness for public health emergencies, particularly following events like the COVID-19 pandemic, significantly boosts the need for medical countermeasures. In 2024, global health security spending is projected to reach new heights, with a substantial portion allocated to stockpiling and developing solutions for emerging threats, directly benefiting companies like Emergent.

The persistent opioid epidemic continues to drive demand for overdose reversal medications like Emergent BioSolutions' NARCAN Nasal Spray. As of early 2024, the Centers for Disease Control and Prevention (CDC) reported over 100,000 drug overdose deaths annually in the United States, with opioids being a major contributor, underscoring the critical need for accessible antidotes.

Public health initiatives and a growing societal call for broader access, including non-prescription availability, directly shape the market for naloxone products. This trend is supported by recent regulatory movements aiming to make naloxone more readily available in pharmacies and community settings, potentially boosting sales volumes for Emergent.

Public trust significantly influences the adoption of medical products, including those developed by Emergent BioSolutions. For instance, a 2023 Gallup poll indicated that only 47% of Americans trusted pharmaceutical companies to act in their best interest, a figure that can directly impact demand for Emergent's offerings.

Negative perceptions, often fueled by past controversies or perceived lack of transparency, can hinder public health initiatives that rely on widespread acceptance of vaccines or treatments. This erosion of trust can lead to decreased uptake of critical medical countermeasures, affecting sales and the overall success of public health partnerships Emergent engages in.

Social Responsibility and ESG Initiatives

Societal expectations for corporate social responsibility and environmental, social, and governance (ESG) practices significantly shape Emergent BioSolutions' reputation and its relationships with various stakeholders. Public scrutiny on how companies operate, particularly in sensitive sectors like biopharmaceuticals, means a strong ESG commitment is no longer optional. This focus directly impacts investor confidence and the company's social license to operate.

Emergent BioSolutions' dedication to ESG principles, encompassing community involvement and environmental stewardship, is becoming a critical factor in attracting top talent and fostering positive public perception. In 2023, companies with robust ESG programs often saw improved employee retention and a stronger employer brand, which is vital for innovation in the life sciences. This commitment also helps mitigate reputational risks associated with product development and manufacturing.

- Reputation Management: Strong ESG performance enhances Emergent's brand image, crucial for public trust in health-related products.

- Talent Acquisition: A clear commitment to social responsibility makes Emergent more attractive to skilled professionals seeking purpose-driven careers.

- Stakeholder Relations: Proactive engagement on ESG issues strengthens relationships with investors, communities, and regulatory bodies.

- Risk Mitigation: Addressing societal expectations around environmental impact and ethical conduct helps prevent potential backlash and operational disruptions.

Workforce and Talent Availability

The availability of a skilled workforce is paramount for Emergent BioSolutions. The life sciences and advanced manufacturing sectors, where Emergent operates, demand specialized expertise. In 2024, the demand for biopharmaceutical manufacturing talent remained high, with reports indicating a significant shortage in experienced professionals.

Emergent's success hinges on its capacity to attract and retain this talent. This is particularly true for its work in biodefense and public health, areas requiring highly specialized knowledge in areas like vaccine development and manufacturing. For instance, the company's role in producing anthrax vaccines requires a workforce with specific biological and chemical engineering skills.

- Talent Shortage: A 2024 industry survey found that over 60% of biopharmaceutical companies reported difficulties in finding qualified candidates for manufacturing roles.

- Specialized Skills: Emergent needs individuals with expertise in areas such as aseptic processing, quality assurance, and regulatory affairs within the biopharmaceutical context.

- R&D Importance: The company's research and development efforts, crucial for creating new medical countermeasures, depend on a robust pipeline of scientists and researchers.

Public concern over health security and emerging threats, including pandemics and the opioid crisis, directly drives demand for Emergent BioSolutions' products. This heightened awareness, amplified by events like COVID-19, fuels government spending on preparedness and medical countermeasures, creating significant market opportunities. The ongoing opioid epidemic, with over 100,000 annual overdose deaths in the US as of early 2024, continues to underscore the critical need for overdose reversal medications like NARCAN Nasal Spray.

Technological factors

Emergent BioSolutions' core business thrives on progress in biotechnology, especially in creating vaccines and treatments for significant public health challenges. For instance, the company's work on anthrax vaccines relies on established biotechnology platforms, and ongoing research into novel delivery systems and more potent formulations is crucial for maintaining its market position.

Innovation in fields such as recombinant protein technology and gene therapy directly impacts Emergent's ability to develop next-generation medical countermeasures. The company's investment in R&D, which represented approximately 10% of its revenue in 2023, underscores its commitment to leveraging these technological advancements to address emerging infectious diseases.

Emergent BioSolutions is increasingly leveraging advanced manufacturing technologies like automation and process analytical technology (PAT) to boost efficiency and product quality in its biological product lines. These investments are critical for staying competitive in a market that demands high purity and consistent output. For instance, the company has been investing in upgrading its manufacturing facilities, which is a key element in its strategy to improve operational performance and meet growing demand for its medical countermeasures.

Emergent BioSolutions can significantly boost its research and development (R&D) and operational capabilities through advanced data analytics and artificial intelligence (AI). These technologies are crucial for accelerating the complex process of drug discovery, making it faster and more efficient.

By employing AI and machine learning, Emergent can optimize clinical trial design and execution, leading to quicker validation of new medical countermeasures. This also extends to improving manufacturing efficiency, ensuring reliable and timely delivery of vital products.

In 2024, the biopharmaceutical industry saw substantial investment in AI for drug discovery, with some estimates suggesting AI could reduce drug development timelines by several years. For Emergent, leveraging these tools offers a distinct competitive edge in bringing life-saving products to market.

Cold Chain and Supply Chain Innovation

Technological advancements in cold chain and supply chain management are paramount for Emergent BioSolutions, particularly for distributing temperature-sensitive biological products. Innovations in real-time temperature monitoring, advanced insulation materials, and optimized route planning are crucial for maintaining product integrity. These technologies directly impact Emergent's capacity to reliably supply products for national stockpiles, ensuring efficacy from production to final delivery.

Emergent BioSolutions leverages sophisticated technologies to safeguard its products. For instance, the company utilizes advanced serialization and track-and-trace systems to monitor product movement throughout the supply chain, enhancing security and preventing counterfeiting. This technological backbone is essential for meeting the stringent requirements of government contracts and public health initiatives.

The company's commitment to innovation in logistics is evident. In 2024, Emergent continued to invest in digital supply chain solutions, aiming to improve visibility and responsiveness. These investments are designed to mitigate risks associated with temperature excursions and ensure that critical medical countermeasures reach their destinations in optimal condition, supporting national health security objectives.

- Real-time Temperature Monitoring: Advanced sensors and IoT devices provide continuous data on product temperature, alerting stakeholders to any deviations.

- Advanced Packaging Solutions: Innovations in passive and active cooling technologies ensure stable temperatures for extended periods during transit.

- Supply Chain Digitization: Implementing AI and blockchain for enhanced visibility, traceability, and predictive analytics in logistics operations.

- Specialized Logistics Networks: Developing partnerships with specialized cold chain logistics providers equipped with the necessary infrastructure and expertise.

Countermeasure Technology Evolution

The landscape of biological and chemical threats is dynamic, compelling Emergent BioSolutions to prioritize ongoing innovation in its countermeasure development. This necessitates a continuous investment in research and development to stay ahead of emerging and evolving pathogens and toxins. For instance, in 2024, Emergent continued its focus on expanding its portfolio beyond anthrax, exploring solutions for emerging viral threats and chemical agents.

Staying competitive demands a proactive approach to technological advancements in countermeasure design. Emergent's R&D efforts in 2024 and 2025 are heavily concentrated on several key areas:

- Novel Delivery Systems: Research into more efficient and patient-friendly methods for administering vaccines and therapeutics, potentially reducing the need for complex injection procedures.

- Broad-Spectrum Antivirals: Developing treatments effective against a wide range of viral families rather than specific strains, offering greater flexibility against unpredictable outbreaks.

- Next-Generation Vaccines: Advancing vaccine platforms, such as mRNA or viral vector technologies, to accelerate development and improve efficacy against novel biological threats.

- Advanced Chemical Countermeasures: Innovating antidotes and protective agents that offer broader coverage and faster action against a wider array of chemical warfare agents.

Emergent BioSolutions' reliance on advanced manufacturing technologies like automation and process analytical technology (PAT) is crucial for enhancing efficiency and product quality in its biological product lines. The company's significant investments in upgrading its facilities in 2024 underscore its strategy to improve operational performance and meet demand for its medical countermeasures.

Leveraging artificial intelligence (AI) and advanced data analytics is key for Emergent to accelerate drug discovery and optimize clinical trials, offering a distinct competitive edge in bringing life-saving products to market. The biopharmaceutical industry saw substantial AI investment in 2024, with estimates suggesting it could reduce drug development timelines by several years.

Innovations in cold chain and supply chain management are paramount for Emergent, particularly for temperature-sensitive biological products. Investments in digital supply chain solutions in 2024 aim to improve visibility and responsiveness, ensuring critical medical countermeasures reach their destinations in optimal condition.

Emergent BioSolutions is actively investing in next-generation vaccine platforms and broad-spectrum antivirals, reflecting a proactive approach to technological advancements in countermeasure design. These R&D efforts in 2024 and 2025 focus on novel delivery systems and advanced chemical countermeasures to address evolving biological threats.

| Key Technological Focus Areas | Impact on Emergent BioSolutions | Relevant 2024/2025 Data/Trends |

| AI & Data Analytics in Drug Discovery | Accelerated R&D, optimized clinical trials | Industry-wide AI investment in drug discovery; potential for multi-year timeline reduction |

| Advanced Manufacturing (Automation, PAT) | Enhanced efficiency, product quality, competitiveness | Facility upgrades to meet demand for medical countermeasures |

| Cold Chain & Supply Chain Digitization | Product integrity, reliable delivery, risk mitigation | Investment in digital supply chain solutions for improved visibility and responsiveness |

| Next-Generation Vaccines & Antivirals | Broader coverage, faster development, response to evolving threats | Focus on mRNA, viral vector technologies, broad-spectrum antiviral research |

Legal factors

Emergent BioSolutions operates within a heavily regulated sector, subject to stringent oversight from agencies like the U.S. Food and Drug Administration (FDA) and similar international bodies. Compliance with Good Manufacturing Practices (GMP) is a cornerstone of their operations, alongside the critical processes of securing and maintaining product licenses. Navigating these complex regulatory landscapes is essential for their continued success and market access.

Emergent BioSolutions' substantial dependence on government contracts necessitates strict adherence to federal procurement laws, including the Federal Acquisition Regulation (FAR). These regulations govern everything from bidding processes to contract performance and reporting, with any deviations potentially leading to penalties or contract termination.

For instance, in 2023, the U.S. government awarded billions in contracts to biopharmaceutical companies for public health initiatives. Emergent BioSolutions' ability to navigate and comply with evolving procurement rules, such as those related to supply chain transparency and cybersecurity, directly influences its revenue streams and operational flexibility.

Increased government oversight or changes in contract terms, as seen with past scrutiny of its pandemic preparedness contracts, can significantly affect Emergent's financial performance and strategic direction. Staying ahead of these regulatory shifts is critical for maintaining its market position.

As a manufacturer of medical products, Emergent BioSolutions faces significant product liability risks. These risks stem from potential claims concerning the efficacy, safety, or manufacturing defects of their diverse product portfolio, which includes vaccines and medical countermeasures. For instance, the company has been involved in litigation related to its Narcan nasal spray, with some cases alleging inadequate warnings about side effects.

Intellectual Property Rights

Protecting its intellectual property (IP) through patents and other legal means is absolutely critical for Emergent BioSolutions to maintain its competitive edge and secure its revenue streams. The company's innovation in areas like vaccine development and biodefense relies heavily on its patent portfolio. For instance, as of early 2024, Emergent held hundreds of patents globally covering its core technologies and products.

Any challenges or infringements to these patents could significantly disrupt Emergent's market position and financial performance. For example, a successful patent challenge could open the door for competitors to produce generic versions of its products, directly impacting sales and market share.

Emergent's legal strategy actively involves monitoring for and pursuing legal action against any perceived IP infringement. This proactive approach is essential to safeguard its investments in research and development and to ensure the continued exclusivity of its proprietary technologies.

- Patent Portfolio Strength: Emergent BioSolutions actively manages a substantial global patent portfolio, a key asset for its biopharmaceutical business.

- Revenue Dependency: The company's revenue generation is closely tied to the protection and exclusivity afforded by its IP rights.

- Litigation Risk: Potential patent litigation, whether as a plaintiff or defendant, poses a significant risk to Emergent's market standing and profitability.

- R&D Investment Protection: Legal protections are vital for recouping the substantial investments made in developing novel medical countermeasures and vaccines.

Environmental Regulations and Compliance

Emergent BioSolutions operates under a stringent framework of environmental regulations governing its manufacturing, waste management, and emissions. Compliance with these laws is not merely a procedural requirement but a critical operational necessity. For instance, the Environmental Protection Agency (EPA) sets standards for hazardous waste disposal, which directly impacts Emergent's production lifecycle.

Failure to adhere to these environmental mandates can trigger severe consequences. These can include substantial financial penalties, such as the millions of dollars in fines levied against companies for environmental violations in recent years, and costly legal battles. Furthermore, a breach in environmental compliance can significantly damage Emergent's public image and stakeholder trust, impacting its ability to secure future contracts and partnerships.

Key legal factors influencing Emergent BioSolutions' operations include:

- Clean Air Act and Clean Water Act Compliance: Adherence to regulations limiting air emissions and water discharge from manufacturing facilities.

- Resource Conservation and Recovery Act (RCRA): Proper management and disposal of hazardous and non-hazardous solid waste generated during production.

- CERCLA (Superfund): Responsibility for the cleanup of historical or current hazardous waste sites, potentially impacting liability.

- Occupational Safety and Health Administration (OSHA) Standards: Ensuring safe handling of chemicals and materials to protect worker health and prevent environmental releases.

Emergent BioSolutions' operations are deeply intertwined with government contracts, necessitating strict adherence to federal procurement laws like the Federal Acquisition Regulation (FAR). Changes in contract terms or increased oversight, as experienced with past pandemic preparedness contracts, can significantly impact revenue and strategy. For example, in 2023, the U.S. government awarded billions for public health initiatives, highlighting the critical nature of navigating these rules for companies like Emergent.

Environmental factors

Climate change poses significant threats to Emergent BioSolutions' operations. Extreme weather events, like the severe flooding impacting parts of the US in early 2024, can directly disrupt manufacturing facilities and critical raw material sourcing, potentially delaying product delivery and impacting revenue.

Building robust supply chain resilience is no longer optional but a necessity for Emergent. By diversifying suppliers and investing in contingency plans, the company can better navigate the unpredictable impacts of climate change, ensuring business continuity and maintaining its ability to meet critical public health needs.

Emergent BioSolutions faces environmental pressures regarding the availability and sustainable sourcing of critical raw materials and utilities essential for its biopharmaceutical manufacturing. For instance, the company's reliance on purified water and specific biological inputs necessitates careful management of water resources, which are increasingly subject to regional scarcity and regulatory scrutiny.

The company's commitment to reducing resource consumption and embracing sustainable practices is gaining traction. In 2023, the biopharmaceutical industry, in general, saw increased investment in green chemistry and waste reduction technologies, with companies aiming to cut water usage by an average of 15% and energy consumption by 10% by 2025.

Emergent BioSolutions faces significant environmental challenges in managing waste from its manufacturing operations and controlling air and water pollution. The company must navigate complex regulations designed to protect ecosystems and public health.

Adherence to these environmental standards is not just a compliance issue but a critical aspect of responsible corporate citizenship. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce strict limits on industrial wastewater discharge, impacting companies like Emergent BioSolutions by requiring investments in advanced treatment technologies.

Investing in pollution control technologies is essential for minimizing environmental impact. This includes upgrading facilities to reduce greenhouse gas emissions and implementing robust waste segregation and disposal protocols, aligning with global sustainability goals and potentially improving operational efficiency.

Biodiversity and Ecosystem Health

While Emergent BioSolutions' core business is not directly tied to heavy industrial output, its broader operational footprint, including manufacturing and supply chain activities, can indirectly impact biodiversity and ecosystem health. This, in turn, can lead to increased regulatory attention and shape public perception of the company's environmental commitment. For instance, in 2023, the Environmental Protection Agency (EPA) continued to emphasize the importance of protecting sensitive ecosystems, a trend likely to persist through 2024 and 2025.

Emergent BioSolutions actively works to minimize its ecological footprint as part of its environmental stewardship initiatives. This includes efforts in waste reduction and responsible resource management across its facilities. The company's sustainability reports often detail progress in these areas, aiming to demonstrate a commitment to preserving natural environments.

The growing global awareness of biodiversity loss and ecosystem degradation means companies are increasingly scrutinized for their environmental impact. This heightened focus could influence investor sentiment and consumer choices, making robust environmental practices crucial for maintaining a positive corporate image and operational license.

- Regulatory Scrutiny: Evolving environmental regulations, particularly those concerning habitat preservation and pollution control, can impact operational costs and require adaptive strategies.

- Public Perception: Negative publicity surrounding environmental damage can erode brand reputation and consumer trust, affecting market share and stakeholder relations.

- Supply Chain Impacts: Ensuring that suppliers also adhere to environmental standards is vital, as disruptions or reputational damage within the supply chain can have cascading effects.

- Corporate Responsibility: Demonstrating a proactive approach to biodiversity conservation and ecosystem health can enhance Emergent's standing as a responsible corporate citizen.

Emerging Environmental Regulations and Reporting

Emergent BioSolutions, like many in the pharmaceutical and biotech sectors, faces an increasingly stringent environmental regulatory landscape. New mandates, particularly around carbon emissions and broader environmental, social, and governance (ESG) reporting, require continuous adaptation and strategic investment. For instance, the U.S. Securities and Exchange Commission's (SEC) proposed climate disclosure rules, while facing ongoing debate and potential revisions, signal a clear trend towards greater transparency in environmental impact. Companies like Emergent must invest in robust data collection and reporting systems to meet these evolving expectations.

The company's proactive approach to environmental stewardship is crucial for maintaining its social license to operate and investor confidence. This includes not only compliance but also anticipating future regulations. For example, the growing focus on the lifecycle assessment of products, from raw material sourcing to waste disposal, will likely lead to more comprehensive reporting requirements. Emergent's ability to demonstrate progress in areas such as water usage, waste reduction, and greenhouse gas (GHG) emissions will be key.

- Increased Scrutiny on GHG Emissions: Companies are expected to report Scope 1, 2, and potentially Scope 3 emissions, requiring detailed tracking and reduction strategies.

- ESG Reporting Frameworks: Adoption of frameworks like the Global Reporting Initiative (GRI) or Sustainability Accounting Standards Board (SASB) is becoming standard practice, demanding standardized environmental data.

- Supply Chain Environmental Due Diligence: Regulations are extending to require companies to assess and manage the environmental impact within their extended supply chains.

- Water and Waste Management: Stricter regulations on water discharge quality and solid waste disposal necessitate investments in advanced treatment and recycling technologies.

Emergent BioSolutions operates within an evolving environmental regulatory framework, with increasing pressure to manage greenhouse gas emissions and enhance ESG reporting. For instance, the anticipated implementation of stricter climate disclosure rules by regulatory bodies like the SEC in 2024-2025 necessitates robust data collection and strategic investment in environmental management systems.

The company's commitment to environmental stewardship is vital for maintaining investor confidence and its social license to operate, requiring proactive adaptation to anticipated regulations concerning product lifecycle assessments and resource management.

Adherence to environmental standards is crucial for corporate responsibility, with a focus on reducing water usage and waste generation. For example, industry-wide targets for 2025 aim for a 15% reduction in water consumption and a 10% decrease in energy use, benchmarks Emergent likely aims to meet.

Emergent BioSolutions must navigate environmental challenges related to raw material sourcing and utility management, particularly water resources, which are subject to increasing scarcity and regulatory oversight.

| Environmental Factor | Impact on Emergent BioSolutions | Key Considerations for 2024-2025 |

|---|---|---|

| Climate Change & Extreme Weather | Disruptions to manufacturing, supply chains, and raw material availability. | Enhancing supply chain resilience, investing in climate-resilient infrastructure. |

| Resource Management (Water, Energy) | Scarcity and regulatory scrutiny on water usage; need for efficient energy consumption. | Implementing water conservation technologies, optimizing energy efficiency in operations. |

| Pollution Control & Waste Management | Compliance with strict regulations on air and water pollution, waste disposal. | Investing in advanced pollution control technologies, robust waste segregation and recycling programs. |

| Biodiversity & Ecosystem Health | Potential impact on public perception and regulatory attention due to operational footprint. | Demonstrating commitment to biodiversity conservation, responsible land use practices. |

| Regulatory Landscape (ESG, Emissions) | Increasingly stringent regulations on GHG emissions and ESG reporting requirements. | Developing comprehensive emissions tracking and reporting, aligning with evolving ESG frameworks. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Emergent BioSolutions is built on a comprehensive review of data from government health agencies, regulatory bodies, and leading financial news outlets. We incorporate insights from industry-specific market research and reports on global public health trends to ensure a holistic understanding of the macro-environment.