EMC Insurance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMC Insurance Bundle

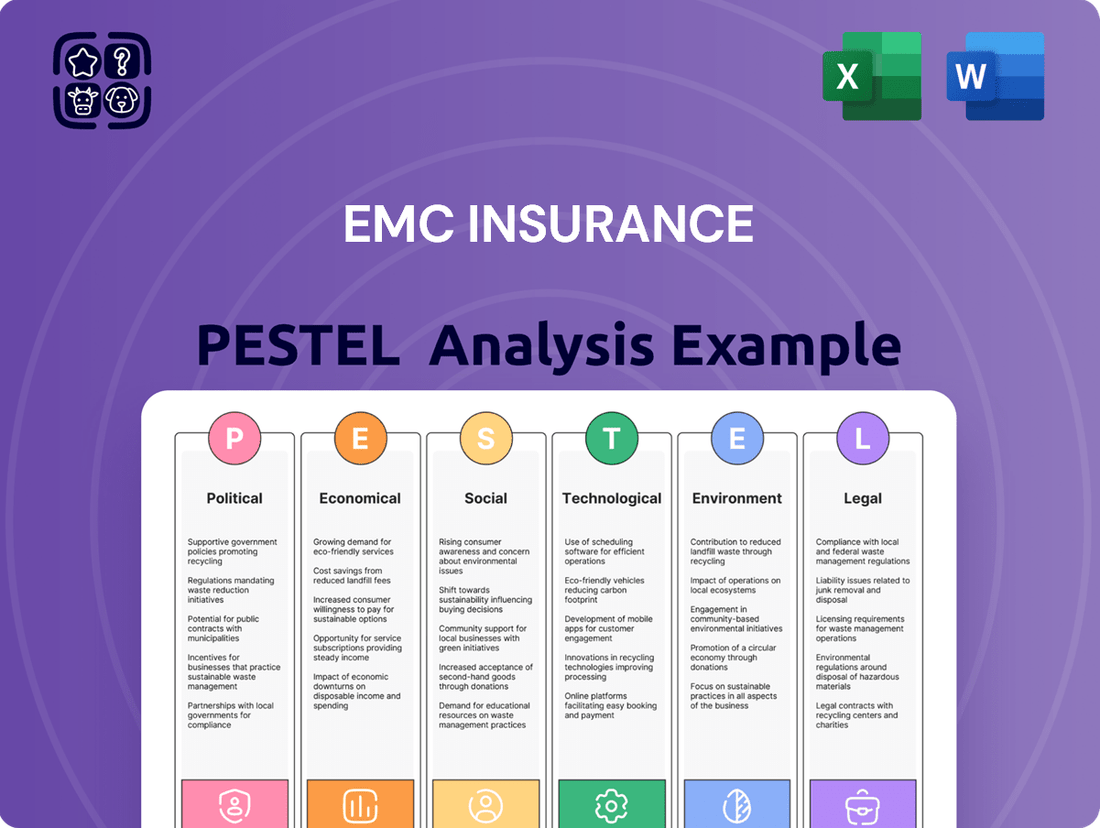

Unlock the strategic advantage with our comprehensive PESTLE Analysis of EMC Insurance. Understand the intricate web of political, economic, social, technological, legal, and environmental factors shaping its landscape. This expert-crafted report provides the clarity you need to anticipate market shifts and make informed decisions. Download the full version now and gain actionable intelligence to propel your strategy forward.

Political factors

In 2025, the U.S. insurance sector, including EMC Insurance, navigates a regulatory environment heavily emphasizing financial stability and transparency. Organizations like the National Association of Insurance Commissioners (NAIC) are pushing for enhanced oversight, particularly concerning climate-related financial risks and ethical marketing. This heightened scrutiny means EMC must remain agile in its compliance strategies to uphold its financial strength and operational standards.

A potential shift towards a Republican administration in the upcoming 2024 or 2025 election cycle could signal a move towards deregulation within the insurance sector. This could offer EMC Insurance greater operational flexibility, potentially reducing compliance costs associated with stringent regulations. For instance, changes in capital reserve requirements or product approval processes could alter the competitive landscape.

Rising geopolitical tensions and proposed trade policies, like tariffs, are creating market uncertainty. This can impact earnings growth and how investors value insurers. For example, increased trade friction could lead to higher costs for essential goods and services, potentially affecting the overall economic stability that underpins insurance markets.

These factors can also directly influence the cost of claims. Higher prices for imported goods, particularly those used in auto repairs or home rebuilding, could drive up claim payouts for insurers like EMC. This is especially relevant for lines such as auto and homeowner insurance, where the cost of parts and materials can fluctuate significantly with trade policy changes.

EMC Insurance, with its diverse product portfolio, needs to carefully consider these broad macroeconomic influences. Adapting underwriting strategies to account for potential increases in claim costs and adjusting investment strategies to navigate market volatility are crucial steps in maintaining financial resilience amidst these evolving geopolitical and trade landscapes.

State-Level Policy Divergence on Climate Risk

States are increasingly charting their own courses on climate risk, creating a patchwork of regulations that directly affects property insurance. This divergence means insurers like EMC must adapt to varying state-level requirements regarding coverage mandates and rate adjustments. For instance, some states might implement stricter building codes for resilience, while others may offer more flexibility, impacting the cost and availability of insurance in different regions.

This fragmented landscape presents significant operational challenges for insurers. Navigating disparate state policies on climate risk, such as differing approaches to flood zone mapping or wildfire mitigation requirements, necessitates a highly adaptable underwriting strategy. EMC, like others in the industry, must meticulously assess how these state-specific rules influence their ability to price risk accurately and maintain market presence in vulnerable areas.

The economic implications are substantial. According to the Insurance Information Institute, insured catastrophe losses in the U.S. reached $54 billion in 2023, a figure heavily influenced by climate-related events. State-level policy divergence can exacerbate these costs; for example, states with aggressive climate adaptation mandates might see lower insured losses over time, while those with less stringent regulations could face higher payouts, impacting insurer solvency and premium stability nationwide.

- State-Specific Climate Regulations: Varying state approaches to climate risk, from building codes to disclosure requirements, create a complex compliance environment for insurers.

- Impact on Underwriting: State-imposed rate caps or mandated coverage in high-risk areas can limit an insurer's ability to reflect true climate-related risks in pricing, potentially affecting profitability.

- Market Access Challenges: Inconsistent state policies can make it difficult for insurers to participate consistently across different markets, particularly in areas facing severe climate impacts.

- Financial Strain on Insurers: The cumulative effect of diverse state regulations and increasing climate-related losses can put significant financial pressure on insurance companies like EMC.

Government Initiatives on Cybersecurity and Data Security

Governments and regulatory bodies, such as the National Association of Insurance Commissioners (NAIC), are actively strengthening data security and cybersecurity mandates for insurers. Many states have adopted new model laws, increasing transparency in data collection and demanding more rigorous security protocols from companies like EMC Insurance.

These evolving regulations necessitate continuous investment in advanced cybersecurity infrastructure and diligent adherence to compliance standards. For EMC Insurance, this means safeguarding sensitive customer information and mitigating the risk of substantial financial penalties associated with data breaches.

- Increased Regulatory Scrutiny: NAIC model laws and state-specific regulations are setting higher bars for data protection.

- Enhanced Compliance Burden: Insurers must adapt to new requirements for data handling and security protocols.

- Financial Penalties for Non-Compliance: Failure to meet these standards can result in significant fines and reputational damage.

- Strategic Cybersecurity Investment: Proactive investment in robust cybersecurity measures is crucial for long-term operational integrity and customer trust.

Political stability and government policy significantly shape the insurance landscape. In 2024 and 2025, a key focus remains on regulatory responses to climate change, with states implementing diverse approaches to risk management and disclosure. This creates a complex compliance environment for EMC Insurance, requiring adaptability in underwriting and operational strategies.

Potential shifts in political administrations could influence deregulation trends, potentially impacting capital requirements and product approvals. Geopolitical tensions and trade policies also introduce market uncertainty, affecting investment strategies and the cost of claims, particularly for lines like auto and homeowner insurance where imported goods are crucial.

The ongoing emphasis on data security and cybersecurity mandates, driven by bodies like the NAIC and state legislatures, necessitates continuous investment in protective infrastructure. Failure to comply can lead to substantial financial penalties, underscoring the importance of robust security protocols for EMC Insurance.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting EMC Insurance across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights designed to support strategic decision-making and identify both threats and opportunities within the insurance market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors easily digestible for strategic discussions.

Economic factors

The U.S. Property and Casualty (P&C) insurance market demonstrated a notable recovery in 2024, achieving significant underwriting gains after a period of losses. This turnaround was largely fueled by strategic rate adjustments, particularly within personal lines of insurance.

Industry analysts anticipate this favorable trend to persist through 2025, projecting a continued enhancement of the combined ratio across the sector. For EMC Insurance, this evolving market dynamic translates into a more robust environment conducive to bolstering profitability and fostering sustained expansion of its primary insurance operations.

The P&C insurance sector experienced robust premium growth in 2024, a trend anticipated to moderate in 2025. Despite this expected slowdown, growth is still projected to outpace overall GDP expansion. For instance, industry-wide P&C direct written premiums were estimated to grow by approximately 6.8% in 2024, with forecasts for 2025 suggesting a still-healthy 5.5% increase, according to industry analyses from late 2024.

Personal lines, particularly homeowners and auto insurance, are expected to remain key drivers of this growth. However, signs of reemerging competition, especially in the personal auto segment, are becoming apparent. This suggests that while demand remains strong, insurers will need to navigate a more competitive landscape, potentially impacting pricing strategies and market share dynamics.

In this environment, EMC Insurance must carefully balance offering competitive pricing to retain and attract customers with the imperative of maintaining strong underwriting profitability. The anticipated deceleration in premium growth means that efficient operations and disciplined risk selection will be crucial for sustained success, ensuring that growth is both profitable and sustainable.

Social inflation, the tendency for litigation and jury awards to rise, is significantly impacting claims costs, especially in areas like workers' compensation and commercial auto. This phenomenon is directly contributing to substantial price hikes, with casualty reinsurance expected to see double-digit increases in 2025.

For EMC Insurance, a property and casualty insurer, this trend necessitates careful management of its financial reserves and pricing strategies. The escalating legal and claims expenses driven by social inflation require proactive adjustments to ensure profitability and solvency in the face of these growing costs.

Reinsurance Market Stability and Capital Levels

The global reinsurance market is expected to maintain its stability through 2025, bolstered by healthy operating profits and strong capital reserves, which hit a record high in 2024. This robust financial footing offers crucial protection against major catastrophe events and ensures a dependable market for EMC Insurance to offload substantial risks.

While the property reinsurance segment is experiencing a moderation in pricing, the casualty reinsurance market continues to see upward pressure on rates. This divergence presents both opportunities and challenges for EMC Insurance as it navigates risk transfer strategies.

- Projected Market Stability: Global reinsurance sector stable through 2025.

- Record Capitalization: Capital levels reached a record high in 2024.

- Risk Transfer Reliability: Provides reliable market for EMC Insurance to transfer significant risks.

- Divergent Rate Trends: Property reinsurance rates easing, casualty rates increasing.

Influence of Interest Rates on Investment Income

Higher interest rates have been a significant boon for insurers like EMC Insurance, positively impacting their investment income. For the Property & Casualty (P&C) sector, this trend contributed to improved profitability throughout 2024 and is anticipated to persist into 2025.

This boost in investment returns acts as a valuable tailwind for EMC Insurance, providing a welcome supplement to its core underwriting results and thereby reinforcing its overall financial stability. For instance, many P&C insurers saw their net investment income increase by double-digit percentages in 2024 compared to prior years.

However, the economic landscape is dynamic. Any market volatility experienced in early 2025 could potentially alter the trajectory of this investment income, introducing an element of uncertainty for the remainder of the year.

- 2024 Impact: Higher interest rates boosted insurer investment income, improving P&C sector profitability.

- 2025 Outlook: Continued higher rates are expected to further support investment income for EMC Insurance.

- Financial Health: Enhanced investment returns strengthen EMC Insurance's financial position, complementing underwriting performance.

- Potential Headwind: Early 2025 market volatility could introduce fluctuations in investment income streams.

The economic environment in 2024 and projected for 2025 presents a mixed but generally favorable outlook for EMC Insurance. While premium growth is expected to moderate, higher interest rates are providing a significant boost to investment income, enhancing overall profitability. However, the persistent challenge of social inflation continues to drive up claims costs, particularly in casualty lines, necessitating careful management of reserves and pricing strategies.

| Economic Factor | 2024 Impact | 2025 Projection | Implication for EMC Insurance |

|---|---|---|---|

| Interest Rates | Boosted investment income, improving P&C profitability. | Continued higher rates expected to support investment income. | Strengthens financial position, complements underwriting. |

| Premium Growth | Robust growth, outperforming GDP. | Expected to moderate but still outpace GDP. | Requires efficient operations and disciplined risk selection for profitable growth. |

| Social Inflation | Increased claims costs, driving price hikes in casualty reinsurance. | Continued upward pressure on casualty rates. | Necessitates careful reserve management and pricing adjustments. |

What You See Is What You Get

EMC Insurance PESTLE Analysis

The preview shown here is the exact EMC Insurance PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the external factors impacting EMC Insurance.

The content and structure shown in the preview is the same EMC Insurance PESTLE Analysis document you’ll download after payment, offering valuable insights into political, economic, social, technological, legal, and environmental influences.

Sociological factors

Consumers are increasingly looking for insurance providers that offer slick digital experiences. This means easy-to-use websites for getting quotes, managing policies, and even filing claims virtually. For instance, a 2024 survey by J.D. Power indicated that over 60% of insurance customers prefer digital channels for routine interactions.

EMC Insurance's recent rebranding highlights its commitment to using technology to improve customer service, a move that directly addresses this shift. By investing in user-friendly online tools and mobile apps, EMC aims to meet the demand for digital convenience without sacrificing the personal connection many customers still value. This focus is crucial as a significant portion of policyholders, estimated to be around 70% by industry analysts in late 2024, expect to be able to handle most insurance needs online.

Public awareness of emerging risks, like cyber threats and climate change impacts, is significantly increasing. A 2024 survey indicated that 70% of businesses now consider cybersecurity a top-three risk, up from 50% in 2022. This heightened concern directly shapes customer expectations for comprehensive insurance coverage, pushing insurers to adapt their offerings.

This trend presents a clear opportunity for EMC Insurance to proactively engage with its network. By educating independent agents and policyholders about these evolving risks, EMC can better position itself to provide specialized solutions. For instance, in 2024, cyber insurance premiums saw an average increase of 15% due to rising claims, highlighting the market demand for such products.

The U.S. population continues to see movement towards Sun Belt states, with states like Florida and Texas experiencing significant growth. For instance, Florida's population grew by an estimated 1.6% in 2023, adding over 170,000 new residents. This migration pattern concentrates property insurance risks in areas increasingly vulnerable to hurricanes and other severe weather events.

However, there's emerging debate about whether increasing climate risks might temper this migration. Some analyses suggest that rising insurance costs and availability challenges in disaster-prone areas could slow or even reverse this trend in specific locales. EMC Insurance must closely monitor these demographic shifts and their correlation with evolving climate risk perceptions and insurance market dynamics.

Growing Importance of ESG in Corporate Reputation

Environmental, Social, and Governance (ESG) factors are significantly shaping how consumers, investors, and other stakeholders view companies, directly impacting brand loyalty and overall corporate image. In 2024, a significant majority of investors, around 70%, indicated that ESG considerations are important in their investment decisions. This trend necessitates insurers like EMC to embed ESG principles across their operations, from how they underwrite policies to where they invest their capital, with transparency in reporting becoming a key expectation.

EMC Insurance's existing commitment to community involvement and charitable giving provides a strong foundation. By further highlighting and integrating these efforts into a comprehensive ESG strategy, EMC can bolster its brand reputation and attract a broader base of environmentally and socially conscious customers and investors. For instance, companies with strong ESG performance often see improved access to capital and lower borrowing costs, a trend observed globally in recent years.

- Consumer Demand: A 2024 survey revealed that over 60% of consumers are more likely to purchase from brands with strong sustainability practices.

- Investor Focus: Global ESG assets under management are projected to reach $50 trillion by 2025, underscoring the financial sector's shift.

- Regulatory Scrutiny: Increasing regulations worldwide mandate greater ESG disclosure, making proactive integration crucial for compliance and reputation.

- Talent Attraction: A significant percentage of the workforce, particularly younger generations, prioritizes working for companies with a clear social and environmental mission.

Workforce Changes and Talent Acquisition Challenges

The insurance sector, including companies like EMC Insurance, is grappling with a shifting workforce landscape. A key challenge is attracting and retaining talent, especially those with expertise in digital technologies and data analytics, crucial for modernizing operations.

EMC Insurance, employing around 2,200 individuals, needs to refine its HR approach to secure these in-demand skills. This involves not only competitive compensation but also cultivating an appealing work environment and providing avenues for professional growth.

- Talent Gap: The demand for data scientists and cybersecurity experts in insurance is projected to outstrip supply.

- Digital Transformation: Companies like EMC are investing in digital tools, requiring a workforce adept at using them.

- Employee Retention: A focus on company culture and development programs is vital to keep skilled employees engaged.

Societal attitudes towards insurance are evolving, with a growing emphasis on digital convenience and transparency. Customers, as evidenced by a 2024 J.D. Power survey showing over 60% preferring digital channels, expect seamless online interactions for policy management and claims. EMC Insurance's investment in user-friendly digital platforms directly addresses this societal shift, aiming to meet the demand for accessible services.

Public awareness of emerging risks like cyber threats and climate change is also a significant sociological factor influencing insurance needs. A 2024 survey indicated 70% of businesses now prioritize cybersecurity, a rise from 50% in 2022, driving demand for specialized coverage. This heightened risk perception necessitates insurers like EMC to adapt their product offerings and communication strategies to address these evolving concerns.

Demographic shifts, such as the migration towards Sun Belt states, concentrate insurance risks in areas more prone to natural disasters, with Florida's population growing by an estimated 1.6% in 2023. This trend requires insurers to reassess risk models and pricing strategies. Concurrently, the increasing importance of Environmental, Social, and Governance (ESG) factors, with 70% of investors in 2024 considering them crucial, compels companies like EMC to integrate sustainability into their operations and brand messaging to maintain stakeholder trust and attract investment.

Technological factors

Artificial Intelligence and Machine Learning are rapidly reshaping the insurance landscape. These technologies are automating routine tasks, significantly boosting the accuracy of risk assessments, and improving the detection of fraudulent activities, all while streamlining claims processing. For instance, by mid-2024, many insurers reported noticeable improvements in claims handling times due to AI integration.

EMC Insurance is actively embracing these advancements, investing in cutting-edge technology and robust data analytics. Their strategy focuses on using AI not to replace human expertise, but to empower their employees, enhancing both customer interactions and overall operational efficiency. This approach underscores a dedication to leveraging AI for a more informed and responsive workforce.

The rise of generative AI is particularly noteworthy, with its mainstream adoption accelerating across the insurance sector throughout 2024 and into 2025. This has opened new avenues for content creation, customer service chatbots, and sophisticated data analysis, further transforming how insurance companies operate and engage with their clients.

Cybersecurity threats like ransomware and data breaches are becoming more sophisticated, frequently targeting insurance companies. In 2024, the average cost of a data breach reached $4.73 million, a significant increase that highlights the financial risk. EMC Insurance must prioritize advanced defenses to safeguard customer data and operational integrity.

To combat these escalating threats, implementing mandatory multi-factor authentication and robust backup systems is crucial. The increasing frequency of attacks means that proactive security measures are no longer optional but essential for business continuity and client confidence.

EMC Insurance's ongoing investment in cutting-edge cybersecurity solutions is vital. As of early 2025, the cybersecurity landscape continues to evolve rapidly, demanding constant adaptation and innovation to stay ahead of malicious actors and protect sensitive information.

The increasing adoption of Internet of Things (IoT) devices and telematics is fundamentally changing how insurers can interact with policyholders. These technologies allow for the collection of real-time data, which is crucial for developing usage-based insurance (UBI) and personalized pricing models, particularly in the auto and property sectors.

For instance, telematics in vehicles can track driving behavior like mileage, speed, and braking habits, enabling insurers to offer discounts to safer drivers. This data-driven approach facilitates more accurate risk assessments, moving beyond traditional demographic factors. The global telematics market was valued at approximately $28.5 billion in 2023 and is projected to grow significantly, indicating a strong consumer and industry embrace of these solutions.

EMC Insurance can leverage this trend by exploring partnerships or developing its own IoT-enabled products. Offering personalized insurance solutions based on actual usage and risk profiles can enhance customer loyalty and provide a competitive edge. This could involve creating tailored auto insurance policies that reward low-mileage drivers or property insurance that adjusts premiums based on real-time environmental data from smart home devices.

Digital Transformation and Process Automation

Digital transformation and robotic process automation (RPA) are fundamentally reshaping the insurance industry. EMC Insurance is leveraging these technologies to streamline operations like policy administration and claims processing. This focus on modernization is crucial for reducing operational costs and boosting efficiency. For instance, many insurers are investing heavily in AI-driven claims management, aiming to cut processing times by up to 30%.

EMC Insurance's commitment to modernizing its digital infrastructure is evident in its adoption of advanced tools. This includes the use of low-code/no-code platforms, which accelerate the development of new applications and services. Such platforms allow for quicker adaptation to evolving market demands and customer expectations. The global market for low-code development platforms was projected to reach $21.2 billion in 2022 and is expected to grow significantly in the coming years.

- Streamlined Operations: RPA and digital tools are automating repetitive tasks in policy issuance and claims handling, leading to faster turnaround times and fewer errors.

- Cost Reduction: By automating processes, EMC Insurance can significantly lower its operational expenses, freeing up resources for strategic initiatives.

- Enhanced Efficiency: Modernizing digital infrastructure, including the use of low-code platforms, enables quicker development and deployment of new insurance products and services.

- Market Adaptability: Digital transformation allows EMC Insurance to respond more rapidly to changing market conditions and customer needs, a key advantage in the competitive insurance landscape.

Advancements in Data Analytics and Cloud Computing

Strategic data analytics is transforming how insurers like EMC Insurance assess risk. By crunching vast amounts of data, companies can develop more precise pricing models and create products tailored to individual customer needs. For instance, in 2024, the global big data analytics market was projected to reach over $300 billion, highlighting the significant investment and reliance on these technologies.

Cloud computing has become the backbone for data storage and processing in the insurance sector. This shift allows for greater scalability and accessibility of information, crucial for real-time analysis and operational efficiency. By mid-2025, it's estimated that over 90% of enterprises will be using cloud services to some extent, underscoring its ubiquity.

EMC Insurance can leverage these technological advancements to its advantage. Deeper insights into market trends and customer behavior, powered by robust data analytics and cloud infrastructure, will enhance their ability to make informed, data-driven decisions. This strategic adoption is key to maintaining a competitive edge in the evolving insurance landscape.

- Data Analytics Market Growth: The global big data analytics market was expected to exceed $300 billion in 2024.

- Cloud Adoption Rate: Projections indicate over 90% of enterprises will utilize cloud services by mid-2025.

- Impact on Risk Assessment: Advanced analytics enable more nuanced pricing and personalized product development.

- Operational Efficiency: Cloud computing provides scalable infrastructure for efficient data management and processing.

Technological advancements, particularly in AI and machine learning, are revolutionizing risk assessment and claims processing for insurers like EMC. The widespread adoption of generative AI by early 2025 is further enhancing customer service and data analysis capabilities, making operations more efficient and responsive.

EMC Insurance is strategically investing in these technologies to empower its workforce, not replace it, focusing on improving customer interactions and operational efficiency through AI integration. This proactive approach ensures they remain competitive by leveraging data-driven insights.

The increasing sophistication of cyber threats, with the average data breach cost reaching $4.73 million in 2024, necessitates robust cybersecurity measures. EMC Insurance's commitment to advanced defenses and multi-factor authentication is critical for protecting sensitive data and maintaining client trust.

The growth of IoT and telematics, with the telematics market valued around $28.5 billion in 2023, offers opportunities for personalized insurance products and usage-based pricing. EMC Insurance can leverage this by developing tailored policies that reward safer driving or efficient property management.

Legal factors

The insurance industry, including EMC Insurance, faces an increasingly complex web of data privacy and security regulations. The National Association of Insurance Commissioners (NAIC) data security model law, for example, continues to gain traction, with more states adopting its provisions. This trend means companies must invest in robust data protection measures and grant consumers more control over their personal data.

Non-compliance with these evolving regulations can carry substantial financial penalties. For instance, under the California Consumer Privacy Act (CCPA), which has influenced similar state laws, penalties can reach $7,500 per intentional violation. EMC Insurance must therefore proactively adapt its data handling practices to meet these heightened privacy standards and avoid significant legal and financial repercussions.

State regulators are increasingly mandating stricter cyber insurance requirements due to rising cyber losses. These new rules often include minimum security standards that policyholders must meet and demand clearer, more precise policy language from insurers. For instance, some states are exploring requirements for multi-factor authentication for policyholders seeking cyber coverage.

These evolving regulations directly influence the design and underwriting of cyber insurance products. EMC Insurance, offering commercial lines, must adapt its cyber insurance portfolio to align with these new state-level standards. This includes ensuring its policies clearly define coverage terms and that policyholders meet specified security prerequisites, a significant shift from previous, less prescriptive environments.

State insurance departments are intensifying their review of insurance rate adjustments and how companies determine the fair value of their products. This is particularly evident in the auto insurance sector, where consumer complaints about rising premiums and coverage gaps, especially in areas prone to climate change impacts, are being actively addressed. Regulators are pushing for greater transparency and ensuring that policyholders receive equitable value.

EMC Insurance must be prepared to rigorously justify any proposed rate changes, clearly articulating the value and benefits its policies offer. In 2024, for instance, several states saw significant increases in auto insurance premiums, with some averaging over 15%, driven by factors like increased repair costs and accident frequency, making regulatory scrutiny even more critical.

Ongoing Impact of Litigation Trends and Social Inflation

Rising litigation and the phenomenon known as social inflation continue to pose significant challenges for the insurance sector, especially impacting casualty insurance lines. This trend directly contributes to adverse loss development, meaning claims are costing more than initially anticipated.

The escalating cost of claims, driven by factors like larger jury awards and broader interpretations of liability, puts considerable pressure on insurance pricing. EMC Insurance, like its peers, must remain vigilant in tracking evolving legal trends and adapt its underwriting strategies and reserving methodologies to effectively manage the financial repercussions of this heightened litigation environment.

For instance, in 2024, reports indicated a continued upward trend in the size of jury verdicts in certain jurisdictions, with some product liability cases exceeding $100 million. This underscores the financial risk associated with social inflation, where societal attitudes can influence litigation outcomes and settlement amounts.

- Increased Litigation Costs: Legal expenses associated with defending claims are rising, impacting overall profitability.

- Adverse Loss Development: Reserves set aside for claims are proving insufficient due to unexpected claim cost increases.

- Pricing Pressures: Insurers face challenges in adequately pricing policies to account for the growing cost of claims.

- Impact on Underwriting: Stricter underwriting criteria and risk selection are becoming necessary to mitigate exposure.

Regulatory Focus on Climate Risk Disclosures

Insurance regulators are intensifying their scrutiny of how companies like EMC Insurance manage and disclose climate-related financial risks. This means a greater demand for transparency regarding how climate change impacts investment portfolios and underwriting decisions. For instance, the National Association of Insurance Commissioners (NAIC) has been actively developing frameworks for climate risk disclosure, with many states adopting or considering similar regulations throughout 2024 and into 2025.

EMC Insurance can anticipate increased pressure to align its reporting with emerging standards, potentially including new legislation or guidelines specifically addressing climate risk and resilience. This regulatory shift is driven by a growing understanding of climate change as a systemic risk to the financial sector. By 2025, it's expected that a significant portion of U.S. states will have implemented or be in the process of implementing enhanced climate disclosure requirements for insurers.

- Regulatory Scrutiny: Insurance regulators are prioritizing climate risk disclosures, pushing for greater transparency in how insurers account for these risks.

- Emerging Frameworks: New legislation and reporting frameworks for climate risk and resilience are being developed and implemented by governmental entities.

- Enhanced Reporting: EMC Insurance will likely face increased demands to improve its reporting and disclosure practices concerning climate-related financial risks.

- State-Level Action: Many U.S. states are actively adopting or considering new regulations for climate risk disclosure among insurance providers.

Legal and regulatory landscapes continue to shape the insurance industry, impacting EMC Insurance's operations and strategy. Data privacy laws, like the CCPA, are increasingly influential, with potential fines reaching $7,500 per intentional violation, demanding robust data protection measures.

State regulators are also tightening cyber insurance requirements, pushing for clearer policy language and minimum security standards for policyholders, potentially including multi-factor authentication mandates.

Furthermore, rising litigation costs and social inflation are driving up claim expenses, particularly in casualty lines, necessitating careful underwriting and reserving to manage adverse loss development, with some jury verdicts in 2024 exceeding $100 million.

Environmental factors

The U.S. insurance sector is grappling with significant financial strain due to the escalating frequency and intensity of natural disasters like wildfires, hurricanes, and floods. These events are causing substantial insured losses, with total insured catastrophe losses in the U.S. reaching an estimated $119 billion in 2023, according to the Insurance Information Institute.

This heightened unpredictability of weather patterns is rendering traditional catastrophe modeling less effective, creating challenges for accurate risk assessment. For EMC Insurance, a property and casualty insurer, this translates to a direct exposure to these growing risks, potentially impacting underwriting profitability and the adequacy of its capital reserves.

Climate change is increasingly challenging the fundamental business of home insurers. This is leading to situations where insurance is becoming unavailable or prohibitively expensive, particularly in regions frequently hit by wildfires or hurricanes. For instance, in 2023, the U.S. saw insured losses from natural catastrophes estimated to be around $100 billion, a significant portion of which was attributed to severe weather events.

As a consequence of these escalating risks, some insurance companies are withdrawing from states with high exposure. This forces more homeowners into state-backed insurance pools, which often come with higher premiums and less coverage. This trend puts pressure on companies like EMC Insurance to re-evaluate their exposure in these vulnerable areas.

EMC Insurance needs to proactively manage these environmental shifts. This involves meticulous risk assessment in areas prone to natural disasters and potentially adjusting their willingness to underwrite policies or revising their pricing models to reflect the heightened risk landscape.

Environmental, Social, and Governance (ESG) principles are increasingly shaping the insurance industry, impacting how companies like EMC Insurance approach underwriting, investments, and risk management. This shift means integrating climate-related risks directly into pricing models and investment portfolios. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) has seen a significant rise in adoption, with many major insurers now reporting on climate risks, a trend expected to continue through 2024 and 2025.

EMC Insurance has a clear opportunity to bolster its resilience and attractiveness by aligning its operations with these growing ESG mandates. This could involve developing new products that incentivize sustainable customer behaviors, such as offering discounts for energy-efficient buildings or electric vehicle usage. By proactively embracing ESG, EMC can not only mitigate future risks but also tap into a market segment increasingly prioritizing corporate responsibility and environmental stewardship.

Limitations of Traditional Catastrophe Models

Traditional catastrophe models, while valuable, often struggle to keep pace with the escalating frequency and severity of extreme weather events, a trend strongly linked to climate change. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters, each causing at least $1 billion in damages, a significant increase from previous years.

This disconnect can lead to inaccurate risk assessments and a substantial underestimation of potential financial liabilities for insurers like EMC Insurance. The models may not fully capture the cascading effects or the long-term impacts of events like prolonged droughts or more intense hurricane seasons.

To navigate this evolving landscape, EMC Insurance must invest in and refine its risk modeling capabilities. This includes incorporating more sophisticated climate science data and developing forward-looking scenarios that better represent the realities of climate-induced risks.

- Underestimation of Climate Risk: Models may not fully price in the heightened probability of severe weather events.

- Financial Exposure: Inaccurate modeling can lead to undercapitalization for extreme loss events.

- Need for Enhanced Modeling: Insurers require advanced analytics that integrate climate science for more robust risk assessment.

- 2023 Disaster Costs: The U.S. faced 28 billion-dollar weather disasters in 2023, highlighting the inadequacy of older models.

Demand for 'Green' Insurance Products and Services

Consumers are increasingly seeking insurance that rewards eco-friendly behavior. For instance, many insurers now offer discounts for electric vehicles, with the U.S. electric vehicle market share projected to reach 15% by 2025, up from around 7.6% in 2023. This shift highlights a significant market opportunity for EMC Insurance to develop and promote policies that align with sustainability, potentially capturing a growing environmentally conscious customer base.

This growing demand translates into tangible business advantages. EMC Insurance could see increased market share by offering innovative products like reduced premiums for businesses with strong ESG (Environmental, Social, and Governance) ratings or for properties built with sustainable materials. A 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, a figure that is expected to rise.

Key areas for EMC Insurance to consider include:

- Developing premium discounts for policyholders demonstrating sustainable practices, such as renewable energy adoption or waste reduction initiatives.

- Creating specialized insurance products for green businesses and sustainable infrastructure projects.

- Partnering with environmental organizations or certification bodies to enhance product credibility and market reach.

- Investing in technology to better assess and underwrite environmental risks and opportunities.

Environmental factors present significant challenges and opportunities for EMC Insurance, primarily driven by climate change and increasing consumer demand for sustainability. The escalating frequency and severity of natural disasters, with U.S. insured catastrophe losses estimated at $119 billion in 2023, directly impact underwriting profitability and capital adequacy.

EMC Insurance must adapt its risk assessment and modeling to account for these evolving environmental risks, incorporating advanced climate science data. The growing consumer preference for eco-friendly products, evidenced by a projected 15% U.S. electric vehicle market share by 2025 and over 60% of consumers considering sustainability in purchases in 2024, presents a clear market opportunity.

By developing sustainable insurance products and incentivizing eco-friendly customer behavior, EMC Insurance can enhance its resilience and market appeal. This strategic alignment with ESG principles is crucial for long-term success in a changing insurance landscape.

| Factor | Impact on EMC Insurance | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Natural Disasters | Increased insured losses, challenges to risk modeling, potential impact on profitability and reserves. | U.S. insured catastrophe losses: $119 billion (2023). 28 billion-dollar weather disasters in the U.S. (2023). |

| Consumer Demand for Sustainability | Opportunity for market share growth through eco-friendly products and services. | U.S. EV market share projected to reach 15% by 2025. Over 60% of consumers consider sustainability in purchases (2024). |

| Regulatory & ESG Pressure | Need to integrate climate-related risks into underwriting and investments; adoption of TCFD reporting increasing. | Growing adoption of Task Force on Climate-related Financial Disclosures (TCFD) reporting expected to continue through 2024-2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for EMC Insurance is built on a robust foundation of data from reputable sources, including government economic reports, industry-specific market research, and regulatory updates. We leverage insights from financial institutions, technology trend analyses, and legal databases to ensure comprehensive coverage of all PESTLE factors.