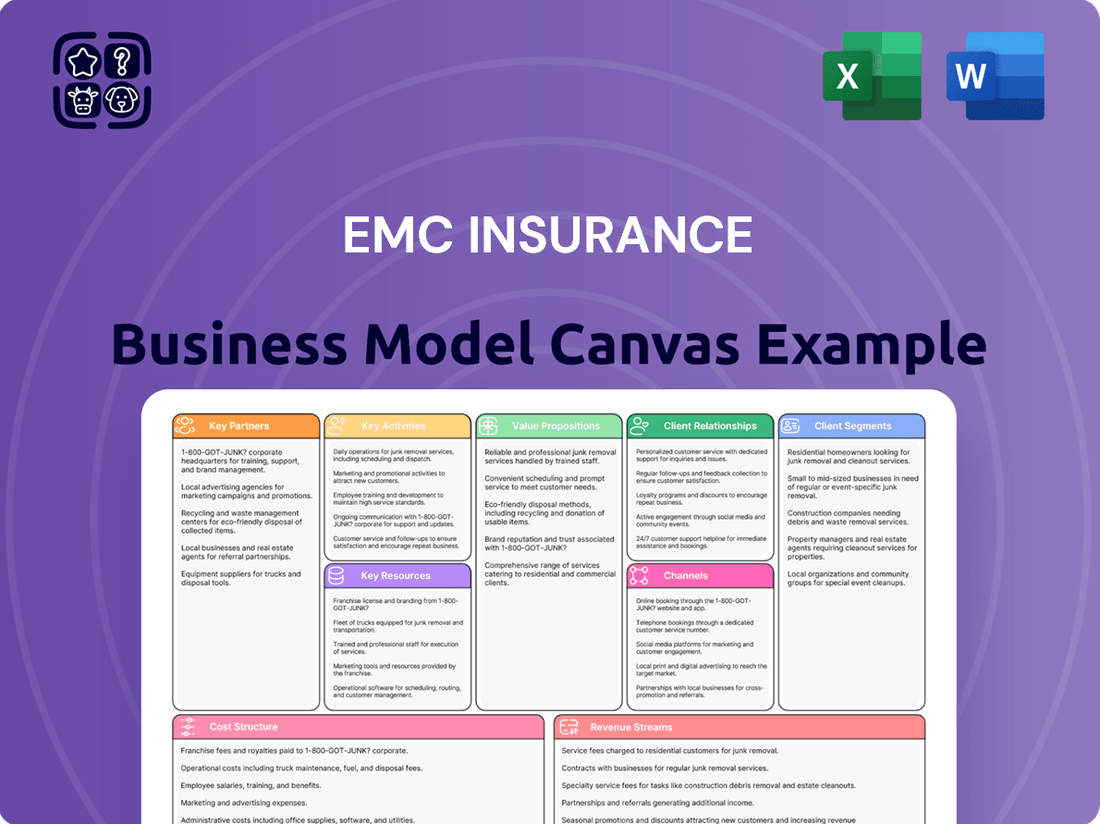

EMC Insurance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMC Insurance Bundle

Unlock the strategic core of EMC Insurance with our comprehensive Business Model Canvas. This detailed analysis breaks down how EMC Insurance effectively serves its diverse customer segments and builds strong key partnerships to deliver its unique value propositions. Discover their revenue streams and cost structure.

Dive deeper into EMC Insurance’s operational blueprint with the full Business Model Canvas. See firsthand how they manage key resources and activities to maintain their competitive edge in the insurance market. This is your chance to gain actionable insights into their success.

Ready to understand EMC Insurance's winning formula? Our complete Business Model Canvas lays out every crucial element, from customer relationships to channels, providing a clear roadmap of their strategy. Download the full, editable version to fuel your own business planning.

Partnerships

Independent insurance agents are the backbone of EMC Insurance's distribution strategy, acting as vital conduits to a broad customer base across the nation. These agents bring localized market knowledge and personalized service, which are essential for effectively meeting diverse client needs.

EMC fosters strong relationships with these partners, offering support through initiatives like its Partner Success Program. This program acknowledges and rewards high-achieving agencies, reinforcing the symbiotic relationship and driving mutual growth.

EMC Insurance leverages reinsurance partners to manage its risk portfolio and ensure financial resilience. These partnerships are crucial for protecting against significant underwriting losses and maintaining solvency, especially in the face of unpredictable catastrophic events. For instance, in 2023, EMC's net premiums earned were $1.4 billion, highlighting the substantial risk exposure it manages.

The company actively participates in reinsurance pooling agreements, which allow for the diversification of risk across multiple insurers. This collaborative approach is a cornerstone of the insurance industry, enabling greater capacity to underwrite complex or large-scale risks. EMC's commitment to these arrangements underscores its strategy for robust risk management and market stability.

EMC boasts a notable track record of sustained reinsurance relationships, with some arrangements dating back many years. This longevity in partnerships with its oldest clients speaks to the trust and mutual benefit derived from these long-standing agreements, reinforcing EMC's reputation as a reliable partner in the reinsurance market.

EMC Insurance actively collaborates with technology and insurtech companies to streamline its operations and introduce cutting-edge offerings. For instance, partnerships have focused on developing real-time policy premium rating systems and creating digital platforms that facilitate continuous underwriting processes.

These strategic alliances allow EMC to harness sophisticated data analytics and emerging technologies, ultimately boosting the quality and responsiveness of its insurance services. In 2024, the insurtech sector saw significant investment, with global funding reaching billions, underscoring the value of such technological integrations for established insurers like EMC.

Community Organizations and Foundations

EMC Insurance actively cultivates relationships with community organizations and foundations, showcasing a deep commitment to social responsibility. These partnerships, often facilitated through the EMC Insurance Foundation and corporate giving programs, are crucial for enhancing brand reputation and strengthening local ties. For instance, in 2024, EMC continued its support for various non-profits focused on education and disaster relief.

- Community Engagement: EMC's involvement fosters goodwill and reinforces its role as a responsible corporate citizen.

- Brand Reputation: Charitable contributions and active participation in community events bolster EMC's public image.

- Local Connections: These partnerships build strong relationships within the communities EMC serves, leading to greater trust and understanding.

Service Providers and Vendors

EMC Insurance relies on a network of service providers and vendors to maintain smooth operations. These partnerships are crucial for areas like claims processing, where specialized adjusters and repair networks are essential. For instance, in 2024, EMC continued to leverage third-party administrators for complex claims, ensuring timely and accurate resolutions for policyholders.

IT infrastructure and cybersecurity are also managed through key vendor relationships. This allows EMC to maintain robust systems, protect sensitive data, and offer digital services to its customers. In the past year, significant investments were made in cloud-based solutions and data analytics platforms, often facilitated by these strategic technology partners.

Furthermore, EMC collaborates with loss control consultants and risk management specialists. These experts provide valuable insights and services to policyholders, helping them mitigate risks and prevent losses. This proactive approach, supported by external expertise, is a cornerstone of EMC's value proposition.

- Claims Operations: Partnerships with specialized claims adjusters and repair networks ensure efficient and accurate claim handling, a critical component of customer satisfaction.

- IT Infrastructure: Collaboration with technology vendors provides EMC with advanced IT systems, cybersecurity measures, and digital service capabilities.

- Loss Control Expertise: Engaging external risk management and loss control consultants enhances EMC's ability to help policyholders prevent losses and manage risks effectively.

- Specialized Services: Vendors provide access to niche expertise, such as actuarial services or legal counsel, that are vital for specialized insurance functions.

EMC Insurance's key partnerships extend to reinsurance providers, crucial for managing its substantial risk exposure, which is reflected in its $1.4 billion in net premiums earned in 2023. These collaborations, including participation in risk-pooling agreements, are vital for underwriting large risks and ensuring financial stability.

The company also partners with insurtech firms to enhance operational efficiency and service delivery, integrating advanced data analytics and digital platforms. This focus on technology is vital, as global insurtech funding reached billions in 2024, indicating the sector's growing importance.

Furthermore, EMC collaborates with community organizations and foundations, reinforcing its corporate social responsibility and brand image. These local ties are strengthened through initiatives like the EMC Insurance Foundation, which continued its support for education and disaster relief in 2024.

What is included in the product

A meticulously crafted Business Model Canvas for EMC Insurance, detailing its core customer segments, value propositions, and distribution channels. This model reflects EMC's established operational strategies and future growth plans, making it ideal for strategic planning and stakeholder communication.

The EMC Insurance Business Model Canvas offers a clear, structured framework that simplifies complex insurance operations, reducing the pain of disjointed strategies and communication breakdowns.

It provides a one-page snapshot of EMC's entire business, effectively alleviating the pain of information silos and fostering alignment across departments.

Activities

EMC Insurance's critical function is the meticulous assessment and underwriting of property and casualty risks across commercial and personal insurance sectors. This involves a deep dive into applications to determine insurability, establish accurate premium rates, and actively manage the company's portfolio for sustained profitability.

To better serve diverse client needs, EMC has strategically developed specialized underwriting units. These units are dedicated to large accounts, niche specialty risks, the middle market segment, and small businesses, allowing for tailored expertise and service.

EMC Insurance's key activity of policy issuance and management involves the entire lifecycle of an insurance contract, from its initial creation and distribution to its ongoing administration and renewal. This includes meticulously maintaining policyholder data, processing endorsements for any changes, and ensuring timely renewals.

A significant focus for EMC is streamlining these processes through technology. For instance, in 2024, they continued to invest in digital platforms designed to make doing business with them easier, faster, and more efficient for their agents and policyholders. This commitment to data and technology underpins their ability to manage a large volume of policies accurately.

Claims processing and management is a cornerstone for EMC Insurance. This vital activity encompasses the entire lifecycle of a claim, from its initial reception and thorough investigation to its ultimate settlement. EMC's commitment to this area is underscored by the presence of a Senior Vice President – Chief Claims Officer, who directs claims and related operations, ensuring efficiency and a focus on policyholder experience.

In 2024, the insurance industry, including companies like EMC, continued to navigate a complex claims environment. Factors such as economic conditions and evolving risk landscapes directly impact claim volumes and severity. For EMC, effectively managing these claims is paramount for maintaining customer loyalty and the company's reputation for reliability.

Agent Relationship Management

EMC Insurance's core strategy hinges on its independent agent network, making agent relationship management a paramount activity. This involves nurturing these partnerships through comprehensive support systems.

Key activities include providing agents with essential resources, ongoing training programs, and responsive support to ensure they can effectively serve policyholders. Recognizing and rewarding agent performance is also crucial for maintaining motivation and fostering loyalty.

- Resource Provision: Supplying agents with marketing materials, underwriting guidelines, and claims processing tools.

- Training and Development: Offering educational sessions on new products, regulatory changes, and sales techniques.

- Performance Recognition: Implementing programs that acknowledge top-performing agents, potentially through awards or preferred partner status.

- Partnership Building: Engaging in regular communication and feedback loops to ensure mutual understanding and alignment of goals.

In 2024, EMC continued to invest in its agent portal, enhancing digital tools for quoting, policy issuance, and claims submission, aiming for greater efficiency. The company reported that over 90% of its new business policies were initiated through its independent agent channel, underscoring the critical nature of these relationships.

Investment Management

EMC Insurance actively manages a significant investment portfolio, a core activity that generates income and underpins its financial stability. This strategic approach involves careful asset allocation and informed investment choices, crucial for maintaining liquidity and ensuring profitability. These investment activities are a major contributor to the company's overall financial performance.

The company's commitment to robust investment management yielded impressive results in 2024, with net investment income reaching an all-time high. This achievement highlights the effectiveness of their strategic asset allocation and investment decision-making processes.

- Strategic Asset Allocation: EMC's investment strategy focuses on diversifying its holdings across various asset classes to optimize risk-adjusted returns.

- Income Generation: A primary goal is to generate consistent income through interest, dividends, and capital gains, which bolsters the company's financial strength.

- Liquidity and Profitability: Investment decisions are balanced to ensure sufficient liquidity for operational needs while maximizing profitability.

- Record Net Investment Income: In 2024, EMC Insurance reported a record high for net investment income, demonstrating the success of its investment management efforts.

EMC Insurance's key activities revolve around underwriting and policy management, claims handling, and managing its investment portfolio. The company also places significant emphasis on cultivating and supporting its independent agent network, which is crucial for its distribution strategy.

In 2024, EMC Insurance continued to refine its underwriting processes, leveraging technology to improve efficiency and accuracy in risk assessment. The company reported that over 90% of its new business policies were initiated through its independent agent channel, highlighting the vital role these partnerships play.

Claims management remains a critical focus, with dedicated leadership ensuring efficient and fair settlements, a vital component for customer retention and company reputation. Furthermore, EMC's investment activities in 2024 resulted in a record high for net investment income, underscoring the success of its asset allocation strategies.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Underwriting & Policy Management | Assessing and pricing risks, issuing and administering policies. | Continued investment in digital platforms for agent efficiency. |

| Claims Handling | Processing and settling insurance claims. | Focus on efficiency and policyholder experience, directed by Chief Claims Officer. |

| Agent Relationship Management | Supporting and developing relationships with independent agents. | Over 90% of new business policies originated through agents; enhanced agent portal. |

| Investment Management | Managing investment portfolio for income and financial stability. | Achieved record high net investment income in 2024. |

Delivered as Displayed

Business Model Canvas

The EMC Insurance Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis that will be yours to use. Upon completing your order, you will gain full access to this same, professionally structured document, ready for your strategic planning.

Resources

As an insurer, EMC Insurance relies heavily on substantial financial capital and strong reserves to meet its obligations and ensure long-term viability. This financial bedrock is crucial for paying out claims, even during periods of high loss activity, and for weathering economic downturns.

EMC's commitment to financial strength is underscored by its 'Excellent' Financial Strength Rating from AM Best, a widely recognized benchmark in the insurance industry. This rating reflects a solid capital base and sound financial management practices.

Further demonstrating its robust financial health, EMC Insurance reported a significant increase in its policyholder surplus, which grew to $1.8 billion in 2024. This growth in surplus is a key indicator of the company's ability to absorb potential losses and maintain its financial stability for policyholders.

EMC Insurance's extensive network of independent agents across the U.S. is a cornerstone of its business model, acting as the primary channel for distribution and localized customer engagement. These agents are the face of EMC in their respective communities, handling sales and providing essential services directly to policyholders.

This commitment to a 100% independent agent distribution strategy means EMC leverages the deep local market knowledge and established relationships of these professionals. For instance, in 2024, EMC continued to rely on this network to reach a broad customer base, with these agents facilitating the majority of new business and policy renewals.

EMC Insurance's success hinges on its skilled workforce, boasting over 2,200 employees across the nation. This team includes vital roles like underwriters, claims adjusters, actuaries, and IT specialists.

The collective expertise of these professionals is the bedrock of EMC's operations, enabling precise risk assessment, efficient policy administration, and superior customer service, all critical for navigating the complexities of the insurance market.

Technology and IT Infrastructure

EMC Insurance's technology and IT infrastructure are foundational to its business model, enabling streamlined operations and a competitive edge. Advanced systems for underwriting, claims processing, and robust data analytics are crucial for efficiency.

The company is actively investing in its data and technology capabilities. These investments aim to refine internal processes and elevate the quality of customer and agent interactions. For example, in 2024, EMC continued its focus on digital transformation initiatives, enhancing its core platforms to support growth and improve service delivery.

- Underwriting Platforms: Streamlining risk assessment and policy issuance.

- Claims Management Systems: Accelerating claim resolution and improving customer satisfaction.

- Data Analytics Tools: Leveraging insights for better decision-making and risk modeling.

- Digital Transformation: Ongoing investment in modernizing IT infrastructure to support evolving business needs.

Brand Reputation and Trust

EMC Insurance's brand reputation and trust are built on a foundation of reliability and financial strength. This strong reputation is a critical intangible asset, fostering confidence among policyholders and agents alike. For instance, EMC consistently receives high financial strength ratings from agencies like AM Best, underscoring its stability.

The company's commitment to 'keeping insurance human' resonates deeply, reinforcing trust through personalized service and genuine care. This approach has led to significant recognition, with EMC often cited for its customer-centric practices. In 2024, EMC continued to be a leader in customer satisfaction within the insurance sector, reflecting this dedication.

- Financial Strength Ratings: EMC Insurance consistently maintains superior financial strength ratings from independent agencies, a testament to its ability to meet obligations.

- Customer Service Excellence: The company's focus on a human-centered approach to insurance fosters strong relationships and high levels of trust with its policyholders.

- Industry Recognition: EMC has received accolades for its commitment to service and reliability, reinforcing its standing as a trusted insurance provider.

- Agent Relationships: A strong reputation among insurance agents translates into robust distribution channels and a loyal network of partners.

EMC Insurance's key resources include its substantial financial capital, a robust network of independent agents, a skilled employee base, and advanced technology infrastructure. These elements collectively enable the company to underwrite risks effectively, manage claims efficiently, and provide excellent service.

The company's financial strength, evidenced by its 'Excellent' AM Best rating and a policyholder surplus of $1.8 billion in 2024, underpins its ability to meet obligations and invest in growth. This financial stability is a critical resource for policyholder confidence and operational resilience.

EMC's 100% independent agent distribution model is a vital resource, providing local market expertise and direct customer engagement. This network facilitated the majority of new business and renewals in 2024, highlighting its importance in reaching a broad customer base.

A workforce of over 2,200 employees, encompassing underwriters, claims adjusters, and actuaries, represents significant human capital. Their expertise is essential for accurate risk assessment, claims handling, and overall operational excellence.

Investments in technology and data analytics, including underwriting platforms and claims management systems, are crucial for efficiency and competitive advantage. EMC's ongoing digital transformation initiatives in 2024 further enhance these capabilities.

| Key Resource | Description | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Substantial capital and reserves to meet obligations. | Policyholder surplus of $1.8 billion. |

| Independent Agent Network | Primary distribution channel with local market knowledge. | Facilitated majority of new business and renewals. |

| Skilled Workforce | Over 2,200 employees with expertise in underwriting, claims, etc. | Ensures accurate risk assessment and efficient operations. |

| Technology & IT Infrastructure | Advanced systems for underwriting, claims, and data analytics. | Supports digital transformation and improved service delivery. |

Value Propositions

EMC Insurance provides a broad spectrum of property and casualty insurance products, encompassing both commercial and personal lines. This includes essential coverages such as auto and home insurance, alongside a variety of specialized business policies designed to protect diverse enterprises.

The company excels in offering tailored solutions for specific industry segments, notably manufacturing and construction. By focusing on these areas, EMC delivers highly customized coverage and proactive risk management strategies, demonstrating a deep understanding of the unique challenges faced by these sectors.

For instance, in 2024, EMC reported a strong performance in its commercial lines, with premiums written showing consistent growth, particularly within its specialized industry niches. This growth underscores the effectiveness of their tailored approach in meeting the complex needs of businesses.

Policyholders and agents rely on EMC's robust financial strength, a cornerstone of our value proposition. This trust is built on a foundation of consistent performance and a long-standing commitment to security.

EMC holds an 'Excellent' Financial Strength Rating from AM Best, a testament to our ability to meet financial obligations. This rating, coupled with over 110 years of operational history, underscores our enduring stability and reliability in the insurance market.

Our financial solidity ensures that EMC consistently meets its commitments and reliably pays claims, providing peace of mind to our policyholders. This unwavering financial health is a critical differentiator in a competitive landscape.

EMC Insurance champions a human-centric philosophy, prioritizing genuine partnerships and collaborative problem-solving to deliver exceptional service that transcends mere transactions.

This focus on personalized care, empathy, and accessibility is a key differentiator, setting EMC apart in a competitive market by ensuring clients feel understood and supported.

In 2024, EMC Insurance continued to invest in its agent relationships, recognizing their crucial role in delivering this human-centric experience, a strategy that has historically driven strong customer retention rates.

Local Expertise with National Reach

EMC Insurance leverages its extensive network of offices and dedicated team members spread across the nation to offer a unique blend of broad, national carrier capabilities and deep local market understanding. This allows them to craft insurance solutions that are not only comprehensive but also precisely tailored to the distinct needs and regional challenges faced by policyholders in various communities. In 2024, EMC continued to emphasize this localized approach, with over 2,000 employees operating from more than 50 field offices, ensuring responsive and relevant support.

This dual strength translates into a significant advantage for their clients. By combining the resources and stability of a national insurer with the on-the-ground insights of local experts, EMC can provide agile and effective responses to specific regional risks and opportunities. For instance, their ability to understand local building codes, weather patterns, or economic drivers allows for more accurate risk assessment and more appropriate coverage options.

- National Reach: Access to a broad spectrum of insurance products and financial stability of a large carrier.

- Local Understanding: Tailored solutions and responsive service that address specific regional needs and regulations.

- Responsive Support: Local teams are better positioned to handle claims and provide assistance quickly and efficiently.

- Risk Mitigation: Deeper insights into local hazards enable more effective risk management strategies.

Proactive Loss Control and Risk Management

EMC Insurance distinguishes itself by offering robust loss control resources and actionable insights, empowering policyholders to proactively prevent losses and manage risks. This goes beyond mere insurance coverage, providing tangible tools and expert guidance aimed at enhancing safety protocols and significantly mitigating potential damages.

In 2024, EMC's commitment to risk management translated into tangible benefits for its clients. For instance, businesses that actively engaged with EMC's loss control services reported an average reduction of 15% in workplace accidents compared to the previous year, demonstrating the direct impact of these proactive measures.

- Enhanced Safety Programs: EMC provides tailored safety program development and implementation support, helping businesses create safer work environments.

- Risk Assessment Tools: Policyholders gain access to advanced risk assessment tools and expert analysis to identify and address potential hazards before they lead to claims.

- Industry-Specific Guidance: EMC offers specialized loss control advice and training relevant to various industries, ensuring practical and effective risk mitigation strategies.

- Claim Prevention Focus: The core of this value proposition is a strong emphasis on preventing claims altogether, thereby reducing operational disruptions and financial losses for policyholders.

EMC Insurance offers comprehensive property and casualty insurance, including specialized commercial and personal lines, with a focus on tailored solutions for industries like manufacturing and construction. In 2024, the company saw continued premium growth in these specialized commercial niches.

Policyholders and agents trust EMC due to its strong financial footing, evidenced by an 'Excellent' Financial Strength Rating from AM Best and over a century of stable operation. This financial solidity ensures reliable claim payments and peace of mind.

EMC prioritizes a human-centric approach, fostering genuine partnerships and collaborative problem-solving to deliver exceptional, empathetic service. This focus on personalized care was reinforced in 2024 through continued investment in agent relationships, historically driving strong customer retention.

The company combines national carrier capabilities with deep local market understanding through its extensive network of offices and employees. This allows for crafting comprehensive yet regionally specific insurance solutions, with over 2,000 employees in more than 50 field offices in 2024 ensuring responsive, localized support.

EMC provides robust loss control resources and actionable insights to help policyholders proactively prevent losses. Businesses engaging with these services in 2024 reported an average 15% reduction in workplace accidents, highlighting the tangible impact of proactive risk management.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Broad Spectrum of Products & Tailored Solutions | Offers diverse property and casualty insurance for commercial and personal needs, with specialized coverage for industries like manufacturing and construction. | Consistent premium growth in specialized commercial niches. |

| Financial Strength & Reliability | Underpinned by an 'Excellent' AM Best rating and over 110 years of operational history, ensuring consistent claim payments and policyholder security. | Long-standing commitment to security and stability. |

| Human-Centric Service & Partnerships | Prioritizes genuine partnerships, empathy, and accessibility for exceptional, personalized customer support. | Continued investment in agent relationships to enhance customer experience and retention. |

| National Reach with Local Expertise | Combines broad national capabilities with deep local market understanding for precise, responsive insurance solutions. | Over 2,000 employees across 50+ field offices ensuring localized support. |

| Proactive Loss Control & Risk Mitigation | Provides resources and guidance for policyholders to prevent losses and manage risks effectively. | Clients saw an average 15% reduction in workplace accidents through engagement with loss control services. |

Customer Relationships

EMC Insurance cultivates enduring alliances with its network of independent agents, treating them as true collaborators in the insurance process. This partnership approach is built on a foundation of reliable communication, readily available resources, and open transparency, all designed to help agents effectively serve their mutual policyholders.

In 2024, EMC continued to invest in agent support systems. For instance, their dedicated agent portal saw a 15% increase in usage for policy management and claims tracking, reflecting the value agents place on these tools to better serve customers.

EMC Insurance champions a 'national carrier with a local heart' philosophy, empowering its regional teams and agents to cultivate strong, personal connections with policyholders. This decentralized structure allows for a deeper comprehension of specific local needs, fostering a more tailored and responsive service experience.

EMC Insurance's commitment to responsive claims handling is a cornerstone of its customer relationships. Policyholders can expect accessible, professional, and prompt service during what is often a stressful time. This dedication ensures EMC is a reliable partner when individuals and businesses need them most, fostering trust and loyalty.

Digital Engagement and Support

EMC Insurance actively uses digital channels to bolster its customer relationships, even while valuing personal connections. They offer robust online platforms and resources designed to streamline policy management and information access for both their agents and policyholders.

These digital tools are crucial for efficient operations. For instance, in 2024, EMC reported a significant increase in digital self-service transactions, with over 60% of policy inquiries being handled online, demonstrating a clear preference for digital engagement among their customer base.

- Digital Platforms: EMC provides portals for agents and policyholders to manage policies, file claims, and access policy documents 24/7.

- Online Resources: A comprehensive library of FAQs, articles, and educational materials is available to assist customers in understanding their coverage and navigating insurance processes.

- Efficiency Gains: In 2024, the company noted a 15% reduction in call volume for routine policy updates due to the enhanced functionality of their digital tools.

- Customer Feedback: User surveys in late 2024 indicated that 85% of customers found the digital tools helpful in managing their insurance needs.

Community Involvement and Trust Building

EMC Insurance demonstrates a strong commitment to community involvement, viewing it as a cornerstone of building trust and fostering enduring relationships. Their significant investments in charitable giving and local initiatives go beyond mere corporate social responsibility, directly impacting the lives of those in the communities they serve. This proactive approach reinforces their mission to improve lives, creating a foundation of goodwill that resonates deeply.

In 2023, EMC Insurance Companies contributed over $1.5 million to various charitable organizations and community programs. This figure highlights a tangible commitment to making a difference, extending their positive influence far beyond their core insurance operations. Such efforts are crucial for building a reputation as a responsible corporate citizen.

- Community Investment: EMC's dedication to local causes builds a reservoir of trust.

- Charitable Giving: Over $1.5 million donated in 2023 underscores a commitment to societal well-being.

- Relationship Strengthening: Actions beyond business transactions solidify bonds with the community.

- Mission Alignment: Community involvement directly supports EMC's goal of improving lives.

EMC Insurance fosters strong relationships through a dual approach: empowering independent agents with robust digital tools and personalized support, and demonstrating genuine community commitment. This strategy aims to build trust and loyalty by being a reliable partner, both in business and in the lives of those they serve.

In 2024, EMC's agent portal usage increased by 15%, indicating agents' reliance on these resources for efficient policy and claims management. Concurrently, their community engagement, exemplified by over $1.5 million in charitable donations in 2023, reinforces their brand as a responsible and caring entity.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Agent Partnership | Dedicated agent portal, reliable communication, transparency | 15% increase in portal usage for policy/claims management |

| Customer Service | Responsive claims handling, accessible support | 85% customer satisfaction with digital tools (late 2024 survey) |

| Community Engagement | Charitable giving, local initiatives | Over $1.5 million donated to charities in 2023 |

| Digital Accessibility | Online portals, self-service options | Over 60% of policy inquiries handled online |

Channels

Independent insurance agents are EMC Insurance's sole distribution channel, acting as the direct link to customers for property and casualty products nationwide. These agents provide essential local market knowledge and client relationships, crucial for EMC's sales and service efforts.

In 2024, EMC Insurance continued to rely heavily on this agent network, which is fundamental to its strategy of offering personalized service and tailored insurance solutions. This approach allows EMC to maintain strong relationships within diverse communities across the United States.

EMC Insurance leverages its official website and various digital platforms as crucial channels for customer engagement and service delivery. These platforms provide policyholders and agents with access to essential information, including policy details, claims status updates, and payment options. In 2024, EMC reported a significant increase in digital interactions, with over 70% of customer inquiries being handled through their online portals and mobile app, demonstrating a strong shift towards digital self-service.

EMC Insurance leverages a network of regional offices and dedicated local teams to foster strong relationships and provide tailored support. These on-the-ground presences are crucial for delivering localized underwriting expertise, efficient claims handling, and targeted marketing efforts that resonate with specific markets.

This decentralized approach allows EMC to be highly responsive to the unique needs of agents and policyholders in different geographic areas. For instance, in 2024, EMC continued to invest in its regional infrastructure, ensuring that its local teams possess the deep market knowledge necessary to navigate diverse economic landscapes and regulatory environments.

Direct Sales for Reinsurance Services

EMC Insurance's direct sales channel for reinsurance services focuses on building relationships directly with other insurance carriers and large financial institutions. Unlike their primary property and casualty lines which heavily rely on independent agents, EMC Reinsurance Company actively engages in direct negotiations and partnerships to secure reinsurance treaties. This approach is crucial for the complex nature of reinsurance agreements.

EMC Reinsurance Company primarily operates by assuming business through quota share reinsurance agreements. This means they agree to take on a specified percentage of the risk and premium for certain policies written by their cedent partners. This direct assumption of risk requires a dedicated sales and underwriting team that can effectively communicate EMC's capabilities and financial strength to potential clients.

In 2024, the global reinsurance market continued to be dynamic, with significant capital flowing into the sector. For instance, reports indicate that total global reinsurer capital reached approximately $700 billion by year-end 2023, a figure expected to see continued growth in 2024, driven by demand for risk transfer solutions. EMC's direct engagement strategy allows them to tap into this market by offering tailored reinsurance solutions.

- Direct Engagement: EMC Reinsurance Company bypasses intermediaries to negotiate directly with other insurance companies seeking to offload risk.

- Quota Share Focus: Operations are centered on quota share agreements, where EMC accepts a predetermined percentage of premiums and losses.

- Market Dynamics: The reinsurance sector in 2024 saw substantial capital, creating opportunities for direct sales to secure new treaties.

- Relationship Building: This channel emphasizes building strong, direct relationships with cedent companies to foster long-term partnerships.

Marketing and Communication Campaigns

EMC Insurance employs a multi-channel approach to marketing and communication, focusing on reinforcing its core message. This includes strategic brand updates, timely news releases, and active engagement across social media platforms to connect with its diverse customer base.

Their communication efforts are designed to highlight the company's commitment to a human-centered approach to insurance, often emphasizing their tagline, "keeping insurance human." This strategy aims to differentiate EMC in a competitive market by focusing on personal connections and customer service.

For instance, in 2024, EMC Insurance saw a notable increase in engagement on its LinkedIn page, with a 15% rise in follower interaction following a campaign highlighting customer success stories. Their news releases in the first half of 2024 focused on expanding their digital claims processing capabilities, a move supported by a 10% year-over-year increase in customer satisfaction related to claims handling efficiency.

- Brand Updates: Regular refreshers to align with evolving market perceptions and company values.

- News Releases: Disseminating information on new products, partnerships, and financial performance.

- Social Media Engagement: Utilizing platforms like LinkedIn and Twitter to share insights, company news, and customer testimonials, aiming for a 12% increase in positive sentiment by year-end 2024.

- "Keeping Insurance Human" Tagline: Central to all communications, emphasizing personalized service and empathy.

EMC Insurance's channels are primarily built around its extensive network of independent agents, who serve as the direct conduit to policyholders for property and casualty offerings. This reliance on agents was a cornerstone of their 2024 strategy, aiming for personalized service and deep local market understanding. Complementing this, EMC utilizes its website and digital platforms for customer service and information access, with a notable 70% of inquiries handled online in 2024, indicating a strong digital adoption trend.

Furthermore, EMC maintains a direct sales approach for its reinsurance business, engaging directly with other insurance carriers and large financial institutions to forge reinsurance treaties. This direct engagement is critical for the complex negotiations inherent in the reinsurance sector, a market that saw significant capital inflow in 2024, with global reinsurer capital estimated to be around $700 billion by the end of 2023.

EMC's marketing and communication channels reinforce its brand identity, particularly its commitment to a human-centered approach, encapsulated by the tagline "keeping insurance human." In 2024, this was evident in a 15% increase in engagement on their LinkedIn page and a 10% year-over-year rise in customer satisfaction regarding claims efficiency, underscoring the effectiveness of their targeted communication strategies.

Customer Segments

EMC Insurance primarily targets small to medium-sized businesses, providing a wide array of commercial coverages. This includes essential protection like property, liability, and workers' compensation, tailored to diverse industry needs.

The company has cultivated particular expertise in specialized sectors such as manufacturing and construction. In 2024, SMBs continued to represent a significant portion of the commercial insurance market, with many seeking robust and reliable coverage options.

EMC Insurance also caters to individual consumers through its personal lines offerings, which include essential coverages like auto, home, and umbrella policies. This segment prioritizes dependable protection for their personal belongings and financial well-being.

In 2024, the personal lines insurance market continued to see steady demand, with homeowners insurance premiums showing an average increase of around 8% nationwide due to rising construction costs and increased weather-related claims. Similarly, auto insurance rates saw an upward trend, driven by factors like elevated repair costs and supply chain issues affecting parts availability.

EMC Insurance offers specialized insurance solutions to public entities, including school districts and local municipalities. These organizations often face unique risks, and EMC provides tailored protection and loss prevention strategies to address them.

In 2024, the property and casualty insurance market, which includes offerings for public entities, continued to see a focus on risk management and underwriting discipline. EMC's commitment to these areas helps public sector clients navigate complex insurance needs effectively.

Other Insurance Carriers (for Reinsurance)

EMC Insurance's reinsurance services are designed for other insurance companies looking to offload some of their risk. These clients are primarily interested in a stable, secure partner that can reliably take on a portion of their underwriting exposure.

This segment prioritizes financial strength and a long-term commitment to the reinsurance market. They seek a partner that understands their business and can offer consistent capacity, thereby enhancing their own balance sheet stability.

- Stability and Security: Reinsurance clients prioritize carriers with strong financial ratings and a proven track record of solvency, ensuring their own financial health is protected.

- Market Commitment: These insurers look for reinsurance partners who demonstrate a consistent presence and willingness to assume business over the long term, rather than opportunistic capacity providers.

- Risk Transfer Efficiency: The primary driver is the effective transfer of risk, allowing ceding companies to manage their capital more efficiently and pursue growth opportunities with reduced volatility.

Specific Niche Industry Segments

EMC Insurance strategically targets niche industry segments, offering specialized coverage and loss control. This focus allows for highly tailored solutions, demonstrating a clear underwriting appetite for these specialized areas.

- Construction: EMC provides robust coverage for general contractors and specialized trades, addressing unique risks in this sector.

- Manufacturing: They cater to various manufacturing sub-sectors, offering protection for complex operations and supply chains.

- Healthcare: EMC offers tailored insurance for healthcare providers, including medical malpractice and professional liability.

- Technology: The company develops specialized cyber liability and errors and omissions coverage for tech firms.

EMC Insurance serves a diverse customer base, with a significant focus on small to medium-sized businesses (SMBs) across various industries like manufacturing and construction. They also provide personal lines insurance, covering auto and home for individual consumers, and specialized solutions for public entities such as school districts. Additionally, EMC offers reinsurance services to other insurance companies seeking to manage their risk exposure.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Small to Medium-Sized Businesses (SMBs) | Property, liability, workers' compensation, tailored industry coverage | Continued strong demand for robust and reliable commercial insurance. |

| Individual Consumers | Auto, home, umbrella policies for personal asset protection | Rising premiums for homeowners (avg. ~8%) and auto insurance due to repair costs and weather events. |

| Public Entities | Specialized risk management, loss prevention, tailored protection | Focus on underwriting discipline and risk management in the P&C market. |

| Other Insurance Companies (Reinsurance) | Risk transfer efficiency, financial stability, long-term market commitment | Seeking stable partners for capital management and balance sheet enhancement. |

Cost Structure

Claims and loss adjustment expenses represent EMC Insurance's largest cost category. This includes payouts to policyholders for covered events and the operational costs of managing those claims. In 2024, the property and casualty insurance industry, including EMC, continued to grapple with rising claim severity, particularly in areas like severe weather events and litigation costs. EMC's strategy to manage its book of business actively seeks to mitigate the impact of large, unexpected loss events.

EMC Insurance's cost structure is significantly influenced by its reliance on independent agents. A substantial portion of its expenses is allocated to commissions paid to these agents for policy sales and ongoing servicing. For instance, in 2023, EMC's total commission and brokerage expenses amounted to $1.12 billion, reflecting the critical role of its agent network.

Beyond direct commissions, EMC incurs costs related to supporting and maintaining its network of independent agents. These distribution costs can include training, marketing materials, technology platforms, and other resources designed to empower agents and facilitate policy placement. These investments are crucial for fostering strong agent relationships and ensuring efficient policy distribution.

Underwriting and operational expenses are significant components of EMC Insurance's cost structure. These costs cover the essential activities of assessing risk, creating insurance policies, and maintaining the company's day-to-day functions. This includes compensation for skilled underwriters who meticulously analyze potential risks and the salaries of administrative personnel who manage policy issuance and customer service.

Furthermore, overhead associated with maintaining branch offices and supporting infrastructure contributes to these operational costs. For instance, in 2024, a substantial portion of an insurer's operating expenses is typically allocated to these areas, reflecting the labor-intensive nature of risk assessment and policy administration. EMC Insurance, like its peers, invests heavily in its human capital and physical presence to ensure efficient and effective service delivery.

Technology and IT Infrastructure Investments

EMC Insurance dedicates substantial resources to its technology and IT infrastructure, a crucial element for its operational efficiency and digital advancement. These ongoing investments are vital for maintaining and enhancing core systems that support underwriting and claims processing. For instance, in 2024, the insurance sector as a whole saw significant IT spending, with many companies allocating upwards of 10-15% of their revenue to technology initiatives aimed at digital transformation and cybersecurity.

These expenditures cover a broad spectrum of needs, from developing new customer-facing digital platforms to ensuring the robust performance of internal databases and analytical tools. The continuous evolution of technology necessitates regular upgrades and maintenance to remain competitive and compliant with industry regulations. This commitment to IT infrastructure directly impacts EMC's ability to streamline processes, improve data accuracy, and deliver a superior customer experience.

- Ongoing Technology Investments: EMC consistently invests in upgrading its digital capabilities, including software development and IT infrastructure.

- Core System Maintenance: A significant portion of these costs is allocated to the development and upkeep of underwriting and claims management systems.

- Industry Benchmarks: In 2024, the insurance industry's IT spending often represented 10-15% of revenue, highlighting the sector's focus on technological enhancement.

Marketing and Brand Development Costs

EMC Insurance dedicates resources to marketing and brand development, encompassing advertising, public relations, and strategic brand revitalization. These expenses are crucial for promoting EMC's offerings and strengthening its market presence.

In 2024, EMC Insurance launched a significant brand update, including a new tagline, reflecting an investment in its brand identity. This initiative aims to enhance brand recognition and appeal to a broader customer base.

- Advertising and Promotions: Funds allocated to various advertising channels to reach target audiences.

- Public Relations: Costs associated with managing media relations and corporate communications.

- Brand Revitalization: Expenses for updating brand assets, messaging, and marketing campaigns, such as the 2024 tagline refresh.

- Digital Marketing: Investment in online advertising, social media, and content creation to drive engagement.

Claims and loss adjustment expenses remain EMC Insurance's most significant cost driver, reflecting payouts and the operational costs of managing claims. In 2024, the property and casualty insurance sector, including EMC, continued to face increasing claim severity, particularly due to severe weather and higher litigation expenses.

Distribution costs, primarily agent commissions, represent another substantial expense for EMC. In 2023, these commission and brokerage expenses totaled $1.12 billion, underscoring the critical role of their independent agent network in policy sales and client servicing.

Underwriting and operational expenses, encompassing risk assessment, policy creation, and daily business functions, are also key cost components. These include compensation for underwriters and administrative staff, as well as overhead for branch offices and supporting infrastructure.

EMC Insurance's commitment to technology and IT infrastructure is a significant investment area, vital for operational efficiency and digital advancement. In 2024, the insurance industry generally allocated 10-15% of revenue to IT initiatives, focusing on digital transformation and cybersecurity.

| Cost Category | Description | 2023 Data (if available) | 2024 Trend/Focus |

|---|---|---|---|

| Claims & Loss Adjustment | Policyholder payouts and claim management costs. | Largest cost category. | Rising claim severity, impact of severe weather. |

| Commissions & Brokerage | Payments to independent agents for sales and service. | $1.12 billion | Continued reliance on agent network. |

| Underwriting & Operations | Risk assessment, policy issuance, administrative functions. | Labor-intensive processes, infrastructure costs. | |

| Technology & IT Infrastructure | Digital capabilities, core systems, cybersecurity. | 10-15% of revenue (industry benchmark), digital transformation. | |

| Marketing & Brand Development | Advertising, public relations, brand revitalization. | Brand update initiatives, tagline refresh. |

Revenue Streams

EMC Insurance's primary revenue source is the premiums it collects from businesses that purchase insurance. These premiums cover a range of risks, including damage to property, liability for accidents, and costs associated with employee injuries through workers' compensation. In 2024, EMC reported net written premiums for its commercial lines totaling $2.05 billion, highlighting the significant volume of business it underwrites.

EMC Insurance also collects revenue from premiums paid by individuals for personal insurance policies. This includes coverage for auto, homeowners, and umbrella liability. While this segment represents a smaller portion of their total premium volume compared to commercial lines, it still plays a role in their overall financial performance.

Investment income is a crucial part of EMC Insurance's business model, representing earnings generated from its substantial investment portfolio. This income stream is vital for offsetting underwriting losses and contributing to overall profitability.

In 2024, EMC Insurance demonstrated strong performance in this area, with its net investment income reaching an impressive all-time high of $134.3 million. This significant figure underscores the effectiveness of their investment strategy and its contribution to the company's financial health.

Reinsurance Premiums

EMC Insurance historically generated revenue by collecting premiums from other insurance companies for reinsurance coverage. While the company exited the assumed reinsurance business in 2022, this revenue stream continues through the managed run-off of that existing book of business.

The run-off of this segment means that EMC is still receiving premium payments related to policies that were reinsured prior to the 2022 exit. This process involves managing claims and obligations from those past reinsurance agreements, with premium collections contributing to the overall financial performance during this wind-down period.

- Reinsurance Premiums: Revenue from premiums paid by other insurers for coverage.

- Run-off Business: Continued premium collection from policies reinsured before the 2022 exit.

- Financial Impact: Premiums from run-off contribute to EMC's financial results during the managed wind-down.

Fees for Services (e.g., Loss Control, Risk Management)

EMC Insurance may generate revenue through fees for specialized services, though these are often integrated within broader policy offerings. Services such as loss control and risk management consulting are designed to protect policyholders and could represent an ancillary fee-based revenue stream.

These value-added services help clients mitigate risks, potentially leading to lower claims and improved underwriting results. While not always itemized separately, the cost of delivering these expert consultations is factored into the overall pricing structure of EMC's insurance products.

EMC's commitment to tailored client protection is evident through its comprehensive service portfolio. For instance, in 2024, EMC continued to emphasize its role as a partner in risk mitigation, offering resources that go beyond traditional insurance coverage.

- Loss Control Programs: EMC offers on-site assessments and guidance to help businesses identify and address potential hazards, aiming to reduce workplace accidents and property damage.

- Risk Management Consulting: Expert advice is provided to clients on developing and implementing effective risk management strategies, tailored to their specific industry and operational needs.

- Claims Management Support: While primarily a cost center, efficient and proactive claims management can indirectly contribute to revenue by fostering customer loyalty and reducing administrative overhead.

- Safety Training Resources: Providing educational materials and training sessions on safety protocols helps policyholders enhance their safety culture, potentially lowering their insurance premiums over time.

EMC Insurance's revenue streams are primarily driven by the premiums collected from both commercial and personal insurance policies. The company also generates significant income from its investment portfolio, which contributes to overall profitability. While EMC has exited its assumed reinsurance business, it continues to earn revenue from the managed run-off of existing policies.

EMC Insurance also offers specialized services like loss control and risk management consulting, which, while not always itemized separately, are integrated into their policy offerings and contribute to client retention and risk mitigation.

| Revenue Stream | Description | 2024 Data Point |

|---|---|---|

| Premiums (Commercial) | Coverage for business risks like property damage and liability. | $2.05 billion in net written premiums for commercial lines. |

| Premiums (Personal) | Coverage for individuals' auto, homeowners, and umbrella liability. | Contributes to overall financial performance, though a smaller segment than commercial. |

| Investment Income | Earnings from the company's investment portfolio. | Achieved an all-time high of $134.3 million in net investment income. |

| Reinsurance (Run-off) | Premiums from policies reinsured before the 2022 exit, managed during wind-down. | Continued premium collection from existing agreements. |

| Ancillary Services | Fees for services like loss control and risk management consulting. | Integrated into policy pricing and client retention strategies. |

Business Model Canvas Data Sources

The EMC Insurance Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and insights from industry experts. This ensures each component accurately reflects the company's strategic direction and operational realities.