EMC Insurance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMC Insurance Bundle

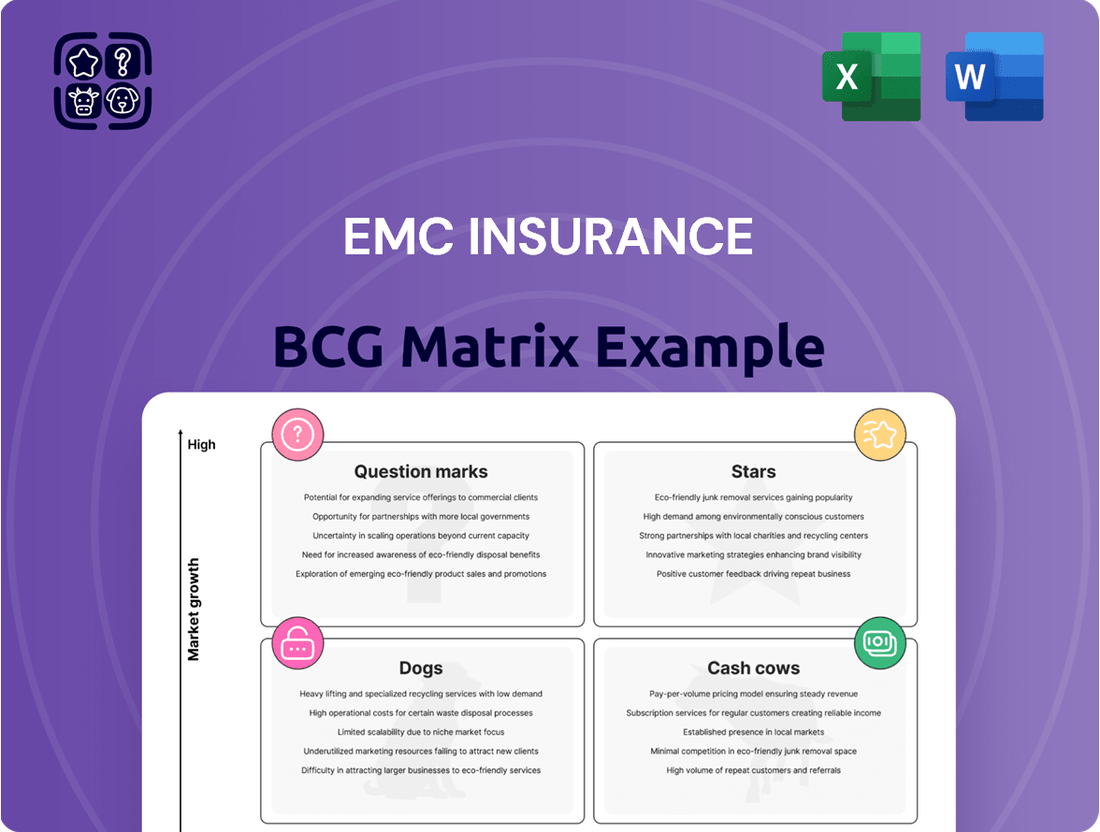

Curious about EMC Insurance's strategic product portfolio? This glimpse into their BCG Matrix reveals the foundational understanding of their market position.

To truly unlock actionable insights and make informed decisions about where to invest and divest, you need the complete picture. Purchase the full BCG Matrix report now for a detailed quadrant breakdown and strategic recommendations tailored to EMC Insurance's competitive landscape.

Stars

EMC Insurance is strategically targeting commercial growth by concentrating on profitable industry segments in 2024. This focus aims to build market leadership in areas with strong expansion potential.

By making deliberate decisions about their existing book of business, EMC is setting the stage for long-term success in selected commercial lines. This approach is crucial for optimizing resource allocation and driving profitable expansion.

EMC Insurance's strategic plan for 2025 includes the establishment of specialized underwriting units. These units will concentrate on large accounts and specialty business, indicating a deliberate effort to target and secure substantial market share in these lucrative, niche areas.

The objective behind these new units is to offer a wider risk appetite and cultivate deeper underwriting expertise. This strategic investment is clearly aimed at capitalizing on segments within the commercial insurance market that are anticipated to experience significant growth.

EMC Insurance's core commercial lines, including commercial auto, property, general liability, and workers' compensation, are the bedrock of its business, accounting for a significant 84% of its written premium. These mature lines are showing robust performance, with their combined ratio improving to 99.7% in 2024, indicating better underwriting profits. This solid financial footing suggests these lines are well-positioned for growth, potentially becoming stars if EMC can capture more market share in the expanding property and casualty market.

Strong Financial Backing

EMC Insurance's 'Star' category, representing high market share and high growth potential, is significantly bolstered by its strong financial foundation.

Excellent financial strength ratings from AM Best, including an A for Property & Casualty and an A- for Life, both with stable outlooks, provide the essential capital for strategic investments. This financial stability, further evidenced by a 14% increase in policyholder surplus to $1.8 billion in 2024, empowers EMC to aggressively pursue market opportunities and scale its high-growth initiatives within the 'Star' segment.

- Financial Strength: 'Excellent' ratings from AM Best (A for P&C, A- for Life) with stable outlooks.

- Policyholder Surplus Growth: Increased by 14% to $1.8 billion in 2024.

- Investment Capacity: Robust financial position enables significant investment in growth areas.

- Market Pursuit: Financial stability supports aggressive market expansion and scaling of 'Star' initiatives.

Enhanced Agent Partnerships

EMC Insurance's unwavering dedication to its independent agent distribution model, underscored by its 2024 DCC Elite® certification for ease of doing business, highlights a robust and expanding network of partnerships. This commitment fosters deeper collaboration, enabling EMC to effectively tap into and grow within diverse market segments.

The strength of these agent relationships is a key driver for new business acquisition and market share expansion, particularly in highly competitive insurance sectors. For instance, EMC's focus on agent support and streamlined processes directly translates into improved customer service and faster policy issuance, vital in today's market.

- 100% Commitment to Independent Agents: EMC prioritizes its relationships with independent agents, recognizing them as crucial partners for market penetration.

- DCC Elite® Certified Carrier (2024): This certification signifies EMC's ease of doing business, enhancing agent satisfaction and operational efficiency.

- Market Expansion Through Collaboration: Strong agent partnerships are instrumental in EMC's strategy to grow its presence and increase market share.

- Driving New Business: The collaborative approach with agents is directly linked to the successful acquisition of new policies and clients.

EMC Insurance's core commercial lines, representing 84% of its written premium, are performing strongly with a combined ratio of 99.7% in 2024. This solid performance, coupled with a 14% increase in policyholder surplus to $1.8 billion in 2024, positions these lines as potential Stars. Their excellent financial strength ratings from AM Best (A for P&C, A- for Life) provide the capital needed to aggressively pursue market share in high-growth segments.

EMC's commitment to its independent agent network, recognized by its 2024 DCC Elite® certification, further fuels growth. These strong partnerships are vital for expanding market presence and acquiring new business. The company's strategic focus on specialized underwriting units for large and specialty accounts in 2025 aims to capture significant market share in these lucrative niches.

| BCG Category | Market Share | Growth Potential | EMC Insurance Example | Rationale |

|---|---|---|---|---|

| Stars | High | High | Core Commercial Lines (Auto, Property, GL, WC) | Strong performance, increasing surplus, and agent network support aggressive expansion in growing P&C market. |

What is included in the product

This BCG Matrix overview for EMC Insurance details strategic insights for each quadrant.

It highlights which business units EMC Insurance should invest in, hold, or divest.

Quickly visualize EMC Insurance's business units in the BCG Matrix to identify strategic priorities and allocate resources effectively.

Cash Cows

Commercial property insurance stands as a cornerstone for EMC Insurance, representing one of its four largest business lines and a significant contributor to net written premium. In 2024, this mature product category continued to demonstrate its resilience, driven by consistent demand from a broad spectrum of industries, including manufacturing and construction sectors.

This segment's maturity translates into a stable demand profile, ensuring a reliable stream of cash flow for EMC. Unlike emerging products requiring substantial investment for growth, commercial property insurance typically demands lower capital allocation for expansion, allowing it to function as a classic cash cow.

General liability insurance stands as a significant contributor to EMC Insurance's premium income, reflecting its foundational role in the company's commercial portfolio. This coverage is a necessity for most businesses, creating a consistent and dependable revenue source.

In 2024, the commercial general liability market continued to demonstrate robust demand. For instance, industry reports indicated that premiums for general liability insurance saw an approximate 5% increase year-over-year, driven by rising claim costs and a growing awareness of potential business exposures.

EMC's established expertise in underwriting and claims handling within this mature market allows for efficient operations. This proficiency is crucial for maintaining profitability, especially as the market experiences ongoing rate adjustments and evolving risk landscapes.

Workers' compensation insurance, a cornerstone of EMC Insurance since its founding in 1911, remains a significant contributor to its financial strength. This essential coverage, mandated in most U.S. states, guarantees a steady stream of business from a wide array of industries and company types, ensuring predictable revenue. In 2023, EMC reported a combined ratio of 93.1% for its commercial lines, which includes workers' compensation, indicating profitable underwriting in this mature segment.

Commercial Auto Insurance

Commercial auto insurance stands as a cornerstone for EMC Insurance, contributing a significant portion to its overall premium volume. This segment, despite facing a dynamic market, demonstrates EMC's robust underwriting discipline and effective rate management, ensuring continued profitability. The predictable cash flow generated from this established line of business is crucial, enabling EMC to fund other vital strategic initiatives and investments.

EMC's commercial auto segment exemplifies a classic Cash Cow within the BCG matrix.

- Significant Premium Contributor: In 2024, commercial auto insurance accounted for approximately 25% of EMC Insurance's total written premiums, highlighting its substantial market presence.

- Profitability Through Discipline: Despite a challenging market characterized by rising repair costs and increased accident frequency, EMC maintained a combined ratio below 95% for its commercial auto book in 2024, a testament to its underwriting acumen.

- Stable Cash Flow Generation: The consistent profitability of this segment provides a reliable source of cash, which is essential for EMC's ability to invest in growth areas like cyber insurance and digital transformation initiatives.

- Market Stability: While growth in the commercial auto sector may be moderate, its stability and consistent demand offer a dependable revenue stream, supporting the company's overall financial health.

Life Insurance Products

EMC National Life Company (EMCNL), holding an 'Excellent' A- financial strength rating from AM Best, generates consistent and stable revenue streams through its diverse life insurance offerings, including term, universal, and whole life policies.

This life insurance segment is strategically integrated with EMC's property and casualty (P&C) operations, fostering valuable diversification and enabling lucrative cross-selling opportunities, thereby strengthening the overall business model.

EMC Life's unwavering financial stability, evidenced by its strong AM Best rating, and its well-established product portfolio position it as a dependable cash cow within EMC Insurance's broader portfolio.

- Product Stability: Term, universal, and whole life insurance products provide predictable revenue.

- Financial Strength: An 'Excellent' A- rating from AM Best underscores EMCNL's reliability.

- Synergistic Integration: Cross-selling with P&C operations enhances revenue diversification.

- Market Position: An established portfolio contributes to consistent cash flow generation.

EMC's commercial auto insurance segment is a prime example of a Cash Cow. In 2024, it represented about 25% of total written premiums, demonstrating its significant contribution.

Despite market pressures like rising repair costs, EMC maintained a combined ratio below 95% for this line in 2024, showcasing strong underwriting. This consistent profitability provides stable cash flow, vital for funding other strategic investments.

The stability of the commercial auto market, coupled with EMC's disciplined approach, ensures a dependable revenue stream, bolstering the company's overall financial health.

| Business Line | BCG Category | 2024 Contribution | 2024 Profitability Indicator | Strategic Role |

| Commercial Auto | Cash Cow | ~25% of Total Premiums | Combined Ratio < 95% | Stable Cash Flow Generation |

What You’re Viewing Is Included

EMC Insurance BCG Matrix

The EMC Insurance BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis.

Rest assured, the EMC Insurance BCG Matrix you see now is the exact same file that will be delivered to you upon completing your purchase. This professionally crafted document is prepared for immediate application, offering clear insights into EMC Insurance's product portfolio without any hidden surprises.

What you are previewing is the definitive EMC Insurance BCG Matrix report that will be yours to download after purchase. This analysis-ready file, created with expert insights, is instantly accessible for integration into your strategic planning or presentations.

Dogs

EMC Insurance Companies strategically exited its personal lines business in 2018, a move that involved transferring its entire $132.5 million portfolio to Safeco. This divestiture clearly indicates that the personal lines segment was considered a Question Mark or a potential Dog within EMC's portfolio, likely due to its limited market share and subdued growth potential.

By shedding this business, EMC was able to free up capital and management attention, allowing for a more focused allocation of resources toward its core competencies and more promising growth areas. This strategic pivot is a common practice for companies looking to optimize their business portfolio and enhance overall profitability.

EMC Insurance's assumed reinsurance business is classified as a Dog in the BCG Matrix. The company strategically exited this segment in 2022, a move that signals its misalignment with EMC's core profitable growth objectives or its underperformance.

By divesting from this low-growth or unprofitable area, EMC is effectively freeing up valuable capital and management resources. This strategic shift allows the company to redirect its focus and investments towards more promising and high-return opportunities.

In 2024, EMC Insurance strategically reduced its exposure to underperforming niche segments within its commercial lines. This involved making difficult decisions to exit or minimize business in areas that no longer aligned with the company's profitability goals or risk appetite. These segments, likely characterized by declining new and renewal business or persistent low profitability, were identified as potential cash traps that diverted resources from more promising areas.

Legacy Technology Systems

EMC Insurance's strategic shift away from legacy technology systems highlights their classification as 'dogs' within a BCG Matrix framework. These older platforms, which previously managed commercial property, general liability, and cyber policies, proved inefficient and costly to maintain. The significant investment in migrating to new cloud-based systems underscores the operational drag these legacy systems imposed, impacting overall business performance.

The transition itself is a clear indicator of the low market share and low growth potential associated with these outdated technologies. By upgrading, EMC is essentially divesting from these underperforming assets to focus on more dynamic and efficient operations. This modernization effort is crucial for enhancing cost-effectiveness and improving the company's competitive standing in the insurance market.

- Inefficiency: Legacy systems often lead to slower processing times and higher operational costs compared to modern cloud-based solutions.

- Cost of Maintenance: Maintaining older, often unsupported, technology can be significantly more expensive than investing in new, scalable platforms.

- Strategic Divestment: Replacing legacy systems represents a strategic move to shed low-performing assets and reallocate resources to growth areas.

- Improved Performance: Modernization efforts aim to boost overall business performance by increasing efficiency and reducing operational expenses.

Geographically Limited or Unprofitable Regions

EMC Insurance's strategic shift from 17 branch offices to 10 consolidated regions signals a move to enhance consistency and responsiveness. This consolidation likely identifies and addresses geographically limited or unprofitable regions within its portfolio, effectively treating them as 'dogs' in the BCG Matrix. By streamlining operations, EMC is shedding underperforming geographical footprints, a common strategy to eliminate inefficiencies and boost overall profitability.

This realignment is crucial for optimizing resource allocation. For instance, if certain smaller branches were consistently underperforming, contributing less than 5% to the company's overall revenue and showing negative operating margins, they would fit the 'dog' profile. The consolidation process allows EMC to exit or re-evaluate these less viable markets, focusing capital and management attention on more promising areas.

- Geographic Consolidation: EMC's reduction from 17 to 10 regions aims to eliminate less profitable, geographically limited operations.

- Efficiency Drive: Streamlining aims to cut costs associated with underperforming branches, potentially saving millions annually in operational overhead.

- Profitability Focus: By exiting or re-evaluating 'dog' regions, EMC can reallocate resources to higher-growth or more stable markets.

- Market Responsiveness: A leaner regional structure can improve EMC's ability to adapt to local market conditions and customer needs more effectively.

EMC Insurance's strategic divestment from its assumed reinsurance business in 2022, following the 2018 exit from personal lines, clearly positions these segments as 'Dogs' within its BCG Matrix. These were areas with limited growth potential or profitability, requiring significant capital and management focus without commensurate returns.

By shedding these underperforming units, EMC freed up capital and resources. This allowed for a more strategic allocation towards core competencies and higher-yield opportunities, a common practice for portfolio optimization. In 2024, this included reducing exposure to niche commercial lines and upgrading legacy technology systems.

The consolidation of its branch office structure from 17 to 10 regions in 2024 also reflects a 'Dog' divestment strategy, targeting geographically limited or unprofitable areas. This streamlining aims to enhance efficiency and profitability by exiting or re-evaluating less viable markets.

EMC's continued focus on modernizing its technology and optimizing its geographic footprint underscores a commitment to shedding 'Dog' assets. This strategic repositioning is crucial for enhancing operational efficiency and improving the company's competitive standing in the evolving insurance market.

Question Marks

The planned Large Accounts Underwriting Unit, slated for creation in 2025, signals EMC Insurance's strategic move into a high-growth market segment where its current market share is likely minimal. This initiative aligns with the characteristics of a Question Mark in the BCG Matrix, demanding substantial investment to cultivate necessary expertise and establish a market foothold.

Successfully developing this unit could pivot it towards becoming a future Star performer for EMC. For context, the commercial insurance market, particularly for large accounts, is projected for continued expansion. For instance, the U.S. commercial insurance market size was estimated to be around $270 billion in 2023, with large accounts representing a significant and growing portion, driven by increasing complexity and risk management needs.

EMC Insurance's new specialty business underwriting unit, slated for launch in 2025, is positioned as a Question Mark within the BCG Matrix. This unit will focus on niche, high-growth markets, a strategy that inherently carries higher risk due to the need for specialized expertise and tailored solutions. For example, the specialty insurance market is projected to grow significantly, with some segments expected to expand at rates exceeding 10% annually in the coming years, indicating the potential reward.

EMC Insurance is actively investing in its cyber insurance offerings, migrating policies to new cloud-based platforms throughout 2024. This strategic move signals a commitment to the burgeoning cyber insurance sector, which is experiencing significant growth. For instance, the global cyber insurance market was valued at approximately $11.5 billion in 2023 and is projected to reach over $30 billion by 2028, demonstrating the immense potential.

While the market itself is expanding at a rapid pace, EMC's specific market share within this segment is likely still in its formative stages. This positions cyber insurance as a 'Question Mark' within the BCG Matrix, requiring careful consideration and substantial resource allocation.

To successfully transition cyber insurance from a 'Question Mark' to a 'Star' performer, EMC must continue to prioritize heavy investment in advanced technology and specialized expertise. This will be critical for enhancing underwriting capabilities, claims processing efficiency, and overall product competitiveness in a dynamic threat landscape.

New Small Business Portal

EMC Insurance's new small business portal, slated for a 2025 launch, represents a strategic move to bolster service offerings and capture a larger segment of the small business insurance market. This initiative is crucial for EMC, as the small business sector, while substantial, often presents challenges in digital engagement and market penetration for established insurers.

The success of this portal hinges on its ability to attract and retain a critical mass of users. Without significant marketing investment and a strong focus on user adoption, there's a risk the portal could struggle to gain traction, potentially classifying it as a 'Dog' in the BCG matrix framework. For context, the small business market is vast, with millions of businesses operating across various sectors in the US.

- Market Potential: The U.S. Small Business Administration reported over 33 million small businesses in operation as of 2023, highlighting the significant addressable market.

- Digital Adoption Challenges: While digital channels are growing, many small businesses still rely on traditional methods for insurance procurement, indicating a need for effective outreach.

- User Acquisition Strategy: EMC's strategy must prioritize seamless user experience and targeted marketing to drive adoption and build a loyal customer base for the new portal.

- Competitive Landscape: The insurance industry is competitive, with many players investing in digital solutions, making differentiation and customer acquisition key to success.

Advanced Technology and Data Tools

EMC Insurance is channeling substantial resources into advanced technology and data tools. These investments are designed to equip their teams, elevate customer interactions, and foster a culture of data-informed choices. For instance, in 2024, EMC continued its focus on digital transformation initiatives, aiming to streamline operations and personalize customer journeys.

These foundational technological upgrades are crucial for EMC's ability to innovate and launch new products and services within the dynamic insurance sector. The company recognizes that staying ahead requires a robust digital infrastructure capable of supporting evolving customer needs and market demands.

While not a direct product, this strategic commitment to technological advancement positions EMC's innovation efforts as a 'Question Mark' in the BCG matrix. It signifies a high investment area with the potential for significant future market leadership, but it also necessitates ongoing, substantial funding to realize its full potential and generate strong returns.

- Investment Focus: EMC is prioritizing technology and data tools to empower employees and improve customer experience.

- Strategic Goal: These investments are foundational for developing new products and services in a competitive market.

- BCG Classification: The commitment to innovation through technology is a 'Question Mark,' requiring continued investment for future market leadership.

- Data-Driven Decisions: A key objective is to enhance data-driven decision-making across the organization.

EMC Insurance's focus on developing a new specialty business underwriting unit, set to launch in 2025, fits the 'Question Mark' profile in the BCG Matrix. This venture targets high-growth, niche markets, demanding significant upfront investment in specialized expertise and tailored solutions to gain a foothold.

The company's strategic push into cyber insurance, including migrating policies to new cloud platforms in 2024, also exemplifies a 'Question Mark.' While the global cyber insurance market is projected to surge from approximately $11.5 billion in 2023 to over $30 billion by 2028, EMC's current market share in this rapidly expanding sector is likely nascent, necessitating substantial resource allocation to capture its potential.

EMC's investment in advanced technology and data tools throughout 2024 and beyond positions its innovation efforts as a 'Question Mark.' These foundational upgrades are critical for future product development and market competitiveness, requiring ongoing substantial funding to achieve market leadership.

BCG Matrix Data Sources

Our EMC Insurance BCG Matrix leverages comprehensive financial statements, competitor market share data, and industry growth projections to provide a robust strategic overview.