Embracer SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Embracer Bundle

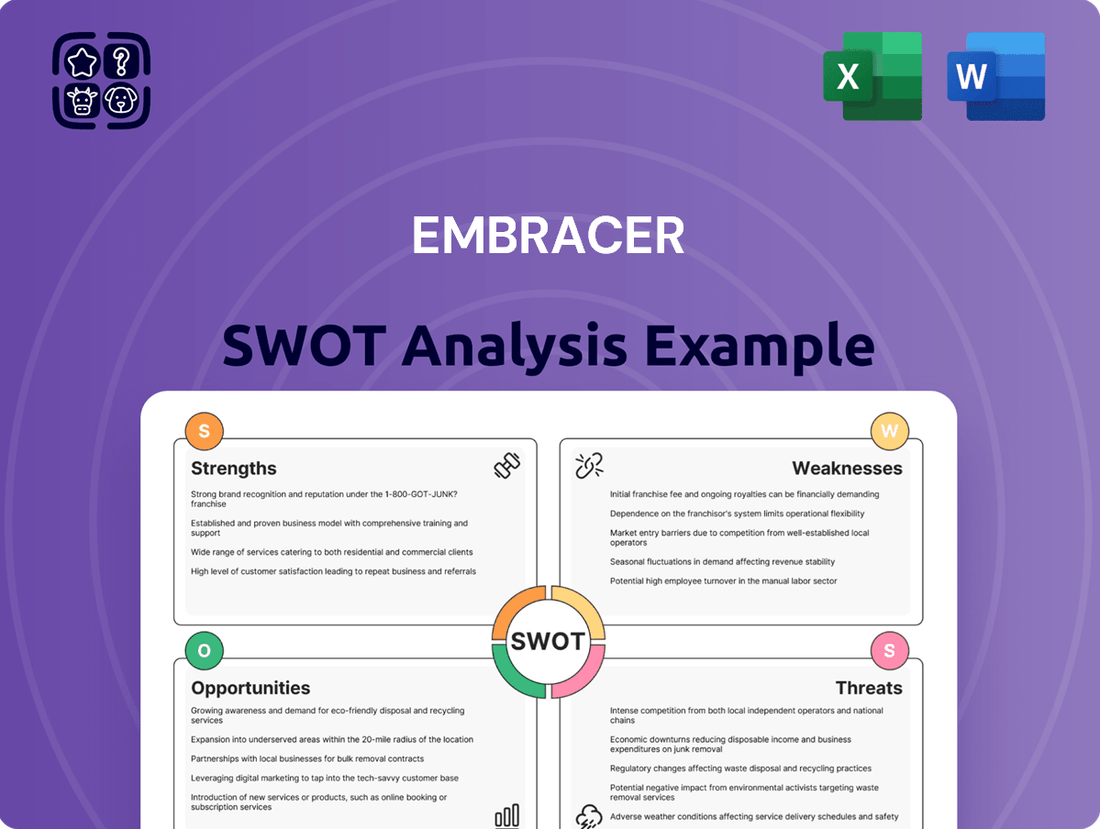

Embracer's impressive portfolio of studios and IPs presents a significant strength, but the company also faces challenges like integration risks and a competitive market. Understanding these dynamics is crucial for anyone looking to invest or strategize within the gaming industry.

Want the full story behind Embracer's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Embracer Group's strength lies in its incredibly diverse and extensive intellectual property (IP) portfolio, encompassing over 450 owned or controlled franchises. This vast library spans PC, console, and mobile gaming, alongside other media, providing a robust foundation for future content creation and cross-media synergies. The sheer breadth of these IPs allows Embracer to cater to a wide array of player preferences and entertainment tastes, a significant advantage in the competitive gaming and media landscape.

Embracer's decentralized business structure, a key strength, allows its numerous studios and companies to operate with significant creative independence. This fosters a dynamic environment ripe for innovation and agility, enabling each unit to pursue distinct visions. For instance, as of their Q3 FY23/24 report, Embracer comprised 13 operating groups with over 100 studios, showcasing the breadth of this decentralized approach.

Embracer Group has initiated a significant strategic restructuring, notably spinning off its tabletop gaming division, Asmodee Group, in late 2024. This move, along with the planned separation of Coffee Stain Group, is designed to sharpen the company's focus on its core gaming operations.

This realignment is projected to enhance profitability and cash flow by allowing management to concentrate on core strengths in game development, publishing, and transmedia. The company aims to unlock long-term value by creating more agile and specialized business units.

Strong Pipeline of Upcoming Releases

Embracer Group boasts a robust pipeline, with plans to release 76 titles across its various studios during the fiscal year 2025/26. This extensive lineup includes a variety of new intellectual properties, anticipated sequels, and revitalized remasters. Such a diverse slate underscores the company's ongoing dedication to developing and launching new content, aiming to drive revenue through its broad gaming portfolio.

The company's strategic focus on a high volume of releases highlights its commitment to sustained growth and market presence. This includes:

- New Intellectual Property Launches: Introducing fresh game concepts to capture new audiences.

- Sequels to Established Franchises: Leveraging existing fan bases for popular game series.

- Remasters and Remakes: Reimagining classic titles for contemporary platforms and players.

Presence Across Multiple Entertainment Sectors

Embracer's strength lies in its broad reach across various entertainment domains, extending well beyond its core video game business. This diversification is a significant advantage, mitigating risks associated with any single market. For instance, the recent spin-off of Asmodee Group highlights its substantial footprint in the thriving board game sector.

Furthermore, Embracer actively participates in other key entertainment segments. Its ownership of Dark Horse Comics demonstrates a solid presence in the comic book industry, a fertile ground for intellectual property (IP) development. This multi-sector approach allows for synergistic opportunities, such as leveraging popular IPs across different media formats.

This strategic diversification is crucial for fostering transmedia adaptations. Embracer can capitalize on its extensive IP portfolio, as seen with potential new Tomb Raider stories planned for streaming and film. This cross-pollination of content across gaming, board games, comics, film, and television significantly enhances its market position and revenue potential.

- Diversified Portfolio: Embracer operates across video games, board games (via Asmodee Group), comics (Dark Horse), and film/distribution.

- Reduced Market Reliance: This broad presence lessens dependence on any single entertainment segment, offering greater stability.

- Transmedia Opportunities: The company can leverage its IPs for cross-platform adaptations, such as Tomb Raider content for streaming and film.

- IP Monetization: Expansion into multiple sectors provides varied avenues for monetizing its intellectual property.

Embracer's primary strength is its vast and diverse intellectual property (IP) portfolio, boasting over 450 franchises across gaming and other media. This extensive library, spanning PC, console, and mobile, provides a strong foundation for future content and cross-media opportunities. The sheer breadth of these IPs allows Embracer to appeal to a wide range of consumer tastes, a significant advantage in the competitive entertainment market.

The company's decentralized structure, comprising over 100 studios as of Q3 FY23/24, fosters innovation and agility by granting significant creative independence to its operating groups. This allows for diverse approaches to game development and IP management.

Embracer is actively streamlining its operations, exemplified by the late 2024 spin-off of Asmodee Group and the planned separation of Coffee Stain Group. This strategic realignment aims to sharpen focus on core gaming operations, enhance profitability, and unlock long-term value by creating more specialized business units.

A robust pipeline is another key strength, with 76 titles slated for release in FY2025/26, including new IPs, sequels, and remasters. This commitment to a high volume of releases ensures sustained market presence and growth opportunities.

Embracer's diversification across video games, board games (Asmodee), comics (Dark Horse), and film/distribution significantly reduces reliance on any single market segment. This broad presence enables lucrative transmedia opportunities, such as leveraging IPs like Tomb Raider for streaming and film adaptations, thereby diversifying revenue streams.

What is included in the product

Analyzes Embracer’s competitive position through key internal and external factors, highlighting its strong brand portfolio and growth opportunities while acknowledging integration challenges and market saturation risks.

Simplifies complex strategic challenges by highlighting key strengths and weaknesses for targeted action.

Weaknesses

Embracer's significant restructuring, which included the layoff of over 1,400 employees and the closure of multiple studios by mid-2024, has undoubtedly created short-term operational turbulence. This extensive overhaul, though aimed at future efficiency, directly impacts current production pipelines and team cohesion. The loss of institutional knowledge and the potential for project delays or cancellations are direct consequences of such widespread workforce adjustments.

Embracer Group has seen a downturn in net sales for both its PC/console and mobile gaming divisions. For the third quarter of fiscal year 2024, net sales for the PC/Console segment were SEK 4,765 million, a decrease from SEK 5,858 million in the same period last year. Similarly, the Mobile segment reported net sales of SEK 1,519 million, down from SEK 1,904 million year-over-year.

Embracer Group's financial performance has shown significant volatility. For the fiscal year ending March 31, 2024, the company reported a net loss of SEK 18.17 billion (approximately $1.7 billion), a stark contrast to the profit achieved in the prior year.

This substantial loss underscores past difficulties in ensuring consistent profitability, particularly in light of the company's aggressive expansion strategy. While ongoing restructuring efforts are intended to bolster financial stability, the recent performance highlights the inherent risks associated with rapid growth and integration of acquired entities.

Dependence on Key IP Performance

Embracer's financial health is closely tied to the performance of its major intellectual properties (IPs). The company's revenue streams are disproportionately influenced by the success of a limited number of high-profile AAA game releases.

Delays in these anticipated flagship titles, like a previously expected unannounced AAA game, can cause significant downward revisions to financial projections and negatively impact overall revenue generation. For instance, the company has previously cited delays in key game development as a reason for financial underperformance.

- Reliance on AAA Titles: Financial results heavily depend on a few major game launches.

- Impact of Delays: Postponements of key releases directly affect revenue forecasts.

- IP Performance Sensitivity: The company's valuation is sensitive to the success of its core intellectual properties.

Challenges with Integration and Synergy

Embracer's aggressive acquisition strategy, while fueling growth, presents significant hurdles in achieving seamless integration and unlocking the full potential of synergies. This decentralized model, though offering operational autonomy, can complicate the harmonization of systems, cultures, and strategic objectives across its diverse portfolio of studios.

The company's recent decision to restructure into three distinct operating groups—Embracer Gaming, Embracer Group Services, and Embracer Investments—underscores past difficulties in fostering optimal value creation within its previous conglomerate structure. This move signals a recognition that the existing framework may not have been conducive to maximizing the collective strengths of its acquired entities.

For instance, while Embracer boasts a vast portfolio, the ability to leverage shared resources, intellectual property, and development talent across these disparate units has been an ongoing challenge. The sheer volume and speed of acquisitions, with over 120 companies acquired by late 2023, naturally strain integration capabilities.

- Integration Strain: Rapid expansion through acquisitions can overwhelm internal resources dedicated to integrating new entities, potentially delaying synergy realization.

- Synergy Realization: Achieving meaningful financial and operational synergies across a highly decentralized and diverse group of companies remains a core challenge.

- Structural Inefficiencies: The split into three entities suggests that the prior conglomerate structure was not effectively facilitating value creation or operational efficiency.

- Cultural and Operational Alignment: Harmonizing diverse company cultures and operational practices is a complex, long-term undertaking that can impede unified strategic execution.

Embracer's significant restructuring, including over 1,400 layoffs by mid-2024, has disrupted operations and potentially impacted game development pipelines. The company's financial performance has been volatile, with a net loss of SEK 18.17 billion for the fiscal year ending March 31, 2024, highlighting profitability challenges. Revenue streams are heavily reliant on a few major AAA titles, making the company vulnerable to release delays and IP performance fluctuations.

The company's rapid acquisition strategy, with over 120 companies acquired by late 2023, has created integration strain and difficulties in realizing synergies across its decentralized structure. The recent split into three operating groups suggests prior structural inefficiencies in fostering value creation. Harmonizing diverse company cultures and operational practices remains a complex, long-term challenge that can hinder unified strategic execution.

| Weakness | Description | Financial Impact (FY24) |

| Integration Strain & Synergy Realization | Difficulty integrating over 120 acquired companies and achieving operational/financial synergies. | Contributes to ongoing restructuring costs and potential underperformance of acquired assets. |

| Reliance on AAA Titles & IP Sensitivity | Revenue heavily dependent on a few major game releases; delays impact financial projections. | Net sales for PC/Console fell to SEK 4,765 million (Q3 FY24) from SEK 5,858 million year-over-year. |

| Profitability Volatility | Significant net loss of SEK 18.17 billion for FY24, indicating challenges in consistent profitability. | Underscores risks associated with aggressive growth and integration strategies. |

| Operational Disruption from Restructuring | Layoffs and studio closures impacting production and team cohesion. | Short-term turbulence affecting current project timelines and institutional knowledge. |

Preview the Actual Deliverable

Embracer SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of Embracer's strategic position, ready for your immediate use.

Opportunities

The strategic decision to spin off entities like Asmodee Group, Coffee Stain & Friends, and Fellowship Entertainment (formerly Middle-earth Enterprises & Friends) is a significant opportunity for focused growth. This separation allows each business to concentrate on its specific market and strategic objectives.

This specialization is expected to unlock more efficient capital allocation and operational improvements, as each company can tailor its strategies to its unique challenges and opportunities. For instance, Asmodee can double down on its tabletop gaming portfolio, while Coffee Stain can pursue its digital entertainment ventures with greater agility.

Furthermore, distinct publicly traded entities provide clearer equity stories, potentially attracting more targeted investor interest and facilitating easier access to capital for each business. This clarity can enhance valuations and support independent expansion plans.

Embracer's ownership of significant intellectual properties (IPs) like The Lord of the Rings through Middle-earth Enterprises (now Fellowship Entertainment) and Tomb Raider presents a prime opportunity for transmedia expansion. This means leveraging these beloved franchises across various platforms beyond just video games.

Developing new content in streaming series, feature films, comic books, and a wide array of merchandise can dramatically broaden the audience reach and create substantial new revenue streams. For instance, the continued success of The Lord of the Rings in various media, including the Amazon Prime series Rings of Power which premiered in September 2022 and generated significant viewership, demonstrates the immense commercial potential.

Furthermore, the Tomb Raider franchise, with its recent game releases and past film adaptations, also holds considerable untapped potential for expansion into new narrative arcs and product lines. The global market for entertainment IPs continues to grow, with the video game market alone projected to reach over $200 billion in 2024, indicating a strong appetite for content across multiple formats.

Following its restructuring, Embracer Group is sharpening its focus on its core PC and console intellectual properties (IPs). This strategic pivot means resources are now being channeled into established franchises like Darksiders, Dead Island, Kingdom Come: Deliverance, and the recently acquired Tomb Raider series.

This concentrated approach on proven IPs is designed to elevate the quality of upcoming releases and improve their market performance. By prioritizing these key franchises, Embracer aims to capitalize on existing brand recognition and fan bases, potentially leading to more predictable and robust commercial outcomes.

Potential for Improved Profitability and Cash Flow

Embracer Group's ongoing restructuring program, which includes strategic divestments and significant cost reduction initiatives, is a key opportunity to bolster its financial health. The primary goal is to enhance cash conversion cycles and streamline operations for greater efficiency. This financial discipline is designed to reduce the need for capital expenditure, paving the way for a stronger balance sheet.

The company anticipates that these measures will translate into improved profitability and a materially better free cash flow generation in the fiscal years ahead. For instance, the divestment of certain studios, like Saber Interactive's operations in Eastern Europe for $247 million in 2023, directly contributes to this cash flow improvement and operational focus. This strategic shift is expected to solidify Embracer's financial standing.

Key aspects of this opportunity include:

- Enhanced Cash Conversion: Streamlining operations and divesting non-core assets to free up capital.

- Operational Efficiency: Implementing cost reductions across the organization to improve margins.

- Reduced Capital Expenditure: Focusing investment on core, high-potential projects.

- Improved Profitability: The combined effect of cost savings and strategic asset management is projected to boost net income.

Capitalizing on New Game Releases

Embracer Group's strategic focus on new game releases presents a significant opportunity. With a robust pipeline of 76 games slated for release across FY 2025/26, the company is well-positioned to capitalize on market demand for fresh content, including sequels and remasters.

Successful launches, especially of anticipated AAA titles, could provide substantial revenue streams and enhance Embracer's market presence. For instance, the company's diverse portfolio allows for cross-promotional opportunities and the leveraging of established intellectual properties to drive sales.

- Pipeline Strength: 76 games scheduled for release in FY 2025/26.

- Revenue Potential: Opportunity to capture significant market share through new titles.

- AAA Impact: Successful unannounced AAA game launches could provide considerable financial uplift.

The strategic spin-offs of Asmodee, Coffee Stain & Friends, and Fellowship Entertainment allow each entity to pursue focused growth and capital allocation. This specialization is expected to unlock operational efficiencies and attract targeted investor interest, enhancing valuations for each independent business.

Leveraging major IPs like The Lord of the Rings and Tomb Raider for transmedia expansion into film, series, and merchandise presents substantial new revenue streams. The continued success of IPs in the growing global entertainment market, with video games alone projected to exceed $200 billion in 2024, underscores this potential.

Embracer's sharpened focus on core PC and console IPs, including Darksiders and Dead Island, aims to improve the quality and market performance of upcoming releases by capitalizing on existing brand recognition. The company's robust pipeline of 76 games for FY 2025/26 offers significant revenue potential, particularly from anticipated AAA titles.

The ongoing restructuring, including divestments like Saber Interactive's Eastern European operations for $247 million in 2023, is enhancing Embracer's financial health by improving cash conversion and reducing capital expenditure. These measures are projected to bolster profitability and free cash flow generation in the coming fiscal years.

| Opportunity Area | Key Aspect | 2024/2025 Data/Projections |

| IP Transmedia Expansion | Leveraging Lord of the Rings & Tomb Raider | Global entertainment IP market growth; video games projected >$200B in 2024. |

| Pipeline Strength | New Game Releases | 76 games slated for release in FY 2025/26. |

| Financial Health Improvement | Divestments & Cost Reductions | Saber Interactive divestment ($247M in 2023) improving cash flow. |

| Strategic Focus | Core PC/Console IPs | Concentration on established franchises like Darksiders, Dead Island. |

Threats

The global gaming market is incredibly crowded, with giants like Tencent and Sony, alongside a surge of independent studios, all fighting for player engagement and revenue. This fierce competition means that even with a vast portfolio, not every Embracer Group studio's title can guarantee significant market penetration or profitability, putting pressure on the company's diverse development efforts.

While Embracer Group's significant restructuring, announced in June 2024, aimed to address financial pressures, the possibility of further project cancellations or layoffs persists. This risk is heightened if the company fails to achieve its revised financial targets or if the gaming market experiences unexpected downturns. For instance, in February 2024, Embracer announced a substantial cost-saving program, including workforce reductions, indicating ongoing financial scrutiny.

Such potential future actions could negatively impact investor sentiment, potentially leading to a decline in share price. Furthermore, a perception of instability could damage Embracer's employer brand, making it harder to attract and retain top talent in a competitive industry, which is crucial for long-term game development success.

While Embracer's split into three distinct entities—Asmodee Group, Coffee Stain & Strategy, and Middle-earth Enterprises & Gaming—aims for enhanced operational focus, the actual execution of this separation presents significant integration challenges. The process of disentangling legal structures, operational systems, and financial reporting for each new public company is inherently complex and could incur substantial, unforeseen costs. For instance, the establishment of independent corporate governance and IT infrastructure for each segment could easily exceed initial budget estimates, potentially impacting their early financial performance.

Dependence on Consumer Preferences and Trends

Embracer's reliance on consumer whims poses a significant threat. The gaming industry is notoriously fickle, with success hinging on hitting the right notes with players. A misstep in anticipating or responding to these shifts can quickly turn a promising title into a financial disappointment.

For instance, the company's performance is tied to the popularity of specific genres and franchises. If a major title fails to resonate with the market, as seen with some releases in the competitive gaming landscape, it can directly impact revenue streams. This dynamic was underscored in early 2024, where slower-than-expected sales for certain projects led to revised financial outlooks.

- Shifting Consumer Tastes: The gaming market constantly evolves, demanding continuous innovation and adaptation to new trends.

- Risk of Underperformance: Failure to align with current player preferences can result in games that don't meet sales expectations.

- Financial Repercussions: Underperforming titles directly impact revenue, potentially leading to financial setbacks and a need for strategic adjustments.

Economic Downturn and Market Volatility

Broader macroeconomic factors present a significant threat to Embracer. An economic downturn, characterized by reduced consumer spending, directly impacts discretionary purchases like video games. This could lead to lower sales volumes and subscription revenues, negatively affecting Embracer's financial performance.

Market volatility, a common feature of economic uncertainty, further exacerbates these risks. For instance, a significant global recession in 2024 or 2025 could see consumers cutting back on entertainment budgets. This would directly hit companies like Embracer that rely on robust consumer demand for their products and services.

- Economic Slowdown Impact: A projected global GDP growth slowdown in 2024-2025 could reduce consumer discretionary income available for entertainment purchases.

- Gaming Market Sensitivity: The video game industry is known to be sensitive to economic cycles, with spending often contracting during periods of recession.

- Revenue Stream Vulnerability: Embracer's reliance on game sales, in-game purchases, and theme park revenues makes it vulnerable to shifts in consumer spending habits during economic downturns.

Intense competition from established players and a growing number of indie developers poses a significant challenge for Embracer's diverse portfolio. This crowded market means that even with numerous studios, achieving widespread market penetration for every title is difficult, potentially impacting overall profitability.

The gaming industry's inherent volatility and rapidly shifting consumer preferences represent a constant threat. A failure to anticipate or adapt to these changes could lead to underperforming titles, directly impacting Embracer's revenue streams and financial outlook, as evidenced by revised forecasts in early 2024 due to slower-than-expected sales.

Broader macroeconomic headwinds, such as a potential economic slowdown in 2024-2025, could significantly curb consumer discretionary spending on entertainment. This sensitivity to economic cycles makes Embracer's various revenue streams, from game sales to theme park income, vulnerable to reduced consumer budgets.

SWOT Analysis Data Sources

This Embracer SWOT analysis is built upon a foundation of credible data, including publicly available financial reports, comprehensive market research from industry analysts, and insights from expert commentary and verified news sources.