Embracer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Embracer Bundle

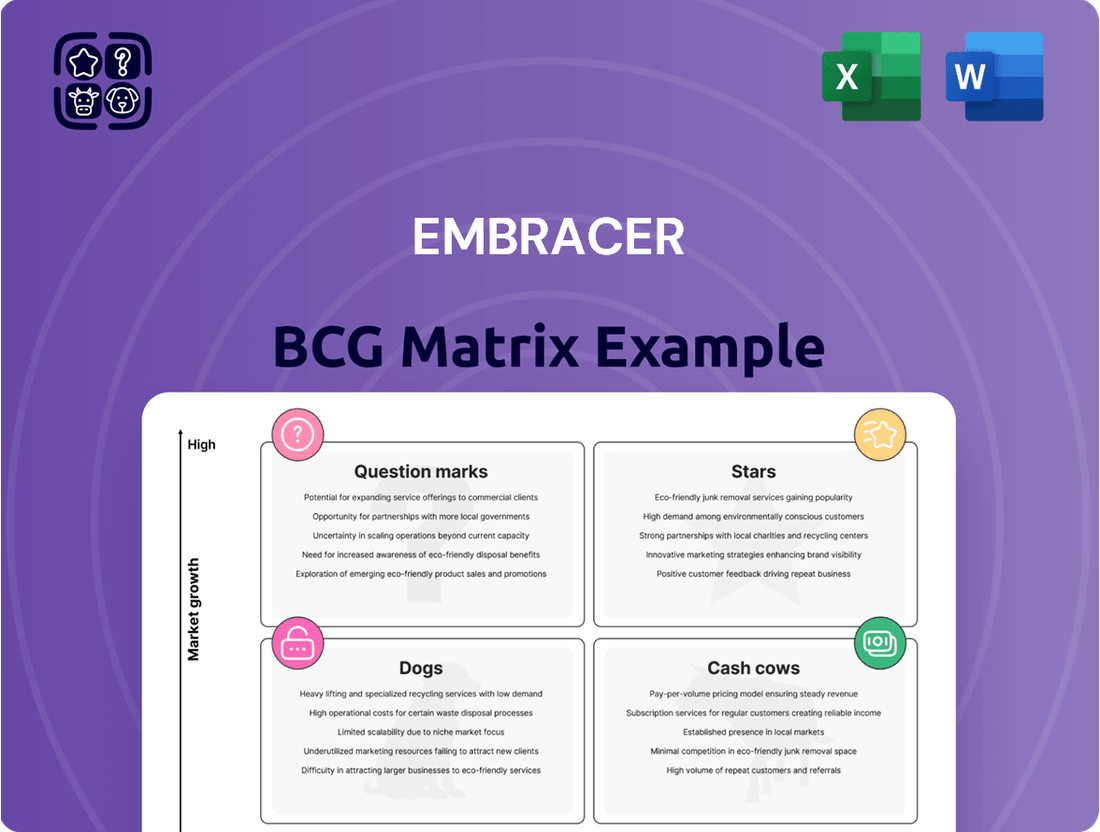

Unlock the strategic potential of Embracer's diverse portfolio with a clear understanding of their BCG Matrix. See which of their ventures are market leaders (Stars), which are generating consistent revenue (Cash Cows), and which require careful consideration (Question Marks or Dogs).

This glimpse into Embracer's strategic positioning is just the beginning. Purchase the full BCG Matrix report for detailed quadrant analysis, actionable insights, and a comprehensive roadmap to optimize their investment and product development strategies for sustained growth and market dominance.

Stars

Kingdom Come: Deliverance II, launched in early February 2025, has significantly surpassed initial projections. By the end of the first quarter, it achieved an impressive 3 million copies sold, demonstrating strong market appeal.

Developed by Warhorse Studios, this title is a crucial contributor to Embracer's PC/Console segment revenue. Its continued financial impact is anticipated through a roadmap of free updates and paid downloadable content planned for the upcoming year.

Deep Rock Galactic: Rogue Core, as a new entry in a beloved franchise, is strategically placed to leverage the existing player base and tap into the burgeoning market for co-op sci-fi shooters. Its predecessor, Deep Rock Galactic, achieved significant commercial success, selling over 6 million units by early 2024, indicating a strong demand for this genre.

Satisfactory, the PC factory simulation game from Coffee Stain Studios, has exceeded management's expectations, especially after its September 2024 update. The game saw nearly 200,000 concurrent players on Steam, a strong indicator of its success.

This performance places Satisfactory firmly in the Stars category of the BCG Matrix. Its dedicated player base and consistent engagement highlight a significant market share within its niche, suggesting strong growth potential and a healthy position in the market.

Star Wars: Unlimited

Star Wars: Unlimited, a new trading card game from Asmodee, is showing significant promise. Its successful launch and the vast appeal of the Star Wars universe position it as a strong contender in the tabletop gaming market. The game's ongoing release schedule, including the upcoming Set 3, Twilight of the Republic, expected in Q3 FY24/25, indicates a strategic push for sustained growth.

This game fits the 'Star' category in the BCG matrix due to its high market share potential and rapid growth. Asmodee's established distribution channels are a key factor in its anticipated success. The franchise's built-in fanbase provides a ready audience, driving initial sales and future engagement.

- High Market Growth: The trading card game market continues to expand, with Star Wars: Unlimited tapping into a well-established and passionate fanbase.

- Strong Brand Recognition: The Star Wars IP offers a significant advantage, attracting both existing fans and new players to the game.

- Strategic Rollout: Planned releases like Set 3 demonstrate a commitment to long-term engagement and product evolution.

- Distribution Network: Asmodee's robust distribution capabilities are crucial for reaching a wide player base effectively.

Coffee Stain Group's Community-Driven Games

Coffee Stain Group, celebrated for its unique titles like Goat Simulator and Satisfactory, is preparing for a significant transition. By the close of 2025, the company is slated to become an independent, publicly traded entity.

This strategic move highlights the group's commitment to fostering community-driven gaming experiences. Their success is particularly evident in the mobile gaming sector, where they've achieved robust organic growth.

- Market Traction: Coffee Stain's portfolio of indie and A/AA premium and free-to-play games is clearly resonating with players, indicating strong market demand.

- Growth Drivers: The company's focus on community engagement and organic growth, especially in mobile, positions them for continued expansion.

- Future Outlook: The upcoming public listing suggests confidence in their business model and future revenue potential.

Stars represent products with high market share in high-growth industries. These are typically market leaders that require significant investment to maintain their growth and competitive edge. Embracer's portfolio features several titles fitting this description.

Kingdom Come: Deliverance II's strong launch and projected continued sales place it firmly in the Stars category, given the PC/Console gaming market's sustained growth. Deep Rock Galactic: Rogue Core, building on its predecessor's success, also exhibits Star characteristics due to the expanding co-op shooter market. Satisfactory's impressive player numbers and market position solidify its Star status, as does the promising trajectory of Star Wars: Unlimited in the growing trading card game sector.

| Product | Market Growth | Market Share | Category |

|---|---|---|---|

| Kingdom Come: Deliverance II | High | High | Star |

| Deep Rock Galactic: Rogue Core | High | High | Star |

| Satisfactory | High | High | Star |

| Star Wars: Unlimited | High | High | Star |

What is included in the product

This BCG Matrix overview analyzes Embracer's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations for investment, holding, or divestment across each quadrant.

The Embracer BCG Matrix provides a clear, quadrant-based overview, alleviating the pain of strategic uncertainty by highlighting growth opportunities.

Cash Cows

Asmodee Group, a prominent player in the tabletop gaming industry, consistently delivers robust cash flow, solidifying its position as a cash cow. Its expansive intellectual property portfolio, featuring beloved titles like Ticket to Ride and Catan, underpins its sustained sales performance.

Even after its spin-off from Embracer in February 2025, Asmodee continued to showcase strong financial health. For the fiscal year 2024/25, the company reported net sales of EUR 1.369 billion, accompanied by a healthy adjusted EBITDA margin, underscoring its reliable cash generation capabilities.

Embracer's remaining Mobile Games segment, post-Easybrain divestment, continues to be a robust performer. This segment, featuring studios like DECA Games and CrazyLabs, demonstrates significant profitability and a healthy earnings trajectory.

The segment achieved impressive organic growth of 30% year-on-year in Q4 FY24/25. This strong performance translates into substantial cash generation, with the added benefit of requiring comparatively lower promotional investments than other high-growth ventures within Embracer's portfolio.

Embracer Group's established PC/Console Back Catalog functions as a significant Cash Cow. This segment leverages a vast library of intellectual property, including beloved franchises like Darkside, Dead Island, Metro, and the recently acquired Tomb Raider. These titles consistently generate revenue through ongoing sales and digital distribution, providing a reliable income stream.

The financial performance of this back catalog is robust. For instance, in the fiscal year ending March 31, 2024, Embracer reported that its PC/Console segment, heavily influenced by its back catalog, continued to be a primary revenue driver. While specific figures for the back catalog alone are not always itemized separately, the overall segment's stability underscores its Cash Cow status, requiring limited incremental investment for continued profitability.

Licensing and IP Management (Middle-earth Enterprises)

Embracer Group's ownership of Middle-earth Enterprises, which holds the rights to The Lord of the Rings and The Hobbit, represents a significant cash cow. This intellectual property generates substantial and consistent revenue through licensing deals across film, television, gaming, and merchandise. The high brand recognition and enduring popularity of these franchises allow for lucrative agreements with relatively minimal ongoing investment.

The licensing and IP management segment, particularly through Middle-earth Enterprises, offers a stable, high-margin revenue stream for Embracer. This is due to the evergreen nature of its core properties, which continue to attract new generations of fans. In 2023, Embracer reported that its Games segment, which heavily features licensed IP, generated SEK 24.7 billion in net sales, with a significant portion attributable to established franchises.

- High Profitability: Licensing agreements for The Lord of the Rings and The Hobbit typically command premium rates due to the IPs' global appeal, leading to high profit margins.

- Low Investment Needs: Once the IP is established, the ongoing investment required to maintain and monetize it through licensing is relatively low compared to developing new content from scratch.

- Consistent Revenue: The enduring popularity of Tolkien's works ensures a steady flow of income from various licensees, providing a predictable revenue stream.

- Strategic Value: Middle-earth Enterprises acts as a stable foundation within Embracer's portfolio, supporting growth initiatives in other business areas.

Plaion Partner Publishing & Film

Plaion's partner publishing and film division, though showing some softness in Q1 FY24/25, has historically provided reliable revenue. This division leverages established distribution and publishing agreements for a variety of entertainment products, indicating a mature market segment.

The division's function within broader distribution networks for games and films suggests a stable, cash-generative business model. Its predictable revenue streams are a key characteristic of a cash cow within the BCG matrix.

- Revenue Contribution: Historically a steady contributor, though Q1 FY24/25 saw some softening.

- Market Position: Operates in a mature market with established distribution networks.

- Cash Generation: Predictable cash flows derived from publishing and distribution agreements.

- Strategic Role: Functions as a reliable source of cash for the broader group.

Cash Cows in Embracer's portfolio represent established businesses with strong market positions and consistent cash generation, requiring minimal new investment. These entities provide a stable financial foundation for the group, funding growth opportunities and acquisitions.

The PC/Console Back Catalog, featuring titles like Dead Island and Metro, is a prime example. Its ongoing sales and digital distribution contribute significantly to revenue, demonstrating a reliable income stream. Similarly, Middle-earth Enterprises, holding The Lord of the Rings and The Hobbit rights, generates substantial and consistent revenue through lucrative licensing deals, benefiting from high brand recognition.

Embracer's Mobile Games segment, post-Easybrain divestment, also fits this category. Studios like DECA Games and CrazyLabs exhibit strong profitability and a healthy earnings trajectory, with significant organic growth reported in Q4 FY24/25. These segments collectively underscore Embracer's ability to leverage mature assets for sustained cash flow.

| Segment | Key IP/Products | FY24/25 Net Sales (EUR bn) | FY24/25 Adj. EBITDA Margin | Cash Generation Strength |

|---|---|---|---|---|

| Asmodee Group | Ticket to Ride, Catan | 1.369 | Strong | High |

| PC/Console Back Catalog | Dead Island, Metro, Tomb Raider | N/A (Part of larger segment) | Stable | Consistent |

| Middle-earth Enterprises | The Lord of the Rings, The Hobbit | N/A (Part of Games segment) | High Margin | Very High |

| Mobile Games | DECA Games, CrazyLabs | N/A (Part of larger segment) | Profitable | Strong |

What You’re Viewing Is Included

Embracer BCG Matrix

The BCG Matrix document you are previewing is the definitive version you will receive immediately after your purchase. This means you're seeing the actual, fully formatted report, devoid of any watermarks or sample data, ready for your strategic application.

Dogs

Embracer Group's divestment of Saber Interactive and Gearbox Entertainment in Q1 FY24/25 clearly places them in the 'dog' category of the BCG Matrix. These studios were frequently a drain on the company's resources, often operating with negative cash flow, which is a hallmark of underperforming assets.

The strategic decision to sell these entities was a direct move to streamline operations, reduce substantial debt, and boost overall profitability. This action underscores their previous status as non-core assets that were no longer contributing positively to Embracer's financial health.

Easybrain, a puzzle game developer, was divested in late 2024/early 2025 for $1.2 billion. This strategic sale aimed to substantially decrease Embracer's net debt.

While Easybrain brought in revenue, its divestment indicates it was likely a cash trap for Embracer, consuming capital that could be deployed more effectively across the group.

Certain PC/Console game releases from Embracer, like Alone in the Dark and Outcast: A New Beginning during FY2024/25, have unfortunately not met their sales targets. These games, likely incurring substantial development expenses, are now positioned in a segment of the market with limited growth potential and consequently, low profitability.

Closed Studios (Volition Games, Free Radical Design, Campfire Cabal)

The closure of Volition Games, known for the Saints Row franchise, Free Radical Design, and Campfire Cabal by Embracer Group highlights assets that are not performing well. These studios and their associated projects likely represent a drain on resources without yielding adequate returns, placing them squarely in the 'dog' category of the BCG matrix. This strategic move by Embracer is aimed at streamlining operations and focusing capital on more promising ventures within their portfolio.

Embracer Group's decision to shutter these studios in 2024, following a period of significant restructuring, indicates a reassessment of their product lines and development capabilities. For instance, Volition Games' most recent release, Saints Row (2022), faced mixed reviews and did not meet commercial expectations, contributing to its classification as a dog. Free Radical Design, while having a legacy in gaming, was reportedly working on a new Timesplitters game that may have been deemed too high-risk or low-return.

- Volition Games Closure: Saints Row (2022) sales figures did not justify continued investment, leading to the studio's closure.

- Free Radical Design Fate: Reports suggested that the Timesplitters revival project was struggling to gain traction or secure sufficient funding.

- Campfire Cabal's Status: This studio was also part of Embracer's broader cost-cutting measures, indicating its projects were not meeting performance benchmarks.

- BCG Matrix Implication: These closures represent Embracer's strategic divestment from underperforming assets to improve overall portfolio health.

Specific Legacy IP with Low Market Relevance

Embracer Group's extensive portfolio contains many legacy intellectual properties with limited current market relevance. These older or niche titles often represent a small fraction of the company's revenue and possess low growth potential, fitting the description of 'dogs' in a BCG matrix analysis.

Revitalizing these assets would necessitate substantial investment in development, marketing, and re-releases. Without a clear path to significant returns, these IPs can become passive drains on financial and operational resources.

- Low Market Share: Many legacy IPs likely hold negligible market share in today's gaming landscape.

- Minimal Revenue Contribution: These titles contribute very little to Embracer's overall financial performance.

- High Revitalization Costs: Significant capital would be required to update or re-release these properties for modern audiences.

- Resource Drain: Maintaining and managing these underperforming assets diverts resources from more promising ventures.

Embracer Group's strategic divestments and studio closures in 2024 and early 2025 clearly signal the presence of 'dog' assets within its portfolio. These underperforming entities, such as Saber Interactive and Gearbox Entertainment, were divested to improve financial health and reduce debt. Easybrain's sale for $1.2 billion in late 2024/early 2025 also reflects a move to cut down net debt, indicating it was a cash trap despite revenue generation.

The underperformance of games like Alone in the Dark and Outcast: A New Beginning in FY2024/25, coupled with the closures of Volition Games and Free Radical Design, further solidify the 'dog' classification for these ventures. These actions highlight Embracer's efforts to streamline operations by shedding assets that consume capital without delivering adequate returns.

Embracer's portfolio also includes legacy intellectual properties with limited market relevance and low growth potential, representing a significant resource drain. Revitalizing these older titles would require substantial investment, making them prime candidates for the 'dog' category due to high revitalization costs and minimal revenue contribution.

| Asset Category | Examples | BCG Classification Rationale | Financial Impact (Illustrative) |

|---|---|---|---|

| Divested Studios | Saber Interactive, Gearbox Entertainment | Negative cash flow, drain on resources, non-core | Reduced debt, improved profitability |

| Divested Business Unit | Easybrain | Cash trap, capital consumption | $1.2 billion debt reduction |

| Underperforming Games | Alone in the Dark, Outcast: A New Beginning | Failed sales targets, high development costs, low market potential | Unrealized revenue, potential write-downs |

| Closed Studios | Volition Games, Free Radical Design | Poor performance, low return on investment | Cost savings, resource reallocation |

| Legacy IPs | Various older titles | Low market relevance, low growth potential, high revitalization costs | Resource drain, minimal revenue |

Question Marks

Marvel 1943: Rise of Hydra, a AAA title from Skydance Games and Plaion, faces a delayed release into early 2026. This positions it as a 'question mark' within the BCG Matrix, as its future market share and profitability remain uncertain.

While the powerful Marvel intellectual property offers substantial potential, the game's economic structure, involving shared revenue with multiple partners, is expected to result in lower profit margins. This shared economics model makes its ultimate financial success a significant question mark until its actual market performance is observed.

The Gothic 1 Remake, targeting a March 2025 release, falls into the question mark category within the BCG matrix. Its success hinges on its ability to attract both the dedicated nostalgic fanbase and a wider audience in the burgeoning remake market, a segment that saw significant growth in 2024 with titles like Final Fantasy VII Rebirth generating substantial revenue.

While THQ Nordic's investment in Alkimia Interactive for this project signals confidence, the remake's market penetration will be crucial. The competitive RPG landscape, especially with major releases and ongoing live-service games in 2024, presents a challenge for a new entry to capture significant market share and transition from a question mark to a star.

Killing Floor 3, slated for release in fiscal year 2025/26, represents Tripwire Interactive's ambition to leverage an established franchise in the co-op shooter genre. While the series has a dedicated player base, its potential to capture a dominant market share and achieve 'star' status remains uncertain, especially given the intense competition.

The 'Third AAA Game' in FY2026/27

Embracer Group has indicated a third unannounced AAA game is now slated for fiscal year 2026/27. This title is anticipated to mirror the financial performance characteristics of Kingdom Come: Deliverance 2, a game that saw significant development time. The extended delay suggests a strong focus on refinement and quality assurance before its market debut.

This unannounced AAA project clearly fits the question mark category within the BCG matrix. It possesses substantial potential for high growth, given its AAA classification and the expected quality. However, the uncertainty surrounding its release date and ultimate market reception introduces significant risk.

- Projected FY2026/27 Release: The game is now scheduled for release in fiscal year 2026/27, a delay from previous expectations.

- Financial Benchmark: Its financial dynamics are expected to align with Kingdom Come: Deliverance 2, highlighting a focus on quality and potentially strong post-launch performance.

- High Growth Potential: As a AAA title, it is positioned to capture a significant market share and generate substantial revenue if successful.

- Market Uncertainty: The unannounced nature and extended development timeline create inherent risks regarding market reception and competitive landscape upon launch.

New IPs and Unannounced Games (76 titles in FY25/26)

Embracer Group is gearing up for a significant content push, with plans to launch 76 games across its various studios during fiscal years 2025 and 2026. This ambitious slate includes a substantial number of new intellectual properties (IPs) alongside established franchises and remasters.

The sheer volume of new IPs, many still unannounced, places these titles squarely in the question mark category of the BCG matrix. These ventures represent high potential growth but also carry considerable risk due to the inherent uncertainty of market reception and the need for significant marketing investment to build brand awareness and capture market share.

- High Volume of New IPs: 76 titles planned for FY25/26, with a notable portion being entirely new concepts.

- Risk and Investment: New IPs require substantial investment in development, marketing, and distribution to establish a foothold.

- Uncertain Market Reception: The success of unannounced games and new IPs is inherently unpredictable, demanding careful monitoring and strategic adjustments.

- Potential for High Growth: If successful, these question mark titles can transition into stars, driving significant future revenue for Embracer.

Question marks, in the context of the BCG matrix, represent products or ventures with low market share but operating in high-growth markets. These are often new products or those that have not yet gained significant traction. Their future is uncertain; they could become stars if they gain market share, or they could become dogs if they fail to grow.

Embracer's upcoming AAA title, slated for FY2026/27 and mirroring Kingdom Come: Deliverance 2's expected performance, exemplifies a question mark. Its AAA status suggests high growth potential, but market reception and competitive pressures remain key uncertainties. Similarly, the numerous new IPs planned for FY25/26 also fall into this category, requiring significant investment to establish market presence.

The Gothic 1 Remake and Marvel 1943: Rise of Hydra are also question marks. While leveraging established IPs, their success depends on attracting new audiences and navigating competitive landscapes, with financial outcomes yet to be determined.

Killing Floor 3, despite its franchise history, faces similar uncertainty. Its ability to capture significant market share in a crowded co-op shooter genre is a key factor in its potential transition from question mark to star.

| Project | Market Growth | Market Share | BCG Category | Notes |

| Marvel 1943: Rise of Hydra | High | Low (Uncertain) | Question Mark | Delayed release, shared revenue model impacts margins. |

| Gothic 1 Remake | High | Low (Uncertain) | Question Mark | Aims to attract nostalgic and new players in a growing remake market. |

| Killing Floor 3 | High | Low (Uncertain) | Question Mark | Leverages franchise, but faces intense competition in co-op shooter genre. |

| Unannounced AAA Title (FY26/27) | High | Low (Uncertain) | Question Mark | High growth potential, but release date and market reception are unknown. |

| New IPs (FY25/26) | High | Low (Uncertain) | Question Mark | High volume, significant investment needed for brand awareness and market capture. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.