Embracer Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Embracer Bundle

Uncover the core strategies that fuel Embracer's rapid growth and market dominance. This comprehensive Business Model Canvas breaks down their unique approach to value creation, customer relationships, and revenue streams.

See how Embracer's key resources and activities translate into a powerful competitive advantage. This in-depth canvas is essential for anyone looking to understand their operational blueprint and strategic partnerships.

Ready to gain a competitive edge? Download the full Embracer Business Model Canvas to analyze their cost structure, revenue drivers, and overall value proposition. It's the strategic roadmap you need for informed decision-making.

Partnerships

Embracer Group's key partnerships are heavily influenced by its strategic acquisition and integration model, aiming to build a vast and diverse gaming portfolio. This approach allows them to tap into various markets, from PC and console to mobile gaming, by bringing established studios and IPs under their umbrella.

This decentralized structure, while fostering creative freedom within acquired studios, also necessitates strong partnerships for resource sharing and operational synergy. For instance, the acquisition of Gearbox Entertainment in 2021 for up to $1.3 billion highlighted this strategy, integrating a major player with established franchises.

While Embracer has historically pursued aggressive acquisition strategies, recent financial reports, such as those from early 2024, indicate a shift towards divestments and restructuring, impacting the nature of these key partnerships as they streamline operations.

Embracer's key partnerships with platform holders like Sony (PlayStation) and Microsoft (Xbox), alongside PC digital storefronts such as Steam and the Epic Games Store, are fundamental to reaching its vast player base. These relationships are the conduits through which Embracer distributes its diverse portfolio of games, from established franchises to new intellectual properties, to a worldwide audience.

The financial performance of Embracer's gaming segment is directly influenced by its presence and visibility on these digital platforms. For instance, Steam, the dominant PC gaming marketplace, reported over 130 million monthly active users in 2024, underscoring the sheer scale of potential reach these partnerships offer. Similarly, PlayStation and Xbox stores are critical for console game sales, with their respective user bases representing significant revenue streams.

The ongoing success of both new game launches and the continued sales of Embracer's extensive back-catalog are heavily dependent on these strategic alliances. Favorable placement, marketing opportunities, and efficient sales processes on these digital storefronts directly translate into revenue and market penetration for Embracer's gaming divisions.

Embracer Group leverages extensive publishing and distribution networks, extending beyond digital storefronts to include major global retailers such as Walmart, GameStop, and Amazon. This strategic partnership is crucial for the physical distribution of their diverse product portfolio, encompassing PC and console games, board games, and a wide array of merchandise.

Through these established relationships, Embracer ensures its content reaches a broad consumer base. Operative groups within Embracer, including PLAION and THQ Nordic, actively utilize these networks to maximize product visibility and sales. For instance, PLAION's commitment to physical retail was evident in its 2023 performance, contributing significantly to the group's overall revenue streams by making their titles widely accessible.

Intellectual Property Owners

Embracer Group's strategic alliances with intellectual property (IP) owners are foundational to its business model. A prime example is its ownership of Middle-earth Enterprises, granting access to the extensive universe of J.R.R. Tolkien's works. This partnership is crucial for creating and distributing games, as well as other transmedia content, leveraging well-established and cherished franchises.

These collaborations extend the reach of IP beyond gaming into other media like comics and film, amplifying brand value and revenue streams. For instance, Embracer's acquisition of Dark Horse Media in 2022, a significant comic book publisher, further solidifies its strategy of integrating diverse IP across multiple platforms. This approach allows for the creation of interconnected narratives and experiences that appeal to a broad audience.

The financial implications of these partnerships are substantial. In 2023, Embracer reported that its acquired companies contributed significantly to its overall revenue, with licensed IP playing a key role in driving sales for new game releases and existing back catalogs. The ability to tap into popular existing IPs significantly reduces market entry risk and accelerates the path to profitability for new projects.

- IP Ownership: Embracer Group's acquisition of Middle-earth Enterprises provides exclusive rights to J.R.R. Tolkien's literary works, a cornerstone for game and transmedia development.

- Transmedia Strategy: Leveraging IP across gaming, comics (e.g., Dark Horse Media acquisition), and film creates synergistic opportunities and broadens market appeal.

- Revenue Generation: Partnerships with IP owners are critical for driving sales of new titles and monetizing extensive back catalogs, as seen in Embracer's 2023 financial performance.

- Brand Synergy: The integration of beloved IPs allows for the creation of cohesive universes, enhancing brand loyalty and attracting new consumer segments.

Co-development and External Studios

Embracer frequently partners with external studios for co-development, a strategy that allows them to tap into specialized skills and boost production capabilities. This approach was evident in projects like Marvel 1943: Rise of Hydra, where economic sharing was part of the agreement.

While a significant portion of Embracer's development is handled in-house, these external collaborations are crucial for managing a diverse project pipeline and spreading risk. It enables the company to tackle a wider array of games, leveraging external talent for specific needs.

- Co-development with External Studios: Embracer collaborates with outside game developers on specific titles.

- Shared Economics: Partnerships can involve shared financial arrangements, as seen with Marvel 1943: Rise of Hydra.

- Capacity and Expertise: External studios provide specialized skills and increase overall development capacity.

- Risk Diversification: These collaborations help diversify the company's project portfolio and associated risks.

Embracer's key partnerships extend to platform holders like Sony and Microsoft, as well as PC storefronts such as Steam. These are vital for distributing their extensive game portfolio to a global audience, with Steam alone boasting over 130 million monthly active users in 2024.

Furthermore, Embracer partners with major global retailers including Walmart and Amazon for the physical distribution of games and merchandise. This ensures broad consumer reach for titles from its various operative groups.

Strategic alliances with IP owners, such as Middle-earth Enterprises, are fundamental, granting access to valuable franchises for game and transmedia development, significantly reducing market entry risk.

Embracer also engages in co-development partnerships with external studios, leveraging specialized skills and expanding production capacity. These collaborations can involve shared economic arrangements, as seen with projects like Marvel 1943: Rise of Hydra.

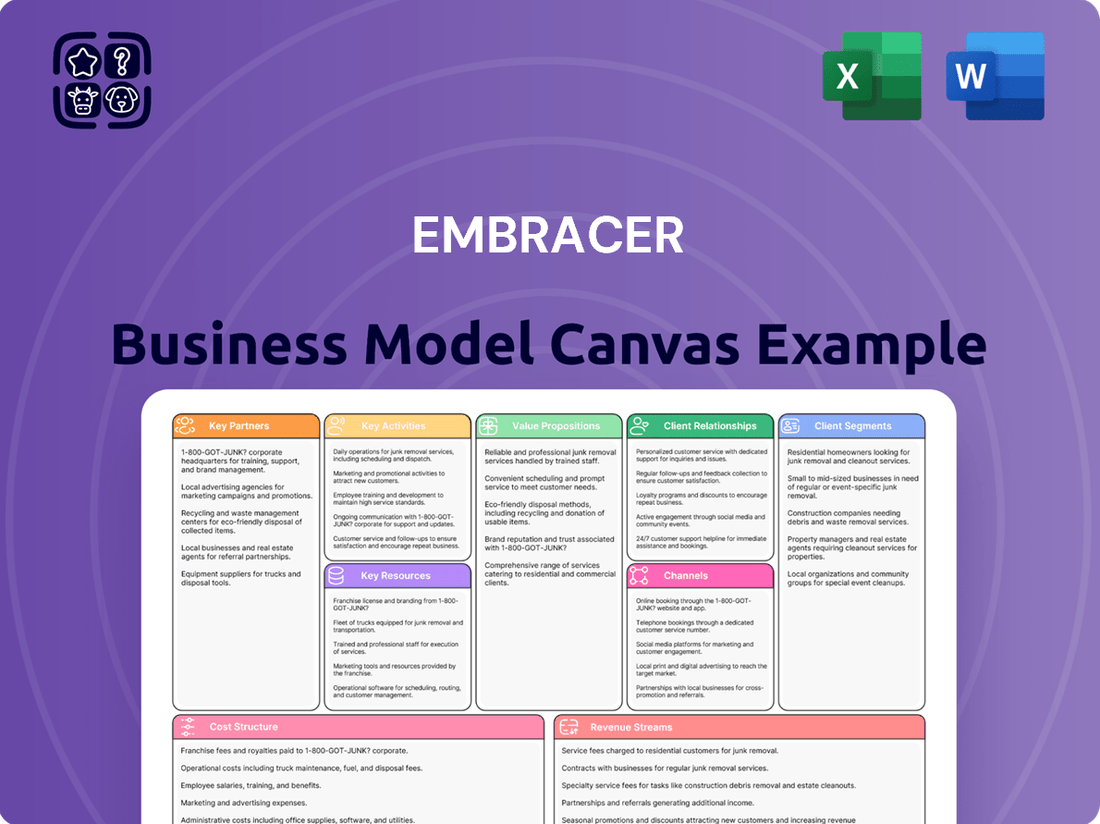

What is included in the product

A comprehensive, pre-written business model tailored to Embracer's acquisition-driven growth strategy, focusing on acquiring and integrating diverse gaming studios and IPs.

Organized into 9 classic BMC blocks, it details Embracer's value propositions, key resources, and revenue streams derived from its extensive gaming portfolio.

The Embracer Business Model Canvas simplifies complex strategies, acting as a pain point reliever by providing a clear, visual overview for immediate understanding.

It streamlines the process of dissecting and communicating business models, reducing the pain of lengthy documentation and abstract concepts.

Activities

Embracer Group's core business revolves around developing and publishing a wide variety of games across PC, console, and mobile platforms. This encompasses managing a large portfolio of internal studios and external development partners, guiding projects from initial ideation through to release and ongoing post-launch engagement.

The company has ambitious plans for content delivery, aiming to launch more than 70 games during the current fiscal year. This aggressive release schedule highlights their commitment to maintaining a constant stream of new titles to engage their diverse player base.

Historically, Embracer's growth has been fueled by a relentless pace of strategic acquisitions, aiming to build a vast and diverse portfolio of game development studios, publishers, and intellectual properties. This has been a core activity, shaping the company's expansive reach within the gaming industry.

While 2023 and early 2024 saw a significant shift towards restructuring and divestments, with a focus on streamlining operations and improving profitability, mergers and acquisitions are still considered a crucial element for Embracer's long-term growth strategy. The company continues to look for opportunities to bolster its catalog of owned or controlled franchises.

For instance, in the fiscal year ending March 31, 2023, Embracer completed 27 acquisitions, demonstrating the ongoing commitment to M&A as a growth driver. Even with the recent strategic adjustments, this activity remains central to their ambition of expanding their gaming ecosystem.

Embracer Group actively manages and leverages its vast portfolio of over 450 owned or controlled franchises as a key activity. This involves not only creating new content within these intellectual properties but also strategically licensing them across various media platforms.

This licensing strategy extends to transmedia initiatives, encompassing areas like comic books, film productions, and merchandise. For instance, in the fiscal year ending March 31, 2024, Embracer reported net sales of SEK 31.5 billion (approximately $3 billion USD), with a significant portion driven by the performance and exploitation of its existing IP catalog.

By developing new content and licensing its popular franchises, Embracer aims to maximize their value and extend their reach to a wider audience. This approach ensures continuous engagement and revenue generation from its core intellectual assets.

Decentralized Group Management

Embracer's core activities revolve around managing its diverse portfolio of operative groups, such as THQ Nordic, PLAION, and Coffee Stain. This involves offering strategic guidance and essential shared services across the organization.

A key function is enabling each group and its studios to retain significant creative freedom and operational control. This decentralized approach is designed to cultivate an entrepreneurial culture within Embracer.

In 2024, Embracer continued to integrate its acquisitions, with the company reporting a net sales of SEK 32,154 million for the fiscal year ending March 31, 2024. This growth underscores the effectiveness of its decentralized management in supporting a broad range of creative endeavors.

- Strategic Oversight: Providing high-level direction and resource allocation to the operative groups.

- Shared Services: Offering centralized support for functions like finance, legal, and HR.

- Autonomy Maintenance: Ensuring individual groups and studios can operate independently and pursue their creative visions.

- Acquisition Integration: Seamlessly incorporating new studios and businesses into the decentralized framework.

Restructuring and Financial Optimization

Embracer Group's key activities include a significant restructuring and financial optimization program. This initiative focuses on enhancing operational efficiency, boosting cash generation, and actively reducing its net debt.

A core part of this strategy involves the divestment of non-core assets and the strategic spin-off of certain business units. For instance, the divestment of Asmodee and the planned separation of the Coffee Stain Group are prime examples of this approach. These moves aim to create more streamlined, focused entities that are financially stronger and better positioned for independent growth.

- Asset Divestment: Completed the sale of Asmodee for €2.75 billion in August 2024.

- Debt Reduction: Aiming to reduce net debt by SEK 10 billion by the end of fiscal year 2025.

- Operational Efficiency: Implementing cost-saving measures across all operational segments.

- Strategic Focus: Spinning off Coffee Stain Group to unlock value and improve financial clarity.

Embracer Group's key activities include managing its extensive portfolio of over 450 franchises, which involves both developing new game content and strategically licensing these intellectual properties across various media. This transmedia approach, encompassing films, comic books, and merchandise, aims to maximize IP value and reach wider audiences.

A significant ongoing activity is the company's restructuring and financial optimization program. This initiative is designed to enhance operational efficiency, boost cash generation, and reduce net debt. Key components include divesting non-core assets and strategically spinning off certain business units to create more focused and financially robust entities.

The company also actively manages its diverse operative groups, such as THQ Nordic and PLAION, providing strategic guidance and shared services while ensuring significant creative freedom and operational autonomy for each. This decentralized management style supports an entrepreneurial culture across its many studios.

| Activity | Description | Key Data/Examples |

|---|---|---|

| Franchise Management & Licensing | Developing new content and licensing IP across various media. | Net sales of SEK 31.5 billion (FY ending March 31, 2024). Over 450 owned or controlled franchises. |

| Restructuring & Financial Optimization | Divesting non-core assets, spinning off units, reducing debt. | Divestment of Asmodee for €2.75 billion (August 2024). Aim to reduce net debt by SEK 10 billion by end of FY25. |

| Operative Group Management | Providing strategic guidance and shared services while maintaining studio autonomy. | Net sales of SEK 32,154 million (FY ending March 31, 2024). Includes groups like THQ Nordic, PLAION, Coffee Stain. |

What You See Is What You Get

Business Model Canvas

The Embracer Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This isn't a mockup or a sample; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this professionally structured and formatted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Embracer Group's extensive intellectual property (IP) catalog is a cornerstone of its business model, boasting over 450 owned or controlled franchises. This vast collection includes highly recognizable names such as Lord of the Rings, Tomb Raider, Saints Row, and Metro, providing a rich foundation for creative endeavors.

This diverse portfolio of games and entertainment properties is a critical asset, enabling the development of new titles, the remastering of existing classics, and the expansion of these IPs across various media formats, including film and television.

Embracer Group's global network of game development studios is a cornerstone of its business model. As of early 2024, the company operates 73 internal studios spread across almost 30 countries. This extensive network allows for the simultaneous development of a wide array of games, catering to diverse genres and platforms.

This distributed talent pool is a significant competitive advantage, enabling Embracer to manage multiple projects concurrently and leverage specialized skills from around the world. The sheer scale of its studio operations, employing thousands of developers, fuels its robust pipeline of upcoming titles.

Embracer Group's strength lies in its over 7,000 global employees, a significant portion of whom are seasoned game developers. This deep pool of talent fuels the creation of high-quality interactive entertainment.

The creativity and passion of these teams are the core drivers behind Embracer's success in developing engaging gaming experiences. Their dedication translates directly into the quality players expect.

A decentralized operational model is key to empowering these creative groups. This structure encourages an entrepreneurial spirit, allowing teams the autonomy to innovate and excel.

Financial Capital and Investment Capacity

Embracer Group, despite ongoing restructuring to manage debt, possesses substantial financial capital. This capacity is crucial for funding its extensive game development pipeline and supporting ongoing operational needs.

The company's financial strength, bolstered by improving cash flow generation, enables it to pursue ambitious projects and capitalize on opportunities within its diverse portfolio of studios and intellectual property.

Key financial resources include:

- Access to capital markets for potential future strategic acquisitions or investments.

- Operating cash flow generated from its various business segments, supporting day-to-day operations and project funding.

- A strong balance sheet that underpins its investment capacity and financial stability.

Proprietary Technology and Development Tools

Embracer's studios leverage and build proprietary game engines and development tools. These internal technologies are vital for streamlining game creation and ensuring high-quality, visually rich experiences on diverse gaming platforms.

These proprietary assets are key to maintaining a competitive edge in game development, allowing for unique artistic visions and technical innovations. For instance, the company's focus on internal tool development aims to reduce reliance on external software and enhance production efficiency.

- Proprietary Game Engines: Studios within Embracer Group often utilize and enhance their own game engines, enabling tailored performance and unique visual styles.

- Custom Development Tools: Embracer invests in creating specialized software and tools that streamline workflows for art, design, and programming teams.

- Technological Innovation: The company's commitment to proprietary technology fosters innovation, allowing for the development of cutting-edge gameplay mechanics and immersive environments.

- Efficiency and Scalability: These internal tools and technologies are designed to improve production efficiency and support the development of games across multiple platforms and genres.

Embracer Group's key resources are its vast intellectual property portfolio, a global network of 73 development studios employing thousands, and its 7,000+ employees, many of whom are skilled game developers. Financial capital, including access to capital markets and operating cash flow, underpins its operations and growth. Proprietary game engines and development tools are also crucial for efficient and innovative game creation.

| Resource Category | Description | Key Data Points (as of early 2024) |

| Intellectual Property (IP) | Owned or controlled franchises | Over 450 franchises, including Lord of the Rings, Tomb Raider, Saints Row, Metro |

| Development Studios | Internal studios | 73 studios in nearly 30 countries |

| Human Capital | Total employees | Over 7,000 employees, with a significant portion in game development |

| Financial Capital | Funding and stability | Access to capital markets, operating cash flow, strong balance sheet |

| Proprietary Technology | Game engines and tools | Internal engines and custom development tools for efficiency and innovation |

Value Propositions

Embracer Group boasts a vast and varied entertainment catalog, spanning PC, console, mobile, and even tabletop gaming. This extensive reach means they have something for almost everyone, from hardcore gamers to casual players. In 2024, their portfolio continued to grow, encompassing numerous studios and intellectual properties.

Their strategy of acquiring and nurturing a wide range of games, including original creations and beloved licensed titles, ensures a steady flow of engaging content. This diversification is key; it means Embracer isn't overly dependent on the success of just one game or platform, providing a more stable business foundation.

Embracer's decentralized model is a cornerstone of its value proposition, directly empowering creative independence across its numerous studios. This structure allows each acquired company to operate with significant autonomy, fostering a unique development environment.

This independence is crucial for innovation. For instance, in 2023, Embracer reported a portfolio of over 230 games in development, a testament to the diverse creative output facilitated by this model. This allows developers to pursue their distinct visions, leading to a wider array of genres and experiences for consumers.

By maintaining creative freedom, studios can better focus on their core strengths and specialties. This often translates into higher quality titles and more distinctive intellectual properties, a key differentiator in the competitive gaming market. Embracer's strategy aims to nurture these unique creative voices rather than homogenize them.

Embracer Group's access to iconic franchises like Lord of the Rings and Tomb Raider is a cornerstone of its value proposition for consumers. These beloved intellectual properties offer immediate recognition and a built-in fanbase, significantly reducing customer acquisition costs and fostering deep player engagement.

For fans, this means a gateway to rich, established universes and characters they already love, ensuring a strong emotional connection. This strategy is particularly effective in the gaming market, where brand loyalty and nostalgia play a crucial role in purchasing decisions.

In 2024, the continued success of franchises like Tomb Raider, with ongoing development and potential new entries, underscores the enduring appeal of these IPs. Embracer's ability to leverage these established brands across various platforms and media, from video games to merchandise, solidifies its market position.

High-Quality Gaming Experiences

Embracer Group is dedicated to creating and releasing top-tier gaming content that captivates players globally. This commitment spans their entire portfolio, from major console releases to engaging mobile titles, ensuring players receive deeply immersive and enjoyable experiences.

Their focus on quality is evident in their robust development pipeline, which includes a variety of projects designed to meet diverse player preferences. This strategic emphasis on high-quality content is a cornerstone of their value proposition.

- AAA Console Titles: Embracer's studios are actively working on numerous AAA projects, aiming for critical acclaim and significant player engagement.

- Mobile Gaming Excellence: The company also prioritizes quality in its mobile offerings, seeking to deliver polished and addictive gameplay experiences.

- Diverse Portfolio: This commitment to quality is applied across Embracer's numerous subsidiaries and game genres, catering to a broad spectrum of gamers.

Long-Term Value Creation for Stakeholders

Embracer's core strategy is centered on building enduring value for everyone involved, from shareholders to employees and partners. This is achieved through careful management of resources, pursuing smart growth opportunities, and ensuring operations run smoothly.

The company's recent restructuring into three distinct operational groups—Asmodee, Savvy Games Group, and the newly formed "Venture" segment—is a key move to highlight and enhance this long-term value proposition. Each group is designed to operate with greater autonomy, allowing for more focused strategies and clearer performance metrics.

This strategic separation aims to unlock hidden value within the diverse portfolio, making each entity more attractive to investors and enabling more tailored capital allocation. For instance, the targeted divestments and restructuring efforts announced in 2024, including the sale of certain studios, are part of this disciplined approach to optimize the business for future growth and shareholder returns.

The goal is to create clearer investment profiles for each business unit, potentially leading to improved valuations and more efficient capital markets access. This focus on operational efficiency and strategic clarity is paramount to delivering sustained financial performance and stakeholder benefits.

Embracer Group's value proposition is built on a foundation of extensive gaming IP ownership, a decentralized operational structure fostering creative freedom, and a commitment to delivering high-quality entertainment across diverse platforms. They aim to build long-term value through strategic management and portfolio optimization.

Their vast catalog, including iconic franchises, provides immediate market recognition and a strong basis for player engagement. This diversification across PC, console, and mobile gaming, coupled with a focus on quality, caters to a broad audience. The company's 2024 strategic realignments, including the formation of distinct operational groups like Asmodee and Savvy Games Group, underscore their commitment to unlocking and enhancing shareholder value through focused management and potential divestitures.

| Value Proposition Component | Description | 2024 Relevance/Data Point |

| Extensive IP Portfolio | Ownership of numerous beloved gaming franchises and original IPs. | Continued leverage of IPs like Lord of the Rings and Tomb Raider. |

| Decentralized Studio Model | Empowering creative independence and autonomy for acquired studios. | Fostered diverse output, with over 230 games in development reported in 2023. |

| Commitment to Quality Content | Focus on delivering high-quality AAA console titles and engaging mobile experiences. | Ongoing development of a wide range of projects across genres. |

| Long-Term Value Creation | Strategic management, resource optimization, and portfolio restructuring. | Formation of three operational groups (Asmodee, Savvy Games Group, Venture) in 2024 to enhance focus and unlock value. |

Customer Relationships

Embracer's operative groups and studios actively engage with their player bases, particularly for games that are continuously updated or operate as live services. This direct interaction allows for the incorporation of player suggestions into game enhancements, thereby nurturing robust community relationships. For instance, Coffee Stain is known for its strong community involvement.

Embracer Group fosters deep customer relationships by nurturing brand loyalty through meticulous intellectual property (IP) management. Their vast portfolio of beloved game franchises forms the bedrock of this connection.

By consistently releasing new, high-quality content and experiences within these established universes, Embracer cultivates a highly engaged and dedicated fanbase. This commitment encourages repeat engagement and anticipation for future titles and transmedia expansions.

For instance, in fiscal year 2024, Embracer reported net sales of SEK 35.5 billion, with a significant portion driven by its extensive catalog of IPs and ongoing game development, underscoring the financial impact of this customer relationship strategy.

Embracer's customer relationships are heavily shaped by digital platform interactions. Players engage with Embracer's extensive game portfolio through digital storefronts like Steam, PlayStation Store, and Xbox Games Store, where they purchase, download, and often interact with games. This direct digital channel is crucial for reaching millions of users globally.

These platforms serve as the primary touchpoint for ongoing customer engagement. Embracer utilizes them to deliver essential game updates, patches, and new content, ensuring a dynamic player experience. Furthermore, community features integrated within these platforms foster player interaction and provide a direct avenue for customer support, building loyalty and a sense of belonging among the player base.

In 2024, the digital distribution of games continued its dominance, with PC gaming revenue alone projected to reach over $50 billion globally. Embracer, with its vast catalog spanning PC, console, and mobile, leverages these digital storefronts to maintain and grow its customer base, making these platforms indispensable for relationship management and future revenue generation.

Subscription and Live Service Models

For many of Embracer's mobile and PC/console games, customer relationships are built on sustained engagement via live service models. This means consistently delivering new content, hosting in-game events, and actively managing the player community. These efforts are crucial for keeping players invested and creating opportunities for ongoing monetization.

This approach is particularly effective for titles with strong player retention. For instance, in 2024, the gaming industry saw live service games continue to dominate revenue streams, with many titles generating significant income through in-game purchases and battle passes long after their initial release. Embracer leverages this by fostering active communities that contribute to the longevity and profitability of its games.

- Live Service Engagement: Ongoing content updates, in-game events, and community management are key to maintaining player interest and fostering long-term participation in mobile and PC/console titles.

- Subscription Potential: Certain games may offer subscription models, providing players with exclusive benefits and content in exchange for recurring payments, further deepening customer relationships.

- Monetization Strategy: These models are designed to monetize player engagement over time, moving beyond a single purchase to create a continuous revenue stream.

- Industry Trend: Live service games have proven to be a highly successful revenue driver in the gaming industry, with many titles consistently generating substantial income through these ongoing engagement strategies.

Investor and Shareholder Communications

Embracer Group actively cultivates relationships with its investors and shareholders. This is achieved through regular, transparent financial reporting, including quarterly and annual updates, and participation in investor conferences. For instance, as of their Q4 FY23/24 report, Embracer highlighted its commitment to clear communication regarding its financial health and strategic initiatives.

Key to these relationships are the Annual General Meetings (AGMs), where shareholders can directly engage with management, ask questions, and vote on important company matters. Embracer's investor relations team also provides ongoing updates and analysis, ensuring stakeholders are well-informed about the company's performance and its strategic direction. This proactive approach aims to build trust and maintain confidence among its financial backers.

- Transparent Financial Reporting: Embracer provides detailed quarterly and annual financial statements to keep investors informed.

- Annual General Meetings (AGMs): These meetings offer a direct forum for shareholder engagement and decision-making.

- Investor Relations Communications: Regular updates and direct engagement channels ensure stakeholders are aware of company performance and strategy.

- Strategic Direction Updates: Shareholders receive clear communication on Embracer's plans for growth and development.

Embracer's customer relationships are largely built through digital platforms, where players purchase and engage with games. These platforms are vital for delivering updates and fostering community, directly impacting loyalty and future revenue.

Live service models are central to maintaining long-term customer engagement, with consistent content delivery and events driving sustained player investment. This strategy proved highly effective in 2024, as live service games continued to be major revenue generators.

Embracer also cultivates strong investor relationships through transparent financial reporting and direct engagement opportunities like Annual General Meetings. This consistent communication builds trust and confidence among financial stakeholders.

| Customer Segment | Engagement Method | Key Activities | 2024 Relevance |

|---|---|---|---|

| Players | Digital Platforms, Live Services | Purchasing, updates, in-game events, community interaction | Dominant revenue driver, high player retention |

| Investors/Shareholders | Financial Reporting, AGMs | Transparent reporting, direct Q&A, voting | Crucial for funding and strategic alignment |

Channels

Embracer's digital game distribution relies heavily on established platforms like Steam for PC, the PlayStation Store, and Xbox Live. These channels offer unparalleled global reach, enabling direct sales and managing game updates and community interactions efficiently.

Embracer Group leverages major mobile app stores, such as Google Play and Apple App Store, as primary distribution channels for its extensive mobile gaming portfolio. These platforms are critical for accessing a massive global audience and facilitating seamless game downloads and in-app transactions.

In 2024, the mobile gaming market continued its robust growth, with global revenue projected to reach over $100 billion. Embracer's presence on these dominant app stores is therefore vital for capturing a significant share of this lucrative market and driving revenue through its free-to-play and premium mobile titles.

Physical retailers continue to be a vital avenue for distributing PC, console, and board games, even with the digital shift. Embracer leverages partnerships with major players like Walmart and GameStop to ensure its titles reach consumers through these traditional brick-and-mortar locations.

These collaborations are crucial for maintaining a broad market presence. For instance, in 2024, physical game sales, while seeing a decline compared to digital, still represented a significant portion of the overall market, with many consumers preferring the tangible experience of purchasing games from stores like GameStop.

Company and Subsidiary Websites

Embracer Group's diverse portfolio of operative groups and studios each operate their own dedicated websites. These digital presences are crucial for disseminating company news, studio updates, and engaging with their respective fan bases. For instance, a studio like Saber Interactive might have a distinct website showcasing its game development pipeline and community forums.

These individual websites also function as important channels for investor relations, providing direct access to financial reports and corporate announcements relevant to that specific operative group or studio. In 2024, Embracer Group continued to emphasize transparency, with these sites serving as key touchpoints for stakeholders seeking detailed information. Some sites may also facilitate direct-to-consumer sales of merchandise or digital content, adding another layer to their business model.

- Direct Information Dissemination: Websites of operative groups and studios provide tailored news and updates.

- Community Engagement Hubs: Platforms for fans to connect with studios and their projects.

- Investor Relations Touchpoints: Offering direct access to financial and corporate information.

- Potential for Direct Sales: Enabling merchandise or digital content sales.

Media, Marketing, and Gaming Events

Embracer leverages gaming industry events like Gamescom and E3 (though its future presence is evolving) to showcase upcoming titles and build anticipation. These gatherings are vital for direct engagement with players and media.

Broad media coverage, including strategic trailers, targeted press releases, and influencer reviews, amplifies reach beyond dedicated gaming communities. In 2024, the gaming industry continued its robust advertising spend, with digital advertising projected to exceed $200 billion globally, underscoring the importance of these promotional channels.

- Gaming Conventions: Essential for hands-on demos and direct player feedback.

- Trailers & Gameplay Reveals: Key drivers of pre-release hype and wishlists.

- Press Releases & Media Outreach: Informing a wider audience about company milestones and game launches.

- Influencer Marketing & Reviews: Leveraging trusted voices to build credibility and reach niche markets.

Embracer's channel strategy encompasses digital storefronts, physical retail, direct-to-consumer via studio websites, and broad media promotion. This multi-faceted approach aims to maximize reach and engagement across diverse consumer segments.

The company's presence on major digital platforms like Steam, PlayStation Store, and Xbox Live is crucial for global game sales and updates. Similarly, mobile app stores such as Google Play and Apple App Store are vital for its substantial mobile gaming portfolio, tapping into a market that saw global revenue exceed $100 billion in 2024.

Physical retail partnerships remain important for PC, console, and board games, reaching consumers who prefer tangible purchases. Furthermore, individual studio websites serve as direct communication channels for news, community engagement, and investor relations, reinforcing transparency in 2024.

Broad media coverage, including trailers, press releases, and influencer marketing, amplifies Embracer's reach. In 2024, the gaming industry's digital advertising spend was projected to surpass $200 billion, highlighting the significance of these promotional efforts.

| Channel Type | Key Platforms/Examples | 2024 Market Relevance | Embracer's Strategy |

|---|---|---|---|

| Digital Distribution | Steam, PlayStation Store, Xbox Live, Google Play, Apple App Store | Mobile gaming revenue projected over $100 billion globally. | Leverages for global reach and sales of PC, console, and mobile titles. |

| Physical Retail | Walmart, GameStop | Significant portion of overall market despite digital shift. | Partnerships to reach consumers preferring tangible game purchases. |

| Direct-to-Consumer (DTC) | Operative Group/Studio Websites | Key for transparency and investor relations in 2024. | Disseminates company news, studio updates, and engages fan bases. |

| Media & Events | Gamescom, E3, Trailers, Press Releases, Influencers | Digital advertising spend projected over $200 billion globally. | Showcases titles, builds anticipation, and amplifies reach. |

Customer Segments

Core PC and console gamers represent a vital customer segment for Embracer, valuing sophisticated gameplay and high-quality visuals. These players are drawn to AAA titles and enduring franchises, which are central to Embracer's financial performance.

In 2024, the global video game market, driven significantly by PC and console gaming, was projected to reach over $200 billion. Embracer's portfolio, with its strong presence in these platforms, directly taps into this lucrative market, with a substantial portion of its revenue historically coming from these dedicated player bases.

Casual and mobile gamers represent a massive, expanding market, with many preferring accessible, free-to-play games on their smartphones. Embracer Group actively targets this demographic through its various mobile studios, offering a wide array of engaging titles designed for quick play sessions and broad appeal.

The mobile gaming market is projected to reach $272 billion by 2024, highlighting the significant revenue potential within this segment. Embracer's strategy acknowledges this by investing in studios that can create titles resonating with these players, often featuring simple mechanics and continuous content updates.

Fans of specific intellectual properties represent a core customer segment for Embracer, deeply invested in franchises like Lord of the Rings, Tomb Raider, and Darksiders. Their loyalty translates into consistent purchasing across various product lines.

This affinity drives demand not only for video games but also for related merchandise, collectibles, and other transmedia content, creating multiple revenue streams. For instance, the Tomb Raider franchise alone has generated over $1.5 billion in revenue globally since its inception, showcasing the significant economic power of dedicated fan bases.

Board Game Enthusiasts

Board game enthusiasts were a core customer segment for Embracer, particularly through its Asmodee division prior to its spin-off. This group actively seeks engaging, physical tabletop experiences that foster social interaction and strategic depth. They often invest in high-quality components and are drawn to games with rich narratives and replayability.

The market for board games has seen substantial growth. For instance, the global board games market size was valued at approximately $15.1 billion in 2023 and is projected to reach $23.8 billion by 2030, growing at a CAGR of 6.7% during the forecast period. This indicates a strong and expanding base of enthusiasts.

- Dedicated Community: Board game enthusiasts form passionate communities, often engaging in online forums, local game stores, and conventions.

- High Engagement: This segment typically exhibits high engagement levels, frequently purchasing new releases and accessories.

- Value Proposition: They value the tactile experience, social connection, and intellectual challenge that board games provide.

Transmedia Consumers and Collectors

Embracer Group actively cultivates a segment of transmedia consumers and collectors who engage with their intellectual properties (IPs) far beyond the core gaming experience. This includes individuals passionate about comic books, films, and various forms of collectible merchandise tied to popular franchises.

These consumers are driven by a desire to immerse themselves in their favorite universes across multiple media platforms, fostering a deeper connection and loyalty to the brands. For instance, the success of merchandise lines and adaptations in film and television directly supports this customer segment.

- Targeting Extended IP Engagement: Embracer aims to capture value from fans who appreciate franchises through merchandise, comics, and film, not just video games.

- Cross-Media Consumption: This segment actively seeks out and consumes content related to their favorite IPs across various entertainment channels.

- Merchandise and Collectibles: A significant driver for this group is the acquisition of physical and digital collectibles that represent their affinity for specific franchises.

Embracer Group also caters to a segment of enterprise clients and partners who leverage their extensive IP portfolio for various commercial ventures. This includes licensing agreements for film, television, merchandise, and theme park attractions, as well as potential collaborations for new game development or distribution.

These business partners seek to capitalize on established brand recognition and fan bases to create successful products and experiences, driving significant revenue through strategic alliances. In 2024, the global licensing market continues to be a substantial revenue driver for major entertainment companies, with gaming IPs increasingly becoming a focus.

| Customer Segment | Description | Key Motivations | 2024 Market Relevance |

|---|---|---|---|

| Enterprise Clients & Partners | Businesses seeking to license Embracer's IP for various commercial projects. | Leveraging established brand recognition, fan engagement, and revenue generation through licensing. | The global licensing market is a multi-billion dollar industry, with gaming IP licensing showing robust growth. |

| Core PC & Console Gamers | Dedicated players valuing high-fidelity, complex gaming experiences. | Appreciation for AAA titles, deep gameplay mechanics, and established franchises. | The PC and console gaming market was projected to exceed $200 billion in 2024. |

| Casual & Mobile Gamers | Broad audience preferring accessible, often free-to-play games on mobile devices. | Convenience, short play sessions, and engaging, easily understandable gameplay. | The mobile gaming market was projected to reach $272 billion by 2024. |

| IP Enthusiasts & Collectors | Fans deeply invested in specific franchises, seeking engagement across multiple media. | Desire for immersion in beloved universes through games, merchandise, comics, and adaptations. | The market for transmedia content and collectibles tied to popular IPs remains strong. |

Cost Structure

Game development and production represent a substantial cost for Embracer, encompassing salaries for its vast workforce of developers, essential software licenses, necessary hardware, and various outsourcing expenditures. This is a core component of bringing their diverse game portfolio to life.

In the fiscal year ending March 31, 2024, Embracer reported significant investments in game development, reflecting the ongoing creation of their extensive game pipeline. The company's strategic focus on efficiency has led to efforts to reduce capitalized game development investments as part of its broader restructuring initiatives.

Embracer Group's cost structure heavily relies on significant investment in sales, marketing, and distribution to bring its diverse game portfolio to a global audience. These expenses are crucial for building brand awareness, driving player engagement, and ensuring games reach consumers effectively across various platforms.

In 2024, advertising campaigns, content creation for marketing materials, and participation in major industry events like Gamescom and E3 remained substantial cost drivers. Fees paid to digital storefronts such as Steam, PlayStation Store, and Xbox Games Store, as well as physical distribution partners, also represent a considerable portion of these costs, impacting net revenue on sales.

User acquisition, particularly for their mobile gaming segment, continues to be a key expenditure. This involves significant spending on in-app advertising, influencer collaborations, and targeted campaigns to attract and retain players in a highly competitive market. For example, in the first half of fiscal year 2024, Embracer reported that marketing and distribution expenses were a significant factor in their operational costs.

Embracer Group has historically allocated substantial resources to its acquisition strategy. These costs encompassed legal expenses, thorough due diligence processes, and the subsequent integration of newly acquired businesses into its existing structure. For instance, the 2021 acquisition of Gearbox Entertainment for up to $1.3 billion, while a strategic move, inherently carried significant transaction and integration costs that impacted the company's financial outlay.

While Embracer's recent strategic direction has shifted towards divestments, the legacy of past mergers and acquisitions continues to influence its cost base. Any future pursuit of growth through acquisitions would necessitate similar expenditures, covering advisory fees, valuation assessments, and the operational alignment of new entities, mirroring the financial commitments made in prior periods.

Employee Salaries and Restructuring Costs

Employee compensation is a significant expense for Embracer, given its vast network of studios and operating groups. In the fiscal year ending March 31, 2023, Embracer reported personnel costs of SEK 12,918 million (approximately USD 1.2 billion), highlighting the substantial investment in its workforce.

The company's recent restructuring efforts, initiated in 2023 and continuing into 2024, have introduced considerable one-off costs. These include expenses tied to workforce reductions and the closure of certain studios, impacting a substantial number of employees as Embracer sought to streamline operations and enhance efficiency.

- Employee Compensation: Personnel costs reached SEK 12,918 million in FY23.

- Restructuring Impact: Layoffs and studio closures have led to significant one-off expenses.

- Efficiency Drive: The goal is to create a leaner and more efficient operational structure.

General and Administrative Overhead

General and Administrative (G&A) overhead represents a significant component of Embracer's cost structure, encompassing expenses related to its decentralized operational model. These costs include salaries for administrative staff across its numerous studios, the maintenance and development of IT infrastructure supporting diverse operations, and the upkeep of office spaces. Furthermore, corporate functions essential for managing this expansive group also contribute to the G&A base.

Embracer is actively pursuing strategies to manage and reduce these fixed operating costs. The company's focus on efficiency measures aims to streamline administrative processes and optimize resource allocation. For example, as of the fiscal year ending June 30, 2024, Embracer's reported Selling, General and Administrative expenses were SEK 9,810 million. This figure reflects the ongoing investment in supporting its vast portfolio of game development studios and ongoing operational needs.

- Administrative Staff: Costs associated with managing the diverse workforce across all Embracer Group entities.

- IT Infrastructure: Expenses for maintaining and upgrading the technology backbone supporting global operations and game development.

- Office Spaces: Costs related to physical office locations for corporate headquarters and various development studios.

- Corporate Functions: Expenditures on central management, legal, finance, and HR services essential for group oversight.

Embracer's cost structure is heavily influenced by its extensive game development and production activities, which include salaries, software, hardware, and outsourcing. The company also incurs significant expenses in sales, marketing, and distribution to promote its diverse game portfolio globally. User acquisition, particularly for mobile games, remains a key expenditure, alongside substantial investments in past acquisitions and ongoing restructuring efforts that have led to one-off costs.

| Cost Category | Description | FY23 Data (SEK million) | FY24 Data (SEK million) |

|---|---|---|---|

| Game Development & Production | Salaries, software, hardware, outsourcing | N/A (Capitalized) | N/A (Capitalized) |

| Sales, Marketing & Distribution | Advertising, content creation, platform fees | N/A | 9,810 (SG&A) |

| Employee Compensation | Salaries for developers, administrative staff | 12,918 | N/A |

| Restructuring Costs | Layoffs, studio closures | N/A | Significant one-off costs |

| Acquisitions | Due diligence, legal, integration | N/A | N/A |

Revenue Streams

Embracer Group's revenue heavily relies on selling PC and console games. This encompasses both exciting new releases and established titles from their extensive back catalog. Sales occur through digital storefronts like Steam, PlayStation Store, and Xbox Live, as well as traditional physical retail channels.

The company saw significant revenue from game sales in its fiscal year ending March 31, 2024. For instance, their Q4 FY24 report highlighted strong performance driven by their gaming segment, with new AAA releases acting as crucial financial catalysts for the business.

Embracer Group's mobile gaming segment generates revenue through multiple avenues, including direct game sales and in-app purchases, offering players various ways to engage and spend. For free-to-play titles, advertising also serves as a key revenue stream, capitalizing on player engagement.

This mobile division has demonstrated consistent organic growth, and projections indicate it will remain a substantial contributor to Embracer's total revenue. In the fiscal year ending March 31, 2024, Embracer reported significant revenue from its mobile operations, underscoring its importance within the company's portfolio.

Embracer Group taps into its vast library of intellectual property by licensing its gaming franchises and other assets for diverse media. This includes opportunities in film, television, and merchandise, allowing brands to reach new audiences beyond interactive entertainment. For example, their ownership of the Middle-earth IP opens significant avenues for licensing in various entertainment sectors.

In 2023, Embracer reported a significant portion of its revenue derived from the licensing of its intellectual property. While specific figures for transmedia licensing are often integrated within broader segment reporting, the strategy is clearly a key driver for extending brand value and generating recurring income streams. This approach diversifies revenue beyond direct game sales and in-game purchases.

Tabletop Games Sales (Historically, now Asmodee)

Before its separation in February 2025, the Asmodee Group, a key part of Embracer, generated substantial revenue from its tabletop games division. This segment was a major income source, encompassing sales of popular board games, collectible card games, and other tabletop entertainment.

The tabletop games sector, historically under Embracer and now operating as Asmodee, demonstrated strong performance. For instance, during the fiscal year ending March 31, 2023, Embracer reported that its Tabletop segment, primarily Asmodee, achieved net sales of SEK 10,331 million (approximately $990 million USD at the time).

- Significant Revenue Driver: Asmodee's tabletop games were a cornerstone of Embracer's financial performance prior to its spin-off.

- Product Diversity: The revenue stemmed from a wide array of products, including board games, card games, and role-playing games.

- Market Presence: Asmodee's established brands and distribution network contributed to its consistent sales figures.

- Historical Financial Impact: In the fiscal year ending March 2023, the Tabletop segment, dominated by Asmodee, contributed SEK 10,331 million to Embracer's net sales.

Platform Deals and Other Commercial Agreements

Embracer Group's revenue is significantly bolstered by platform deals and other commercial agreements, which go beyond traditional game sales. These arrangements include partnerships with digital storefronts, inclusion in subscription services, and other strategic collaborations.

For instance, in the fiscal year ending March 31, 2024, Embracer reported net sales of SEK 34.5 billion (approximately $3.2 billion USD). A portion of this revenue undoubtedly stems from these platform-centric deals, offering a more stable and predictable income stream.

These agreements can manifest in several ways:

- Upfront Payments: Securing a spot on a major digital storefront or a prominent placement within a subscription service can generate immediate revenue.

- Revenue Sharing: Deals often involve a percentage of sales generated through the platform, providing ongoing royalties.

- Licensing and IP Deals: Partnerships can extend to licensing Embracer's intellectual property for use in other media or on different platforms, creating additional revenue channels.

Embracer Group's revenue streams are diverse, encompassing direct game sales across PC and consoles, both new releases and back catalog titles. Mobile gaming contributes significantly through direct sales, in-app purchases, and advertising. Furthermore, licensing intellectual property for film, TV, and merchandise provides additional income, with the Middle-earth IP being a prime example of this strategy.

Platform deals and commercial agreements, including upfront payments and revenue sharing with digital storefronts and subscription services, also play a crucial role in bolstering Embracer's financial performance. These partnerships offer a more predictable income stream alongside traditional sales.

| Revenue Stream | Description | Key Examples/Notes |

|---|---|---|

| PC & Console Game Sales | Direct sales of new and existing games. | Digital storefronts (Steam, PlayStation Store), physical retail. |

| Mobile Gaming | Sales, in-app purchases, and advertising. | Free-to-play titles, consistent organic growth. |

| IP Licensing | Allowing franchises and assets for film, TV, merchandise. | Middle-earth IP licensing in various entertainment sectors. |

| Platform Deals & Commercial Agreements | Partnerships with digital storefronts, subscription services. | Upfront payments, revenue sharing, IP licensing for other platforms. |

Business Model Canvas Data Sources

The Embracer Business Model Canvas is built upon a foundation of diverse data sources, including Embracer's own financial reports, investor presentations, and internal operational data. This ensures a comprehensive understanding of the company's current state and strategic direction.