Embracer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Embracer Bundle

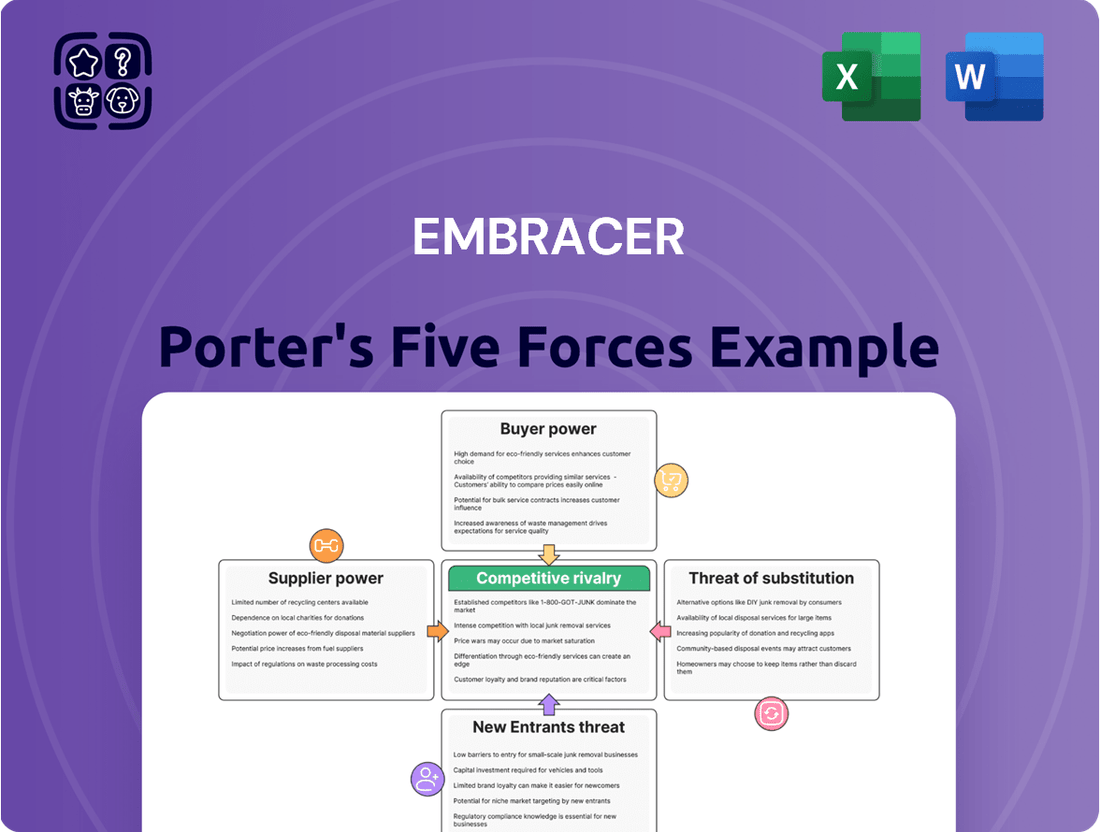

Embracer's competitive landscape is shaped by intense rivalry, significant buyer power, and the constant threat of substitutes within the dynamic gaming industry. Understanding these forces is crucial for navigating its market.

The complete report reveals the real forces shaping Embracer’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of key talent and developers within the gaming industry, particularly for a company like Embracer, is significant. Specialized skills in game development, art, and engineering are the bedrock of creating successful titles. When these talent pools are limited or in high demand, these individuals and teams gain leverage, which can translate into demands for higher compensation or more advantageous contractual arrangements.

Embracer's operational strategy, which involves a decentralized model built upon acquiring and integrating numerous studios, amplifies the importance of retaining these creative teams. For instance, in 2023, the global gaming market size was estimated to be around $184 billion, underscoring the immense value generated by skilled developers. The ability to keep these core groups engaged and motivated is paramount to the continued success and output of Embracer's diverse portfolio of games.

Intellectual property licensors wield considerable bargaining power, especially when Embracer Group relies on highly popular or exclusive licensed properties. These licensors can dictate terms, royalty rates, and usage rights, directly impacting Embracer's profitability and creative freedom. For instance, if a major franchise like Lord of the Rings, which Embracer has rights to, experiences a surge in popularity, the licensor's leverage increases significantly during renegotiations.

Embracer's dependence on specific major IPs creates vulnerability; unfavorable renegotiations or the loss of crucial licensing agreements could severely disrupt its product pipeline and revenue streams. This power dynamic is particularly evident when considering the high costs associated with securing rights for well-known intellectual properties, which can represent a substantial portion of a game's development budget.

Platform holders like Sony, Microsoft, and Nintendo wield significant bargaining power. Their control over console distribution channels and app stores for mobile gaming, such as Apple's App Store and Google Play, allows them to dictate terms, including revenue-sharing agreements. For instance, Apple and Google typically take a 30% cut of in-app purchases, a standard that publishers must accept to reach these vast user bases.

Marketing and Distribution Partners

Marketing and distribution partners, such as specialized agencies or large advertising platforms, can exert significant bargaining power over Embracer. This power stems from their ability to provide unique market access, specialized promotional services, or extensive consumer reach that Embracer might find difficult or costly to replicate internally. For instance, a dominant digital advertising platform might command higher prices if it offers unparalleled targeting capabilities for Embracer's game releases.

The influence of these partners directly impacts Embracer's promotional strategies and associated costs. If a key distribution channel for physical board games is controlled by a few powerful entities, they can negotiate more favorable terms, affecting Embracer's margins and market penetration. In 2024, the global digital advertising market was valued at over $600 billion, highlighting the scale of influence these platforms can wield.

- Unique Reach: Partners with exclusive access to specific demographics or geographic markets can command higher fees.

- Specialized Services: Agencies offering niche marketing expertise, like influencer collaborations for gaming, can leverage their specialized skills.

- Platform Dominance: Major advertising networks or retail distribution platforms hold sway due to their widespread user base and infrastructure.

- Negotiating Leverage: The ability of these partners to limit market access or dictate terms can increase costs for Embracer.

Hardware and Technology Vendors

Hardware and technology vendors, particularly those supplying specialized equipment like servers and advanced computing infrastructure crucial for game development and online services, can hold significant bargaining power. This is especially true when Embracer Group relies on cutting-edge technologies where alternative suppliers are limited.

Disruptions in the supply chain or unexpected price hikes for essential components from these vendors can directly impact Embracer's operational efficiency and potentially delay critical development timelines. For instance, a global shortage of high-performance GPUs, a common occurrence in recent years, could force Embracer to incur higher costs or wait longer for necessary development hardware.

- Component Scarcity: Recent semiconductor shortages, extending into 2024, have demonstrated the vulnerability of tech supply chains, leading to increased lead times and prices for critical hardware.

- Technological Dependence: Embracer's reliance on specialized server infrastructure for its growing online gaming services means that providers of these high-capacity, low-latency solutions wield considerable influence.

- Vendor Consolidation: In certain niches of advanced computing, a limited number of dominant suppliers can consolidate power, allowing them to dictate terms more effectively.

The bargaining power of suppliers for Embracer is a critical factor, especially concerning intellectual property (IP) licensors and hardware/technology vendors. IP holders can command high royalty rates and strict usage terms, directly impacting profitability. Similarly, specialized technology providers, particularly those supplying essential components for game development and online services, can exert significant leverage, especially during periods of component scarcity. For example, the ongoing demand for high-end GPUs in 2024 continues to give chip manufacturers considerable pricing power.

| Supplier Type | Key Leverage Points | Impact on Embracer |

|---|---|---|

| IP Licensors | Popularity of IP, exclusivity, brand recognition | Higher royalty rates, restricted creative control, potential revenue loss if rights are not renewed |

| Hardware/Tech Vendors | Component scarcity (e.g., GPUs), technological specialization, limited alternatives | Increased hardware costs, longer lead times for development equipment, potential operational delays |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Embracer's gaming and entertainment ecosystem.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Individual gamers wield significant bargaining power. With a plethora of entertainment choices available, from other video games to streaming services and social media, gamers can easily switch allegiances if a game or company fails to meet their expectations. This high substitutability means Embracer must constantly innovate and offer compelling value to retain its player base.

Digital distribution platforms like Steam, PlayStation Store, and the Apple App Store wield considerable power over game publishers such as Embracer. These platforms act as gatekeepers, controlling not only access to consumers but also setting crucial terms like revenue splits and content guidelines. For instance, Steam's standard revenue share is 70/30, meaning developers receive 70% of sales, a structure that directly impacts Embracer's profitability.

Embracer's dependence on these digital storefronts means they must often comply with platform-specific policies and algorithms that influence game discoverability. This reliance grants platforms leverage in negotiations, as publishers need these channels to reach their player base effectively. The sheer volume of games available on these platforms further amplifies their bargaining power, as publishers compete for visibility.

For physical game copies and board games, major retailers and wholesalers wield significant bargaining power. Their control over prime shelf space and established distribution networks means they can dictate terms to publishers like Embracer. This power translates into demands for favorable pricing, co-op advertising funds, and generous return policies, directly affecting Embracer's profitability and inventory control.

The retail landscape for physical games is increasingly concentrated. For instance, in 2024, the top five major retailers in many Western markets still command a substantial portion of physical game sales, giving them leverage. This consolidation means fewer buyers for Embracer's physical products, amplifying their ability to negotiate better terms and potentially limiting Embracer's reach if agreements aren't met.

Subscription Service Providers

The increasing prevalence of gaming subscription services like Xbox Game Pass and PlayStation Plus positions these platforms as significant customers for game developers and publishers. In 2024, these services continue to grow, offering vast libraries of games to subscribers, which directly impacts how content is licensed and distributed.

These subscription providers wield considerable bargaining power. They can leverage their large subscriber bases to negotiate favorable bulk licensing agreements for game content, potentially influencing the per-unit revenue publishers receive for individual game sales. This dynamic forces companies like Embracer to carefully consider their distribution strategies.

- Subscription Service Growth: Xbox Game Pass reported over 34 million subscribers as of early 2024, while PlayStation Plus has over 100 million monthly active users.

- Licensing Power: The ability of these services to offer hundreds of games means they can demand significant discounts on licensing fees.

- Revenue Diversification: Embracer needs to balance direct-to-consumer sales with the revenue generated from placing its titles on these popular subscription platforms.

Community and Influencers

The collective voice of gaming communities, amplified by influential streamers and content creators, holds significant sway over a game's trajectory. Negative sentiment or widespread poor reviews can rapidly dissuade potential buyers, thereby increasing customer power through viral social proof. For instance, in 2024, games that received substantial backlash on platforms like Twitch and YouTube often saw immediate drops in player numbers and sales, demonstrating the tangible impact of community feedback.

Embracer must proactively engage with and respond to its player base to mitigate this power. This involves not just addressing complaints but also fostering positive relationships and incorporating feedback into game development and updates. A proactive community management strategy can turn potential detractors into advocates, a crucial tactic in the competitive gaming landscape where word-of-mouth is paramount.

- Community Sentiment: In 2024, a significant percentage of gamers reported that influencer opinions and community discussions heavily influenced their purchasing decisions.

- Viral Feedback Loops: Negative experiences shared widely on social media can create rapid, damaging feedback loops that are difficult for companies to counteract.

- Influencer Impact: Top-tier gaming influencers can drive millions of views, directly translating to awareness and potential sales, but also to criticism if a game underdelivers.

- Engagement Strategy: Embracer's ability to foster genuine dialogue and respond effectively to community concerns in 2024 was a key differentiator for its individual studios' success.

Customers, both individual gamers and large platform holders, possess substantial bargaining power. The ease with which gamers can switch to alternative entertainment options, coupled with the gatekeeping role of digital storefronts like Steam and console marketplaces, means Embracer must consistently deliver value and adhere to platform terms. Retailers, particularly for physical media, also exert influence through their control over shelf space and return policies.

The rise of subscription services further concentrates customer power. Companies like Xbox Game Pass, with over 34 million subscribers in early 2024, can negotiate favorable licensing deals for vast game libraries. This necessitates a strategic approach from Embracer, balancing direct sales with the revenue potential of these subscription platforms.

Community sentiment, amplified by influencers, also plays a critical role. In 2024, a significant portion of gamers cited influencer opinions and community discussions as key purchasing influences. Negative feedback shared widely can swiftly impact sales, underscoring the importance of proactive community engagement for Embracer.

| Customer Segment | Bargaining Power Factor | Impact on Embracer (2024) |

|---|---|---|

| Individual Gamers | High substitutability of entertainment options | Need for continuous innovation and value proposition |

| Digital Platforms (e.g., Steam) | Control over distribution and revenue splits (70/30 standard) | Negotiating leverage on terms, impacting profitability |

| Major Retailers (Physical Games) | Control over shelf space and distribution networks | Demands for favorable pricing, co-op advertising, and return policies |

| Subscription Services (e.g., Game Pass) | Large subscriber bases (Xbox Game Pass: >34M early 2024) | Ability to negotiate bulk licensing, influencing per-unit revenue |

| Gaming Communities/Influencers | Amplified voice through social media and streaming | Significant impact on purchasing decisions and game trajectory |

Preview the Actual Deliverable

Embracer Porter's Five Forces Analysis

This preview shows the exact, professionally written Embracer Porter's Five Forces analysis you'll receive immediately after purchase. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the gaming industry. Rest assured, there are no surprises or placeholders; this is the complete, ready-to-use document.

Rivalry Among Competitors

The global gaming market is a battleground with countless players, from massive corporations to nimble indie teams, all vying for players' attention and dollars. Embracer faces off against industry titans like Tencent, which reported over $32 billion in revenue for 2023, and platform holders such as Sony and Microsoft, whose console sales continue to drive significant market activity. This intense fragmentation means constant pressure to innovate and remain competitive on pricing.

The gaming market is incredibly crowded, with a relentless influx of new titles hitting PC, consoles, and mobile devices. This sheer volume means Embracer's games face intense competition for player attention and spending, driving up marketing and development expenses just to get noticed. For instance, in 2023, over 12,000 new games were released on Steam alone.

This saturation leads to a constant battle for visibility, forcing companies like Embracer to invest heavily in promotion and unique features to differentiate their offerings. Player fatigue and the finite nature of disposable income further intensify this rivalry, making it challenging for any single title to achieve widespread, sustained success.

Embracer's aggressive acquisition strategy, while fueling growth, inherently intensifies competitive rivalry. By snapping up numerous studios and intellectual properties, the company creates internal competition for capital, talent, and strategic focus. Externally, this M&A spree directly escalates the battle for attractive acquisition targets, driving up prices and making it harder for Embracer to secure deals that align with its strategic goals.

The gaming industry in 2024 saw continued robust M&A activity, with major players like Microsoft's acquisition of Activision Blizzard (valued at approximately $68.7 billion) setting a high bar and demonstrating the competitive landscape. This trend means Embracer faces well-funded rivals also seeking to consolidate market share through acquisitions, further increasing the cost and complexity of its own growth-by-acquisition model.

Furthermore, the sheer volume of acquisitions presents a significant integration challenge. If these newly acquired entities are not effectively integrated into Embracer's operational structure and culture, it can lead to inefficiencies, hinder synergy realization, and ultimately create a competitive disadvantage compared to rivals with more streamlined operations.

Cross-Platform Competition and Genre Saturation

Embracer Group faces intense competition not just within specific gaming genres but also across the diverse platforms where games are played, including PC, consoles, and mobile devices. A hit title on one platform or within a particular genre can easily siphon player attention and spending away from Embracer’s offerings. For instance, the mobile gaming market, a significant revenue driver for many companies, saw global revenues reach approximately $90 billion in 2023, showcasing the sheer scale and competition within that segment alone.

The company’s broad portfolio, encompassing numerous studios and intellectual properties, acts as a strategic advantage by diversifying its market presence. However, this breadth also means Embracer must contend with a wide array of competitors simultaneously, each demanding specialized knowledge, development resources, and tailored marketing approaches. This multi-front competition necessitates a robust and adaptable strategy to maintain market share across different gaming ecosystems.

- Platform Diversity: Competition spans PC, console, and mobile gaming markets, each with distinct player bases and monetization models.

- Genre Saturation: Popular genres like action-adventure, RPG, and battle royale are highly saturated, intensifying rivalry for player engagement.

- Cross-Platform Impact: Success on one platform can directly impact player acquisition and retention on others, creating a dynamic competitive landscape.

- Portfolio Management: Embracer's diverse portfolio requires managing competition across multiple genres and platforms, demanding varied expertise and resource allocation.

Talent Wars and IP Retention

The competition for skilled game developers and valuable intellectual property (IP) is intense, directly impacting companies like Embracer. Competitors are actively trying to hire away experienced talent or purchase studios with sought-after games, which can deplete Embracer's own creative resources.

For instance, in 2023, the gaming industry saw significant M&A activity, with major players like Microsoft's acquisition of Activision Blizzard for $68.7 billion, highlighting the high stakes in acquiring talent and IP. This trend continued into 2024 as companies sought to bolster their creative pipelines.

Embracer's decentralized operational model aims to foster creative independence, which is crucial for retaining top talent. However, managing this decentralized structure effectively while fending off aggressive talent acquisition by rivals presents a significant challenge. The ability to keep developers engaged and inspired is paramount in this talent war.

- Talent Acquisition: Competitors actively recruit experienced developers, creating a competitive hiring market.

- IP Competition: Studios and valuable game franchises are frequently targets for acquisition by rivals.

- Retention Strategy: Embracer's decentralized model supports creative freedom, vital for keeping talent.

- Management Challenge: Balancing independence with centralized oversight is key to retaining talent amidst fierce competition.

The competitive rivalry within the gaming industry is fierce, characterized by a constant influx of new titles and a battle for player attention across multiple platforms. Embracer Group contends with industry giants like Tencent, which generated over $32 billion in revenue in 2023, and platform holders such as Sony and Microsoft, whose console sales significantly influence market dynamics. This intense market saturation, with over 12,000 games released on Steam alone in 2023, forces companies to invest heavily in marketing and innovation to stand out.

Embracer's aggressive acquisition strategy, exemplified by the ongoing M&A activity in 2024, directly escalates this rivalry. The industry saw major consolidations, such as Microsoft's approximately $68.7 billion acquisition of Activision Blizzard, driving up the cost of acquiring valuable studios and intellectual property. This necessitates robust integration strategies for newly acquired entities to avoid inefficiencies and maintain a competitive edge.

Competition also extends to securing top talent and desirable intellectual property, with rivals actively recruiting experienced developers and acquiring studios with popular franchises. Embracer’s decentralized operational model, while fostering creative independence crucial for talent retention, presents a challenge in managing this talent war effectively amidst aggressive competitor strategies.

| Competitor | 2023 Revenue (Approx.) | Key Strengths |

|---|---|---|

| Tencent | $32 billion+ | Vast portfolio, strong mobile presence, significant global reach |

| Sony (PlayStation) | Not directly comparable (division) | Exclusive console titles, strong first-party studios, established brand loyalty |

| Microsoft (Xbox) | Not directly comparable (division) | Growing first-party studios, Game Pass subscription model, cloud gaming initiatives |

SSubstitutes Threaten

Other digital entertainment forms, like streaming video services and social media, are significant substitutes for video games and board games. These alternatives vie for consumers' limited leisure time and discretionary spending. For example, in 2024, global spending on video games was projected to reach over $200 billion, while the streaming video market was expected to surpass $300 billion.

The ease with which consumers can switch between these entertainment options is remarkably high. A user can easily transition from playing a game to watching a show on a streaming platform or scrolling through social media feeds, making the threat of substitution quite potent.

Beyond the digital realm, traditional entertainment and hobbies pose a significant threat of substitution for Embracer. Consumers can opt for activities like watching movies, reading books, attending live sporting events, engaging in outdoor pursuits, or pursuing non-digital hobbies such as crafting or playing board games not affiliated with Embracer. These alternatives compete for discretionary income and leisure time, particularly impacting casual consumers seeking varied leisure options.

The rise of free-to-play (F2P) games and ad-supported online content presents a substantial threat of substitutes for Embracer. Consumers increasingly opt for entertainment that requires no upfront cost, such as mobile F2P titles or platforms offering free news and short-form videos. This trend directly challenges premium pricing strategies in the gaming industry, forcing companies like Embracer to consider alternative monetization methods.

In 2024, the mobile gaming market, heavily dominated by F2P models, continued its robust growth, with global revenue projected to reach over $100 billion. This vast market offers readily available, often high-quality, entertainment alternatives that directly compete with paid game offerings. Embracer must acknowledge and strategize around this pervasive 'free' value proposition.

User-Generated Content and Metaverse Platforms

Platforms that heavily feature user-generated content (UGC) and metaverse-like experiences present a significant threat of substitutes for companies like Embracer. Games such as Roblox and Minecraft, for example, allow players to create and share their own content, fostering deep engagement and virtually endless replayability. This can divert player time and spending away from traditional game purchases.

These UGC platforms offer an immersive environment where users can not only play but also build and socialize, blurring the lines between entertainment and creation. Fortnite's creative modes exemplify this trend, enabling users to design and play custom games within the existing ecosystem. This constant stream of novel, player-driven content reduces the need for consumers to seek out new, commercially developed titles.

The economic scale of these UGC platforms is substantial. For instance, Roblox reported over 70 million daily active users as of early 2024, with a significant portion of their revenue derived from in-game purchases within user-created experiences. This user-driven economy demonstrates the powerful appeal and potential to capture consumer attention and discretionary spending that might otherwise go to companies like Embracer.

- Roblox's Daily Active Users: Exceeded 70 million in early 2024, showcasing immense user engagement.

- Minecraft's Sales: Surpassed 300 million copies sold by late 2023, indicating broad appeal and longevity.

- Fortnite's Creative Mode: Continues to attract millions of players who engage with user-generated games and experiences.

- UGC Value Proposition: Offers endless replayability and personalized content, directly competing with traditional game releases.

Emerging Technologies and Trends

Emerging technologies like virtual reality (VR) and augmented reality (AR) pose a significant threat of substitution for traditional gaming platforms. As these immersive technologies mature and become more accessible, they could draw consumers away from PC, console, and mobile gaming. For instance, the global VR market was valued at approximately $28 billion in 2023 and is projected to grow substantially, indicating a rising interest in these alternative experiences.

Evolving social trends also contribute to the threat of substitutes. New forms of digital interaction and entertainment, such as interactive streaming platforms or decentralized social networks, compete for consumer attention and time. The increasing popularity of short-form video content, for example, demonstrates how quickly consumer engagement can shift to new digital formats, potentially impacting time spent on traditional gaming.

Embracer Group must actively monitor and adapt to these technological and social shifts to mitigate the threat of substitutes. This involves investing in or partnering with companies developing these new technologies and exploring how to integrate them into their existing portfolio or create new offerings. Failure to adapt could see a significant portion of their target audience migrate to these emerging entertainment alternatives.

- VR and AR Market Growth: The VR market's projected expansion highlights the increasing appeal of immersive, alternative entertainment experiences.

- Shifting Consumer Habits: The rise of new digital interaction forms, like short-form video, underscores the dynamic nature of consumer engagement and potential diversion from gaming.

- Strategic Adaptation: Embracer's proactive engagement with emerging technologies and trends is crucial for maintaining market relevance and mitigating substitution risks.

The threat of substitutes for Embracer is significant, as consumers have a wide array of entertainment options beyond video games and board games. These include streaming services, social media, and other digital or traditional leisure activities that compete for both time and money. For instance, global video game spending was projected to exceed $200 billion in 2024, while the streaming market was expected to surpass $300 billion, illustrating the scale of these competing entertainment sectors.

The ease of switching between entertainment forms further amplifies this threat. Consumers can fluidly move from gaming to watching videos or engaging on social media, making it simple to divert attention and spending. Furthermore, the rise of free-to-play (F2P) games and ad-supported content directly challenges premium pricing models, as seen in the mobile gaming market, which was projected to generate over $100 billion in revenue in 2024.

Platforms emphasizing user-generated content (UGC) like Roblox, which reported over 70 million daily active users in early 2024, and Minecraft, with over 300 million copies sold by late 2023, offer endless replayability and personalized experiences. These platforms capture significant consumer attention and spending, potentially diverting it from traditional game purchases. Emerging technologies like VR, with its market valued at approximately $28 billion in 2023, also present compelling alternative entertainment experiences that Embracer must consider.

| Substitute Category | Key Examples | 2024 Market Projection (USD) | Key Competitive Factor |

| Digital Entertainment | Streaming Video, Social Media | Video Games: >$200 Billion; Streaming: >$300 Billion | High ease of switching, broad appeal |

| Free-to-Play (F2P) & Ad-Supported Content | Mobile F2P Games, Online Video Platforms | Mobile Gaming: >$100 Billion | No upfront cost, accessibility |

| User-Generated Content (UGC) Platforms | Roblox, Minecraft, Fortnite Creative | Roblox DAU: >70 Million (Early 2024); Minecraft Sales: >300 Million (Late 2023) | Endless replayability, community engagement |

| Immersive Technologies | Virtual Reality (VR), Augmented Reality (AR) | VR Market: ~$28 Billion (2023) | Novelty, enhanced immersion |

Entrants Threaten

Developing and publishing AAA console and PC games demands massive upfront capital. This includes substantial investments in skilled personnel, cutting-edge technology, extensive marketing campaigns, and established distribution networks. For instance, the development budget for a single AAA title can easily exceed $100 million, with marketing costs often adding tens of millions more.

This immense financial requirement acts as a significant barrier, deterring many potential new entrants from even attempting to establish a large-scale game publishing operation from the ground up. While companies like Embracer can grow through strategic acquisitions of existing studios, the sheer cost and risk associated with building a new AAA publisher from scratch are prohibitive for most.

Established gaming giants, including companies like Embracer Group, possess a significant advantage through their robust intellectual property (IP) portfolios and deeply ingrained brand recognition. Franchises like Lord of the Rings, Borderlands, and Dead Island, for instance, come with built-in fan bases and established market presence, making them immediately attractive to consumers. This existing loyalty presents a formidable barrier for newcomers.

New entrants into the gaming industry face the monumental task of not only developing high-quality games but also cultivating brand loyalty and creating original intellectual property that can resonate with players. In 2024, the average cost to develop a AAA video game can exceed $200 million, a substantial investment that new companies must absorb without the benefit of established recognition. Furthermore, building a reputation and cutting through the noise in an increasingly saturated market requires significant marketing spend and innovative strategies to capture consumer attention.

New companies entering the gaming market face significant hurdles in securing placement on major digital storefronts like Steam, PlayStation Store, and the App Store. These platforms, controlled by powerful entities, often favor established publishers with proven sales histories and strong relationships. For instance, Apple's App Store and Google Play Store have rigorous review processes and can be selective about new titles, especially those without a clear marketing strategy or established developer reputation. Embracer's existing portfolio of studios and its established presence within the industry provide a distinct advantage in navigating these gatekeepers and securing favorable terms.

Talent Acquisition and Retention

The threat of new entrants in the gaming industry, particularly concerning talent acquisition and retention, is significant. The specialized skills required for game development, such as programming, art, and design, create a persistent demand for qualified professionals. New companies face a steep challenge in attracting and retaining this talent when competing against established players like Embracer, which can offer more attractive compensation packages, comprehensive benefits, and the allure of working on well-known franchises and a diverse array of projects.

Embracer's strategic advantage lies in its decentralized structure and broad portfolio, which appeals to a wide range of creative talent seeking varied experiences and career growth. This makes it difficult for nascent companies to poach skilled individuals. For instance, in 2024, the global gaming market was projected to generate over $200 billion in revenue, highlighting the intense competition for market share and the talent that drives it. Companies like Embracer, with their established reputation and numerous studios, are better positioned to secure and keep the best minds in the field.

- High Demand for Specialized Skills: Game development requires niche expertise in areas like AI programming, 3D modeling, and narrative design, leading to a competitive talent landscape.

- Established Companies' Advantages: Firms like Embracer can leverage their financial resources and brand recognition to offer superior compensation, benefits, and career development opportunities, making it hard for newcomers to compete for top talent.

- Embracer's Decentralized Model Appeal: The opportunity to work across diverse game genres and IPs within Embracer's network can be a significant draw for talent, creating a barrier for startups aiming to attract and retain skilled employees.

Economies of Scale in Publishing and Marketing

Economies of scale significantly deter new entrants in the publishing and marketing sectors. Established players like Embracer Group leverage their size to secure more favorable terms with suppliers and distributors, reducing their per-unit costs for development and promotion.

For instance, a large publisher can negotiate bulk discounts on marketing campaigns, reaching a broader audience more cost-effectively than a newcomer. This cost advantage makes it difficult for new companies to compete on price or marketing spend.

- Reduced Marketing Costs: Embracer's scale allows for more efficient marketing spend, potentially achieving a higher return on investment compared to smaller, less experienced entities.

- Infrastructure Advantages: Shared backend services and infrastructure across multiple studios lower operational overheads for large organizations.

- Negotiating Power: Access to better deals from vendors and service providers directly impacts the profitability and competitiveness of established firms.

- Market Penetration Barriers: The sheer volume of marketing required to gain traction in the current landscape presents a substantial financial hurdle for startups.

The threat of new entrants for Embracer is considerably low due to the immense capital required to enter the AAA gaming market. Developing and marketing high-quality games demands hundreds of millions of dollars, a barrier most startups cannot overcome. For example, in 2024, the average development budget for a AAA title often surpassed $200 million, coupled with substantial marketing expenditures.

Established players like Embracer benefit from strong brand recognition and existing intellectual property, which newcomers struggle to replicate. Building brand loyalty and a recognizable IP from scratch is a lengthy and costly endeavor. Furthermore, securing prominent placement on digital storefronts like Steam or the PlayStation Store presents a significant challenge for new companies without established track records or relationships.

Talent acquisition and retention also pose a substantial hurdle for new entrants. The gaming industry's demand for specialized skills means companies must offer competitive compensation and benefits to attract top talent. Embracer's decentralized structure and diverse portfolio of studios make it an attractive employer, making it difficult for smaller, newer companies to poach skilled professionals. The global gaming market's projected revenue of over $200 billion in 2024 underscores the intense competition for both market share and the talent needed to achieve it.

| Factor | Impact on New Entrants | Embracer's Advantage |

|---|---|---|

| Capital Requirements | Extremely High (>$200M for AAA) | Established financial capacity and access to capital |

| Intellectual Property (IP) & Brand Recognition | Low (must build from scratch) | Strong existing IPs (e.g., Borderlands, Lord of the Rings) |

| Distribution & Storefront Access | Difficult (gatekeepers favor established players) | Existing relationships and proven sales history |

| Talent Acquisition & Retention | Challenging (competing with established firms) | Attractive employer brand, diverse projects, competitive compensation |

| Economies of Scale | Limited (higher per-unit costs) | Lower marketing and operational costs through bulk purchasing and shared infrastructure |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Embracer leverages data from company filings, investor presentations, and industry-specific market research reports. We also incorporate insights from news articles and analyst commentary to provide a comprehensive view of the competitive landscape.