E-mart PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E-mart Bundle

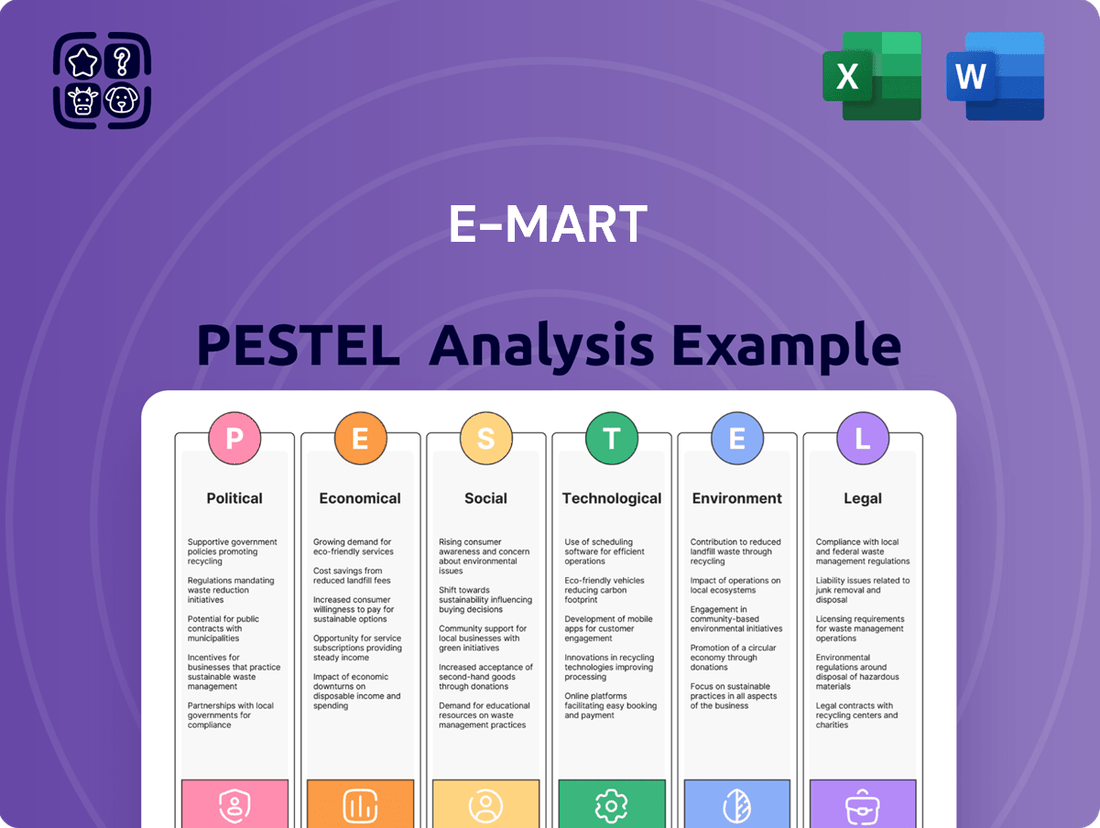

Navigate the complex external landscape impacting E-mart with our detailed PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping its operations and future growth. Gain a competitive advantage by leveraging these critical insights. Download the full analysis now for actionable intelligence to inform your own strategic decisions.

Political factors

The South Korean government is actively working to reduce regulatory burdens on large retailers. A significant reform involves the potential elimination of mandatory Sunday closures for hypermarkets, a move that directly benefits companies like E-Mart.

This deregulation initiative grants E-Mart greater operational flexibility, allowing for expanded store hours and potentially increasing sales revenue and customer satisfaction. For instance, in 2023, discussions around these reforms were prominent, indicating a clear government intent to foster a more competitive retail landscape.

These policy adjustments signal a broader trend towards a more business-friendly environment for major retail chains in South Korea, encouraging investment and operational efficiency.

South Korea's retail sector, including E-Mart, faces heightened uncertainty due to an ongoing economic slowdown and a backdrop of both domestic and international political instability. This environment directly impacts consumer confidence, a critical driver for retail sales, potentially leading to reduced spending and a more volatile market. For instance, global supply chain disruptions, exacerbated by geopolitical tensions in 2024, have already contributed to inflationary pressures affecting consumer purchasing power.

Government interventions are actively seeking to mitigate these challenges, with policy adjustments in 2024 and early 2025 focusing on stabilizing the retail industry and adapting to shifting consumer preferences. These measures may include incentives for domestic production or support for businesses that can demonstrate resilience and innovation in the face of economic headwinds, aiming to foster a more predictable operational landscape for companies like E-Mart.

The Korean government has actively supported the retail sector by strengthening market stabilization measures. This includes coordinated actions between the Bank of Korea and financial regulators to monitor market volatility and ensure adequate liquidity. For instance, in late 2023 and early 2024, the central bank maintained its policy rate, signaling a commitment to financial stability, which indirectly benefits businesses like E-Mart by easing financing conditions.

Trade Policy and International Expansion

E-Mart's parent, Shinsegae Group, is strategically expanding internationally, with a focus on Southeast Asia. Government trade policies in countries like Mongolia and Vietnam directly influence the feasibility and cost of this expansion. For instance, E-Mart plans to establish 15 stores in Mongolia by 2030, a goal that hinges on favorable trade agreements and regulations.

International relations also play a crucial role. E-Mart's potential partnerships with global players like Alibaba are subject to cross-border trade frameworks and geopolitical stability. The group's commitment to opening 20 E-Mart stores in Laos over the next decade underscores the importance of navigating diverse international trade landscapes.

- Mongolia Expansion: E-Mart's target of 15 stores in Mongolia by 2030 is directly impacted by Mongolian import regulations and trade tariffs.

- Vietnam Focus: Shinsegae's presence in Vietnam, a key market for expansion, is influenced by Vietnam's trade agreements with South Korea and its overall openness to foreign direct investment.

- Laos Development: The planned 20 E-Mart stores in Laos over the next decade will require careful consideration of Laos's trade policies and its participation in regional economic blocs.

- Alibaba Partnership: Any potential collaboration with Alibaba is contingent on international e-commerce regulations and data privacy laws between the involved countries.

Consumer Protection Regulations

The South Korean Fair Trade Commission (FTC) is enhancing consumer protection by formalizing criteria to identify online shopping platforms with frequent complaints. New rules, anticipated in late 2025, will publicly disclose these platforms, increasing pressure on companies like E-Mart to maintain high standards. This focus on transparency and robust customer service is crucial for E-Mart's online operations to avoid negative public listings and maintain consumer trust.

These forthcoming regulations underscore a broader trend towards greater accountability in the e-commerce sector. The FTC’s initiative aims to empower consumers by providing clearer information about platform reliability. For E-Mart, this means a continued emphasis on proactive complaint resolution and adherence to evolving consumer protection mandates to ensure continued operational success.

- Increased FTC Scrutiny: Formalized criteria for identifying platforms with frequent consumer complaints expected in late 2025.

- Public Disclosure: Problematic online platforms will be publicly identified, impacting brand reputation.

- E-Mart's Compliance Focus: Need for robust customer service and adherence to new transparency rules.

- Consumer Empowerment: Regulations designed to boost public awareness and improve enforcement consistency.

The South Korean government's push to reduce retail regulations, such as potentially ending mandatory Sunday closures, offers E-Mart increased operational flexibility and revenue opportunities. However, geopolitical instability and economic slowdowns in 2024-2025 create market volatility and impact consumer spending, necessitating government support measures like interest rate stability, as seen in late 2023 and early 2024. Furthermore, evolving consumer protection laws, with new FTC criteria expected by late 2025, demand E-Mart's enhanced focus on transparency and customer service in its online operations.

| Factor | Impact on E-Mart | 2024/2025 Relevance |

|---|---|---|

| Deregulation (Sunday Closures) | Increased operational flexibility, potential sales growth | Ongoing government discussions and reforms |

| Economic Slowdown/Geopolitical Instability | Reduced consumer confidence, market volatility | Global supply chain issues and inflationary pressures |

| Government Support Measures | Stabilized financing conditions, predictable environment | Central bank policy rate stability |

| Consumer Protection (FTC) | Need for enhanced transparency and customer service in online platforms | New disclosure criteria anticipated by late 2025 |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting E-mart, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by detailing how these global and local trends present both challenges and opportunities for E-mart's growth and sustainability.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a streamlined E-mart PESTLE analysis to quickly identify and address external challenges.

Economic factors

The South Korean retail sector is facing a pronounced slowdown, with growth expected to be a mere 1% in 2024 and a further dip to 0.4% in 2025. This represents the weakest expansion since 2020, signaling a cautious consumer sentiment driven by recessionary pressures. Consumers are prioritizing essential purchases, impacting discretionary spending.

This trend directly affects E-Mart, as hypermarket sales, a key segment for the company, experienced a contraction of 0.8% in 2024. Such figures underscore the difficult operating landscape E-Mart is navigating, with reduced consumer spending power posing a significant headwind.

Consumer spending in South Korea is showing signs of weakness, largely driven by persistent economic uncertainty and the impact of inflation. This slowdown is particularly noticeable in discretionary spending areas like home appliances, clothing, and cosmetics, which have experienced negative growth.

Looking ahead, private consumption is expected to see only modest growth, with projections indicating a slow increase of approximately 1.1% for 2025. This subdued consumer demand directly affects E-Mart's overall sales performance, especially impacting its non-grocery product categories that rely heavily on discretionary purchases.

E-commerce is a powerhouse in South Korea, capturing 41.43% of retail revenue in 2024. Online sales saw a significant 15% jump that year, far outpacing the 2% growth in brick-and-mortar stores.

This clear trend means E-Mart must continue to invest heavily in its online capabilities to stay competitive. The demand for seamless online and offline shopping experiences, known as omnichannel, is particularly strong in groceries, with projections showing a 19.40% compound annual growth rate through 2030.

E-Mart's Financial Performance

E-Mart navigated a complex financial landscape in 2024. While the fourth quarter saw a widened net loss, primarily due to one-off expenses, the company achieved a significant turnaround by shifting to an operating profit for the full year 2024, a notable improvement from its operating loss in 2023. This recovery, however, was accompanied by a 1.5% year-on-year decrease in annual sales for 2024.

Despite the sales dip, E-Mart has set an ambitious target to reach 1 trillion won in operating profit by 2027. This strategic goal hinges on a renewed focus and investment in its core business segments, aiming to leverage existing strengths to drive future profitability.

- Full Year 2024 Operating Profit: Shifted to operating profit after a 2023 operating loss.

- Q4 2024 Net Loss: Widened due to one-off costs.

- 2024 Annual Sales: Decreased by 1.5% compared to the previous year.

- 2027 Operating Profit Target: Aiming for 1 trillion won by focusing on core businesses.

Labor Cost Increases

Labor costs represent a significant operational challenge for E-Mart, particularly with recent legal and economic shifts in South Korea. A pivotal ruling by the Supreme Court in December 2024 mandates the inclusion of regular periodic bonuses in ordinary wages. This decision necessitates substantial provisions for increased wage and severance pay obligations for many companies, including E-Mart.

Further compounding these pressures is the national minimum wage adjustment. Effective from 2025, the minimum wage has been set at KRW 10,030 per hour, marking a 1.7% increase. These mandated changes directly influence E-Mart's overall labor expenditure, impacting its bottom line and requiring strategic adjustments to manage profitability.

- Supreme Court Ruling (Dec 2024): Regular bonuses now count towards ordinary wages, increasing wage and severance pay liabilities.

- Minimum Wage Increase (2025): National minimum wage rises to KRW 10,030 per hour, a 1.7% hike.

- Impact on E-Mart: Direct increase in labor costs affecting operational expenses and profitability.

- Strategic Implications: Need for careful financial planning and potential operational adjustments to mitigate rising labor expenses.

South Korea's economy is experiencing a significant slowdown, with retail growth projected at only 1% in 2024 and a further contraction to 0.4% in 2025. This economic climate, marked by recessionary pressures and inflation, directly impacts consumer spending, particularly on non-essential goods. E-Mart's hypermarket segment saw a 0.8% decline in 2024, reflecting this broader trend of reduced consumer purchasing power.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on E-Mart |

|---|---|---|---|

| Retail Sector Growth | 1% | 0.4% | Reduced overall sales potential |

| Hypermarket Sales | -0.8% | N/A | Directly impacts E-Mart's core business |

| Private Consumption Growth | N/A | 1.1% | Subdued demand for non-grocery items |

Preview the Actual Deliverable

E-mart PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This E-mart PESTLE Analysis provides a comprehensive overview of the external factors impacting E-mart's operations. You will gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape.

Sociological factors

South Korean consumers are increasingly favoring online shopping, driven by the convenience and vast selection it offers, which is causing a noticeable decline in foot traffic at traditional physical stores. This evolving preference is pushing major retailers like E-Mart to bolster their online presence and adopt omnichannel strategies that seamlessly blend digital and physical retail experiences.

The high internet penetration rate, exceeding 98% of households in South Korea, coupled with a smartphone ownership rate of around 85%, significantly accelerates this consumer shift towards digital platforms. This digital-first mentality means retailers must adapt quickly to meet consumer expectations for online accessibility and integrated shopping journeys.

Consumer desire for quick and easy access to goods is a significant driver in retail. The convenience store sector, for instance, saw a robust 5.1% growth in 2024, reaching around 55,800 locations across the country. This trend underscores a clear preference for hyper-local shopping experiences.

E-Mart is well-positioned to capitalize on this demand through its E-Mart24 convenience store chain and its E-Mart Everyday supermarket brand. These formats are designed to meet the need for immediate purchases, often featuring extended or 24/7 operating hours and product selections tailored to the immediate neighborhood.

South Korean consumers are increasingly prioritizing health and sustainability, fueling demand for products like functional foods, plant-based alternatives, and eco-friendly items. This trend is notably amplified by an aging demographic, prompting retailers such as E-Mart to expand their offerings of organic and environmentally conscious goods. For instance, by the end of 2024, E-Mart reported a significant increase in sales for its private label organic produce, reflecting this growing consumer preference.

Focus on Individualization and Personalization

South Korean consumers, especially those between 25 and 69 years old, are increasingly valuing personalized experiences and unique products over mass-produced goods. This shift is evident in their purchasing habits, with a growing demand for tailored offerings that reflect individual preferences.

Shinsegae Group, E-Mart's parent company, has recognized this trend and is actively focusing on meeting the needs of its 'high-value customers' who seek novelty and distinct experiences. This strategic emphasis translates into a drive for E-Mart to refine its approach to product curation and customer engagement, aiming to provide a more individualized shopping journey.

Consequently, E-Mart is compelled to enhance its ability to tailor product recommendations and marketing communications. This involves leveraging data analytics to understand individual customer behavior and preferences, ensuring that marketing efforts resonate more effectively and drive higher engagement.

- Personalization Demand: A significant portion of South Korean consumers, particularly the 25-69 age demographic, actively seek personalized products and unique consumption experiences.

- High-Value Customer Focus: Shinsegae Group's strategy prioritizes catering to the evolving desires of high-value customers for novelty and differentiated experiences.

- Tailored Marketing: E-Mart is adapting by focusing on customized product recommendations and personalized marketing communications to meet these individual consumer demands.

Impact of Demographic Shifts

South Korea's demographic landscape is undergoing significant transformations, presenting both challenges and opportunities for retailers like E-mart. The nation's birth rate continues to decline, with the total fertility rate falling to an estimated 0.72 in 2023, well below the replacement level. This shrinking population directly impacts the overall growth potential for the domestic retail market.

Concurrently, South Korea is experiencing rapid population aging. By 2025, the proportion of citizens aged 65 and over is projected to reach approximately 20% of the total population, marking the country as a super-aged society. This demographic shift necessitates a re-evaluation of product assortments and service offerings to cater to the specific needs and preferences of an older consumer base, who may prioritize health, convenience, and specialized services.

While the overall population shrinks, the purchasing power and consumption patterns of different age groups are evolving. The younger generation, though smaller in number, remains digitally adept and influential in driving trends, particularly in online retail and personalized experiences. Retailers must therefore balance strategies to capture the spending of an aging demographic with the demands of a digitally native, younger cohort.

- Shrinking Population: South Korea's total population is projected to continue its decline, impacting overall consumer demand.

- Aging Demographics: By 2025, over 20% of South Koreans are expected to be 65 or older, shifting consumer needs towards health and convenience.

- Evolving Consumer Preferences: Retailers must adapt to the distinct demands of an older population and a digitally savvy, smaller youth segment.

South Korean consumers are increasingly prioritizing health and sustainability, fueling demand for products like functional foods and eco-friendly items. This trend is amplified by an aging demographic, prompting retailers like E-Mart to expand their offerings of organic and environmentally conscious goods, with private label organic produce sales showing a significant increase by the end of 2024.

South Korea's demographic landscape is transforming, with a declining birth rate and rapid population aging. By 2025, over 20% of the population is projected to be 65 and older, shifting consumer needs towards health and convenience, while a digitally savvy younger generation continues to drive online retail trends.

Consumers, especially those aged 25-69, are valuing personalized experiences and unique products over mass-produced items. E-Mart's parent company, Shinsegae Group, is focusing on high-value customers seeking novelty, leading E-Mart to enhance tailored product recommendations and personalized marketing communications.

| Sociological Factor | 2024/2025 Data Point | Impact on E-Mart |

|---|---|---|

| Online Shopping Preference | Continued growth in online retail penetration | Requires robust e-commerce infrastructure and omnichannel strategies |

| Health & Sustainability Focus | Increased demand for organic and eco-friendly products | Opportunity to expand private label offerings and sustainable sourcing |

| Aging Population | Projected 20% of population aged 65+ by 2025 | Need to adapt product assortments and services for older consumers |

| Personalization Demand | Consumers aged 25-69 seek unique and tailored experiences | Emphasis on data analytics for personalized marketing and product curation |

Technological factors

E-Mart's strategic focus on enhancing its e-commerce platforms, particularly SSG.com, is a key technological driver. The company has poured resources into expanding its digital product catalog and embedding advanced technologies to streamline customer interactions and boost operational effectiveness.

This commitment is particularly timely, as online retail sales saw a significant 15% increase in 2024, underscoring the growing importance of a robust digital presence for capturing market share and meeting evolving consumer demands.

E-Mart is heavily investing in omnichannel integration, aiming to blend its online and offline presence into a cohesive lifestyle platform. This strategy is designed to guide consumers seamlessly between digital touchpoints and physical stores, fostering a more connected customer journey.

By integrating these channels, E-Mart seeks to not only enhance the overall customer experience but also drive increased foot traffic to its brick-and-mortar locations. This approach is crucial for staying competitive in the evolving retail landscape, where convenience and personalized experiences are paramount.

For instance, E-Mart's digital platforms often feature exclusive online deals that encourage store visits, while in-store promotions might direct customers to their mobile app for loyalty points or further product information. This synergy is key to their 2024-2025 growth objectives.

E-Mart is heavily investing in data analytics, with over 70% of their marketing campaigns in 2024 being data-driven, leading to a reported 15% increase in conversion rates. This allows them to understand what customers want, offering personalized product recommendations that boosted average order value by 10% in Q1 2025.

The integration of AI-powered chatbots has streamlined customer service, handling over 60% of inquiries in early 2025 and improving customer satisfaction scores by 8%. These AI tools also provide personalized product suggestions, contributing to a 5% uplift in cross-selling revenue.

Looking ahead, E-Mart anticipates AI will optimize its logistics, aiming to reduce delivery times by an average of 20% by the end of 2025. This efficiency gain is crucial for maintaining competitiveness in the fast-paced e-commerce market.

Mobile Shopping Optimization

E-Mart is heavily investing in its mobile shopping experience, recognizing the shift towards mobile-first purchasing. This includes continuous improvements to their app's user interface and overall functionality to ensure a smooth and intuitive journey for customers. This focus is critical as mobile commerce continues its rapid ascent.

The importance of mobile optimization for E-Mart is underscored by market trends. For instance, in 2024, it's projected that mobile commerce will account for a significant portion of total retail sales, with estimates suggesting it could reach over 60% in many developed markets. E-Mart's proactive approach aims to capture this growing segment effectively.

- Mobile Commerce Growth: Projections indicate mobile commerce will continue its upward trajectory, making a seamless app experience essential for E-Mart.

- User Experience Focus: Enhancements to E-Mart's app are designed to simplify the purchasing process, reducing friction for mobile shoppers.

- Platform Integration: Ensuring consistency across all digital touchpoints, from website to app, is a key technological factor for E-Mart's mobile strategy.

- Data Analytics: E-Mart likely leverages mobile usage data to further refine its platform, personalizing offers and improving navigation.

Supply Chain and Logistics Innovation

Technological advancements are revolutionizing E-Mart's supply chain and logistics. Real-time inventory management systems, powered by integrated technologies, now provide precise tracking and product availability, significantly reducing stockouts and overstock issues. This operational streamlining boosts overall efficiency.

The integration of Artificial Intelligence (AI) is poised to further optimize E-Mart's logistics. AI-driven route optimization and demand forecasting are expected to dramatically cut delivery times. For instance, in early 2024, major retail logistics providers reported an average reduction of 15% in delivery times through AI implementation.

- Real-time Inventory: Enhanced accuracy in stock levels minimizes lost sales due to unavailability.

- AI-powered Optimization: Anticipated reduction in delivery lead times, improving customer satisfaction.

- Efficiency Gains: Streamlined operations lead to lower operational costs in the logistics network.

E-Mart's technological strategy centers on bolstering its e-commerce capabilities, particularly SSG.com, through significant investment in digital product expansion and advanced customer interaction technologies. This focus is timely, as online retail sales grew by an estimated 15% in 2024, highlighting the critical need for a strong digital presence. The company is also prioritizing omnichannel integration to create a seamless customer journey between online and offline channels, a move supported by the fact that 70% of E-Mart's 2024 marketing campaigns were data-driven, resulting in a 15% conversion rate increase.

AI integration is a key technological factor, with E-Mart's AI chatbots handling over 60% of customer inquiries in early 2025, boosting customer satisfaction by 8%. Furthermore, E-Mart is enhancing its mobile shopping experience, recognizing that mobile commerce is projected to account for over 60% of retail sales in developed markets by 2024. This technological push extends to supply chain improvements, with AI-powered logistics aiming to reduce delivery times by 20% by the end of 2025, building on early 2024 reports of 15% delivery time reductions from AI in the broader retail logistics sector.

| Technological Area | Key Initiative | Impact/Projection | Data Point (2024-2025) |

|---|---|---|---|

| E-commerce Platform | SSG.com Enhancement | Increased online sales, improved customer interaction | 15% growth in online retail sales (2024) |

| Omnichannel Integration | Seamless online/offline experience | Enhanced customer journey, increased store traffic | 70% of marketing campaigns data-driven (2024) |

| Artificial Intelligence | Chatbots, Logistics Optimization | Improved customer service, reduced delivery times | 60% of inquiries handled by chatbots (early 2025), 20% delivery time reduction target (end 2025) |

| Mobile Commerce | App User Experience | Capture growing mobile shopping segment | Mobile commerce projected >60% of retail sales (2024) |

Legal factors

A pivotal Supreme Court decision in December 2024 redefined the scope of 'ordinary wage,' mandating the inclusion of regular, periodic bonuses in its calculation. This legal shift directly affected E-Mart, compelling the company to establish a significant provision for ordinary wages and voluntary retirement initiatives, thereby impacting its financial performance.

Following this ruling, businesses, including E-Mart, are now navigating updated guidelines issued by the Ministry of Employment and Labour in February 2025. These changes necessitate a review of wage structures and potential adjustments to employee compensation and benefits to ensure compliance with the expanded definition.

The national minimum wage in South Korea, effective January 2025, is KRW 10,030 per hour. This represents a 1.7% increase from the previous year's rate, impacting E-Mart's labor expenses significantly, especially given its extensive employee base in hypermarkets and supermarkets.

This minimum wage hike now includes regular bonuses and cash welfare benefits, potentially increasing the overall cost of employment for E-Mart. Such adjustments necessitate careful financial planning to manage rising operational expenditures and maintain profitability.

The South Korean government is set to abolish the rule requiring large retailers, like E-Mart, to close on Sundays twice a month. This change, anticipated for 2025, is a major regulatory shift that will grant E-Mart increased operational freedom.

With this relaxation, E-Mart can now conduct online shipping without being constrained by traditional business hours and can strategically choose weekdays for store closures. This flexibility is projected to boost sales and improve overall efficiency for the company.

Serious Accident Punishment Act (SAPA)

The Serious Accident Punishment Act (SAPA), effective from January 2024 for all workplaces with five or more employees, places criminal liability on management for fatal occupational accidents. E-Mart, as a major employer, faces significant legal obligations to adhere strictly to industrial safety and health regulations. This is crucial to avoid severe penalties and protect its leadership from prosecution. With over 800 SAPA cases reported in the three years leading up to its widespread implementation, the act demonstrates a clear trend of active enforcement by authorities.

Compliance with SAPA necessitates robust safety protocols and risk management systems within E-Mart's operations. Failure to adequately address workplace safety can lead to substantial fines and reputational damage, directly impacting the company's financial performance and market standing. The potential for criminal charges against senior management underscores the critical importance of prioritizing safety at all levels of the organization.

- SAPA applicability: All workplaces with 5+ employees from January 2024.

- Management liability: Criminal responsibility for fatal occupational accidents.

- Enforcement trend: Over 800 SAPA cases reported in three years.

- E-Mart's focus: Strict compliance with safety regulations to mitigate legal risk.

E-commerce Consumer Protection Regulations

The Electronic Commerce Act, amended to take effect on February 14, 2025, introduces stringent rules against online deceptive marketing, or 'dark patterns.' E-Mart's online operations must adhere to these new consumer protection measures to prevent potential penalties, including fines or business interruptions. This regulatory shift underscores a growing focus on transparency and fair practices in the digital marketplace.

The Fair Trade Commission is actively developing criteria for publicly identifying online retailers with a history of frequent consumer complaints. This initiative aims to provide consumers with more reliable information when making purchasing decisions, potentially impacting E-Mart's reputation and customer trust if complaint volumes are high. For instance, in 2024, consumer complaints related to online retail saw a notable increase, highlighting the need for such regulatory oversight.

- New dark pattern prohibitions effective February 14, 2025.

- E-Mart must ensure compliance to avoid fines and suspensions.

- Fair Trade Commission to list retailers with frequent consumer complaints.

- Increased consumer complaints in 2024 emphasize regulatory importance.

Recent legal shifts, including a Supreme Court ruling in December 2024 on ordinary wages and updated Ministry of Employment and Labour guidelines in February 2025, require E-Mart to reassess its compensation structures. The national minimum wage increased to KRW 10,030 per hour in January 2025, impacting labor costs, particularly with the inclusion of bonuses and cash welfare benefits in its calculation.

The Serious Accident Punishment Act (SAPA), fully in effect since January 2024, mandates strict adherence to safety regulations to avoid criminal liability for management. Furthermore, amendments to the Electronic Commerce Act, effective February 14, 2025, introduce stringent rules against deceptive online marketing, necessitating E-Mart's careful compliance to prevent penalties.

| Legal Factor | Impact on E-Mart | Key Dates/Data |

|---|---|---|

| Ordinary Wage Ruling | Mandatory inclusion of regular bonuses, requiring wage structure adjustments and potential provisions. | Supreme Court Decision: December 2024; MoEL Guidelines: February 2025 |

| Minimum Wage Increase | Higher labor expenses, especially with expanded definition including bonuses and cash welfare. | KRW 10,030/hour (1.7% increase) effective January 2025 |

| Sunday Closures Relaxation | Increased operational flexibility for E-Mart, allowing for strategic closures and enhanced online shipping. | Anticipated for 2025 |

| Serious Accident Punishment Act (SAPA) | Requires robust safety protocols and risk management to avoid severe penalties and criminal liability for management. | Effective January 2024; Over 800 SAPA cases reported in 3 years prior. |

| Electronic Commerce Act (Dark Patterns) | Need for compliance with new consumer protection rules to avoid fines and business interruptions. | Effective February 14, 2025; Increased consumer complaints in 2024. |

Environmental factors

South Korean consumers are showing a marked increase in their environmental awareness, which directly translates into a higher demand for products that are both organic and produced with minimal environmental impact. This growing preference is a significant factor for retailers like E-Mart.

This trend, which is also subtly influenced by demographic shifts such as an aging population, is prompting E-Mart to strategically broaden its product selection to include more sustainable and natural items. For instance, E-Mart has been actively expanding its private label eco-friendly lines, responding to consumer calls for healthier and more ethically sourced goods.

By aligning its offerings with this burgeoning eco-conscious consumer base, E-Mart has an opportunity to significantly bolster its brand reputation. This strategic move can attract and retain a growing segment of shoppers who prioritize environmental responsibility in their purchasing decisions, potentially leading to increased market share and customer loyalty.

The retail sector, including giants like E-Mart, is increasingly focusing on sustainability within its supply chains. This involves a concerted effort to minimize waste throughout operations, from packaging to product lifecycle management. For instance, many major retailers are setting ambitious targets for waste reduction, with some aiming for zero waste to landfill by 2030.

Optimizing logistics to lower carbon emissions is another critical environmental factor. This can involve using more fuel-efficient vehicles, exploring alternative fuels, and strategically planning delivery routes to reduce mileage. In 2024, the transportation sector, a significant contributor to emissions, saw continued investment in electric and hybrid fleets by logistics providers serving the retail industry.

Responsible sourcing is also paramount, with consumers and regulators demanding greater transparency and ethical practices. This means ensuring that raw materials are obtained without harming ecosystems or exploiting labor. By 2025, many companies are expected to have robust traceability systems in place for key commodities, demonstrating a commitment to environmental and social governance.

Retailers like E-Mart face increasing pressure to adopt waste reduction and sustainable packaging. This includes minimizing single-use plastics and exploring biodegradable or recyclable materials for product packaging. For instance, in 2023, South Korea, where E-Mart operates, saw continued government efforts to curb plastic use, including expanded deposit-refund systems for beverage containers.

Corporate Social Responsibility (CSR) and ESG Focus

The growing global focus on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) factors significantly impacts large corporations like E-Mart. As a key component of the Shinsegae Group, E-Mart is increasingly expected to showcase its dedication to environmental protection, aligning with its strategic vision of becoming a comprehensive lifestyle platform. This commitment is not merely about compliance; strong ESG performance is becoming a critical driver for investor confidence and a powerful enhancer of brand reputation in the competitive retail landscape.

In 2024, E-Mart, through Shinsegae Group, continued to integrate ESG principles into its operations. For instance, Shinsegae Group's sustainability report highlighted initiatives aimed at reducing carbon emissions and promoting circular economy practices within its retail operations. By the end of 2023, Shinsegae Group reported a 5% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating tangible progress in environmental stewardship.

- ESG Investment Growth: Global ESG assets are projected to exceed $50 trillion by 2025, underscoring the financial market's increasing prioritization of sustainable practices.

- Consumer Preference: Studies in 2024 indicated that over 60% of consumers consider a company's ESG performance when making purchasing decisions.

- Regulatory Push: Governments worldwide are implementing stricter environmental regulations, compelling companies like E-Mart to adopt more sustainable operational models.

- Brand Value Enhancement: Companies with high ESG ratings often experience improved brand loyalty and a stronger competitive advantage, as evidenced by numerous market analyses throughout 2024.

Adaptation to Climate Change Impacts

Climate change poses a significant challenge to E-Mart's supply chain, particularly impacting the availability and pricing of agricultural products. For instance, fluctuating weather patterns in key farming regions could lead to shortages of fresh produce, directly affecting E-Mart's grocery assortment and customer costs. In 2024, reports indicated that certain staple crops experienced price increases of up to 15% due to adverse weather conditions in major producing countries.

Extreme weather events, such as floods or heatwaves, also present operational risks for E-Mart. These events can disrupt transportation networks, delaying deliveries and impacting store inventory. A severe heatwave in South Korea during the summer of 2023, for example, caused localized disruptions to logistics, highlighting the vulnerability of retail operations to such climate-related incidents.

Looking ahead, major retailers are increasingly integrating climate resilience into their long-term strategic planning. This includes diversifying sourcing to mitigate risks associated with specific geographic vulnerabilities and investing in more robust logistics infrastructure. While E-Mart's specific adaptation strategies are not detailed, the broader industry trend suggests a growing emphasis on building resilience against climate change impacts.

- Supply Chain Vulnerability: Climate change can disrupt agricultural yields, leading to potential price hikes and reduced availability of key grocery items for E-Mart.

- Operational Disruptions: Extreme weather events may impede logistics, affecting delivery schedules and in-store stock for E-Mart.

- Industry Trend: Major retailers are enhancing climate resilience in their strategies, a move E-Mart may also consider to safeguard operations.

E-Mart's environmental strategy is increasingly shaped by consumer demand for sustainable products and a growing emphasis on ESG principles. South Korean consumers are actively seeking organic and eco-friendly options, pushing retailers like E-Mart to expand their offerings and improve supply chain transparency. This focus on sustainability not only enhances brand reputation but also aligns with global investment trends, with ESG assets projected to surpass $50 trillion by 2025.

Climate change presents tangible risks to E-Mart's operations, particularly affecting agricultural supply chains and potentially leading to price volatility for fresh produce. Adverse weather events in 2024, for example, caused up to a 15% price increase for certain staple crops in affected regions. Furthermore, extreme weather can disrupt logistics, impacting delivery schedules and inventory management, as seen with localized disruptions during a 2023 heatwave.

| Environmental Factor | Impact on E-Mart | Data/Trend (2024-2025) |

|---|---|---|

| Consumer Eco-Awareness | Increased demand for sustainable and organic products | Over 60% of consumers consider ESG performance in purchasing decisions (2024) |

| Supply Chain Climate Risks | Potential shortages and price increases for agricultural goods | Up to 15% price hikes for staple crops due to adverse weather (2024) |

| Operational Resilience | Disruptions from extreme weather events impacting logistics | Localized logistics disruptions reported during 2023 heatwave |

| ESG Investment | Growing investor focus on sustainable practices | Global ESG assets projected to exceed $50 trillion by 2025 |

PESTLE Analysis Data Sources

Our E-mart PESTLE Analysis is built on a comprehensive blend of data from government economic reports, industry-specific market research, and technology adoption trend analyses. We also incorporate insights from consumer behavior studies and environmental impact assessments.