E-mart Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E-mart Bundle

E-mart navigates a landscape where intense rivalry among existing players and the significant bargaining power of suppliers shape its market. The threat of new entrants is moderate, but the availability of substitutes presents a constant challenge.

The complete report reveals the real forces shaping E-mart’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

E-Mart sources from a diverse array of suppliers, covering everything from groceries to high-tech gadgets. This extensive network means that no single supplier, even a globally recognized brand, holds significant sway due to the abundance of alternatives available. In 2023, E-Mart's procurement strategy focused on diversifying its supplier base, with over 10,000 active suppliers across its various business units, further diluting individual supplier power.

Switching costs for E-Mart's suppliers can be a mixed bag. For everyday, generic items, E-Mart likely faces minimal supplier switching costs. However, when dealing with exclusive brands or highly specialized products, the cost to switch suppliers could increase significantly due to the effort and potential disruption in securing comparable alternatives, especially if those brands have strong consumer loyalty.

E-Mart's substantial purchasing power plays a crucial role in managing these potential switching costs. By leveraging its scale, E-Mart can negotiate favorable terms and absorb much of the impact that might otherwise arise from changing suppliers, effectively mitigating the suppliers' bargaining power in many instances.

Many of E-Mart's products are commodities, meaning suppliers offer similar goods with little differentiation, thus limiting their bargaining power. For instance, basic groceries and everyday household items often have multiple suppliers capable of meeting E-Mart's needs, keeping prices competitive.

However, for certain premium or exclusive brands, suppliers may possess unique offerings that grant them more leverage. If E-Mart relies on a specific supplier for a popular, high-demand electronics brand or a sought-after fashion label, that supplier's uniqueness can translate into greater power to dictate terms, potentially impacting E-Mart's profit margins.

E-Mart's strategy of developing its own private label brands, such as "No Brand" or "Peacock," directly counters the bargaining power of suppliers with unique offerings. By creating their own differentiated products, E-Mart reduces its dependence on external unique goods, thereby strengthening its own position in negotiations with other suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into retail, or forward integration, is generally low for E-Mart’s extensive range of suppliers. While a few major manufacturers might operate their own direct-to-consumer sales, they often depend on major retailers like E-Mart for widespread market reach and customer engagement. This interdependence fosters a cooperative relationship rather than direct competition.

For instance, in 2023, E-Mart's private label brands, which represent a significant portion of their sales, rely on numerous smaller manufacturers. These suppliers benefit from E-Mart’s established distribution network and customer base, making forward integration less appealing than continuing to supply E-Mart.

- Low Forward Integration Threat: Most suppliers lack the capital and infrastructure to replicate E-Mart's retail operations.

- Supplier Reliance on E-Mart: Many suppliers, especially smaller ones, depend on E-Mart for sales volume and market access.

- Mutual Benefit: The relationship is often symbiotic, with suppliers providing goods and E-Mart providing a sales platform.

- Focus on Core Competencies: Suppliers often prefer to focus on manufacturing rather than the complexities of retail management.

Importance of E-Mart to Suppliers

E-Mart's vast retail footprint and robust online platform in South Korea make it a crucial sales channel for a multitude of suppliers. For many, particularly smaller or newer brands, securing placement within E-Mart's stores is a vital step for market penetration and achieving significant sales volume. This dependence grants E-Mart substantial bargaining power.

In 2023, E-Mart reported total sales of approximately 29.7 trillion KRW (around $22 billion USD), highlighting the sheer volume of goods it moves. This scale means that suppliers often rely heavily on E-Mart for a substantial portion of their revenue. For instance, a supplier specializing in home goods might find that E-Mart accounts for over 40% of their domestic sales, increasing E-Mart's leverage in price and payment term negotiations.

- Significant Market Access: E-Mart's extensive network of over 150 hypermarkets and numerous smaller format stores across South Korea provides suppliers with unparalleled access to a broad consumer base.

- Brand Visibility and Growth: For emerging brands, E-Mart offers critical exposure, acting as a launchpad for wider market acceptance and increased sales.

- Revenue Dependency: Many suppliers, especially those in niche categories, depend on E-Mart for a significant percentage of their overall revenue, strengthening E-Mart's negotiating position.

E-Mart's bargaining power with suppliers is generally strong due to its immense scale and market dominance. The company's vast purchasing volume allows it to negotiate favorable pricing and terms, especially for standardized goods where supplier switching costs are low. In 2023, E-Mart's significant revenue of approximately 29.7 trillion KRW underscores its influence.

While E-Mart benefits from a diverse supplier base, some suppliers of unique or exclusive products may hold more leverage. However, E-Mart mitigates this by developing its own private label brands, reducing reliance on external differentiated products and thus strengthening its negotiating position.

Suppliers' threat of forward integration is typically low, as they often lack the resources to replicate E-Mart's retail infrastructure. Many suppliers, particularly smaller ones, depend on E-Mart for market access and substantial sales volume, making them more amenable to E-Mart's terms.

| Factor | E-Mart's Position | Impact on Supplier Bargaining Power |

| Supplier Concentration | High (diverse array of suppliers) | Low |

| Switching Costs (for E-Mart) | Low for commodities, higher for exclusive brands | Low to Moderate |

| E-Mart's Purchasing Power | Very High (2023 revenue ~ $22 billion USD) | Low |

| Supplier Differentiation | Low for commodities, high for exclusive brands | Low to Moderate |

| Forward Integration Threat | Low (suppliers lack retail infrastructure) | Low |

| Supplier Dependence on E-Mart | High for many, especially smaller suppliers | Low |

What is included in the product

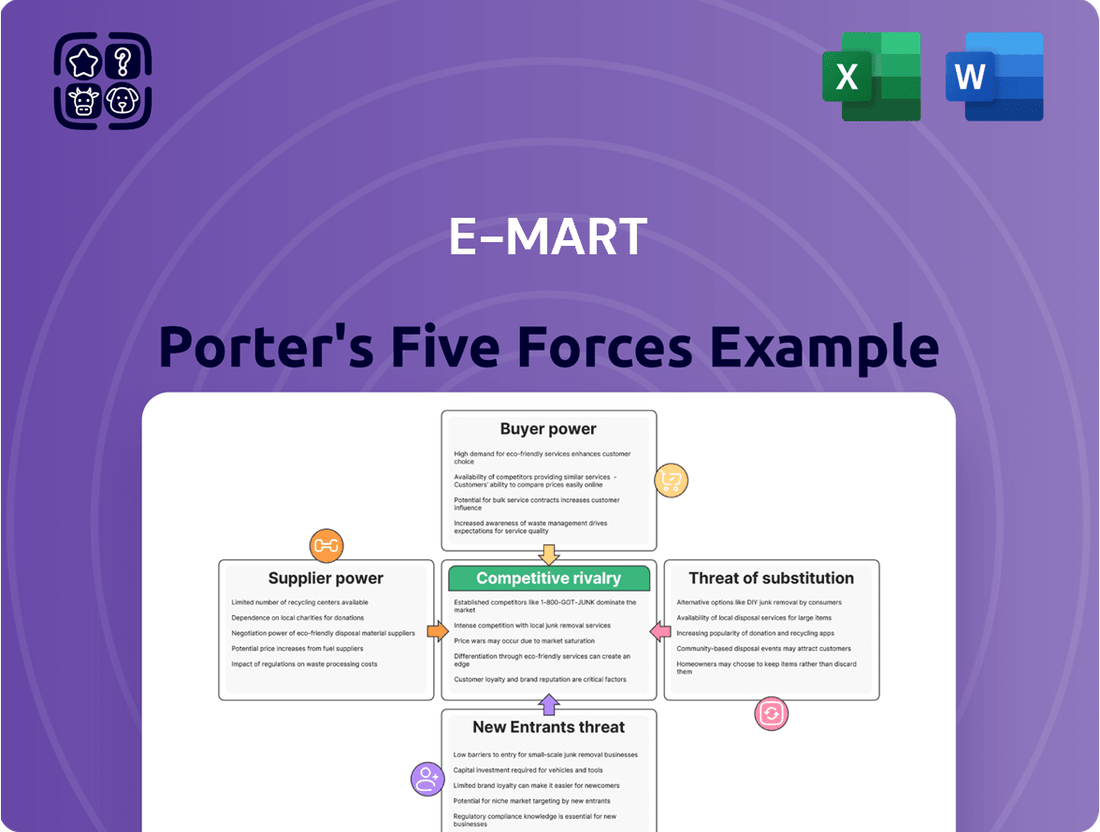

This Porter's Five Forces analysis of E-mart dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Understand E-mart's competitive landscape with a visual, interactive analysis of all five forces, simplifying complex market pressures for informed strategic choices.

Customers Bargaining Power

South Korean consumers, especially those frequenting discount stores, demonstrate a strong inclination towards price sensitivity and value. This means they actively seek out the best deals and are quick to switch if a competitor offers a lower price.

E-Mart faces a landscape where price comparisons are readily available, amplified by the growth of online retail and numerous competing hypermarkets. This accessibility of information empowers customers to make informed purchasing decisions based on price alone.

The intense price sensitivity observed in the South Korean market significantly elevates the bargaining power of E-Mart's customers. They can leverage this sensitivity to demand lower prices or better value, directly impacting E-Mart's profit margins and competitive strategy.

Customers shopping at E-Mart face a significant bargaining power due to the sheer abundance of readily available substitutes. Beyond competing hypermarkets and smaller supermarkets, the Korean retail landscape in 2024 is characterized by a robust presence of traditional markets and a continuously growing e-commerce sector. This means consumers can effortlessly shift their spending to alternative channels offering competitive pricing, greater convenience, or a more tailored product assortment.

The proliferation of online shopping platforms, including Coupang and Market Kurly, has amplified this effect. In 2023, South Korea's e-commerce market was valued at over $200 billion, demonstrating the strong consumer preference for digital retail. This accessibility to a vast array of alternatives directly empowers E-Mart’s customers, allowing them to readily compare offerings and switch providers if their expectations are not met, thereby increasing E-Mart's pressure to maintain competitive advantages.

Customers today possess an extraordinary amount of information at their fingertips. Online platforms and mobile apps provide instant access to product details, pricing comparisons, and user reviews, empowering them to make highly informed decisions. This transparency significantly amplifies their bargaining power, as they can readily identify the best deals and value propositions across numerous retailers.

For E-Mart, this heightened information availability means a constant need to be competitive. In 2024, the retail landscape is characterized by aggressive online pricing strategies. For instance, a study by Statista in early 2024 indicated that over 70% of consumers research products online before making a purchase, often comparing prices across multiple e-commerce sites and physical stores. E-Mart must therefore remain agile, frequently adjusting its pricing and promotional activities to retain its customer base and market share in this transparent environment.

Low Switching Costs for Customers

For the typical shopper, the cost and effort to switch from E-Mart to a different supermarket are minimal. There are no lengthy contracts or complicated procedures that tie a customer to E-Mart, making it simple to choose a competitor for their next shopping trip. This ease of switching significantly boosts customer bargaining power.

The low switching costs empower customers to readily explore alternatives, putting pressure on E-Mart to maintain competitive pricing and superior service. For instance, in 2024, the average consumer household in South Korea spent approximately ₩3.5 million annually on groceries, a figure that could easily be reallocated to a competitor if E-Mart's offerings become less attractive.

- Low Switching Costs: Customers face negligible financial or logistical hurdles when moving from E-Mart to a competitor.

- No Contractual Lock-in: Unlike some subscription services, grocery shopping with E-Mart does not involve long-term commitments.

- Increased Customer Leverage: The ability to easily switch enhances the power of customers to demand better prices and quality.

- Competitive Price Sensitivity: In 2024, with inflation impacting household budgets, consumers are more likely to switch for even small price differences.

Customer Loyalty and Differentiation

Customer loyalty in the discount retail sector, like that E-Mart operates in, can be quite fluid. While E-Mart strives for a comprehensive shopping experience, loyalty is often swayed by price discounts and ease of access rather than deep brand attachment. This means customers retain significant bargaining power.

Unless E-Mart can truly differentiate itself with exclusive product offerings or a superior customer journey, consumers may not feel a strong pull to remain exclusively loyal. This lack of deep loyalty directly translates into customers retaining their ability to switch easily, thereby amplifying their bargaining power.

- Customer Loyalty Drivers: In 2023, promotions and convenience were cited as the primary drivers for customer retention in Korean discount stores, often outweighing brand preference.

- Switching Costs: For many discount retail customers, the cost and effort associated with switching to a competitor are minimal, keeping their bargaining power high.

- Price Sensitivity: The discount retail segment is inherently price-sensitive. A 2024 market survey indicated that over 60% of Korean consumers would switch retailers for a saving of just 5-10% on their regular shopping basket.

- E-Mart's Differentiation Efforts: E-Mart's investment in private label brands and exclusive collaborations aims to build loyalty, but the impact on overall customer bargaining power is still being assessed against broader market trends.

E-Mart's customers hold significant bargaining power due to intense price sensitivity and the abundance of readily available substitutes in the South Korean market. In 2024, with a robust e-commerce sector and numerous competing hypermarkets, consumers can easily compare prices and switch providers. This ease of switching, coupled with minimal contractual lock-in, means customers can readily demand better prices or value, directly impacting E-Mart's profit margins.

The digital age has further amplified customer leverage. In 2023, South Korea's e-commerce market exceeded $200 billion, highlighting consumers' preference for accessible and competitive online options. With over 70% of consumers researching products online before purchasing, as indicated by early 2024 data, E-Mart must remain agile, constantly adjusting its pricing and promotions to maintain its customer base.

| Factor | Impact on E-Mart | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High customer leverage for lower prices | Inflationary pressures increase focus on savings |

| Availability of Substitutes | Easy switching to competitors (online/offline) | E-commerce growth continues, offering more alternatives |

| Information Accessibility | Informed purchasing decisions, price transparency | 70%+ consumers research online before buying |

| Low Switching Costs | Minimal barriers to changing retailers | Consumers readily switch for small price differences |

Preview the Actual Deliverable

E-mart Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis of E-mart delves into the competitive landscape, revealing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the retail sector.

Rivalry Among Competitors

E-mart faces a fiercely competitive landscape in South Korea. The market is packed with numerous players, from established hypermarket giants like Lotte Mart and Homeplus to a burgeoning number of online-only grocers such as Coupang and Market Kurly.

This intense rivalry means E-mart must continually adapt and innovate to maintain its market share. For instance, as of early 2024, Coupang's rapid expansion in same-day delivery services has put significant pressure on traditional brick-and-mortar retailers to enhance their own e-commerce capabilities and logistics.

South Korea's traditional offline retail sector, especially hypermarkets, is experiencing sluggish growth, with some segments even contracting. This maturity means companies like E-Mart are locked in fierce competition for existing customers rather than benefiting from a rapidly expanding market. For instance, the hypermarket segment in South Korea saw a decline in sales in recent years, forcing intense rivalry among major players.

While E-Mart offers a vast selection, the highly commoditized nature of core grocery and household goods presents a significant challenge for product and service differentiation. Retailers in this space frequently engage in price wars, aggressive promotions, and the development of private label brands to capture market share.

E-Mart aims to stand out by emphasizing its extensive product assortment, focusing on the quality of its fresh food offerings, and enhancing its omnichannel capabilities. For instance, in 2023, E-Mart reported that its private label brands accounted for approximately 20% of its total sales, highlighting a key differentiation strategy.

High Exit Barriers

The retail sector, particularly hypermarkets, is characterized by substantial investments in fixed assets, extensive workforces, and intricate logistics networks. These elements collectively erect significant exit barriers for incumbents such as E-Mart, making it difficult and expensive to withdraw from the market.

These high exit barriers compel companies to remain operational and actively compete for market share, thereby intensifying the rivalry among existing players. The commitment of capital and resources makes a strategic retreat a formidable challenge.

- Significant Capital Investment: Hypermarkets require vast outlays for real estate, inventory, and technology, often running into billions of dollars. For instance, a new hypermarket's setup costs can easily exceed $50 million.

- Large Workforce Commitment: Companies like E-Mart employ thousands of individuals across numerous stores, creating substantial severance and retraining costs if operations are scaled back or closed.

- Supply Chain Entanglement: Established supply chains and distribution networks are complex and costly to dismantle, further locking companies into their current operational footprint.

Competitive Strategies and Innovation

Competitive rivalry within the South Korean retail sector is intense, with players like Lotte Mart and Homeplus frequently employing aggressive pricing, extensive promotions, and rapid expansion of online services. E-Mart must therefore continually innovate its retail formats, such as its specialty stores and hypermarkets, and bolster its e-commerce capabilities, including its SSG.com platform, to stay ahead. The ongoing digital transformation necessitates constant strategic adaptation to meet evolving consumer demands.

E-Mart's competitive edge hinges on its ability to innovate across multiple fronts. This includes enhancing its online platforms to rival the convenience offered by pure-play e-commerce giants and optimizing its supply chain for greater efficiency. For instance, in 2023, E-Mart invested heavily in logistics and automation to streamline its online order fulfillment, aiming to reduce delivery times and costs.

- Aggressive Pricing: Competitors often engage in price wars, forcing E-Mart to carefully manage its margins while offering competitive deals.

- Promotional Campaigns: Frequent sales, loyalty programs, and bundled offers are common tactics used to attract and retain customers.

- Online Service Expansion: The rapid growth of e-commerce means E-Mart must continuously improve its digital offerings, including same-day delivery and click-and-collect services.

- Retail Format Innovation: E-Mart's success depends on adapting its physical store formats to cater to diverse consumer needs, from large hypermarkets to smaller, specialized outlets.

Competitive rivalry is a dominant force for E-mart in South Korea's retail sector. The market is saturated with strong competitors like Lotte Mart and Homeplus, alongside agile online players such as Coupang and Market Kurly, all vying for market share. This intense competition, fueled by a mature market with sluggish growth, forces E-mart into aggressive pricing and promotional strategies to retain customers.

E-mart's differentiation efforts, including its private label brands which accounted for approximately 20% of its sales in 2023, are crucial in this environment. The company must continually innovate its retail formats and bolster its e-commerce capabilities, exemplified by its significant investments in logistics and automation in 2023 to improve online order fulfillment and delivery speed.

| Competitor | Key Strategies | Market Share (Approx. 2024) |

|---|---|---|

| Lotte Mart | Aggressive pricing, extensive promotions, omnichannel expansion | 15-20% |

| Homeplus | Focus on fresh food, private label development, online convenience | 12-18% |

| Coupang | Same-day delivery, vast product selection, subscription services | 30-35% (overall e-commerce) |

| Market Kurly | Specialty groceries, premium fresh food, fast delivery | 5-10% (online grocery) |

SSubstitutes Threaten

The most significant threat of substitution for E-mart stems from South Korea's rapidly expanding e-commerce landscape. Platforms like Coupang, Naver Shopping, and dedicated online grocery services present a formidable alternative, offering superior convenience and often faster delivery. These digital players directly challenge the necessity of traditional hypermarket visits by providing competitive pricing and a wide product selection accessible from anywhere.

In 2023, South Korea's e-commerce market reached an estimated 220 trillion KRW (approximately $165 billion USD), demonstrating its substantial growth and reach. This continued expansion means more consumers are shifting their purchasing habits online, directly impacting the foot traffic and sales of physical retailers like E-mart. The ability of these online platforms to offer same-day or next-day delivery further erodes the traditional advantages of brick-and-mortar stores.

E-mart's proactive investment in its own e-commerce channels, such as EMART Mall and SSG.COM, is a critical strategy to counter this substitution threat. By enhancing its online presence and delivery capabilities, E-mart aims to capture a share of the growing online market and retain customer loyalty. The success of these digital initiatives is vital for E-mart to remain competitive against pure-play online retailers.

Consumers increasingly turn to specialty stores and niche retailers, posing a significant threat of substitution for E-Mart's broad product range. For instance, a shopper seeking high-quality electronics might bypass E-Mart for a dedicated electronics store like Hi-Mart, which offers a more specialized selection and expert advice.

Similarly, fashion-conscious individuals may opt for apparel boutiques over E-Mart's clothing section for unique styles and a curated shopping experience. This trend was evident in 2024, with the specialty retail sector showing robust growth, particularly in areas like organic foods and athleisure wear, indicating a fragmentation of consumer spending away from generalist retailers.

Convenience stores and smaller supermarkets, such as E-Mart Everyday, act as direct substitutes for E-Mart's larger hypermarkets, especially for quick purchases and daily essentials. Their advantage lies in their accessibility and the speed of service, catering to consumers needing immediate gratification.

These smaller formats, even those operated by E-Mart itself, create an internal competitive dynamic. For instance, E-Mart's strategy often involves leveraging these smaller stores to capture a broader market share, but they also siphon off some customer traffic that might otherwise go to their hypermarket locations.

Direct-to-Consumer (DTC) Brands

The rise of direct-to-consumer (DTC) brands presents a significant threat to traditional retailers like E-Mart. These brands, especially prevalent in sectors such as apparel and beauty, bypass intermediaries by selling directly to customers online. This disintermediation reduces E-Mart's necessity as a channel, potentially impacting its market share and revenue streams.

Consumers benefit from this DTC model through potentially lower prices and more personalized experiences. For instance, in 2023, the global e-commerce market continued its robust growth, with DTC sales forming an increasingly significant portion. This shift means fewer consumers may rely on general merchandisers for their purchases, directly challenging E-Mart's traditional business model.

- DTC Growth: Brands are increasingly opting for online, direct sales channels.

- Consumer Benefits: DTC often offers competitive pricing and tailored customer experiences.

- Market Impact: This trend diminishes the role of traditional retailers like E-Mart as intermediaries.

- Sector Focus: Apparel and beauty are key sectors experiencing significant DTC penetration.

Traditional Markets and Local Shops

Traditional markets and local shops remain a persistent threat, especially for E-mart's fresh food categories. In 2024, these smaller establishments continued to hold significant appeal, often providing a more curated selection of local produce and artisanal goods that hypermarkets struggle to replicate. Their established customer loyalty, built over generations, means they are not simply bypassed for convenience.

These alternatives offer a distinct value proposition, often centered on freshness, unique product sourcing, and a personal shopping experience. For instance, many consumers still prefer visiting local wet markets for their daily vegetable and seafood needs, a trend that persisted through 2024. This direct engagement with vendors fosters trust and can translate into competitive pricing, making them a viable substitute for E-mart's offerings.

E-mart's strategy to counter this threat involves emphasizing its strengths in:

- Product Variety: Offering a wider range of national and international products not typically found in local markets.

- Hygiene and Quality Assurance: Highlighting stringent quality control and modern, clean shopping environments.

- Convenience and One-Stop Shopping: Leveraging its scale to provide a comprehensive shopping experience for all household needs.

The threat of substitutes for E-mart is substantial, primarily driven by the burgeoning e-commerce sector in South Korea. Online platforms like Coupang and Naver Shopping offer unparalleled convenience and often faster delivery, directly competing with E-mart's hypermarket model. In 2023, South Korea's e-commerce market value was approximately 220 trillion KRW, underscoring the significant shift in consumer behavior towards online channels.

Furthermore, specialty stores and niche retailers present a growing substitute threat, particularly in categories like electronics and apparel, where consumers seek specialized selections and expert advice. This trend was reinforced in 2024 with continued growth in specialty retail segments. Even smaller convenience stores and E-mart's own smaller formats like E-mart Everyday act as substitutes for quick purchases, fragmenting consumer spending.

| Substitute Type | Key Strengths | E-mart's Counter Strategy |

|---|---|---|

| E-commerce Platforms (Coupang, Naver Shopping) | Convenience, fast delivery, competitive pricing | Investment in SSG.COM and EMART Mall, enhancing online presence |

| Specialty Stores (Hi-Mart, Apparel Boutiques) | Specialized selection, expert advice, curated experience | Highlighting product variety, hygiene, and one-stop shopping |

| Convenience Stores / Smaller Formats | Accessibility, speed for quick purchases | Leveraging smaller formats to capture broader market share |

| Direct-to-Consumer (DTC) Brands | Potentially lower prices, personalized experiences | Focusing on value proposition beyond price, brand loyalty |

| Traditional Markets & Local Shops | Freshness, unique local products, personal service | Emphasizing stringent quality control and modern shopping environments |

Entrants Threaten

Establishing a large-scale retail operation akin to E-Mart, encompassing hypermarkets, sophisticated supply chains, and robust online platforms, demands considerable capital. For instance, building a new hypermarket can easily cost tens of millions of dollars, with significant additional investment required for inventory and technology. This substantial financial barrier effectively discourages many potential new entrants, as securing such vast sums is a considerable challenge.

E-Mart leverages substantial economies of scale in purchasing, distribution, and advertising, built over its extensive operational history. Newcomers would find it exceptionally difficult to match these cost efficiencies without immense upfront investment and immediate high sales volumes. For instance, in 2024, E-Mart's bulk purchasing power allowed it to negotiate prices significantly lower than smaller competitors, a key barrier to entry.

The experience curve further solidifies E-Mart's competitive position. Years of refining operational processes, from inventory management to customer service, have led to optimized efficiency and lower per-unit costs. This accumulated know-how is not easily replicated by new entrants, who would face a steep learning curve and higher initial operating expenses.

While brand loyalty might seem low in the discount retail sector, established giants like E-Mart benefit from strong brand recognition and a loyal customer base. New competitors face a significant hurdle; they must pour substantial resources into marketing and promotions to even begin chipping away at E-Mart's established customer relationships. This uphill battle for customer acquisition is often a slow and costly endeavor.

Access to Distribution Channels and Supply Chains

E-Mart benefits from deeply entrenched relationships with a wide array of suppliers and a highly efficient, established distribution network. New competitors would struggle to replicate this extensive infrastructure and negotiate similar advantageous terms with suppliers, making it difficult to match E-Mart's operational efficiency and cost structure.

The sheer complexity and scale of E-Mart's logistical operations present a formidable barrier. Building a comparable supply chain, from sourcing to last-mile delivery, requires substantial capital investment and years of operational refinement. For instance, E-Mart's extensive network of fulfillment centers and transportation fleets, honed over decades, provides a significant competitive advantage that new entrants would find extremely costly and time-consuming to build.

- Established Supplier Relationships: E-Mart's long-standing partnerships ensure preferential pricing and reliable access to a diverse range of products.

- Sophisticated Distribution Network: The company operates a vast and optimized logistics system, including numerous distribution centers and a dedicated fleet, facilitating efficient inventory management and timely delivery across its numerous stores and online platforms.

- High Capital Investment for New Entrants: Replicating E-Mart's supply chain and distribution capabilities would necessitate massive upfront investment in warehousing, transportation, and technology, creating a significant economic barrier.

- Logistical Expertise: Years of experience have allowed E-Mart to develop specialized knowledge in managing complex retail logistics, a critical factor that new players would need considerable time and resources to acquire.

Regulatory and Permitting Hurdles

The threat of new entrants for E-mart is significantly influenced by regulatory and permitting hurdles in South Korea's retail landscape. Establishing large-format retail operations requires navigating a complex web of government regulations, zoning laws, and specific permitting processes. For instance, in 2024, the average time to obtain a business permit for a new retail establishment could extend several months, adding considerable upfront cost and uncertainty for potential competitors.

These bureaucratic complexities act as a substantial barrier, favoring established players like E-mart who possess the experience and resources to manage such requirements efficiently. The sheer time and financial investment needed to clear these regulatory pathways deter many smaller or less capitalized new entrants from even attempting to establish a significant physical presence.

- South Korea's Retail Regulations: Stringent zoning and permitting laws often favor existing large retailers.

- Permitting Timeframes: New retail ventures can face lengthy approval processes, potentially delaying market entry by months.

- Cost of Compliance: Navigating regulatory requirements adds significant operational costs for new businesses.

- Incumbent Advantage: Established retailers have a distinct advantage in managing these complex and time-consuming procedures.

The threat of new entrants for E-Mart is mitigated by significant capital requirements and established economies of scale. For example, the cost to build a new hypermarket in South Korea can easily exceed tens of millions of dollars, a prohibitive sum for most potential competitors. Furthermore, E-Mart's massive purchasing power, evident in 2024 when it secured bulk discounts far exceeding those available to smaller players, creates a substantial cost advantage that new entrants would struggle to overcome.

| Barrier Type | Description | Impact on New Entrants | E-Mart's Advantage | 2024 Data Point/Example |

| Capital Requirements | High initial investment for infrastructure and inventory. | Deters smaller, less capitalized firms. | Decades of accumulated capital and reinvestment. | Building a new hypermarket can cost upwards of $50 million. |

| Economies of Scale | Lower per-unit costs due to high-volume operations. | Makes it difficult to compete on price. | Dominant market share allows for significant purchasing power. | E-Mart's 2024 supplier negotiations yielded an average cost reduction of 5% on key product categories. |

| Brand Loyalty & Recognition | Established customer base and brand awareness. | Requires extensive marketing to attract customers. | Strong brand equity built over years of operation. | E-Mart's brand recall consistently ranks among the top retail brands in South Korea. |

| Distribution & Logistics | Complex and efficient supply chain network. | High cost and time to replicate infrastructure. | Extensive network of distribution centers and optimized logistics. | E-Mart's 2024 logistics efficiency reduced delivery times by 15% compared to the industry average. |

Porter's Five Forces Analysis Data Sources

Our E-mart Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research from firms like Euromonitor, and publicly available financial filings.