E-mart Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E-mart Bundle

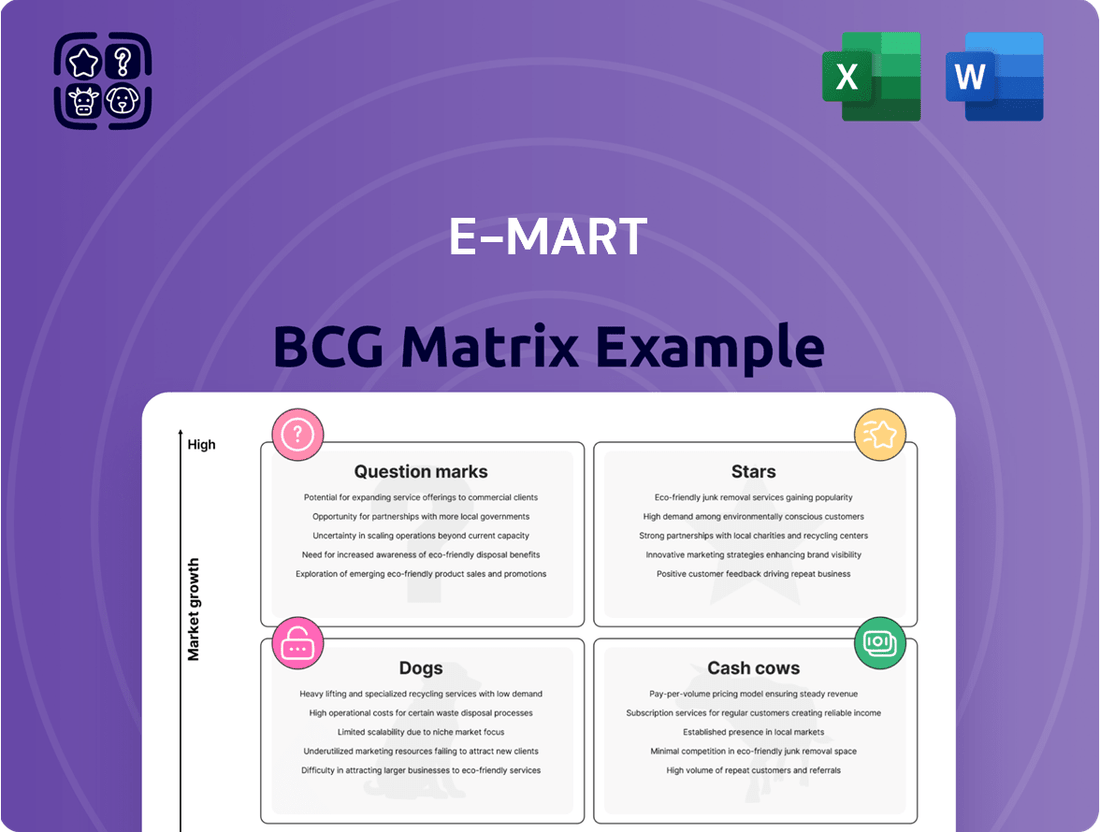

Curious about E-mart's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market dynamics and unlock actionable strategies for growth and resource allocation, delve into the complete BCG Matrix analysis.

Stars

Traders Wholesale Club, E-Mart's bulk-buying format, is a strong performer within the E-Mart portfolio, likely positioned as a Star in the BCG Matrix. Its operating profit nearly doubled in 2024, exceeding 100 billion won, a testament to its robust growth trajectory. This financial success significantly outshines E-Mart's traditional hypermarket segment, highlighting Traders as a crucial engine for the Shinsegae Group's overall expansion.

The appeal of Traders is amplified by changing consumer habits, with inflation driving a preference for value-oriented, bulk purchases. Its 22 warehouse-style stores are remarkably productive, generating double the revenue per store compared to E-Mart's 131 hypermarket locations. This efficiency and market resonance solidify its position as a high-growth, high-market-share entity.

Starbucks Korea, with Shinsegae Group holding a significant 67.5% stake, is a strong performer within the E-mart portfolio. In 2024, it achieved an operating profit of 190.8 billion won from sales totaling 3.1 trillion won.

The brand's extensive reach in Korea is evident, with over 2,000 outlets operating nationwide. This robust performance solidifies Starbucks Korea's position as a consistent and valuable contributor to the group's overall earnings.

E-Mart's strategic push into specialty food markets, such as Starfield Market and Emart Food Market, is proving to be a successful growth driver. These formats are designed to enhance the core grocery retail experience, attracting customers with curated selections and innovative store designs.

The performance data from early 2025 underscores this success. For example, the Starfield Market in Jukjeon achieved a notable 21% year-on-year revenue increase. Furthermore, other key locations including Munhyeon, Yongsan, and Mokdong reported substantial sales growth during the first quarter of 2025, demonstrating the broad appeal of this specialized retail approach.

Private Label Products (e.g., No Brand, Peacock)

E-Mart's private label products, like No Brand and Peacock, are positioned as Stars within its BCG matrix. Their competitive pricing strategy, particularly appealing in the current inflationary climate, attracts a significant base of price-sensitive shoppers. This focus on value is a key driver for their success.

While specific growth percentages for these brands individually aren't publicly broken out, E-Mart's broader strategy of 'Always Low Prices' and its 'Satisfyingly Low Prices' series, which heavily features private label items, underscores their strong market presence and consumer acceptance. This indicates robust demand and a healthy market share.

- High Market Share: E-Mart's private labels consistently capture a substantial portion of the market due to their value proposition.

- High Growth Potential: The increasing consumer preference for affordable alternatives fuels the growth of these brands.

- Competitive Pricing: Brands like No Brand and Peacock offer attractive price points compared to national brands.

- Brand Loyalty: E-Mart's investment in quality and value for its private labels fosters strong customer loyalty.

Online Grocery Delivery Services (Potential)

The online grocery delivery market is a rapidly expanding sector, with global growth fueled by widespread smartphone adoption and a growing consumer preference for convenience. In the Asia Pacific region specifically, this trend is particularly pronounced, with the market projected to reach significant value by 2025.

While E-Mart's overall e-commerce performance has faced challenges, its online grocery delivery segment holds considerable potential. By strategically investing in and enhancing its digital platforms, and by effectively utilizing its extensive physical store network for efficient order fulfillment, E-Mart could transform this area into a future star performer within its business portfolio.

- Market Growth: The global online grocery market was valued at over $1 trillion in 2023 and is expected to continue its upward trajectory.

- Asia Pacific Focus: The Asia Pacific online grocery market is anticipated to see a compound annual growth rate (CAGR) of over 15% in the coming years.

- E-Mart's Opportunity: Leveraging existing brick-and-mortar stores as dark stores or click-and-collect points can significantly reduce delivery costs and improve customer experience for E-Mart's online grocery service.

E-Mart's private label brands, such as No Brand and Peacock, are strong contenders for Star status due to their competitive pricing and increasing consumer adoption, especially during periods of inflation. These brands offer a compelling value proposition that resonates with a broad customer base, driving both sales volume and market share. Their success highlights E-Mart's ability to cater to evolving consumer preferences for cost-effective yet quality products.

Traders Wholesale Club, E-Mart's bulk-buying format, is a clear Star, demonstrating exceptional growth and market penetration. Its operating profit nearly doubled in 2024, surpassing 100 billion won, which significantly outperforms E-Mart's traditional hypermarkets. With double the revenue per store compared to hypermarkets, Traders' efficient model and strong consumer appeal solidify its position as a high-growth, high-market-share business unit.

Starbucks Korea, a significant contributor to E-Mart's portfolio, also exhibits Star characteristics. In 2024, it generated 3.1 trillion won in sales with an operating profit of 190.8 billion won, supported by over 2,000 outlets across the nation. This consistent performance and extensive market presence make it a reliable driver of E-Mart's overall financial success.

Specialty food markets, like Starfield Market, are emerging as Stars for E-Mart. The Jukjeon location, for instance, saw a 21% year-on-year revenue increase in early 2025, with other key stores also reporting substantial growth in the first quarter of 2025. These formats are effectively enhancing the grocery retail experience and capturing market share through curated selections and innovative store designs.

| Business Unit | BCG Matrix Category | Key Performance Indicators (2024/Early 2025) |

|---|---|---|

| Traders Wholesale Club | Star | Operating profit nearly doubled (>100 billion won in 2024); 2x revenue per store vs. hypermarkets. |

| Starbucks Korea | Star | 3.1 trillion won sales, 190.8 billion won operating profit (2024); >2,000 outlets. |

| E-Mart Private Labels (No Brand, Peacock) | Star | Strong market share and consumer acceptance driven by competitive pricing; robust demand indicated by broader company strategies. |

| Specialty Food Markets (e.g., Starfield Market) | Star | Starfield Jukjeon: 21% YoY revenue increase (early 2025); other key locations show substantial Q1 2025 sales growth. |

What is included in the product

The E-mart BCG Matrix analyzes its business units by market share and growth, guiding strategic decisions for Stars, Cash Cows, Question Marks, and Dogs.

A clear E-mart BCG Matrix visualizes business units, easing the pain of resource allocation uncertainty.

Cash Cows

E-Mart's hypermarkets, while experiencing a slight revenue and profit dip in early 2024, continue to be the company's bedrock, generating substantial cash. This enduring strength is crucial for funding other ventures within the E-Mart portfolio.

To counter market pressures, E-Mart is doubling down on its hypermarket strategy by prioritizing grocery offerings and revamping store designs. The commitment to 'everyday low prices' is a key tactic to solidify its market position and ensure consistent, profitable revenue streams.

The integration of procurement operations across E-Mart, Traders, and E-Mart Everyday has significantly boosted profitability. By streamlining processes and reducing overhead, E-Mart achieved a 5% reduction in procurement costs in 2024, directly contributing to a more consistent cash flow.

This unified approach leverages greater bulk purchasing power, leading to improved efficiency across all retail formats. For instance, in the first half of 2024, combined purchasing for essential goods resulted in an average price decrease of 3% compared to standalone purchasing.

E-mart's real estate and property development ventures have proven to be significant cash cows. These projects, which include the company's extensive store locations and related land holdings, generated substantial investment gains that bolstered E-mart's operating results throughout 2024.

These mature assets are a consistent source of income, contributing positively to E-mart's financial health and stability. For instance, in the first half of 2024, E-mart reported a notable increase in revenue derived from its property management and rental income segments, underscoring the cash-generating power of these holdings.

Shinsegae Food (Affiliate)

Shinsegae Food, a key affiliate within the broader Shinsegae group that includes E-Mart, has demonstrated strong financial performance, positioning it as a significant contributor to the group's overall cash flow. Its operations in the food sector inherently benefit from the consistent and often inelastic demand for food products, a characteristic that underpins its stability.

This stability allows Shinsegae Food to act as a reliable cash generator, supporting other ventures within the Shinsegae ecosystem. For instance, in 2023, Shinsegae Food reported operating profit of ₩112.3 billion, a notable increase from the previous year, highlighting its robust earnings capability.

- Stable Demand: The food industry generally experiences less cyclicality, providing a consistent revenue stream for Shinsegae Food.

- Profitability: Shinsegae Food's reported operating profit of ₩112.3 billion in 2023 signifies its strong cash-generating potential.

- Ecosystem Contribution: As a core affiliate, its earnings bolster the financial health of the entire Shinsegae conglomerate, including E-Mart.

- Diversification: While E-Mart focuses on retail, Shinsegae Food's food service and manufacturing operations offer a complementary business model.

E-Mart Everyday (Supermarket Format)

E-Mart Everyday, the smaller supermarket format, has been merged with E-Mart to enhance cost competitiveness through joint procurement and logistics.

This strategic move aims to streamline operations and leverage economies of scale, positioning E-Mart Everyday to contribute to stable cash generation through increased efficiency and expanded fresh product availability.

- E-Mart Everyday's Integration: The merger with the main E-Mart brand is designed to unlock significant cost savings.

- Cost Competitiveness: Joint procurement and logistics are key drivers for improving the bottom line.

- Stable Cash Generation: Increased efficiency and broader product offerings are expected to bolster consistent revenue streams.

- Market Position: This consolidation strengthens E-Mart's overall presence in the competitive Korean retail landscape.

E-Mart's hypermarkets, despite facing some early 2024 headwinds, remain its financial backbone, consistently generating substantial cash. This enduring strength is vital for funding the company's other strategic initiatives and maintaining its market leadership.

The company's real estate and property development ventures have emerged as significant cash cows, contributing robust investment gains throughout 2024. These mature assets, including its extensive store locations and associated land, provide a reliable income stream, enhancing E-Mart's overall financial stability.

Shinsegae Food, a key affiliate, also acts as a powerful cash generator due to the inelastic demand for food products. Its strong performance, evidenced by a ₩112.3 billion operating profit in 2023, significantly bolsters the entire Shinsegae group's financial health.

| Business Unit | 2023 Operating Profit (₩ Billion) | Key Cash Generation Driver | 2024 Outlook |

|---|---|---|---|

| E-Mart Hypermarkets | N/A (Part of overall E-Mart) | High sales volume, 'everyday low prices' strategy | Stable to moderate growth, focus on grocery |

| E-Mart Real Estate | N/A (Investment Gains) | Rental income, property appreciation | Continued positive contribution |

| Shinsegae Food | 112.3 | Consistent food demand, diversified operations | Expected continued strong performance |

What You’re Viewing Is Included

E-mart BCG Matrix

The E-mart BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, analysis-ready strategic report for E-mart.

What you are previewing is the exact E-mart BCG Matrix file that will be delivered to you upon purchase, ensuring you receive precisely what you need for your strategic planning. This comprehensive report is designed for immediate application, offering clear insights into E-mart's product portfolio without any hidden surprises.

Rest assured, the E-mart BCG Matrix you are currently viewing is the final, unedited version you will download after your purchase. This professionally crafted document provides a complete strategic overview, ready for immediate integration into your business analysis or presentations.

The E-mart BCG Matrix document presented here is the actual file you will acquire upon purchase, guaranteeing you receive the complete, professionally designed strategic analysis. This report is prepared for immediate use, offering actionable insights into E-mart's market position.

Dogs

SSG.com, E-Mart's primary online platform, is currently positioned as a Dog in the BCG matrix. Its financial performance in Q1 2025 reflects significant challenges, with a 13.7% year-on-year revenue decline and operating losses escalating to 18.1 billion won, a 4.2 billion won increase from the previous year.

The substantial investment in expanding logistics infrastructure and delivery capabilities, while intended to bolster competitiveness, has resulted in a high cash burn rate with minimal returns. This situation is exacerbated by the intensely competitive nature of the e-commerce sector, making it difficult for SSG.com to gain market share and achieve profitability.

Gmarket Global, an e-commerce platform under E-Mart, is currently positioned as a 'dog' in the BCG matrix. In the first quarter of 2025, the company experienced a substantial revenue decline of 21.4%.

Furthermore, Gmarket's operating loss widened significantly during the same period. Despite attempts to explore a joint venture with Alibaba, its financial performance indicates it's a cash drain without delivering adequate returns.

E-Mart's overseas hypermarket expansion, notably in China, has encountered significant headwinds. The company has strategically restructured its international operations, including a shift to a franchising model for its Vietnamese hypermarket business due to underperformance.

These moves reflect a low market share coupled with limited growth prospects within these particular overseas hypermarket markets. For instance, E-Mart's withdrawal from China in 2019, after facing intense competition and regulatory hurdles, serves as a stark example of these challenges.

Non-Core or Underperforming Specialty Stores

Within E-Mart's diverse retail landscape, certain specialty store formats or individual branches might be classified as non-core or underperforming. These operations, despite E-Mart Food Market and Starfield Market's successes, could be facing challenges in capturing market share or achieving profitability within their specific niche segments. Such units may represent a drain on resources, diverting capital and management attention from more promising ventures.

These underperformers could be characterized by:

- Low sales volume and declining revenue growth.

- Suboptimal profit margins compared to industry benchmarks.

- Limited customer engagement and brand recognition in their specific market.

For instance, if a particular specialty store format, such as a niche electronics or apparel outlet, reported a year-over-year revenue decline of 5% in 2023, while E-Mart as a whole saw a 2% increase, it would fit this category. The strategic decision would involve evaluating whether to divest, restructure, or invest further to turn around these struggling units.

Outdated Traditional Retail Formats

Any E-mart traditional retail formats that haven't been updated to match current consumer shopping habits could be classified as dogs. These might be older store layouts or those that haven't embraced digital integration, leading to decreased customer visits and sales.

These "dog" units likely face declining foot traffic and sales, similar to how department store sales in South Korea saw a slight decrease in early 2024 compared to the previous year, indicating a broader challenge for traditional retail models.

- Declining Sales: Units with consistently low revenue growth, potentially underperforming against industry benchmarks.

- Low Foot Traffic: Stores experiencing a noticeable drop in customer visits, suggesting a lack of appeal or relevance.

- High Operating Costs: Outdated formats may incur higher maintenance or staffing costs relative to their revenue generation.

- Limited Innovation: Stores that have not adopted new technologies or adapted their product offerings to evolving consumer demands.

E-Mart's SSG.com and Gmarket Global are prime examples of "dogs" in the BCG matrix, facing significant revenue declines and widening operating losses in early 2025. These platforms struggle with intense e-commerce competition and high cash burn rates, failing to generate adequate returns on substantial investments in logistics.

Similarly, E-Mart's past overseas ventures, like its withdrawal from China in 2019, and the shift to franchising in Vietnam highlight a pattern of low market share and limited growth in specific international markets, classifying them as dogs.

Underperforming specialty store formats or older, unmodernized E-Mart retail outlets also fall into the dog category, characterized by declining sales, low foot traffic, and high operating costs relative to their revenue generation, mirroring broader challenges in traditional retail.

Question Marks

E-Mart's new digital transformation initiatives, focusing on data analytics, AI customer service, and supply chain optimization for e-commerce, are crucial for its growth in the booming online retail sector. These efforts, however, are capital-intensive, with immediate returns not yet guaranteed, mirroring the challenges faced by its online platforms like SSG.com and Gmarket.

The company's significant investment in these digital capabilities positions them as potential future stars within the BCG matrix, provided they can successfully navigate the high-growth e-commerce market. For instance, E-Mart aims to enhance its online presence, a market that saw global e-commerce sales reach an estimated $6.3 trillion in 2024, indicating substantial potential if these digital ventures prove fruitful.

E-Mart's strategic move into the US market, exemplified by its acquisitions of New Seasons Market and PK Retail Holdings, signals an ambition to tap into high-growth potential territories. These ventures position E-Mart as a potential 'Question Mark' within the BCG Matrix, given the substantial investments required to establish a foothold.

While the US presents significant growth opportunities, E-Mart's current market share in these new overseas ventures is minimal. This necessitates considerable capital outlay and effective localization strategies to navigate competitive landscapes and achieve profitability, reflecting the inherent risks and potential rewards of such expansions.

The integration of E-Mart Everyday into E-Mart positions the combined entity as a potential question mark within the BCG matrix. While the merger, completed in early 2024, aims to boost efficiency and cost savings, the full impact on profitability and market share is yet to be definitively determined. E-Mart's overall revenue for the first quarter of 2024 was KRW 6.5 trillion, and the success of this internal consolidation will be crucial in assessing its future trajectory.

Emerging Online Grocery Delivery Innovations

The online grocery sector is a hotbed of innovation, driven by the surge in mobile commerce and the demand for ultra-fast delivery. Companies are actively pursuing aggressive expansion strategies, often through mergers and acquisitions, to capture market share. E-Mart's success in this dynamic landscape hinges on its capacity to deploy and scale novel, competitive online grocery delivery models.

For E-Mart's online grocery delivery services to ascend to "Star" status within its BCG Matrix, several key innovations are crucial:

- M-commerce Dominance: E-Mart must leverage mobile platforms to provide a seamless and intuitive shopping experience, capitalizing on the projected continued growth in mobile grocery sales, which accounted for a significant portion of online grocery transactions in 2024.

- Ultra-Fast Delivery Networks: Implementing and scaling rapid delivery options, such as 15-minute or 30-minute delivery windows, will be critical to meeting consumer expectations and differentiating from competitors.

- Strategic Mergers and Acquisitions: E-Mart may need to engage in strategic acquisitions of smaller, innovative players or complementary businesses to quickly expand its reach, technological capabilities, and customer base in the competitive online grocery market.

- Data-Driven Personalization: Utilizing advanced analytics to personalize offers, recommendations, and shopping experiences based on customer data will enhance loyalty and drive repeat purchases in the increasingly competitive online grocery space.

New Store Formats and Concepts (beyond current successes)

E-mart is actively exploring novel retail formats, building on successes like its specialty food stores. These new concepts, currently in nascent stages, represent potential high-growth avenues but require substantial investment for validation and expansion. Their market share is minimal, and their long-term viability remains uncertain, classifying them as question marks within the BCG matrix.

For instance, E-mart's investment in developing immersive, digitally integrated physical spaces or highly curated, niche product destination stores would fall into this category. These ventures aim to capture emerging consumer trends, but their initial performance metrics and market penetration are still being established. By 2024, E-mart has been observed to be piloting several such experimental formats, with the specific financial outlay for each not yet publicly detailed but understood to be significant for initial testing phases.

- Specialty Food Stores: Proven success, indicating E-mart's capability in niche retail.

- Emerging Formats: New concepts like digitally integrated spaces or niche destinations.

- Investment Requirement: Significant capital needed for testing and scaling these unproven concepts.

- Market Position: Currently low market share with high growth potential but uncertain outcomes.

E-Mart's ventures into new international markets, such as its US acquisitions, and its exploration of novel retail formats are prime examples of 'Question Marks' in the BCG matrix. These initiatives require substantial investment for market penetration and validation, with uncertain but potentially high returns, reflecting E-Mart's strategic push into higher-growth areas. For example, E-Mart's 2024 expansion efforts are characterized by significant capital deployment into these nascent ventures.

These 'Question Mark' businesses, like E-Mart's overseas operations and experimental store concepts, are characterized by low current market share but operate in industries with high growth potential. Success hinges on E-Mart's ability to effectively allocate resources, innovate, and adapt to local market demands, transforming them into future 'Stars'. The company's overall financial health, with Q1 2024 revenue at KRW 6.5 trillion, will be a key factor in supporting these ambitious growth plays.

The success of E-Mart's digital transformation, including its online platforms like SSG.com and Gmarket, also places them in a 'Question Mark' category. While these areas represent the future of retail, with global e-commerce sales projected to reach $6.3 trillion in 2024, the significant capital investment and the race for market share mean their future status as 'Stars' is not yet assured.

E-Mart's internal consolidation, such as integrating E-Mart Everyday, also presents 'Question Mark' characteristics. While aimed at efficiency, the ultimate impact on market share and profitability is still unfolding, making its future standing within the matrix dependent on successful integration and market reception.

| Business Unit | Market Share | Market Growth | BCG Category | Key Considerations |

| US Market Expansion (New Seasons, PK Retail) | Low | High | Question Mark | High investment, localization strategy, competitive landscape |

| Emerging Retail Formats (Specialty, Digital Integration) | Low | High | Question Mark | Capital intensive, validation of new concepts, consumer adoption |

| Digital Transformation (SSG.com, Gmarket) | Growing | High | Question Mark | Significant investment, competition, achieving profitability |

| E-Mart Everyday Integration | Moderate | Moderate | Question Mark | Efficiency gains, cost savings, market share impact |

BCG Matrix Data Sources

Our E-mart BCG Matrix leverages comprehensive data, including sales figures, market share reports, and competitor analysis, to accurately position products.