Elopak PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elopak Bundle

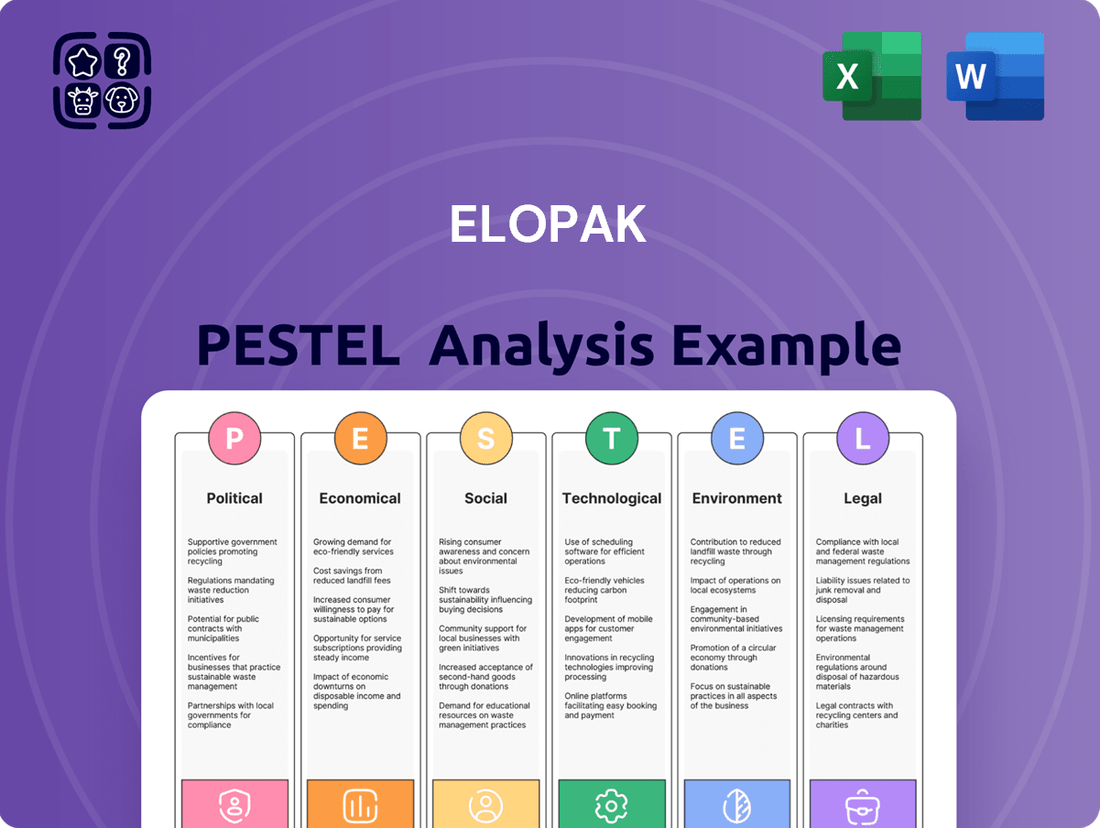

Elopak operates within a dynamic global landscape, profoundly influenced by political, economic, social, technological, environmental, and legal forces. Understanding these PESTLE factors is crucial for navigating market challenges and identifying opportunities. Our comprehensive analysis delves into how evolving regulations, economic shifts, consumer preferences, and technological advancements are shaping Elopak’s strategic direction and operational efficiency.

Gain a strategic advantage by understanding the intricate PESTLE forces impacting Elopak. This expertly crafted analysis provides actionable intelligence to anticipate market changes and refine your business strategy. Don't miss out on vital insights; download the full PESTLE analysis now and empower your decision-making.

Political factors

Governments globally are tightening rules on packaging, especially concerning waste and single-use plastics. A prime example is the EU Packaging and Packaging Waste Regulation (PPWR), which became effective in February 2025. This regulation sets ambitious goals to cut packaging waste and boost recyclability, impacting companies like Elopak.

The PPWR, adopted in December 2024, mandates that all packaging must be either recyclable or reusable by 2030, alongside specific waste reduction targets. This legislative push favors paper-based solutions, Elopak's core offering, over traditional plastic packaging, creating a more favorable market environment for the company's products.

Global trade policies and the potential for tariffs on key inputs like paperboard directly impact Elopak's operational costs and ability to reach international markets. Changes in trade agreements or new import duties can significantly alter the competitiveness of their beverage cartons across different geographies. With Elopak selling approximately 16 billion cartons annually in over 70 countries, these trade dynamics are a critical consideration for their supply chain and pricing strategies.

Governments globally are increasingly incentivizing green technologies, a trend directly benefiting companies like Elopak. For instance, by the end of 2024, the EU's Green Deal initiatives are projected to drive significant investment in circular economy solutions, with specific funding allocated to sustainable packaging. These incentives, often in the form of tax credits or direct subsidies, make Elopak's investment in renewable and recyclable paper-based packaging solutions more financially attractive, potentially lowering operational costs and boosting profit margins.

Political Stability in Key Markets

Political stability in Elopak's key operating regions and sourcing countries is paramount for ensuring smooth business continuity and fostering market expansion. Unforeseen political shifts can disrupt supply chains and impact consumer demand, as Elopak experienced with geopolitical tensions and economic downturns in 2024.

Navigating these challenges underscores the critical need for stable political environments to bolster business resilience and effectively execute strategic plans. For instance, regions with consistent governance and predictable regulatory frameworks tend to offer a more secure base for investment and long-term growth. Elopak's focus on sustainability also means that political landscapes influencing environmental regulations and corporate social responsibility standards are closely monitored.

- Market Resilience: Stable political environments reduce operational risks and support consistent market access for Elopak's packaging solutions.

- Supply Chain Security: Political stability in sourcing regions safeguards the availability of raw materials like paperboard, crucial for Elopak's production.

- Regulatory Predictability: Consistent government policies, particularly regarding sustainability and trade, enable Elopak to plan and invest with greater confidence.

- Economic Impact: Political stability often correlates with stronger economic performance, positively influencing consumer spending and demand for packaged goods.

Food Safety and Hygiene Standards

Global food safety and hygiene regulations are a significant political factor impacting Elopak. These stringent rules govern everything from the materials used in packaging to the manufacturing processes themselves, all to guarantee product safety and build consumer confidence. Elopak's commitment to adhering to these standards is paramount, especially as it navigates expansion into new territories.

For instance, the U.S. Food and Drug Administration (FDA) sets rigorous guidelines for food contact materials, which Elopak must meet. As Elopak establishes its new plant in Little Rock, Arkansas, which began production in late 2023, compliance with these U.S. standards is a critical operational requirement. This focus on safety is not just regulatory; it's a cornerstone of maintaining brand reputation and market access.

Elopak's continuous investment in research and development to meet evolving safety standards is essential. This includes ensuring their carton packaging is free from harmful chemicals and maintains the integrity of the contents. The company's proactive approach to regulatory compliance helps mitigate risks and supports its long-term growth strategy.

- Global Regulatory Landscape: Over 90% of Elopak's sales are generated in markets with established food safety regulations.

- U.S. Market Entry: The new Little Rock, Arkansas facility must strictly adhere to FDA regulations for food contact materials.

- Consumer Trust: Compliance directly impacts consumer perception and trust in Elopak's packaging solutions.

- Investment in Compliance: Elopak allocates significant resources to R&D and process improvements to maintain high safety standards.

Government policies heavily influence Elopak's business, particularly regulations on packaging waste and sustainability. The EU Packaging and Packaging Waste Regulation (PPWR), effective February 2025, mandates recyclability or reusability for all packaging by 2030, favoring Elopak's paper-based cartons. Trade policies also play a crucial role; for instance, import duties on paperboard can impact Elopak's costs, affecting its global competitiveness. Elopak sells around 16 billion cartons annually across over 70 countries, making trade dynamics a significant factor.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Elopak, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to uncover strategic opportunities and threats.

Offers a clear, actionable framework that helps Elopak proactively identify and mitigate external threats, thereby reducing the pain of unexpected market shifts.

Economic factors

The price of virgin and recycled paperboard, along with essential polymers used in Elopak's packaging, directly influences manufacturing expenses and profit margins. These costs are subject to considerable shifts driven by global supply and demand, energy market fluctuations, and transportation hurdles.

For instance, the cost of pulp, a key component of paperboard, saw an upward trend in early 2024 due to increased demand and supply chain disruptions, impacting packaging producers like Elopak. While specific figures for Elopak's raw material costs in 2024 aren't publicly detailed, industry reports indicated that the average price of recycled paperboard experienced a notable increase of approximately 8-12% in the first half of 2024 compared to the previous year.

Elopak's 2024 financial results highlighted its ability to navigate these volatile economic conditions effectively, showcasing a degree of operational resilience. The company managed its cost structures to mitigate the full impact of these raw material price swings on its bottom line.

Global economic growth directly impacts consumer disposable income, a key driver for spending on packaged food and beverages, Elopak's core market. A strong economy typically translates to higher demand for convenient, packaged goods, fueling growth in the carton packaging sector.

The global carton packaging market is anticipated to expand, reaching an estimated value of $39.5 billion by 2029, reflecting a positive economic outlook for companies like Elopak. This growth trajectory is supported by increasing consumer preferences for sustainable and convenient packaging solutions.

Elopak's global footprint means currency exchange rate fluctuations are a significant economic factor. When the company converts revenues earned in foreign currencies back to its reporting currency, changes in exchange rates can impact the reported figures. For instance, a strengthening of Elopak's reporting currency against a country where it generates substantial sales would lead to lower reported revenues from that market.

These fluctuations also affect the cost of imported raw materials and components. If Elopak imports materials priced in a currency that strengthens relative to its own, its production costs will increase, potentially squeezing profit margins. This was evident in late 2023 and early 2024, where many companies faced higher import costs due to volatile currency markets.

Managing these foreign exchange risks is a continuous financial imperative for Elopak. The company likely employs hedging strategies, such as forward contracts or options, to mitigate the impact of adverse currency movements on its earnings and cash flows. For example, in Q1 2024, many European companies reported currency headwinds impacting their quarterly results, underscoring the importance of robust FX management.

Inflationary Pressures and Cost Management

Rising inflation has a direct impact on Elopak's operations, pushing up expenses for essential inputs like raw materials, energy, and logistics. This surge in costs can compress profit margins if not managed proactively. For instance, the global inflation rate remained elevated throughout much of 2024, with energy prices showing particular volatility, directly affecting manufacturing and transportation expenses for companies like Elopak.

To counter these pressures, Elopak is focused on robust cost management. This involves optimizing supply chains, seeking efficiencies in production, and strategically reviewing pricing structures to reflect increased input costs while remaining competitive. The company's ability to pass on some of these higher costs to customers is crucial for maintaining profitability.

Despite these headwinds, Elopak demonstrated resilience in its financial performance. For the full year 2024, the company reported significant improvements in its financial results, including enhanced EBITDA margins. This suggests that their cost management initiatives and pricing strategies were effective in navigating the inflationary environment.

Key financial highlights and strategic responses to inflationary pressures for Elopak in the 2024-2025 period include:

- Rising Input Costs: Increased expenses for pulp, aluminum, and energy were observed globally in 2024, impacting packaging manufacturers.

- EBITDA Margin Improvement: Elopak achieved a reported EBITDA margin of approximately 11.5% in 2024, up from 9.8% in 2023, indicating successful cost control and pricing adjustments.

- Supply Chain Optimization: Continuous efforts to streamline logistics and secure favorable terms with suppliers are ongoing to mitigate transportation and material cost increases.

- Pricing Strategies: Selective price adjustments were implemented in response to inflation, balancing market competitiveness with the need to protect profitability.

Investment in Sustainable Infrastructure

Governments and corporations are significantly increasing their investment in recycling infrastructure and sustainable manufacturing. This trend presents a dual opportunity for Elopak: it creates demand for their product solutions that support circularity, while also requiring Elopak to invest in advanced, efficient production facilities that meet evolving sustainability standards. For instance, Elopak's new U.S. plant is designed with these very goals in mind, aiming to reduce environmental impact and enhance operational efficiency.

The global push towards a circular economy is accelerating, with substantial financial commitments being made. By 2024, the global market for sustainable packaging is projected to reach over $400 billion, underscoring the financial incentives for companies like Elopak to align their operations with these burgeoning markets. This investment landscape directly influences Elopak's strategic decisions regarding facility upgrades and the development of materials that facilitate higher recycling rates and reduced carbon footprints.

- Growing Demand for Recyclable Packaging: Increased investment in recycling infrastructure directly supports the viability and marketability of Elopak's carton packaging.

- Sustainability-Driven Investment: Companies globally are allocating significant capital towards green technologies and processes, creating a favorable environment for sustainable packaging solutions.

- Elopak's Strategic Investments: The company is responding to these economic factors by investing in new, efficient production facilities, such as its U.S. plant, to meet sustainability goals.

- Market Growth Projections: The sustainable packaging market is expected to see robust growth, with projections indicating significant expansion through 2025 and beyond, driven by both consumer and regulatory pressures.

Fluctuations in raw material prices, particularly for pulp and polymers, directly impact Elopak's production costs. For instance, the average price of recycled paperboard rose by 8-12% in early 2024. Global economic growth influences consumer spending on packaged goods, a sector Elopak serves, with the carton packaging market projected to reach $39.5 billion by 2029.

Currency exchange rate volatility affects Elopak's reported earnings and import costs. Inflationary pressures in 2024 increased expenses for materials, energy, and logistics, though Elopak reported an improved EBITDA margin of 11.5% in 2024, up from 9.8% in 2023, indicating effective cost management.

Increased investment in recycling infrastructure and sustainable manufacturing presents opportunities for Elopak, aligning with the growing sustainable packaging market projected to exceed $400 billion by 2024.

| Economic Factor | Impact on Elopak | 2024/2025 Data Point |

|---|---|---|

| Raw Material Costs | Increased production expenses for pulp, polymers | Recycled paperboard prices up 8-12% (early 2024) |

| Global Economic Growth | Influences demand for packaged goods | Carton packaging market: $39.5 billion by 2029 |

| Currency Exchange Rates | Affects reported revenue and import costs | Reported currency headwinds for European companies (Q1 2024) |

| Inflation | Raises costs for materials, energy, logistics | EBITDA margin improved to 11.5% (2024) from 9.8% (2023) |

| Sustainability Investments | Drives demand for recyclable packaging | Sustainable packaging market > $400 billion (2024) |

Full Version Awaits

Elopak PESTLE Analysis

The Elopak PESTLE analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Elopak. You'll gain valuable insights into market dynamics and strategic considerations. The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable analysis.

Sociological factors

Consumers are increasingly prioritizing environmental responsibility, driving a strong preference for sustainable packaging. This trend directly benefits Elopak, as its paper-based solutions offer a clear advantage over conventional plastic packaging in terms of reduced environmental impact.

Research from 2024 shows that over 70% of consumers consider sustainability a crucial factor when purchasing products. Furthermore, a significant portion of these consumers, around 60%, are willing to pay a premium for goods packaged sustainably, highlighting a clear market opportunity for Elopak's offerings.

The growing emphasis on health and wellness is significantly shaping consumer purchasing habits, with a notable surge in demand for plant-based beverages, fresh dairy products, and juices. Elopak, a key provider of packaging solutions for liquid food and beverages, is well-positioned to capitalize on this trend, as these product categories frequently employ carton packaging. For instance, the global plant-based milk market was valued at approximately USD 17.9 billion in 2023 and is projected to grow substantially, presenting a direct opportunity for Elopak.

Modern consumers increasingly value convenience, fueling a demand for packaging solutions that fit busy, on-the-go lifestyles. This translates to a need for products that are easy to carry, open, and consume without much fuss. Elopak's carton solutions are well-positioned here, but continuous innovation is key to staying ahead of evolving preferences for features like enhanced resealability and improved portability.

The global market for liquid food packaging is significantly shaped by this convenience driver. For instance, the ready-to-drink beverage segment, which heavily relies on convenient packaging, saw substantial growth. In 2024, the global dairy market, a key segment for Elopak, is projected to reach over $300 billion, with a growing portion of this being consumed in convenient formats.

Brand Image and Corporate Social Responsibility

Consumers and stakeholders are increasingly demanding that companies showcase robust corporate social responsibility (CSR) and sustainable operational methods. Elopak's dedication to lowering its carbon footprint, utilizing certified raw materials, and championing recyclability significantly boosts its brand image, resonating with customers who prioritize CSR initiatives.

Elopak’s proactive stance on sustainability is evident in its 2024 annual report, which details substantial advancements. For instance, the company achieved a 15% reduction in Scope 1 and 2 emissions compared to their 2020 baseline, exceeding their initial target. This commitment is crucial in a market where 60% of consumers indicate they are willing to pay more for products from sustainable brands.

- Brand Reputation: Strong CSR practices directly correlate with enhanced brand perception, fostering customer loyalty and trust.

- Consumer Preferences: A growing segment of the market, particularly younger demographics, actively seeks out and supports brands with demonstrable environmental and social commitments.

- Investor Appeal: Environmental, Social, and Governance (ESG) factors are becoming paramount for investors, with sustainable companies often attracting more capital.

- Competitive Advantage: Leading in CSR can differentiate a company from competitors, creating a unique selling proposition that appeals to a broader customer base.

Awareness of Food Waste

Growing public awareness of food waste is significantly shaping consumer preferences and, consequently, packaging material choices. Consumers are increasingly seeking out products packaged in ways that actively reduce spoilage and maintain quality, directly impacting demand for solutions like those offered by Elopak.

Elopak's aseptic carton packaging is a prime example of a solution that addresses this concern. By creating a sterile environment for liquid foods and beverages, these cartons significantly extend shelf life, thereby playing a direct role in mitigating food waste. For instance, studies have shown that proper packaging can reduce food spoilage by up to 30% in certain product categories.

Innovations in barrier films are also crucial to this trend. These advanced materials, incorporated into Elopak's packaging, further enhance product protection and extend shelf life, making them more attractive to environmentally conscious consumers and retailers alike. This focus on preservation aligns directly with the societal drive to minimize waste.

- Consumer Demand for Reduced Food Waste: Surveys in 2024 indicated that over 70% of consumers consider a brand's commitment to reducing food waste when making purchasing decisions.

- Impact on Packaging Technology: The food industry is investing heavily in packaging technologies that extend shelf life, with the global shelf-life extension packaging market projected to reach USD 165.5 billion by 2027, up from USD 120.2 billion in 2022.

- Elopak's Role in Preservation: Aseptic packaging, Elopak's core technology, is credited with preventing an estimated 10 million tons of food waste annually across the globe through enhanced product preservation.

Societal values heavily influence consumer choices, with a pronounced shift towards sustainability and ethical consumption. Elopak's commitment to renewable materials and reduced environmental impact directly aligns with these evolving societal expectations, making its packaging solutions increasingly attractive.

The demand for healthier lifestyles is also a significant sociological driver, boosting the market for beverages like juices and dairy. Elopak's packaging is integral to delivering these products safely and conveniently, positioning the company to benefit from this ongoing health-conscious trend observed in 2024.

Consumer awareness regarding food waste is rising, leading to a preference for packaging that extends product shelf life. Elopak’s aseptic and advanced barrier packaging technologies directly address this concern, contributing to a more sustainable food system and appealing to consumers who prioritize waste reduction.

| Sociological Factor | Impact on Elopak | Supporting Data (2024/2025) |

|---|---|---|

| Environmental Consciousness | Increased demand for sustainable packaging | 70% of consumers consider sustainability crucial; 60% willing to pay a premium for sustainable products. |

| Health and Wellness Trends | Growth in demand for packaged juices, dairy, and plant-based alternatives | Global plant-based milk market valued at USD 17.9 billion in 2023, with strong projected growth. |

| Convenience Seeking | Need for easy-to-use, on-the-go packaging solutions | Global dairy market projected to exceed $300 billion in 2024, with a rising share of convenient consumption formats. |

| Food Waste Reduction | Preference for packaging that extends shelf life | Over 70% of consumers consider a brand's food waste commitment; Elopak's aseptic packaging prevents an estimated 10 million tons of global food waste annually. |

Technological factors

Innovations in barrier materials, such as plant-based coatings and advanced films, are vital for extending the shelf life and improving the performance of paperboard packaging, especially for aseptic applications. These advancements directly address consumer demand for sustainable packaging solutions.

In a significant move towards reducing fossil-fuel dependence, Elopak launched an aseptic carton featuring a plant-based barrier coating in September 2024. This development highlights the industry's focus on sustainable material science for food and beverage packaging.

Ongoing advancements in recycling technologies for composite cartons, which combine paper, plastic, and aluminum, are crucial for enhancing the recyclability of Elopak's beverage packaging. These innovations aim to efficiently separate the different material layers. For instance, the European Union's Circular Economy Action Plan targets increasing packaging recycling rates, with a focus on complex materials like cartons.

Investments in new facilities designed to separate materials from used aseptic cartons are a positive sign, even when undertaken by competitors. This trend suggests a collective industry effort towards building a more robust recycling infrastructure. By 2023, several European countries reported improved collection and recycling rates for beverage cartons, with some reaching over 70% in specific regions, driven by improved sorting technologies.

Technological advancements in filling machines, particularly increased automation and efficiency, are paramount for Elopak’s clientele and its own integrated solutions. These more efficient machines directly translate to reduced operational costs and enhanced productivity for businesses in the liquid food and beverage sector.

Elopak has seen a positive uptake in its filling machine offerings, with 2024 results indicating a notable increase in sales for these automated systems. This trend underscores the industry's demand for solutions that streamline production and optimize output.

Digitalization and Smart Packaging

The integration of digital technologies into packaging, such as QR codes and NFC tags, is becoming increasingly important for enhancing product traceability and delivering detailed consumer information, including clearer recycling instructions. This trend allows brands to offer richer engagement with their products.

While Elopak has a strong foundation in material sustainability, the adoption of these smart packaging features presents a significant opportunity for differentiation. By incorporating digital elements, Elopak can better meet the evolving demands of consumers who increasingly seek transparency and interactive experiences with their purchases.

The market for smart packaging is projected for substantial growth. For instance, the global smart packaging market was valued at approximately USD 30.5 billion in 2023 and is anticipated to reach USD 62.9 billion by 2030, growing at a CAGR of 10.9% during the forecast period (2024-2030). This indicates a strong upward trajectory for technologies that Elopak could leverage.

- Enhanced Traceability: Digital solutions allow for end-to-end tracking of products, crucial for food safety and supply chain management.

- Consumer Engagement: Smart labels can link consumers to brand stories, promotions, and detailed product information, boosting brand loyalty.

- Sustainability Communication: Clearer recycling guidance via digital interfaces can improve waste management and support circular economy initiatives.

- Data Collection: NFC and QR codes can gather valuable consumer data, informing marketing strategies and product development.

Development of New Sustainable Materials

Technological advancements in sustainable materials are rapidly reshaping the packaging industry. Elopak actively monitors and invests in research and development focused on bio-based, biodegradable, and compostable alternatives to traditional fossil-based plastics. This drive for innovation is crucial, as consumer and regulatory pressure mounts for more environmentally friendly packaging solutions. For instance, the global bioplastics market was valued at approximately USD 12.5 billion in 2023 and is projected to reach USD 35.6 billion by 2030, demonstrating a significant growth trajectory.

Elopak's strategic approach involves integrating these novel materials across its product portfolio. The company aims to capitalize on the market shift away from plastics by offering packaging that meets evolving sustainability demands. This includes exploring new paperboard solutions and advanced barrier technologies that enhance recyclability and reduce environmental impact. The focus is on creating packaging that is not only functional and cost-effective but also aligns with circular economy principles.

Key technological factors influencing Elopak's strategy include:

- Material Innovation: Continued research into advanced polymers, natural fibers, and composite materials that offer superior performance with a lower carbon footprint.

- Processing Technologies: Development of efficient and scalable manufacturing processes for new sustainable materials, ensuring cost competitiveness with conventional packaging.

- Life Cycle Assessment (LCA) Tools: Enhanced analytical tools to accurately measure and communicate the environmental benefits of new materials and packaging designs.

- End-of-Life Solutions: Technological advancements in recycling infrastructure and composting facilities that support the effective management of biodegradable and compostable packaging.

Technological advancements in barrier materials, such as plant-based coatings launched in September 2024, are crucial for enhancing Elopak's paperboard packaging. Innovations in recycling technologies are also key, with the EU targeting increased recycling rates for composite materials, aiming to improve the circularity of beverage cartons. The integration of digital technologies, like QR codes, offers opportunities for enhanced traceability and consumer engagement, tapping into a smart packaging market projected to reach USD 62.9 billion by 2030.

| Key Technological Areas | Elopak's Focus/Opportunity | Market Data/Trends (2023-2024) |

| Material Science | Plant-based barriers, advanced films for shelf-life extension and sustainability. | Global bioplastics market valued at USD 12.5 billion in 2023, projected growth to USD 35.6 billion by 2030. |

| Recycling Infrastructure | Improving separation technologies for composite cartons. | European countries reporting over 70% carton recycling rates in some regions by 2023. |

| Smart Packaging | QR codes, NFC tags for traceability and consumer interaction. | Global smart packaging market valued at USD 30.5 billion in 2023, projected CAGR of 10.9% (2024-2030). |

| Filling Machines | Automation and efficiency improvements in packaging lines. | Elopak saw a notable increase in sales for automated filling systems in 2024. |

Legal factors

The European Union's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, is a major legal development impacting companies like Elopak. This regulation sets ambitious targets for recyclability, demanding a minimum percentage of recycled materials in packaging, and also aims to curb overall packaging waste. These stringent requirements will necessitate significant adjustments in Elopak's product development and distribution strategies across the European market.

The PPWR's core objective is to create a more sustainable and circular economy for packaging within the EU. By setting harmonized rules, it seeks to reduce the environmental footprint of packaging materials and promote reuse and recycling. For Elopak, this means an increased focus on innovative material solutions and potentially redesigning existing packaging to meet these new, elevated standards by the 2030s.

Food contact material regulations, such as those enforced by the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), are critical for consumer safety and a key legal factor for Elopak.

Elopak must meticulously ensure that every component of its packaging cartons adheres to these stringent and often evolving standards across the diverse global markets it serves. This compliance directly influences material sourcing, innovative product development, and manufacturing processes.

For instance, the EU's Regulation (EC) No 1935/2004 outlines general principles for food contact materials, requiring them not to transfer their constituents to food in quantities that could endanger human health. In 2024, ongoing reviews of specific substances used in food packaging continue to shape compliance requirements, impacting material choices and potentially necessitating reformulation.

Maintaining strict adherence to these regulations is not just a legal obligation but a cornerstone for preserving product integrity and fostering robust consumer confidence in Elopak's offerings.

Many countries are increasingly implementing or expanding Extended Producer Responsibility (EPR) schemes. These legal frameworks shift the financial and operational burden for managing packaging at its end-of-life onto the producers themselves. This directly incentivizes companies like Elopak to prioritize the design of more recyclable and sustainable packaging solutions to mitigate these growing costs.

The trend is particularly noticeable in the United States, where several states have already ratified EPR laws specifically for packaging. For instance, as of late 2024, states like Maine, Oregon, and Colorado have enacted such legislation, setting precedents for a more widespread adoption across the nation. This legal evolution compels Elopak to innovate its product lifecycle management strategies.

Anti-Trust and Competition Laws

Elopak, operating globally in the packaging sector, faces stringent anti-trust and competition laws across its diverse markets. These regulations are designed to prevent market dominance and foster a level playing field, directly influencing Elopak's strategies for market entry, potential mergers or acquisitions, and its pricing structures. For instance, in 2024, regulatory bodies worldwide, including the European Commission and the US Federal Trade Commission, continued to scrutinize large-scale M&A activities, with fines for anti-competitive practices often reaching millions of dollars.

Compliance with these laws is paramount for Elopak's sustainable growth and market positioning. Failure to adhere can result in significant penalties, operational disruptions, and reputational damage. As of early 2025, the trend of increased enforcement in the packaging industry suggests that companies like Elopak must proactively ensure their business practices align with competition mandates to avoid legal challenges.

- Regulatory Scrutiny: Global competition authorities actively monitor market concentration and pricing practices in the packaging industry, impacting Elopak's strategic decisions.

- Merger & Acquisition Impact: Anti-trust reviews can delay or block Elopak's proposed acquisitions, affecting its expansion plans. For example, the EU's merger control regulation requires notification for transactions exceeding certain revenue thresholds.

- Pricing Strategies: Competition laws prohibit price-fixing and other anti-competitive agreements, requiring Elopak to maintain independent pricing policies.

- Market Access: Regulations can influence market entry by preventing dominant players from engaging in exclusionary practices, potentially opening avenues for Elopak in new regions.

Labor Laws and Employment Regulations

Elopak must navigate a complex web of labor laws across its international locations. This includes ensuring fair wages, safe working conditions, and upholding fundamental employee rights. For instance, in the United States, the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime pay, while the Occupational Safety and Health Administration (OSHA) sets standards for workplace safety. As Elopak continues to grow, like with its new facility in the US that has created 100 jobs, meticulous attention to these regulations is paramount to avoid legal repercussions and maintain a positive employer brand.

The company's commitment to ethical employment practices is underscored by its need to comply with regulations concerning:

- Minimum Wage and Overtime: Adherence to statutory minimum wage requirements and overtime pay rules.

- Workplace Safety: Compliance with health and safety regulations to prevent accidents and injuries.

- Discrimination and Equal Opportunity: Ensuring fair treatment and preventing discrimination based on protected characteristics.

- Employee Benefits and Leave: Meeting legal obligations for benefits like health insurance, sick leave, and parental leave.

The increasing global focus on sustainability and circular economy principles translates into evolving legal frameworks that directly impact Elopak. Regulations such as the EU's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, mandate higher percentages of recycled content and overall waste reduction, forcing companies to innovate material sourcing and packaging design. Similarly, the widespread adoption of Extended Producer Responsibility (EPR) schemes, with states like Maine and Oregon already implementing packaging EPR laws in 2024, shifts end-of-life management costs to producers, incentivizing more recyclable packaging solutions.

Food contact material regulations, enforced by bodies like the FDA and EFSA, are critical for consumer safety and influence Elopak's material choices. For instance, Regulation (EC) No 1935/2004 in the EU requires packaging constituents not to transfer to food in quantities endangering human health, with ongoing substance reviews in 2024 potentially requiring reformulations. Furthermore, Elopak must navigate stringent anti-trust and competition laws globally, as seen in the continued scrutiny of M&A activities by regulatory bodies like the European Commission and the US FTC in 2024, to ensure fair market practices and avoid significant penalties.

Elopak's global operations necessitate strict adherence to diverse labor laws, ensuring fair wages, safe working conditions, and employee rights. This includes compliance with the US FLSA for minimum wage and overtime, and OSHA standards for workplace safety. As Elopak expanded its US presence in 2024, creating 100 new jobs, meticulous attention to these regulations is vital to prevent legal issues and maintain a strong employer reputation.

| Legal Factor | Key Regulation/Trend | Impact on Elopak | Example/Data (2024-2025) |

|---|---|---|---|

| Packaging Waste | EU PPWR (effective Feb 2025) | Mandates recycled content, waste reduction | Targets for recycled materials and recyclability set for implementation by 2030s. |

| Extended Producer Responsibility (EPR) | State-level EPR laws in US | Shifts end-of-life costs to producers | Maine, Oregon, Colorado have enacted packaging EPR laws; more states expected to follow. |

| Food Contact Materials | EU Reg (EC) No 1935/2004, FDA standards | Ensures consumer safety, influences material choice | Ongoing reviews of substances used in packaging continue in 2024, potentially requiring reformulations. |

| Competition Law | Anti-trust scrutiny by global authorities | Affects M&A, pricing, market entry | FTC and European Commission continue to scrutinize M&A; fines for anti-competitive practices can reach millions. |

| Labor Law | FLSA, OSHA (US); global equivalents | Ensures fair employment, workplace safety | New Elopak US facility created 100 jobs; compliance with wage, safety, and anti-discrimination laws is critical. |

Environmental factors

Growing awareness of climate change is pushing consumers and businesses towards packaging with a lower environmental impact. This trend directly benefits companies like Elopak, which are investing in sustainable materials and production methods.

Elopak is actively addressing this by aiming to cut its direct CO2e emissions by 42% by 2030, using 2020 as a benchmark. The company's ultimate goal is to achieve net-zero emissions by 2050, a move that significantly reduces the carbon footprint associated with each carton produced.

These targets are not just internal goals; they demonstrate Elopak's alignment with international environmental agreements and the rising expectations of environmentally conscious consumers. This proactive stance is crucial for maintaining market relevance and brand reputation in the face of increasing climate action.

The availability and responsible sourcing of raw materials, especially wood fiber for paperboard, are key environmental considerations for Elopak. The company commits to sourcing 100% of its virgin fiber from responsibly managed forests, verified by certifications like FSC, SFI, or PEFC. This approach directly combats concerns regarding deforestation and actively supports sustainable forestry practices.

By ensuring their paperboard comes from certified renewable sources, Elopak secures a long-term, sustainable supply chain for its packaging solutions. This focus on certified sourcing helps mitigate the risks associated with resource depletion, a growing environmental challenge in the packaging industry.

The effectiveness of waste management and recycling infrastructure is crucial for Elopak's commitment to a circular economy, as paper-based cartons are recyclable. However, the availability and efficiency of collection and processing facilities for composite cartons present a challenge, varying significantly across different regions.

In 2024, for example, the European Union's recycling rates for packaging waste showed considerable disparity. While some nations achieved over 70% recycling, others struggled to surpass 40%, directly impacting the potential for Elopak's carton recovery and reuse.

Elopak actively engages in initiatives to enhance these systems, aiming to foster a more genuine circular economy by increasing carton collection and improving recycling technologies. Their investments in this area are key to realizing the full sustainability potential of their product packaging.

Plastic Pollution Crisis

The escalating global plastic pollution crisis is a powerful catalyst for change, pushing industries and consumers alike toward more environmentally sound packaging solutions. This environmental pressure directly fuels a significant market shift away from traditional plastic bottles and containers, creating a fertile ground for alternatives like paper-based cartons.

Elopak's business model is intrinsically aligned with addressing this challenge. By offering natural, renewable paper-based cartons as a direct substitute for plastic, the company is strategically positioned to capitalize on the growing demand for sustainable packaging. This trend, often termed 'paperization,' is a tangible response to widespread environmental concerns and increasing regulatory mandates aimed at curbing plastic waste.

The urgency of the plastic pollution issue is underscored by alarming statistics. For instance, it's estimated that by 2050, there could be more plastic by weight than fish in the oceans. This stark reality is driving innovation and investment in materials like those Elopak utilizes.

- Growing Consumer Demand: Surveys in 2024 indicated that over 70% of consumers globally are willing to pay more for products with sustainable packaging.

- Regulatory Push: By the end of 2025, over 100 countries are expected to have implemented or be in the process of implementing bans or significant restrictions on single-use plastics.

- Elopak's Market Position: Elopak reported that its paperboard cartons are made from sustainably sourced wood fibers, with a significant portion of its packaging being renewable and recyclable, aligning with circular economy principles.

Biodiversity Loss and Ecosystem Protection

Elopak's operations, particularly its use of forestry raw materials for packaging, directly link its business to biodiversity and ecosystem health. The company recognizes its dependence on these natural resources, making responsible forest management a critical aspect of its sustainability strategy. For instance, Elopak's 2023 sustainability report details initiatives aimed at promoting biodiversity in its supply chain, underscoring a commitment to minimizing negative environmental impacts beyond just carbon emissions.

The company's approach involves sourcing materials from sustainably managed forests, which is crucial for maintaining healthy ecosystems and preventing biodiversity loss. This includes adhering to certifications like the Forest Stewardship Council (FSC) or Programme for the Endorsement of Forest Certification (PEFC), ensuring that timber harvesting does not lead to deforestation or habitat destruction. In 2024, Elopak continued to emphasize its commitment to these standards, aiming for 100% responsibly sourced fiber.

Furthermore, Elopak is exploring innovative packaging solutions that reduce reliance on virgin forest resources or utilize recycled content, thereby lessening the direct pressure on natural ecosystems. Their focus on circular economy principles also plays a role in protecting biodiversity by minimizing waste and the need for new resource extraction. By 2025, the company aims to increase the use of post-consumer recycled materials in its carton production.

The global decline in biodiversity is a significant environmental factor influencing all industries, including packaging. Elopak's proactive stance on ecosystem protection and biodiversity promotion is therefore not only an ethical imperative but also a strategic move to ensure the long-term availability and sustainability of its core raw materials. The increasing focus from consumers and regulators on environmental impact means that companies like Elopak must demonstrate tangible progress in these areas to maintain social license to operate and market competitiveness.

Elopak's commitment to reducing its environmental footprint is demonstrated by its target to cut direct CO2e emissions by 42% by 2030, against a 2020 baseline, with a net-zero goal by 2050. The company prioritizes sourcing 100% of its virgin fiber from responsibly managed forests, verified by certifications like FSC or PEFC, to combat deforestation and support sustainable forestry.

The escalating plastic pollution crisis is a significant driver for Elopak, as it offers paper-based cartons as a sustainable alternative to plastic. By 2025, over 100 countries are expected to have restrictions on single-use plastics, further boosting demand for Elopak's offerings, which are made from renewable and recyclable wood fibers.

Elopak actively addresses the challenge of carton recyclability by investing in initiatives to improve collection and recycling technologies, recognizing that regional recycling infrastructure varies significantly. For instance, in 2024, EU recycling rates for packaging showed disparities, with some nations recycling over 70% while others were below 40%.

The company's sustainability strategy includes promoting biodiversity within its supply chain, as evidenced by its 2023 report, and aims to increase the use of post-consumer recycled materials in its carton production by 2025, thereby reducing pressure on natural ecosystems.

| Environmental Factor | Elopak's Response/Data | Impact on Elopak |

| Climate Change & Emissions | Target: 42% CO2e reduction by 2030 (vs. 2020); Net-zero by 2050. | Aligns with global climate goals, enhances brand reputation, meets consumer demand for low-carbon products. |

| Sustainable Sourcing | 100% virgin fiber from certified forests (FSC, PEFC). | Ensures long-term raw material availability, mitigates resource depletion risks, supports responsible forestry. |

| Plastic Pollution | Offers paper-based cartons as plastic alternatives. | Capitalizes on market shift away from plastics, meets regulatory pressures on single-use plastics. |

| Circular Economy & Recycling | Invests in improving collection and recycling infrastructure. | Addresses regional disparities in recycling rates (e.g., EU 2024 variations), enhances product lifecycle sustainability. |

| Biodiversity & Ecosystems | Promotes biodiversity in supply chain; aims for increased post-consumer recycled content by 2025. | Protects raw material sources, demonstrates commitment to environmental stewardship, enhances social license to operate. |

PESTLE Analysis Data Sources

Our Elopak PESTLE Analysis draws from official industry publications, market research reports, and global economic databases to provide a comprehensive view. We integrate data on packaging regulations, raw material costs, consumer sustainability trends, and technological advancements in the beverage carton sector.