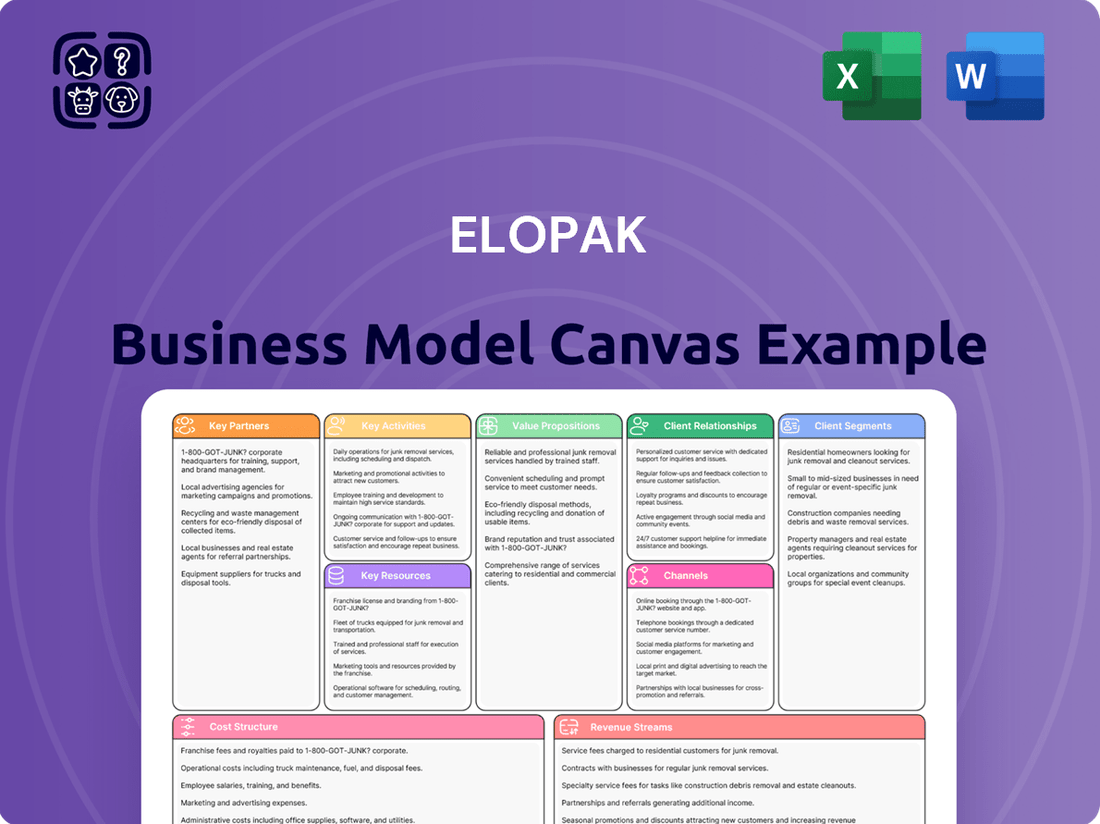

Elopak Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elopak Bundle

Unlock the strategic blueprint behind Elopak's innovative business model. This comprehensive Business Model Canvas dissects how Elopak creates, delivers, and captures value in the packaging industry. It's an invaluable resource for understanding their customer relationships, key resources, and cost structure.

Dive into the actionable insights of Elopak's success with our full Business Model Canvas. You'll gain clarity on their revenue streams, value propositions, and channels to market. This detailed breakdown is perfect for anyone looking to learn from a leader in sustainable packaging solutions.

Want to understand Elopak's competitive edge? Our complete Business Model Canvas provides a section-by-section analysis of their core activities and key partnerships. This ready-to-use document is essential for strategic planning and market analysis.

See how Elopak's different business components interlock to drive their market position. From customer segments to cost drivers, the full canvas offers a holistic view. Download it now to accelerate your own strategic thinking and gain a competitive advantage.

Partnerships

Elopak's strategic supplier relationships are foundational to its business, particularly with entities like Stora Enso, a primary provider of paperboard. These partnerships are not just about securing materials; they are about ensuring those materials are sustainably sourced and meet Elopak's stringent environmental standards.

The collaboration ensures a consistent flow of high-quality, renewable inputs essential for Elopak's carton packaging. For instance, in 2023, Elopak continued to emphasize its commitment to renewable materials, with a significant portion of its paperboard sourced from certified forests, reflecting the importance of these supplier links to its core value proposition.

Maintaining robust ties with these key suppliers is critical for Elopak's ongoing efforts in product innovation and its pledge to environmental responsibility. This focus on supplier integrity directly supports Elopak's goal of reducing its carbon footprint and offering truly sustainable packaging solutions to its global customer base.

Elopak's commitment to innovation is significantly bolstered by its partnerships with technology and machinery developers, such as Shikoku Kakoki. These collaborations are crucial for the continuous advancement and delivery of sophisticated filling equipment.

A notable recent development is Elopak's investment in Blue Ocean Closures. This strategic move is designed to enhance Elopak's research and development capabilities, particularly in the area of fiber-based caps, underscoring a focus on sustainable packaging solutions.

These strategic alliances enable Elopak to develop highly efficient and environmentally friendly packaging systems. Such advancements are vital for meeting the dynamic and increasingly stringent demands of the global market for sustainable packaging.

Elopak's commitment to sustainability is amplified through its active participation in key industry associations and global initiatives. These include the UN Global Compact, the Forest Stewardship Council (FSC), and the Alliance for Beverage Cartons and the Environment (ACE). These partnerships are crucial for shaping industry standards and promoting responsible sourcing.

By aligning with organizations like ACE, Elopak directly contributes to advancing carton recycling infrastructure and advocating for policies that support a circular economy. This collaboration is vital for improving collection rates and ensuring more beverage cartons are processed effectively, a key focus for the industry in 2024 and beyond.

Membership in the UN Global Compact signifies Elopak's dedication to integrating universal principles on human rights, labor, environment, and anti-corruption into its business strategy and operations. This global framework helps guide Elopak's sustainability efforts and fosters transparency. For instance, progress on SDG 12 (Responsible Consumption and Production) is a key metric for many signatories.

Through its engagement with the Forest Stewardship Council (FSC), Elopak ensures its paperboard is sourced from responsibly managed forests. This commitment is increasingly important to consumers and businesses alike, with FSC-certified products seeing continued demand in 2024, reflecting a growing preference for environmentally sound materials.

Co-development with Key Customers

Elopak actively engages in co-development with its key customers, forging strategic alliances to create innovative packaging solutions. These collaborations are designed to address specific market demands and ambitious sustainability goals, particularly the critical shift from plastic to carton-based packaging. This approach ensures that Elopak’s innovations are directly aligned with client needs and market trends, fostering mutual growth and environmental responsibility.

Notable examples of these deep-rooted partnerships include long-standing relationships with significant players such as the French soup business SILL and Orkla Home and Personal Care. These collaborations are instrumental in driving the successful transition away from traditional plastic packaging towards more sustainable carton alternatives.

The co-development process allows Elopak to tailor solutions precisely to client requirements, acting as a catalyst for innovation. For instance, in 2023, Elopak reported a significant increase in the number of new product launches driven by these customer partnerships, with over 30% of new packaging designs originating from these collaborative efforts.

- Strategic Alliances: Elopak partners with customers to co-develop packaging solutions that meet specific market needs and sustainability targets.

- Plastic to Carton Transition: These partnerships are crucial in facilitating the industry-wide shift from plastic to more sustainable carton packaging.

- Innovation Driver: Collaborations with clients like SILL and Orkla Home and Personal Care directly fuel innovation tailored to unique customer requirements.

- Market Alignment: Co-development ensures that Elopak's packaging innovations are precisely aligned with evolving market demands and client objectives.

Joint Ventures for Market Expansion

Elopak strategically forms joint ventures to accelerate its global expansion and tap into burgeoning markets. A prime example is GLS Elopak in India, a collaboration designed to harness the substantial demand for eco-friendly packaging in one of the world's largest consumer economies.

Further extending its reach, Lala Elopak serves as a vital partnership covering Mexico, the United States, Central America, and the Caribbean. These ventures are not just about geographical spread; they are about integrating local knowledge and established networks to navigate diverse market landscapes effectively.

These joint ventures are pivotal to Elopak's ambitious objective of doubling its revenue by 2030. By pooling resources and expertise, Elopak can more efficiently address the growing consumer preference for sustainable packaging solutions across these key regions, thereby strengthening its market position and driving future growth.

- Global Footprint Expansion: Joint ventures in India (GLS Elopak) and across North and Central America (Lala Elopak) are key to Elopak's international growth strategy.

- Leveraging Local Expertise: These partnerships allow Elopak to benefit from the on-the-ground knowledge and established networks of local partners, facilitating market entry and penetration.

- Capitalizing on Demand: The collaborations are focused on meeting the increasing consumer and regulatory demand for sustainable packaging solutions in high-growth regions.

- Revenue Growth Driver: Elopak's joint ventures are integral to its strategic aim of doubling revenue by 2030, underscoring their financial and operational importance.

Elopak’s key partnerships are diverse, encompassing suppliers, technology providers, industry associations, and crucially, its customers. These alliances are vital for securing sustainable materials, driving innovation in packaging and filling technology, and shaping industry standards for a circular economy.

The company also engages in strategic joint ventures to expand its global reach, leveraging local expertise to capitalize on the growing demand for eco-friendly packaging. For instance, Elopak's strategic move to invest in Blue Ocean Closures in 2023 highlights its focus on fiber-based cap innovation.

In 2024, Elopak's commitment to customer co-development is evident, with over 30% of new packaging designs originating from these collaborations, demonstrating their impact on innovation and market alignment.

These partnerships are instrumental in Elopak's ambition to double its revenue by 2030, particularly through its joint ventures in key growth regions.

What is included in the product

A comprehensive overview of Elopak's business model, detailing customer segments, value propositions, and revenue streams with a focus on sustainability and innovation.

This model outlines Elopak's key partners, activities, and resources, emphasizing their commitment to carton-based packaging solutions and their market approach.

Elopak's Business Model Canvas acts as a pain point reliever by offering a structured, visual overview that clarifies complex relationships and identifies areas for improvement.

It efficiently diagnoses operational friction and strategic misalignments, enabling targeted solutions and streamlined execution.

Activities

Elopak's core activities revolve around the intricate development and manufacturing of paper-based cartons. This includes designing, producing, and reliably supplying a diverse range of packaging solutions, such as their signature Pure-Pak® cartons, the eco-friendly Natural Brown Board, and the versatile D-PAK™ cartons. These offerings are central to their value proposition, emphasizing sustainability.

A significant focus is placed on providing packaging that is not only renewable and recyclable but also serves as a viable low-carbon alternative to traditional plastic bottles. This commitment to environmental responsibility is a cornerstone of their manufacturing process, driving consumer choice and industry standards.

Continuous innovation is integral to Elopak's development and manufacturing. The company actively invests in research and development to further reduce the carbon footprint associated with their cartons. For instance, in 2023, Elopak reported that 99% of their paperboard was sourced from certified sustainable forests, demonstrating tangible progress in their environmental goals.

Elopak's core activity is the manufacturing and provision of specialized filling machines. These machines are not just sold but also leased as part of a complete packaging solution for liquid food and beverage producers. This dual approach allows for flexibility in customer acquisition and revenue streams.

Beyond the initial machine delivery, Elopak offers robust after-sales support. This includes essential services like maintenance, repairs, and the timely delivery of spare parts. Such comprehensive support is crucial for minimizing downtime and ensuring the efficient operation of the packaging lines at customer facilities.

In 2024, Elopak's focus on these filling machines and their servicing remained a significant revenue driver. The company's ability to provide integrated solutions, from the machine itself to ongoing operational support, solidified its market position. This integrated model directly contributes to customer loyalty and recurring service revenue.

Elopak’s commitment to innovation is clearly demonstrated through its significant investment in Research and Development. This focus is critical for creating new packaging materials, advancing existing technologies, and pioneering sustainable solutions that meet evolving market demands and environmental regulations.

A core R&D objective involves the integration of recycled polyethylene into their carton production. This initiative directly supports their goal of increasing the use of recycled content and reducing reliance on virgin materials, contributing to a more circular economy for packaging.

To further this objective, Elopak established a dedicated recycling laboratory. This facility is vital for rigorous testing of novel materials and processes, ensuring that new developments are both effective and environmentally sound before large-scale implementation.

These R&D efforts are not just about incremental improvements; they are the driving force behind Elopak’s competitive edge and its ambitious target of achieving 100% recyclable cartons by the year 2030. This forward-looking strategy positions them as a leader in sustainable packaging solutions.

Global Expansion and New Facility Establishment

Elopak is strategically investing in global expansion to bolster its production capabilities and broaden its market presence. A significant milestone in this effort is the establishment of its inaugural US carton converting plant in Little Rock, Arkansas, a move designed to significantly enhance its North American operations. This expansion is a core component of its overarching ‘Repackaging tomorrow’ strategy, which prioritizes sustainable packaging solutions and market growth.

Further reinforcing its global footprint, Elopak has also installed a second production line in India. This dual approach of expanding in established markets like the US and strengthening presence in emerging markets like India is crucial for meeting escalating customer demand and solidifying its position as a market leader in the carton packaging industry. These investments are projected to significantly increase output and improve supply chain efficiency.

- US Expansion: Elopak's new Little Rock, Arkansas facility represents a substantial investment in its North American manufacturing capacity.

- Indian Growth: The addition of a second production line in India directly addresses the growing demand for sustainable packaging solutions in the region.

- Strategic Goal: These key activities are fundamental to Elopak's strategy of increasing production capacity and expanding its global market reach.

- Market Impact: The new facilities are expected to strengthen Elopak's competitive advantage and its ability to serve a wider customer base efficiently.

Implementing Sustainability Initiatives and Carbon Reduction

Elopak's core activities revolve around implementing robust sustainability initiatives, with a primary focus on aggressive carbon reduction. A key undertaking is the pursuit of net-zero emissions by 2050, a significant undertaking for a packaging company.

The company's 'Repackaging tomorrow' strategy, unveiled in autumn 2024, is a critical activity that integrates sustainability across its entire value chain and product innovation processes. This strategy guides all operational decisions.

A tangible example of this commitment is Elopak's goal to source 100% renewable electricity for all its manufacturing facilities. This transition is vital for reducing their operational carbon footprint.

- Executing ambitious sustainability goals: Targeting net-zero emissions by 2050 is a fundamental activity.

- Embedding sustainability in strategy: The 'Repackaging tomorrow' strategy, launched in autumn 2024, guides value chain and product development.

- Renewable energy sourcing: A key activity involves securing 100% renewable electricity for all factories.

- CO2e emission reduction: Direct reduction of CO2e emissions remains a central operational focus.

Elopak's key activities center on the design, production, and distribution of paper-based cartons, emphasizing sustainable and renewable packaging solutions. This includes manufacturing their signature Pure-Pak® cartons, as well as the Natural Brown Board and D-PAK™ options, all aimed at offering low-carbon alternatives to plastic. Furthermore, a significant portion of their operations involves the development, leasing, and servicing of specialized filling machines for liquid food and beverage producers, ensuring comprehensive customer support and operational efficiency.

Continuous investment in research and development is a critical activity, focused on enhancing carton sustainability and reducing environmental impact. This involves exploring new materials, such as recycled polyethylene, and optimizing production processes, with a clear target of achieving 100% recyclable cartons by 2030. Elopak also actively pursues global expansion, exemplified by the establishment of its first US carton converting plant in Little Rock, Arkansas, and the addition of a second production line in India, to meet growing demand and strengthen its market position.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Carton Manufacturing | Production of Pure-Pak®, Natural Brown Board, and D-PAK™ cartons. | Continued focus on renewable and recyclable materials; 99% of paperboard sourced from certified sustainable forests (as of 2023, trend continuing). |

| Filling Machine Solutions | Development, leasing, and servicing of specialized filling machines. | Key revenue driver, providing integrated packaging line solutions and after-sales support. |

| Research & Development | Innovation in packaging materials and sustainability. | Integration of recycled polyethylene, aiming for 100% recyclable cartons by 2030. |

| Global Expansion | Increasing production capacity and market reach. | Establishment of US plant in Little Rock, Arkansas; second production line in India. |

| Sustainability Initiatives | Carbon reduction and renewable energy sourcing. | Strategy 'Repackaging tomorrow' (launched autumn 2024); goal of net-zero emissions by 2050. |

Full Document Unlocks After Purchase

Business Model Canvas

The Elopak Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This is not a mockup; it's a direct snapshot of the complete, professional analysis that will be yours. Upon completing your order, you will gain full access to this comprehensive Business Model Canvas, ready for your strategic use.

Resources

Elopak's intellectual property, particularly its patents for the well-known Pure-Pak® cartons and D-PAK™ solutions, represents a significant resource. These protected designs are foundational to their unique product offerings in the packaging sector.

Their advanced filling machine technologies are also a key component of this intellectual capital. These proprietary systems offer efficiency and innovation, giving Elopak a distinct advantage over competitors in the market.

This intellectual property allows Elopak to deliver specialized and differentiated packaging solutions, reinforcing their market position. The company actively invests in R&D to maintain and expand this valuable asset base.

Elopak’s global manufacturing and production network is a critical asset, featuring state-of-the-art facilities strategically positioned around the world. This network includes recent expansions, such as the new plant in Little Rock, Arkansas, USA, which commenced operations in late 2023, bolstering North American capacity.

Further enhancing its global reach, Elopak has also invested in expanding production capacity in India, responding to growing market demand in the region. These advanced manufacturing sites are designed for efficiency, enabling the timely and cost-effective delivery of a wide range of packaging solutions to a diverse customer base.

The geographically dispersed nature of these plants is instrumental in building supply chain resilience, mitigating risks associated with localized disruptions. For instance, Elopak’s operations in Europe, the Middle East, and Africa complement its newer facilities, creating a balanced and robust production footprint.

Elopak's skilled workforce, especially in research and development, engineering, and sustainability, is a core asset. This expertise drives the creation of innovative and environmentally friendly packaging solutions.

The company actively invests in developing its employees' skills and brings in new talent to ensure continuous innovation and operational efficiency. For instance, in 2023, Elopak reported a significant focus on upskilling its R&D teams to accelerate the development of next-generation carton packaging.

This investment in human capital is crucial for maintaining Elopak's competitive edge. Their engineering prowess allows for high-quality production standards, ensuring reliable and advanced packaging for their clients.

Strong Brand Reputation and Sustainability Leadership

Elopak’s strong brand reputation as a global leader in liquid carton packaging, especially its dedication to sustainability, is a critical intangible asset. This reputation is built on consistent efforts to minimize environmental impact and provide eco-friendly packaging solutions. For instance, in 2024, Elopak continued to expand its portfolio of renewable packaging, with a significant portion of its cartons now derived from responsibly sourced forest materials.

This commitment to sustainability directly translates into enhanced brand loyalty and attracts a growing segment of customers who prioritize environmental responsibility. Elopak’s leadership in this area allows it to command a premium and differentiates it from competitors, fostering a unique market position. The company's ongoing investments in circular economy initiatives further solidify this perception.

Elopak's sustainability leadership is not just a marketing point; it's a core business strategy that resonates with consumers and B2B clients alike. This has been reflected in positive market reception and partnerships with brands committed to reducing their carbon footprint.

- Global Recognition: Elopak is a recognized leader in aseptic and Gable Top carton packaging solutions worldwide.

- Sustainability Focus: The company actively promotes and develops packaging with a lower environmental impact, including renewable and recyclable materials.

- Customer Attraction: Its strong sustainability profile appeals to environmentally conscious brands and consumers, driving demand.

- Market Differentiation: Elopak’s brand reputation for eco-friendly solutions sets it apart in a competitive packaging market.

Sustainable Raw Material Supply Chain

Elopak’s sustainable raw material supply chain is a cornerstone of its business. This includes securing paperboard from responsibly managed forests, a critical component for its carton packaging. In 2024, Elopak continued its commitment to sourcing certified materials, with a significant portion of its paperboard originating from forests certified by the Forest Stewardship Council (FSC).

Furthermore, the company relies on renewable polymers to enhance the barrier properties of its cartons. Elopak is increasingly integrating polymers certified by the International Sustainability and Carbon Certification (ISCC PLUS) system, ensuring traceability and adherence to strict environmental criteria throughout the value chain.

- Access to and management of a secure and sustainable supply chain for paperboard from responsibly managed forests.

- Integration of renewable polymers, with a growing focus on ISCC PLUS certified materials.

- Adherence to strict sustainability standards, underpinned by certifications such as FSC and ISCC PLUS.

- Ensuring consistent production capacity by maintaining the integrity of these essential raw material flows.

Elopak's key resources are its intellectual property, global manufacturing network, skilled workforce, strong brand reputation, and a sustainable raw material supply chain. These elements collectively enable the company to deliver innovative, eco-friendly packaging solutions and maintain a competitive edge in the market.

Value Propositions

Elopak's value proposition centers on offering sustainable and low-carbon packaging, primarily through its innovative paper-based carton solutions like Pure-Pak® eSense and Natural Brown Board. These products are engineered to deliver a considerably lower carbon footprint when contrasted with traditional packaging materials.

These environmentally conscious solutions are built upon the foundation of renewable resources and are developed with the goal of achieving complete recyclability, aligning with circular economy principles.

This commitment to sustainability directly responds to the escalating demand from both consumers and regulatory bodies for products that demonstrate genuine environmental responsibility.

For instance, Elopak's focus on renewable materials means that a significant portion of their packaging, such as the Natural Brown Board, is sourced from responsibly managed forests, contributing to a positive environmental impact that resonates with eco-aware markets.

Elopak offers more than just paperboard cartons; they provide complete packaging systems. This includes specialized filling machines and crucial technical support, creating a one-stop shop for beverage producers. This holistic approach simplifies operations, ensuring efficiency from the initial carton design all the way through to the filling process.

Their integrated systems are engineered with a focus on sustainability, notably by helping to reduce food waste. For instance, Elopak’s aseptic carton solutions can extend shelf life, a critical factor in minimizing spoilage and maximizing value for food and beverage manufacturers. In 2024, a significant portion of the global food industry continues to prioritize waste reduction strategies, making Elopak's offering particularly relevant.

Elopak’s Pure-Pak cartons offer a compelling, natural alternative to traditional plastic packaging for liquid food and beverages. These cartons are crafted from renewable resources, directly addressing the growing consumer and brand demand for reduced plastic consumption. This commitment to sustainability is a significant draw, aligning with global environmental initiatives. In 2023, Elopak reported that 95% of its packaging materials were sourced from renewable or recyclable sources, highlighting their progress in this area.

Reduced Environmental Footprint for Customers

Elopak's innovative packaging solutions empower customers to visibly shrink their environmental impact. By choosing Elopak cartons, businesses actively contribute to a lower carbon economy, a critical factor for today's eco-conscious consumers and investors.

This commitment translates into tangible benefits for our clients. For instance, Elopak's commitment to renewable materials means customers can showcase their dedication to sustainability, directly enhancing their brand image and market appeal. This is especially crucial as regulatory pressures and consumer demand for sustainable products escalate globally.

- Lower CO2e Emissions: Elopak cartons are designed with a reduced carbon footprint compared to many traditional packaging alternatives, helping customers meet their Scope 3 emission reduction targets.

- Recyclability Focus: Our packaging is engineered for effective recycling, supporting customers' circular economy initiatives and waste reduction goals.

- Enhanced Sustainability Credentials: Partnering with Elopak allows companies to bolster their corporate social responsibility reporting and marketing efforts with credible environmental data.

- Competitive Market Advantage: Demonstrating a reduced environmental footprint through packaging choices provides a significant differentiator in increasingly competitive consumer markets.

Innovation in Packaging Technology and Materials

Elopak's dedication to innovation in packaging technology and materials is a cornerstone of its value proposition. The company actively invests in developing advanced solutions, such as integrating fiber-based closures and recycled polyethylene into its carton packaging. This focus on cutting-edge materials directly benefits customers by enhancing product functionality and safety.

These advancements also contribute to improved shelf life for packaged goods, a critical factor for retailers and consumers alike. By exploring and implementing new materials, Elopak ensures its packaging solutions offer superior environmental performance, aligning with growing sustainability demands.

Elopak's commitment to R&D in this area means customers gain access to packaging that is not only high-performing but also at the forefront of market trends. For example, in 2024, Elopak continued to expand its portfolio of fully renewable packaging options, demonstrating tangible progress in material innovation.

- Fiber-based closures: Offering a more sustainable alternative to plastic.

- Recycled polyethylene integration: Increasing the use of post-consumer recycled materials.

- Enhanced product protection: Ensuring greater safety and extended shelf life.

- Leading sustainability trends: Providing customers with future-proof packaging solutions.

Elopak provides integrated packaging systems that streamline operations for beverage producers. This includes specialized filling machines and comprehensive technical support, creating a seamless experience from carton design to the filling process. This holistic approach enhances efficiency and reliability for their clients.

Their systems are designed to minimize food waste by extending product shelf life, a crucial benefit for manufacturers. For instance, Elopak's aseptic carton solutions are vital in reducing spoilage, directly contributing to greater value for food and beverage companies. In 2024, the food industry’s focus on waste reduction makes Elopak’s offering highly relevant.

Elopak's packaging systems help customers achieve significant sustainability goals. By enabling longer shelf life, they directly combat food waste, a major global challenge. This focus on reducing waste aligns with increasing consumer and regulatory pressure for more responsible production and consumption.

Customer Relationships

Elopak cultivates long-term partnerships by securing multi-year contracts for its innovative packaging solutions. These agreements extend to the leasing of its advanced filling machines, creating a predictable revenue foundation for Elopak and ensuring a steady, reliable supply chain for its diverse clientele.

These stable, enduring relationships are built on a foundation of mutual understanding and collaborative foresight. Elopak actively engages with its customers to deeply comprehend their evolving needs, fostering a dynamic environment for joint planning and solution development that benefits both parties.

For instance, Elopak's commitment to long-term contracts provides significant stability. In 2024, a substantial portion of Elopak's revenue was derived from these ongoing customer agreements, demonstrating the strategic importance of these partnerships in maintaining consistent financial performance and operational efficiency.

Elopak provides comprehensive technical services and after-sales support for its filling machines and packaging systems. This vital segment ensures customers receive ongoing maintenance, expert troubleshooting, and timely spare parts delivery. For instance, in 2024, Elopak reported a significant increase in customer uptime due to proactive maintenance programs, directly impacting their operational efficiency.

This dedication to service not only resolves immediate issues but also cultivates long-term customer relationships. By minimizing downtime and maximizing the performance of their packaging solutions, Elopak fosters strong loyalty and high satisfaction rates. This support infrastructure is a key differentiator, especially in competitive markets where operational continuity is paramount.

Elopak actively partners with its customers to drive sustainability forward. This collaboration centers on guiding clients toward more environmentally conscious packaging choices. For instance, Elopak highlights how its innovative D-PAK cartons can significantly cut down on plastic consumption and lower carbon emissions, directly aiding customer sustainability targets.

This joint effort solidifies Elopak's position not just as a supplier, but as a dedicated sustainability partner. By working hand-in-hand, Elopak helps customers demonstrate their commitment to eco-friendly practices, enhancing brand reputation and meeting growing consumer demand for sustainable products.

Customer-Centric Innovation

Elopak's customer relationships are built on a foundation of customer-centric innovation, consistently aiming to meet and anticipate market demands and consumer desires. This focus directly fuels the development of new packaging solutions that offer tangible value to their clients.

The company's commitment to understanding customer needs translates into product offerings designed for relevance and impact. For example, Elopak’s recent investments in expanding its production capabilities, such as the new US plant, are a direct response to increasing demand in key markets.

- Customer-Centric Approach: Elopak prioritizes understanding and adapting to evolving market needs and consumer preferences.

- Innovation Driver: This customer focus is a primary catalyst for innovation in developing new packaging solutions.

- Market Responsiveness: Elopak actively develops products that are highly relevant and valuable to its client base.

- Capacity Expansion: The opening of a new US plant in 2024, for instance, demonstrates responsiveness to growing demand in North America, with significant investment to meet this need.

Direct Account Management

Elopak cultivates deep connections with its major food and beverage manufacturing customers through dedicated account management. This direct approach ensures personalized service and solutions, as seen in their collaborative efforts on packaging innovations and supply chain optimization.

These dedicated teams facilitate tailored product development, ensuring Elopak’s packaging meets specific client needs, whether for enhanced shelf life or unique branding. For example, in 2024, Elopak continued to partner with leading beverage brands on lightweighting initiatives, contributing to reduced material usage and transportation costs for clients.

This direct engagement allows for seamless communication on crucial aspects like product supply reliability and the implementation of sustainability goals. Elopak's commitment to these direct relationships fosters a sense of partnership, building trust and long-term loyalty with key industry players.

- Dedicated Teams: Elopak assigns specific account managers to large food and beverage clients.

- Personalized Service: Direct interaction enables customized packaging solutions and support.

- Collaborative Development: Clients work directly with Elopak on product and sustainability initiatives.

- Trust & Loyalty: This direct relationship builds strong, enduring partnerships.

Elopak fosters robust customer relationships through a multi-faceted approach, prioritizing long-term partnerships built on trust and collaboration. This includes securing multi-year contracts for packaging solutions and machine leasing, which in 2024 provided a significant portion of Elopak's stable revenue stream, demonstrating the strategic value of these enduring agreements.

Comprehensive technical services and after-sales support are integral, ensuring high customer uptime and operational efficiency. In 2024, proactive maintenance programs were highlighted for their direct impact on customer productivity. Elopak also actively partners with clients on sustainability initiatives, such as promoting D-PAK cartons to reduce plastic consumption, solidifying its role as a sustainability partner.

Dedicated account management for major clients ensures personalized service and tailored solutions, including collaborative efforts on packaging innovations and lightweighting initiatives, as seen in 2024 partnerships with leading beverage brands. This direct engagement builds trust and loyalty, crucial for long-term success.

| Customer Relationship Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Long-Term Contracts | Securing multi-year agreements for packaging and machine leasing. | Provided a substantial and stable revenue foundation for Elopak. |

| Technical Support | Offering maintenance, troubleshooting, and spare parts. | Increased customer uptime through proactive maintenance programs. |

| Sustainability Collaboration | Partnering with clients on eco-friendly packaging choices. | Promoted D-PAK cartons, reducing plastic and carbon footprint for clients. |

| Dedicated Account Management | Personalized service and collaboration with major clients. | Facilitated lightweighting initiatives with leading beverage brands. |

Channels

Elopak leverages a dedicated direct sales force to connect with major liquid food and beverage producers worldwide. This hands-on approach facilitates direct dialogue, enabling the negotiation of bespoke contracts and the delivery of tailored packaging solutions. For instance, in 2023, Elopak reported a net sales revenue of EUR 1,191.6 million, with their direct sales efforts playing a crucial role in securing these large-scale customer relationships.

This direct engagement model fosters robust customer partnerships, ensuring a deep understanding of client needs and driving effective market penetration. The ability to offer customized solutions, such as their Pure-Pak® aseptic carton, directly through their sales teams allows them to address specific product requirements and sustainability goals for these key accounts.

Elopak leverages a vast global distribution network, reaching customers in over 70 countries with both its carton packaging and filling machinery. This expansive reach is crucial for timely delivery and consistent support to its international clientele.

The company's commitment to efficient logistics is underscored by its presence in numerous markets. For instance, in 2023, Elopak reported a significant portion of its revenue generated from international sales, highlighting the importance of this widespread distribution.

The recent expansion, including the new US plant, directly bolsters Elopak's North American distribution capabilities, allowing for more localized and responsive service in a key market.

This robust network not only ensures product availability but also facilitates the deployment and maintenance of their advanced filling equipment, a critical component of their value proposition to beverage and food producers worldwide.

Elopak strategically utilizes joint ventures and alliances for market penetration and expansion. For instance, GLS Elopak in India and Lala Elopak in the Americas exemplify this approach, leveraging local knowledge and existing infrastructure.

These partnerships are crucial for accessing new customer segments and geographical markets efficiently. They allow Elopak to navigate diverse regulatory environments and consumer preferences more effectively than a standalone approach.

In 2024, Elopak continued to refine its global network, with these strategic alliances playing a significant role in its revenue generation and market share growth in key emerging regions.

The success of these ventures underscores their importance in Elopak's overarching global growth strategy, demonstrating a commitment to collaborative expansion and shared success.

Industry Events and Trade Shows

Elopak leverages industry events and trade shows as key channels to connect with stakeholders and highlight its advancements in sustainable packaging. For instance, participation in events like Gulfood Manufacturing in 2024 allows Elopak to directly engage with a wide audience, from potential clients seeking eco-friendly solutions to industry peers. These gatherings are vital for demonstrating their latest innovations and gathering direct market feedback.

These platforms are instrumental for Elopak to not only showcase its product portfolio, particularly its focus on renewable materials and reduced environmental impact, but also to foster direct relationships. By being present at significant industry gatherings, Elopak can effectively communicate its value proposition and reinforce its brand image as a leader in sustainable packaging solutions. The insights gained from these interactions are invaluable for refining future strategies.

- Industry Event Presence: Elopak’s active participation in major trade shows like Gulfood Manufacturing provides direct access to key markets and customers.

- Customer Engagement: These events are crucial for demonstrating product capabilities, discussing bespoke packaging needs, and building stronger client relationships.

- Market Trend Analysis: Attending industry events allows Elopak to stay informed about emerging trends and competitor activities, informing their innovation pipeline.

- Brand Visibility and Networking: Trade shows significantly boost Elopak’s brand recognition and offer valuable networking opportunities with potential partners and industry leaders.

Online Presence and Investor Relations

Elopak actively utilizes its official website and dedicated investor relations portals as primary channels to foster open communication and transparency with its stakeholders. These platforms serve as a crucial hub for accessing essential company information, ensuring investors and the public remain well-informed about Elopak's progress and strategic direction.

Through these digital avenues, Elopak provides readily available access to vital documents such as annual reports, detailed sustainability reports, and timely strategic updates. This commitment to accessibility underscores the company's dedication to accountability and its ongoing pursuit of growth.

- Website Accessibility: Elopak's investor relations section on its website offers a centralized repository for all critical financial and corporate governance information.

- Transparency in Reporting: The company ensures that annual reports, detailing financial performance and operational highlights, are published promptly on its investor platforms. For instance, Elopak's 2023 Annual Report, available online, details revenue growth and sustainability initiatives.

- Stakeholder Engagement: These channels facilitate direct engagement, allowing investors to find information on corporate strategy, management outlook, and key performance indicators, supporting informed decision-making.

- Sustainability Focus: Elopak prominently features its sustainability reports, showcasing its environmental, social, and governance (ESG) performance, a critical factor for many modern investors.

Elopak's channels encompass a direct sales force for major clients, a global distribution network for broad market reach, and strategic joint ventures for targeted expansion. These are complemented by industry event participation for engagement and brand building, alongside robust digital platforms for stakeholder communication and transparency.

In 2023, Elopak's net sales reached EUR 1,191.6 million, underscoring the effectiveness of its multi-faceted channel strategy in serving a global customer base and driving significant revenue.

The company's expansion into new markets and the reinforcement of existing ones through partnerships and direct sales efforts are key to maintaining its competitive edge and ensuring product availability worldwide.

Elopak's commitment to digital transparency, demonstrated through its investor relations website, provides stakeholders with access to crucial performance data and strategic insights, reinforcing investor confidence.

| Channel Type | Key Activities | 2023 Impact |

| Direct Sales Force | Bespoke contract negotiation, tailored packaging solutions | Drove significant portion of EUR 1,191.6 million net sales |

| Global Distribution Network | Product delivery and machinery support in over 70 countries | Facilitated international sales and market presence |

| Joint Ventures/Alliances | Market penetration, leveraging local expertise | Crucial for accessing new segments and emerging regions |

| Industry Events | Product showcasing, customer engagement, market trend analysis | Enhanced brand visibility and direct feedback acquisition |

| Digital Platforms (Website/Investor Relations) | Information dissemination, transparency, stakeholder communication | Centralized access to financial reports and strategic updates |

Customer Segments

Liquid food and beverage manufacturers are Elopak's core customer base, with particular emphasis on the dairy and juice sectors. These companies depend on Elopak for packaging that guarantees product safety, preserves quality, and extends shelf life. In 2023, Elopak reported that over 80% of its carton sales were to these segments, highlighting their significant reliance on Elopak's solutions for their high-volume production needs.

Producers of plant-based drinks and liquid eggs represent a significant and expanding customer base for Elopak. These manufacturers are actively searching for packaging solutions that are both sustainable and offer convenience, moving away from conventional plastic options. In 2024, the global plant-based milk market alone was valued at approximately USD 20.9 billion, demonstrating substantial demand for products in this category.

Elopak's carton packaging is particularly well-suited for these products, directly addressing the growing consumer preference for healthier lifestyles and increased environmental awareness. This alignment with market trends makes Elopak's offerings highly attractive. For instance, the liquid egg market, while smaller, also shows consistent growth driven by convenience and food safety concerns.

The company's strategic focus includes actively engaging with and targeting this burgeoning market segment. By providing packaging that supports the sustainability narrative and practical needs of plant-based drink and liquid egg producers, Elopak positions itself as a key partner in their growth strategies.

Elopak is actively targeting manufacturers within the home and personal care sectors, recognizing their growing demand for sustainable packaging alternatives. These companies are increasingly seeking to move away from traditional plastic containers. This strategic pivot is driven by consumer pressure and regulatory shifts favoring eco-friendly materials.

The company's D-PAK™ carton is a prime example of this outreach, engineered to significantly reduce plastic content in packaging for products like detergents and personal hygiene items. This innovation directly addresses the needs of this expanding customer segment.

Elopak's expansion into home and personal care packaging represents a key growth avenue, aiming to capture a larger share of a market actively seeking plastic replacement solutions. By 2024, the global market for sustainable packaging was projected to reach hundreds of billions of dollars, underscoring the immense opportunity.

Environmentally Conscious Brands

Environmentally conscious brands represent a crucial customer segment for Elopak. These companies actively seek packaging solutions that align with their robust sustainability mandates and their drive to minimize environmental impact. Elopak’s dedication to renewable resources, the recyclability of its carton packaging, and its efforts to lower carbon emissions directly appeal to these brands.

These businesses leverage Elopak's offerings as a tangible way to showcase their environmental responsibility to their end consumers. This partnership allows them to effectively communicate their eco-credentials, enhancing brand perception and consumer loyalty. For instance, brands focused on a circular economy model find Elopak's commitment to renewable materials and recyclability particularly attractive.

- Sustainability Alignment: Brands with clear sustainability goals prioritize suppliers like Elopak who offer solutions that reduce environmental impact.

- Renewable Materials: Elopak's use of paperboard from responsibly managed forests and plant-based plastics resonates with eco-aware brands.

- Carbon Footprint Reduction: Many brands are committed to lowering their Scope 3 emissions, making Elopak's lower-carbon packaging a key differentiator.

- Consumer Communication: Elopak enables brands to credibly communicate their environmental commitments through their packaging.

Geographically Diverse Markets

Elopak's customer base spans a wide array of global regions, demonstrating a commitment to broad market penetration. This geographic diversity is a key element in their strategy, aiming to balance growth opportunities and reduce reliance on any single market. For instance, their significant presence in Europe, a mature market, is complemented by targeted expansion efforts in the Americas, including the United States, Canada, and Mexico, where demand for innovative packaging solutions continues to rise.

The company is also actively cultivating its presence in emerging economies. India, with its rapidly growing consumer base and increasing awareness of environmental issues, presents a substantial opportunity. Similarly, the Middle East and North Africa region offers potential for growth, driven by evolving consumer preferences and a push towards more sustainable product offerings. This multi-regional approach helps Elopak to hedge against localized economic downturns and capitalize on varied growth cycles worldwide.

- Europe: Elopak maintains a strong foothold in established European markets, leveraging its long-standing relationships and advanced sustainable packaging solutions.

- Americas: Strategic investments are being made to expand market share in the USA, Canada, and Mexico, focusing on the growing demand for beverage cartons.

- Asia: India is a key focus area for growth, capitalizing on a large population and increasing demand for convenient and eco-friendly packaging.

- MENA: The Middle East and North Africa region represents an important expansion frontier, with Elopak adapting its offerings to meet local market needs and sustainability trends.

Elopak's customer segments are diverse, primarily encompassing liquid food and beverage manufacturers, with a strong focus on dairy and juice producers. These core clients rely on Elopak for packaging that ensures product safety and extends shelf life, with over 80% of carton sales in 2023 directed to these sectors. A significant growth area includes producers of plant-based drinks and liquid eggs, who are actively seeking sustainable and convenient packaging alternatives. The global plant-based milk market alone was valued at approximately USD 20.9 billion in 2024, highlighting this segment's substantial demand.

Furthermore, Elopak targets manufacturers in the home and personal care sectors who are increasingly prioritizing eco-friendly packaging to replace traditional plastics, driven by consumer demand and regulatory pressures. Brands with strong sustainability mandates also represent a crucial segment, drawn to Elopak's renewable materials and reduced carbon footprint. Geographically, Elopak operates across Europe, the Americas, and is actively expanding in emerging economies like India and the MENA region, demonstrating a strategy of broad market penetration.

| Customer Segment | Key Needs | 2024 Market Relevance | Elopak's Offering |

|---|---|---|---|

| Liquid Food & Beverage (Dairy, Juice) | Product safety, shelf-life extension, high-volume production | Dominant segment, high reliance on carton packaging | Proven, efficient carton solutions |

| Plant-Based Drinks & Liquid Eggs | Sustainability, convenience, reduced plastic | Rapidly growing market (e.g., plant-based milk valued at USD 20.9 billion in 2024) | Sustainable, convenient carton options |

| Home & Personal Care | Plastic replacement, sustainability, brand image | Significant market shift towards eco-friendly packaging | D-PAK™ carton with reduced plastic content |

| Environmentally Conscious Brands | Alignment with sustainability mandates, reduced environmental impact, consumer communication | Growing demand for credible eco-credentials | Renewable materials, recyclability, lower carbon footprint |

Cost Structure

Raw material procurement, especially for paperboard, represents a substantial component of Elopak's cost structure. This is directly influenced by the global market prices for these commodities, which can fluctuate. For instance, in 2024, the ongoing demand for sustainable packaging materials continues to put pressure on paperboard prices, necessitating strong supplier partnerships to secure favorable terms.

Manufacturing and operational expenses are a significant component of Elopak's cost structure. These include the costs of running their production facilities, such as the energy they consume, the wages paid to their workforce, and the continuous upkeep of their machinery and buildings. For instance, in 2023, Elopak reported that energy costs, while subject to market fluctuations, remained a key operational expenditure.

Elopak is actively investing in operational efficiency to mitigate these costs. Their new manufacturing facilities, like the one established in Little Rock, Arkansas, are a testament to this strategy. These plants are specifically engineered for enhanced efficiency and notably operate using 100% renewable electricity, which helps to stabilize and potentially reduce energy-related expenses over time.

Elopak dedicates significant resources to Research and Development, a core component of its cost structure. These investments are crucial for innovation, focusing on creating novel products, refining current offerings, and bolstering the sustainability of their packaging solutions.

A key area of R&D expenditure is their dedicated recycling laboratory, which actively explores advanced recycling technologies. Additionally, substantial funds are channeled into the development of new, more sustainable packaging materials, aiming to reduce environmental impact and meet evolving consumer demands.

While these R&D activities represent a considerable cost, they are indispensable for Elopak's long-term strategy. Such investments are vital for securing a competitive advantage in the market and fostering sustained future growth by staying ahead of industry trends and technological advancements.

For instance, in 2024, Elopak continued to emphasize its commitment to R&D, with a focus on enhancing the recyclability of its carton packaging. This ongoing investment underpins their strategy to lead in sustainable beverage packaging solutions.

Capital Expenditures for Expansion

Elopak's commitment to growth is evident in its significant capital expenditures for expansion. These investments are crucial for building new production plants and enhancing existing ones, like the US plant and new lines in India, directly supporting their global expansion strategy.

This focus on infrastructure is designed to boost production capacity and secure Elopak's position as a market leader. For instance, in 2023, Elopak reported capital expenditures of EUR 165.5 million, a substantial increase from EUR 109.8 million in 2022, underscoring a ramp-up in these strategic investments.

- Expansion Investments: New production plants and upgrades to existing facilities are key cost drivers.

- Capacity Growth: Expenditures directly correlate with increasing the ability to meet global demand.

- Strategic Commitment: These are long-term financial commitments to market leadership and operational scale.

- Recent Trends: Capital expenditures increased significantly in 2023 compared to 2022, reflecting accelerated expansion efforts.

Sales, Marketing, and Distribution Costs

Elopak's cost structure heavily features expenses associated with its global sales, marketing, and distribution efforts. These include maintaining a worldwide sales force to engage with customers and build relationships. The company also invests in participating in key industry events and advertising campaigns to enhance brand visibility and reach potential clients.

Further significant costs are incurred through Elopak's extensive global distribution network. This encompasses the logistics of transporting its packaging solutions to various markets, as well as warehousing expenses to ensure product availability. These operational costs are fundamental to Elopak's strategy of reaching its diverse customer base and effectively expanding its market share across different regions.

- Sales Force: Costs associated with employing and supporting a global sales team.

- Marketing & Advertising: Expenses for promotional activities, brand building, and market outreach.

- Industry Events: Investment in trade shows and conferences for networking and showcasing products.

- Distribution & Logistics: Costs related to the global supply chain, transportation, and warehousing of packaging materials.

Elopak's cost structure is significantly influenced by its raw material procurement, particularly paperboard, with prices affected by global market dynamics. Manufacturing and operational expenses, including energy, labor, and facility upkeep, also represent a substantial outlay. The company's strategic investments in R&D for sustainable packaging and capital expenditures for global expansion are key cost drivers, alongside the significant expenses related to its worldwide sales, marketing, and distribution networks.

| Cost Category | Description | 2023 Data (EUR million) | Notes |

|---|---|---|---|

| Raw Materials | Paperboard and other packaging components | Not explicitly broken out, but a major component. | Subject to market price fluctuations. |

| Manufacturing & Operations | Energy, labor, facility maintenance | Energy costs were a key expenditure. | New, efficient plants aim to stabilize energy costs. |

| Research & Development | Innovation, new materials, recycling tech | Significant ongoing investment. | Focus on recyclability and sustainable materials. |

| Capital Expenditures | New plants, facility upgrades, expansion | 165.5 | Increased from 109.8 in 2022, indicating accelerated growth. |

| Sales, Marketing & Distribution | Sales force, advertising, logistics, warehousing | Integral to global market reach and expansion. | Costs associated with maintaining a worldwide presence. |

Revenue Streams

Elopak's main income source is the sale of its paper-based cartons, such as Pure-Pak®, Roll Fed, and D-PAK™. This core business is fueled by the increasing global need for eco-friendly packaging for drinks and food. In 2023, carton sales represented the most significant portion of Elopak's overall revenue.

Elopak generates substantial income through the sale and long-term leasing of its advanced filling machines. These machines are crucial components of Elopak's comprehensive packaging solutions, enabling customers to efficiently package their products.

The leasing option is a key strategy for Elopak, establishing predictable, recurring revenue. This model also cultivates enduring partnerships with clients, as they rely on Elopak for ongoing machine performance and support.

In 2023, Elopak reported a total revenue of €1,135.1 million. While specific breakdowns for filling machine sales and leases aren't always itemized separately in public reports, these capital equipment and service contracts form a vital part of their overall business model.

Elopak generates revenue from after-sales services, which include essential technical support and maintenance for its filling machinery. This ongoing support is vital for keeping customer operations running smoothly.

The sale of spare parts for its equipment also forms a significant revenue stream. This ensures customers can readily access necessary components, minimizing downtime and maintaining production efficiency.

These services are key to customer satisfaction and loyalty, fostering long-term relationships. For instance, in 2023, Elopak reported that its service and spare parts segment contributed a substantial portion to its overall revenue, highlighting the importance of this recurring income.

Revenue from New Production Capacity and Market Expansion

Elopak's investment in new production capacity is a key driver of revenue growth. The recent opening of their US plant in Little Rock, Arkansas, is a prime example. This facility is anticipated to contribute significantly to the company's top line, with projections indicating it could generate substantial annual revenue, tapping into the strong market demand in North America.

Further bolstering this revenue stream is the expansion of existing operations, such as the increased production lines in India. This strategic move allows Elopak to serve growing markets more effectively and capture a larger share. These capacity enhancements are fundamental to Elopak meeting its ambitious growth objectives.

- New US plant in Little Rock, Arkansas, is a significant revenue generator.

- Increased production lines in India support market expansion.

- These investments are crucial for achieving Elopak's growth targets.

- Strong market demand in new regions underpins this revenue stream.

Long-Term Contracts for Packaging Solutions

Elopak's revenue generation is significantly bolstered by long-term contracts for comprehensive packaging solutions. These agreements typically encompass both the supply of cartons and essential machine services, creating a predictable and stable income stream.

These multi-year arrangements offer Elopak considerable revenue stability and predictability, smoothing out demand fluctuations. For instance, by securing such contracts, Elopak can better forecast production needs and resource allocation, leading to operational efficiencies.

The company's focus on complete solutions, including the machinery that fills and seals their cartons, fosters deep customer relationships and locks in demand. This integrated approach ensures a consistent uptake of Elopak’s primary product: the packaging itself.

- Revenue Stability: Long-term contracts provide a predictable revenue base, reducing market volatility impact.

- Customer Retention: Bundling cartons and machine services encourages customer loyalty and reduces churn.

- Demand Predictability: These agreements allow for better forecasting of carton production and material sourcing.

- Integrated Offering: Elopak's ability to supply both the packaging material and the filling machinery creates a strong value proposition.

Elopak's revenue primarily stems from selling its innovative paper-based cartons, like Pure-Pak®, which saw significant sales contribution in 2023. The company also generates income from the sale and leasing of specialized filling machines, a key component of their packaging solutions.

Recurring revenue is further strengthened by after-sales services, including technical support and the sale of spare parts for their machinery, ensuring operational continuity for clients and fostering customer loyalty.

Strategic investments in new production facilities, such as the Little Rock, Arkansas plant, and expanding existing ones, like in India, are designed to capture growing market demand and drive top-line growth, with the US plant expected to significantly boost annual revenue.

Long-term contracts that bundle carton supply with machine services create a stable and predictable revenue stream, enhancing customer retention and providing valuable demand forecasting capabilities for Elopak.

| Revenue Stream | Description | 2023 Impact |

|---|---|---|

| Carton Sales | Primary income from selling paper-based cartons. | Largest portion of total revenue. |

| Filling Machine Sales & Leasing | Revenue from selling and leasing advanced packaging machinery. | Vital for comprehensive packaging solutions. |

| After-Sales Services & Spare Parts | Income from technical support and replacement parts. | Contributes substantially to recurring revenue. |

| Capacity Expansion | Revenue growth from new plants and increased production lines. | US plant projected to generate significant annual revenue. |

| Long-Term Contracts | Revenue from bundled carton and service agreements. | Provides revenue stability and predictability. |

Business Model Canvas Data Sources

The Elopak Business Model Canvas is built upon a foundation of comprehensive market research, financial performance data, and internal operational insights. These diverse sources ensure that each component of the canvas accurately reflects Elopak's strategic positioning and market realities.