Elopak Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elopak Bundle

Uncover the strategic brilliance behind Elopak's product portfolio with our insightful BCG Matrix analysis. See how their offerings are categorized into Stars, Cash Cows, Dogs, and Question Marks, revealing their current market standing and future potential.

This preview offers a glimpse into the powerful framework used to assess market share and growth rates, but the true value lies in the comprehensive data and actionable insights.

Don't just understand the theory; empower your decision-making. Purchase the full Elopak BCG Matrix report to gain a detailed breakdown of each quadrant, including specific product placements and strategic recommendations tailored for growth and resource optimization.

With our complete report, you'll receive a ready-to-use strategic tool that clarifies where to invest, divest, or nurture your product lines for maximum impact.

Elevate your strategic planning and gain a competitive edge by securing the full Elopak BCG Matrix today.

Stars

Elopak's strategic expansion into the Americas, particularly with its new facility in Little Rock, Arkansas, positions it for significant growth. This plant, operational since Q1 2025, is a substantial investment aimed at capitalizing on the booming North American demand for its eco-friendly carton solutions. The market's embrace of sustainable packaging has been robust, driving unprecedented uptake for Elopak's offerings.

The success of the Little Rock plant is already evident, with the production capacity for its initial line fully committed, indicating a strong market reception. This sold-out status highlights the intense demand and suggests a clear pathway for sustained high revenue generation in the region. Elopak's commitment to this market is a testament to the growing preference for environmentally conscious packaging solutions.

The Pure-Pak eSense aseptic carton, a product championed by Elopak, is making significant waves in the packaging industry. Its design prioritizes enhanced recyclability and notably omits aluminum, a key differentiator. This positions it squarely within a high-growth segment of the aseptic packaging market, which industry forecasts indicate will see substantial expansion.

This innovative carton boasts a reduced carbon footprint, cutting emissions by as much as 50% when compared to conventional aseptic packaging. Major players in the dairy and beverage sectors are increasingly adopting the eSense carton, signaling strong market acceptance.

The eco-conscious attributes of Pure-Pak eSense directly address the escalating consumer preference for sustainable products. This alignment with market trends and its performance metrics place it as a frontrunner in a rapidly expanding and environmentally focused market segment.

Elopak's Natural Brown Board, launched in 2017, and the recently introduced Natural White Board in May 2025, represent significant advancements in sustainable packaging. These carton boards boast a considerably lower carbon footprint compared to conventional alternatives, appealing to an increasingly eco-conscious market.

The Natural Brown Board, in particular, has seen robust market penetration, especially within Europe. This success highlights its strong positioning in a market segment that prioritizes environmentally friendly solutions. By 2023, Elopak reported that over 60% of its beverage carton portfolio in Europe was made from renewable materials, a testament to the growing demand for such products.

The key differentiator for these carton boards is their reduced environmental impact, directly addressing customer needs for lower CO2 emissions. This focus on sustainability not only aligns with global environmental goals but also provides a competitive edge in the packaging industry. The uptake of these products is expected to continue growing as more businesses prioritize their environmental, social, and governance (ESG) commitments.

Global Plastic Replacement Solutions

Elopak's commitment to global plastic replacement solutions places it at the forefront of a market driven by environmental consciousness and regulatory shifts. The company is actively developing and promoting alternatives to plastic packaging across diverse sectors like home and personal care. This strategic direction taps into a significant market opportunity, as demand for sustainable packaging solutions continues to surge.

Consumer and regulatory pressure is a major catalyst for this shift. For instance, by mid-2024, many regions have seen increased legislation targeting single-use plastics, creating a fertile ground for Elopak's innovative offerings. The company’s focus on replacing plastic aligns with this global trend, positioning it for substantial growth.

Elopak's strategic partnerships underscore its market leadership. Collaborations, such as the one with Orkla Home and Personal Care, demonstrate tangible success in bringing these plastic-free solutions to market. This approach not only expands Elopak’s reach but also validates the viability and demand for its plastic replacement technologies.

- Market Growth: The global sustainable packaging market is projected to reach USD 432.1 billion by 2027, growing at a CAGR of 6.7%.

- Regulatory Impact: Over 60 countries have implemented some form of plastic bag ban or tax by 2023, influencing packaging choices.

- Partnership Success: Elopak's cartons, for example, are made from renewable resources and are recyclable, offering a clear advantage over traditional plastic packaging.

- Consumer Demand: A 2024 survey indicated that 72% of consumers are willing to pay more for products with sustainable packaging.

Advanced Aseptic Filling Technology

Elopak's advanced aseptic filling technology, exemplified by the E-PS120AH machine installed for Malo Dairy in 2024, positions it strongly within the growth quadrant of the BCG Matrix. This technology facilitates the efficient production of sustainable, long-life carton solutions.

These high-efficiency machines cater to the surging global demand for aseptic packaging, particularly in developing economies and for novel product introductions. The flexibility to manage diverse carton formats and materials, including aluminum-free options, underpins Elopak's market dominance.

- E-PS120AH Machine: A key innovation contributing to Elopak's growth.

- Malo Dairy Installation: A real-world application showcasing the technology's impact in 2024.

- Market Demand: Addresses the increasing need for aseptic packaging globally.

- Sustainability Focus: Supports the production of environmentally conscious carton solutions.

Elopak's advanced aseptic filling technology, particularly highlighted by the E-PS120AH machine installed for Malo Dairy in 2024, firmly places its offerings in the Stars quadrant of the BCG Matrix. This technology is instrumental in meeting the escalating global demand for aseptic packaging, especially for new product launches and in emerging markets.

The Pure-Pak eSense carton, with its aluminum-free, enhanced recyclability design, is a prime example of a Star product. This innovation directly caters to the strong consumer and regulatory push for sustainable packaging, a market segment experiencing rapid expansion. By mid-2024, the demand for such eco-friendly solutions has made these offerings highly competitive.

Elopak's commitment to sustainable materials, such as the Natural Brown Board and the May 2025-launched Natural White Board, further solidifies its Star position. These products offer a significantly reduced carbon footprint, aligning with the 72% of consumers in a 2024 survey willing to pay more for sustainable packaging, driving market adoption.

The strategic expansion into the Americas, with the Little Rock, Arkansas facility becoming operational in Q1 2025, is designed to capitalize on the robust demand for these Star products. The initial production lines at this facility are already fully committed, demonstrating strong market acceptance and revenue potential.

| Category | Product/Technology | BCG Matrix Quadrant | Key Differentiator | Market Trend Alignment |

| Aseptic Packaging Technology | E-PS120AH Filling Machine | Star | High-efficiency, flexible carton production | Growing global demand for aseptic solutions |

| Sustainable Carton Solutions | Pure-Pak eSense Carton | Star | Aluminum-free, enhanced recyclability | Consumer preference for eco-friendly packaging |

| Sustainable Carton Boards | Natural Brown Board & Natural White Board | Star | Reduced carbon footprint, renewable materials | ESG commitments, regulatory pressure on plastics |

What is included in the product

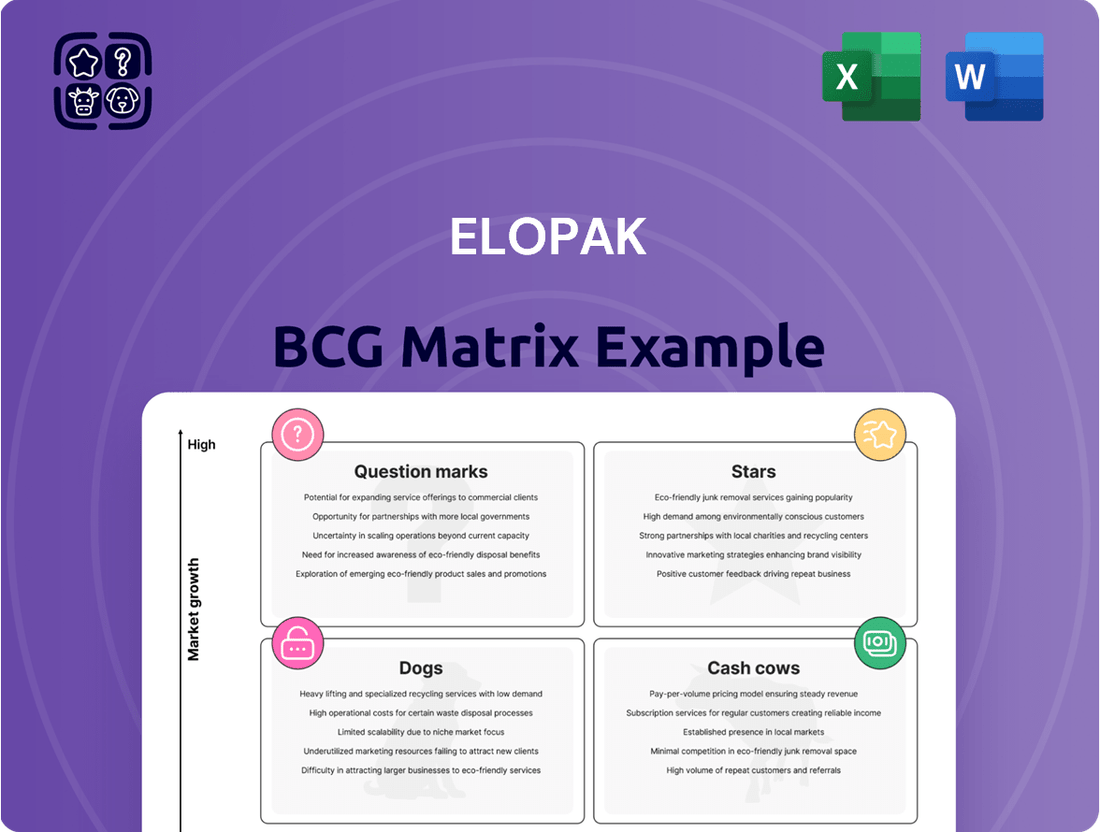

The Elopak BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment decisions.

Elopak's BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Elopak's Standard Pure-Pak cartons for chilled products in EMEA are a classic cash cow. This segment benefits from Elopak's long-standing presence and strong market share in a mature region where demand for these packaging solutions remains consistent. The company's established customer base and the reliable nature of chilled beverage consumption contribute to predictable revenue streams.

In 2023, Elopak reported a total net sales of EUR 1,215.5 million, with the EMEA region being a significant contributor. While specific segment data isn't always broken down granularly in public reports, the stability of the Pure-Pak carton business in this area underpins Elopak's overall financial health, providing the necessary cash flow to invest in other growth areas.

Established filling machine sales and service represent a classic cash cow for Elopak. The consistent revenue generated from selling and maintaining these reliable machines to their loyal customer base is a significant profit driver. These machines are crucial to Elopak's integrated packaging solutions, fostering strong customer relationships and ensuring recurring service agreements.

The proven performance and efficiency of these established systems mean Elopak doesn't need to spend a lot on marketing or development to keep sales flowing, allowing for maximum cash generation. For instance, Elopak's focus on their core filling technologies in 2024 likely contributed to their overall operational efficiency and profitability in established markets.

Elopak's core markets benefit significantly from long-term customer contracts, like the 30-year partnership with SILL Enterprises. These established relationships guarantee consistent demand for their current carton packaging. This stability translates into predictable revenue, a hallmark of a cash cow.

These enduring partnerships reduce the need for extensive sales and marketing efforts, directly boosting profitability. The high-volume, consistent orders generated by these core market contracts are key drivers of Elopak's strong cash flow generation.

Gable Top Cartons for Dairy and Juice

The iconic gable top carton, a familiar sight for fresh milk and juice, is a classic Cash Cow for packaging companies like Elopak. This design has secured a commanding market share in many developed countries, benefiting from high consumer familiarity and extensive distribution channels.

The mature nature of this market means that growth investments are minimal. This allows Elopak to generate substantial cash flow from its gable top carton segment. These earnings can then be strategically channeled into promising, higher-growth ventures within the company's portfolio.

- Market Dominance: Gable top cartons hold a significant share of the liquid dairy and juice packaging market in developed regions.

- Low Investment Needs: As a mature product, it requires less capital for expansion or innovation.

- Strong Cash Generation: This stability translates into consistent and significant cash flow for the business.

- Strategic Reinvestment: Funds generated are crucial for supporting other business units with higher growth potential.

Responsible Sourcing and Production Efficiencies

Elopak's dedication to responsible sourcing, including 100% certified sustainable raw cardboard from FSC, SFI, and PEFC, directly supports its Cash Cow status. This commitment, coupled with the utilization of renewable electricity at all sites since 2016, significantly boosts operational efficiencies.

These sustainable practices translate into tangible financial benefits. By optimizing resource use and energy consumption, Elopak reduces its cost base, thereby safeguarding and enhancing the profitability of its established product lines. This focus on efficiency is crucial for generating consistent cash flow from these mature businesses.

- Sustainable Sourcing: 100% of raw cardboard certified sustainable (FSC, SFI, PEFC).

- Renewable Energy: 100% renewable electricity across all sites since 2016.

- Cost Optimization: Reduced operational costs through efficiency gains.

- Supply Chain Security: Enhanced reliability and reduced risk in raw material procurement.

Elopak's established Pure-Pak carton business in mature markets, particularly for chilled products in EMEA, functions as a prime cash cow. These segments benefit from a strong market share and consistent demand, generating predictable revenue streams. The company's 2023 net sales of EUR 1,215.5 million highlight the substantial contribution from these stable, high-volume operations.

The consistent performance of Elopak's core filling machine sales and service also represents a significant cash cow. These reliable systems, supported by recurring service agreements and a loyal customer base, provide a steady profit driver. Elopak's focus on optimizing these proven technologies in 2024 further solidifies their contribution to consistent cash flow.

Long-term customer contracts, such as the 30-year partnership with SILL Enterprises, are crucial to Elopak's cash cow strategy. These enduring relationships guarantee consistent demand for existing packaging solutions, minimizing the need for extensive sales and marketing efforts and boosting profitability through high-volume, predictable orders.

The iconic gable top carton, a staple for liquid dairy and juice in developed nations, remains a strong cash cow for Elopak. Its high consumer familiarity and extensive distribution channels ensure minimal investment needs for growth, allowing substantial cash generation to be reinvested in promising ventures.

Delivered as Shown

Elopak BCG Matrix

The preview you are viewing is the complete and final Elopak BCG Matrix report you will receive after purchase. This means the analysis, formatting, and insights are precisely what you will download, ready for immediate strategic application without any watermarks or altered content. You're seeing the actual, professionally crafted document that will empower your business decisions, offering a clear roadmap for managing Elopak's product portfolio. Once purchased, this comprehensive report is yours to edit, present, and integrate into your strategic planning processes.

Dogs

Legacy packaging with high fossil plastic content, such as older carton designs relying on non-renewable polyethylene (PE), can be classified as Dogs in the Elopak BCG Matrix. These products represent an aging portfolio with low growth prospects as Elopak prioritizes a shift towards more sustainable materials.

Elopak's commitment to a plastic replacement strategy, aiming for 100% recyclable cartons by 2030, directly impacts these legacy products. Their continued production may divert resources from innovation and growth areas, making them a drain on profitability.

The market is increasingly favoring environmentally friendly packaging, leading to declining demand for options with high fossil plastic content. This trend further solidifies their position as a Dog, with limited potential for future market share expansion.

By 2024, Elopak has made significant strides in reducing virgin fossil plastic in its packaging. For instance, their Pure-Pak® cartons increasingly incorporate renewable or recycled content, pushing legacy products with high fossil plastic content further into the Dog category as they are phased out.

Older generations of Elopak filling machines, particularly those from before the widespread adoption of advanced automation and energy-saving technologies, might be categorized as Dogs. These legacy models, while still functional, often exhibit lower production speeds and higher energy consumption per unit compared to their contemporary counterparts. For instance, a machine from the early 2010s might process 6,000 cartons per hour, while a 2023 model can achieve over 10,000, representing a significant efficiency gap.

The market demand for these older, less efficient filling machines is typically low. Most new investments by beverage producers are directed towards newer, more adaptable, and environmentally friendly systems. Consequently, the resale value of these older units is also diminished, and their operational costs, including maintenance and spare parts, can escalate as they age, making them unattractive for further capital expenditure.

Elopak's strategic direction, as evidenced by their emphasis on sustainability and operational optimization, points towards a gradual phasing out of such legacy machinery. Their investments in developing more energy-efficient filling solutions and smart logistics systems underscore a commitment to modernizing their product portfolio. For example, Elopak's focus on reducing energy consumption by up to 30% in their latest EF 330 machine model highlights this forward-looking approach, leaving older, less efficient models behind.

Niche or low-volume regional product lines within Elopak's portfolio might be classified as Dogs. These are products with limited market share and low growth potential, often due to their specialized nature or geographical constraints. For example, a specific packaging solution designed for a very small, localized market might fall into this category.

These product lines typically contribute minimally to Elopak's overall revenue and profitability. They may represent earlier diversification efforts that never achieved significant traction or have been outpaced by broader market trends. The challenge lies in identifying these products and assessing whether the resources invested in them could yield better returns if reallocated elsewhere.

In 2024, businesses are increasingly scrutinizing their product portfolios for underperformers. Companies like Elopak might analyze sales data showing less than 1% of total revenue from such niche offerings, coupled with declining or stagnant market growth rates below 2% annually for these specific segments. This data would reinforce their classification as Dogs, prompting strategic decisions about divestment or discontinuation.

Packaging Solutions Without Enhanced Recyclability Features

Carton solutions without enhanced recyclability features, such as easy-fold lines or designs optimized for current recycling infrastructure, are often considered 'Dogs' in the Elopak BCG Matrix context. These products may struggle to gain market share as consumer and regulatory focus intensifies on circular economy principles. For instance, older carton designs that are more difficult to flatten or separate components could face a decline in demand.

Elopak's commitment to making all its cartons 100% recyclable and consumer-friendly means that products lacking these advancements are at a disadvantage. In 2023, the global flexible packaging market, which includes cartons, saw growth, but the emphasis on sustainability means that less recyclable options are likely to see stagnant or declining sales. This segment requires careful management to minimize losses or potential phase-out.

- Diminishing Market Appeal: Cartons lacking advanced recyclability features face reduced consumer preference and potential regulatory hurdles.

- Increased Processing Effort: These solutions may demand more effort from consumers and waste management facilities to process correctly.

- Focus on Circularity: The market trend towards a circular economy favors packaging designed for easy recycling and material recovery.

- Potential for Obsolescence: Without updates to meet evolving recycling standards, these products risk becoming obsolete.

Products Not Aligned with 'Repackaging Tomorrow' Strategy

Products or services that don't fit Elopak's 'Repackaging tomorrow' vision are considered Dogs. This strategy focuses on global expansion, solidifying their market lead, and moving away from plastics. Offerings outside this scope might drain resources without aiding Elopak's goal of doubling revenue by 2030 or their sustainability objectives.

These 'Dog' products could be prime candidates for being sold off or undergoing a thorough review. For instance, if Elopak has a legacy packaging line that is heavily reliant on traditional materials and offers minimal sustainability benefits, it would likely fall into this category. Such a product line might require significant investment to retool or reposition, without a clear path to contributing to the company's ambitious growth and environmental targets. In 2023, Elopak reported a revenue of NOK 10.6 billion, and identifying and addressing underperforming assets is crucial to achieving their stated goals.

- Misaligned Offerings: Products or services that do not support Elopak's core strategy of global growth, core leadership, and plastic replacement.

- Resource Drain: These 'Dogs' may consume valuable capital and management attention without contributing to key performance indicators like doubling revenue by 2030.

- Divestment Potential: Non-strategic products are often candidates for divestiture to free up resources for more promising ventures.

- Strategic Re-evaluation: Companies typically undertake a rigorous assessment to determine if these underperforming assets can be revitalized or if their removal is the best course of action.

Products that are not aligned with Elopak's sustainability goals, particularly those with significant virgin fossil plastic content, are categorized as Dogs. These offerings face declining market interest as the industry shifts towards eco-friendly alternatives.

For example, legacy carton formats that rely heavily on non-renewable polyethylene (PE) and lack advanced recyclability features represent these 'Dogs'. By 2024, Elopak's increased use of renewable and recycled content in its packaging, like the Pure-Pak cartons, further marginalizes these older, less sustainable options.

These products often have low market share and minimal growth prospects, potentially diverting resources from more innovative and profitable ventures. Elopak's strategic focus on achieving 100% recyclable cartons by 2030 means these legacy products are on a path to obsolescence, requiring careful management to mitigate losses.

Question Marks

Elopak's strategic investment in Blue Ocean Closures, announced in March 2025, positions fiber-based caps as a key growth driver, targeting the replacement of traditional plastic closures. This venture into innovative, sustainable packaging solutions addresses a significant market demand for environmentally friendly alternatives.

Despite the promising potential, Blue Ocean Closures is still in its early stages, with a currently low market share reflecting its nascent status in the industry. The development of this technology is crucial for Elopak's sustainability goals, aiming to capture a substantial portion of the market in the coming years.

The path to widespread adoption necessitates considerable investment in scaling production capabilities and further market penetration. This high investment requirement, coupled with the uncertain but high potential for market growth, classifies fiber-based closures and caps within Elopak's BCG Matrix as a classic Question Mark.

Elopak's strategic push into new geographies like India exemplifies a classic Question Mark scenario within the BCG Matrix. Despite the Americas being a recognized Star, the company's significant investment, including a second Roll Fed packaging production line installed in 2024, signals a strong belief in India's potential.

This aggressive expansion is yielding impressive early results, with a reported 60% year-on-year growth in Q1 2025 for the Indian market. This rapid revenue increase suggests strong market reception and growing demand for Elopak's offerings.

However, the designation as a Question Mark implies that while the market growth is substantial, Elopak's current market share may still be modest when juxtaposed with incumbent competitors. Significant ongoing investment will be crucial to solidify their position and vie for market leadership.

The company must carefully manage these investments, balancing the need for aggressive growth initiatives with the objective of achieving profitability and a sustainable competitive advantage in this burgeoning market.

Elopak's D-PAK™ cartons, launched in June 2025, represent a significant leap in sustainable packaging by integrating both circular (recycled) and bio-circular (renewable) polymers. This innovation directly addresses growing market demand and anticipates future European Union regulations mandating recycled content. The company is proactively positioning itself for future growth, with the global sustainable packaging market projected to reach $1.4 trillion by 2030, according to recent industry forecasts.

While D-PAK™ offers a compelling value proposition, its market penetration is still in its early stages. As a very new product, its current market share and widespread adoption are limited, meaning its contribution to Elopak's overall revenue is currently minimal. However, this nascent adoption signals a strong potential for future market capture as sustainability becomes an even more critical factor in consumer and regulatory choices.

Smart Packaging and Digital Solutions Development

Elopak's commitment to smart packaging and digital solutions development aligns with its strategic R&D investments, including its recycling laboratory set to become operational in spring 2025. This lab is a key component in exploring innovative materials and designs aimed at achieving 100% recyclability by 2030, with a forward-looking focus on integrating smart packaging functionalities.

These ventures are situated within markets characterized by rapid technological evolution and high growth potential. However, as these initiatives are currently in their nascent stages, often limited to early development or pilot programs, they represent significant future upside but currently hold a low market share. Success hinges on effective commercialization of these advanced concepts.

- R&D Focus: Elopak is actively investing in research and development for smart packaging and digital solutions, aiming for 100% recyclability by 2030.

- Recycling Laboratory: A dedicated recycling laboratory will be operational from spring 2025, facilitating the exploration of new materials and packaging designs.

- Market Position: These smart packaging initiatives are positioned in high-growth, technologically dynamic markets but are in early development, indicating low current market share.

- Future Potential: Despite low current market share, these early-stage developments hold substantial future potential if successfully brought to market and adopted by consumers.

Expansion into Non-Traditional Liquid Food Segments (e.g., Soups, Homecare)

Elopak's expansion into non-traditional liquid food segments like soups and homecare positions these offerings as potential question marks within the BCG matrix. These are large, growing markets where Elopak is entering with a relatively new product offering compared to its established dairy and juice segments. For example, the global soup market was valued at approximately USD 18.5 billion in 2023 and is projected to grow, presenting a significant opportunity.

The strategic challenge for Elopak is building market share in these categories, which are currently dominated by plastic packaging. Success hinges on Elopak's ability to demonstrate the environmental and functional advantages of its carton solutions to new customer segments and convince them to switch from established plastic formats. This requires substantial investment in marketing, sales, and potentially R&D to tailor packaging for diverse product needs.

- High Growth Potential: Segments like ready-to-eat soups and liquid detergents are experiencing robust growth, offering Elopak avenues for expansion beyond its core beverage markets.

- Low Initial Market Share: As a new entrant in these specific categories, Elopak likely holds a minimal share, necessitating significant effort to gain traction against incumbent plastic packaging solutions.

- Investment Required: Converting customers from established plastic packaging to carton solutions will demand strategic investments in sales, marketing, and potentially adapting packaging designs for specific product requirements, such as barrier properties for extended shelf life.

- Competitive Landscape: Elopak faces competition not only from other packaging providers but also from established plastic manufacturers who have strong relationships with manufacturers in these non-traditional segments.

Question Marks represent emerging opportunities with high growth potential but currently low market share. Elopak's investment in Blue Ocean Closures for fiber-based caps exemplifies this, targeting a growing demand for sustainable alternatives. Similarly, the expansion into new markets like India, showing a 60% year-on-year growth in Q1 2025, signifies a Question Mark due to the need for further investment to capture a larger market share against established players.

Elopak's D-PAK™ cartons, integrating recycled and bio-circular polymers, are also classified as Question Marks. Despite their innovative appeal and alignment with future regulations, their market penetration is still in its early stages, contributing minimally to current revenue but holding significant future promise.

Investments in smart packaging and digital solutions, supported by a new recycling laboratory operational from spring 2025, are positioned in high-growth markets. However, these are early-stage developments with low current market share, requiring successful commercialization to realize their potential.

Finally, Elopak's foray into non-traditional liquid food segments like soups, a market valued at USD 18.5 billion in 2023, also represents Question Marks. These require substantial investment to build market share against incumbent plastic packaging solutions.

BCG Matrix Data Sources

Our Elopak BCG Matrix leverages a robust blend of internal financial disclosures, market research reports, and industry growth forecasts to accurately position each business unit.