Elevance Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Elevance Health Bundle

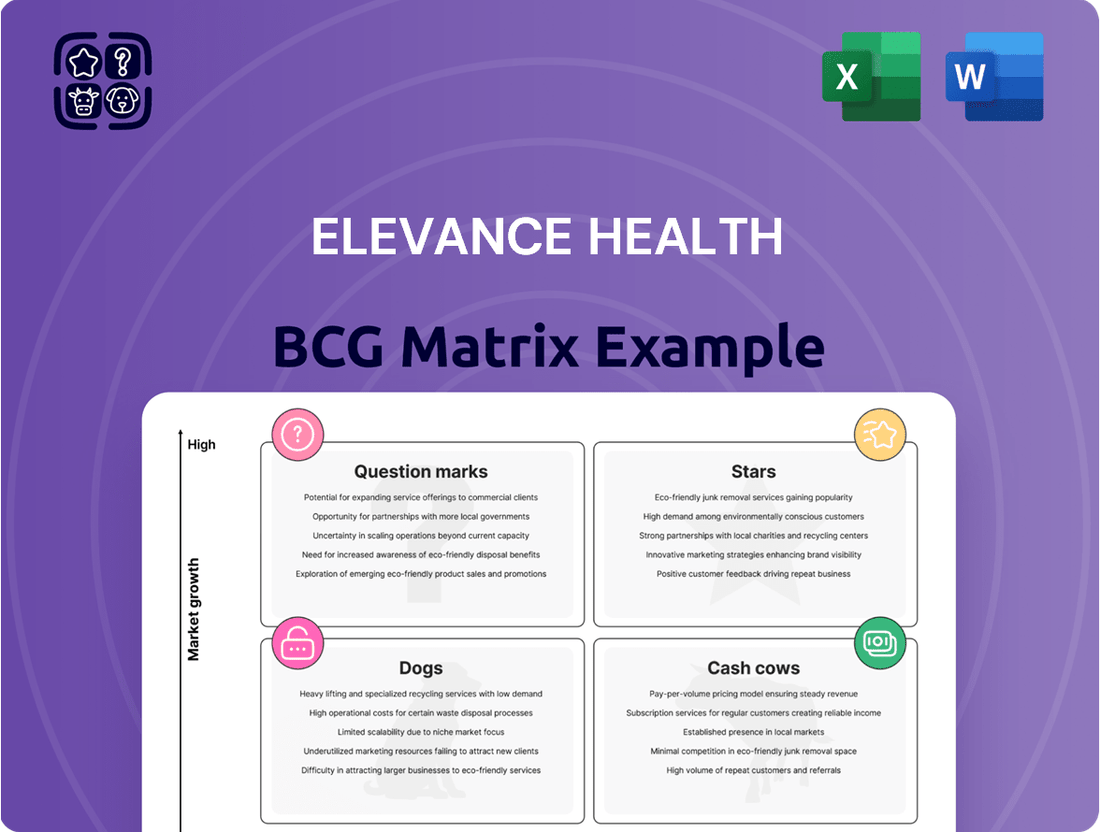

Curious about Elevance Health's strategic product portfolio? Our preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks, hinting at their market dominance and growth opportunities. To truly grasp their competitive edge and unlock actionable strategies, dive into the full BCG Matrix. Purchase the complete report for a comprehensive breakdown and the insights you need to navigate the healthcare landscape.

Stars

Elevance Health is aggressively pursuing growth in Medicare Advantage (MA), forecasting a 7-9% membership increase for 2025. This expansion is notable as some rivals are reportedly reducing their MA presence.

This strategic move highlights Elevance Health's robust market standing and effective approach in the rapidly expanding MA sector, positioning it as a significant contributor to the company's future earnings.

The company's optimism is further supported by impressive member retention and well-calibrated pricing strategies, even amidst rising healthcare costs.

Carelon Health Services is a major growth driver for Elevance Health. In the first quarter of 2025, its operating revenue surged by an impressive 38% year-over-year. For the entirety of 2024, Carelon achieved a solid 12% increase in operating revenue.

This expansion is fueled by Carelon Services' growing risk-based capabilities and strategic acquisitions, such as CareBridge, which bolster its home health services. These moves are demonstrably contributing to Elevance Health's overall performance and strategic objectives.

Elevance Health's individual ACA plan business is a star performer, showing impressive momentum. In 2024, this segment saw growth exceeding 30%, and projections indicate continued strong performance into 2025.

The company's strategic expansion into three new states has been a key driver, effectively attracting members who are transitioning from Medicaid. This success highlights Elevance's ability to offer innovative and cost-effective health solutions that resonate with consumers in a growing market.

CarelonRx Pharmacy Solutions

CarelonRx Pharmacy Solutions, as the pharmacy benefit management (PBM) division of Carelon, is a significant driver of Elevance Health's financial performance. In 2024, it demonstrated robust growth, with adjusted prescription claims volume increasing by 3.2%. This uptick is directly linked to strong product revenue and the successful acquisition of external members, underscoring its expanding reach in the market.

The PBM sector is highly competitive, yet CarelonRx has solidified its position. Its substantial market share within the rapidly evolving pharmacy benefits landscape, coupled with its consistent growth trajectory, places it as a star performer within Elevance Health's broader Carelon segment. This strategic positioning suggests continued investment and focus on this area.

- CarelonRx's 3.2% increase in adjusted prescription claims volume in 2024 highlights its operational strength.

- The PBM arm contributes significantly to Elevance Health's overall revenue and growth.

- Strong product revenue and external member growth are key drivers for CarelonRx's success.

- Its high market share and continued expansion solidify its status as a star in the dynamic pharmacy benefits market.

Strategic Digital Health Investments

Elevance Health is strategically investing in digital health, targeting $1 billion in annual revenue from these ventures by 2025. This aggressive growth objective underscores the company's commitment to digital transformation as a key driver of future performance.

Digital tools like Sydney Health are central to this strategy, improving member engagement and care accessibility through personalized features and telehealth services. These platforms are designed to streamline the healthcare experience for consumers.

- Digital Revenue Target: $1 billion annually by 2025.

- Member Engagement Tool: Sydney Health app offering personalized experiences and telehealth.

- Technology Focus: Exploration of AI and cloud computing for enhanced digital health solutions.

Elevance Health's individual ACA plan business is a star performer, showing impressive momentum. In 2024, this segment saw growth exceeding 30%, and projections indicate continued strong performance into 2025. The company's strategic expansion into three new states has been a key driver, effectively attracting members who are transitioning from Medicaid. This success highlights Elevance's ability to offer innovative and cost-effective health solutions that resonate with consumers in a growing market.

What is included in the product

This BCG Matrix overview highlights Elevance Health's portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

The Elevance Health BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Elevance Health's established employer group business, encompassing both risk-based and fee-based models, is a cornerstone of its operations. This segment boasts a significant market share, translating into consistent and predictable revenue streams for the company. Its maturity, however, means it generates substantial cash flow with relatively modest investment needs.

The strength of this business lies in its deep-rooted client relationships and a rigorous approach to commercial underwriting. This focus ensures stable premium yields, contributing significantly to Elevance Health's financial stability. For instance, in 2024, employer group health plans remained a dominant force in the U.S. health insurance market, with Elevance Health holding a strong position within this segment.

Elevance Health's core operations, primarily functioning as a Blue Cross licensee across multiple states, represent a significant cash cow within its portfolio. These established brands, like Anthem Blue Cross Blue Shield, command substantial market share in the traditional health insurance sector, consistently generating robust and stable cash flows.

In 2024, Elevance Health reported strong performance in its Health Benefits segment, which largely encompasses these core insurance operations. This segment continues to be a primary driver of earnings, demonstrating the maturity and consistent profitability of these businesses. The company's extensive network and strong brand loyalty are key factors in maintaining this advantageous market position.

Elevance Health's Federal Employee Program (FEP) represents a significant cash cow within its portfolio. This program, backed by the government, offers a stable and predictable revenue stream due to Elevance Health's substantial market share and consistent membership base.

In 2024, FEP continues to be a cornerstone of Elevance Health's business, contributing reliably to earnings. Its mature market status ensures minimal growth volatility, making it a dependable generator of cash with low reinvestment needs.

Medicaid Managed Care (despite current challenges)

Medicaid Managed Care, despite current headwinds, represents a significant cash cow for Elevance Health. The company holds a substantial market share in this sector, serving millions of members.

In 2024, Elevance Health navigated unprecedented challenges, including member redeterminations and increased medical costs. However, the company views these as temporary, projecting a return to profitability for the Medicaid managed care business.

- Market Dominance: Elevance Health is a leading player in the Medicaid managed care market, demonstrating a strong and established presence.

- Profitability Outlook: Despite 2024 challenges, management anticipates the segment will remain profitable as temporary issues subside.

- Cash Generation Potential: Its high market share in this mature, government-funded segment positions it as a consistent contributor to cash flow once normalized.

Mature Care Management Solutions

Elevance Health's mature care management solutions, particularly those focused on chronic conditions and complex care, are firmly positioned as Cash Cows within its business portfolio. These established services command a significant market share in a stable, albeit mature, segment of the healthcare industry.

These offerings are designed to deliver predictable and substantial revenue streams by demonstrably improving member health outcomes and effectively managing healthcare costs. This translates into consistent cash flow generation for Elevance Health.

The company's investment in these mature care management services has already yielded significant returns, meaning they require minimal additional investment for market development. This allows them to continue generating strong profits without needing to chase new growth opportunities aggressively.

- Established Market Position: Elevance Health holds a high market share in the mature care management segment.

- Steady Revenue Generation: Chronic and complex care management services provide consistent income by improving health outcomes and controlling costs.

- Low Investment Needs: These Cash Cows require minimal new investment, maximizing profitability.

Elevance Health's core insurance operations, including its Blue Cross Blue Shield licenses and the Federal Employee Program (FEP), are prime examples of its Cash Cows. These segments benefit from strong brand recognition, substantial market share, and mature customer bases, ensuring consistent and predictable cash flows with limited need for aggressive expansion investment.

In 2024, Elevance Health's Health Benefits segment, which houses these core businesses, continued to be a primary earnings driver. The company's established employer group business, a significant portion of this segment, demonstrated its stability, generating robust revenue streams. FEP membership also remained a reliable contributor, underscoring its Cash Cow status.

The company's Medicaid managed care business, despite facing temporary challenges in 2024, is also positioned as a Cash Cow due to its large membership base and market dominance. Management anticipates a return to profitability as member redetermination processes normalize, reinforcing its long-term cash-generating potential.

| Business Segment | BCG Matrix Classification | 2024 Performance Indicators | Cash Flow Contribution | Investment Needs |

|---|---|---|---|---|

| Core Insurance (BCBS Licenses) | Cash Cow | Dominant market share, stable premium yields | High, consistent | Low |

| Federal Employee Program (FEP) | Cash Cow | Stable membership, government backing | High, predictable | Low |

| Medicaid Managed Care | Cash Cow (potential) | Large membership, market leader (navigating 2024 headwinds) | Significant (projected to normalize) | Low to moderate (for normalization) |

Delivered as Shown

Elevance Health BCG Matrix

The Elevance Health BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional-grade report ready for immediate application. You can confidently use this preview as a true representation of the valuable strategic insights contained within the complete Elevance Health BCG Matrix report.

Dogs

Elevance Health's strategic exit from underperforming Medicare Advantage plans and counties, along with benefit adjustments for 2025, clearly places these initiatives within the 'Dogs' quadrant of the BCG Matrix. These specific plans or regions likely represented a low market share and insufficient profitability, draining resources without generating adequate returns. For instance, the company's 2024 financial reports may highlight specific segments where revenue growth lagged behind operational costs, necessitating such divestments.

Elevance Health has strategically adjusted its Medicaid footprint in certain states, a move that resulted in a decrease in membership. This action aligns with the company's overall Medicaid business being a Cash Cow, indicating that these specific state-level adjustments were likely made to divest from underperforming or low-margin segments within the larger, profitable Medicaid operation.

Elevance Health is making significant strides in moving away from older IT systems towards cloud-based solutions. This transition aims to boost efficiency and harness the power of newer technologies.

However, any remaining legacy IT infrastructure that hasn't been fully updated or optimized can be categorized as a 'Dog' in the BCG matrix. These systems often come with substantial maintenance expenses while offering little in terms of innovation or a competitive edge.

For instance, in 2023, many large enterprises reported that a significant portion of their IT budget was still allocated to maintaining these older systems, diverting funds that could be used for growth initiatives.

Programs with Low Member Effectuation Rates

Elevance Health observed a concerning trend in its Affordable Care Act (ACA) business during the second quarter of 2025, with lower member effectuation rates, especially for individuals transitioning from Medicaid. This resulted in a noticeable decline in membership, indicating a challenge in retaining these newly acquired members.

These specific instances of poor conversion and retention within the ACA segment, despite ACA generally being a growth market, are indicative of 'Dog' characteristics. These situations consume valuable resources and attention without generating the expected profitable membership growth.

- ACA Membership Attrition: Q2 2025 data showed lower member effectuation in Elevance Health's ACA business, particularly for Medicaid transitions.

- Resource Drain: Low conversion and retention rates in this segment represent 'Dog' elements that divert resources.

- Profitability Impact: These 'Dog' segments fail to secure and retain profitable members, impacting overall business performance.

Areas with Persistent High Medical Loss Ratios

Elevance Health experienced a rise in its medical loss ratio (MLR) during 2024, notably influenced by escalating Medicaid medical costs. Certain geographic regions or member groups consistently show elevated MLRs, meaning a larger portion of premium income is allocated to healthcare services without sufficient rate adjustments.

These high-cost areas can function as financial burdens, consuming resources that could otherwise be invested in growth initiatives or innovation. For instance, if a specific state's Medicaid program faces higher-than-anticipated utilization or service costs, Elevance's MLR in that market could be significantly impacted.

- Medicaid Medical Cost Trends: Higher utilization and cost of services within the Medicaid population are key drivers of increased MLRs.

- Persistent High MLR Areas: Specific markets or member segments where MLRs consistently exceed targets, indicating pricing or utilization challenges.

- Financial Strain: These areas can act as 'cash traps,' diverting funds from strategic investments due to disproportionate healthcare spending.

- Pricing and Utilization Management: The need for targeted strategies to address underlying cost drivers in these persistent high-MLR segments.

Elevance Health's strategic pruning of underperforming Medicare Advantage plans and counties, alongside benefit adjustments for 2025, firmly places these initiatives in the 'Dogs' category of the BCG Matrix. These specific ventures likely suffered from low market share and insufficient profitability, draining resources without yielding adequate returns. For instance, 2024 financial reports may pinpoint segments where revenue growth lagged behind operational costs, necessitating such divestments.

The company's observed decline in ACA membership, particularly among those transitioning from Medicaid, as noted in Q2 2025, signifies 'Dog' characteristics. This poor conversion and retention consume valuable resources without delivering the anticipated profitable membership growth, impacting overall business performance.

Furthermore, legacy IT systems not yet transitioned to cloud-based solutions represent 'Dogs.' These systems incur substantial maintenance costs and offer minimal innovation, diverting funds from growth initiatives, a trend observed across many large enterprises in 2023 where IT budgets were heavily allocated to maintaining older infrastructure.

Elevated medical loss ratios (MLRs) in specific Medicaid markets during 2024, driven by escalating medical costs and higher utilization, also classify these areas as 'Dogs.' These persistent high-MLR segments act as financial burdens, consuming resources that could be invested in strategic growth.

| Initiative | BCG Category | Rationale | Supporting Data (Illustrative) |

| Underperforming MA Plans/Counties | Dogs | Low market share, insufficient profitability, resource drain. | 2024 reports may show specific segments with negative ROI. |

| ACA Membership Attrition (Post-Medicaid Transition) | Dogs | Low conversion/retention, resource consumption without profitable growth. | Q2 2025 data indicated challenges in member effectuation. |

| Legacy IT Infrastructure | Dogs | High maintenance costs, low innovation, diverts funds from growth. | 2023 IT spending trends showed significant allocation to legacy systems. |

| Persistent High MLR Medicaid Markets | Dogs | Escalating costs, higher utilization, financial burden. | 2024 MLR trends indicated specific markets with disproportionate healthcare spending. |

Question Marks

Mosaic Health, launched in 2024 by Elevance Health, represents a strategic entry into the burgeoning national primary care market. This platform aims to integrate clinical and digital services, positioning itself for substantial growth.

As a new entrant, Mosaic Health is classified as a question mark in the BCG matrix. While the primary care sector shows strong potential for expansion, Mosaic Health's current market share is minimal, necessitating considerable investment to build its brand and operational footprint.

Elevance Health's strategic move into Florida, Maryland, and Texas for ACA coverage in 2025 positions these states as potential Stars in its BCG matrix. These are high-growth markets, but Elevance starts with a low market share, requiring significant upfront investment to build brand recognition and customer base.

Elevance Health is heavily investing in advanced AI and predictive analytics, aiming to unlock actionable data insights and streamline operations. These technologies are seen as crucial for enhancing consumer health outcomes and automating key business functions. For instance, by mid-2024, the company was reportedly dedicating significant resources to AI research and development, signaling a strategic shift towards data-driven decision-making.

While the potential for AI is immense, many of its cutting-edge applications and predictive tools are still in their early stages. This means they likely have low market penetration currently, demanding substantial upfront investment for development and widespread adoption. The company's commitment reflects a long-term vision, acknowledging the developmental hurdles inherent in pioneering AI solutions within the healthcare sector.

Specific Health Equity & Whole Health Initiatives

Elevance Health's commitment to health equity, including a $90 million investment over three years, positions these initiatives as potential stars in the BCG matrix. These efforts aim to address social determinants of health and improve overall well-being, reflecting a high-growth potential market. The development of the Whole Health Index (WHI) further underscores a strategic focus on holistic health assessment.

- Health Equity Investment: $90 million committed over three years to drive health equity.

- Whole Health Index (WHI): A tool developed to assess holistic health outcomes.

- Market Potential: High growth potential due to focus on underserved populations and social determinants of health.

- Strategic Focus: Long-term investments aimed at improving health outcomes rather than immediate revenue generation.

Emerging Value-Based Care Models

Elevance Health is actively advancing its commitment to value-based care, a paradigm shift rewarding providers for positive patient outcomes rather than service volume. This strategic pivot includes the rollout of innovative models, such as the oncology care model specifically designed for Medicare Advantage beneficiaries.

While the broader trend of value-based care demonstrates robust growth, the specific implementation and expansion of novel models, like those Elevance is pursuing, are still in nascent stages. This presents a landscape characterized by significant future growth potential coupled with currently limited market penetration.

- Oncology Care Model Expansion: Elevance Health is piloting and expanding value-based oncology programs, aiming to improve patient outcomes and reduce costs in cancer treatment.

- Medicare Advantage Focus: A key area for these new models is Medicare Advantage, where the focus on managing chronic conditions and improving quality aligns well with value-based principles.

- Provider Collaboration: Success hinges on strong partnerships with healthcare providers, incentivizing them to adopt new care delivery methods and focus on patient health metrics.

- Market Penetration: Despite the growing trend, specific value-based care models, particularly in specialized areas like oncology, still have relatively low market penetration, indicating substantial room for growth and innovation.

Mosaic Health, a new primary care venture by Elevance Health launched in 2024, is positioned as a question mark. It operates in a high-growth sector but currently holds a negligible market share.

Significant investment is required to establish brand awareness and operational capacity for Mosaic Health. This aligns with the typical investment needs of question mark entities in the BCG matrix.

Elevance Health's AI and predictive analytics initiatives, while promising high future growth, are currently in early development stages with low market penetration. This necessitates substantial upfront capital for research and widespread adoption, characteristic of question marks.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.