EFG International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EFG International Bundle

Uncover the intricate web of external factors shaping EFG International's destiny with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, understand the forces that will drive or hinder their success. Equip yourself with actionable intelligence to refine your investment strategy or competitive positioning. Download the full PESTLE analysis now and gain the foresight you need to thrive.

Political factors

Global political stability and evolving trade policies are critical for EFG International's operational landscape. Geopolitical tensions, like the ongoing conflict in Ukraine and the situation in the Middle East, contribute to market volatility, directly affecting client sentiment and the movement of investment capital. For instance, the IMF projected global growth to slow to 2.9% in 2024, a figure heavily influenced by these geopolitical risks.

Changes in international trade agreements and the implementation of tariffs create further complexities. These shifts can impact cross-border financial transactions, alter investment flows, and generally influence the investment climate in regions where EFG International operates. The World Trade Organization (WTO) has noted an increase in trade-restrictive measures globally in recent years, posing a direct challenge to international financial services firms.

The political landscape significantly shapes EFG International's operational environment through its regulatory frameworks. For instance, the Swiss Financial Market Supervisory Authority (FINMA) continuously updates regulations concerning capital adequacy and client protection, impacting EFG's compliance costs and strategic planning. Changes in global data privacy laws, such as the ongoing evolution of GDPR-like regulations in various jurisdictions, also require constant adaptation of EFG's data handling practices.

Government priorities and legislative shifts directly influence the financial services sector. In 2024, discussions around stricter anti-money laundering (AML) enforcement and enhanced due diligence requirements are prominent across Europe, directly affecting how EFG International manages its client onboarding and transaction monitoring processes. These evolving mandates necessitate ongoing investment in compliance technology and personnel.

Political stability in key financial hubs is paramount for EFG International’s international business. Switzerland’s long-standing political neutrality and stable governance have historically been a draw for international capital. However, geopolitical tensions and shifts in international relations can create uncertainties that may affect cross-border financial flows and investor confidence in established markets, requiring EFG to diversify its geographic focus and risk exposure.

Changes in national and international tax policies significantly affect wealth management profitability. For instance, the potential expiration of certain provisions within the US Tax Cuts and Jobs Act of 2017, which could impact capital gains and estate taxes, may alter investment strategies for high-net-worth clients in 2025.

Discussions around wealth taxation, particularly in European markets, could lead to increased demand for tax-efficient investment solutions. Switzerland, a key market for EFG International, maintains a competitive tax environment, but global trends towards higher taxation on wealth could indirectly influence client behavior and the firm's strategic planning.

Government Spending and Fiscal Policies

Government spending and fiscal policies significantly shape the economic landscape, directly impacting EFG International's performance. For instance, increased government investment in infrastructure or green initiatives, as seen in the Biden administration's Inflation Reduction Act which allocated hundreds of billions towards climate and energy, can stimulate economic growth and create favorable conditions for asset management. Conversely, substantial government deficits could lead to higher interest rates, potentially unsettling bond markets and affecting investment portfolios managed by EFG International.

The fiscal stance adopted by major economies, including the United States and the European Union, directly influences global macroeconomic conditions. For example, in early 2024, many governments continued to grapple with post-pandemic inflation, leading central banks to maintain higher interest rates. This environment, driven by fiscal decisions to manage debt and inflation, affects the cost of capital and investment returns, thus influencing EFG International's profitability and asset growth strategies.

- Government Stimulus Measures: Continued government spending on economic recovery and social programs in key markets like the US and EU may support consumer spending and business investment, indirectly benefiting EFG International's asset under management.

- Fiscal Deficits and Debt Levels: Rising national debt in major economies, potentially exceeding 120% of GDP in some developed nations by 2025, could pressure governments to implement austerity or tax increases, impacting investor sentiment and market stability.

- Central Bank Independence: The degree to which central banks remain independent from fiscal policy pressures is crucial for maintaining stable interest rate environments, a key factor for EFG International's investment strategies.

International Relations and Sanctions

International relations and the imposition of sanctions directly impact EFG International's global reach, potentially limiting its operations in certain markets or with specific counterparties. For instance, the ongoing geopolitical tensions and the resulting sanctions regimes, such as those impacting Russia and Iran, require EFG International to maintain rigorous compliance protocols and continuously monitor evolving international regulations. Failure to do so can expose the company to significant legal and financial penalties.

The increasing fragmentation of the global political landscape, often exacerbated by sanctions, can lead to a deterioration of asset quality within financial institutions like EFG International. This is because sanctions can disrupt cross-border transactions, increase counterparty risk, and negatively affect the value of assets held in or linked to sanctioned jurisdictions. For example, reports from late 2023 and early 2024 highlighted how financial firms with exposure to regions under strict sanctions experienced increased non-performing loan ratios.

- Geopolitical Risk: EFG International must navigate a complex web of international relations, where shifts in alliances and trade policies can create new operational challenges.

- Sanctions Compliance: Robust compliance frameworks are essential to avoid penalties associated with sanctions, which are frequently updated by bodies like the UN, EU, and US Treasury.

- Asset Quality Impact: Sanctions and geopolitical instability can directly affect the value and performance of EFG International's loan portfolios and investments, particularly in affected regions.

- Market Access: Restrictions imposed by sanctions can limit EFG International's ability to access certain markets, thereby impacting revenue generation and strategic growth opportunities.

Political stability in key financial hubs is paramount for EFG International’s international business, with Switzerland’s long-standing neutrality historically attracting capital. However, geopolitical tensions can introduce uncertainty, affecting cross-border flows and investor confidence, prompting EFG to diversify its geographic focus and risk exposure.

Changes in national and international tax policies significantly affect wealth management profitability, with potential shifts in US tax law in 2025 influencing client strategies. Global trends toward higher wealth taxation may also increase demand for tax-efficient solutions, impacting EFG's strategic planning.

Government spending and fiscal policies, such as the US Inflation Reduction Act, can stimulate economic growth and create favorable conditions for asset management. Conversely, substantial government deficits may lead to higher interest rates, unsettling bond markets and affecting investment portfolios managed by EFG International.

International relations and sanctions directly impact EFG International's global reach, requiring rigorous compliance protocols. Sanctions can disrupt transactions, increase counterparty risk, and negatively affect asset values in affected jurisdictions, as seen with increased non-performing loan ratios in some firms in late 2023 and early 2024.

What is included in the product

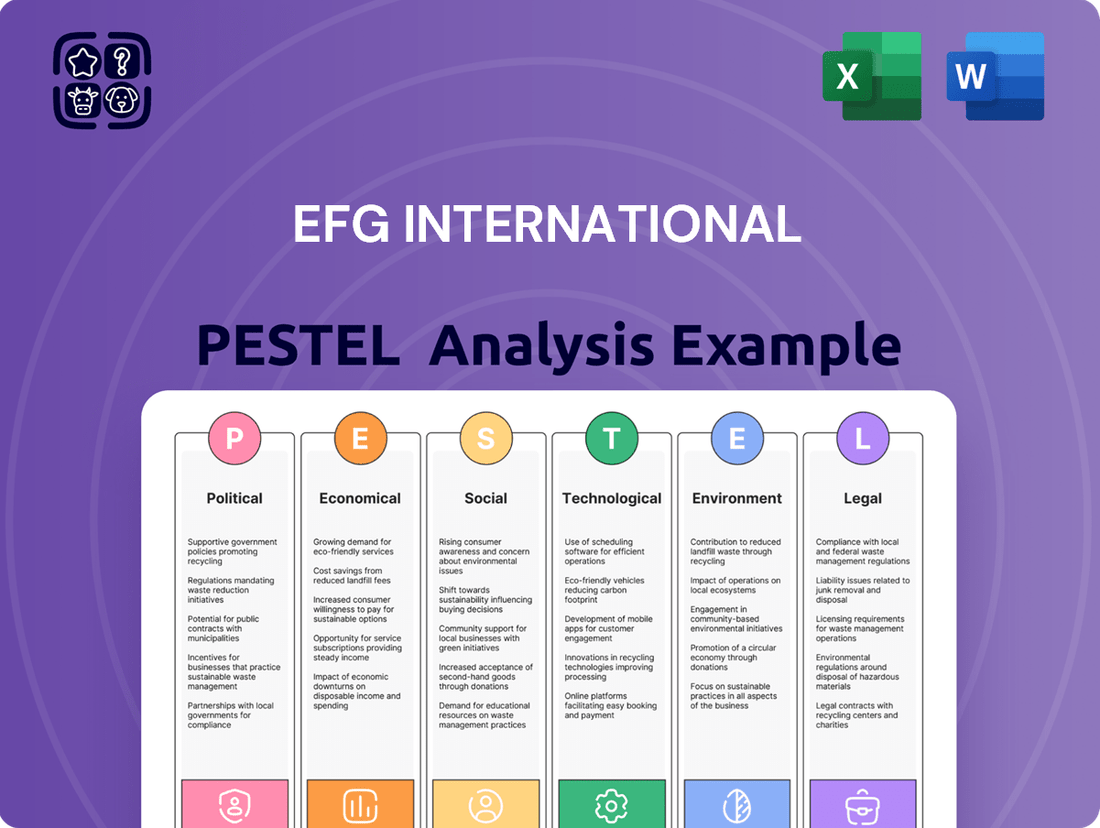

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing EFG International, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within these key areas.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, effectively translating complex external factors into actionable insights for EFG International.

Economic factors

Global economic growth is a fundamental driver for EFG International's performance, directly influencing wealth creation and the demand for asset management services. A robust global economy typically translates into higher disposable incomes and greater investment appetite, benefiting EFG's core business.

Despite various headwinds, the global economy demonstrated resilience through 2024, with projections indicating continued expansion into 2025 and 2026. For instance, the IMF's October 2024 World Economic Outlook projected global growth at 3.1% for 2024 and 3.2% for 2025, underscoring a generally supportive environment for financial services.

EFG International capitalized on this positive momentum, experiencing significant growth in assets under management during 2024. This was largely fueled by rising global equity markets, which saw major indices like the S&P 500 reach new highs, and strong net new money inflows, demonstrating client confidence and increased investment activity.

The interest rate environment significantly impacts EFG International. While slower-than-expected interest rate cuts in 2024 offered some stability for financial institutions, anticipated rate reductions in 2025 could compress returns on conventional savings products. This shift may encourage clients to explore more aggressive, higher-yield investment avenues.

Inflation presents a persistent challenge for wealth preservation. For instance, the US inflation rate, which averaged around 4.1% in 2023, remained a concern throughout 2024, impacting the real value of assets. EFG International must navigate this environment by offering strategies that aim to outpace inflation, thereby protecting client capital.

The global population of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) experienced significant growth in 2024. This expansion is a key economic factor directly benefiting EFG International, as these demographics represent their core clientele.

Factors like increased wealth accumulation and the ongoing effects of globalization fueled this robust growth. For instance, reports indicated a substantial rise in HNWI population and their aggregate wealth, underscoring a positive environment for wealth management services.

The continued expansion of this affluent segment is paramount for EFG International's business model. Their increasing wealth and numbers translate directly into greater demand for the sophisticated financial services EFG provides, solidifying its market position.

Investment Trends and Asset Allocation

High-net-worth individuals (HNWIs) are increasingly shifting their investment focus. There's a notable surge in demand for alternative assets, such as private equity and hedge funds, alongside a strong commitment to sustainable investing, often driven by Environmental, Social, and Governance (ESG) principles. For instance, global ESG assets are projected to reach $50 trillion by 2025, demonstrating this significant trend.

EFG International is responding to these evolving preferences by refining its product suite and advisory services. The firm is concentrating on delivering bespoke investment solutions and holistic guidance, catering to client desires for portfolio diversification. This strategic adaptation aims to strike a balance between safeguarding capital and achieving robust growth.

- Growing HNWI interest in alternative assets: Private equity and hedge fund allocations are on the rise.

- Increased demand for ESG investments: Sustainable investing is a key driver for portfolio construction.

- EFG's strategic response: Tailored solutions and diversified strategies are being emphasized.

- Balancing client objectives: Focus on capital preservation alongside growth opportunities.

Currency Fluctuations and Foreign Exchange Impacts

Currency fluctuations significantly influence EFG International's global operations, affecting its assets under management and overall financial health. The company's broad international presence means that shifts in exchange rates can lead to substantial gains or losses.

In 2024, EFG International experienced a positive impact from foreign exchange movements. This contributed to an increase in the company's assets under management, highlighting the sensitivity of its financial performance to global currency markets.

- Currency Volatility: EFG International's extensive international network exposes it to the risks and opportunities presented by fluctuating exchange rates.

- 2024 Performance: Positive foreign exchange impacts were a notable factor in the growth of EFG's assets under management during 2024.

- Impact on Financials: Changes in currency values directly affect the reported value of EFG's international assets and its consolidated financial statements.

The economic landscape in 2024 and projections for 2025 present a mixed but generally supportive environment for EFG International. While global growth is steady, persistent inflation and evolving interest rate policies require strategic navigation.

The increasing wealth of High-Net-Worth Individuals (HNWIs) and their growing appetite for alternative and ESG-focused investments present significant opportunities for EFG International. The firm's ability to adapt its offerings to these trends will be crucial for continued success.

Currency fluctuations also played a notable role in 2024, positively impacting EFG International's assets under management. This underscores the importance of managing currency risk in its global operations.

| Economic Factor | 2024 Data/Trend | 2025 Projection/Trend | Impact on EFG International |

|---|---|---|---|

| Global GDP Growth | IMF projected 3.1% (Oct 2024) | IMF projected 3.2% (Oct 2024) | Supports demand for asset management services. |

| Inflation (US Avg) | Around 4.1% (2023), concern in 2024 | Expected to moderate but remain a factor | Necessitates inflation-hedging investment strategies. |

| HNWI Population Growth | Significant rise in 2024 | Continued robust growth | Directly increases client base and AUM potential. |

| ESG Assets Under Management | Projected to reach $50 trillion by 2025 | Continued strong growth | Drives demand for sustainable investment products. |

| Foreign Exchange Impact | Positive contribution to AUM in 2024 | Ongoing potential for positive or negative impact | Requires active currency risk management. |

Full Version Awaits

EFG International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This EFG International PESTLE Analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. It's designed to offer actionable insights for strategic decision-making.

Sociological factors

A major sociological force shaping private banking, including EFG International, is the massive inter-generational wealth transfer. Estimates suggest that by 2048, a staggering $80 trillion in wealth will transition to younger generations in the US alone, with similar trends globally.

This influx of wealth to Gen X, millennials, and Gen Z, often termed 'Next-gen HNWIs,' presents a significant opportunity. These demographics typically exhibit different investment priorities, favoring sustainable and impact investing, digital engagement, and personalized advice.

EFG must therefore adapt its service models and communication strategies to resonate with these evolving client preferences. Understanding their digital fluency and desire for purpose-driven investments is crucial for retaining and attracting this new wave of high-net-worth individuals.

High-net-worth individuals are increasingly demanding highly personalized financial guidance, seeking services that truly reflect their unique goals, lifestyle choices, and core values. This trend is a significant sociological factor influencing the wealth management sector.

EFG International's strategic focus on a client-centric model, particularly its Client Relationship Officer (CRO) framework, directly addresses this demand. This approach aims to provide bespoke financial solutions, fostering deeper, more enduring client relationships by blending individualized attention with a broad, global outlook.

High-net-worth and ultra-high-net-worth clients are increasingly prioritizing Environmental, Social, and Governance (ESG) factors in their investment decisions. This shift reflects a growing awareness of sustainability and a desire for portfolios to align with personal values. For instance, a 2024 survey by Capgemini indicated that 68% of wealth management clients are interested in ESG investing, a significant jump from previous years.

EFG International is actively responding to this demand by embedding ESG considerations into its investment strategies and product development. The firm aims to cater to clients seeking socially responsible investment options, recognizing that sustainable practices are becoming a key differentiator in wealth management. This strategic focus is crucial for attracting and retaining clients who view ESG not just as an ethical choice, but also as a driver of long-term financial performance.

Talent Acquisition and Retention

The private banking sector, particularly in Asia and the Middle East, is experiencing a persistent scarcity of skilled professionals, especially for Relationship Manager (RM) roles. This talent gap can impede expansion plans and put pressure on operational efficiency, impacting cost-to-income ratios. For instance, in 2024, industry reports indicated that the demand for experienced RMs in these growth regions outstripped supply by as much as 30%.

EFG International's proactive strategy includes significant investments aimed at bolstering its talent pool and broadening client engagement. This involves the recruitment of new Chief Representative Officers (CROs) and other key personnel. Such initiatives are vital for EFG International to maintain its growth trajectory and competitive edge in these dynamic markets.

- Talent Shortage Impact: The ongoing shortage of qualified Relationship Managers in key growth markets like Asia and the Middle East directly impacts the ability of private banks to scale operations and manage client relationships effectively.

- Cost-to-Income Ratios: A lack of available talent can lead to increased recruitment costs and higher compensation demands, potentially widening the cost-to-income ratio for firms like EFG International.

- Strategic Hiring: EFG International's focus on expanding its talent base, including the hiring of new CROs, is a critical component of its growth strategy, aiming to capture market share and enhance client service.

- Market Competitiveness: The ability to attract and retain top talent is a key differentiator in the competitive private banking landscape, directly influencing a firm's capacity for client acquisition and asset growth.

Changing Lifestyles and Digital Engagement

Next-generation High Net Worth Individuals (HNWIs) are increasingly prioritizing digital convenience. A 2024 report indicated that 75% of HNWIs under 40 expect their wealth managers to offer sophisticated digital platforms for portfolio tracking and transactions, mirroring their experiences with other digital services.

While digital engagement is crucial, clients still value the personal touch. EFG International must therefore navigate the expectation for streamlined digital interactions alongside the enduring need for trusted, human-led advice. This means integrating technology to enhance, not replace, client relationships.

- Digital Expectations: Over 70% of surveyed HNWIs in 2024 expressed a desire for omnichannel wealth management solutions, allowing seamless transitions between digital and human interaction.

- Efficiency Gains: By adopting advanced digital tools, EFG can potentially reduce operational costs associated with client onboarding and routine inquiries, freeing up advisors for more complex advisory services.

- Client Retention: Failure to adapt to digital demands could lead to attrition, with a significant portion of younger HNWIs indicating they would switch providers if digital offerings are subpar.

The evolving preferences of High Net Worth Individuals (HNWIs) represent a significant sociological shift impacting EFG International. Younger generations, in particular, are driving demand for ESG-focused investments and digital-first client experiences, with a 2024 survey showing 68% of wealth management clients interested in ESG. This necessitates a strategic adaptation of service models to align with these values and technological expectations.

The inter-generational wealth transfer is another key sociological factor, with trillions set to pass to younger demographics. These 'Next-gen HNWIs' often prioritize personalized advice and digital engagement, requiring wealth managers like EFG to enhance their digital platforms and communication strategies to cater to these evolving needs.

Societal expectations for personalized service are paramount, with clients seeking financial guidance that truly reflects their unique goals and values. EFG International's client-centric approach, exemplified by its CRO framework, directly addresses this by offering bespoke solutions and fostering deeper relationships.

Technological factors

The private banking sector is rapidly embracing digital transformation, with EFG International at the forefront of adopting innovative technologies. This push for digitalization aims to streamline operations and enhance client interactions.

EFG International's commitment to its simplicity mindset is driving increased automation across its processes. For instance, in 2024, the firm continued to invest in digital platforms designed to boost operational efficiency and deliver a superior client experience, reflecting a broader industry trend towards technological integration.

Artificial Intelligence and Machine Learning are increasingly crucial for competitive advantage in private banking. These technologies facilitate predictive analytics, refine risk management, streamline compliance, and personalize client interactions. For instance, by 2024, wealth management firms are expected to invest billions in AI to enhance client advisory services and operational efficiency.

EFG can harness AI to deliver more precise and tailored investment suggestions, improve internal operational workflows, and bolster fraud detection capabilities. The adoption of AI in financial services is projected to grow significantly, with an estimated global market size of over $100 billion by 2025, underscoring its transformative potential for firms like EFG.

Cybersecurity and data protection are critical for EFG International. In 2023, the financial services industry experienced a significant rise in cyber threats, with reports indicating a 45% increase in ransomware attacks compared to the previous year. EFG must prioritize investments in cutting-edge security technologies and comprehensive employee training to counter sophisticated threats like phishing and malware.

The banking sector, in particular, faces persistent risks from cybercriminals targeting sensitive client data. A recent study by IBM’s 2024 Cost of a Data Breach Report found that the average cost of a data breach in financial services reached $5.90 million, underscoring the financial and reputational damage at stake. EFG's commitment to robust data governance and advanced protective measures is essential for maintaining client trust and operational integrity.

Blockchain Technology and Tokenization

Blockchain technology and asset tokenization are fundamentally altering the landscape of private banking. This shift offers opportunities for increased liquidity and transparency in traditionally illiquid asset classes, potentially making private banking more accessible. For instance, the global tokenized assets market was projected to reach $20 trillion by 2030, indicating significant growth potential.

EFG International can leverage these advancements to attract a younger, digitally native high-net-worth individual (HNWI) client base. By offering tokenized investment products, EFG can tap into new revenue streams and provide innovative solutions that resonate with tech-savvy investors.

Key implications for EFG include:

- Enhanced Client Engagement: Offering tokenized assets can appeal to younger HNWIs who are more comfortable with digital platforms and new investment vehicles.

- Expanded Product Offerings: Tokenization can unlock investment opportunities in previously inaccessible or illiquid assets, such as real estate or fine art, broadening EFG's portfolio.

- Operational Efficiencies: Blockchain's inherent transparency and automation capabilities can streamline back-office processes, reducing costs and improving settlement times.

Cloud Computing and Data Management

Cloud computing is transforming financial services by offering significant cost reductions and increased agility. EFG International can leverage cloud-native platforms to streamline operations, enhance data accessibility, and improve scalability. For instance, in 2024, the global cloud computing market in financial services was projected to reach over $100 billion, highlighting the widespread adoption and its impact on efficiency.

The ability to access data securely from multiple locations is a key advantage. This facilitates more efficient data management and empowers data-driven decision-making across EFG's operations. By adopting robust cloud solutions, EFG can ensure its infrastructure can adapt to evolving market demands and regulatory landscapes.

- Reduced Operational Costs: Cloud solutions typically lower infrastructure and maintenance expenses.

- Enhanced Flexibility and Scalability: EFG can quickly adjust resources based on business needs.

- Improved Data Availability and Security: Secure access to data across different locations supports global operations.

- Data-Driven Decision-Making: Efficient data management enables better strategic insights.

EFG International is navigating a landscape shaped by rapid technological advancements, particularly in AI and blockchain, which are crucial for competitive advantage. The firm's investment in digital platforms and automation, as seen in its 2024 initiatives, reflects a broader industry trend towards leveraging these technologies to enhance client experience and operational efficiency.

Legal factors

EFG International navigates a global financial regulatory environment that is both intricate and dynamic. Staying compliant with rules from bodies like the SEC and FINRA is crucial for achieving sustained profitability and growth.

Regulators are increasingly scrutinizing areas such as environmental, social, and governance (ESG) disclosures, cybersecurity measures, and the monitoring of off-channel communications. For instance, the SEC's proposed rules on climate-related disclosures, which are expected to be finalized in 2024, will significantly impact how financial institutions report their environmental impact.

Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations present a substantial compliance challenge for private banks like EFG International. These laws, designed to combat financial crime, necessitate rigorous customer due diligence and ongoing transaction monitoring. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting global regulatory frameworks throughout 2024 and into 2025, requiring continuous adaptation.

Failure to adhere to evolving AML/KYC standards can result in severe penalties, including hefty fines and reputational damage. EFG International, like its peers, must invest heavily in technology and personnel to ensure robust compliance, a cost that is expected to remain significant in the 2024-2025 period as regulatory scrutiny intensifies.

Evolving data privacy regulations like GDPR and CCPA significantly impact EFG International's operations, demanding strict adherence to customer data handling. Compliance requires substantial investment in data governance, including advanced encryption and secure storage solutions, to safeguard sensitive client information and maintain trust.

Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. In 2024, many financial institutions, including those in wealth management like EFG International, are enhancing their data protection measures to meet these growing legal obligations and avoid significant financial and reputational damage.

Consumer Protection Laws

Consumer protection laws significantly shape EFG International's operational framework, influencing everything from product development to client communication. These regulations mandate transparency, robust disclosure practices, and fair treatment of clients, directly impacting how EFG structures its financial services and manages potential conflicts of interest. For instance, in 2024, regulatory bodies globally continued to scrutinize financial institutions for adherence to consumer protection standards, with fines for non-compliance reaching substantial figures in cases of mis-selling or inadequate risk disclosure.

Adherence to these legal mandates is not merely a compliance exercise but a cornerstone of maintaining client trust and EFG International's reputation. Failure to comply can lead to severe penalties, reputational damage, and loss of business. In the first half of 2025, several major financial services firms faced significant regulatory actions related to consumer protection, underscoring the ongoing importance of robust compliance programs.

- Transparency Requirements: Laws dictate the clarity and accessibility of information provided to consumers regarding financial products and services.

- Disclosure Obligations: EFG International must ensure comprehensive and accurate disclosure of fees, risks, and terms to all clients.

- Fair Practices: Regulations prohibit unfair or deceptive practices, ensuring clients are not misled or exploited.

- Investor Protection: Specific rules govern how investors are safeguarded, including suitability requirements and anti-fraud measures.

Acquisition and Merger Regulations

EFG International's growth strategy heavily relies on mergers and acquisitions, making compliance with acquisition and merger regulations paramount. For instance, the company's agreed acquisition of Cité Gestion in early 2024 required rigorous scrutiny from regulatory bodies to ensure it did not stifle competition or jeopardize financial stability within the Swiss banking landscape. These regulatory hurdles are designed to maintain a healthy market environment.

Navigating these complex legal frameworks is crucial for successful integration and long-term operational viability. Failure to adhere to these regulations can result in significant penalties, delays, or even the termination of deals. EFG International must therefore maintain a proactive approach to regulatory compliance, staying abreast of evolving legal requirements in all its operating jurisdictions.

Key regulatory considerations include:

- Antitrust reviews: Ensuring the acquisition does not create a dominant market position that could harm consumers or other businesses.

- Financial Stability Assessments: Regulators evaluate the potential impact of the merger on the stability of the financial system.

- Shareholder approvals: Obtaining necessary consent from shareholders of both acquiring and target companies.

- Cross-border regulatory coordination: For international deals, multiple regulatory bodies may need to grant approval.

The legal landscape for EFG International is characterized by stringent data privacy laws, such as GDPR and CCPA, demanding robust data governance and security measures. For example, GDPR fines can reach up to 4% of global annual revenue, a significant deterrent for non-compliance. In 2024, EFG International, like many financial institutions, continued to invest in advanced encryption and secure storage to protect sensitive client information and maintain trust, a trend expected to persist through 2025.

Environmental factors

Climate change presents a significant challenge, driving a global push for immediate climate action. EFG International acknowledges that true sustainability requires a careful balance of economic prosperity, environmental stewardship, and social equity. This commitment is detailed in their annual reports, showcasing their dedication to operating responsibly.

In 2024, the financial sector faced increased scrutiny regarding its role in climate finance. For instance, the European Central Bank's 2024 climate stress test revealed that banks' exposures to high-carbon sectors could lead to significant losses under severe climate scenarios. EFG International's sustainability reports, such as the one published in early 2025, likely detail their strategies for managing climate-related risks and capitalizing on green finance opportunities, aiming to align their portfolio with net-zero targets.

The financial sector, including EFG International, is increasingly prioritizing ethical investing and meeting Environmental, Social, and Governance (ESG) requirements. This focus is driven by a growing client demand for socially responsible investment options. For instance, in 2024, global sustainable investment assets were projected to reach $50 trillion, highlighting the significant market shift.

EFG is actively integrating ESG factors into its investment strategies to attract and retain clients who value sustainability. This proactive approach aims to align with evolving market expectations. However, this trend also brings heightened scrutiny from regulators concerned about 'greenwashing,' the practice of making misleading claims about environmental benefits.

To combat greenwashing, regulatory bodies are intensifying oversight, demanding greater transparency and credibility in sustainability reporting. For example, the EU's Sustainable Finance Disclosure Regulation (SFDR) is a key piece of legislation requiring financial firms to disclose how they integrate sustainability risks and consider adverse sustainability impacts in their investment processes, impacting firms like EFG.

Broader environmental risks like resource scarcity and extreme weather events, while not directly impacting EFG International's operations, can significantly influence the economic stability of regions where their clients hold investments. For instance, the increasing frequency of droughts in agricultural regions, a key sector for many investors, could lead to reduced crop yields and economic downturns, affecting asset valuations.

Water scarcity, a growing concern globally, presents a material risk for businesses reliant on water resources, potentially impacting their profitability and long-term viability. This could translate into challenges for EFG's clients invested in sectors such as manufacturing, agriculture, and energy, necessitating a careful assessment of asset resilience.

According to the World Meteorological Organization, the period from 2023 to 2025 is projected to continue the trend of record-breaking temperatures, with El Niño conditions potentially exacerbating extreme weather events. Such events can disrupt supply chains, damage infrastructure, and lead to significant economic losses, directly influencing investment decisions and the perceived risk of assets within EFG's client portfolios.

Environmental Regulations and Reporting

Environmental regulations are tightening globally, with a significant focus on climate-related disclosures for public companies. EFG International must adapt by enhancing transparency and precision in its reporting to meet these evolving requirements. This means investing in robust systems for accurately tracking and reporting Environmental, Social, and Governance (ESG) metrics.

Integrating these ESG factors into investment strategies is becoming crucial for risk management and identifying opportunities. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are increasingly being adopted, with many jurisdictions mandating similar reporting frameworks. By 2024, a growing number of countries were implementing or considering mandatory climate-risk reporting, reflecting a significant shift in regulatory expectations.

- Increased Scrutiny on ESG Data: Regulators are demanding more granular and verifiable ESG data from financial institutions.

- Climate Risk Integration: EFG needs to embed climate-related risks and opportunities into its core business and investment decision-making processes.

- Reporting Standards Evolution: Staying abreast of evolving global reporting standards, such as those from the International Sustainability Standards Board (ISSB), is paramount.

- Investor Demand for Transparency: Investors are increasingly prioritizing companies with strong ESG performance and transparent reporting, influencing EFG's strategic direction.

Reputational Risk from Environmental Impact

EFG International's reputation is closely tied to its environmental stewardship. A strong commitment to sustainability can bolster its image, attracting clients who prioritize eco-friendly investments. For instance, by actively financing projects aligned with the EU's Green Deal objectives, EFG can signal its dedication to a low-carbon future.

Conversely, any perceived indifference to environmental concerns poses a significant reputational threat. Negative press or public scrutiny regarding the company's carbon footprint or investment portfolio could alienate stakeholders and lead to a decline in client trust. In 2024, for example, financial institutions facing scrutiny for financing fossil fuel projects saw a notable dip in ESG (Environmental, Social, and Governance) fund inflows.

- Enhanced Brand Image: Aligning with global sustainability goals, such as the UN Sustainable Development Goals, can significantly improve EFG International's brand perception.

- Client Attraction: A demonstrable commitment to green finance can attract a growing segment of environmentally conscious investors and corporate clients.

- Risk Mitigation: Proactively addressing environmental impact reduces the likelihood of negative publicity and associated reputational damage.

Climate change and resource scarcity are increasingly influencing investment decisions and regulatory landscapes. EFG International must navigate these environmental shifts by integrating sustainability into its core strategies, as evidenced by the growing demand for ESG-aligned investments and stricter disclosure requirements globally.

The financial sector's role in climate finance is under intense scrutiny, with regulators like the European Central Bank highlighting potential losses from high-carbon exposures. EFG International's commitment to sustainability, as detailed in its 2025 reports, likely focuses on managing climate risks and capitalizing on green finance opportunities to align with net-zero targets.

Global sustainable investment assets were projected to exceed $50 trillion in 2024, underscoring the market's strong shift towards ethical investing and ESG compliance. EFG's integration of ESG factors aims to attract clients valuing sustainability, though it necessitates vigilance against greenwashing accusations, a concern amplified by regulations like the EU's SFDR.

| Environmental Factor | Impact on EFG International | Data/Trend (2024-2025) |

| Climate Change & Net-Zero Targets | Risk management, green finance opportunities, reputational impact | Global push for climate action; ECB climate stress tests highlight risks (2024) |

| Resource Scarcity (e.g., Water) | Asset valuation, client portfolio risk in water-dependent sectors | Growing global concern; potential impact on agriculture, manufacturing, energy sectors |

| Extreme Weather Events | Supply chain disruption, infrastructure damage, economic volatility affecting investments | Projected continued record temperatures (WMO 2023-2025); El Niño exacerbating events |

| Regulatory & Reporting Demands (ESG/TCFD) | Increased transparency, compliance costs, need for robust data systems | Mandatory climate risk reporting adoption by more countries (2024); ISSB standards evolution |

PESTLE Analysis Data Sources

Our PESTLE Analysis for EFG International is built on data from official government publications, international financial institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.