EFG International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EFG International Bundle

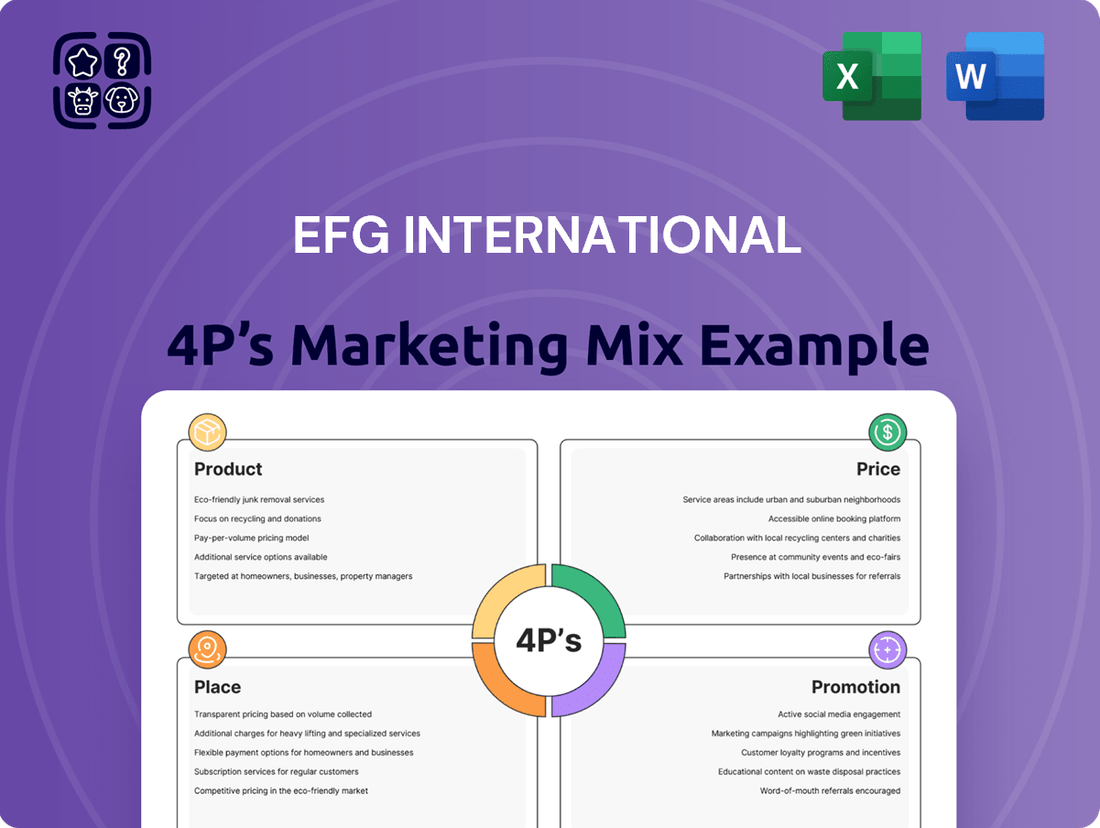

Discover how EFG International masterfully crafts its product offerings, sets competitive prices, strategically places its services, and promotes its brand to a global audience. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Unlock the full potential of EFG International's marketing strategy with our comprehensive 4Ps analysis. Gain actionable insights into their product development, pricing models, distribution channels, and promotional campaigns, all presented in an editable, presentation-ready format.

Save valuable time and gain a competitive edge with our pre-written, in-depth 4Ps Marketing Mix Analysis for EFG International. This report provides structured thinking, real-world examples, and strategic insights perfect for business planning or academic benchmarking.

Product

Tailored Investment Solutions are a cornerstone of EFG International's offering, focusing on bespoke strategies for high-net-worth and ultra-high-net-worth clients. These solutions are meticulously crafted to align with individual financial goals, tolerance for risk, and long-term investment timelines.

EFG International provides access to a diverse array of asset classes, allowing for comprehensive portfolio diversification. Clients can select between discretionary mandates, entrusting investment decisions to EFG's seasoned professionals, or advisory mandates, where they retain control with expert support.

In 2024, EFG International reported managing CHF 142.4 billion in client assets, underscoring the significant scale of its personalized wealth management services. This vast asset base reflects the trust placed in their ability to deliver customized investment outcomes.

EFG International's comprehensive wealth management advice is the cornerstone of its product strategy, offering clients a holistic approach that extends beyond mere investment management. This includes detailed financial planning, sophisticated wealth structuring, and crucial succession planning, all designed to ensure wealth is managed, preserved, and grown effectively across generations, even amidst fluctuating market environments.

In 2024, EFG International continued to emphasize this integrated service, aiming to address the complex needs of affluent individuals and families. For instance, the firm's advisors work closely with clients to develop customized strategies that align with long-term objectives, such as navigating evolving tax regulations and optimizing philanthropic endeavors, a critical component of wealth preservation for many.

The firm's commitment to providing robust wealth management solutions is reflected in its client engagement. By offering a broad spectrum of services, EFG International aims to be a trusted partner in guiding clients through intricate financial landscapes, ensuring their financial legacy is secured and enhanced for the future.

EFG International's Trust and Fund Services extend beyond conventional banking, offering sophisticated wealth protection and transfer solutions. They leverage structures like trusts, companies, and foundations, demonstrating a commitment to comprehensive estate planning for their clients.

Furthermore, EFG International provides robust fund administration and support services tailored for investment managers. This dual focus highlights their ability to cater to both individual wealth management needs and the operational requirements of the broader financial industry.

In 2024, EFG International reported a significant increase in assets under administration for its wealth management segment, underscoring the growing demand for specialized trust and fund services. This growth reflects client confidence in EFG's expertise in navigating complex financial landscapes.

Credit and Financing Solutions

EFG International's credit and financing solutions are a cornerstone of its wealth management offering, designed to empower clients' investment endeavors. These flexible options cater to both domestic and international needs, ensuring clients have the capital required to seize opportunities and achieve their financial objectives.

These financing services are not standalone products but are strategically integrated into EFG's holistic wealth management approach. This ensures clients receive seamless access to liquidity, enabling them to capitalize on market movements or fund significant life events without disrupting their long-term investment strategies. For instance, in 2024, EFG reported a significant increase in the utilization of its Lombard lending facilities, demonstrating client confidence in leveraging assets for liquidity.

- Flexible Credit Lines: EFG provides tailored credit facilities, including Lombard loans, allowing clients to borrow against their investment portfolios.

- International Reach: Solutions are available for clients with cross-border investment needs, facilitating global financial activities.

- Integrated Wealth Management: Financing is a component of a broader strategy, supporting clients' overall financial planning and investment goals.

- Liquidity Support: Clients gain access to capital when needed, ensuring they can act on investment opportunities or manage cash flow effectively.

Digital Tools and Platforms

EFG International is actively enhancing its digital tools and platforms to improve client experience and streamline operations. A key initiative is the development of multi-custody platforms specifically designed for independent asset managers. These platforms are built to offer sophisticated capabilities in client relationship management, portfolio oversight, and detailed reporting, signaling a strategic shift towards more responsive and data-informed financial solutions.

These digital advancements are crucial for EFG's competitive positioning. For instance, in 2024, the wealth management sector saw significant investment in digital client onboarding, with many firms reporting completion times reduced by up to 50% through digital solutions. EFG's multi-custody platforms are designed to deliver similar efficiencies, providing asset managers with enhanced control and transparency.

- Enhanced Client Relationship Management: Tools for deeper client insights and personalized service.

- Advanced Portfolio Management: Capabilities for sophisticated asset allocation and risk assessment.

- Streamlined Reporting: Automated and customizable reports for clients and internal use.

- Multi-Custody Functionality: Enabling asset managers to consolidate and manage assets from various custodians efficiently.

EFG International's product strategy centers on delivering comprehensive wealth management solutions, encompassing tailored investment strategies, trust and fund services, and integrated credit and financing options. These offerings are designed to meet the complex needs of high-net-worth clients, providing holistic financial planning, wealth structuring, and liquidity support.

The firm's commitment to innovation is evident in its digital platform enhancements, including multi-custody solutions for asset managers, aiming to improve client experience and operational efficiency. In 2024, EFG International managed CHF 142.4 billion in client assets, highlighting the substantial trust and scale of its personalized wealth management services.

| Product Offering | Key Features | 2024 Data/Insight |

|---|---|---|

| Tailored Investment Solutions | Bespoke strategies, diverse asset classes, discretionary/advisory mandates | CHF 142.4 billion in client assets managed |

| Trust and Fund Services | Wealth protection, estate planning, fund administration for investment managers | Significant increase in assets under administration for wealth management segment |

| Credit and Financing Solutions | Flexible credit lines (e.g., Lombard loans), international reach, integrated with wealth management | Increased utilization of Lombard lending facilities |

| Digital Platforms | Multi-custody platforms for asset managers, enhanced CRM, advanced portfolio management | Focus on improving client experience and operational efficiency through digital tools |

What is included in the product

This analysis offers a comprehensive examination of EFG International's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It provides a deep dive into EFG International's marketing positioning, perfect for managers, consultants, and marketers seeking a thorough understanding of their approach.

Simplifies complex marketing strategy into actionable insights, alleviating the pain of overwhelming data for EFG International.

Provides a clear, concise overview of EFG International's 4Ps, reducing the burden of detailed analysis for busy executives.

Place

EFG International's extensive global network, spanning over 40 locations across key regions like Europe, Asia Pacific, the Americas, and the Middle East, is a cornerstone of their place strategy. This expansive footprint allows them to deliver specialized Swiss private banking solutions to a diverse international clientele.

This widespread presence is more than just geographical reach; it signifies a commitment to offering localized expertise. By having offices in over 40 locations, EFG ensures clients receive services that understand regional nuances while benefiting from a unified global perspective, a critical advantage in the complex world of international finance.

Switzerland, with its strategic hubs in Zurich, Geneva, and Lugano, forms the bedrock of EFG International's global presence. These locations are not just operational centers but are integral to the bank's identity as a premier Swiss private bank, fostering deep client relationships and underpinning core banking functions.

These Swiss hubs are critical for EFG International's governance and client interaction strategies. In 2023, EFG International reported total client assets of CHF 141.4 billion, underscoring the significance of these well-established financial centers in managing and growing wealth for their clientele.

EFG International's distribution strategy heavily relies on its Client Relationship Officer (CRO) model, focusing on personalized client engagement and local market presence. This approach aims to build deep client trust and drive net new assets.

The bank's commitment to this model is evident in its active recruitment of CROs, recognizing them as crucial drivers of growth. In 2024, EFG reported that CROs were instrumental in achieving significant increases in client acquisition and retention.

This personalized outreach fosters stronger client loyalty, a key differentiator in the competitive wealth management landscape. The emphasis on geographic proximity allows CROs to better understand and cater to the specific needs of their local client base.

Acquisitions for Market Expansion

EFG International is actively pursuing market expansion through strategic acquisitions. This approach allows them to quickly gain market share and enhance their service capabilities in targeted regions. For instance, the agreement to acquire Swiss private bank Cité Gestion is a significant move to strengthen their domestic position and client base.

Further demonstrating this strategy, EFG International is acquiring a majority stake in New Zealand's Investment Services Group. This expansion into Oceania broadens their geographical footprint and diversifies their investment product suite. These moves are crucial for EFG's growth trajectory in the competitive global wealth management landscape.

- Acquisition of Cité Gestion: Enhances EFG's Swiss market presence and private banking expertise.

- Investment in Investment Services Group (New Zealand): Expands EFG's reach into the Asia-Pacific region and diversifies service offerings.

- Strategic Growth: Acquisitions are a core component of EFG International's strategy to bolster market share and expand service capabilities.

Digital Accessibility and Client Reach

EFG International, while rooted in private banking, is actively enhancing its digital accessibility. This strategic shift aims to streamline client interactions and broaden its reach beyond traditional physical touchpoints. The investment in digital platforms signifies a commitment to providing convenient and efficient service delivery.

This digital push is crucial for meeting the evolving expectations of clients and independent asset managers who increasingly value seamless online experiences. It complements EFG's established physical presence by offering an alternative, often more immediate, channel for engagement and service provision.

By focusing on digital transformation, EFG is positioning itself to cater to a wider audience and improve operational efficiency. This includes:

- Enhanced Client Portals: Offering secure, user-friendly platforms for account management and transaction initiation.

- Digital Onboarding: Streamlining the process for new clients and asset managers to engage with EFG's services.

- Data Analytics: Leveraging digital interactions to gain insights into client needs and preferences, thereby personalizing service offerings.

EFG International's place strategy is characterized by a robust global network of over 40 locations, with Switzerland serving as its core operational and reputational hub. This physical presence is augmented by a digital strategy focused on enhancing client accessibility and service delivery.

The bank's distribution model emphasizes personalized client engagement through its Client Relationship Officer (CRO) network, supported by strategic acquisitions to expand market reach and capabilities.

In 2023, EFG International managed CHF 141.4 billion in client assets, highlighting the scale and importance of its strategically located Swiss centers and global network in serving its clientele.

| Location Focus | Strategy Element | Key Data/Impact |

|---|---|---|

| Global Network | Extensive reach (40+ locations) | Serves diverse international clientele with specialized Swiss private banking. |

| Swiss Hubs (Zurich, Geneva, Lugano) | Core identity and operations | Underpin governance, client relationships, and core banking functions. |

| Client Relationship Officers (CROs) | Personalized engagement | Crucial for client acquisition, retention, and net new assets growth. |

| Strategic Acquisitions | Market expansion | Enhances market share and service capabilities in targeted regions (e.g., Cité Gestion, Investment Services Group). |

| Digital Platforms | Enhanced accessibility | Streamlines client interactions and broadens reach beyond physical touchpoints. |

What You See Is What You Get

EFG International 4P's Marketing Mix Analysis

The preview you see here is the exact same EFG International 4P's Marketing Mix Analysis document that you will receive instantly after purchase. There are no hidden surprises or altered content; what you preview is precisely what you will download. This ensures you get a complete and ready-to-use analysis immediately upon completing your order.

Promotion

EFG International's promotion strategy is deeply rooted in its Client Relationship Officer (CRO) model. This approach prioritizes building robust, trusted, and enduring connections with high-net-worth and ultra-high-net-worth individuals. It's all about that direct, personal touch and tailored advice, which really sets EFG apart in the market.

EFG International actively cultivates thought leadership by disseminating insightful market outlooks and expert analyses. This strategic approach, exemplified by their regular publications, aims to equip financially literate individuals and professionals with critical information on emerging trends and effective investment strategies.

By consistently providing valuable perspectives, EFG International solidifies its reputation as a trusted authority and a reliable partner within the competitive financial landscape. For instance, in 2024, their research highlighted a significant shift towards sustainable investing, with global ESG assets projected to reach $50 trillion by 2025, underscoring their forward-looking analysis.

EFG International actively promotes its robust financial performance, highlighting achievements like record profits and substantial net new asset growth. These positive results are communicated through official reports and investor presentations, serving as a key promotional element.

For instance, in the first half of 2024, EFG International reported a net profit of CHF 252 million, a notable increase and a testament to their effective strategies. This transparency in sharing strong financial data directly builds investor confidence and attracts new clients.

Targeted Public Relations and Media Engagement

EFG International leverages targeted public relations and media engagement as a key component of its marketing strategy. This involves proactively disseminating information about significant corporate milestones, such as strategic acquisitions and key leadership changes, to prominent financial news outlets. This strategic communication aims to secure favorable media coverage, thereby reinforcing EFG International's established market position and broadening its brand recognition among its intended audience.

By consistently engaging with the media, EFG International ensures its narrative is shaped and amplified. For instance, announcements of new business developments or strategic partnerships can generate valuable earned media, directly impacting brand perception and investor confidence. This proactive approach is crucial in a competitive financial landscape.

The effectiveness of this strategy is underscored by the media's role in disseminating EFG International's achievements. Key performance indicators for PR success often include the volume and sentiment of media mentions, as well as the reach of publications. In 2024, financial news outlets reported extensively on EFG International's expansion initiatives, contributing to a notable increase in brand visibility.

- Strategic Announcements: EFG International regularly issues press releases detailing acquisitions, executive appointments, and significant business achievements.

- Media Coverage: This proactive communication secures placements in leading financial publications, enhancing brand visibility and credibility.

- Market Positioning: Consistent media presence reinforces EFG International's standing as a key player in the global financial services sector.

- Brand Awareness: Targeted PR efforts expand reach and awareness among investors, clients, and industry stakeholders.

Strategic Plan Communication

EFG International's strategic plan, spanning 2023-2025, emphasizes profitable growth, scale, and operational efficiency. This clear articulation of their roadmap fosters confidence among stakeholders by demonstrating a focused approach to long-term value creation. The bank's commitment to communicating these objectives is a key element in its marketing strategy, aligning internal efforts with external perceptions.

The bank's communication of its 2023-2025 strategic plan directly supports its marketing efforts by providing a clear narrative for investors and clients. This transparency builds trust and highlights EFG International's dedication to achieving specific financial targets and enhancing its market position. For instance, the bank reported a 12% increase in net profit in the first half of 2024 compared to the same period in 2023, underscoring progress towards its profitability goals.

- Strategic Focus: Profitable growth, scale, and operational efficiency for 2023-2025.

- Communication Goal: Promote vision and commitment to long-term value creation.

- Financial Performance Indicator: 12% net profit increase in H1 2024 (year-on-year).

- Market Impact: Building stakeholder confidence through transparent strategic reporting.

EFG International's promotion centers on its client-centric model, emphasizing personalized advice and long-term relationships. They actively build brand authority through thought leadership, sharing market insights and research, as evidenced by their focus on sustainable investing trends in 2024. This approach is reinforced by transparent communication of strong financial performance, such as their CHF 252 million net profit in H1 2024, which builds investor trust.

EFG International utilizes strategic public relations to highlight corporate milestones and expansion efforts, aiming for positive media coverage to enhance brand recognition. Their 2023-2025 strategic plan, focused on profitable growth and efficiency, is a key promotional tool, with a 12% net profit increase in H1 2024 demonstrating progress towards these goals.

| Promotional Element | Key Activity | Impact/Data Point |

|---|---|---|

| Client Relationship Model | Personalized advice from CROs | Fosters trust and enduring client connections |

| Thought Leadership | Market outlooks and expert analysis | Establishes authority; highlighted ESG trend focus in 2024 |

| Financial Performance Communication | Reporting profits and growth | Builds investor confidence; H1 2024 net profit CHF 252 million |

| Public Relations | Media engagement on milestones | Enhances brand visibility and credibility; reported expansion initiatives in 2024 |

| Strategic Plan Communication | Articulating 2023-2025 roadmap | Builds stakeholder confidence; H1 2024 net profit up 12% YoY |

Price

EFG International recognizes that high-net-worth clients have unique needs, so they offer tailored fee structures. This means pricing isn't one-size-fits-all.

One popular option is an 'all-in' fee. This fee is calculated based on the average value of a client's entire portfolio, conveniently bundling brokerage and administration costs into a single, predictable charge.

This flexible approach allows EFG International to customize pricing, ensuring clients only pay for the specific services and products they actually use, aligning costs directly with their wealth management requirements.

EFG International likely employs value-based pricing for its bespoke wealth management solutions, aligning costs with the significant value delivered to its high-net-worth clientele. This approach emphasizes the personalized advice, comprehensive financial planning, and exclusive access to global investment opportunities that differentiate its offerings.

The perceived value for clients stems from tailored strategies designed to preserve and grow wealth, often involving complex international structures and specialized investment vehicles. For instance, in 2024, EFG reported a significant portion of its assets under management were from ultra-high-net-worth individuals, underscoring the premium nature of the services they receive.

EFG International's pricing within private banking is carefully calibrated against industry benchmarks, ensuring its services remain competitive without compromising value. While exact figures are proprietary, the bank actively monitors competitor pricing to maintain an attractive market position.

The bank's pricing strategy is underpinned by a strong emphasis on client-centricity and the delivery of specialized, high-value services. This approach allows EFG to justify its price points, differentiating itself in a crowded and competitive private banking landscape.

Discounts and Retrocession Models

EFG International's pricing strategy incorporates flexible retrocession models, offering clients a choice between retrocession and '0' retrocession options. This flexibility allows for potential further fee reductions, especially for clients with specific portfolio structures or service engagements.

The '0' retrocession model, in particular, can translate into direct cost savings for clients by eliminating certain intermediary fees. This approach underscores EFG's commitment to providing tailored solutions that can optimize client expenses.

- Retrocession Models: EFG provides options that include retrocessions, which are typically shared fees with intermediaries.

- '0' Retrocession Models: These models eliminate retrocession fees, potentially leading to lower overall costs for clients.

- Fee Optimization: The availability of these models allows clients to actively manage and potentially reduce their service fees based on their specific needs and portfolio.

- Client-Centric Pricing: This tiered approach to pricing indicates a focus on accommodating diverse client financial situations and preferences.

Consideration of Market and Economic Conditions

EFG International's pricing strategies are deeply intertwined with prevailing market and economic conditions. Their ability to maintain profitable growth, as evidenced by their strong financial performance in 2024 and projected for 2025, indicates that their pricing policies are well-calibrated to market demand and broader economic trends. This suggests a dynamic approach to pricing that adapts to the economic landscape.

The company's pricing decisions likely consider factors such as inflation rates, interest rate movements, and overall consumer or business spending power. For instance, if economic indicators point to a slowdown, EFG might adjust its pricing to remain competitive or offer more value-added services. Conversely, in a robust economic environment, they may leverage increased demand to optimize pricing for higher profitability.

Key considerations influencing EFG's pricing include:

- Economic Outlook: Monitoring GDP growth, inflation, and employment figures to gauge market capacity and willingness to spend.

- Market Demand: Assessing the current and projected demand for their services, which directly impacts their ability to set prices.

- Competitive Landscape: Analyzing competitor pricing to ensure EFG's offerings remain attractive and strategically positioned.

- Profitability Goals: Balancing market competitiveness with the strategic objective of sustaining profitable growth, as demonstrated by their financial results.

EFG International's pricing is designed to reflect the premium nature of its wealth management services, often employing value-based strategies. This approach means fees are aligned with the significant value and personalized advice provided to high-net-worth clients. The bank also offers flexible fee structures, including an 'all-in' fee option that bundles costs for predictability.

The introduction of '0' retrocession models provides clients with direct cost-saving opportunities by eliminating intermediary fees, showcasing a client-centric approach to fee optimization. This flexibility allows clients to choose options that best suit their portfolio and service needs, further enhancing perceived value.

EFG International's pricing is also dynamically adjusted based on market conditions and economic trends, as evidenced by their consistent financial performance. For instance, their 2024 results demonstrated an ability to maintain profitable growth, suggesting their pricing strategies effectively balance competitiveness with profitability goals.

The bank actively monitors competitor pricing to ensure its services remain attractive and strategically positioned within the competitive private banking sector. This ensures that while offering specialized, high-value services, EFG maintains a compelling market proposition.

| Pricing Strategy Element | Description | Client Benefit |

|---|---|---|

| Value-Based Pricing | Fees aligned with personalized advice and wealth growth | Justifies premium service costs, reflects delivered value |

| Flexible Fee Structures | Options like 'all-in' fees, '0' retrocession models | Predictability, potential cost savings, choice in fee management |

| Market Calibration | Pricing adjusted based on economic conditions and competition | Maintains competitiveness, ensures profitability, reflects market demand |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for EFG International is grounded in comprehensive data, including official company reports, investor communications, and detailed industry research. We leverage insights from their financial disclosures, product portfolios, distribution network information, and marketing campaign activities to provide a thorough understanding of their market strategy.