EFG International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EFG International Bundle

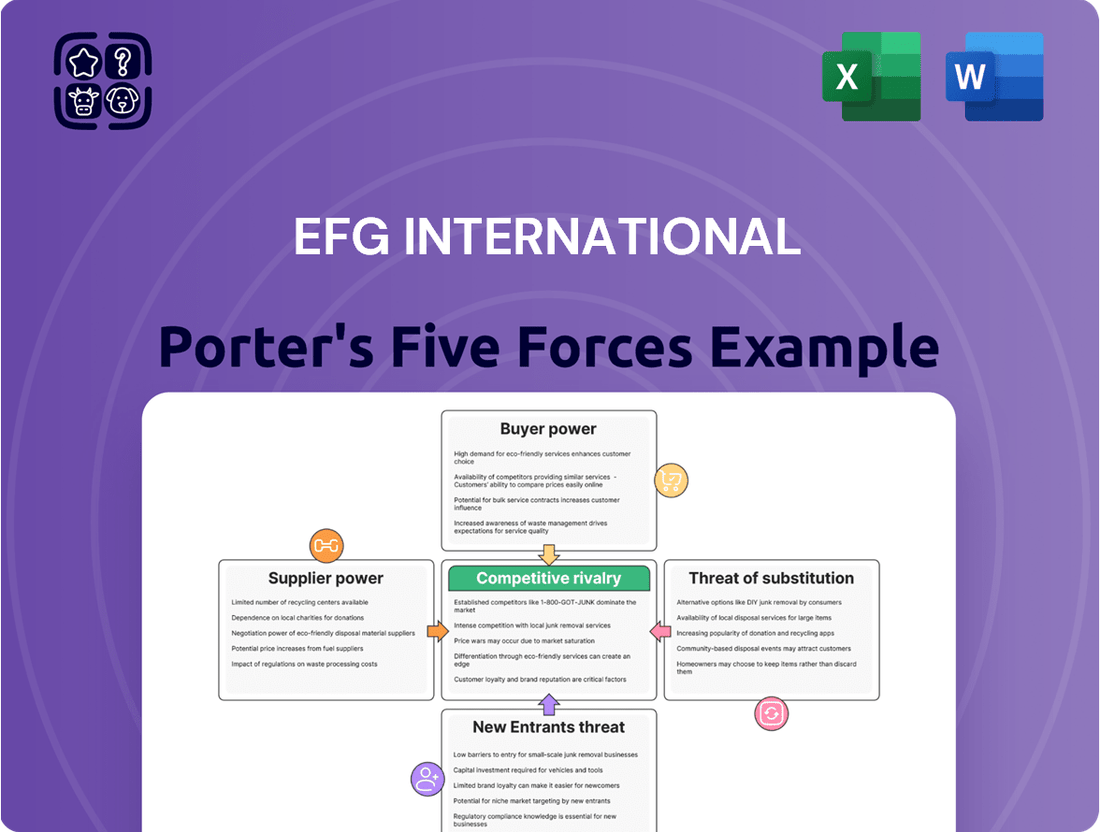

EFG International operates within a competitive landscape shaped by several key forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes is crucial for navigating its market. This brief overview highlights the core dynamics at play.

The complete report reveals the real forces shaping EFG International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

EFG International, operating in the competitive private banking sector, is significantly influenced by specialized technology providers. These suppliers are crucial for delivering advanced wealth management platforms, robust data analytics, and essential cybersecurity measures, all vital for serving high-net-worth and ultra-high-net-worth clientele.

The bargaining power of these technology suppliers can be substantial. This power is amplified when their solutions are highly customized to EFG International's unique operational needs or when they possess proprietary technology that is difficult to replicate. Furthermore, a limited number of alternative providers capable of offering comparable advanced functionalities directly translates to higher supplier leverage.

The bargaining power of suppliers, in this case, highly skilled Client Relationship Officers (CROs), is substantial for EFG International. The firm's client-centric approach hinges on these professionals, making their availability and retention critical. The scarcity of experienced CROs, especially in burgeoning markets like Asia and the Middle East, amplifies their leverage. EFG International's hiring efforts in 2024 saw 73 new CROs join, with projections of 50-70 annually, underscoring the competitive demand for this vital talent pool.

Financial data and information providers hold significant bargaining power over EFG International. Access to real-time, accurate market data and research is fundamental for EFG's core investment solutions and wealth management advice, making these providers indispensable. For instance, Bloomberg Terminal, a leading provider, charges substantial subscription fees, with a single terminal costing upwards of $24,000 annually as of 2024, reflecting the critical nature of its integrated data and analytics.

Regulatory and Compliance Software Vendors

The bargaining power of suppliers for regulatory and compliance software is significant for EFG International, given the private banking sector's stringent and ever-changing regulatory landscape. Companies providing specialized software crucial for navigating these complexities, particularly those ensuring operational integrity and risk management, can exert considerable influence. For instance, the global RegTech market, which encompasses these solutions, was projected to reach $12.1 billion in 2023 and is expected to grow substantially, indicating a concentrated supplier base for critical functionalities.

These specialized software vendors often possess unique intellectual property and deep expertise in regulatory interpretation, making it difficult for EFG International to switch providers or develop in-house solutions quickly. The cost and time associated with implementing new compliance systems further solidify the suppliers' position. For example, a single major compliance software upgrade can cost millions of dollars and require extensive integration efforts.

- High Switching Costs: Implementing and integrating new regulatory software can be a lengthy and expensive process for financial institutions like EFG International.

- Specialized Expertise: Vendors often hold proprietary knowledge and unique algorithms essential for interpreting and adhering to complex financial regulations.

- Critical Functionality: The software is vital for EFG International's operational continuity and risk mitigation, making reliable suppliers indispensable.

- Market Concentration: The market for highly specialized compliance software may have a limited number of dominant players, increasing their leverage.

Custodial and Settlement Service Providers

Custodial and settlement service providers hold significant bargaining power over EFG International. These third-party entities are crucial for the safekeeping of client assets and the smooth execution of transactions, making their reliability and security non-negotiable. In 2024, the increasing complexity of global financial markets and a greater emphasis on regulatory compliance further solidify the position of these specialized service providers.

The bargaining power of custodial and settlement service providers stems from their essential role and the high switching costs associated with changing providers, especially for a firm like EFG International dealing with diverse asset classes and cross-border operations. Their ability to offer robust infrastructure and extensive networks is a key differentiator.

- Essential Infrastructure: Custodians provide the secure vault for client assets, a fundamental requirement that cannot be bypassed.

- Transaction Execution: Settlement services ensure trades are completed efficiently and accurately, directly impacting client satisfaction and operational risk.

- Global Reach: For international asset management, providers with a strong global presence and expertise in various regulatory environments are indispensable, limiting EFG International's alternatives.

The bargaining power of suppliers for EFG International is a critical factor, particularly concerning specialized technology, skilled personnel, data providers, regulatory software, and custodial services. These suppliers often possess unique expertise, proprietary technology, or indispensable infrastructure, making them difficult to replace and leading to significant leverage.

The concentration of providers in niche areas like advanced wealth management platforms and regulatory compliance software further enhances supplier power. High switching costs, due to integration complexities and the need for specialized knowledge, also contribute to this leverage. For instance, the expense and time involved in changing a core banking system or a critical data provider can be substantial.

The demand for experienced Client Relationship Officers (CROs) remains high, with EFG International actively recruiting, highlighting the competitive market for talent. Similarly, the indispensable nature of real-time market data, exemplified by the significant costs of services like Bloomberg Terminal, underscores the power of these information providers.

| Supplier Category | Key Dependencies for EFG International | Factors Amplifying Bargaining Power | Illustrative Cost/Market Data (2023-2024) |

|---|---|---|---|

| Technology Providers (e.g., Wealth Management Platforms) | Advanced client solutions, data analytics, cybersecurity | Proprietary technology, customization, limited alternatives | High subscription and integration costs; market growth projected |

| Client Relationship Officers (CROs) | Client acquisition, retention, personalized service | Scarcity of experienced professionals, high demand | 73 new CROs hired in 2024; projected annual hires of 50-70 |

| Financial Data & Information Providers | Investment solutions, wealth management advice, market insights | Indispensable real-time data, critical analytics | Bloomberg Terminal: ~$24,000+ annually per terminal (2024) |

| Regulatory & Compliance Software Vendors | Navigating complex regulations, risk management, operational integrity | Unique IP, regulatory interpretation expertise, high implementation costs | Global RegTech market projected to reach $12.1 billion (2023) |

| Custodial & Settlement Service Providers | Safekeeping of assets, transaction execution, regulatory compliance | Essential infrastructure, global reach, high switching costs | Increasing complexity of global markets bolsters their position |

What is included in the product

Uncovers the competitive intensity, buyer and supplier power, threat of new entrants and substitutes specifically for EFG International's wealth management sector.

Instantly identify and address competitive threats with a clear, actionable breakdown of EFG International's Porter's Five Forces.

Customers Bargaining Power

High-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals, EFG International's core clientele, wield significant bargaining power. These sophisticated clients, managing substantial wealth, have numerous global private banking and wealth management alternatives. Their ability to easily switch providers, coupled with their demand for highly customized services and superior investment returns, means they can negotiate favorable terms and pricing, directly impacting EFG's margins.

Ultra-high-net-worth (UHNW) clients are increasingly demanding highly personalized investment strategies, moving beyond standard portfolios to include access to alternative assets like private credit. This trend indicates a growing customer power as they seek bespoke solutions and comprehensive financial planning that addresses their unique needs.

EFG International, like other wealth managers, faces this heightened customer demand. The ability to provide specialized services, such as access to exclusive private equity deals or sophisticated hedge fund structures, becomes crucial. However, clients are aware of their ability to demand these specific, often complex, offerings, thereby increasing their bargaining power.

High-net-worth and ultra-high-net-worth individuals often engage with multiple private banks globally, allowing them to easily shift assets or services between institutions. This widespread access and the ability to diversify offerings significantly bolsters their bargaining power.

The ease with which clients can switch providers, coupled with a competitive landscape featuring numerous private banking options, means EFG International must consistently deliver exceptional service and strong investment performance to foster client loyalty. In 2024, the wealth management industry saw continued client mobility; reports indicate that approximately 15% of HNW clients consider switching their primary wealth manager annually, highlighting the constant need for client retention strategies.

Influence of Family Offices

Family offices, managing substantial wealth for Ultra High Net Worth (UHNW) individuals, represent a significant concentration of client power. These entities are not passive recipients of services; they are active, sophisticated negotiators. For instance, in 2024, it's estimated that family offices globally oversee trillions of dollars in assets, a figure that continues to grow, underscoring their considerable influence.

These professionalized organizations, often staffed with experts, scrutinize service offerings and pricing meticulously. They demand tailored, integrated solutions that go beyond standard wealth management. This informed approach allows them to effectively leverage their collective financial muscle, pushing for better terms and specialized services from financial institutions like EFG International.

- Concentrated Client Base: Family offices consolidate the financial power of multiple UHNW families.

- Professional Negotiation: Staffed by financial experts, they possess the knowledge to negotiate favorable terms.

- Demand for Integration: They seek comprehensive, customized wealth management solutions, not just basic services.

- Significant Asset Under Management: In 2024, family offices manage assets in the trillions, giving them substantial leverage.

Transparency and Digitalization

The digital wave in wealth management has significantly boosted client bargaining power. Clients now have unprecedented access to information regarding fees, investment performance, and the array of services offered by various financial institutions. This transparency makes it easier for them to compare offerings and negotiate better terms.

The proliferation of WealthTech solutions is a key driver. These platforms provide retail investors with access to tools and insights previously only available to institutional clients. For instance, by mid-2024, robo-advisors, a significant WealthTech segment, managed an estimated $1.5 trillion globally, offering low-cost, algorithm-driven investment management that sets a benchmark for traditional advisors.

- Increased Information Access: Clients can easily research and compare fees, performance metrics, and service quality across multiple wealth managers.

- Democratization of Tools: Sophisticated investment analysis and portfolio management tools are now accessible to a broader client base, leveling the playing field.

- Price Sensitivity: Greater transparency and readily available alternatives make clients more sensitive to pricing, pushing providers to offer competitive fees.

- Provider Switching: Digital platforms simplify the process of onboarding with new providers, reducing switching costs for clients and intensifying competition.

The bargaining power of EFG International's clients, particularly high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals, is substantial due to the availability of numerous global private banking and wealth management alternatives. These sophisticated clients can easily switch providers, demanding highly customized services and competitive returns, which directly impacts EFG's profitability.

In 2024, the wealth management sector experienced continued client mobility, with an estimated 15% of HNW clients considering a change in their primary wealth manager annually. This underscores the imperative for EFG to consistently deliver superior service and investment performance to retain its clientele.

The rise of WealthTech has further amplified customer power by increasing transparency around fees and performance, making it simpler for clients to compare offerings and negotiate better terms. For instance, robo-advisors, a key WealthTech segment, managed approximately $1.5 trillion globally by mid-2024, setting a benchmark for competitive pricing.

| Client Segment | Asset Under Management (Global Estimate) | Key Bargaining Factors | Impact on EFG International |

| HNW Individuals | Trillions | Service customization, investment performance, fee sensitivity | Pressure on margins, need for differentiation |

| UHNW Individuals / Family Offices | Trillions (Family Offices alone) | Sophisticated negotiation, demand for integrated solutions, access to alternative assets | Requires specialized offerings, potential for higher service costs, strong relationship management |

| Digital Investors (via WealthTech) | $1.5 Trillion (Robo-advisors mid-2024) | Low fees, accessibility, transparency, ease of switching | Benchmark for pricing, need to compete on efficiency and digital experience |

Same Document Delivered

EFG International Porter's Five Forces Analysis

This preview showcases the exact EFG International Porter's Five Forces Analysis you will receive immediately after purchase, ensuring complete transparency and no hidden surprises. You're looking at the actual, professionally written document, fully formatted and ready for your strategic planning needs. Once your purchase is complete, you'll gain instant access to this comprehensive analysis, empowering you with valuable insights into EFG International's competitive landscape.

Rivalry Among Competitors

EFG International operates in a fiercely competitive private banking landscape, facing off against giants like UBS and Credit Suisse, which boasted combined assets under management exceeding CHF 2 trillion as of early 2024. These large global banks leverage their vast resources and established reputations to attract high-net-worth clients.

Simultaneously, EFG must contend with agile boutique private banks that often differentiate themselves through highly specialized services and deeply personalized client relationships. These smaller, focused players can offer tailored solutions that larger institutions may find difficult to replicate, creating a dynamic competitive environment where both scale and specialization are key differentiators.

The wealth management sector is characterized by a relentless pursuit of both client assets and skilled professionals. EFG International, for instance, has demonstrated robust net new asset (NNA) growth through the first half of 2025, a testament to its ability to attract and retain High Net Worth (HNW) and Ultra High Net Worth (UHNW) clients. However, this success occurs within an intensely competitive landscape.

This fierce rivalry extends beyond client acquisition to the critical area of talent. The battle for experienced Client Relationship Officers (CROs) who can bring established client relationships and their associated assets is a significant factor. The ability to secure and retain these key individuals is paramount for sustained growth and market share in 2024 and beyond.

The private banking sector is experiencing significant pressure on fees and profitability. This is largely due to an increasingly competitive landscape, where client expectations are shifting, and digital solutions are becoming more prevalent, all contributing to tighter margins for services.

While EFG International achieved record profits in 2024, the broader industry continues to grapple with maintaining healthy profit levels. This challenge stems from evolving pricing strategies and rising operational expenses that impact the bottom line.

Technological Advancements and Digital Transformation

Technological advancements, particularly in areas like artificial intelligence and blockchain, are fundamentally reshaping the competitive landscape for private banks. These innovations are not just buzzwords; they are actively driving the need for significant investment in digital transformation.

Banks that fail to embrace these changes risk obsolescence. For instance, by the end of 2024, it's projected that global spending on AI in financial services will reach tens of billions of dollars, highlighting the scale of investment required to stay competitive. This investment is crucial for developing sophisticated digital platforms and personalized client advisory tools that meet evolving client expectations.

The rise of WealthTech firms, often unburdened by legacy systems, presents a direct challenge. These agile players are leveraging new technologies to offer highly efficient and personalized services, forcing traditional institutions to adapt rapidly.

- AI and Machine Learning: Enhancing client profiling, risk management, and personalized investment recommendations.

- Blockchain: Streamlining cross-border payments, improving settlement times, and enhancing security for transactions.

- Digital Platforms: Offering seamless online and mobile banking experiences, including digital onboarding and wealth management tools.

- WealthTech Competition: The increasing market share of specialized fintech companies providing advanced digital wealth solutions.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) activity in the private banking sector is showing a moderate increase, suggesting a move towards industry consolidation. This trend means that companies are looking to combine forces to grow and gain an edge.

EFG International's own acquisition of Cité Gestion in 2024 is a prime example of these strategic plays. Such moves are often driven by the desire to expand market reach, achieve greater operational efficiency through scale, and bring in new, specialized skills or client bases. This heightened M&A activity naturally intensifies the competitive landscape for all players involved.

- Industry Consolidation: The private banking sector is witnessing a trend towards consolidation, with M&A activity picking up.

- Strategic Rationale: Acquisitions are driven by the need to strengthen market presence, achieve economies of scale, and acquire specialized capabilities.

- EFG International's Move: EFG International's acquisition of Cité Gestion in 2024 exemplifies this industry trend.

- Competitive Impact: Increased M&A activity heightens competitive rivalry as firms seek to bolster their positions.

The competitive rivalry within private banking remains intense, with EFG International navigating a landscape populated by global behemoths and specialized boutiques. The drive to acquire both client assets and top talent is a constant. For instance, by mid-2025, EFG reported strong net new asset growth, underscoring the ongoing competition for high-net-worth individuals.

This rivalry is further amplified by technological disruption and a push for industry consolidation. Firms are investing heavily in digital transformation, with global AI spending in financial services projected to reach tens of billions by the end of 2024. EFG's acquisition of Cité Gestion in 2024 highlights the trend of firms seeking scale and specialized capabilities to gain an edge.

The pressure on fees and profitability is a direct consequence of this heightened competition. EFG's record profits in 2024 were achieved amidst broader industry challenges related to evolving pricing and rising operational costs.

| Competitor Type | Key Characteristics | Impact on EFG International |

|---|---|---|

| Global Banks (e.g., UBS, Credit Suisse) | Vast resources, established reputation, large AUM (over CHF 2 trillion combined early 2024) | Significant client acquisition challenges, need for scale and broad service offerings |

| Boutique Private Banks | Specialized services, personalized relationships, agility | Need for differentiation, potential loss of niche clients to specialized providers |

| WealthTech Firms | Cutting-edge technology, efficient digital platforms, often unburdened by legacy systems | Pressure to innovate rapidly, investment in digital transformation, risk of obsolescence |

SSubstitutes Threaten

Independent Asset Managers (IAMs) and multi-family offices present a strong substitute threat to traditional private banks. These entities offer comparable wealth management and advisory services, often with greater client flexibility in selecting custodians and investment products. For instance, the growth of the independent advisor channel, which includes many IAMs, has been robust, with assets under management in the US independent advisor space reaching an estimated $3.3 trillion in 2023, according to Cerulli Associates.

This flexibility, coupled with their ability to attract top-tier Relationship Managers departing from larger institutions, directly challenges the client loyalty and service models of established banks. As these independent players gain traction, they siphon away potential clients and revenue streams that might otherwise flow to traditional private banking arms, impacting market share.

The proliferation of digital investment platforms, including robo-advisors and direct-to-consumer apps, presents a significant threat of substitutes for traditional wealth management services. These platforms allow individuals to manage their investments, often with lower fees. For instance, by mid-2024, the assets under management for leading robo-advisors in the US alone were projected to surpass $3 trillion, demonstrating their growing appeal.

While these digital solutions traditionally catered to a mass market, their increasing sophistication and user-friendliness are beginning to attract a wider range of investors, including some high-net-worth (HNW) individuals. As these platforms expand their offerings to include more complex financial planning tools and personalized advice, they could siphon off business from established players like EFG International, particularly for less intricate wealth management needs.

Clients increasingly turn to specialized financial advisory firms, focusing on niche areas such as tax planning, estate management, or charitable giving. These firms provide a depth of expertise that can be more appealing than a broad private banking relationship, effectively unbundling services previously bundled by larger institutions.

For instance, the wealth management sector saw a significant rise in independent advisors, with the U.S. market alone accounting for billions in assets under management by these specialized entities in 2024, demonstrating a clear preference for focused expertise.

Alternative Investment Vehicles (e.g., Private Credit)

The increasing appeal of alternative investment vehicles, such as private credit and private equity, poses a significant threat to traditional liquid asset management. These alternatives, accessible via specialized funds or direct investment, offer diversification and potentially higher returns, drawing capital away from conventional offerings. For instance, the global private debt market was projected to reach $2.7 trillion by the end of 2024, a substantial figure indicating its growing prominence.

Wealth managers are actively responding to this shift by broadening their services to include these alternative asset classes. This strategic adaptation aims to retain clients and capture new market share by providing comprehensive investment solutions. By 2025, it's anticipated that alternative investments will constitute a larger portion of institutional portfolios, further intensifying this competitive pressure.

- Growing Private Credit Market: The global private debt market is expected to reach $2.7 trillion by the end of 2024, highlighting its substantial growth as a substitute.

- Diversification Appeal: Alternatives offer clients diversification benefits and the potential for enhanced returns, attracting capital from traditional liquid assets.

- Wealth Manager Adaptation: Financial institutions are expanding their alternative investment offerings to meet client demand and remain competitive.

- Portfolio Shift: Projections indicate that alternative investments will represent an increasing share of institutional portfolios by 2025, intensifying the threat.

Self-Directed Investing by Sophisticated Individuals

Highly sophisticated High Net Worth (HNW) and Ultra High Net Worth (UHNW) individuals are increasingly capable of managing substantial portions of their wealth independently. This trend is fueled by enhanced access to market data and advanced trading platforms, diminishing their reliance on traditional full-service private banking models.

For instance, a 2024 survey indicated that over 60% of UHNW individuals globally actively participate in managing their investment portfolios. This self-directed approach can limit the scope and depth of engagement for firms like EFG International, as these clients may bypass certain advisory services.

- Increased access to sophisticated trading technology and real-time market data.

- Growing confidence and expertise among wealthy individuals in managing their own assets.

- Potential for cost savings by avoiding traditional wealth management fees.

- Reduced reliance on intermediaries for investment execution and research.

The threat of substitutes for EFG International is significant, driven by the rise of independent asset managers and multi-family offices that offer flexible, client-centric wealth management. Digital platforms, including robo-advisors, are also capturing market share by providing lower-cost, accessible investment solutions, with US robo-advisor assets projected to exceed $3 trillion by mid-2024.

Specialized advisory firms focusing on niche areas like tax or estate planning are unbundling services, appealing to clients seeking deep expertise. Furthermore, the growing popularity of alternative investments, such as private credit, which was expected to reach $2.7 trillion globally by the end of 2024, draws capital away from traditional liquid asset management.

Even sophisticated High Net Worth individuals are increasingly managing their wealth independently, fueled by better access to data and trading platforms, as over 60% of UHNW individuals globally actively manage their portfolios according to a 2024 survey.

| Substitute Type | Key Characteristics | Market Trend/Data Point (2024/2025 Projections) | Impact on EFG International |

|---|---|---|---|

| Independent Asset Managers & Multi-Family Offices | Client flexibility, personalized service, advisor mobility | Robust growth in independent advisor channel; US assets ~$3.3 trillion (2023) | Loss of clients and revenue to more agile competitors |

| Digital Investment Platforms (Robo-Advisors) | Lower fees, accessibility, user-friendliness | US robo-advisor AUM projected to surpass $3 trillion (mid-2024) | Erosion of market share, particularly for less complex needs |

| Specialized Advisory Firms | Niche expertise (tax, estate, etc.), unbundled services | Significant rise in independent advisors managing billions in assets (US market) | Clients opt for focused expertise over broad private banking |

| Alternative Investments | Diversification, potentially higher returns | Global private debt market projected at $2.7 trillion (end of 2024); alternatives to constitute larger share of institutional portfolios by 2025 | Capital diversion from traditional liquid assets |

| Self-Directed Wealth Management | DIY approach, enhanced data access, advanced trading | Over 60% of UHNW individuals actively manage portfolios (2024 survey) | Reduced reliance on traditional advisory services for HNW/UHNW clients |

Entrants Threaten

Entering the private banking sector demands significant capital. For instance, establishing a new Swiss private bank in 2024 could easily require hundreds of millions of Swiss Francs for licensing, technology, and initial operations, a sum prohibitive for many. This high cost of entry immediately filters out potential competitors.

Furthermore, the regulatory environment presents a formidable barrier. Navigating complex licensing procedures, adhering to strict anti-money laundering (AML) and know-your-customer (KYC) regulations, and maintaining ongoing compliance with bodies like FINMA or the FCA demands considerable expertise and resources, effectively deterring many newcomers.

Brand reputation and trust are paramount in private banking, a sector where discretion and a proven track record are non-negotiable. New entrants face a significant hurdle in replicating the deep-seated trust and long-standing relationships that established players like EFG International have meticulously built over decades. For instance, in 2024, attracting High Net Worth (HNW) and Ultra-High Net Worth (UHNW) clients, who often seek stability and proven expertise, requires more than just competitive offerings; it demands a history of reliability and a strong, recognizable brand.

The threat of new entrants is amplified by the difficulty in accessing skilled Client Relationship Officers (CROs). These individuals are crucial for EFG International's client-centric model, as they often bring established client networks with them. A persistent shortage of experienced CROs, especially in crucial markets, makes it tough for newcomers to build a strong client base quickly.

Scalability and Network Effects

The threat of new entrants for EFG International is significantly mitigated by the immense capital and time required to build a comparable international network. Serving High Net Worth (HNW) and Ultra High Net Worth (UHNW) individuals necessitates a global footprint, which is a substantial barrier. For instance, establishing and maintaining operations across multiple jurisdictions, as EFG International does, involves navigating complex regulatory landscapes and significant upfront investment.

New players would find it exceedingly difficult to replicate EFG International's established global presence and the accompanying economies of scale. A large, loyal client base, cultivated over years, provides a competitive advantage that is hard to overcome. In 2023, EFG International reported total client assets of CHF 146.4 billion, a testament to its significant market penetration and client trust.

Network effects also play a crucial role. The more HNW and UHNW clients EFG International serves, the more attractive its services become due to enhanced capabilities and a broader range of offerings. This creates a virtuous cycle, making it challenging for newcomers to gain traction. For example, a strong referral network among existing clients and advisors further solidifies EFG's position.

- High Capital Requirements: Establishing a global banking and wealth management infrastructure demands substantial financial resources, deterring smaller entities.

- Time and Relationship Building: Cultivating trust and relationships with HNW and UHNW clients is a lengthy process, a hurdle for new entrants.

- Economies of Scale: EFG International's size allows for cost efficiencies in operations and service delivery that new entrants cannot immediately match.

- Network Effects: A larger client base enhances service offerings and referral opportunities, creating a barrier to entry for less established firms.

Technological Investment and Integration

The threat of new entrants in wealth management is significantly shaped by the high cost of technological investment and integration. New players need to deploy advanced, integrated wealth management platforms, robust cybersecurity measures, and cutting-edge AI-driven solutions to even approach parity with incumbent firms. For instance, the global WealthTech market was valued at approximately $10.5 billion in 2023 and is projected to grow substantially, indicating the scale of investment required to gain traction.

- High Capital Outlay: Developing or acquiring sophisticated WealthTech capabilities demands substantial upfront capital, creating a significant barrier for new entrants.

- Cybersecurity Imperative: The need for advanced, integrated wealth management platforms and robust cybersecurity requires significant ongoing investment to protect client data and maintain trust.

- AI Integration Costs: Implementing AI-driven solutions for personalized advice, risk management, and operational efficiency adds another layer of considerable expense for newcomers.

- Competitive Parity: Without these technological investments, new entrants struggle to compete effectively with established players who already possess these integrated systems and AI capabilities.

The threat of new entrants for EFG International is considerably low due to the substantial barriers to entry in the private banking sector. These include immense capital requirements for licensing and operations, complex regulatory hurdles, and the critical need to build brand trust and long-term client relationships, which takes years. For instance, establishing a new private bank in Switzerland in 2024 could necessitate hundreds of millions of Swiss Francs.

Furthermore, attracting and retaining skilled Client Relationship Officers (CROs) is a significant challenge for newcomers, as these professionals often bring established client networks. EFG International's extensive global network and the resulting economies of scale also present a formidable obstacle, making it difficult for new players to achieve competitive parity. In 2023, EFG International managed client assets totaling CHF 146.4 billion, reflecting its established market position.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | High costs for licensing, technology, and initial operations. | Prohibitive for most potential competitors. |

| Regulatory Complexity | Navigating licensing, AML, and KYC regulations. | Demands significant expertise and resources. |

| Brand Reputation & Trust | Building decades of trust and client relationships. | Extremely difficult for new entrants to replicate. |

| Skilled Personnel | Access to experienced Client Relationship Officers. | Challenging to build a strong client base quickly. |

| Global Network & Scale | Establishing international presence and economies of scale. | Difficult to match EFG International's established footprint. |

Porter's Five Forces Analysis Data Sources

Our EFG International Porter's Five Forces analysis is built upon a foundation of diverse data sources, including EFG International's official annual reports and investor presentations, alongside industry-specific market research reports from reputable firms. We also incorporate data from financial news outlets and relevant regulatory filings to provide a comprehensive view of the competitive landscape.