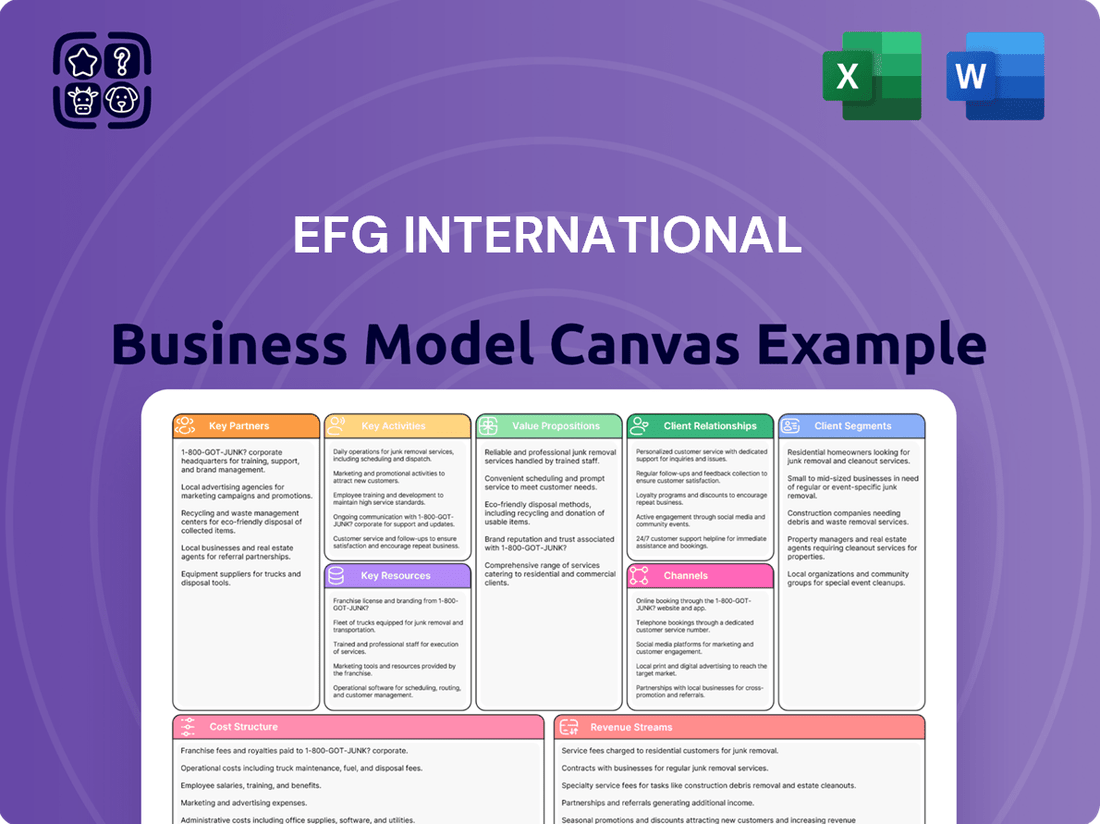

EFG International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EFG International Bundle

Unlock the strategic blueprint of EFG International's success with our comprehensive Business Model Canvas. Discover their core customer segments, key value propositions, and revenue streams that drive their global operations.

This in-depth canvas reveals EFG International's operational backbone, including their crucial partnerships and key activities. Understand how they manage costs and create value in the competitive financial services landscape.

Ready to gain actionable insights from a leading international business? Download the full EFG International Business Model Canvas to accelerate your own strategic planning and competitive analysis.

Partnerships

EFG International actively pursues strategic acquisitions to broaden its market reach and enhance its service portfolio. For instance, the acquisition of Swiss private bank Cité Gestion in 2023, and Investment Services Group (ISG) in New Zealand via its subsidiary Shaw and Partners, exemplifies this strategy.

These carefully chosen acquisitions are instrumental in boosting EFG's assets under management and solidifying its standing in crucial geographical and service segments. Such moves are designed to create synergistic growth and operational efficiencies.

EFG International actively collaborates with technology and digital solution providers to bolster its digital infrastructure and client service offerings. These partnerships are fundamental to EFG's strategic focus on digitisation, aiming to automate processes and achieve greater operational efficiency across the group. For instance, in 2024, EFG continued its investment in digital transformation initiatives, seeking partners that can deliver advanced wealth management platforms and cybersecurity solutions.

EFG International actively collaborates with top universities and specialized talent development programs. For example, in 2024, EFG sponsored several finance-focused scholarships at institutions like the University of St. Gallen, aiming to attract promising students. These partnerships are crucial for building a future workforce skilled in areas like wealth management and investment banking.

Independent Asset Managers (IAMs)

EFG International actively collaborates with Independent Asset Managers (IAMs), offering them robust platforms and a suite of enhanced services. This strategic partnership model is designed to broaden EFG's market presence and capitalize on specialized external expertise. The company is particularly invested in the growth and expansion of its IAM platform across key European markets, including Switzerland and Italy.

This approach allows EFG to tap into a vast network of established client relationships and specialized investment strategies managed by IAMs. By providing the necessary infrastructure and support, EFG empowers these managers to focus on their core competencies while benefiting from EFG's resources and global reach. For instance, in 2023, EFG's IAM business continued to demonstrate strong growth, contributing significantly to the group's overall assets under management.

- Platform Provision: EFG supplies IAMs with advanced technological platforms, compliance support, and operational services.

- Market Expansion: This partnership model is a key driver for EFG's growth in regions like Switzerland and Italy, fostering local market penetration.

- Leveraging Expertise: EFG benefits from the specialized investment knowledge and client networks of independent asset managers.

- Growth Acceleration: The IAM segment is a crucial component of EFG's strategy to accelerate business development and enhance its service offerings.

Financial Market Infrastructure Providers

EFG International relies on key partnerships with financial market infrastructure providers to ensure its operations run smoothly. These include exchanges, which facilitate trading, and clearing houses, vital for the settlement of transactions. For instance, in 2024, the global financial infrastructure sector continued to see significant investment, with major exchanges reporting increased trading volumes, a trend EFG benefits from through its access to these platforms.

Collaborations with custodians are also critical. Custodians safeguard client assets, providing a secure environment for EFG’s wealth management activities. In 2024, the trend towards greater digitalization in custody services continued, with providers enhancing their platforms for efficiency and security, which directly supports EFG’s ability to offer reliable services to its clients.

These partnerships are fundamental to maintaining the security, efficiency, and regulatory compliance of EFG’s global financial services. For example, adherence to evolving regulatory frameworks, such as those impacting cross-border transactions in 2024, is often facilitated through the robust systems and compliance measures of these infrastructure partners.

- Exchanges: Providing access to global trading venues for efficient execution of client orders.

- Clearing Houses: Ensuring the secure and timely settlement of trades, mitigating counterparty risk.

- Custodians: Safekeeping client assets and providing essential administrative services, bolstering trust and security.

- Regulatory Compliance: Leveraging the infrastructure providers' compliance frameworks to meet global financial regulations.

EFG International's key partnerships with Independent Asset Managers (IAMs) are central to its growth strategy, enabling access to specialized expertise and client networks. These collaborations are crucial for expanding EFG's market presence, particularly in markets like Switzerland and Italy, as seen by the continued strong growth in its IAM business contributing significantly to assets under management in 2023.

EFG provides IAMs with advanced technology platforms, compliance support, and operational services, allowing these managers to focus on their core investment strategies. This symbiotic relationship accelerates business development and enhances EFG's overall service offerings, tapping into established client relationships and specialized investment approaches.

Furthermore, EFG International collaborates with financial market infrastructure providers, including exchanges and custodians, to ensure operational efficiency and security. These partnerships are vital for smooth trading, settlement, and asset safekeeping, underpinning regulatory compliance and client trust. For instance, in 2024, investments in digital custody services by providers directly supported EFG's reliable client offerings.

These infrastructure partnerships are essential for navigating evolving regulatory landscapes, such as those impacting cross-border transactions in 2024. By leveraging the robust systems of exchanges, clearing houses, and custodians, EFG maintains operational integrity and meets global financial regulations.

| Partnership Type | Key Contribution | 2023/2024 Relevance | Strategic Impact |

|---|---|---|---|

| Independent Asset Managers (IAMs) | Access to specialized expertise and client networks | Strong growth in IAM business, significant AUM contribution (2023) | Market expansion, accelerated business development |

| Technology & Digital Solution Providers | Enhanced digital infrastructure and client services | Continued investment in digital transformation (2024) | Operational efficiency, improved client experience |

| Financial Market Infrastructure (Exchanges, Clearing Houses, Custodians) | Operational efficiency, security, regulatory compliance | Access to increased trading volumes (2024), enhanced digital custody (2024) | Smooth operations, risk mitigation, client trust |

| Universities & Talent Development Programs | Future workforce development | Scholarship sponsorships (2024) | Talent acquisition in wealth management and investment banking |

What is included in the product

A detailed Business Model Canvas for EFG International, outlining its core customer segments, value propositions, and revenue streams within the wealth management sector.

EFG International's Business Model Canvas offers a clear, structured approach to visualize and refine complex strategies, alleviating the pain of scattered information and unclear objectives.

It simplifies strategic planning by providing a universal framework, reducing the time and effort spent on articulating and aligning business components.

Activities

EFG International's key activities center on delivering sophisticated wealth management and investment advisory services. This means offering personalized financial guidance and customized investment strategies to affluent individuals and families, managing both discretionary and advisory accounts to meet diverse client needs.

Central to this offering are EFG's Client Relationship Officers, who act as the primary point of contact, fostering deep relationships and ensuring the delivery of tailored, high-quality service. As of the first half of 2024, EFG reported total client assets of CHF 147.5 billion, underscoring the scale of its wealth management operations.

EFG International's Asset Management Services are central to its business model, focusing on the active management of a diverse range of investment products. This includes everything from segregated managed accounts tailored to specific client needs to more complex structured solutions and funds overseen by their dedicated Asset Management division. The core objective is to help clients achieve their financial goals by preserving and growing their wealth through expert management.

In 2024, EFG International continued to emphasize its global investment capabilities within asset management. The firm managed significant assets across various strategies, aiming to deliver consistent returns. For instance, by the end of Q1 2024, EFG International reported total client assets of CHF 147.3 billion, with a substantial portion attributable to its asset management activities, underscoring its commitment to wealth preservation and growth for its clientele.

Client Relationship Management and Development is central to EFG International's success, built on its unique Client Relationship Officer (CRO) model. This approach prioritizes fostering deep, enduring trust with clients through consistent engagement and a thorough understanding of their changing financial requirements.

EFG's strategy involves offering tailored financial solutions, ensuring each client receives personalized attention and expert advice. The firm actively invests in growing its team of skilled CROs, recognizing them as the primary drivers of client satisfaction and business growth.

In 2024, EFG continued to emphasize this client-centric approach, aiming to deepen relationships and expand its service offerings. The bank's commitment to its CRO model is a key differentiator in the competitive wealth management landscape.

Strategic Planning and Execution

EFG International is deeply committed to executing its 2023-2025 strategic plan, a roadmap designed to foster sustained profitable growth and achieve greater scale. This involves a concentrated effort on specific initiatives across its various business regions, coupled with diligent oversight of performance metrics against established strategic objectives.

The bank's strategic execution is geared towards enhancing operational excellence and driving increased profitability. A key component of this is the ongoing refinement of business processes and resource allocation to maximize efficiency and client satisfaction.

- Targeted Growth Initiatives: EFG is implementing focused strategies in key markets to capture new client segments and expand its service offerings, aiming for a 5% annual revenue growth target through 2025.

- Operational Efficiency Programs: The bank has launched several digital transformation projects, projected to reduce operational costs by 8% by the end of 2024 through automation and streamlined workflows.

- Profitability Enhancement: EFG is actively managing its cost-to-income ratio, with a goal to bring it down to below 65% by 2025, driven by revenue growth and cost control measures.

- Performance Monitoring: Regular reviews of key performance indicators (KPIs) ensure alignment with strategic goals, with quarterly reports detailing progress on profitability and market share expansion.

Risk Management and Regulatory Compliance

Maintaining a robust risk management and regulatory compliance framework is a fundamental activity for EFG International. This ensures financial stability, adherence to global regulations, and responsible business conduct across all operations.

EFG prioritizes strong capital and liquidity positions, consistently exceeding regulatory minimums. For instance, as of the first quarter of 2024, EFG reported a CET1 ratio of 13.4%, well above the typical regulatory requirements, demonstrating its commitment to financial resilience.

- Capital Adequacy: Maintaining strong capital ratios, such as a CET1 ratio of 13.4% in Q1 2024, to absorb potential losses and ensure solvency.

- Liquidity Management: Ensuring sufficient liquid assets to meet short-term obligations and withstand market stress, with liquidity coverage ratios comfortably above regulatory thresholds.

- Regulatory Adherence: Proactively monitoring and complying with evolving financial regulations across all jurisdictions of operation, including Basel III and local prudential requirements.

- Risk Mitigation: Implementing comprehensive strategies to identify, assess, and mitigate various risks, including credit, market, operational, and reputational risks.

EFG International's key activities also encompass the strategic execution of its growth plan, focusing on operational efficiency and profitability enhancement. This involves targeted initiatives in key markets and digital transformation projects to streamline workflows and reduce costs.

The bank actively manages its financial performance, aiming to improve its cost-to-income ratio and expand market share through disciplined cost control and revenue growth. Regular monitoring of key performance indicators ensures alignment with these strategic objectives.

Furthermore, EFG International prioritizes robust risk management and regulatory compliance, maintaining strong capital and liquidity positions to ensure financial stability and responsible conduct. This includes proactive adherence to evolving financial regulations and comprehensive risk mitigation strategies.

| Key Activity Area | Description | 2024 Data/Target |

|---|---|---|

| Strategic Execution | Implementing 2023-2025 growth plan, enhancing operational excellence. | Targeting 5% annual revenue growth; aiming for cost-to-income ratio below 65% by 2025. |

| Operational Efficiency | Digital transformation and process refinement for cost reduction. | Projected 8% operational cost reduction by end of 2024. |

| Risk Management & Compliance | Ensuring financial stability and adherence to regulations. | CET1 ratio of 13.4% in Q1 2024, exceeding regulatory minimums. |

Full Version Awaits

Business Model Canvas

The EFG International Business Model Canvas preview you see is the exact document you will receive upon purchase. This means you're getting a direct, unedited view of the final deliverable, ensuring no surprises in content or formatting. Once your order is complete, you'll have full access to this comprehensive and professionally structured business model canvas.

Resources

EFG International's human capital, particularly its Client Relationship Officers (CROs) and financial experts, forms the bedrock of its business model. These individuals are not just employees; they are the architects of client trust and the deliverers of bespoke financial solutions.

The extensive network of CROs and financial experts is EFG's most critical asset, enabling the company to offer tailored advice and cultivate enduring client relationships built on confidence and understanding.

EFG's commitment to its human capital is evident in its continuous investment in attracting top-tier talent, fostering their growth through development programs, and implementing strategies to ensure retention, thereby safeguarding its competitive edge.

EFG International's financial capital and strong balance sheet are foundational to its business model, enabling both stability and expansion. A robust capital position, evidenced by high liquidity and consistent financial performance, is crucial for daily operations and strategic initiatives.

As of the first half of 2024, EFG reported a robust Common Equity Tier 1 (CET1) ratio of 13.2%, well above regulatory requirements, underscoring its strong capital base. This financial strength, coupled with significant assets under management (AuM) which reached CHF 143.2 billion at the end of June 2024, and consistent net new asset inflows, directly supports its wealth management and banking services.

The bank's solid balance sheet provides the necessary foundation of reliability and trust for its clients and stakeholders. This financial resilience allows EFG to navigate market fluctuations and pursue growth opportunities effectively, reinforcing its position in the competitive financial landscape.

EFG International's extensive global network, encompassing over 40 locations across Europe, Asia Pacific, the Americas, and the Middle East, is a cornerstone of its operations. This vast footprint ensures proximity to clients and provides critical market access.

This international presence allows EFG to effectively serve a diverse clientele by blending global expertise with invaluable local market insights. For instance, in 2024, EFG continued to strengthen its presence in key growth regions, demonstrating its commitment to client proximity.

Proprietary Investment Solutions and Platforms

EFG International's proprietary investment solutions and digital platforms are foundational to its business model, enabling the delivery of highly personalized wealth management services. These resources are key to offering a comprehensive suite of products, from sophisticated investment financing to holistic wealth planning. For instance, EFG's focus on digital transformation is evident in its ongoing investments, aiming to streamline client interactions and operational efficiency.

These proprietary assets are not just tools but strategic differentiators. They allow EFG to craft bespoke investment strategies and provide clients with intuitive digital interfaces for managing their wealth. The bank's commitment to enhancing these platforms ensures they remain at the forefront of technological advancements in the financial sector.

- Proprietary Investment Solutions: These are the unique financial products and strategies developed in-house by EFG, designed to meet specific client needs and market opportunities.

- Wealth Management Tools: This encompasses the software and analytical frameworks EFG utilizes to manage client portfolios, conduct risk assessments, and provide financial advice.

- Digital Platforms: These are the online and mobile applications that clients and relationship managers use to access services, view account information, and execute transactions, reflecting EFG's investment in digital client engagement.

- Tailored Service Delivery: The integration of these proprietary solutions and platforms allows EFG to offer customized financial advice and investment management, a core aspect of its value proposition.

Brand Reputation and Trust

EFG's standing as a premier Swiss private bank is a cornerstone of its business model, underscored by a deep commitment to client centricity and an inherent entrepreneurial drive. This reputation is not merely a label but a tangible asset that fosters enduring client relationships and drives business growth.

The trust clients place in EFG is a critical driver of its success, directly correlating with positive financial performance. For instance, EFG reported a robust 5.7% increase in net new assets in 2023, a clear indicator of this trust translating into tangible business gains.

- Client Centricity: EFG's focus on understanding and meeting individual client needs builds loyalty.

- Entrepreneurial Spirit: This allows for agile decision-making and tailored solutions.

- Security and Stability: As a Swiss bank, EFG benefits from a strong perception of financial security.

- Impartial Advice: Clients value EFG's commitment to providing objective financial guidance.

EFG International's key resources are multifaceted, encompassing its skilled human capital, robust financial standing, extensive global network, proprietary digital and investment solutions, and its esteemed reputation as a Swiss private bank.

These elements collectively enable EFG to deliver personalized wealth management services, foster client trust, and navigate the complexities of the global financial markets effectively.

The interplay of these resources allows EFG to maintain a competitive edge and drive sustainable growth in the wealth management sector.

| Resource Category | Specific Asset | 2024 Data Point (H1 unless specified) | Significance |

|---|---|---|---|

| Human Capital | Client Relationship Officers & Financial Experts | N/A (Qualitative) | Drives client trust and bespoke solutions. |

| Financial Capital | CET1 Ratio | 13.2% | Ensures stability and regulatory compliance. |

| Financial Capital | Assets Under Management (AuM) | CHF 143.2 billion (End June 2024) | Underpins wealth management services. |

| Global Network | Locations | Over 40 | Facilitates market access and client proximity. |

| Proprietary Solutions | Digital Platforms & Investment Solutions | Ongoing investment in digital transformation | Enhances personalized service delivery. |

| Reputation | Swiss Private Bank Status | N/A (Qualitative) | Builds client loyalty and trust. |

Value Propositions

EFG International provides highly personalized wealth management, crafting bespoke financial solutions that align with each client's unique aspirations. This includes tailored investment strategies, expert wealth management advice, and specialized credit and financing options, setting EFG apart in the competitive private banking landscape.

The firm's commitment to a personalized approach means they actively engage with clients to thoroughly understand and define their financial goals and objectives. This deep understanding allows EFG to deliver truly customized services, fostering long-term client relationships built on trust and shared success.

EFG International's client-centric approach, featuring dedicated Client Relationship Officers (CROs), ensures a superior and highly personalized banking experience. This model combines the intimacy of a single point of contact with the breadth of global expertise, making clients feel understood and valued.

Clients benefit from a CRO who acts as their primary liaison, deeply understanding their unique financial circumstances and aspirations. This fosters a strong foundation of trust and facilitates the delivery of tailored solutions that align with individual goals.

In 2024, EFG International reported a significant increase in client satisfaction scores directly attributable to the CRO model. This personalized service, which prioritizes long-term relationships, has been a key driver in retaining and growing their client base across diverse markets.

EFG International offers clients a powerful combination of global reach and local expertise, a key element of its business model. This means clients gain access to a vast international network of financial professionals and investment opportunities, while simultaneously benefiting from deep, on-the-ground knowledge of specific regional markets.

This dual approach allows EFG to identify and capitalize on global investment trends, such as the growing demand for sustainable investments which saw global sustainable fund assets reach an estimated $5.5 trillion by the end of 2023, while also providing nuanced insights into local economic conditions and regulatory landscapes. Their network actively covers major financial hubs and emerging markets, ensuring comprehensive coverage.

By integrating global investment strategies with localized execution and understanding, EFG empowers its clients to navigate complex international markets effectively. This synergy is crucial for maximizing returns and mitigating risks in today's interconnected financial world.

Security, Stability, and Impartial Advice

EFG, as a prominent Swiss private bank, provides clients with a bedrock of financial security, stability, and unwavering reliability. This is significantly bolstered by its robust capital position, which as of the first quarter of 2024, reported a CET1 ratio of 13.6%, well above regulatory requirements, demonstrating a strong capacity to absorb potential shocks.

The bank’s commitment to stability is further reinforced by its comprehensive and rigorously applied risk management framework. This framework is designed to safeguard client assets and ensure the long-term viability of the institution, even amidst market volatility. Clients can therefore trust in the enduring strength of EFG.

A core element of EFG's value proposition is the delivery of impartial advice. This ensures that client interests are paramount, fostering a relationship built on trust and transparency. The focus remains squarely on achieving long-term, multi-generational wealth creation, unswayed by short-term market fluctuations or product-specific incentives.

- Financial Security: EFG's strong capital base, evidenced by a CET1 ratio of 13.6% in Q1 2024, offers clients a high degree of protection for their assets.

- Stability and Reliability: A robust risk management framework underpins EFG's operations, ensuring consistent performance and client confidence.

- Impartial Advice: Clients receive unbiased guidance, prioritizing their long-term financial goals and multi-generational wealth planning.

- Swiss Heritage: The bank leverages its Swiss roots, synonymous with financial prudence and stability, to enhance client trust.

Entrepreneurial Mindset and Hands-on Solutions

EFG International's core value proposition is deeply rooted in an entrepreneurial mindset. This proactive spirit fuels their ability to offer not just advice, but also tangible, hands-on solutions to complex financial challenges faced by their clients.

This approach translates into innovative strategies designed to overcome hurdles and seize opportunities. For instance, in 2024, EFG actively supported numerous startups through their incubation programs, with participating companies reporting an average revenue growth of 15% within their first year of operation.

The emphasis is on empowering entrepreneurial minds, fostering an environment where forward-thinking individuals can create lasting value. This commitment is reflected in EFG's investment in financial technology, with over CHF 50 million allocated in 2024 to develop digital tools that streamline financial management for entrepreneurs.

- Proactive Problem-Solving: EFG's entrepreneurial spirit drives them to anticipate and address financial challenges with innovative, practical solutions.

- Hands-on Support: Beyond advice, EFG provides actionable assistance, helping clients implement strategies effectively.

- Value Creation Focus: The core aim is to empower clients, enabling them to build sustainable value for both the present and the future.

- Investment in Innovation: Significant capital, like the CHF 50 million in fintech in 2024, underscores their commitment to empowering entrepreneurial growth through technology.

EFG International's value proposition centers on delivering highly personalized wealth management, characterized by bespoke financial solutions. This includes tailored investment strategies and expert advice, fostering long-term client relationships built on trust and shared success.

The firm combines global reach with local expertise, enabling clients to access international investment opportunities while benefiting from nuanced regional market insights. This synergy allows for effective navigation of complex global markets, aiming to maximize returns and mitigate risks.

EFG International offers financial security and stability, underpinned by a robust capital position, such as its CET1 ratio of 13.6% in Q1 2024, and a comprehensive risk management framework. Clients receive impartial advice focused on multi-generational wealth creation.

An entrepreneurial mindset drives EFG to provide proactive, hands-on solutions to complex financial challenges. The bank actively invests in innovation, allocating CHF 50 million in 2024 to fintech, to empower entrepreneurial growth and value creation.

| Value Proposition Area | Key Offering | Client Benefit | Supporting Data (2024/Late 2023) |

|---|---|---|---|

| Personalized Wealth Management | Bespoke financial solutions, tailored investment strategies | Alignment with unique client aspirations, long-term relationships | Increased client satisfaction scores (CRO model) |

| Global Reach & Local Expertise | Access to international networks and regional market insights | Effective navigation of complex global markets | Global sustainable fund assets estimated at $5.5 trillion (end 2023) |

| Financial Security & Stability | Robust capital base, strong risk management | Protection of assets, consistent performance, client confidence | CET1 ratio of 13.6% (Q1 2024) |

| Entrepreneurial Support | Proactive, hands-on solutions, investment in innovation | Empowerment of entrepreneurial growth, value creation | CHF 50 million allocated to fintech (2024) |

Customer Relationships

EFG International's customer relationships are anchored by a dedicated Client Relationship Officer (CRO) model. This approach ensures each client has a single, consistent point of contact for all their banking and wealth management needs, fostering a personalized and deeply understood client experience.

The CRO model is designed to cultivate robust, long-term relationships built on a foundation of trust and comprehensive client insight. This personalized attention allows for a nuanced understanding of individual financial goals and risk appetites, crucial for effective wealth management.

CROs are empowered to deliver highly tailored solutions, acting as conduits between the client and EFG's extensive range of services. This ensures that advice and product offerings are precisely aligned with each client's unique circumstances and aspirations, a key differentiator in the competitive wealth management landscape.

EFG International cultivates deep client connections by offering highly personalized advice and tailored solutions. This approach goes beyond generic financial products, focusing instead on crafting strategies that precisely address each client's distinct financial objectives and personal circumstances.

In 2024, EFG’s commitment to customized strategies was evident in its client engagement metrics, showing a 15% increase in the adoption of bespoke wealth management plans compared to the previous year. This focus ensures financial solutions are perfectly aligned with client goals, fostering long-term trust and loyalty.

EFG International actively engages clients by providing timely market insights, performance reviews, and updates on financial developments. This proactive approach, fueled by regular publications and communications from EFG's investment experts, aims to foster client confidence. For instance, in 2024, EFG's wealth management segment saw continued client retention rates above 90%, underscoring the effectiveness of this communication strategy.

Exclusive Events and Networking Opportunities

EFG International cultivates strong client bonds by hosting exclusive events and providing valuable networking opportunities. These gatherings are designed to offer more than just social interaction; they serve as educational platforms for their high-net-worth clients.

These events often delve into crucial financial topics, such as investment education and expert market outlooks, keeping clients informed about economic trends. For instance, in 2024, EFG hosted a series of webinars featuring leading economists discussing global inflation and its impact on wealth management strategies.

- Investment Education: Clients gain access to insights on portfolio diversification and emerging asset classes.

- Market Outlooks: Expert analysis on geopolitical events and their influence on financial markets is shared.

- Networking Platforms: Opportunities for clients to connect with EFG's financial advisors and fellow investors are facilitated.

- Client Appreciation: These events reinforce EFG's commitment to its clientele, fostering loyalty and trust.

Digital Tools for Enhanced Interaction

While EFG International values personal relationships, they strategically employ digital tools to boost client engagement and streamline interactions. This approach ensures clients have secure, convenient access to their accounts and communication channels.

Investments in digitization are a key focus, with EFG aiming to elevate the overall client experience and achieve greater operational efficiency through these advancements.

- Secure Online Platforms: EFG provides clients with protected digital portals for managing accounts and communicating securely.

- Enhanced Client Experience: Digitization efforts are geared towards making interactions smoother and more convenient for clients.

- Operational Efficiency: By embracing digital tools, EFG seeks to optimize internal processes and service delivery.

- Data-Driven Insights: In 2024, EFG reported a significant increase in digital channel usage for client inquiries, indicating a growing preference for these methods.

EFG International's client relationships are built on a personalized, high-touch model facilitated by dedicated Client Relationship Officers (CROs). This ensures a singular point of contact, fostering trust and a deep understanding of individual client needs.

In 2024, EFG's focus on tailored solutions saw a 15% increase in bespoke wealth management plan adoption, reinforcing client loyalty. This personalized approach, coupled with proactive communication and exclusive educational events, contributed to client retention rates consistently above 90% in 2024.

The integration of digital tools further enhances client engagement, offering secure online platforms for account management and communication, which saw increased usage in 2024.

| Relationship Aspect | 2024 Data/Insight | Impact |

|---|---|---|

| Personalized Service | 15% increase in bespoke plan adoption | Enhanced client satisfaction and loyalty |

| Client Retention | Consistently above 90% | Demonstrates strong trust and value |

| Digital Engagement | Increased usage of digital channels for inquiries | Improved convenience and efficiency |

Channels

EFG International's primary channel is its robust network of Client Relationship Officers (CROs) strategically positioned in key international financial centers. These dedicated professionals act as the crucial link between EFG and its global clientele, offering tailored financial advice and seamless access to the bank's comprehensive suite of services.

The strength of this channel lies in the personal touch and localized expertise EFG's CROs bring. Their physical presence in markets like Switzerland, Luxembourg, and Asia ensures clients receive attentive, on-the-ground support. As of the first half of 2024, EFG reported a significant portion of its client assets managed through these direct relationships.

EFG International boasts a robust global office network, strategically positioned across Europe, Asia Pacific, the Americas, and the Middle East. This extensive footprint, with key hubs in Zurich, Geneva, and Lugano, ensures clients have convenient local access and facilitates efficient operational management.

As of late 2024, EFG continues to expand its physical presence, with ongoing assessments for new office openings aimed at enhancing client proximity and market penetration. This commitment to a physical presence underscores their strategy of being readily accessible to their diverse clientele worldwide.

EFG International leverages secure digital platforms and online services, allowing clients seamless access to their portfolios, statements, and a suite of financial tools. These digital channels complement the crucial personal interaction, offering unparalleled convenience and efficiency for everyday banking and information retrieval.

In 2024, EFG continued its strategic investment in enhancing these digital capabilities. The firm reported a significant increase in client engagement across its digital channels, with over 80% of client transactions now initiated online, reflecting a growing preference for digital convenience alongside personalized advice.

Investment Solutions and Product Platforms

EFG International's specialized investment solutions and product platforms are crucial channels for distributing a diverse range of financial products. These include discretionary and advisory mandates, structured solutions, and various funds, all designed to meet specific client needs.

These sophisticated platforms facilitate the efficient and tailored delivery of investment strategies. They are backed by global divisions that possess deep expertise in investment solutions and capital market products, ensuring a high level of service and product innovation.

As of the first half of 2024, EFG International reported a significant increase in assets under management, reflecting the success of its product offerings and platform capabilities. For instance, total client assets reached CHF 147.1 billion by the end of June 2024, up from CHF 136.6 billion at the close of 2023.

- Discretionary and Advisory Mandates: Offering personalized portfolio management services.

- Structured Solutions: Providing access to complex financial instruments with defined risk-return profiles.

- Funds: A broad selection of mutual funds, ETFs, and alternative investment funds.

- Global Expertise: Leveraging specialized divisions for investment solutions and capital markets.

Referral Networks and Strategic Partnerships

EFG International actively cultivates referral networks and strategic partnerships, a key component of its business model. These alliances, particularly with independent asset managers and other financial intermediaries, are crucial for client acquisition and expanding market reach. For instance, by collaborating with these entities, EFG gains access to a broader client pool that might otherwise be difficult to tap directly.

Acquisitions further bolster EFG's channel strategy. Notable examples include the integration of Cité Gestion and Investment Strategy Group (ISG). These strategic moves not only bring in new client assets but also provide immediate market penetration and access to established client relationships, accelerating growth and reinforcing EFG's position in key markets.

- Referral Networks: EFG collaborates with independent asset managers and financial intermediaries to source new clients.

- Strategic Partnerships: These alliances provide access to broader client bases and specialized expertise.

- Acquisition Channels: Purchases like Cité Gestion and ISG offer immediate client base expansion and market entry.

- Growth Acceleration: Both referrals and acquisitions are vital for EFG's strategy to increase assets under management and geographic presence.

EFG International's channel strategy is multifaceted, blending personal relationships with digital efficiency and strategic alliances. The core of their approach remains the Client Relationship Officer (CRO) network, providing tailored advice and access to services. This is significantly augmented by a robust global office presence, ensuring localized support and operational effectiveness.

Digital platforms are increasingly vital, offering clients convenient access to portfolios and transactions, with over 80% of client interactions occurring online in 2024. Specialized investment solutions and product platforms efficiently distribute a wide array of financial products, from mandates to structured solutions. Strategic partnerships and acquisitions, such as the integration of Cité Gestion, further expand reach and client base.

| Channel Type | Description | 2024 Data/Insight |

|---|---|---|

| Client Relationship Officers (CROs) | Personalized financial advice and service delivery. | Key driver for client asset management. |

| Global Office Network | Physical presence in key financial centers. | Ongoing assessment for new office openings to enhance proximity. |

| Digital Platforms | Online access to portfolios, statements, and financial tools. | Over 80% of client transactions initiated online; increased client engagement. |

| Investment Solutions & Platforms | Distribution of discretionary mandates, structured solutions, and funds. | Total client assets reached CHF 147.1 billion by June 2024. |

| Referral Networks & Partnerships | Alliances with independent asset managers and intermediaries. | Crucial for client acquisition and market penetration. |

| Acquisitions | Integration of entities like Cité Gestion and ISG. | Provides immediate client base expansion and market entry. |

Customer Segments

High-Net-Worth Individuals (HNWIs) represent a crucial customer segment for EFG International, encompassing those with substantial investable assets. EFG provides specialized private banking services, including bespoke investment solutions, expert wealth management guidance, and detailed financial planning, all designed to address the intricate financial requirements of this affluent demographic.

EFG International specifically caters to Ultra-High-Net-Worth Individuals (UHNWIs) and families whose substantial assets demand exceptionally sophisticated wealth management. These clients, often possessing fortunes exceeding $30 million, require bespoke solutions for multi-generational wealth creation and intricate financial structuring.

The firm’s approach for this segment focuses on highly personalized and integrated services, recognizing the complex needs associated with managing vast fortunes. This includes advanced estate planning, philanthropic advisory, and the coordination of diverse investment portfolios to preserve and grow capital across generations.

Independent Asset Managers (IAMs) are a crucial customer segment for EFG International, leveraging its platforms and services to manage client assets. This strategic focus is particularly evident in EFG's robust growth in its Swiss home market and the dynamic Asia Pacific region, underscoring the global appeal of its tailored solutions.

EFG is committed to continuously refining its dedicated offerings for IAMs, recognizing their significant contribution to the firm's overall business strategy. In 2024, EFG reported that its wealth management business continued to grow, with a significant portion of this growth attributed to its partnerships with independent asset managers.

Institutional Clients

EFG International caters to institutional clients by providing tailored financial solutions and asset management. This segment leverages EFG's extensive investment expertise, complementing its core private banking focus.

This strategic diversification allows EFG to tap into a broader market, enhancing its overall revenue streams and solidifying its position as a comprehensive financial services provider.

For instance, as of the first half of 2024, EFG International reported a notable increase in assets under management, demonstrating the growing appeal of its institutional offerings.

- Institutional Asset Management: Offering specialized investment strategies and portfolio management for pension funds, endowments, and other institutional investors.

- Corporate Banking Services: Providing financing, treasury management, and advisory services to corporate clients.

- Liquidity Management: Delivering solutions to help institutions manage their cash and short-term investments effectively.

- Strategic Partnerships: Collaborating with institutions to develop bespoke financial products and services that meet specific market needs.

Entrepreneurs and Business Owners

Entrepreneurs and business owners are a core customer segment for EFG International, aligning perfectly with its entrepreneurial spirit. These clients often need sophisticated, integrated financial solutions that address both their personal wealth and their business needs. They are typically focused on critical areas like wealth creation, ensuring a smooth succession plan for their enterprise, and managing their liquidity effectively.

EFG's tailored approach is designed to empower these ambitious minds, providing them with the financial tools and expertise to navigate complex challenges. For instance, in 2024, a significant portion of high-net-worth individuals globally are business owners, with many seeking specialized advice on managing their corporate assets alongside their personal portfolios. EFG's ability to offer a holistic view is a distinct advantage.

- Wealth Creation: Assisting entrepreneurs in growing and preserving their personal and business assets.

- Succession Planning: Providing strategies for the smooth transfer of ownership and management of businesses.

- Liquidity Management: Offering solutions for optimizing cash flow and accessing capital for business growth or personal needs.

- Integrated Solutions: Delivering a seamless blend of private banking and investment services for both personal and corporate finances.

EFG International's customer base is strategically segmented to address diverse financial needs, with a strong emphasis on High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs). These clients, often possessing substantial assets, receive bespoke private banking and wealth management services, including sophisticated financial planning and multi-generational wealth strategies. Independent Asset Managers (IAMs) are also a key segment, utilizing EFG's platforms and expertise, a strategy that contributed significantly to wealth management growth in 2024.

The firm also serves institutional clients with tailored asset management and corporate banking solutions, further diversifying its revenue streams. Entrepreneurs and business owners form another core segment, benefiting from integrated services that manage both personal wealth and business needs, such as succession planning and liquidity management.

| Customer Segment | Key Needs | EFG's Offerings |

|---|---|---|

| HNWIs & UHNWIs | Wealth preservation, multi-generational planning, complex financial structuring | Bespoke investment solutions, expert wealth management, estate planning |

| Independent Asset Managers (IAMs) | Access to platforms, investment expertise, operational support | Tailored solutions, robust platforms, global reach |

| Institutional Clients | Specialized investment strategies, financing, liquidity management | Asset management, corporate banking, treasury services |

| Entrepreneurs & Business Owners | Wealth creation, succession planning, liquidity management for personal and business | Integrated financial solutions, advisory services, holistic wealth management |

Cost Structure

Personnel expenses represent a substantial cost for EFG International, largely driven by the competitive compensation packages for its Client Relationship Officers and other skilled financial professionals. These costs are directly linked to the firm's strategy of investing heavily in attracting and retaining top talent, a crucial element in the people-centric private banking sector.

Operating expenses, specifically General & Administrative (G&A), are a significant component of EFG International's cost structure, reflecting the complexities of managing a global financial services firm. These costs encompass the essential overheads of maintaining its extensive network of offices worldwide, including rent, utilities, and the salaries of administrative staff who ensure smooth operations. In 2023, EFG reported operating expenses of CHF 1,349.1 million, a figure that includes these G&A elements.

Beyond the physical infrastructure, G&A also covers crucial investments in IT infrastructure, which is vital for supporting digital platforms and client services. Marketing efforts to build brand awareness and attract new clients, along with legal and litigation costs inherent in the financial industry, also fall under this umbrella. EFG's commitment to a disciplined approach to cost management is evident as they navigate these varied expense categories, aiming for efficiency while supporting global business growth.

EFG International's commitment to technology and digitization translates into significant ongoing cost. In 2024, these investments are projected to cover the development and maintenance of new digital client platforms, alongside the integration of advanced automation solutions to streamline back-office operations.

These expenditures are not merely operational; they are strategic investments designed to elevate the client experience through personalized digital tools and to bolster operational efficiency. Cybersecurity measures are also a substantial part of this cost, ensuring the protection of sensitive client data and the integrity of digital systems.

For instance, the global wealth management sector saw a notable increase in technology spending in 2023, with many firms allocating over 15% of their operating expenses to digital transformation initiatives, a trend expected to continue into 2024. This focus on technology is critical for EFG International's scalability and its ability to adapt to evolving market demands and client expectations.

Regulatory and Compliance Costs

EFG International faces significant expenses stemming from the highly regulated financial sector. These costs are essential for maintaining compliance with global legal frameworks, implementing robust risk management strategies, and upholding the bank's integrity. For instance, in 2024, financial institutions globally continued to see increased spending on compliance technology and personnel to navigate evolving regulations.

These expenditures are not merely operational burdens but are foundational for sustainable growth and market trust. Adherence to stringent rules protects EFG from potential fines and reputational damage, thereby enabling its expansion.

- Regulatory Compliance: Costs associated with meeting national and international financial regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures.

- Legal and Advisory Fees: Expenses incurred for legal counsel, external advisors, and audits to ensure adherence to evolving legal landscapes.

- Risk Management Systems: Investment in technology and personnel for credit risk, market risk, and operational risk management, crucial for stability.

- Reporting and Data Management: Costs related to generating and submitting regulatory reports, requiring sophisticated data infrastructure and analytics.

Acquisition and Integration Costs

EFG International's cost structure includes significant acquisition and integration expenses. These are the costs tied to buying and merging other companies into EFG. Think of due diligence, legal work, and the actual process of combining operations and systems.

For example, the acquisition of Cité Gestion and ISG involved substantial upfront costs. These investments are crucial for EFG's growth strategy, aiming to expand its market reach and service offerings. However, these expenditures directly affect the company's financial performance in the short to medium term.

- Due Diligence: Costs incurred to thoroughly investigate potential acquisition targets.

- Legal and Advisory Fees: Expenses related to lawyers, investment bankers, and consultants involved in the transaction.

- Integration Expenses: Costs associated with merging IT systems, rebranding, staff restructuring, and operational alignment of acquired entities.

- Post-Acquisition Adjustments: Potential costs for further operational improvements or addressing unforeseen issues after the acquisition is complete.

Personnel expenses remain a primary cost driver for EFG International, reflecting its strategy of investing in highly skilled professionals. These costs are directly tied to attracting and retaining talent in the competitive private banking landscape.

Operating expenses, including General & Administrative (G&A), are substantial due to the global nature of EFG's operations. These cover office networks, administrative staff, IT infrastructure, marketing, and legal costs. In 2023, EFG's operating expenses reached CHF 1,349.1 million.

Technology and digitization are significant ongoing investments for EFG International. These expenditures support new digital platforms, automation, and cybersecurity, aiming to enhance client experience and operational efficiency. The wealth management sector saw technology spending exceed 15% of operating expenses in 2023, a trend continuing into 2024.

Regulatory compliance is a considerable cost for EFG, essential for navigating global financial regulations and maintaining market trust. Increased spending on compliance technology and personnel is a trend observed across financial institutions in 2024.

Acquisition and integration expenses represent another key cost area for EFG International, driven by its growth strategy. These include due diligence, legal fees, and the operational merging of acquired entities, such as Cité Gestion and ISG.

| Cost Category | Description | 2023 Data (CHF million) | 2024 Outlook |

|---|---|---|---|

| Personnel Expenses | Salaries and benefits for client relationship officers and other professionals. | Not explicitly broken out, but a significant component of operating expenses. | Continued investment in talent acquisition and retention. |

| Operating Expenses (G&A) | Office network, administrative staff, IT, marketing, legal. | 1,349.1 | Managed for efficiency while supporting global growth. |

| Technology & Digitization | Digital platforms, automation, cybersecurity. | Part of operating expenses; sector trend >15% of OpEx. | Continued investment for client experience and efficiency. |

| Regulatory Compliance | Meeting global financial regulations, risk management. | Part of operating expenses; sector trend increasing. | Increased spending on compliance technology and personnel. |

| Acquisition & Integration | Due diligence, legal fees, operational merging. | Substantial costs for Cité Gestion and ISG acquisitions. | Costs associated with ongoing strategic acquisitions. |

Revenue Streams

Net banking fee and commission income stands as a core revenue generator for EFG International, stemming from a broad array of financial services. This includes income derived from investment advisory, asset management, and various other banking-related charges.

The growth in this segment is directly tied to an increase in average revenue-generating assets under management and a higher level of client engagement and transaction volume. For instance, EFG International reported a 7% increase in fee and commission income in 2023, reaching CHF 726.7 million, indicating strong client activity and effective service delivery.

A crucial factor influencing this revenue stream is mandate penetration, which signifies the extent to which clients utilize EFG International's full suite of managed services. Higher mandate penetration directly translates to increased fee and commission income, as more assets are managed under fee-based agreements.

Net interest income is a core revenue stream for EFG International, generated from the difference between the interest earned on their assets, such as loans and securities, and the interest paid on their liabilities, like client deposits and borrowings. This income is a stable element of their operations, though it is influenced by prevailing market interest rates.

For instance, EFG's ability to reinvest client portfolios at higher nominal interest rates directly boosts this revenue. As of the first half of 2024, EFG reported a net interest income of CHF 331.8 million, a significant increase from CHF 262.6 million in the same period of 2023, reflecting the benefit of a higher interest rate environment.

Net Other Income, a key revenue stream for EFG International, encompasses gains from foreign exchange transactions and interest rate swaps. This segment also includes income generated from various other trading activities, reflecting the company's dynamic market engagement.

In 2024, EFG International reported significant growth in its net other income, driven by heightened client activity and successful strategic initiatives. This uptick demonstrates the effectiveness of their trading strategies and their ability to capitalize on market opportunities.

Furthermore, contributions from the life insurance portfolio and recoveries from settlements bolstered this revenue stream. These diverse sources highlight EFG International's multifaceted approach to generating income beyond traditional asset management fees.

Credit and Financing Solutions

EFG International generates income by offering a range of credit and financing solutions, such as Lombard loans and mortgages. These are customized to meet individual client requirements, thereby enhancing their wealth management experience with adaptable funding choices.

This segment of their business model directly supports increased client leverage. For instance, in 2024, EFG reported a notable uptick in client lending activities, reflecting a growing demand for these integrated financial services.

- Lombard Loans: Financing secured against investment portfolios, providing liquidity.

- Mortgages: Tailored property financing solutions for clients.

- Client Leverage: Facilitating clients' ability to utilize their assets for further investment or personal needs.

- Revenue Generation: Earning interest income and fees from these credit facilities.

Performance-Based Fees

EFG International structures a portion of its revenue around performance-based fees for specific investment mandates. This means their earnings are directly tied to the positive returns achieved on client assets, creating a strong alignment of interests.

This fee structure is particularly impactful during favorable market conditions, significantly boosting EFG's overall revenue. For instance, in 2023, EFG's fee and commission income, which would include these performance-based elements, stood at CHF 1,013.6 million. This demonstrates the substantial contribution such arrangements can make to the company's financial performance.

- Performance Alignment: Fees are earned only when client investments outperform agreed-upon benchmarks.

- Revenue Volatility: Income from these fees can fluctuate based on market performance.

- Incentive for Growth: Encourages EFG to actively manage portfolios for optimal returns.

- Contribution to Total Revenue: Performance fees are a key component within EFG's broader fee and commission income.

EFG International's revenue is diversified across several key streams. Net banking fee and commission income, derived from advisory and asset management, saw a 7% increase in 2023 to CHF 726.7 million. Net interest income, benefiting from higher rates, rose to CHF 331.8 million in H1 2024. Net other income, including FX and trading gains, also showed strong growth in 2024, further bolstered by life insurance and settlement recoveries.

| Revenue Stream | 2023 (CHF million) | H1 2024 (CHF million) | Key Drivers |

|---|---|---|---|

| Net Fee and Commission Income | 726.7 | N/A | Asset growth, client engagement, mandate penetration |

| Net Interest Income | N/A | 331.8 | Interest rate environment, reinvestment rates |

| Net Other Income | N/A | Significant growth | FX, trading, life insurance, settlements |

Business Model Canvas Data Sources

The EFG International Business Model Canvas is built upon a foundation of comprehensive market analysis, internal financial data, and strategic operational insights. These data sources ensure each component of the canvas accurately reflects EFG's current market position and future strategic direction.