Edwards Lifesciences PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

Gain a critical edge with our comprehensive PESTLE Analysis of Edwards Lifesciences. Uncover how political stability, economic fluctuations, and technological advancements are shaping the cardiovascular device market. Equip yourself with the foresight needed to navigate these external forces and bolster your strategic planning. Download the full analysis now for actionable intelligence.

Political factors

Changes in government healthcare policies, particularly those affecting reimbursement rates for medical devices and procedures, directly influence Edwards Lifesciences' revenue streams and ability to access markets. For instance, shifts in Medicare reimbursement for cardiovascular procedures in 2024 could impact the adoption of their transcatheter aortic valve replacement (TAVR) systems.

The increasing global focus on value-based care models, where providers are reimbursed based on patient outcomes rather than the volume of services, presents both opportunities and challenges. Edwards Lifesciences' commitment to demonstrating the long-term cost-effectiveness and improved patient quality of life associated with its therapies is therefore a critical strategic imperative.

New national health initiatives, such as those aimed at expanding access to cardiac care or promoting preventative measures, can significantly shape the demand for Edwards Lifesciences' advanced heart valve therapies and critical care solutions. Monitoring these policy trends is essential for effective strategic planning and successful market penetration in key regions.

Regulatory bodies like the U.S. Food and Drug Administration (FDA) and international equivalents exert considerable control over Edwards Lifesciences. The FDA's stringent approval process, for instance, directly impacts how quickly new devices like their transcatheter aortic valve replacement (TAVR) systems can reach the market. In 2024, the FDA continued to emphasize robust clinical evidence for medical device approvals, potentially extending timelines and increasing development costs.

Global trade agreements and geopolitical tensions directly influence Edwards Lifesciences' operational landscape. For instance, the ongoing shifts in trade policies, such as those impacting medical device imports and exports, can alter supply chain costs and market access. In 2024, the World Trade Organization (WTO) continues to navigate complex trade disputes, which could indirectly affect the cost of raw materials or finished goods for a company like Edwards Lifesciences.

Tariffs and trade barriers pose significant risks, potentially disrupting manufacturing processes and impacting profitability in key international markets. Political instability in regions where Edwards Lifesciences operates or sources materials can lead to unforeseen operational challenges. For example, a sudden imposition of import duties on cardiovascular devices in a major European market could necessitate a rapid adjustment of pricing strategies or sourcing locations.

Maintaining diversified supply chains and closely monitoring international relations are crucial for mitigating these political risks. Edwards Lifesciences' reliance on global suppliers means that trade disruptions in one region could necessitate swift sourcing from another. The company's ability to adapt to evolving trade regulations, such as those related to data privacy or product registration in different countries, will be a key determinant of its success in international markets through 2025.

Political Stability in Key Markets

Political stability in key markets significantly impacts Edwards Lifesciences' strategic decisions and operational continuity. For instance, the company's presence in diverse regions means navigating varying levels of governance and policy predictability. A stable political landscape, like that in the United States, where a substantial portion of its revenue is generated, provides a more predictable environment for regulatory approvals and market access.

Conversely, regions experiencing political upheaval can introduce considerable risk. Economic uncertainty stemming from political instability can lead to currency fluctuations, affecting profit margins when repatriating earnings. Furthermore, there's always the underlying, albeit often low, risk of nationalization or adverse policy changes that could disrupt supply chains or market access, directly impacting long-term business viability. For example, geopolitical tensions in Eastern Europe in 2024-2025 continue to create economic headwinds and supply chain vulnerabilities for many global medical device companies.

A stable political environment fosters predictable market conditions and bolsters investor confidence, which is crucial for a company like Edwards Lifesciences that relies on consistent growth and access to capital. The company's 2024 financial reports likely reflect an emphasis on markets with robust legal frameworks and consistent policy enforcement.

- Market Stability: Political stability in the US, a primary market for Edwards Lifesciences, contributes to consistent demand and regulatory predictability.

- Economic Impact: Geopolitical tensions in other regions can lead to currency volatility, impacting revenue translation and operational costs.

- Investor Confidence: Stable governance in operating countries enhances investor sentiment, supporting the company's valuation and access to funding.

- Regulatory Environment: Predictable political systems facilitate smoother navigation of healthcare regulations and market approvals for new devices.

Public Health Initiatives

Government-backed public health campaigns aimed at reducing cardiovascular disease incidence or improving treatment access directly influence the market for Edwards Lifesciences' innovative cardiac solutions. For instance, increased funding for heart disease screening programs, as seen in various national health strategies throughout 2024 and projected into 2025, can broaden the patient population diagnosed with conditions treatable by Edwards' transcatheter heart valves and critical care monitoring systems. The Centers for Disease Control and Prevention (CDC) reported in late 2024 that heart disease remains the leading cause of death in the US, underscoring the continued relevance of these initiatives.

These public health efforts can translate into tangible market expansion for Edwards Lifesciences. As awareness grows and preventative measures are emphasized, more individuals may seek early diagnosis and intervention, directly benefiting companies offering advanced treatment options. Edwards Lifesciences' strategic alignment with these national health priorities, such as those focusing on expanding access to minimally invasive cardiac procedures, can significantly bolster its market penetration and patient engagement.

Key impacts include:

- Expanded Patient Pool: Public health focus on early detection of conditions like aortic stenosis can increase the number of patients identified as candidates for TAVR procedures.

- Increased Funding for Treatment: Government investment in cardiovascular health infrastructure and patient access programs directly supports the adoption of advanced medical devices.

- Market Alignment: Companies like Edwards Lifesciences that align their product development and marketing with national public health goals can gain a competitive advantage.

- Enhanced Brand Reputation: Participation in or support of public health initiatives can improve a company's public image and its role as a healthcare partner.

Government healthcare policies, particularly reimbursement rates for medical devices and procedures, directly influence Edwards Lifesciences' revenue. Shifts in Medicare reimbursement for cardiovascular procedures in 2024 could impact the adoption of their TAVR systems, a critical growth area. The company's focus on value-based care, demonstrating long-term cost-effectiveness, is key to navigating these policy shifts and ensuring market access.

Government-backed public health campaigns targeting cardiovascular disease can expand the patient pool for Edwards Lifesciences' solutions. For example, increased funding for heart disease screening programs in 2024, as highlighted by the CDC's report on heart disease being the leading US cause of death, can identify more candidates for TAVR procedures.

Political stability in key markets like the US provides a predictable environment for regulatory approvals and market access, bolstering investor confidence. Conversely, geopolitical tensions in regions like Eastern Europe in 2024-2025 create economic headwinds and supply chain vulnerabilities for global medical device companies.

| Political Factor | Impact on Edwards Lifesciences | 2024/2025 Relevance |

|---|---|---|

| Healthcare Policy & Reimbursement | Affects revenue, market access, and device adoption rates. | Changes in Medicare reimbursement for cardiovascular procedures in 2024. |

| Public Health Initiatives | Expands patient pool and market for cardiac solutions. | Increased funding for heart disease screening programs; CDC data on heart disease prevalence. |

| Political Stability & Geopolitics | Influences operational continuity, currency fluctuations, and investor confidence. | Stable US market vs. geopolitical tensions in Eastern Europe impacting supply chains. |

What is included in the product

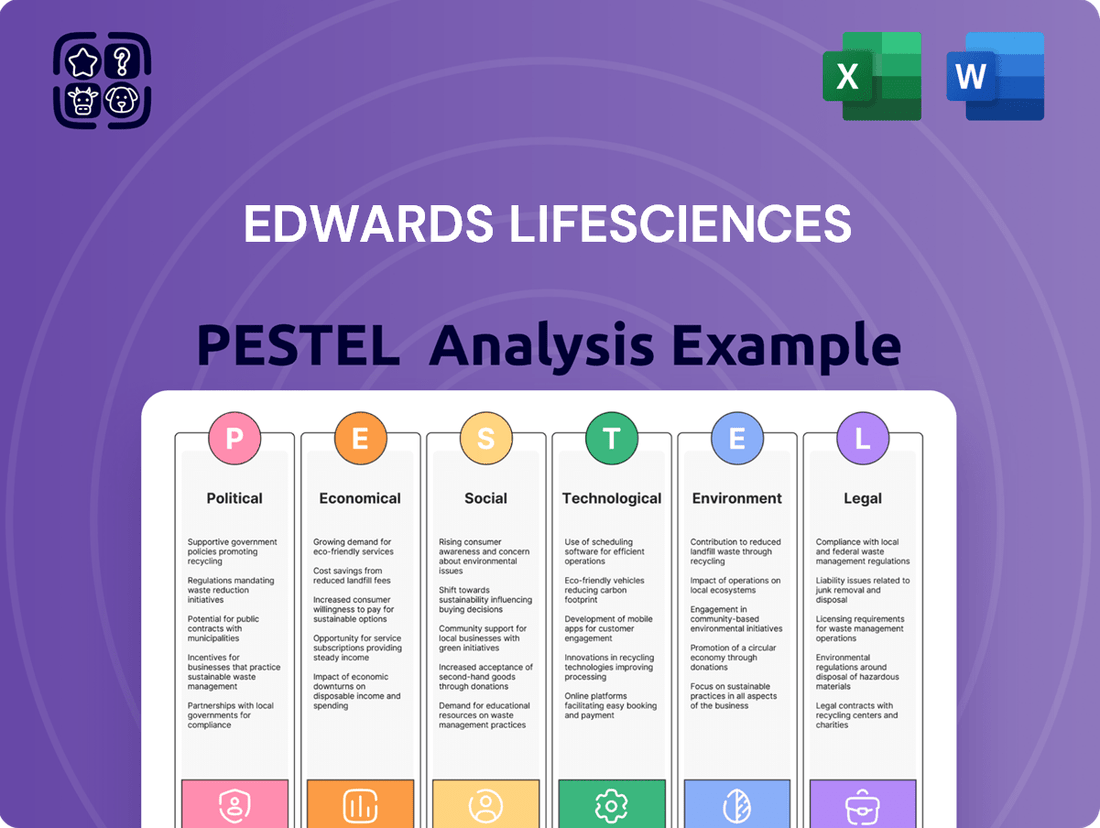

This PESTLE analysis for Edwards Lifesciences examines the impact of political, economic, social, technological, environmental, and legal factors on its operations and strategy.

It provides a comprehensive overview of the external forces shaping the cardiovascular medical device industry, offering insights for strategic decision-making.

A concise Edwards Lifesciences PESTLE analysis that highlights key external factors, serving as a pain point reliever by enabling rapid identification of opportunities and threats for strategic decision-making.

Economic factors

The global economic landscape significantly shapes demand for Edwards Lifesciences' advanced cardiovascular solutions. As of early 2025, projections indicate a moderate global GDP growth of around 2.7%, a slight deceleration from 2024's estimated 3.0%. This environment directly impacts healthcare budgets worldwide, influencing hospital capital expenditures and patient ability to afford elective procedures, which are crucial for products like transcatheter heart valves.

Economic slowdowns can translate into tighter hospital purse strings, potentially delaying investments in new technologies or leading to postponement of non-urgent procedures. Conversely, periods of strong economic expansion, characterized by higher disposable incomes and increased government revenue, typically bolster healthcare spending. This can result in greater adoption of innovative therapies and devices, benefiting companies like Edwards Lifesciences that offer life-saving treatments.

National healthcare spending is a significant driver for Edwards Lifesciences. In the US, healthcare expenditures reached an estimated $4.7 trillion in 2024, representing about 17.3% of the GDP. This overall spending level directly influences the budgets available for purchasing advanced medical devices like those produced by Edwards Lifesciences.

Shifts in how this money is allocated are also crucial. For instance, a growing emphasis on value-based care and preventative measures, while potentially beneficial long-term, could temporarily alter demand for interventional products. However, the aging global population, particularly in developed nations, continues to drive demand for cardiac and vascular interventions, a core market for Edwards.

Private healthcare spending, often through insurance, plays a vital role. In 2024, private health insurance accounted for approximately 28% of total US healthcare spending. Changes in insurance coverage, reimbursement policies, and patient out-of-pocket costs can directly impact the adoption rates and sales volumes of Edwards Lifesciences' innovative technologies.

Rising inflation, a persistent concern throughout 2024 and into 2025, directly impacts Edwards Lifesciences by increasing the cost of essential components, manufacturing processes, and skilled labor. For instance, the producer price index (PPI) for medical devices saw a notable uptick in late 2024, signaling higher input costs that could compress Edwards' profit margins if not effectively passed on to consumers or offset by operational efficiencies.

Furthermore, the prevailing higher interest rate environment, with central banks maintaining tighter monetary policy to combat inflation, presents a significant challenge for capital-intensive industries like medical technology. Increased borrowing costs for funding crucial research and development projects, as well as for expanding manufacturing capacity, could potentially decelerate Edwards Lifesciences' pace of innovation and strategic growth initiatives. For example, a 1% increase in interest rates could add millions to the cost of servicing debt for large-scale capital investments.

Currency Exchange Rates

Currency exchange rates significantly influence Edwards Lifesciences' financial results due to its extensive global operations. Fluctuations can impact the reported value of international sales and the cost of imported materials. For instance, a stronger US dollar in 2024 would likely make Edwards' products more expensive for overseas buyers, potentially dampening demand and reducing reported revenue when converted back into dollars. Conversely, a weaker dollar would have the opposite effect, making international sales appear larger.

Managing this foreign exchange exposure is critical for financial stability. Edwards Lifesciences employs various hedging strategies, such as forward contracts and currency options, to mitigate the impact of adverse currency movements. This proactive approach aims to protect profit margins and enhance the predictability of earnings, allowing for more effective financial planning and investor confidence.

- Global Revenue Impact: Edwards Lifesciences' reported revenues from international markets are directly affected by currency conversions. A stronger USD against currencies like the Euro or Yen can reduce the dollar value of sales generated in those regions.

- Cost of Goods Sold: Similarly, the cost of manufacturing components or finished goods sourced from foreign countries can increase or decrease based on exchange rate shifts, impacting Edwards' gross margins.

- Hedging Strategies: The company actively uses financial instruments to hedge against currency volatility, aiming to lock in exchange rates for future transactions and reduce the uncertainty in its financial performance.

- 2024/2025 Outlook: Analysts anticipate continued currency volatility in 2024 and 2025, making robust FX risk management a key focus for Edwards Lifesciences to maintain consistent profitability.

Patient Affordability and Reimbursement

Patient affordability and reimbursement are critical economic factors for Edwards Lifesciences. The ability of patients to afford innovative cardiovascular therapies, coupled with the extent of coverage provided by insurance and government programs, directly influences market access and sales. For instance, in 2024, the average out-of-pocket cost for TAVR procedures can vary significantly, impacting patient willingness to proceed with treatment.

Changes in reimbursement policies, such as shifts in Medicare coverage decisions or private payer negotiations, can have a substantial effect on Edwards Lifesciences' revenue streams. If reimbursement rates are reduced or patient co-pays increase substantially, it can create a barrier to the adoption of their high-value products. Edwards Lifesciences actively engages in advocating for favorable reimbursement policies to ensure continued patient access.

- Reimbursement Landscape: In 2024, Medicare reimbursement for TAVR procedures remains a key driver, but variations in coverage among private payers continue to influence market dynamics.

- Out-of-Pocket Costs: For patients without comprehensive insurance, out-of-pocket expenses for advanced cardiac devices can range from thousands to tens of thousands of dollars, impacting affordability.

- Policy Advocacy: Edwards Lifesciences invests in health economics and outcomes research to demonstrate the long-term value of its therapies, supporting arguments for favorable reimbursement.

- Market Access Challenges: Persistent issues with prior authorization requirements and differing coverage criteria across insurance providers can delay or deny patient access to critical treatments.

Global economic growth, projected at 2.7% for 2025, influences healthcare budgets and patient affordability for Edwards Lifesciences' products. Inflationary pressures in 2024 and 2025 increased operational costs, impacting profit margins. Higher interest rates also present a challenge for capital-intensive R&D and expansion.

| Economic Factor | 2024/2025 Data Point | Impact on Edwards Lifesciences |

|---|---|---|

| Global GDP Growth | Projected 2.7% (2025) | Influences healthcare spending and device adoption. |

| Inflation (PPI for Medical Devices) | Notable uptick (late 2024) | Increases input costs, potentially compressing margins. |

| Interest Rates | Higher, maintained by central banks | Increases borrowing costs for R&D and expansion. |

| US Healthcare Spending | ~$4.7 trillion (2024) | Indicates overall market size for medical devices. |

Preview the Actual Deliverable

Edwards Lifesciences PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Edwards Lifesciences delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions within the cardiovascular medical device industry.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain insights into market trends, regulatory landscapes, and competitive pressures that shape Edwards Lifesciences' business environment, enabling informed strategic planning.

Sociological factors

The world's population is getting older. By 2050, it's projected that nearly 17% of the global population will be over 65, a significant jump from around 10% in 2022. This demographic shift is a major sociological factor for Edwards Lifesciences.

Age is a key risk factor for conditions like structural heart disease, meaning more older individuals mean a larger potential patient base for Edwards' TAVR and surgical heart valve replacement technologies. For instance, the prevalence of aortic stenosis, a condition often treated by TAVR, increases significantly with age, affecting approximately 2.5% of individuals over 75.

This growing elderly demographic also puts pressure on healthcare systems, requiring more advanced medical infrastructure and specialized cardiac care services. Countries like Japan already have over 29% of their population aged 65 and above, highlighting the immediate need for solutions catering to an aging populace.

The increasing incidence of chronic diseases, particularly cardiovascular ailments, is a significant driver for Edwards Lifesciences. Factors like evolving lifestyle patterns, dietary shifts, and longer life expectancies are contributing to this trend. For instance, in 2023, the CDC reported that approximately 697,000 Americans died from heart disease, a leading cause of mortality.

This rise in chronic conditions directly translates to a greater need for advanced medical technologies, including those offered by Edwards Lifesciences for heart valve repair, replacement, and critical care monitoring. As more people require interventions for conditions like aortic stenosis or mitral regurgitation, the market for their specialized products naturally expands.

Furthermore, public health initiatives aimed at early detection and management of chronic diseases are crucial. Increased diagnosis rates mean more patients are identified as candidates for life-saving procedures and devices, thereby bolstering demand for Edwards Lifesciences' innovative solutions and contributing to their market growth.

Growing public awareness of heart health and the array of available treatments significantly impacts the demand for advanced cardiovascular therapies. Patients are increasingly empowered, actively seeking information and becoming more involved in their healthcare decisions, which in turn drives their interest in innovative solutions like transcatheter aortic valve replacement (TAVR).

This proactive patient engagement is a key driver for companies such as Edwards Lifesciences, encouraging greater investment in patient education initiatives and advocacy programs to meet the rising demand for less invasive procedures. In 2023, Edwards Lifesciences reported TAVR sales of $4.3 billion, reflecting the strong market adoption of these advanced therapies.

Lifestyle and Dietary Changes

Societal shifts towards more sedentary lifestyles and less healthy dietary habits are unfortunately contributing to a rise in cardiovascular diseases globally. This trend, while concerning, indirectly creates a sustained demand for medical interventions like those provided by Edwards Lifesciences. For instance, the World Health Organization reported in 2023 that non-communicable diseases, largely driven by lifestyle factors, accounted for an estimated 74% of all deaths worldwide, with cardiovascular diseases being the leading cause.

These lifestyle changes, characterized by increased screen time and processed food consumption, unfortunately exacerbate the prevalence of conditions such as atherosclerosis and hypertension. This ongoing health challenge underscores the critical and continuous need for advanced medical devices and therapies to manage and treat these progressing heart conditions. The market for cardiovascular devices, therefore, remains robust as these societal trends persist.

- Rising Chronic Disease Burden: Lifestyle factors contribute to an increasing incidence of chronic conditions like diabetes and obesity, which are significant risk factors for cardiovascular disease.

- Demand for Interventions: As heart conditions become more prevalent due to these lifestyle shifts, the demand for innovative treatments and medical devices, including those from Edwards Lifesciences, is expected to grow.

- Healthcare System Strain: The increasing burden of lifestyle-related diseases places greater demand on healthcare systems, potentially leading to increased investment in advanced medical technologies.

Healthcare Access and Equity

Healthcare access and equity significantly shape the market for Edwards Lifesciences' cardiovascular therapies. Disparities in access, often linked to socioeconomic status, geographic location, or ethnicity, can limit who receives life-saving treatments. For instance, in 2024, the U.S. saw continued challenges in rural areas, where an estimated 20% of the population lives, facing greater barriers to specialized cardiac care compared to urban centers.

Efforts to enhance healthcare equity and broaden access to specialized medical care in underserved communities directly translate to a larger potential patient base for Edwards Lifesciences. Initiatives focused on reducing these disparities are crucial, not only for ethical considerations but also for unlocking new market opportunities. By 2025, projections indicate that expanding access to care in these regions could represent a substantial growth area.

- Disparities in Access: Socioeconomic, geographic, and ethnic factors create barriers to specialized cardiac care, impacting patient reach.

- Market Expansion Potential: Improving healthcare equity can significantly broaden the addressable market for Edwards Lifesciences' therapies.

- Ethical and Business Imperative: Addressing access issues is vital for both corporate social responsibility and long-term market growth.

- Rural Healthcare Challenges: In 2024, approximately 20% of the U.S. population in rural areas faced greater hurdles in accessing advanced cardiac treatments.

Societal attitudes towards health and wellness are evolving, with a growing emphasis on preventative care and minimally invasive treatments. This shift benefits Edwards Lifesciences as patients increasingly seek less disruptive medical interventions. For example, the global minimally invasive surgical instruments market was valued at approximately $25 billion in 2023 and is projected to grow substantially.

This trend aligns perfectly with Edwards' core offerings, such as TAVR, which represents a significant advancement over traditional open-heart surgery. As patient and physician awareness of these benefits increases, so does the demand for these advanced therapies. Edwards Lifesciences' commitment to innovation in this space positions it well for continued market leadership.

Furthermore, the increasing acceptance of telehealth and remote patient monitoring technologies, accelerated by events in recent years, also plays a role. These advancements can improve patient access to follow-up care and streamline the management of chronic cardiovascular conditions, indirectly supporting the market for implanted devices and related services. By 2025, the telehealth market is expected to reach over $300 billion globally.

Technological factors

Edwards Lifesciences thrives on continuous innovation in medical device technology, especially in minimally invasive procedures like Transcatheter Aortic Valve Replacement (TAVR). These advancements are key to their market position.

Breakthroughs in areas like advanced polymers and sophisticated imaging are directly translating into safer, more effective, and less invasive treatment options for patients. This technological edge is crucial.

For instance, the company's TAVR portfolio, a major revenue driver, directly benefits from these ongoing technological leaps. Edwards Lifesciences reported TAVR sales of $4.4 billion in 2023, highlighting the commercial impact of these innovations.

The increasing integration of digital health, artificial intelligence (AI), and machine learning (ML) into critical care monitoring is a key technological driver. These advancements allow for more precise diagnostics and predictive analytics, directly impacting the effectiveness of hemodynamic monitoring solutions like those offered by Edwards Lifesciences.

AI and ML can significantly enhance diagnostic accuracy and enable early prediction of patient deterioration, leading to more proactive interventions. For instance, AI algorithms are being developed to analyze complex physiological data streams, potentially improving the early detection of sepsis or cardiac events in critical care settings, as seen in pilot programs in leading hospitals during 2024.

By leveraging these technologies, Edwards Lifesciences can refine its hemodynamic monitoring systems to offer more sophisticated insights, optimizing treatment protocols and improving patient outcomes. This technological shift promises to boost operational efficiency within healthcare facilities, a trend that saw digital health investments exceeding $200 billion globally in 2024, with a substantial portion directed towards AI in healthcare.

Edwards Lifesciences' commitment to research and development (R&D) is a cornerstone of its technological advancement and market leadership. This sustained investment fuels innovation, leading to the development of next-generation medical devices and therapies for cardiovascular diseases. For instance, in 2023, the company reported R&D expenses of approximately $1.1 billion, underscoring its dedication to pioneering new solutions.

This significant R&D outlay directly supports the discovery of novel treatment approaches and the enhancement of existing product lines, such as their transcatheter aortic valve replacement (TAVR) systems. A strong R&D pipeline is essential for Edwards Lifesciences to maintain its competitive edge by consistently introducing groundbreaking technologies that address critical unmet patient needs in the structural heart and critical care markets.

Manufacturing Process Innovation

Innovations in manufacturing processes are critical for Edwards Lifesciences. Embracing automation, advanced robotics, and 3D printing can significantly boost the efficiency, precision, and cost-effectiveness of producing their intricate medical devices, like transcatheter aortic valve replacement (TAVR) systems. These technological leaps translate into shorter production timelines, less material waste, and higher product quality. For instance, the medical device industry saw a significant increase in automation adoption, with a notable rise in robotic-assisted manufacturing, contributing to an estimated 15% reduction in production costs for complex components in 2024.

Optimizing manufacturing is not just about improving current operations; it's fundamental for scaling up production to meet the growing global demand for life-saving cardiovascular solutions. Edwards Lifesciences' commitment to these advancements directly impacts their ability to serve a larger patient population. The company has invested heavily in advanced manufacturing capabilities, aiming to increase output by 20% by the end of 2025, a move that will be crucial for their market expansion strategies.

- Enhanced Efficiency: Automation and robotics reduce manual labor, speeding up assembly and quality control processes for devices like the Edwards SAPIEN 3 TAVR system.

- Improved Precision: 3D printing allows for the creation of highly complex and customized device components, ensuring superior fit and performance.

- Cost Reduction: Streamlined processes and reduced waste contribute to lower manufacturing costs, potentially impacting product pricing and accessibility.

- Scalability: Modernized manufacturing infrastructure is essential for Edwards Lifesciences to meet the projected 10-15% annual growth in the TAVR market through 2026.

Telemedicine and Remote Monitoring

The increasing adoption of telemedicine and remote patient monitoring offers significant avenues for Edwards Lifesciences, especially within its critical care offerings. These advancements facilitate ongoing data gathering, virtual consultations, and prompt interventions, potentially shortening hospitalizations and enhancing patient recovery. For instance, the global telemedicine market was projected to reach over $250 billion by 2027, indicating a substantial growth trajectory that Edwards can leverage.

By integrating their advanced monitoring systems with these remote platforms, Edwards can broaden their market access and increase the practical application of their technologies. This strategic alignment is crucial as healthcare systems increasingly prioritize efficient, patient-centric care models. The company's existing portfolio, which includes sophisticated hemodynamic monitoring, is well-positioned to benefit from this trend, allowing for continuous patient oversight outside traditional clinical settings.

- Market Growth: The global telemedicine market is experiencing rapid expansion, with projections indicating continued strong growth through 2025 and beyond, creating a fertile ground for connected medical devices.

- Enhanced Patient Care: Remote monitoring allows for earlier detection of patient deterioration, enabling timely interventions and potentially improving outcomes for individuals with cardiovascular conditions.

- Operational Efficiency: By reducing the need for constant in-person visits, telemedicine can lower healthcare costs and improve the efficiency of clinical resource allocation for Edwards' customer base.

Technological advancements are central to Edwards Lifesciences' strategy, particularly in minimally invasive cardiovascular solutions like TAVR. The company's substantial R&D investment, approximately $1.1 billion in 2023, fuels innovation in areas such as advanced polymers and imaging, directly enhancing product safety and efficacy. The integration of AI and machine learning into hemodynamic monitoring is also a key focus, promising more precise diagnostics and predictive analytics, with pilot programs in hospitals during 2024 demonstrating AI's potential in early patient deterioration detection.

Legal factors

Edwards Lifesciences navigates a complex web of global medical device regulations, with the U.S. Food and Drug Administration (FDA) and Europe's CE Mark being critical approval pathways. Meeting rigorous pre-market approval, ongoing post-market surveillance, and robust quality system requirements are non-negotiable for market entry and continued operation.

In 2024, the regulatory landscape continues to evolve, with potential impacts on product development cycles and market access for innovative cardiovascular technologies. For instance, the EU's Medical Device Regulation (MDR) continues to mature, requiring ongoing vigilance and adaptation from manufacturers like Edwards.

Edwards Lifesciences heavily relies on its intellectual property, particularly patents, to protect its groundbreaking medical technologies like the TAVR systems and advanced critical care monitoring. In 2023, the company reported significant investment in research and development, underscoring the importance of these patents in maintaining its competitive edge and preventing rivals from replicating its innovations.

The legal landscape surrounding patent infringement can be a significant challenge. Edwards Lifesciences actively monitors for potential infringements to safeguard its market position and recoup its substantial R&D investments. A robust patent portfolio not only deters competitors but also serves as a critical incentive for continued innovation in the highly regulated medical device industry.

Edwards Lifesciences operates under a stringent legal framework governing product liability and patient safety. Failure to meet these exacting standards, particularly concerning their cardiovascular devices, can result in significant legal repercussions. For instance, in 2023, the medical device industry saw numerous product recalls and litigations, underscoring the constant vigilance required.

The potential for lawsuits, product recalls, and damage to their reputation means Edwards must prioritize robust quality control and rigorous clinical testing. Adherence to regulations like those set by the FDA is paramount; in 2024, the FDA continued to emphasize post-market surveillance and data transparency for medical devices, a trend expected to intensify.

Ensuring comprehensive clinical trials and clear, accurate product labeling are critical strategies for mitigating these legal risks. These measures not only protect patients but also safeguard Edwards Lifesciences from costly litigation and regulatory penalties, a crucial aspect of their operational strategy in the highly regulated healthcare sector.

Data Privacy and Cybersecurity Regulations

Edwards Lifesciences operates within a landscape increasingly shaped by stringent data privacy and cybersecurity regulations. The company must navigate complex frameworks like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States, especially as it integrates digital health technologies and manages vast amounts of sensitive patient data. For instance, GDPR fines can reach up to 4% of global annual turnover, underscoring the financial risks of non-compliance.

Maintaining robust cybersecurity measures is paramount, not just for legal adherence but to safeguard patient trust and protect intellectual property. A significant data breach could lead to substantial financial penalties and irreparable damage to Edwards Lifesciences' reputation. The increasing sophistication of cyber threats in the healthcare sector means continuous investment in advanced security protocols and employee training is essential.

- GDPR Fines: Up to 4% of global annual turnover or €20 million, whichever is higher.

- HIPAA Penalties: Fines can range from $100 to $50,000 per violation, with annual maximums reaching $1.5 million per violation category.

- Cybersecurity Spending: Global healthcare cybersecurity spending was projected to reach over $125 billion in 2023, highlighting the industry's focus on this area.

- Patient Data Sensitivity: Medical records are highly sensitive, making breaches particularly damaging to patient trust and company reputation.

Anti-Kickback and Anti-Bribery Laws

Edwards Lifesciences operates under stringent anti-kickback, anti-bribery, and anti-corruption regulations, including the U.S. Foreign Corrupt Practices Act (FCPA) and comparable international statutes. These laws are critical for regulating how the company interacts with healthcare professionals and government representatives, ensuring ethical business conduct and preventing illicit payments or inducements.

Violations of these legal frameworks can lead to severe consequences, including substantial financial penalties, legal sanctions, and significant damage to the company's reputation. For instance, in 2022, Johnson & Johnson agreed to pay $100 million to resolve alleged violations of the FCPA related to its marketing practices in Greece, Turkey, and Poland, highlighting the financial risks involved.

- FCPA Compliance: Adherence to the FCPA and similar global anti-bribery laws is paramount for Edwards Lifesciences' international operations.

- Healthcare Professional Interactions: Strict guidelines govern payments, gifts, and other benefits provided to healthcare providers to prevent conflicts of interest.

- Regulatory Scrutiny: Companies in the medical device sector face intense scrutiny, making robust compliance programs essential to avoid legal repercussions.

- Reputational Risk: Maintaining a strong ethical standing is vital; any breach of anti-corruption laws can erode trust among patients, providers, and investors.

The evolving regulatory landscape, particularly the EU's Medical Device Regulation (MDR), continues to demand significant adaptation from Edwards Lifesciences in 2024, impacting product development and market access for its cardiovascular technologies.

Edwards Lifesciences' reliance on intellectual property, especially patents for its TAVR systems, is substantial, with R&D investments in 2023 underscoring the need to protect its innovations from competitors.

The company must maintain rigorous quality control and clinical testing to mitigate legal risks associated with product liability and patient safety, a necessity highlighted by industry-wide recalls and litigations in 2023.

Navigating data privacy regulations like GDPR and HIPAA is crucial for Edwards Lifesciences, especially with its increasing use of digital health technologies, as non-compliance can result in severe financial penalties, with GDPR fines potentially reaching 4% of global annual turnover.

| Legal Factor | Description | 2024/2025 Relevance | Potential Impact |

| Regulatory Compliance | Adherence to FDA, EU MDR, and other global medical device regulations. | Continued evolution of MDR, increased post-market surveillance. | Delays in product approvals, increased compliance costs. |

| Intellectual Property | Protection of patents for core technologies like TAVR. | Ongoing R&D investment to maintain competitive edge. | Litigation risks from infringement, loss of market exclusivity. |

| Product Liability & Safety | Ensuring device safety and managing potential patient harm. | Heightened scrutiny on device performance and data transparency. | Costly lawsuits, product recalls, reputational damage. |

| Data Privacy & Cybersecurity | Compliance with GDPR, HIPAA for patient data. | Increasing sophistication of cyber threats in healthcare. | Significant fines for breaches, erosion of patient trust. |

Environmental factors

Edwards Lifesciences is increasingly focusing on sustainable manufacturing, a key environmental consideration. This includes efforts to reduce waste, lower energy consumption, and minimize water usage across its production sites. For instance, in 2023, the company reported a 15% reduction in greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress in their environmental stewardship.

Adopting these eco-friendly processes offers several benefits. It can lead to significant cost savings through greater efficiency, enhance the company's public image as a responsible corporate citizen, and ensure compliance with evolving environmental regulations. These practices are crucial for maintaining a competitive edge and meeting stakeholder expectations.

Investing in green technologies is not just about compliance; it directly supports Edwards Lifesciences' corporate social responsibility objectives. By prioritizing sustainability, the company aims to build long-term value while minimizing its environmental footprint, aligning with global efforts towards a more sustainable future.

Edwards Lifesciences faces increasing pressure to address the environmental footprint of its global supply chain. This involves scrutinizing the carbon emissions from transporting raw materials and finished goods, ensuring the ethical sourcing of components, and verifying that suppliers meet stringent environmental regulations. For instance, in 2023, the company reported its Scope 1 and 2 greenhouse gas emissions, highlighting areas for improvement within its operational and supply chain activities.

A proactive approach to supply chain sustainability can significantly mitigate operational risks, such as disruptions due to climate-related events or stricter environmental policies. Furthermore, demonstrating a commitment to eco-friendly practices, like reducing packaging waste and promoting energy efficiency among suppliers, can bolster Edwards Lifesciences' brand reputation. This resonates particularly well with investors and consumers who prioritize environmental, social, and governance (ESG) factors in their decision-making, a trend that has gained considerable momentum through 2024 and is projected to continue.

Edwards Lifesciences faces significant environmental considerations in waste management and product lifecycle, especially with its medical devices. Proper disposal and recycling of components are paramount, impacting the company's sustainability footprint. For instance, in 2024, the medical device industry is increasingly focused on reducing landfill waste, with many companies setting targets for waste diversion.

The company must navigate stringent regulations regarding medical waste disposal, ensuring compliance across its global operations. Promoting circular economy principles, such as designing products for easier disassembly and material recovery, will be key to minimizing end-of-life environmental impact. By 2025, expect further regulatory scrutiny on the lifecycle management of medical products.

Climate Change and Resource Scarcity

The intensifying effects of climate change pose significant risks to Edwards Lifesciences' global operations. Extreme weather events, such as the increasing frequency of hurricanes and floods, could disrupt critical supply chains for components and finished goods, impacting production and delivery timelines. For instance, in 2024, several major shipping routes experienced delays due to severe weather, highlighting the vulnerability of global logistics.

Resource scarcity, particularly concerning raw materials essential for medical device manufacturing, is another growing concern. Edwards Lifesciences must actively pursue strategies to mitigate these risks. This includes diversifying its supplier base to reduce reliance on single geographic regions and investing in climate-resilient infrastructure at its manufacturing sites. The company is also exploring material innovations to reduce its dependence on scarce resources.

Adapting to these environmental shifts is not just about risk mitigation but also about ensuring long-term business continuity and sustainability. By proactively addressing climate change impacts and resource scarcity, Edwards Lifesciences can strengthen its operational resilience and maintain its competitive edge in the evolving global market.

- Supply Chain Vulnerability: Climate change-induced extreme weather events can cause significant disruptions to global supply chains, impacting the timely delivery of critical medical components.

- Resource Scarcity Risks: The availability and cost of essential raw materials used in medical device production may be affected by climate change, necessitating proactive sourcing strategies.

- Operational Resilience: Diversifying sourcing and implementing climate-resilient infrastructure are crucial for maintaining business continuity and mitigating the impact of environmental disruptions.

- Material Innovation: Investing in the development and use of sustainable and less scarce materials can reduce reliance on volatile supply chains and enhance environmental stewardship.

Environmental Regulations and Compliance

Edwards Lifesciences must navigate an increasingly complex web of environmental regulations. These rules, covering everything from emissions and waste disposal to chemical use, are not just about being a good corporate citizen; they are legal necessities. For instance, the company's operations, particularly manufacturing, are subject to stringent air and water quality standards in various jurisdictions. Failure to comply can lead to significant financial penalties and damage to its hard-earned reputation.

The company's commitment to sustainability means actively tracking and adapting to these evolving environmental standards. This proactive approach is vital for ensuring long-term operational viability and maintaining stakeholder trust. In 2023, for example, companies in the medical device sector faced increased scrutiny regarding their carbon footprints and the lifecycle management of their products, a trend expected to continue and intensify through 2025.

- Regulatory Landscape: Adherence to global environmental laws concerning emissions, hazardous materials, and water usage is mandatory.

- Risk of Non-Compliance: Penalties for violations can include substantial fines, legal challenges, and severe reputational harm.

- Sustainability Focus: Continuous monitoring and adaptation to new environmental standards are key to responsible and sustainable business practices.

- Industry Trends: The medical device sector, including Edwards Lifesciences, is seeing heightened focus on carbon neutrality and circular economy principles leading up to 2025.

Edwards Lifesciences is actively working to reduce its environmental impact through sustainable manufacturing practices. In 2023, the company achieved a 15% reduction in greenhouse gas emissions intensity compared to its 2019 baseline, demonstrating a commitment to eco-friendly operations and aligning with growing investor and consumer demand for ESG-focused businesses.

The company is also addressing the environmental footprint of its supply chain, which is crucial given the increasing focus on Scope 1, 2, and 3 emissions. By 2025, heightened regulatory scrutiny on the lifecycle management of medical products, including waste disposal and recycling, will necessitate further innovation in circular economy principles.

Climate change presents tangible risks, with extreme weather events in 2024 already disrupting global logistics. Edwards Lifesciences is mitigating these by diversifying its supplier base and investing in climate-resilient infrastructure, aiming to ensure business continuity and operational resilience in the face of environmental volatility.

| Environmental Factor | 2023 Data/Trend | 2024/2025 Outlook | Impact on Edwards Lifesciences |

|---|---|---|---|

| Greenhouse Gas Emissions Intensity | 15% reduction vs. 2019 baseline | Continued reduction targets | Cost savings, enhanced reputation |

| Supply Chain Sustainability | Focus on Scope 1, 2, 3 emissions | Increased scrutiny on lifecycle management | Risk mitigation, brand loyalty |

| Climate Change Impact | Extreme weather events disrupting logistics | Increased frequency and severity of events | Supply chain vulnerability, need for resilience |

| Regulatory Compliance | Stringent air/water quality standards | Heightened focus on carbon neutrality and circular economy | Financial penalties, reputational risk, operational viability |

PESTLE Analysis Data Sources

Our PESTLE analysis for Edwards Lifesciences is informed by a comprehensive review of data from leading financial institutions, regulatory bodies, and market research firms. We integrate insights from global economic reports, healthcare policy updates, technological advancements, and industry-specific legal frameworks to provide a well-rounded perspective.