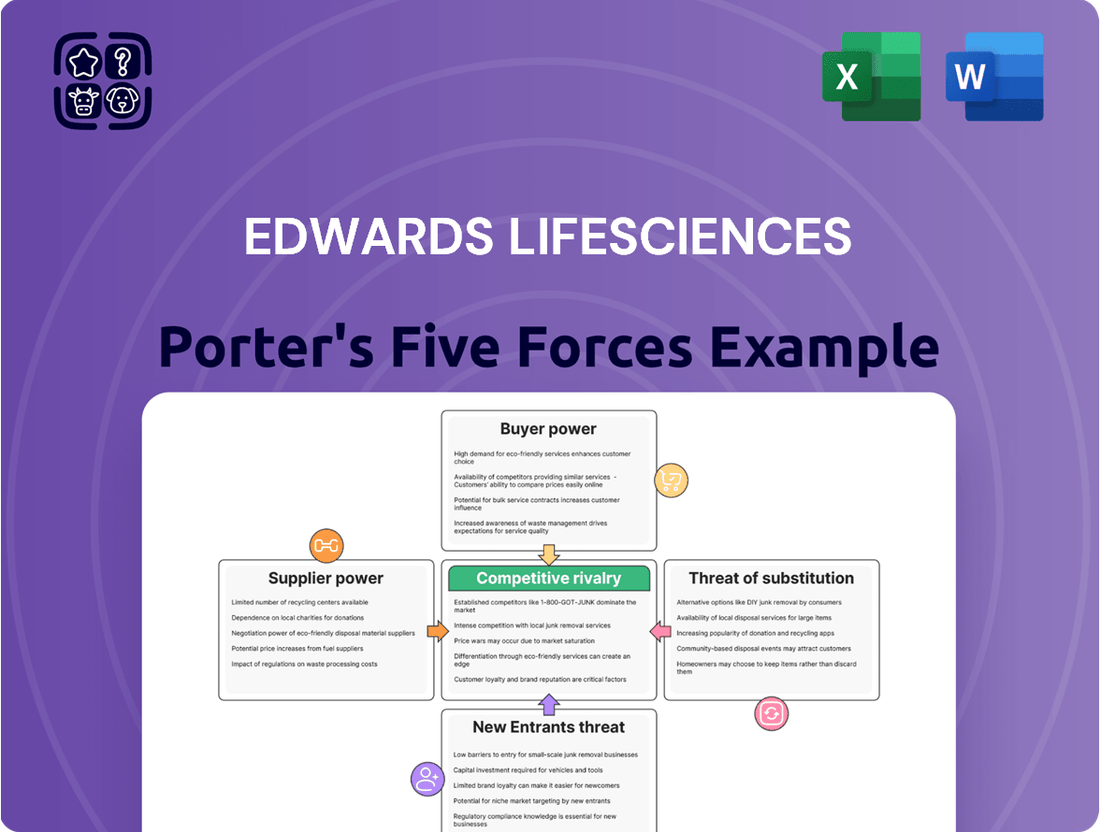

Edwards Lifesciences Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

Edwards Lifesciences operates in a dynamic medical device market, where the threat of new entrants is moderate due to high R&D costs and regulatory hurdles, but buyer power is significant, especially from large hospital systems. The intensity of rivalry among established players is high, driving innovation and price sensitivity.

The complete report reveals the real forces shaping Edwards Lifesciences’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Edwards Lifesciences depends on a select group of specialized suppliers for crucial materials such as bovine pericardial tissue, vital chemicals, and intricate electronic assemblies. This reliance on a concentrated supplier base inherently grants these suppliers greater leverage, particularly when finding or switching to alternative sources presents significant cost or logistical hurdles.

The company actively works to foster enduring, reliable partnerships with its suppliers. A key aspect of this strategy involves rigorous oversight and continuous assessment of the quality and consistency of components sourced from its supplier network, aiming to mitigate risks associated with supplier concentration.

The uniqueness of inputs significantly bolsters supplier bargaining power. For instance, Edwards Lifesciences relies on highly specialized materials like bovine pericardial tissue for its advanced heart valve technologies. This specialized nature means few suppliers can meet the stringent quality and regulatory demands, giving those suppliers considerable leverage.

Switching suppliers in the medical technology sector, particularly for vital components in life-saving equipment, often incurs substantial expenses. These costs encompass rigorous supplier qualification processes, navigating complex regulatory approvals, and guaranteeing the unwavering quality and safety of the final product. For instance, in 2024, the average time to qualify a new medical device component supplier could extend over six months, with associated costs potentially reaching tens of thousands of dollars per component.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing medical devices for Edwards Lifesciences is a nuanced consideration. If suppliers possess the capability and a strong incentive to produce components or even complete finished devices themselves, their bargaining power naturally escalates.

However, this particular threat is generally considered lower within the highly specialized realm of medical device manufacturing. The significant capital investment required for research and development, coupled with the stringent regulatory hurdles, acts as a substantial barrier to entry for most potential suppliers looking to make such a leap.

- High R&D Investment: Developing and obtaining approval for medical devices requires substantial financial commitment, often in the tens or hundreds of millions of dollars.

- Regulatory Hurdles: Navigating bodies like the FDA in the US or the EMA in Europe involves rigorous testing and compliance, a process that can take years and significant resources. For instance, the average time to market for a new medical device can exceed 3-5 years.

- Specialized Manufacturing: Producing high-quality, reliable medical devices demands specialized facilities, skilled labor, and adherence to strict quality control standards (e.g., ISO 13485), which are difficult for component suppliers to replicate quickly.

Importance of Edwards Lifesciences to Suppliers

Edwards Lifesciences' reliance on specific suppliers for critical components, such as advanced polymers or specialized electronic sensors used in its minimally invasive heart valves, can create a degree of dependence. For suppliers of highly specialized, niche components, Edwards may represent a substantial portion of their total sales. For instance, if a single supplier provides a unique material essential for Edwards' transcatheter aortic valve replacement (TAVR) systems, Edwards' business could be vital to that supplier's revenue stream, potentially diminishing the supplier's bargaining power.

However, for larger, more diversified suppliers that cater to multiple industries, the importance of Edwards Lifesciences as a customer might be less pronounced. These suppliers might have a broader customer base and a wider range of products, meaning that the loss or reduction of business from Edwards would have a comparatively smaller impact on their overall financial health. This diversification can shift the bargaining power back towards these larger suppliers.

- Supplier Dependence: Edwards' need for specialized components can make certain suppliers crucial to its operations.

- Niche Supplier Power: For suppliers whose products are highly specific to Edwards' needs, Edwards' business can be a significant revenue driver, potentially limiting the supplier's leverage.

- Diversified Supplier Leverage: Larger, more broadly focused suppliers may have less dependence on Edwards, thus retaining greater bargaining power.

- Market Dynamics: The overall market demand for the components supplied to Edwards also influences the bargaining power of both parties.

Edwards Lifesciences faces moderate bargaining power from its suppliers, primarily due to the specialized nature of many components and the significant costs associated with switching. For example, qualifying a new medical device component supplier in 2024 could take over six months and cost tens of thousands of dollars, highlighting the switching costs.

The uniqueness of inputs, such as bovine pericardial tissue for heart valves, grants suppliers considerable leverage as few can meet the stringent quality and regulatory demands. While Edwards aims to build strong supplier partnerships through rigorous oversight, the reliance on niche suppliers for critical, high-value components remains a key factor influencing supplier power.

The threat of backward integration by suppliers is generally low in this sector due to high R&D investment and complex regulatory pathways, which can take 3-5 years on average to navigate for new medical devices.

| Factor | Impact on Edwards Lifesciences | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | Moderate to High | Reliance on specialized suppliers for critical materials like bovine pericardial tissue. |

| Switching Costs | High | Over 6 months and tens of thousands of dollars to qualify new medical device component suppliers in 2024. |

| Uniqueness of Inputs | High | Specialized materials for advanced heart valve technologies have few alternative sources. |

| Supplier Forward Integration Threat | Low | High capital investment and regulatory hurdles (3-5 years average time to market) deter suppliers. |

What is included in the product

This analysis uncovers the competitive forces impacting Edwards Lifesciences, from supplier and buyer power to the threat of new entrants and substitutes, all within the context of the cardiovascular medical device industry.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on Edwards Lifesciences' market landscape.

Customers Bargaining Power

Edwards Lifesciences' customer base is primarily composed of hospitals, medical professionals, and group purchasing organizations (GPOs). These entities, particularly the larger GPOs, wield significant bargaining power due to the sheer volume of products they procure. This concentration allows them to negotiate more favorable pricing, potentially impacting Edwards Lifesciences' revenue and profit margins.

The price sensitivity of customers for Edwards Lifesciences' products is a nuanced factor. While the life-saving nature of their advanced cardiovascular devices, such as transcatheter aortic valve replacement (TAVR) systems, might imply a degree of inelastic demand, the reality is more complex.

Healthcare systems globally are under immense pressure to control expenditures. This cost-consciousness means that even for critical medical technologies, the economic viability and demonstrated cost-effectiveness of Edwards' offerings are paramount. For instance, in 2023, global healthcare spending continued its upward trend, but with a keen focus on value-based purchasing, pushing manufacturers to justify their pricing through improved patient outcomes and reduced long-term healthcare costs.

Reimbursement policies from government bodies and private insurers play a significant role in customer purchasing decisions. Edwards must navigate these complex landscapes, often providing extensive data on the economic benefits of their devices to secure favorable reimbursement rates, which directly impacts the effective price paid by healthcare providers.

While transcatheter aortic valve replacement (TAVR) offers a less invasive option compared to traditional open-heart surgery (SAVR), SAVR remains a strong alternative for many patients. This availability of distinct, yet effective, treatment pathways inherently provides customers with choices, thereby influencing their bargaining power.

The competitive landscape within the TAVR market is also intensifying. As more companies enter and innovate in this space, the sheer number of available TAVR devices and providers increases. For instance, by early 2024, several major medical device companies were actively competing in the TAVR market, offering a wider array of valve options and technologies, which further empowers patients and physicians to select the most suitable treatment and negotiate terms.

Customer Information and Transparency

Customers, especially large hospital networks and Group Purchasing Organizations (GPOs), are increasingly well-informed. They leverage readily available clinical data, comparative effectiveness research, and detailed pricing benchmarks. This heightened transparency empowers them to scrutinize product value and negotiate more aggressively, thereby amplifying their bargaining power against Edwards Lifesciences.

- Informed Decision-Making: Hospitals and GPOs can access and analyze extensive clinical trial results and real-world evidence for various cardiovascular devices.

- Price Transparency: Publicly available data and industry reports provide insights into the pricing structures of competing medical technologies.

- Negotiating Leverage: This access to information allows customers to compare offerings and demand more favorable terms, impacting Edwards Lifesciences' pricing strategies.

- Volume Purchasing: GPOs, representing a significant portion of hospital purchasing power, can consolidate demand to secure volume discounts, further increasing their influence.

Threat of Backward Integration by Customers

The threat of healthcare providers or Group Purchasing Organizations (GPOs) integrating backward to manufacture complex medical devices, such as heart valves, is exceptionally low for Edwards Lifesciences. This stems from the immense capital required for specialized research and development, coupled with the rigorous regulatory hurdles and high barriers to entry inherent in medical device production.

For instance, the global medical device market was valued at approximately $560 billion in 2023, with significant investments needed for advanced manufacturing and compliance. Developing and obtaining approval for a new heart valve can take over a decade and cost hundreds of millions of dollars, making backward integration an impractical strategy for most healthcare entities.

- Minimal Financial Viability: The substantial upfront investment and ongoing operational costs associated with medical device manufacturing, particularly for highly regulated products like heart valves, make it financially unfeasible for most healthcare providers or GPOs.

- Technical Expertise and R&D Intensity: Producing sophisticated medical devices demands highly specialized engineering talent and continuous investment in research and development, areas where device manufacturers like Edwards Lifesciences possess a distinct competitive advantage.

- Regulatory Complexity: Navigating the stringent regulatory landscape, including FDA approvals and quality control standards, presents a formidable barrier to entry for entities not already established in the medical device industry.

Edwards Lifesciences faces significant customer bargaining power, primarily from large hospital systems and Group Purchasing Organizations (GPOs). These entities leverage their substantial purchasing volume to negotiate lower prices, directly impacting Edwards' revenue. For example, GPOs often represent a large percentage of a hospital's purchasing power, allowing them to secure volume discounts and favorable contract terms. The increasing availability of alternative treatments and the growing price sensitivity within healthcare systems further amplify this customer leverage.

| Customer Segment | Bargaining Power Drivers | Impact on Edwards Lifesciences |

|---|---|---|

| Hospitals | Volume purchasing, price sensitivity, availability of alternatives | Pressure on pricing, demand for cost-effectiveness |

| Group Purchasing Organizations (GPOs) | Consolidated purchasing power, negotiation expertise | Significant leverage for price concessions and contract terms |

| Medical Professionals | Clinical preference, influence on purchasing decisions | Can drive demand for specific products, but price remains a factor |

Same Document Delivered

Edwards Lifesciences Porter's Five Forces Analysis

This preview showcases the complete Edwards Lifesciences Porter's Five Forces analysis, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes. The document you are viewing is the exact, professionally formatted report you will receive immediately after purchase, offering a comprehensive understanding of the competitive landscape for Edwards Lifesciences without any placeholders or alterations.

Rivalry Among Competitors

The transcatheter aortic valve replacement (TAVR) market, Edwards Lifesciences' primary focus, is intensely competitive. Major players like Medtronic are significant rivals, alongside Abbott.

While Boston Scientific was a competitor, they exited the TAVR market in 2025, shifting the competitive landscape. Newer companies are continually introducing innovative technologies, adding further pressure.

The global TAVR market is a hotbed of activity, with projections showing it reaching $6.2 billion in 2024 and expected to climb to $10 billion by 2029. This impressive expansion, at a compound annual growth rate of 9.9%, signals a dynamic and expanding sector.

While such robust growth typically tempers competitive intensity, the TAVR market's expansion is simultaneously fueling innovation and attracting considerable investment. This influx of new ideas and capital ensures that the competitive landscape remains vigorous, with multiple players vying for market share.

Edwards Lifesciences heavily relies on product differentiation, primarily through its innovative Sapien transcatheter aortic valve replacement (TAVR) platform, emphasizing superior clinical performance and improved patient outcomes. This focus on advanced technology and demonstrable patient benefits creates a strong competitive advantage.

Despite Edwards' leadership, rivals are actively pursuing their own differentiation strategies. Competitors are investing in developing even smaller devices and more user-friendly delivery systems, aiming to capture market share by offering alternative technological advancements and potentially lower costs.

Exit Barriers

High exit barriers in the structural heart medical technology market significantly influence competitive rivalry. These barriers include substantial investments in specialized manufacturing facilities and ongoing, extensive research and development, often running into hundreds of millions of dollars annually for leading players like Edwards Lifesciences. For instance, the development of a new transcatheter aortic valve replacement (TAVR) system can take over a decade and cost upwards of $500 million, making it incredibly difficult for companies to simply walk away from such commitments.

The lengthy and rigorous regulatory approval processes, such as those managed by the FDA, also act as a major deterrent to exiting. Companies must navigate clinical trials and gain market clearance, which can take years and require significant resources. This commitment means that even during periods of lower demand or increased competition, firms are compelled to stay invested and continue competing rather than cutting their losses, thereby intensifying rivalry.

- Specialized Manufacturing: Facilities designed for sterile, high-precision medical device production are costly to build and maintain, representing sunk costs.

- R&D Investment: Continuous innovation in areas like biomaterials and delivery systems requires ongoing, significant capital expenditure.

- Regulatory Hurdles: Time-consuming and expensive clinical trials and approvals create a high cost of exit.

- Brand Reputation: Established brands in the medical device sector have built trust over years, making it difficult for new entrants and costly to abandon existing market positions.

Industry Concentration and Market Share

The transcatheter aortic valve replacement (TAVR) market is highly concentrated, with Edwards Lifesciences and Medtronic dominating. Edwards Lifesciences held a significant 72.3% share of the U.S. TAVR market in 2025. This duopoly intensifies rivalry as both companies vie for greater market penetration and explore new patient demographics.

This concentrated market structure means that competitive rivalry is a significant force. The battle for market share is fierce, even among just two major players.

- Market Dominance: Edwards Lifesciences and Medtronic are the primary players in the TAVR market.

- High U.S. Market Share: Edwards Lifesciences commanded an estimated 72.3% of the U.S. TAVR market in 2025.

- Intense Competition: Despite the duopoly, competition remains high as companies seek to expand their reach and patient base.

Competitive rivalry in the transcatheter aortic valve replacement (TAVR) market, where Edwards Lifesciences operates, is characterized by intense competition among a few dominant players and emerging innovators. Edwards Lifesciences, with a substantial 72.3% share of the U.S. TAVR market in 2025, faces significant rivalry from Medtronic, creating a duopoly that drives aggressive market strategies. The market's projected growth to $6.2 billion in 2024 and $10 billion by 2029, a CAGR of 9.9%, fuels this competition as companies invest heavily in product differentiation, such as advanced delivery systems and improved patient outcomes.

High exit barriers, including substantial R&D investments exceeding $500 million for a single TAVR system and lengthy regulatory approval processes, compel companies to remain active competitors. This environment fosters continuous innovation, with rivals focusing on developing smaller devices and more user-friendly systems to capture market share, ensuring that competition remains vigorous despite market concentration.

| Competitor | 2025 U.S. TAVR Market Share (Estimated) | Key Competitive Strategy |

|---|---|---|

| Edwards Lifesciences | 72.3% | Product differentiation via Sapien platform, clinical performance, patient outcomes |

| Medtronic | Significant | Developing advanced technologies, expanding patient demographics |

| Abbott | Present | Innovation in TAVR technology |

SSubstitutes Threaten

While transcatheter aortic valve replacement (TAVR) continues to gain traction, surgical aortic valve replacement (SAVR) remains a significant substitute, especially for younger, lower-risk patients or those with complex health issues. In 2024, SAVR still accounts for a substantial portion of aortic valve procedures, demonstrating its continued relevance and effectiveness as an alternative.

The threat of substitutes for Edwards Lifesciences' transcatheter aortic valve replacement (TAVR) systems is primarily driven by surgical aortic valve replacement (SAVR). TAVR offers significant advantages like less invasive procedures, quicker recovery, and enhanced patient quality of life, making it increasingly attractive, particularly for high-risk individuals. In 2024, TAVR procedures continued to gain market share, with estimates suggesting they accounted for a substantial portion of the total aortic valve replacement market, reflecting this patient preference.

However, the economic considerations of TAVR versus SAVR remain a critical factor. While TAVR may have higher upfront costs, its potential to reduce hospital stays and associated complications can improve overall cost-effectiveness. The reimbursement policies enacted by payers, including Medicare and private insurers, significantly influence the adoption rate of TAVR, directly impacting its competitive threat to SAVR.

Patient and physician preferences are a significant factor influencing the threat of substitutes for Edwards Lifesciences' transcatheter aortic valve replacement (TAVR) devices. There's a clear trend towards minimally invasive procedures, with TAVR gaining traction over traditional open-heart surgery for many patients due to its reduced recovery times and lower complication rates. This preference shift is driven by both patient desire for less invasive options and physician recognition of these benefits.

However, traditional surgical aortic valve replacement (SAVR) remains a viable and often preferred substitute for specific patient groups. These include younger, healthier patients or those with complex anatomical issues where surgical intervention might offer a more durable or predictable outcome. Edwards Lifesciences must consider that while TAVR adoption is growing, SAVR still holds a significant market share, particularly in these complex cases.

Patient advocacy groups also play a role in shaping preferences and driving demand for improved care. These organizations often highlight the benefits of less invasive options and can influence both patient choices and physician adoption of new technologies like TAVR. For instance, patient testimonials and educational resources provided by advocacy groups can significantly impact how patients perceive and request treatment options.

Technological Advancements in Substitutes

Technological advancements in substitutes present a significant threat to Edwards Lifesciences. Ongoing innovation in traditional surgical techniques, alongside the emergence of new pharmaceutical treatments or less invasive, non-device-based therapies for heart conditions, could reduce the demand for Edwards' core products, particularly transcatheter aortic valve replacement (TAVR). For instance, developments in minimally invasive surgical approaches continue to refine existing procedures, offering alternatives that may appeal to certain patient populations or healthcare providers.

Edwards itself acknowledges this competitive landscape by actively investing in a broader portfolio of structural heart therapies. Their commitment to Transcatheter Mitral and Tricuspid Therapies (TMTT) demonstrates a strategic move to diversify beyond TAVR and address other unmet needs in the structural heart market. This internal development of alternative solutions highlights the dynamic nature of the industry and the constant pressure to innovate in response to evolving treatment paradigms.

The threat is amplified as new entrants or existing players in adjacent medical fields develop novel, non-device-based solutions. These could include advanced drug therapies or regenerative medicine approaches that offer comparable or superior outcomes to current device-based interventions. The market for cardiovascular treatments is highly dynamic, with significant R&D investment across the sector.

Key areas of substitute threat include:

- Advancements in minimally invasive surgical techniques that improve outcomes and reduce recovery times for traditional valve repair or replacement.

- Development of novel pharmaceutical agents that can manage or reverse heart conditions, potentially negating the need for device intervention.

- Emergence of regenerative medicine or bio-engineered solutions that offer biological repair or replacement of damaged heart tissues.

- Increased adoption of non-device-based diagnostic or monitoring tools that could lead to earlier intervention with less invasive methods.

Regulatory and Reimbursement Landscape for Substitutes

Changes in regulatory approvals or reimbursement policies for substitute treatments can significantly influence the market for Edwards Lifesciences' products. For example, if governments or insurers increase funding and reimbursement for traditional open-heart surgery, it could make these older methods more financially attractive compared to minimally invasive procedures, potentially impacting Edwards' sales.

The regulatory environment for medical devices is constantly evolving. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continues to review and approve new technologies, but also scrutinizes existing ones. Similarly, reimbursement rates set by Medicare and private insurers in 2024 directly affect how readily alternative treatments are adopted by healthcare providers and patients.

- Regulatory Hurdles: New or stricter regulations for competing devices could favor Edwards' existing product lines.

- Reimbursement Shifts: Favorable reimbursement for minimally invasive techniques supports Edwards, while increased coverage for traditional surgery poses a threat.

- Global Variations: Different countries have distinct regulatory pathways and reimbursement structures, creating a complex global landscape for substitutes.

The primary substitute threat to Edwards Lifesciences' transcatheter aortic valve replacement (TAVR) systems remains surgical aortic valve replacement (SAVR). While TAVR offers less invasiveness and faster recovery, SAVR is often preferred for younger, healthier patients or those with complex anatomies, maintaining a significant market presence in 2024. The economic viability of each procedure, influenced by hospital stays and reimbursement policies, continues to shape patient and physician choices.

Advancements in alternative treatments, including refined surgical techniques and emerging pharmaceutical or regenerative medicine solutions, also pose a threat. These innovations could potentially reduce the reliance on device-based interventions like TAVR. For example, ongoing research into drug therapies for valvular heart disease could offer non-device alternatives in the future.

| Substitute | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Surgical Aortic Valve Replacement (SAVR) | Traditional open-heart surgery, often preferred for younger/healthier patients or complex cases. | Continues to hold a substantial share of the aortic valve replacement market. |

| Minimally Invasive Surgical Techniques | Refined surgical approaches that reduce invasiveness and recovery time. | Increasingly competitive with TAVR, especially for specific patient profiles. |

| Pharmaceutical Agents | Medications aimed at managing or potentially reversing heart conditions. | Represents a future threat if effective treatments emerge, reducing the need for devices. |

| Regenerative Medicine/Bio-engineered Solutions | Biological repair or replacement of damaged heart tissues. | Emerging area with potential to offer non-device alternatives in the long term. |

Entrants Threaten

High capital requirements present a significant threat to new entrants in the structural heart device market. Developing and launching a new medical technology, particularly in a highly regulated field like cardiovascular health, demands immense financial resources. For instance, the extensive research and development, rigorous clinical trials, and sophisticated manufacturing capabilities needed for devices like transcatheter aortic valve replacement (TAVR) systems can easily run into hundreds of millions of dollars. Edwards Lifesciences, a leader in this space, demonstrates this with its consistent R&D spending, which was approximately $1.4 billion in 2023, reflecting the ongoing investment required to maintain a competitive edge and navigate the lengthy approval processes.

The medical device sector, particularly for sophisticated products like heart valves, faces significant barriers to entry due to extensive regulatory hurdles. Bodies such as the U.S. Food and Drug Administration (FDA) and European competent authorities impose rigorous standards, making the approval process for new devices lengthy, complex, and exceptionally costly. For instance, the average time to obtain FDA approval for a new medical device can span several years and involve millions of dollars in development and testing, significantly deterring potential new competitors.

Edwards Lifesciences' dominance in transcatheter aortic valve replacement (TAVR) is significantly protected by its robust intellectual property portfolio. Developing comparable or superior technologies requires immense R&D investment and the ability to navigate a complex patent landscape, acting as a substantial barrier to entry for new competitors.

Established Brand Reputation and Customer Loyalty

Edwards Lifesciences benefits from its deeply entrenched brand reputation as a pioneer in structural heart disease solutions. This long-standing leadership fosters significant customer loyalty among clinicians and hospitals, built on years of proven performance and reliable patient outcomes. For any new entrant, replicating this level of trust and commitment in a sector where patient well-being is the ultimate priority presents a substantial barrier to entry.

The threat of new entrants is therefore considerably weakened by Edwards Lifesciences' established brand equity and the strong, enduring relationships it cultivates within the medical community. New companies face the daunting task of not only developing innovative technologies but also navigating the complex landscape of clinical validation and gaining the confidence of healthcare providers who prioritize safety and efficacy above all else.

Consider these factors:

- Brand Loyalty: Edwards Lifesciences' reputation as a trusted innovator in structural heart disease creates a strong barrier.

- Clinician Relationships: Decades of working closely with healthcare professionals build deep loyalty and trust.

- Patient Outcome Focus: The paramount importance of patient safety makes hospitals hesitant to adopt unproven technologies from new players.

- High Switching Costs: For hospitals, switching from a trusted provider like Edwards involves significant retraining, inventory changes, and potential risks, further deterring new entrants.

Access to Distribution Channels and Clinical Expertise

New entrants face a significant hurdle in establishing robust distribution channels for cardiovascular devices. Edwards Lifesciences has cultivated extensive networks and partnerships with hospitals and medical facilities worldwide, a process that takes years and substantial investment to replicate. For instance, Edwards reported total sales of $5.2 billion in 2023, underscoring the scale of their established market presence and distribution reach.

Furthermore, gaining access to clinical expertise is paramount. New companies must secure the trust and collaboration of highly specialized cardiac surgeons and cardiologists for product adoption, training, and ongoing support. This requires demonstrating superior product performance and providing comprehensive educational resources, a steep climb against Edwards' established reputation and deep relationships within the cardiac surgery community.

- Distribution Network Strength: Edwards' established global distribution infrastructure presents a formidable barrier for new entrants seeking to reach healthcare providers efficiently.

- Clinical Validation and Adoption: Securing endorsement and active use by leading cardiac surgeons and cardiologists is critical for market penetration, a process where Edwards holds a significant advantage due to long-standing relationships and proven product efficacy.

- Training and Support Infrastructure: The need for extensive training programs and ongoing technical support for complex medical devices further solidifies the position of incumbents like Edwards, who have invested heavily in these areas.

The threat of new entrants into the structural heart device market, where Edwards Lifesciences is a dominant player, is significantly mitigated by several factors. High capital requirements for research, development, and regulatory approval, estimated in the hundreds of millions of dollars, create a substantial financial barrier.

The extensive regulatory landscape, requiring years and significant investment for approvals from bodies like the FDA, further deters new companies. Edwards' strong intellectual property portfolio and established brand loyalty, built on decades of proven performance and clinician relationships, also present formidable challenges for any potential competitor aiming to gain market traction and trust.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | High R&D, clinical trials, and manufacturing costs (hundreds of millions USD) | Significant financial hurdle |

| Regulatory Hurdles | Lengthy and complex FDA/EMA approval processes (years, millions USD) | Time-consuming and costly entry |

| Intellectual Property | Edwards' robust patent portfolio | Requires significant innovation to circumvent |

| Brand Reputation & Loyalty | Decades of trust and proven outcomes with clinicians and hospitals | Difficult to replicate, leading to high switching costs for customers |

| Distribution & Clinical Expertise | Established global networks and deep clinician relationships | Challenging to build comparable reach and gain clinical endorsement |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Edwards Lifesciences is built upon a foundation of financial disclosures, including annual and quarterly reports, alongside industry-specific market research from reputable firms and data from regulatory bodies.