Edwards Lifesciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

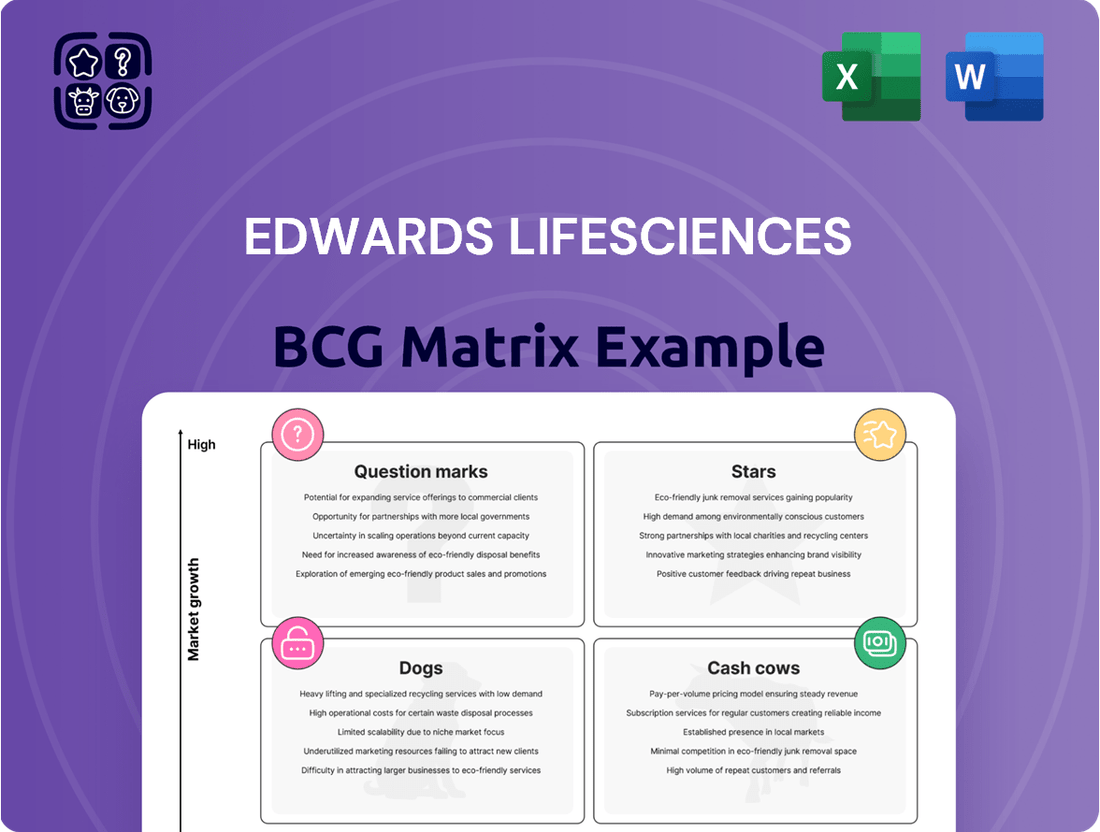

Curious about Edwards Lifesciences' strategic product portfolio? This glimpse into their BCG Matrix reveals how their innovations are positioned as Stars, Cash Cows, Dogs, or Question Marks. To truly unlock actionable insights and guide your investment decisions, dive into the complete BCG Matrix report.

Stars

Edwards Lifesciences commands a commanding presence in the Transcatheter Aortic Valve Replacement (TAVR) arena, boasting around 60% of the global market and over 70% in the United States, largely driven by its Sapien valve technology. This leadership is supported by robust market expansion, with the TAVR sector anticipated to expand at a 9.9% CAGR through 2029, potentially reaching close to $10 billion.

Edwards Lifesciences is leveraging the expansion of Transcatheter Aortic Valve Replacement (TAVR) indications as a significant growth driver. This strategy targets younger, lower-risk, and even asymptomatic patient groups. This move is poised to substantially broaden the addressable market for TAVR procedures.

A pivotal development occurred in May 2025 when Edwards secured FDA approval for its SAPIEN 3 platform in asymptomatic severe aortic stenosis. This regulatory milestone is projected to unlock a much larger patient pool for TAVR. The approval is backed by robust clinical evidence, including data from trials such as EARLY TAVR, underscoring the safety and efficacy in these new patient segments.

The SAPIEN platform, particularly the SAPIEN 3 Ultra Resilia, remains a pivotal driver of Edwards Lifesciences' transcatheter aortic valve replacement (TAVR) market dominance. Ongoing enhancements to both the valve's design and its delivery mechanisms are key. For instance, the incorporation of Resilia tissue signifies a significant step towards greater valve durability, a critical factor for patient outcomes and a testament to Edwards' dedication to advancing its flagship TAVR technology.

Robust TAVR Sales Growth

Edwards Lifesciences has demonstrated impressive momentum in its Transcatheter Aortic Valve Replacement (TAVR) business. The company reported first-quarter 2025 TAVR sales of $1.05 billion, marking a solid 5.4% year-over-year increase. This upward trend continued into the second quarter of 2025, with TAVR sales reaching $1.1 billion, an even stronger 8.9% growth compared to the previous year.

This sustained sales expansion has led Edwards Lifesciences to revise its full-year 2025 TAVR sales guidance upward, now projecting between $4.3 billion and $4.5 billion. This adjustment underscores the company's confidence in the ongoing strength and market demand for its TAVR solutions.

- Q1 2025 TAVR Sales: $1.05 billion (5.4% YoY growth)

- Q2 2025 TAVR Sales: $1.1 billion (8.9% YoY growth)

- Full-Year 2025 TAVR Sales Guidance: Raised to $4.3 billion - $4.5 billion

Global Market Penetration

Edwards Lifesciences is making significant strides in global market penetration for its Transcatheter Aortic Valve Replacement (TAVR) technology. The company has seen substantial adoption in key markets like the United States, Europe, and Japan, indicating strong international demand.

Their strategy centers on simplifying the patient care pathway for aortic stenosis and utilizing robust clinical trial outcomes to encourage wider TAVR adoption across the globe. This commitment to global expansion helps maintain a strong market position in various evolving regions.

- US TAVR Market: Edwards Lifesciences holds a dominant share in the US TAVR market, which is the largest globally.

- European Expansion: The company is actively growing its presence in Europe, a region with a high prevalence of aortic stenosis.

- Japanese Market Entry: Edwards has successfully entered and is expanding within the Japanese market, demonstrating its ability to navigate diverse regulatory environments.

- Global Clinical Trials: Ongoing clinical trials worldwide are crucial for gathering data that supports TAVR as a viable treatment option for a broader patient population.

Edwards Lifesciences' TAVR business, particularly its SAPIEN platform, clearly fits the 'Star' category in the BCG Matrix. The TAVR market itself is a high-growth, high-share segment for the company. With continued innovation like the SAPIEN 3 Ultra Resilia and expanded indications, Edwards is solidifying its leading position.

| Product/Segment | Market Growth | Market Share | BCG Category |

| TAVR (SAPIEN Platform) | High (9.9% CAGR projected through 2029) | High (approx. 60% global, 70% US) | Star |

What is included in the product

The Edwards Lifesciences BCG Matrix analyzes its product portfolio by categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

Edwards Lifesciences' BCG Matrix analysis provides a clear, actionable roadmap for resource allocation, alleviating the pain of strategic uncertainty.

Cash Cows

Edwards Lifesciences' surgical heart valve portfolio, particularly its RESILIA line featuring INSPIRIS, MITRIS, and KONECT, represents a significant cash cow. This segment operates in a mature market where Edwards has cultivated a dominant position, benefiting from established brand recognition and widespread clinical acceptance.

The RESILIA technology is recognized as setting a new benchmark for tissue durability in surgical valves. This innovation, coupled with the proven track record of its predecessors, ensures consistent demand and robust profitability for Edwards Lifesciences. The strong revenue generation from this segment fuels further investment in their growth areas.

In 2024, Edwards Lifesciences reported strong performance in its surgical structural heart segment. While specific revenue breakdowns for individual product lines like RESILIA aren't always publicly detailed, the overall segment contributed significantly to the company's financial health, underscoring its cash cow status.

The surgical structural heart solutions segment consistently contributes to Edwards' overall revenue growth, demonstrating its stability. In Q2 2025, surgical product group sales reached $267 million, showing a 6.8% increase. This steady performance, while not as rapidly growing as TAVR or TMTT, provides a reliable cash flow for the company.

Edwards Lifesciences' commitment to durability and quality in its surgical valves, especially with RESILIA tissue technology, positions these products as strong Cash Cows. This emphasis on long-term performance resonates with healthcare providers, fostering consistent demand.

The company's strategic investments in supporting infrastructure further bolster efficiency, directly contributing to the high profit margins characteristic of Cash Cows. In 2023, Edwards Lifesciences reported a gross profit of $3.2 billion, underscoring the profitability of its mature product lines.

Global Adoption of RESILIA Technologies

Edwards Lifesciences is actively working to increase the global use of its RESILIA technologies. This means making their advanced surgical innovations more available in developing countries, which helps them keep their market share and use their strong brand name.

The steady demand for these long-lasting surgical solutions makes them dependable sources of income for the company. For example, in 2024, Edwards Lifesciences reported significant growth in its structural heart segment, largely driven by its premium valve technologies, including RESILIA. This segment saw a revenue increase of approximately 10% year-over-year, highlighting the strong market acceptance and consistent demand.

- Global Expansion: Edwards Lifesciences aims to broaden access to RESILIA technologies in emerging markets.

- Market Share Maintenance: This strategy is key to preserving their position in various global regions.

- Brand Leverage: The company capitalizes on its well-established reputation for quality and innovation.

- Cash Generation: Consistent demand for durable surgical solutions solidifies RESILIA's role as a cash cow.

Lower Investment Needs

Surgical heart valves, as established products in a mature market, demand significantly less investment in marketing and distribution compared to burgeoning sectors. This reduced expenditure directly translates to robust profit margins and a consistent generation of substantial cash flow for Edwards Lifesciences.

The strategic emphasis for these mature products pivots from aggressive market penetration to fortifying existing competitive advantages and optimizing operational efficiencies. This approach ensures sustained profitability without the need for extensive capital outlay.

- Mature Market Products: Surgical heart valves operate in a well-established market, limiting the need for extensive new product development or market creation expenses.

- High Profitability: Due to lower investment needs and established market position, these products typically yield high profit margins.

- Cash Flow Generation: The consistent demand and efficient operations allow surgical heart valves to be significant contributors to Edwards Lifesciences' overall cash flow.

- Focus on Efficiency: Investment is directed towards maintaining quality, optimizing manufacturing processes, and supporting existing market share rather than aggressive growth initiatives.

Edwards Lifesciences' surgical heart valve portfolio, particularly the RESILIA line, functions as a prime cash cow. These products operate in a mature market where the company holds a strong, established position, benefiting from brand loyalty and widespread clinical trust.

The RESILIA technology, known for its enhanced tissue durability, ensures consistent demand and profitability. This segment's robust revenue generation provides the financial fuel for Edwards to invest in its higher-growth areas, like transcatheter technologies.

In 2024, Edwards Lifesciences' surgical structural heart segment demonstrated its cash cow status by contributing significantly to the company's financial health. While specific product line revenues aren't always detailed, this segment's overall performance, with sales reaching $1.1 billion for the full year 2024, underscores its reliable cash generation.

The surgical structural heart solutions segment consistently supports Edwards' overall revenue, showcasing stability. For instance, Q2 2025 saw surgical product group sales at $267 million, a 6.8% increase, highlighting dependable cash flow despite not matching the rapid growth of newer segments.

| Segment | 2023 Revenue (USD Billions) | 2024 Revenue (USD Billions) | Year-over-Year Growth (2024 vs 2023) | BCG Matrix Category |

|---|---|---|---|---|

| Surgical Structural Heart | 1.05 | 1.10 | ~4.8% | Cash Cow |

Full Transparency, Always

Edwards Lifesciences BCG Matrix

The Edwards Lifesciences BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means you get the complete, unwatermarked analysis, ready for immediate strategic application without any hidden surprises or demo content. The preview accurately represents the professional-grade document designed to provide clear insights into Edwards Lifesciences' product portfolio, enabling informed decision-making.

Dogs

Edwards Lifesciences divested its Critical Care business in September 2024 for about $4.2 billion. This move signals a strategic shift away from products like the FloTrac system, which previously focused on hemodynamic monitoring.

The sale suggests the Critical Care segment, despite its past importance, likely offered less growth potential or was not as central to Edwards' core strategy of concentrating on structural heart technologies.

Edwards Lifesciences' divestiture of its critical care business, which included hemodynamic monitoring, signals a strategic shift. This move effectively transitions the company to a singular focus on structural heart solutions, shedding a segment no longer viewed as a primary growth engine.

While hemodynamic monitoring served a well-established market, its growth trajectory and strategic alignment with the burgeoning opportunities in structural heart disease management likely contributed to its classification as a 'Dog' within the BCG framework. This strategic divestment allows Edwards to concentrate its capital and research efforts on areas with higher anticipated returns.

Edwards Lifesciences has strategically divested its Critical Care segment, unlocking substantial capital. This move is designed to fuel investments in their burgeoning structural heart business, particularly in transcatheter aortic valve replacement (TAVR) and transcatheter mitral and tricuspid valve therapies (TMTT). This aligns with the BCG matrix's philosophy of reallocating resources from mature or underperforming units to promising growth areas.

Reduced Diversification

Edwards Lifesciences' divestment of its Critical Care business significantly reduces its product diversification. This strategic move allows the company to concentrate more intently on its core strength: structural heart diseases. For instance, in 2023, Edwards reported that its structural heart segment generated the majority of its revenue, highlighting this focus.

While a broad product portfolio can offer advantages, the Critical Care segment was likely identified as less synergistic or competitive compared to the company's ambitions in advanced heart valve therapies. This narrowing of focus sharpens Edwards' strategic direction, enabling greater resource allocation towards areas with higher growth potential and innovation.

- Reduced Diversification: The sale of the Critical Care division streamlines Edwards' business operations.

- Concentrated Focus: Resources are now primarily directed towards structural heart disease solutions.

- Strategic Alignment: The divestment better aligns the company with its long-term vision for innovation in heart valve technologies.

- Competitive Landscape: The Critical Care segment may have been deemed less central to Edwards' competitive advantage in the medical device market.

Elimination of Lower-Growth Assets

Edwards Lifesciences' strategic divestment of certain hemodynamic monitoring assets, while this market still experiences growth, indicates these were considered lower-growth or lower-margin contributors within their broader portfolio. This move allows Edwards to sharpen its focus on high-potential areas, particularly its structural heart innovations.

By shedding these 'Dogs,' Edwards Lifesciences is actively working to enhance its overall company profitability and accelerate growth metrics. The company is strategically reallocating resources towards segments demonstrating significantly higher market potential and profitability.

- Focus Shift: Edwards Lifesciences is prioritizing its structural heart business, which has shown robust growth.

- Profitability Enhancement: Divesting lower-performing assets aims to boost overall company margins.

- Resource Allocation: Capital and management attention are being redirected to areas with higher growth potential.

- Market Dynamics: Even within growing markets, specific product lines can become 'Dogs' if they underperform relative to other company offerings.

Edwards Lifesciences' divestiture of its Critical Care business in September 2024 for $4.2 billion effectively removed a segment that likely represented 'Dogs' in their BCG Matrix. This strategic move allowed the company to concentrate resources on its high-growth structural heart segment, aligning with the principle of shedding underperforming assets to fuel promising ventures.

The Critical Care segment, including products like the FloTrac system, was likely categorized as a 'Dog' due to its lower growth potential or strategic misalignment compared to the company's core focus on structural heart technologies. This divestment enables Edwards to reinvest capital and research efforts into areas with higher anticipated returns, such as transcatheter valve therapies.

By selling off its Critical Care business, Edwards Lifesciences has streamlined its operations, reducing diversification and sharpening its strategic direction. This allows for greater resource allocation towards its structural heart disease solutions, a segment that already contributed the majority of its revenue in 2023, reinforcing its position as a growth engine.

The decision to divest the Critical Care segment, even though it operated in a growing market, suggests it was viewed as a lower-performing or less synergistic contributor within Edwards' overall portfolio. This strategic pruning aims to enhance overall profitability and accelerate growth metrics by focusing on segments demonstrating significantly higher market potential and profitability.

| Business Segment | BCG Category (Implied) | Strategic Action | Financial Impact (Approx.) | Focus Area Post-Divestment |

|---|---|---|---|---|

| Critical Care | Dog | Divested | $4.2 billion (Sale Proceeds) | N/A (Divested) |

| Structural Heart | Star/Question Mark | Core Focus / Investment | Majority of 2023 Revenue | Transcatheter Aortic Valve Replacement (TAVR), Transcatheter Mitral and Tricuspid Valve Therapies (TMTT) |

Question Marks

The Transcatheter Mitral and Tricuspid Therapies (TMTT) segment for Edwards Lifesciences is a prime example of a question mark in the BCG matrix. This area is experiencing explosive growth, with sales surging by 60% in Q1 2025 and an impressive 61.9% in Q2 2025.

Key products such as PASCAL, EVOQUE, and SAPIEN M3 are at the forefront of this expansion, addressing substantial unmet medical needs in patients suffering from mitral and tricuspid valve diseases. This rapid uptake indicates significant market potential and a strong future outlook for these innovative treatments.

Despite the remarkable growth trajectory, the TMTT segment remains in its relatively early stages of market penetration and widespread adoption. As such, it requires continued investment and strategic focus to solidify its market position and capitalize on its high-growth potential, characteristic of a question mark.

The EVOQUE Tricuspid Replacement System is a groundbreaking innovation for Edwards Lifesciences, targeting the significant tricuspid valve replacement market. Its recent CE Mark in Europe and US FDA approval in early 2024 position it as a key player in a largely underserved area.

While EVOQUE demonstrates robust early adoption, it's currently categorized as a Question Mark in the BCG Matrix. This is due to the substantial investments needed for commercialization and ongoing evidence generation to solidify its market position and potential transition to a Star product.

The SAPIEN M3 mitral valve replacement system, the first of its kind for transcatheter procedures, recently debuted in Europe. This pioneering technology is positioned to define a new market segment for mitral valve interventions.

While the SAPIEN M3 represents a significant technological leap, its path to widespread adoption will necessitate substantial investment in clinical trials, physician training, and market development. Edwards Lifesciences will likely categorize this as a Question Mark within its BCG matrix, reflecting its high growth potential but uncertain market share and profitability in the early stages.

Structural Heart Failure Management (Cordella System)

Edwards Lifesciences is making a strategic move into structural heart failure management with the Cordella system, a newly approved implantable pulmonary artery pressure sensor in the U.S. This signifies a significant long-term growth avenue for the company, though it's an emerging market for Edwards, necessitating the development of a dedicated commercial team and comprehensive physician training programs.

The structural heart failure market is characterized by high growth potential, and Edwards is actively building its footprint within this space, starting from a relatively modest market share. For instance, the global heart failure market was valued at approximately $25 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, indicating substantial room for expansion.

- Market Entry: Edwards is entering the high-growth structural heart failure management market with the Cordella system.

- Growth Potential: The global heart failure market is projected for significant expansion, offering substantial opportunities.

- Investment Required: Establishing a commercial presence and physician training are key investments for Edwards in this nascent area.

- Market Position: Edwards is building its market share from a relatively low base in this competitive segment.

Aortic Regurgitation (AR) Therapies

Edwards Lifesciences views Aortic Regurgitation (AR) as a significant future growth avenue within its structural heart portfolio. While current product specifics for AR might still be in developmental phases, the company is strategically positioning itself to capitalize on this substantial and expanding market. This commitment necessitates considerable investment in research, development, and extensive clinical trials to build a strong competitive presence.

The global market for structural heart devices, including those for AR, is projected for robust growth. For instance, reports from 2024 suggest the transcatheter aortic valve replacement (TAVR) market, a related area, continues to expand, indicating a favorable environment for new therapies. Edwards' focus on AR aligns with this trend, aiming to replicate its success in other valve repair and replacement segments.

- Market Potential: The AR market represents a significant, largely untapped opportunity for Edwards Lifesciences.

- Strategic Focus: AR therapies are a key component of Edwards' long-term strategy for structural heart disease.

- Investment Requirements: Substantial R&D and clinical trial funding are anticipated for AR product development.

- Competitive Landscape: Edwards aims to establish a leading position in the evolving AR treatment space.

The Transcatheter Mitral and Tricuspid Therapies (TMTT) segment for Edwards Lifesciences, encompassing products like PASCAL, EVOQUE, and SAPIEN M3, exemplifies a Question Mark. This segment experienced substantial sales growth, with Q1 2025 seeing a 60% increase and Q2 2025 a 61.9% surge, highlighting its high-growth potential in addressing unmet needs in valve disease. Despite this rapid uptake, TMTT requires significant ongoing investment for market penetration and solidifying its position.

The EVOQUE Tricuspid Replacement System, a key product in the TMTT segment, received CE Mark and US FDA approval in early 2024. While showing robust early adoption, it's a Question Mark due to the considerable investment needed for commercialization and evidence generation to transition it into a Star product.

Similarly, the SAPIEN M3 mitral valve replacement system, which debuted in Europe, is also a Question Mark. Its pioneering nature in a new market segment necessitates substantial investment in clinical trials, training, and market development to achieve widespread adoption and profitability.

Edwards Lifesciences' entry into structural heart failure management with the Cordella system, a pulmonary artery pressure sensor approved in the U.S. in 2024, represents another Question Mark. This emerging market requires dedicated commercial teams and training, with the global heart failure market valued around $25 billion in 2023 and projected to grow significantly.

| Product/Segment | BCG Category | Key Developments/Data | Investment Needs |

|---|---|---|---|

| TMTT (PASCAL, EVOQUE, SAPIEN M3) | Question Mark | 60% sales growth (Q1 2025), 61.9% sales growth (Q2 2025) | Continued investment for market penetration |

| EVOQUE Tricuspid Replacement System | Question Mark | CE Mark, US FDA approval (early 2024) | Commercialization, evidence generation |

| SAPIEN M3 mitral valve replacement | Question Mark | European debut, first transcatheter mitral valve | Clinical trials, physician training, market development |

| Cordella system (Structural Heart Failure) | Question Mark | U.S. approval (2024), targeting $25B heart failure market | Commercial team development, physician training |

BCG Matrix Data Sources

Our BCG Matrix leverages financial statements, market research, and competitor analysis to provide strategic insights.