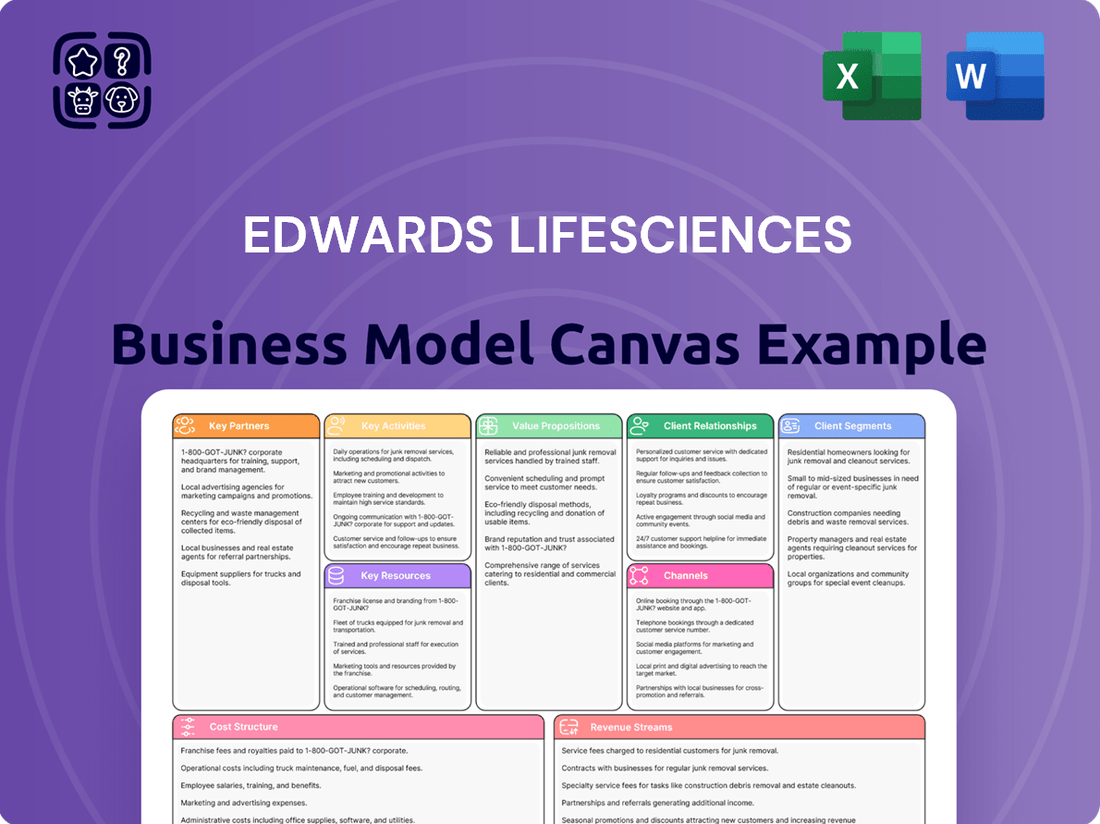

Edwards Lifesciences Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

Discover the intricate workings of Edwards Lifesciences's business model with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, key resources, and revenue streams, offering a clear roadmap to their success. Unlock the full blueprint today to gain strategic insights for your own ventures.

Partnerships

Edwards Lifesciences' key partnerships with healthcare providers and hospitals are foundational to its success. These collaborations include major hospital systems, specialized cardiac centers, and individual clinicians like cardiac surgeons and cardiologists who are the end-users of Edwards' innovative cardiovascular devices.

These relationships are vital for driving product adoption and gathering critical clinical feedback. For instance, the adoption of transcatheter aortic valve replacement (TAVR) technology heavily relies on surgeons and cardiologists receiving comprehensive training and ongoing support from Edwards. This ensures safe and effective patient outcomes.

Furthermore, Edwards works closely with hospital heart teams to optimize patient care pathways and streamline the treatment process for complex cardiovascular conditions. In 2023, Edwards reported that its TAVR systems were used in over 100,000 procedures globally, underscoring the widespread reliance on these provider partnerships.

Edwards Lifesciences actively collaborates with prestigious research institutions and universities globally. These partnerships are crucial for conducting rigorous clinical trials, which are essential for validating new treatments and expanding the use of their innovative devices. For example, in 2023, Edwards Lifesciences sponsored numerous studies across leading medical centers, contributing to a significant body of evidence that underpins their product development and market access strategies.

Edwards Lifesciences depends on a robust network of suppliers and manufacturers to source critical components and raw materials for its advanced medical technologies. These partnerships are vital for maintaining the high quality and reliability that patients and healthcare providers expect from Edwards' products.

In 2024, Edwards Lifesciences continued to emphasize strong, collaborative relationships with its key suppliers. This focus ensures a consistent flow of specialized materials, like advanced polymers and biocompatible metals, which are essential for the intricate design and manufacturing of their transcatheter heart valves and critical care monitoring systems.

Patient Advocacy Groups and Foundations

Edwards Lifesciences actively collaborates with patient advocacy groups and foundations, such as the Edwards Lifesciences Foundation. These partnerships are crucial for enhancing the diagnosis, treatment, and overall management of heart valve disease and other cardiovascular conditions. By working together, they aim to amplify the voices of patients, provide support to communities that need it most, and broaden access to vital healthcare services worldwide.

These collaborations are instrumental in driving patient-centric initiatives and addressing unmet needs within the cardiovascular community. For instance, in 2023, the Edwards Lifesciences Foundation continued its commitment to improving access to care and education, supporting numerous programs that directly benefit patients and their families.

- Patient Empowerment: Partnering with groups to educate patients about their conditions and treatment options.

- Access to Care: Initiatives focused on reaching underserved populations and improving healthcare accessibility.

- Research and Awareness: Supporting research efforts and raising public awareness about cardiovascular diseases.

- Global Reach: Expanding support and resources to patients across various international markets.

Industry Collaborators and Acquired Companies

Edwards Lifesciences actively cultivates key partnerships, including strategic collaborations and acquisitions, to enhance its technological offerings and broaden its market presence. These alliances are crucial for staying at the forefront of cardiovascular innovation.

Recent strategic moves underscore this commitment. For instance, acquisitions in areas like implantable heart failure monitoring sensors and advanced transcatheter valve replacement technologies exemplify Edwards' dedication to pushing the boundaries of structural heart therapies. This focus on acquiring cutting-edge capabilities is a core element of their growth strategy.

- Acquisition of Calypso Medical: In 2024, Edwards Lifesciences acquired Calypso Medical, a company specializing in advanced imaging and treatment delivery systems for prostate cancer. This move diversifies their portfolio beyond cardiac care.

- Collaboration with Abbott: Edwards Lifesciences maintains ongoing collaborations with other leading medical device companies, such as Abbott, on various research and development initiatives, particularly in the realm of cardiovascular diagnostics and treatments.

- Partnerships for Technological Advancement: The company frequently partners with academic institutions and research organizations to foster innovation in areas like biomaterials and minimally invasive surgical techniques.

Edwards Lifesciences' key partnerships are multifaceted, encompassing healthcare providers, research institutions, suppliers, and even patient advocacy groups. These collaborations are critical for product development, market access, and patient support.

In 2024, Edwards continued to strengthen its ties with hospitals and cardiac centers, facilitating the adoption of its advanced TAVR technologies. The company also deepened relationships with key suppliers to ensure the consistent availability of specialized materials for its high-quality devices.

Strategic acquisitions and collaborations with other medical technology firms further bolster Edwards' innovation pipeline, as seen with the 2024 acquisition of Calypso Medical, expanding its reach into new therapeutic areas. These partnerships are vital for maintaining its leadership in cardiovascular care.

What is included in the product

This Edwards Lifesciences Business Model Canvas provides a detailed overview of their strategy, focusing on their innovative heart valve technologies and patient-centric approach to healthcare.

It meticulously outlines customer segments, key partnerships, and revenue streams, reflecting their commitment to improving cardiovascular care through advanced medical devices.

Edwards Lifesciences' Business Model Canvas acts as a pain point reliever by clearly mapping their value proposition of innovative cardiac solutions to specific customer segments, streamlining their path to market.

Activities

Edwards Lifesciences dedicates significant resources to research and development, focusing on pioneering solutions for structural heart disease and critical care. In 2024, the company continued to advance its transcatheter aortic valve replacement (TAVR) technology, a cornerstone of its innovation pipeline.

The company's R&D efforts extend to developing novel transcatheter mitral and tricuspid therapies (TMTT), addressing unmet needs in these complex valve conditions. Edwards is also actively exploring new frontiers in structural heart failure and aortic regurgitation, aiming to broaden its impact on patient outcomes.

Edwards Lifesciences manufactures its advanced medical devices, including artificial heart valves and hemodynamic monitoring systems, across multiple global facilities. This geographically diverse manufacturing footprint is crucial for ensuring supply chain resilience and meeting global demand. In 2024, the company continued to emphasize its commitment to rigorous quality control, a non-negotiable aspect of producing life-sustaining technologies.

The company's manufacturing processes are designed to adhere to the strictest regulatory standards, such as those set by the FDA and other international health authorities. This meticulous attention to detail is paramount for patient safety and product efficacy, covering everything from raw material sourcing to the final assembly of complex devices like the SAPIEN 3 Ultra transcatheter aortic valve replacement system.

Edwards Lifesciences’ key activities heavily involve conducting rigorous clinical trials to prove the safety and efficacy of their advanced cardiovascular devices. These trials are essential for securing vital regulatory approvals from bodies like the U.S. Food and Drug Administration (FDA) and European notified bodies for the CE Mark, which are gateways to market access.

Gaining these approvals allows Edwards to expand the approved uses, or indications, for their innovative technologies. For instance, in 2024, the company continued to advance its SAPIEN 3 Ultra system trials for various patient populations, aiming to broaden its applicability and market reach.

Sales, Marketing, and Distribution

Edwards Lifesciences prioritizes a robust global sales, marketing, and distribution network to deliver its critical medical technologies to patients and healthcare professionals worldwide. This involves direct engagement with clinicians, comprehensive product training, and strategic efforts to broaden access to their innovations across both developed and developing economies.

In 2024, Edwards Lifesciences continued to invest heavily in its commercial infrastructure. For instance, the company's commitment to expanding its reach in emerging markets is a key driver for future growth, aiming to make its advanced cardiovascular solutions more accessible.

- Global Reach: Edwards maintains a significant international presence, ensuring its life-saving technologies are available to a broad patient population.

- Clinical Engagement: Direct collaboration with physicians and surgeons is crucial for understanding needs and facilitating the adoption of new technologies.

- Market Expansion: Strategic initiatives focus on increasing access in both established and emerging markets, driving volume and patient benefit.

- Training and Support: Providing extensive training to healthcare providers ensures the safe and effective use of Edwards' complex medical devices.

Professional Education and Training

Edwards Lifesciences’ professional education and training is crucial for the successful adoption of its advanced medical technologies. This involves providing in-depth instruction to healthcare professionals on the intricate implantation procedures for devices like the Edwards SAPIEN 3 transcatheter aortic valve replacement (TAVR) system and their transcatheter mitral and tricuspid valve therapies (TMTT).

The goal is to ensure clinicians are fully equipped to achieve the best possible patient outcomes. For instance, in 2024, Edwards continued to invest heavily in its global training programs, recognizing that effective device utilization directly impacts patient safety and the long-term success of these life-saving interventions. This commitment is vital for fostering confidence and competence among surgeons and interventional cardiologists.

- Device Implantation Expertise: Training clinicians on the precise techniques for TAVR and TMTT systems.

- Patient Outcome Focus: Ensuring education leads to optimal results for patients receiving valve replacements.

- Technology Adoption Facilitation: Accelerating the uptake of innovative cardiovascular solutions through skilled practitioners.

- Global Reach of Training: Edwards' commitment to providing education across various international markets in 2024.

Edwards Lifesciences’ key activities revolve around innovation and clinical validation. The company actively pursues research and development to create next-generation transcatheter heart valve replacement therapies, particularly for aortic, mitral, and tricuspid valve diseases. In 2024, a significant focus remained on advancing clinical trials for these novel treatments, aiming to gather robust data on safety and efficacy to support regulatory submissions.

Manufacturing excellence is another core activity, ensuring the high-quality production of complex medical devices like the SAPIEN 3 Ultra TAVR system. This involves stringent quality control across its global facilities to meet demanding regulatory standards. Edwards also dedicates substantial resources to sales, marketing, and distribution, working to expand patient access to its life-saving technologies worldwide, with a particular emphasis on growing markets in 2024.

Preview Before You Purchase

Business Model Canvas

The Edwards Lifesciences Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. You'll get full access to this comprehensive analysis, ready for your strategic planning and decision-making needs.

Resources

Edwards Lifesciences' intellectual property, particularly its extensive patent portfolio covering heart valves and transcatheter systems, is a cornerstone of its business model. These proprietary technologies, including advancements in minimally invasive valve replacement, are crucial for maintaining its market leadership. For instance, in 2023, Edwards reported significant R&D investment, underscoring its commitment to innovation and patent protection.

Edwards Lifesciences relies heavily on its specialized R&D and engineering talent, a crucial resource for its innovation-driven business model. This highly skilled workforce, comprising engineers, scientists, and clinical experts, is the engine behind the company's continuous development of groundbreaking therapies and the refinement of its advanced medical technologies.

In 2024, Edwards Lifesciences continued to invest significantly in its human capital, recognizing that this talent pool is indispensable for maintaining its competitive edge in the cardiovascular device market. The expertise of these professionals directly translates into the creation of next-generation heart valves and hemodynamic monitoring systems, ensuring the company remains at the forefront of the industry.

Edwards Lifesciences operates a global network of manufacturing facilities, including key sites in Irvine, California, Utah, Costa Rica, and Singapore. This strategically distributed infrastructure is crucial for producing its life-saving medical devices.

The company's commitment to a resilient supply chain underpins its ability to ensure the consistent availability of high-quality products worldwide. This robust network supports Edwards Lifesciences' extensive global operations.

Clinical Data and Research Evidence

Edwards Lifesciences heavily relies on its extensive clinical trial data and real-world evidence as a cornerstone of its business model. This robust collection of information showcases the safety, effectiveness, and economic advantages of their innovative cardiovascular therapies. For instance, in 2024, the company continued to present compelling data from trials like the PARTNER 3 study, which demonstrated superior outcomes for their transcatheter aortic valve replacement (TAVR) solutions compared to surgical options in low-risk patients.

This evidence is absolutely critical for securing regulatory approvals from bodies like the FDA and EMA, facilitating broader market adoption by healthcare providers, and building unwavering confidence among clinicians who prescribe and utilize their technologies. The consistent generation and dissemination of high-quality clinical data directly translate into market access and competitive differentiation.

- Demonstrated Safety and Efficacy: Clinical trials consistently validate the performance of Edwards' TAVR and other cardiac devices.

- Cost-Effectiveness Data: Real-world evidence highlights the long-term economic benefits of their therapies, supporting reimbursement.

- Regulatory Support: Comprehensive data packages are essential for gaining and maintaining product approvals globally.

- Clinician Confidence: Strong evidence builds trust and encourages the adoption of new treatment paradigms.

Brand Reputation and Clinical Leadership

Edwards Lifesciences' formidable brand reputation, particularly in structural heart disease and critical care, is a cornerstone of its business model. This recognition is built on a legacy of innovation, with the company consistently introducing groundbreaking technologies that improve patient outcomes. For instance, their pioneering work in transcatheter aortic valve replacement (TAVR) has reshaped cardiac care.

This established clinical leadership directly translates into trust and preference among cardiologists, cardiac surgeons, and hospital administrators. This trust is a critical intangible asset, influencing purchasing decisions and fostering strong relationships within the healthcare ecosystem. The company's commitment to rigorous clinical trials and data dissemination further solidifies this leadership position.

- Brand Strength: Edwards Lifesciences is widely recognized as a leader in the transcatheter heart valve market.

- Clinical Validation: Decades of pioneering technologies and positive patient outcomes underpin their market standing.

- Professional Trust: Healthcare professionals rely on Edwards' innovation and proven results, driving market share.

- Market Leadership: Their reputation directly influences adoption rates and competitive advantage in key therapeutic areas.

Edwards Lifesciences' intellectual property, particularly its extensive patent portfolio covering heart valves and transcatheter systems, is a cornerstone of its business model. These proprietary technologies, including advancements in minimally invasive valve replacement, are crucial for maintaining its market leadership. For instance, in 2023, Edwards reported significant R&D investment, underscoring its commitment to innovation and patent protection.

Edwards Lifesciences relies heavily on its specialized R&D and engineering talent, a crucial resource for its innovation-driven business model. This highly skilled workforce, comprising engineers, scientists, and clinical experts, is the engine behind the company's continuous development of groundbreaking therapies and the refinement of its advanced medical technologies.

In 2024, Edwards Lifesciences continued to invest significantly in its human capital, recognizing that this talent pool is indispensable for maintaining its competitive edge in the cardiovascular device market. The expertise of these professionals directly translates into the creation of next-generation heart valves and hemodynamic monitoring systems, ensuring the company remains at the forefront of the industry.

Edwards Lifesciences operates a global network of manufacturing facilities, including key sites in Irvine, California, Utah, Costa Rica, and Singapore. This strategically distributed infrastructure is crucial for producing its life-saving medical devices.

The company's commitment to a resilient supply chain underpins its ability to ensure the consistent availability of high-quality products worldwide. This robust network supports Edwards Lifesciences' extensive global operations.

Edwards Lifesciences heavily relies on its extensive clinical trial data and real-world evidence as a cornerstone of its business model. This robust collection of information showcases the safety, effectiveness, and economic advantages of their innovative cardiovascular therapies. For instance, in 2024, the company continued to present compelling data from trials like the PARTNER 3 study, which demonstrated superior outcomes for their transcatheter aortic valve replacement (TAVR) solutions compared to surgical options in low-risk patients.

This evidence is absolutely critical for securing regulatory approvals from bodies like the FDA and EMA, facilitating broader market adoption by healthcare providers, and building unwavering confidence among clinicians who prescribe and utilize their technologies. The consistent generation and dissemination of high-quality clinical data directly translate into market access and competitive differentiation.

- Demonstrated Safety and Efficacy: Clinical trials consistently validate the performance of Edwards' TAVR and other cardiac devices.

- Cost-Effectiveness Data: Real-world evidence highlights the long-term economic benefits of their therapies, supporting reimbursement.

- Regulatory Support: Comprehensive data packages are essential for gaining and maintaining product approvals globally.

- Clinician Confidence: Strong evidence builds trust and encourages the adoption of new treatment paradigms.

Edwards Lifesciences' formidable brand reputation, particularly in structural heart disease and critical care, is a cornerstone of its business model. This recognition is built on a legacy of innovation, with the company consistently introducing groundbreaking technologies that improve patient outcomes. For instance, their pioneering work in transcatheter aortic valve replacement (TAVR) has reshaped cardiac care.

This established clinical leadership directly translates into trust and preference among cardiologists, cardiac surgeons, and hospital administrators. This trust is a critical intangible asset, influencing purchasing decisions and fostering strong relationships within the healthcare ecosystem. The company's commitment to rigorous clinical trials and data dissemination further solidifies this leadership position.

- Brand Strength: Edwards Lifesciences is widely recognized as a leader in the transcatheter heart valve market.

- Clinical Validation: Decades of pioneering technologies and positive patient outcomes underpin their market standing.

- Professional Trust: Healthcare professionals rely on Edwards' innovation and proven results, driving market share.

- Market Leadership: Their reputation directly influences adoption rates and competitive advantage in key therapeutic areas.

Edwards Lifesciences' key resources are its robust patent portfolio, highly skilled R&D and engineering talent, a global manufacturing network, extensive clinical trial data, and a strong brand reputation. These elements collectively enable the company to innovate, produce, and market life-saving cardiovascular devices effectively. The company's significant investment in R&D in 2023 and continued focus on human capital in 2024 highlight the strategic importance of these resources for maintaining its market leadership and competitive edge.

Value Propositions

Edwards Lifesciences' commitment to improving patient outcomes is central to its value proposition. Their innovative solutions, particularly in structural heart disease and critical care, directly address patient well-being.

The company’s transcatheter aortic valve replacement (TAVR) technology, for instance, offers a less invasive approach compared to open-heart surgery. This translates to quicker recovery times and a better quality of life for patients.

In 2023, Edwards Lifesciences reported TAVR sales of $4.2 billion, underscoring the significant adoption and impact of these life-enhancing technologies. This financial success reflects the real-world benefit delivered to a growing number of patients.

Edwards Lifesciences is a leader in pioneering minimally invasive heart valve therapies, particularly in transcatheter aortic valve replacement (TAVR). This innovative approach offers a less invasive alternative for patients who might be considered high-risk for traditional open-heart surgery.

The benefits of these minimally invasive procedures are significant. Patients typically experience shorter recovery times and reduced hospital stays compared to conventional methods. For instance, in 2023, Edwards Lifesciences reported strong growth in its TAVR segment, reflecting the increasing adoption of these patient-friendly solutions.

Edwards Lifesciences provides advanced hemodynamic monitoring solutions that equip healthcare professionals with real-time, actionable data. This empowers them to make critical, informed decisions in intensive care environments, leading to optimized patient care and better health outcomes. For instance, in 2023, Edwards reported significant growth in its critical care and surgical products, which include these advanced monitoring systems, underscoring their value in improving patient management.

Commitment to Clinical Evidence and Durability

Edwards Lifesciences places a strong emphasis on clinical evidence and the long-term durability of its medical devices. This focus is crucial for building trust with healthcare professionals and patients, assuring them of the safety and effectiveness of their implantable technologies.

A prime example of this commitment is the RESILIA tissue technology, incorporated into their TAVR (transcatheter aortic valve replacement) valves. This advanced material is designed to resist calcification and degradation over time, contributing to the extended performance of the valves.

- RESILIA Tissue Durability: Edwards reports that RESILIA tissue offers enhanced durability, aiming to reduce the need for reintervention in TAVR patients.

- Clinical Trial Data: Extensive clinical trials support the long-term performance of Edwards' TAVR devices, demonstrating favorable patient outcomes and device longevity.

- Patient Confidence: The emphasis on robust clinical evidence and device durability directly translates to increased confidence among patients undergoing life-changing procedures.

- Physician Adoption: Clinicians are more likely to adopt technologies backed by strong, consistent data on safety and long-term efficacy, which Edwards actively provides.

Comprehensive Portfolio for Structural Heart Disease

Edwards Lifesciences provides a wide array of treatments for various structural heart conditions, including issues with the aortic, mitral, and tricuspid valves. This extensive range covers current needs and future possibilities for heart failure patients, establishing them as a frontrunner in the field.

Their commitment to innovation is evident in their diverse product pipeline, aiming to address unmet clinical needs across the spectrum of structural heart disease. This strategic approach ensures they can cater to a broad patient population.

- Broadest Portfolio: Covers aortic, mitral, and tricuspid valve diseases, plus emerging heart failure solutions.

- Leadership Position: Addresses diverse patient needs in structural heart care, solidifying market dominance.

- Innovation Focus: Continuously developing new therapies to meet evolving clinical demands.

- Comprehensive Care: Offers a complete suite of solutions for structural heart patients.

Edwards Lifesciences offers groundbreaking minimally invasive solutions, particularly its transcatheter aortic valve replacement (TAVR) technology. This innovation provides a less invasive alternative to open-heart surgery, leading to faster recovery and improved patient quality of life. In 2023, TAVR sales reached $4.2 billion, highlighting the significant impact and adoption of these life-enhancing treatments.

The company also provides advanced hemodynamic monitoring systems that deliver real-time data to healthcare professionals. This empowers clinicians to make critical decisions in intensive care settings, optimizing patient care and outcomes. Edwards reported strong growth in its critical care and surgical products in 2023, demonstrating the value of these monitoring solutions.

Edwards Lifesciences prioritizes the long-term durability and clinical evidence for its devices, fostering trust with both patients and medical professionals. Technologies like RESILIA tissue, used in their TAVR valves, are designed to resist degradation, ensuring extended performance and reducing the need for reintervention. This commitment to evidence-based innovation is key to their value proposition.

Edwards Lifesciences offers a comprehensive portfolio for structural heart diseases, addressing aortic, mitral, and tricuspid valve issues, alongside developing solutions for heart failure. This broad range caters to diverse patient needs and solidifies their leadership in the field, driven by a continuous focus on innovation to meet evolving clinical demands.

| Value Proposition | Key Aspect | Supporting Data/Fact (2023) |

|---|---|---|

| Minimally Invasive Therapies | TAVR technology | TAVR sales: $4.2 billion |

| Advanced Hemodynamic Monitoring | Real-time data for critical care | Strong growth in Critical Care segment |

| Device Durability & Clinical Evidence | RESILIA tissue technology | Focus on long-term performance and reduced reintervention |

| Comprehensive Structural Heart Solutions | Broadest portfolio (aortic, mitral, tricuspid) | Leadership in addressing diverse structural heart conditions |

Customer Relationships

Edwards Lifesciences cultivates direct relationships with healthcare professionals via its extensive sales force and specialized clinical support teams. These professionals offer crucial product insights, technical aid, and real-time procedural assistance, directly impacting device efficacy and patient well-being.

In 2024, Edwards Lifesciences continued to emphasize this direct engagement. For instance, their sales and marketing expenses were a significant component of their operational costs, reflecting the investment in these customer-facing roles. This direct interaction allows for immediate feedback, crucial for product development and market adaptation.

Edwards Lifesciences cultivates deep customer loyalty by providing comprehensive training and educational programs. These initiatives are crucial for surgeons, cardiologists, and other healthcare professionals to master the use of Edwards' sophisticated medical devices.

By offering these extensive programs, Edwards ensures healthcare providers are not only proficient with their products but also stay abreast of the latest advancements and best practices in cardiovascular care. This commitment to education directly supports patient outcomes and reinforces Edwards' position as a trusted partner.

Edwards Lifesciences actively fosters long-term partnerships with influential figures in cardiothoracic surgery and leading medical institutions. These collaborations are crucial for advancing cardiovascular care through joint research initiatives and clinical trials.

By engaging with key opinion leaders, Edwards gains invaluable insights that directly inform the development of innovative products and treatment protocols. This strategic approach ensures their offerings remain at the forefront of medical advancement.

In 2024, Edwards continued to invest in these relationships, recognizing their impact on shaping clinical practice and driving the adoption of new technologies. This focus on collaborative innovation is a cornerstone of their customer relationship strategy.

Post-Market Surveillance and Feedback Mechanisms

Edwards Lifesciences prioritizes post-market surveillance, actively collecting feedback from healthcare professionals and patients. This ensures their medical devices, particularly in cardiovascular care, are continuously refined for optimal safety and efficacy.

This ongoing dialogue is crucial for addressing any emergent needs or potential concerns, directly influencing product development cycles. For instance, in 2024, feedback on their transcatheter aortic valve replacement (TAVR) systems led to targeted software updates aimed at enhancing procedural predictability.

- Clinician Feedback: Direct input from surgeons and cardiologists on device performance and usability.

- Patient Reported Outcomes: Gathering data on patient experiences and quality of life post-implantation.

- Adverse Event Reporting: Robust systems for tracking and analyzing any reported complications.

- Continuous Improvement: Utilizing insights to drive innovation and refine existing product lines.

Patient-Focused Initiatives and Support

Edwards Lifesciences actively cultivates patient relationships through dedicated initiatives. The Edwards Lifesciences Foundation, for instance, supports patient advocacy groups, fostering a sense of community and shared purpose. This commitment extends to providing crucial resources for patients in underserved communities, underscoring a philosophy that transcends mere product transactions.

The Every Heartbeat Matters program exemplifies this patient-centric approach by offering vital support and education to individuals navigating heart conditions. These efforts demonstrate a deep-seated dedication to patient well-being and empowerment, building trust and loyalty beyond the clinical setting. In 2024, the foundation continued its work, with specific grant allocations aimed at expanding access to care and patient education programs.

- Patient Advocacy Support: Funding patient organizations to enhance awareness and support networks.

- Resource Provision: Delivering essential resources and educational materials to underserved patient populations.

- Community Building: Fostering connections among patients and healthcare providers through various programs.

- Long-Term Engagement: Cultivating enduring relationships built on trust and a shared commitment to cardiac health.

Edwards Lifesciences nurtures strong customer relationships through direct engagement with healthcare professionals, offering technical support and educational programs. These efforts, evident in their substantial sales and marketing investments in 2024, ensure proficiency with their advanced cardiovascular devices.

Strategic partnerships with key opinion leaders and institutions drive innovation, with 2024 seeing continued investment in these collaborations to shape clinical practice. Post-market surveillance and patient feedback loops are also vital, informing continuous product improvement, such as the 2024 software updates for TAVR systems.

Furthermore, Edwards extends its reach to patients through initiatives like the Edwards Lifesciences Foundation, supporting advocacy groups and providing resources to underserved communities, reinforcing a commitment to cardiac health beyond the product itself.

| Customer Relationship Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| Direct Professional Engagement | Sales force and clinical support providing product insights and technical aid. | Significant investment in sales and marketing expenses reflecting direct interaction. |

| Education and Training | Comprehensive programs for healthcare professionals on device usage and best practices. | Crucial for mastering sophisticated medical devices and staying current with advancements. |

| Key Opinion Leader (KOL) Partnerships | Collaborations with leading surgeons and institutions for research and trials. | Continued investment in 2024 to influence clinical practice and technology adoption. |

| Post-Market Surveillance | Collecting feedback from professionals and patients for continuous refinement. | Led to targeted software updates for TAVR systems in 2024 based on feedback. |

| Patient Support Initiatives | Foundation work, advocacy group support, and resource provision for patients. | Grant allocations in 2024 aimed at expanding access to care and patient education. |

Channels

Edwards Lifesciences relies heavily on its dedicated direct sales force to connect with hospitals, cardiac centers, and medical professionals worldwide. This approach ensures hands-on engagement, allowing for thorough product demonstrations and tailored support for their sophisticated medical devices.

In 2023, Edwards Lifesciences reported total sales of $5.3 billion, with a significant portion attributed to the effectiveness of their direct sales channel in promoting innovative cardiovascular technologies and therapies.

Edwards Lifesciences' products, including their critical care and structural heart therapies, are distributed through established hospital procurement systems and robust supply chains. This integration ensures that their life-saving devices are readily available within the regular workflow of medical institutions, facilitating timely patient care.

In 2024, Edwards Lifesciences continued to leverage these established channels, a key component of their business model. This approach is crucial for maintaining consistent product availability, especially given the critical nature of their offerings, which are often used in emergency and elective surgical procedures.

The efficiency of these hospital supply chains directly impacts Edwards' ability to serve healthcare providers and patients. For example, in 2023, Edwards reported net sales of $5.3 billion, a testament to the effectiveness of their distribution and procurement strategies in reaching a wide market.

Edwards Lifesciences utilizes its dedicated clinical education and training centers as a vital channel to reach healthcare professionals. These facilities are instrumental in disseminating knowledge and best practices surrounding their advanced medical technologies.

Through hands-on training sessions, the company ensures that medical practitioners are proficient in the effective use of their innovative products. This focus on education is a cornerstone for driving adoption and maximizing patient outcomes.

In 2024, Edwards Lifesciences continued to invest in its global network of training facilities, underscoring the strategic importance of these channels in supporting the growth of its minimally invasive surgical solutions.

Conferences, Workshops, and Medical Journals

Edwards Lifesciences actively participates in major medical conferences, such as the Transcatheter Cardiovascular Therapeutics (TCT) and the American Association for Thoracic Surgery (AATS) annual meetings. These events are crucial for presenting new clinical data and engaging with cardiologists and cardiac surgeons. In 2024, TCT saw thousands of attendees, providing a significant platform for Edwards to showcase its latest innovations in structural heart disease and critical care technologies.

The company also hosts specialized workshops focused on training healthcare professionals in the use of its advanced devices, particularly in transcatheter valve replacement procedures. These hands-on sessions are vital for building confidence and expertise among clinicians, thereby expanding the adoption of Edwards' technologies. For instance, workshops in late 2024 focused on the evolving techniques for TAVR procedures, reinforcing Edwards' commitment to education.

Furthermore, Edwards Lifesciences prioritizes publishing its research in high-impact, peer-reviewed medical journals. This ensures that clinical evidence supporting their products, such as the Edwards SAPIEN 3 Ultra system, reaches the global medical community authoritatively. In 2024, multiple studies detailing the long-term outcomes and patient benefits of their TAVR solutions were published, reinforcing their market leadership.

- Conference Participation: Edwards Lifesciences leverages global medical conferences to disseminate clinical trial results and product updates to key opinion leaders and healthcare providers.

- Workshop Hosting: The company conducts educational workshops to train surgeons and interventional cardiologists on the latest procedural techniques, enhancing device utilization and patient outcomes.

- Medical Journal Publications: Research findings and clinical data supporting Edwards' portfolio, including advancements in minimally invasive cardiac surgery, are regularly published in leading medical journals.

- Community Engagement: These channels collectively serve to strengthen relationships within the cardiovascular community, driving innovation and market penetration for Edwards' life-saving technologies.

Online Platforms and Digital Resources

Edwards Lifesciences leverages its corporate website, edwards.com, as a primary channel to disseminate information. This platform serves as a hub for detailed product specifications, clinical trial data, and educational resources for healthcare professionals. In 2024, the company continued to emphasize digital engagement, with its website acting as a critical touchpoint for all stakeholders.

Beyond product and clinical information, Edwards utilizes its digital presence to offer comprehensive investor relations content. This includes financial reports, SEC filings, and webcast presentations, ensuring transparency and accessibility for investors. The company also highlights career opportunities, attracting talent through its online portals.

- Corporate Website (edwards.com): Centralized information on products, clinical data, investor relations, and careers.

- Digital Engagement: Focus on reaching healthcare professionals, investors, and potential employees through online channels.

- Content Variety: Offers product details, clinical resources, financial updates, and recruitment information.

Edwards Lifesciences' channels are multifaceted, encompassing direct sales, robust supply chains, clinical education, conference participation, and digital platforms. These diverse avenues ensure effective reach to healthcare providers, patients, and investors.

In 2024, the company continued to rely on its direct sales force and integrated hospital supply chains to deliver critical cardiovascular technologies. Participation in key medical conferences like TCT and AATS, alongside targeted workshops and journal publications, reinforced its commitment to clinical education and market leadership.

The corporate website, edwards.com, served as a vital digital hub in 2024, providing comprehensive product information, clinical data, and investor relations content, underscoring the company's strategic digital engagement with all stakeholders.

Customer Segments

Cardiologists and cardiac surgeons are Edwards Lifesciences' primary customer segment. This group includes interventional cardiologists who perform transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve therapy (TMTT) procedures, as well as cardiac surgeons who conduct open-heart valve repair and replacement surgeries. These medical professionals are the direct end-users of Edwards' innovative cardiovascular devices.

The demand for these specialists and their procedures continues to grow. In 2024, the global TAVR market alone was projected to reach tens of billions of dollars, driven by an aging population and the increasing adoption of minimally invasive techniques. Edwards Lifesciences, a leader in this space, relies heavily on the expertise and procedural volume of these cardiologists and surgeons to drive its revenue.

Hospitals and dedicated cardiac centers are crucial customers for Edwards Lifesciences, purchasing their comprehensive suite of structural heart and critical care technologies. These healthcare facilities are at the forefront of adopting innovative medical procedures and managing patient care pathways.

In 2024, Edwards Lifesciences continued to see strong demand from these segments, with their transcatheter aortic valve replacement (TAVR) systems being a significant driver. The global TAVR market was projected to reach over $10 billion by 2025, with hospitals being the primary purchasers and implementers of these life-saving technologies.

Critical care clinicians, including physicians and nurses in ICUs and operating rooms, are key users of advanced hemodynamic monitoring. These professionals rely on precise data to manage patients with complex conditions. Edwards Lifesciences' solutions directly support their decision-making in high-stakes environments.

Patients with Structural Heart Disease

Patients with structural heart disease, such as aortic stenosis, mitral regurgitation, and tricuspid regurgitation, are the ultimate beneficiaries of Edwards Lifesciences' innovations. These individuals face significant health challenges that impact their quality of life and longevity. Edwards' focus is on providing advanced treatment options that directly address these conditions.

Edwards Lifesciences' commitment is to enhance the lives of these patients by offering groundbreaking medical technologies. These solutions are designed to alleviate symptoms, improve heart function, and ultimately extend survival rates for those with severe structural heart issues. The company's efforts are centered on patient outcomes and well-being.

- Aortic Stenosis: A leading indication, affecting millions globally.

- Mitral Regurgitation: Another significant condition where Edwards offers solutions.

- Tricuspid Regurgitation: A growing area of focus for the company's advancements.

- Improved Quality of Life: The primary goal for patients undergoing treatment.

Healthcare Payers and Government Health Systems

Healthcare payers and government health systems are pivotal, even though they don't directly use Edwards Lifesciences' medical devices. Their decisions on reimbursement and coverage significantly shape how widely Edwards' innovative therapies are adopted. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to refine payment models for cardiovascular procedures, directly impacting the economic viability of new technologies.

Edwards actively engages with these entities to showcase the long-term cost-effectiveness and overall value proposition of their treatments. This involves presenting data that highlights reduced hospital readmissions and improved patient outcomes, which are key considerations for payers. In 2023, Edwards reported that their transcatheter aortic valve replacement (TAVR) procedures demonstrated a significant reduction in overall healthcare costs compared to surgical AVR in certain patient populations, a crucial data point for payer discussions.

- Influence on Adoption: Payers and government health systems control reimbursement, directly affecting market access for Edwards' products.

- Value Demonstration: Edwards presents data proving cost-effectiveness and improved patient outcomes to secure favorable coverage decisions.

- 2024 Focus: Ongoing adjustments to payment models by agencies like CMS are critical for Edwards' strategic planning.

- Cost Savings Evidence: Data from 2023 indicated that TAVR procedures offered substantial healthcare cost savings in specific patient groups.

Edwards Lifesciences' customer base extends beyond direct medical practitioners to include hospitals and healthcare systems that are the primary purchasers of their advanced cardiovascular technologies. These institutions are vital for the widespread adoption and delivery of treatments like TAVR. In 2024, the increasing prevalence of structural heart disease, particularly among aging populations, fueled demand for these sophisticated hospital-based interventions.

The company also targets critical care clinicians, such as intensivists and nurses in intensive care units, who utilize Edwards' hemodynamic monitoring systems. These professionals require precise, real-time data to manage critically ill patients effectively. The market for advanced patient monitoring solutions remained robust in 2024, driven by the need for improved patient safety and outcomes in complex care settings.

Patients with structural heart diseases, like aortic stenosis and mitral regurgitation, represent the ultimate beneficiaries of Edwards' innovations. These individuals seek improved quality of life and longevity through less invasive and more effective treatment options. The company's product development is directly aligned with addressing the unmet needs of this growing patient population.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Cardiologists & Cardiac Surgeons | Perform TAVR, TMTT, and open-heart surgeries; direct end-users. | Driving adoption of minimally invasive procedures. |

| Hospitals & Cardiac Centers | Purchasers of cardiovascular devices; implementers of new therapies. | Key sites for TAVR procedures, with significant capital investment in advanced technology. |

| Critical Care Clinicians | Utilize hemodynamic monitoring in ICUs and ORs. | Demand for real-time data to manage complex patient conditions. |

| Patients with Structural Heart Disease | Beneficiaries seeking improved quality of life and longevity. | Growing demographic due to aging population and increased diagnosis. |

| Healthcare Payers & Government Systems | Influence reimbursement and coverage decisions. | Crucial for market access; 2023 data showed TAVR cost savings in certain groups. |

Cost Structure

Edwards Lifesciences dedicates a substantial portion of its resources to Research and Development (R&D), underscoring its focus on pioneering advancements in cardiovascular care. This investment is crucial for the continuous innovation and enhancement of their product portfolio, aiming to address unmet patient needs.

In 2023, Edwards Lifesciences reported R&D expenses of $1.15 billion. This significant outlay supports critical activities such as extensive clinical trials for new devices, foundational scientific research into cardiovascular disease, and the meticulous development of next-generation technologies like transcatheter heart valves and critical care monitoring systems.

Manufacturing and production costs are a significant component of Edwards Lifesciences' business model, primarily driven by the intricate processes involved in creating advanced medical devices. These costs encompass the procurement of specialized raw materials, such as the biological tissues essential for their pioneering heart valve replacements, along with the skilled labor required for assembly and the operational expenses of maintaining a global network of production facilities.

The company's commitment to rigorous quality control and adherence to stringent regulatory compliance standards further elevates these manufacturing expenses. For instance, in 2023, Edwards Lifesciences reported cost of sales of $2.3 billion, reflecting the substantial investment in producing their life-saving technologies.

Sales, General, and Administrative (SG&A) expenses are crucial for Edwards Lifesciences, encompassing everything from compensating their dedicated sales force and executing impactful marketing campaigns to managing the essential administrative overhead and intricate distribution logistics that keep their global operations running smoothly. These costs are fundamental to promoting their innovative cardiovascular solutions, nurturing vital customer relationships, and ensuring efficient worldwide reach.

For fiscal year 2023, Edwards Lifesciences reported SG&A expenses of $1.28 billion. This figure reflects significant investment in their commercial infrastructure, supporting their mission to advance patient care through groundbreaking medical technologies.

Clinical Trial and Regulatory Compliance Costs

Edwards Lifesciences faces substantial costs related to clinical trials and regulatory compliance. These expenses are fundamental for gaining market access and ensuring product safety and efficacy. For instance, the development and execution of extensive clinical trials, often spanning multiple phases and patient populations, represent a significant financial commitment.

Maintaining compliance with global healthcare regulations, such as those set by the FDA in the United States and EMA in Europe, also incurs ongoing costs. This includes rigorous documentation, quality control processes, and periodic audits. These regulatory hurdles are critical for the long-term viability and market acceptance of their innovative medical devices.

- Clinical Trial Expenses: Costs associated with designing, conducting, and analyzing multi-phase clinical trials for new cardiovascular devices.

- Regulatory Approval Fees: Payments to regulatory bodies like the FDA for submitting and obtaining approvals for new products and variations.

- Compliance and Quality Assurance: Ongoing expenses for maintaining adherence to global quality standards (e.g., ISO 13485) and post-market surveillance.

Intellectual Property and Litigation Costs

Edwards Lifesciences incurs significant costs to safeguard its innovations. These include expenses for filing and maintaining patents globally, which are crucial for protecting their advanced medical devices. For instance, in 2023, the company reported $328 million in research and development expenses, a portion of which directly supports intellectual property protection.

Beyond proactive protection, the company must also budget for potential litigation. This covers costs associated with defending its patents against infringement claims or addressing product liability issues. Such legal battles can be substantial, impacting overall operational expenditures.

- Patent Protection Expenses: Costs for filing, prosecuting, and maintaining patents worldwide.

- Litigation Defense: Funds allocated for defending against patent infringement lawsuits.

- Product Liability Costs: Expenses related to potential claims arising from product use.

- R&D Investment: A portion of the $328 million R&D spend in 2023 was dedicated to IP strategy.

Edwards Lifesciences' cost structure is heavily influenced by its commitment to innovation and quality in the medical device sector. Key expenditures include significant investments in research and development, manufacturing, sales and marketing, and regulatory compliance.

In 2023, the company reported substantial figures across these areas, reflecting the complex nature of developing and distributing life-saving cardiovascular technologies. These costs are essential for maintaining their competitive edge and ensuring patient safety.

| Cost Category | 2023 Expense (in billions USD) | Key Drivers |

|---|---|---|

| Research & Development (R&D) | 1.15 | New product development, clinical trials, scientific research |

| Cost of Sales | 2.30 | Raw materials, skilled labor, manufacturing overhead, quality control |

| Sales, General & Administrative (SG&A) | 1.28 | Sales force compensation, marketing, distribution, administrative overhead |

| Intellectual Property (IP) Protection & Legal | 0.33 (portion of R&D) | Patent filing/maintenance, litigation defense, product liability |

Revenue Streams

Transcatheter Aortic Valve Replacement (TAVR) systems, predominantly the SAPIEN platform, represent Edwards Lifesciences' most significant revenue generator, treating patients with aortic stenosis.

This segment has consistently been the primary engine for the company's growth. For instance, TAVR sales reached approximately $4.2 billion in 2023, showcasing its critical role in Edwards Lifesciences' financial performance.

Transcatheter Mitral and Tricuspid Therapies (TMTT) sales are a key driver for Edwards Lifesciences, generating significant revenue from innovative valve repair and replacement systems. Products like the PASCAL system for mitral valve repair and the EVOQUE system for tricuspid valve replacement are at the forefront of this expanding market.

This segment is experiencing robust growth, with TMTT sales contributing substantially to Edwards' overall financial performance. The company's strategic focus on developing and commercializing these minimally invasive solutions positions TMTT as a critical component of its future revenue streams.

Edwards Lifesciences generates significant revenue from its surgical structural heart products. This includes sales of advanced heart valves and repair devices, such as those within the RESILIA portfolio, which encompasses products like INSPIRIS, MITRIS, and KONECT.

These surgical solutions are critical for patients undergoing traditional open-heart procedures. For instance, in the first quarter of 2024, Edwards Lifesciences reported global sales of $1.5 billion for its Transcatheter Aortic Valve Replacement (TAVR) and surgical structural heart businesses combined, demonstrating the substantial contribution of surgical sales.

Critical Care Product Sales (Historical/Transitioning)

Historically, Edwards Lifesciences' critical care product sales, encompassing advanced hemodynamic monitoring solutions, were a significant revenue driver. For instance, in the first nine months of 2023, the Critical Care segment generated $913.5 million in sales.

However, this revenue stream is undergoing a significant transformation. Edwards Lifesciences announced its intention to spin off its Critical Care unit, a process expected to be completed by the end of 2024. This strategic move will establish the critical care business as an independent company, thereby changing how its revenue is recognized and managed within the broader Edwards Lifesciences' business model.

- Historical Revenue Contribution: The Critical Care segment consistently contributed to Edwards Lifesciences' top line, with sales reaching $1.2 billion in 2022.

- Strategic Spin-off: The planned separation by the end of 2024 marks a pivotal shift, creating a standalone entity for critical care technologies.

- Transitioning Revenue Stream: Post-spin-off, the revenue generated by these products will belong to the new, independent critical care company.

Licensing and Royalty Agreements

Edwards Lifesciences generates revenue through licensing its innovative technologies to other companies. These agreements often involve royalty payments based on the sales of products that utilize Edwards' intellectual property.

For instance, annual royalty payments are a common component of these deals, directly linked to the net sales generated by specific Edwards products. This stream diversifies their income beyond direct product sales.

- Licensing Fees: Upfront or recurring payments for the right to use Edwards' patented technologies.

- Royalty Payments: A percentage of net sales for products incorporating licensed intellectual property.

- Technology Partnerships: Revenue from collaborative ventures where technology is shared or co-developed.

- Intellectual Property Monetization: Generating income by strategically licensing patents and other IP assets.

Edwards Lifesciences' revenue streams are primarily driven by its advanced cardiovascular technologies, with a strong emphasis on minimally invasive solutions. The company's strategic focus on innovation and market leadership in these areas underpins its financial performance.

The company's TAVR and TMTT segments are key revenue generators, reflecting the growing demand for less invasive cardiac treatments. Surgical structural heart products also contribute significantly, serving patients who undergo traditional open-heart surgery.

While historically a substantial contributor, the Critical Care segment is undergoing a strategic spin-off, expected to be completed by the end of 2024, which will alter its direct revenue reporting for Edwards Lifesciences.

| Revenue Segment | Key Products | 2023 Sales (Approx.) | 2024 Q1 Combined (TAVR & Surgical) |

|---|---|---|---|

| Transcatheter Aortic Valve Replacement (TAVR) | SAPIEN platform | $4.2 billion | $1.5 billion (combined with Surgical) |

| Transcatheter Mitral and Tricuspid Therapies (TMTT) | PASCAL, EVOQUE | Not separately disclosed, but significant growth | Included in combined TAVR & Surgical |

| Surgical Structural Heart | RESILIA portfolio (INSPIRIS, MITRIS, KONECT) | Included in combined TAVR & Surgical | $1.5 billion (combined with TAVR) |

| Critical Care | Hemodynamic monitoring solutions | $913.5 million (first nine months) | Spin-off expected end of 2024 |

Business Model Canvas Data Sources

The Edwards Lifesciences Business Model Canvas is built upon a foundation of detailed financial reports, comprehensive market research on cardiovascular devices, and internal strategic planning documents. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to their innovative medical technology solutions.