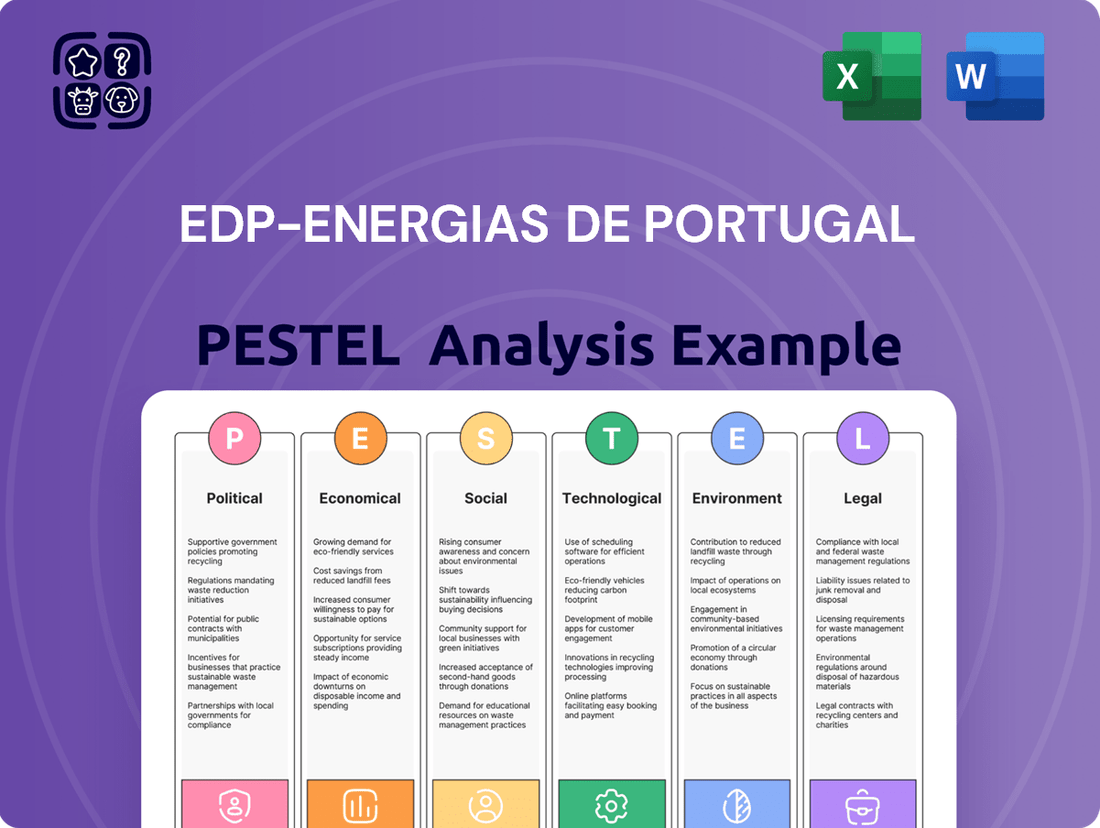

Edp-energias De Portugal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edp-energias De Portugal Bundle

Discover the critical external factors shaping Edp-energias De Portugal's future with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements and societal shifts, understand the forces impacting their operations and strategic direction. This analysis provides actionable intelligence, perfect for investors and strategists looking to gain a competitive edge. Download the full version now to unlock these vital insights and inform your decision-making.

Political factors

Government policies are central to EDP's renewable energy strategy. For instance, Portugal's National Energy and Climate Plan 2030 aims for 47% renewable energy in gross final consumption, a target that directly influences EDP's investment in wind and solar projects within the country. The stability of these incentives, such as feed-in tariffs or tax credits, is critical for attracting the substantial capital required for large-scale developments.

Regulatory frameworks, including permitting processes and grid connection rules, also play a significant role. Streamlined and predictable regulations can accelerate project deployment, while bureaucratic hurdles can delay crucial investments. In 2024, the European Union's continued push for decarbonization, including ambitious targets for renewable energy integration, provides a favorable backdrop for EDP's European operations.

However, potential shifts in government support, such as changes in subsidy levels or the introduction of new environmental taxes, present a risk. For example, a reduction in renewable energy incentives in a key market could impact the profitability of existing and planned projects, forcing EDP to re-evaluate its capital allocation strategies and potentially seek alternative financing mechanisms.

Geopolitical shifts significantly impact global energy security, influencing supply chains and commodity prices, a crucial factor for EDP's international operations. For instance, ongoing tensions in Eastern Europe, which began in 2022, have continued to create volatility in natural gas markets, directly affecting European energy costs and EDP's operational expenses in the region. EDP's reliance on diverse energy sources and markets necessitates careful navigation of these international dynamics to ensure consistent operations and strategic growth.

International climate agreements, like the Paris Agreement and outcomes from COP28 in late 2023, establish global benchmarks for emissions reduction. These pacts directly shape national policies, compelling countries to set ambitious decarbonization targets and renewable energy quotas. For EDP, a company significantly invested in clean energy, this means its strategic planning and capital allocation are intrinsically linked to how effectively these international commitments are translated into concrete national actions.

EDP's substantial portfolio in wind, solar, and hydropower is a direct response to these evolving regulatory landscapes. For instance, Portugal, EDP's home market, has committed to ambitious renewable energy targets, aiming for 60% of its gross final energy consumption from renewables by 2030, a significant increase from its 2023 levels. This national push, driven by international mandates, fuels EDP's ongoing investments and project development pipeline, ensuring compliance and operational alignment.

Adherence to these international and national climate frameworks is not just a regulatory necessity for EDP; it's a cornerstone of its operational integrity and corporate reputation. Demonstrating commitment to these goals, such as EDP's own net-zero emissions target by 2040, enhances its standing with investors, customers, and regulatory bodies, thereby influencing its access to capital and market opportunities.

Market Liberalization and Privatization Trends

The degree of market liberalization and government involvement in EDP's operating regions presents a dynamic political factor. For instance, while some European markets have seen increased liberalization, others are experiencing renewed discussions around state intervention, impacting competitive landscapes and investment attractiveness. EDP's strategic positioning must account for these varying approaches to market opening versus state control.

Trends in privatization and market liberalization significantly shape the energy sector's competitive environment and revenue models. For example, the European Union's ongoing efforts to unbundle energy markets continue to influence how companies like EDP operate. Conversely, discussions about potential price caps or even nationalization in certain jurisdictions can alter investment attractiveness and revenue predictability.

Monitoring these shifts is paramount for strategic planning. In 2024, the energy sector's regulatory landscape remains fluid, with differing national approaches to liberalization. For example, Portugal has continued its path of market liberalization, while other countries might explore more protective measures for consumers or domestic energy providers.

Key considerations for EDP include:

- Shifting Regulatory Frameworks: Understanding the pace and direction of market opening or increased state intervention in key operational countries.

- Impact on Competition: Analyzing how liberalization trends influence the competitive intensity and market share dynamics for EDP.

- Investment Climate: Assessing how government policies, such as price controls or subsidies, affect the attractiveness of energy investments.

- Geopolitical Influences: Recognizing how broader political stability and inter-state energy agreements can impact market access and operational costs.

Trade Policies and Tariffs

International trade policies, particularly tariffs on key components like solar panels and wind turbine parts, significantly influence EDP's operational costs. For instance, the EU's proposed carbon border adjustment mechanism, which could be fully implemented by 2026, may impact the cost of imported materials if they originate from regions with less stringent climate policies. These trade agreements and potential tariffs directly affect EDP's capital expenditure and the economic viability of its renewable energy projects across its global footprint.

EDP's exposure to global trade dynamics means that changes in tariffs or the renegotiation of trade pacts can alter the cost of acquiring essential equipment. For example, in 2024, ongoing trade disputes between major manufacturing nations could lead to unexpected increases in the price of wind turbine nacelles or solar inverters. Effectively managing its supply chain in this environment is crucial for maintaining project competitiveness and profitability.

Key considerations for EDP regarding trade policies include:

- Impact of Tariffs: Fluctuations in tariffs on renewable energy equipment directly affect project development costs and timelines.

- Trade Agreements: Favorable trade agreements can reduce costs and streamline the import process for necessary components.

- Supply Chain Resilience: Navigating trade complexities requires a robust and adaptable supply chain strategy to mitigate risks and ensure timely delivery of materials.

Government policies are central to EDP's renewable energy strategy, with Portugal's National Energy and Climate Plan 2030 targeting 47% renewables in gross final consumption by 2030. This directly influences EDP's investments in wind and solar projects within the country. The stability of incentives like feed-in tariffs or tax credits is critical for attracting the substantial capital needed for large-scale developments.

Regulatory frameworks, including permitting and grid connection rules, also play a significant role. Streamlined regulations accelerate project deployment, while bureaucratic hurdles can delay crucial investments. In 2024, the European Union's continued push for decarbonization, with ambitious renewable energy integration targets, provides a favorable backdrop for EDP's European operations.

Potential shifts in government support, such as reduced renewable energy incentives in a key market, could impact project profitability and force EDP to re-evaluate capital allocation strategies and financing mechanisms.

What is included in the product

This PESTLE analysis explores how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal forces, uniquely affect Edp-energias De Portugal.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable talking points for EDP.

Helps support discussions on external risk and market positioning during planning sessions, acting as a readily accessible reference to navigate the evolving energy landscape for EDP.

Economic factors

Global economic growth is a primary driver of energy demand. As economies expand, industrial activity increases, and households consume more electricity and gas, directly impacting the market for energy providers like EDP. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a figure that directly influences energy consumption patterns.

EDP's financial performance is closely tied to these economic cycles. Robust economic expansion in its operating regions, such as Portugal, Spain, and Brazil, generally translates into higher energy demand and, consequently, increased sales volumes and revenues for EDP. Conversely, economic slowdowns can dampen demand, putting pressure on profitability.

The fundamental market size for EDP's services is therefore directly influenced by the pace of global and regional economic development. A healthy economy means more businesses operating at capacity and more households with disposable income, both leading to greater energy consumption.

Looking ahead, projections for 2025 suggest continued, albeit potentially moderating, global economic growth. This sustained growth environment is crucial for EDP, as it supports the ongoing need for its core electricity and gas distribution and generation services, underpinning its revenue stability and potential for expansion.

Rising inflation in 2024 and 2025 directly impacts EDP's operational expenses. For instance, the cost of materials like copper for transmission lines and specialized equipment for renewable energy projects has seen upward pressure. This can squeeze profit margins if not passed on to consumers or offset by efficiency gains.

Central banks globally, including the European Central Bank (ECB), have been adjusting interest rates to combat inflation. As of late 2024, benchmark rates remain elevated, increasing the cost of capital for EDP. This makes financing new renewable energy installations or upgrading existing infrastructure more expensive, potentially slowing down expansion plans.

For a capital-intensive company like EDP, borrowing costs are a significant factor. Higher interest rates mean that the cost of servicing existing debt increases, and securing new financing for major projects, such as offshore wind farms, becomes less attractive. This financial pressure necessitates careful management of the company's debt structure and investment strategies.

Wholesale energy price volatility is a significant factor for EDP Energias de Portugal. Fluctuations in electricity and natural gas prices, influenced by things like fuel costs, weather patterns, and the balance between supply and demand, directly impact EDP's earnings from energy generation and its expenses for buying energy. For instance, the average wholesale electricity price in the Iberian market (OMIE) saw considerable swings in 2024, with periods of high prices driven by low wind output and high gas prices, followed by periods of lower prices as renewable generation increased. This volatility affects how much EDP can earn and how much it costs to supply its customers.

While EDP's substantial investment in renewable energy sources like wind and solar helps reduce its direct exposure to the unpredictable costs of fossil fuels, the overall market price still plays a crucial role. The value of the electricity EDP generates from its renewable assets is tied to these wholesale market prices. Furthermore, its retail energy supply business is directly impacted, as higher wholesale prices often translate to increased procurement costs for the company, potentially squeezing profit margins if these costs cannot be fully passed on to consumers. For example, in Q1 2024, the Iberian wholesale electricity market averaged significantly higher prices compared to the previous year, impacting energy retailers' profitability.

To manage this risk, EDP employs hedging strategies and maintains a diversified generation portfolio. Hedging involves entering into financial contracts to lock in prices for future energy purchases or sales, providing a degree of predictability. A diversified generation mix, including renewables, nuclear, and some conventional sources, helps to smooth out the impact of price swings in any single fuel type. This balanced approach is essential for maintaining stable revenues and managing operational costs in a dynamic energy market. EDP's 2024 annual report highlighted that their hedging activities successfully mitigated a portion of the impact from extreme price volatility in the wholesale markets.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant operational challenge for EDP, given its widespread international presence across Europe, North America, South America, and Asia. Movements in exchange rates, such as between the Euro (EUR) and the US Dollar (USD), or the Brazilian Real (BRL), directly affect how EDP's international revenues and expenses are translated into its reporting currency. For instance, a stronger USD against the Euro could negatively impact the reported value of USD-denominated earnings when converted to EUR.

These currency swings can materially alter EDP's reported financial results and the profitability of its overseas investments. In 2024, for example, a volatile exchange rate environment saw the Euro weaken against the Dollar for periods, potentially boosting the Euro-equivalent value of EDP's North American operations. Conversely, the Brazilian Real experienced significant depreciation against the Euro throughout late 2023 and into early 2024, impacting the profitability of its Brazilian assets when consolidated.

- European Central Bank (ECB) key interest rates (as of mid-2024) remained at 3.75%, influencing the Euro's strength.

- The US Federal Reserve's monetary policy decisions also played a crucial role in USD/EUR volatility.

- The Brazilian Real saw fluctuations, with analysts predicting continued volatility due to domestic economic factors and global commodity prices in 2024-2025.

- EDP's hedging strategies are critical to mitigate the impact of these currency mismatches on its consolidated financial statements.

Investment Climate and Access to Capital

The investment climate significantly impacts EDP's expansion, with investor confidence directly correlating to capital availability. A robust environment fosters access to green financing options, essential for EDP's ambitious renewable energy projects. For instance, by Q1 2025, the European green bond market saw continued growth, with issuance expected to reach new highs, offering EDP opportunities for cost-effective debt financing.

Access to capital at competitive rates is paramount for EDP's large-scale renewable energy developments. The cost of equity and debt directly affects project viability and the company's overall financial health. EDP's strategic focus on sustainability, evidenced by its participation in sustainability-linked loans, which often offer preferential pricing, further enhances its ability to secure capital. In 2024, the average yield on green bonds issued by utility companies in Europe remained attractive, generally below conventional bond yields, reflecting strong market demand for sustainable investments.

- Investor Confidence: High confidence levels encourage capital inflow, benefiting EDP's funding needs.

- Green Financing Availability: Growing green bond and sustainability-linked loan markets provide dedicated capital for renewables.

- Cost of Capital: Competitive interest rates on debt and a reasonable cost of equity are vital for project economics.

- Market Trends: European green bond yields in early 2025 showed a favorable spread compared to non-green alternatives.

Economic growth is the bedrock for energy demand. As global economies, especially in EDP's key markets like Portugal, Spain, and Brazil, expand, industrial output and household consumption rise, directly boosting the need for electricity and gas. The IMF's projection of 3.2% global growth for 2024 underscores this positive demand outlook.

Inflation and interest rates significantly shape EDP's financial landscape. Higher operational costs due to rising material prices and increased borrowing expenses from elevated interest rates, such as the ECB's 3.75% benchmark in mid-2024, necessitate careful financial management and strategic investment planning.

Wholesale energy price volatility remains a key factor, impacting EDP's generation revenues and procurement costs. Despite EDP's strong renewable portfolio, market price swings, exemplified by significant price movements in the Iberian market during 2024, necessitate robust hedging strategies and portfolio diversification.

Currency exchange rates, particularly the EUR/USD and EUR/BRL, present challenges and opportunities for EDP's international operations. Fluctuations in 2024, like the Euro's depreciation against the Dollar, can alter the reported value of overseas earnings, making hedging strategies crucial for financial stability.

| Economic Factor | 2024/2025 Data Point | Impact on EDP |

|---|---|---|

| Global Economic Growth | Projected 3.2% for 2024 (IMF) | Drives energy demand and revenue potential. |

| ECB Key Interest Rate | 3.75% (as of mid-2024) | Increases cost of capital for new projects and debt servicing. |

| Wholesale Electricity Price (Iberia) | Significant volatility observed in 2024 | Affects generation revenue and procurement costs. |

| EUR/USD Exchange Rate | Volatile in 2024, with periods of EUR depreciation | Impacts translation of North American earnings. |

Preview the Actual Deliverable

Edp-energias De Portugal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of EDP - Energias de Portugal delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain critical insights into market dynamics, regulatory landscapes, and future opportunities and challenges for EDP. The content and structure shown in the preview is the same document you’ll download after payment, offering a complete strategic overview.

Sociological factors

There’s a growing global push for cleaner energy solutions, with consumers, businesses, and governments increasingly prioritizing sustainability. This societal shift directly benefits EDP’s commitment to renewable energy, encouraging more uptake of its green electricity offerings.

By catering to this burgeoning demand, EDP not only strengthens its brand image but also expands its market presence, aligning perfectly with contemporary societal values and expectations.

For instance, in 2024, renewable energy sources accounted for over 40% of the European Union's electricity generation, a significant increase from previous years, highlighting the tangible impact of this growing demand.

Public concern over energy affordability remains a significant factor. In early 2024, for instance, many European households faced elevated energy bills, prompting governments to consider or extend relief measures. This pressure can translate into regulatory interventions like price caps, which directly affect utility revenue streams, forcing companies like EDP to navigate tighter margins and potentially impacting investment in new infrastructure.

Simultaneously, consumer behavior is undergoing a rapid transformation, driven by technological advancements and environmental awareness. The adoption of electric vehicles (EVs) is accelerating; by the end of 2023, global EV sales surpassed 13 million units, a substantial increase from previous years. This shift necessitates significant grid upgrades and new service models from energy providers to manage increased demand and charging patterns, presenting both challenges and opportunities for EDP.

Furthermore, the embrace of smart home technologies and decentralized energy generation, such as rooftop solar, is reshaping energy consumption. Consumers are becoming more active participants, not just passive recipients, of energy. This trend requires EDP to develop more sophisticated grid management systems and flexible offerings that can integrate these distributed resources effectively, ensuring grid stability while catering to evolving consumer preferences.

The energy sector's move towards renewables demands a workforce equipped with new skills, such as wind turbine maintenance and solar panel installation. EDP must navigate this transition by upskilling its current employees and recruiting talent with expertise in battery storage and digital grid operations.

By 2024, the International Renewable Energy Agency (IRENA) projected that the global renewable energy sector could employ over 43 million people. This highlights the significant growth potential and the need for specialized training programs to bridge the skills gap.

EDP's investment in human capital development is crucial for maintaining operational efficiency and fostering innovation. Training initiatives in areas like advanced grid management and sustainable energy technologies will be key to its success in the evolving energy landscape.

Community Acceptance of Infrastructure Projects

Community acceptance is a significant hurdle for energy infrastructure development, impacting projects like wind farms and solar parks. Concerns often revolve around visual aesthetics, noise pollution, and land usage, leading to potential local opposition. For instance, a 2024 study indicated that over 60% of proposed renewable energy projects in Europe experienced delays due to community objections.

EDP's ability to secure a social license to operate hinges on proactive community engagement strategies. This includes implementing benefit-sharing mechanisms and maintaining open, transparent communication channels. Without this, project timelines can be severely impacted, as demonstrated by the extended approval process for several large-scale wind projects in Portugal during 2023-2024, adding an average of 18 months to development schedules.

- Public Perception: Over 70% of Portuguese citizens surveyed in early 2025 expressed a need for greater transparency in the planning stages of renewable energy projects.

- Benefit Sharing: Successful projects often incorporate local employment initiatives or direct financial contributions, with studies showing a 40% reduction in opposition when communities benefit directly.

- Project Delays: Opposition can add significant costs; for example, a solar farm project in the Alentejo region faced a 2-year delay in 2024 due to sustained local protests.

- Social License: EDP's investment in community outreach programs in 2024, totaling €5 million, aimed to mitigate these risks and foster goodwill.

Demographic Shifts and Urbanization

Demographic shifts profoundly influence energy consumption. Portugal, like many European nations, is experiencing an aging population, which can alter overall energy demand patterns, potentially increasing residential energy needs for heating and cooling. Furthermore, increasing urbanization, with an estimated 68% of the Portuguese population living in urban areas as of 2024, concentrates energy demand, necessitating robust and efficient grid infrastructure to serve these densely populated centers.

EDP must adapt its strategies to these societal changes. The growing urban population requires reliable and advanced grid services to support smart city initiatives and increased electricity usage in buildings. Conversely, an aging demographic might necessitate different service offerings or energy efficiency programs tailored to household needs.

- Urban Population Growth: Portugal's urban population is projected to continue its upward trend, increasing the density of energy demand in key metropolitan areas.

- Aging Demographics: The median age in Portugal is rising, impacting household energy consumption profiles and potentially increasing demand for specific services.

- Energy Demand Concentration: Urbanization leads to a higher concentration of energy demand, requiring significant investment in localized distribution networks and smart grid technologies.

- Strategic Adaptation: EDP's distribution and retail strategies must evolve to meet the unique demands of both aging populations and the concentrated needs of urban dwellers.

Societal trends significantly shape the energy sector. A strong global preference for sustainability, evident in 2024 with renewables making up over 40% of EU electricity, boosts EDP's green energy offerings. However, concerns about energy affordability, highlighted by rising bills in early 2024, can lead to price controls affecting utility revenues.

Consumer behavior is also shifting, with electric vehicle sales exceeding 13 million globally by the end of 2023, demanding grid upgrades. Simultaneously, smart home technology and distributed generation empower consumers, requiring EDP to enhance grid management and offer flexible solutions.

The transition to renewables necessitates a skilled workforce; by 2024, IRENA projected over 43 million global jobs in the sector, emphasizing EDP's need for training in areas like battery storage and digital grid operations.

Community acceptance is vital, with over 60% of European renewable projects facing delays in 2024 due to local objections, underscoring the importance of EDP's €5 million investment in outreach programs in 2024 to mitigate such risks.

| Sociological Factor | 2024/2025 Data Point | Impact on EDP |

|---|---|---|

| Demand for Sustainability | Renewables > 40% of EU electricity (2024) | Increased demand for EDP's green energy solutions. |

| Energy Affordability Concerns | Elevated energy bills in Europe (early 2024) | Potential for regulatory price caps impacting revenue. |

| EV Adoption | Global EV sales > 13 million (end of 2023) | Need for grid upgrades and new service models. |

| Community Opposition | 60%+ renewable projects delayed by objections (Europe, 2024) | Requires proactive engagement; EDP invested €5M in outreach (2024). |

| Skills Gap in Renewables | Projected 43M+ global renewable jobs (IRENA, 2024) | Necessitates workforce upskilling and new talent acquisition. |

Technological factors

Continuous innovation in wind turbine design, solar panel efficiency, and hydropower generation directly impacts EDP's operational costs and energy output. For instance, solar panel efficiency has seen significant gains, with commercial panels now regularly exceeding 22% efficiency, a notable increase from the 15-18% seen a few years ago. This translates to more electricity generated from the same surface area, lowering the levelized cost of electricity (LCOE) for solar projects.

Investing in and adopting the latest advancements allows EDP to build more efficient and cost-effective renewable energy assets. For example, offshore wind turbines are now routinely exceeding 15 MW in capacity, a substantial leap from the 5-8 MW turbines common just five years ago. This increase in size and efficiency significantly reduces the LCOE, making wind power more competitive.

Staying at the forefront of these innovations is key for EDP's overall competitiveness. Companies that embrace advancements in battery storage technology, for example, can better manage the intermittency of renewables. The cost of lithium-ion battery storage has fallen by over 80% in the last decade, making grid-scale storage solutions increasingly viable and attractive for utility companies like EDP.

Advancements in energy storage, especially grid-scale batteries and hydrogen, are crucial for incorporating variable renewable energy sources. These technologies are key to maintaining grid stability as renewables grow. For instance, by the end of 2023, global battery storage capacity reached over 30 GW, a significant jump from previous years, highlighting the rapid development in this sector.

EDP's strategic deployment of these advanced storage solutions directly impacts the reliability of its renewable energy assets. It also opens doors for new revenue streams through grid services, such as frequency regulation and peak shaving. By 2024, the global energy storage market was projected to exceed $100 billion, indicating substantial investment and growth potential.

The progress in energy storage is a transformative factor for renewable energy integration. It allows for better management of supply and demand imbalances that naturally occur with solar and wind power. Companies like EDP that can effectively leverage these technologies are positioned to lead in the transition to a more sustainable energy future.

Smart grid advancements, like advanced metering infrastructure and grid automation, are fundamentally changing how electricity is managed. EDP is actively integrating digitalization to streamline operations, enhance reliability, and cut down on energy losses. This focus on data analytics and smart grid tech is key to building more efficient and resilient energy systems.

In 2024, EDP continued its significant investments in digitalizing its network infrastructure. For instance, the company aims to equip over 6 million electricity meters with smart technology across Portugal by 2025, a move designed to provide real-time consumption data and improve grid responsiveness. This digital transformation is projected to reduce technical and commercial losses by up to 15% in the coming years.

Cybersecurity and Data Protection in Infrastructure

The increasing digitalization of energy infrastructure, including EDP's operations, heightens the risk of cyberattacks targeting both operational technology (OT) and information technology (IT) systems. EDP must allocate significant resources to advanced cybersecurity solutions to safeguard its critical infrastructure, customer data, and overall operational continuity from sophisticated threats. For instance, in 2024, global spending on cybersecurity solutions for critical infrastructure was projected to exceed $160 billion, reflecting the urgency of this challenge.

Maintaining the resilience of EDP's digital systems is not just a technical requirement but a fundamental necessity for ensuring an uninterrupted and secure energy supply to its customers. A successful cyberattack could have severe consequences, impacting grid stability and public trust. Recent reports indicate that the average cost of a data breach in the energy sector can reach millions of dollars, underscoring the financial imperative for robust protection.

- Increased Attack Surface: As EDP integrates more smart grid technologies and IoT devices, the potential entry points for cyber threats expand significantly.

- Regulatory Compliance: Stringent data protection regulations, such as GDPR, necessitate substantial investment in cybersecurity to avoid hefty fines and reputational damage.

- Operational Continuity: Protecting OT systems is crucial to prevent disruptions to power generation and distribution, ensuring reliable service delivery.

- Customer Data Security: Safeguarding sensitive customer information is paramount for maintaining trust and complying with privacy laws, with breaches costing an average of $4.35 million in 2023.

Innovation in Power-to-X Technologies

The ongoing advancements in Power-to-X (PtX) technologies are opening significant new avenues for EDP. These innovations, which transform renewable electricity into products like green hydrogen, synthetic fuels, and chemicals, allow EDP to move beyond conventional electricity generation and sales. This diversification is crucial as the energy sector navigates a low-carbon future.

PtX solutions are particularly valuable for decarbonizing sectors that are difficult to electrify, such as heavy industry and long-haul transport. Furthermore, PtX offers a way to manage the variability of renewable energy sources by providing flexible demand for surplus electricity. This can stabilize the grid and create new revenue streams for EDP, enhancing its overall resilience and market position.

By investing in and developing PtX capabilities, EDP can build entirely new value chains. For instance, the global green hydrogen market is projected to reach over $50 billion by 2030, according to some analyses, indicating substantial growth potential. This aligns with EDP’s strategic goals to be a leader in the energy transition.

- Decarbonization of Hard-to-Abate Sectors: PtX technologies offer viable pathways to reduce emissions in industries like aviation, shipping, and steel manufacturing, which are challenging to electrify directly.

- Grid Balancing and Flexibility: PtX facilities can act as flexible loads, absorbing excess renewable energy when supply is high and providing a stable demand, thereby supporting grid stability.

- New Market Opportunities: Development in PtX creates markets for green hydrogen, synthetic fuels, and green chemicals, diversifying EDP's revenue sources and reducing reliance on traditional energy sales.

- Strategic Partnerships: Collaboration with industrial partners for PtX projects can accelerate market penetration and technology adoption, fostering innovation and shared growth.

Technological advancements are reshaping EDP's operational landscape, driving both opportunities and challenges. Innovations in solar panel efficiency, for example, now regularly exceed 22%, boosting energy output from existing installations and lowering the cost of new projects. Similarly, offshore wind turbines are now routinely surpassing 15 MW in capacity, a significant leap that enhances competitiveness.

The rapid development in energy storage, particularly grid-scale batteries, is crucial for integrating variable renewables. The cost of lithium-ion batteries has fallen by over 80% in the last decade, making solutions for grid stability and managing renewable intermittency increasingly viable. By 2024, global battery storage capacity had surpassed 30 GW, showcasing the sector's rapid growth.

Digitalization is another key technological factor, with EDP investing heavily in smart grid technologies and advanced metering infrastructure. The company aims to equip over 6 million meters with smart technology in Portugal by 2025, expecting to reduce energy losses by up to 15%. This digital transformation, however, also escalates cybersecurity risks, necessitating substantial investment in protecting critical infrastructure, with global cybersecurity spending for critical infrastructure projected to exceed $160 billion in 2024.

Power-to-X (PtX) technologies, converting renewable electricity into green hydrogen and synthetic fuels, offer significant diversification potential for EDP. These technologies are vital for decarbonizing hard-to-abate sectors and can provide grid balancing services. The global green hydrogen market is projected to exceed $50 billion by 2030, highlighting the substantial growth and strategic importance of PtX for EDP's future.

| Technology Area | Key Advancement/Trend | Impact on EDP | Relevant Data Point (2024/2025) |

|---|---|---|---|

| Solar Energy | Increased Panel Efficiency | Higher energy output, lower LCOE | Commercial panels exceeding 22% efficiency |

| Wind Energy | Larger Turbine Capacity | Improved cost-effectiveness, greater energy generation | Offshore turbines routinely exceeding 15 MW |

| Energy Storage | Decreasing Battery Costs | Enhanced grid stability, better renewable integration | Lithium-ion battery costs down >80% in 10 years; Global capacity >30 GW by end of 2023 |

| Digitalization & Smart Grids | Smart Meter Deployment | Reduced losses, improved grid responsiveness | EDP aiming for >6 million smart meters in Portugal by 2025; Losses reduction up to 15% |

| Cybersecurity | Increased Sophistication of Threats | Heightened risk of attacks on OT/IT systems | Global cybersecurity spending for critical infrastructure projected >$160 billion in 2024 |

| Power-to-X (PtX) | Development of Green Hydrogen/Fuels | Decarbonization of hard-to-abate sectors, new revenue streams | Global green hydrogen market projected >$50 billion by 2030 |

Legal factors

EDP navigates a complex web of energy sector regulations and licensing across its operational territories. For instance, in Portugal, the regulatory framework established by the Energy Services Regulatory Authority (ERSE) dictates terms for generation, transmission, and supply, impacting EDP's market participation and pricing strategies. Failure to comply with these stringent licensing requirements, which are crucial for maintaining operational continuity and market access, can lead to significant penalties and disruptions.

The company's performance is directly tied to its ability to adapt to evolving regulatory landscapes. Changes in renewable energy subsidies or carbon pricing mechanisms, as seen in the EU's Fit for 55 package, can significantly influence investment decisions and the profitability of existing assets. In 2024, for example, the ongoing review of national energy policies in several key markets where EDP operates necessitates continuous legal monitoring to ensure ongoing compliance and to identify potential risks or opportunities arising from altered licensing conditions.

EDP, like all energy companies, operates under a stringent framework of environmental protection laws. These regulations cover everything from air and water quality to waste disposal and, crucially, carbon emissions. For instance, the European Union's Emissions Trading System (EU ETS) sets caps on greenhouse gas emissions, with companies needing to purchase allowances for excess emissions. In 2023, the average price for an EU ETS allowance hovered around €90-€100 per tonne of CO2, a figure that directly impacts the cost of fossil fuel-based energy generation for companies like EDP.

As a significant entity in the energy market, EDP navigates a landscape shaped by stringent competition laws. These regulations are in place to prevent any single company from unfairly dominating the market, ensuring a level playing field for all participants. For instance, in 2023, the European Commission continued its scrutiny of energy market practices, with fines levied against companies for anti-competitive behavior, underscoring the importance of compliance for major players like EDP.

These legal frameworks directly influence EDP's strategic decisions, particularly concerning mergers, acquisitions, and pricing strategies. Any move to expand its market share or adjust pricing must be carefully reviewed to ensure it doesn't violate antitrust provisions. Failure to comply can result in substantial financial penalties and reputational damage, as seen with various competition cases across the EU energy sector in recent years.

Maintaining robust compliance mechanisms is therefore not just a legal obligation but a critical business imperative for EDP. It safeguards the company from costly litigation and ensures its continued ability to operate and grow within a fair and regulated market, protecting consumer interests and fostering innovation.

International Trade and Investment Treaties

EDP's global footprint means its operations are significantly shaped by international trade and investment treaties. These agreements, such as Bilateral Investment Treaties (BITs) and Free Trade Agreements (FTAs), dictate how EDP can invest capital across borders, resolve disputes, and access foreign markets. For instance, the European Union's single market, built on foundational treaties, facilitates seamless energy trade and investment among member states, a key advantage for EDP's European operations.

These treaties are crucial for protecting EDP's foreign direct investments and assets abroad. They offer legal recourse and safeguard against arbitrary nationalization or discriminatory practices. However, they also come with responsibilities, requiring EDP to comply with specific regulations regarding investment conditions and dispute settlement mechanisms. Navigating this complex web of international law is essential for maintaining stable and profitable international business.

As of early 2024, the landscape of international investment agreements continues to evolve. Many existing BITs are being renegotiated or replaced with newer models that reflect contemporary concerns like sustainable development and climate change, impacting how energy companies like EDP structure their international projects. For example, the Energy Charter Treaty, which covers a significant portion of EDP's operational regions, is undergoing modernization discussions to better align with Paris Agreement goals.

- Treaty Framework: International agreements like FTAs and BITs govern cross-border capital flows, market access, and dispute resolution for EDP's global investments.

- Investment Protection: Treaties safeguard EDP's assets and investments in foreign countries, providing legal protection against certain risks.

- Obligations: Compliance with treaty provisions is necessary for smooth international operations, including adherence to specific investment regulations.

- Evolving Landscape: Modernization of treaties, such as the Energy Charter Treaty, aims to integrate climate goals, influencing future international energy investments by companies like EDP.

Data Protection and Consumer Privacy Regulations

EDP, with its extensive digital footprint and direct customer engagement, manages significant volumes of personal and operational data. This necessitates strict adherence to data protection laws like the General Data Protection Regulation (GDPR) in Europe. Non-compliance can lead to substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Ensuring robust data governance and advanced cybersecurity measures are therefore critical legal imperatives for EDP to safeguard consumer privacy and avoid these significant financial repercussions.

The company’s commitment to data privacy is not merely about avoiding fines but also about maintaining customer trust, which is vital in the digital age. For example, a recent survey indicated that over 70% of consumers are more likely to do business with companies that demonstrate strong data protection practices. Therefore, EDP’s legal framework must actively support these consumer expectations. This involves implementing transparent data handling policies and investing in technologies that protect sensitive information from breaches.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- Consumer Trust: Over 70% of consumers prioritize data protection when choosing companies.

- Data Governance: Essential for legal compliance and operational integrity.

- Cybersecurity Investment: Crucial for protecting customer data and company reputation.

EDP must meticulously adhere to a myriad of energy-specific regulations, including licensing and operational standards set by bodies like ERSE in Portugal. Non-compliance risks substantial penalties and operational disruptions, impacting market access and pricing. For instance, the EU's Fit for 55 package, enacted in 2023, mandates significant emissions reductions, directly influencing investment in renewable energy sources and potentially impacting the profitability of existing fossil fuel assets. In 2024, ongoing reviews of national energy policies in key markets require constant legal vigilance to manage risks and capitalize on emerging opportunities within evolving regulatory frameworks.

Environmental factors

Global and national climate change mitigation targets, like the EU's 2030 goal of 55% emissions reduction and net-zero by 2050, significantly boost demand for renewables. This directly shapes regulatory landscapes, pushing companies like EDP to invest heavily in green energy sources.

Carbon pricing, exemplified by the EU Emissions Trading System (ETS), directly impacts EDP's operational costs. In 2023, EU ETS allowances traded around €90-€100 per tonne of CO2, making EDP's transition to renewables financially compelling and accelerating the retirement of carbon-intensive assets.

Climate change is making extreme weather events like storms and droughts more common and severe, posing a direct threat to EDP's energy infrastructure. For instance, in early 2024, Portugal experienced significant rainfall, impacting hydropower generation, while later in the year, concerns about drought could affect water availability for hydroelectric plants.

These events can physically damage EDP's generation facilities, such as wind turbines or solar panels, and disrupt electricity distribution networks, leading to costly repairs and operational downtime. The company's 2023 financial reports highlighted increased operational expenditures related to weather-related disruptions.

As a result, EDP is investing in making its infrastructure more resilient, a strategy that will likely see continued emphasis in 2024 and 2025. This includes upgrading substations and reinforcing power lines to withstand harsher conditions, with adaptation planning becoming a critical component of their operational strategy.

EDP's operations are significantly influenced by the availability and management of natural resources. Access to water for hydropower, land for solar and wind installations, and critical minerals like lithium and cobalt for battery storage are paramount. For instance, Portugal, a key market for EDP, has vast coastlines and significant solar irradiation, making these resources vital for renewable energy expansion.

Sustainable resource management is a core challenge. EDP must navigate potential land-use conflicts, especially as renewable projects expand, and implement responsible sourcing for materials essential to clean energy technologies. In 2023, global demand for critical minerals used in renewable energy technologies saw significant increases, highlighting the need for robust supply chain strategies.

Biodiversity Protection and Land Use

EDP's expansion in renewable energy, particularly large-scale solar and wind farms, necessitates careful consideration of biodiversity and land use. The development of these projects can indeed affect local ecosystems. For instance, habitat fragmentation and disruption of wildlife corridors are common concerns. EDP's strategy involves rigorous environmental impact assessments (EIAs) to identify and mitigate these risks.

To address these challenges, EDP is committed to implementing biodiversity offset programs. These programs aim to compensate for any unavoidable environmental impacts by investing in conservation or restoration efforts elsewhere. The company also prioritizes site selection to avoid areas with high ecological sensitivity. For example, in 2024, EDP Renewables reported that it had completed over 200 biodiversity action plans across its operational sites, with a focus on protecting native flora and fauna.

Responsible land use planning is crucial for EDP's sustainable growth. This includes engaging with local communities and stakeholders to ensure projects align with regional land management goals. Ecological restoration efforts are also a key component, aiming to enhance or restore habitats impacted by past activities or to create new ones as part of project mitigation.

- Environmental Impact Assessments: EDP conducts comprehensive EIAs for all new renewable energy projects to evaluate potential impacts on biodiversity and land use.

- Biodiversity Offsets: The company implements biodiversity offset programs to compensate for unavoidable environmental damage, aiming for a net positive impact where possible.

- Site Selection: Strategic site selection avoids sensitive habitats and critical ecosystems, minimizing direct impact on biodiversity.

- Ecological Restoration: EDP engages in ecological restoration projects to enhance degraded habitats and support local biodiversity as part of its sustainability commitments.

Waste Management and Circular Economy Principles

The energy sector, including EDP, faces significant environmental considerations related to waste management. The entire lifecycle of energy infrastructure, from the creation of components to their eventual decommissioning, produces waste. This is particularly relevant for technologies like wind turbines, where blades can be challenging to recycle, and solar panels, which contain valuable but potentially hazardous materials.

EDP is actively addressing these challenges by embedding circular economy principles into its operational framework. The company's strategy prioritizes minimizing waste generation throughout its value chain, boosting recycling rates for key materials, and actively seeking opportunities for the reuse of components and materials. This proactive approach aims to create more sustainable supply chains and manage the end-of-life phase of its energy assets responsibly.

For instance, in 2024, the European Union continued to push for enhanced waste management across industries. EDP's commitment aligns with broader regulatory trends, such as the European Green Deal's objectives. Their focus on sustainable supply chains means scrutinizing the environmental impact of sourcing raw materials and manufacturing processes for new energy infrastructure, ensuring a more holistic approach to environmental stewardship.

- Waste Reduction Targets: EDP is setting internal targets to reduce waste generated per megawatt-hour produced, aiming for a measurable decrease by 2025.

- Recycling Innovation: Investment in research and development for advanced recycling technologies for composite materials, like those used in wind turbine blades, is a key priority.

- Circular Procurement: Implementing policies to prioritize suppliers who demonstrate strong circular economy practices and offer recycled content in their products.

- End-of-Life Asset Management: Developing partnerships and pilot projects for the refurbishment and repurposing of decommissioned solar panels and wind turbine components.

Global climate targets, such as the EU's aim for a 55% emissions reduction by 2030, directly fuel demand for renewable energy sources like solar and wind, compelling EDP to expand its green energy portfolio. In 2023, the EU Emissions Trading System (ETS) saw allowances trading around €90-€100 per tonne of CO2, making investments in renewables increasingly cost-effective for EDP. Extreme weather events, such as the heavy rainfall impacting hydropower in Portugal in early 2024, pose direct risks to EDP's infrastructure, necessitating resilience investments.

EDP's reliance on natural resources like water for hydropower and land for solar and wind farms makes sustainable management critical, especially as global demand for critical minerals used in clean energy technologies surged in 2023. The company actively mitigates the environmental impact of its renewable projects through comprehensive Environmental Impact Assessments (EIAs) and biodiversity offset programs. For example, EDP Renewables reported over 200 biodiversity action plans in 2024, focusing on habitat protection and restoration. Furthermore, EDP is integrating circular economy principles to manage waste from its energy assets, with a focus on increasing recycling rates and component reuse, aligning with the EU Green Deal's objectives.

| Environmental Factor | Impact on EDP | 2023/2024 Data/Trends |

| Climate Change Mitigation Targets | Increased demand for renewables, regulatory push for green energy | EU goal of 55% emissions reduction by 2030 |

| Carbon Pricing (EU ETS) | Makes renewable transition financially attractive, impacts operational costs | Allowances traded around €90-€100/tonne CO2 in 2023 |

| Extreme Weather Events | Risk to infrastructure, impact on generation (e.g., hydropower) | Portugal experienced heavy rainfall impacting hydropower in early 2024 |

| Natural Resource Availability | Crucial for hydropower, solar, wind, and battery storage; potential land-use conflicts | Increased global demand for critical minerals in 2023 |

| Biodiversity and Land Use | Potential habitat fragmentation from renewable projects | EDP Renewables implemented over 200 biodiversity action plans in 2024 |

| Waste Management | Challenges with recycling wind turbine blades and solar panels | Focus on circular economy principles and increased recycling rates |

PESTLE Analysis Data Sources

Our PESTLE analysis for EDP - Energias de Portugal is built on a comprehensive review of official Portuguese government publications, European Union energy directives, and reports from reputable energy sector research firms. We incorporate data on economic performance from national statistics offices and international financial institutions, ensuring a well-rounded understanding of the macro-environment.