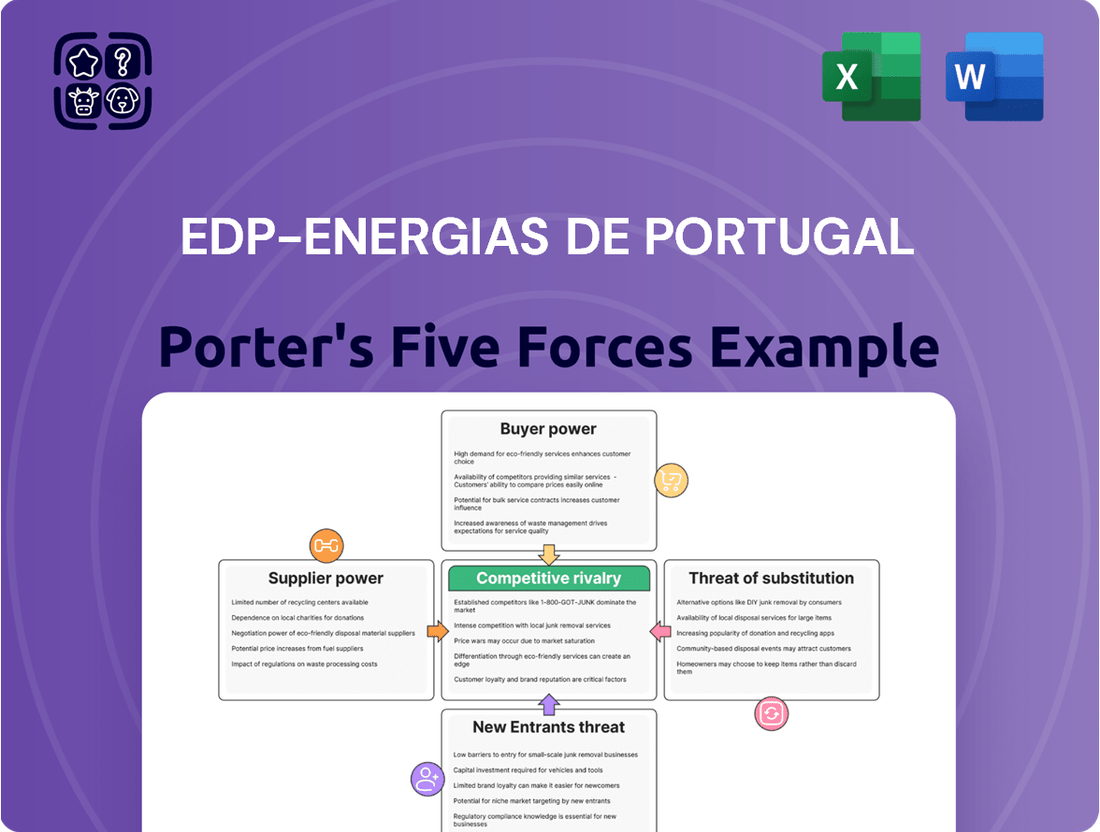

Edp-energias De Portugal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edp-energias De Portugal Bundle

Edp-energias De Portugal navigates a complex energy landscape shaped by powerful competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Edp-energias De Portugal’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

EDP's substantial investments in renewable energy, especially wind and solar, are directly impacted by the market concentration of key equipment suppliers. Companies providing specialized wind turbines and solar panels hold some leverage due to the significant capital expenditure and technical expertise required for their products. For instance, in 2024, the global wind turbine market saw major players like Vestas and Siemens Gamesa dominate, indicating a degree of supplier concentration.

The high barriers to entry for manufacturing advanced renewable energy components mean that EDP, like other major utilities, must navigate relationships with a limited number of leading suppliers. This concentration can translate into higher prices or less favorable contract terms if suppliers perceive limited alternatives for their specialized goods. The intricate technical specifications and the need for reliable, high-performance equipment further bolster supplier bargaining power.

However, EDP's considerable global footprint and its substantial purchasing volume allow it to mitigate some of this supplier power through economies of scale. By diversifying its procurement across different geographies and suppliers where possible, EDP can enhance its negotiation position. This strategic approach helps secure more competitive pricing and ensures supply chain resilience for its ambitious renewable energy expansion plans.

While EDP's significant pivot to renewables, achieving 95% renewable energy generation in 2024, substantially lessens its dependence on volatile fossil fuel suppliers, the company still faces supplier power through essential raw materials. The manufacturing of solar panels and batteries, critical components for EDP's renewable infrastructure, relies on specific minerals. Disruptions in the supply chains for these minerals can directly influence the cost of new projects and extend their implementation schedules.

The energy sector, particularly in complex areas like transmission, distribution, and advanced renewables, relies heavily on specialized service providers. These companies offer unique expertise and proprietary technologies crucial for maintenance, digitalization, and modernizing grid infrastructure. This specialization can grant them significant bargaining power.

EDP's substantial €930 million investment in its networks during 2024 underscores the critical need for these specialized suppliers. Their unique skills in areas such as grid modernization and digital solutions mean EDP must carefully manage these relationships to ensure access to essential services and technologies.

Labor Market and Skilled Workforce

The energy sector, especially renewables, is grappling with finding and keeping skilled workers. A notable skills gap exists, compounded by an aging workforce in established areas. This situation significantly boosts the bargaining power of specialized labor, potentially driving up costs and causing project timelines to slip. For instance, in 2024, reports indicated that the demand for wind turbine technicians outstripped supply in many European markets, leading to salary increases of up to 15% in some regions.

EDP's success in its ambitious investment plans, particularly in expanding its renewable energy portfolio, hinges directly on its capacity to attract and retain top-tier talent. The company's 2024 strategic outlook highlighted a need for increased investment in training and development programs to bridge this skills deficit. Without a robust, skilled workforce, the execution of new solar and wind farm projects could face considerable headwinds.

- Skills Gap: A shortage of qualified professionals in areas like renewable energy engineering and grid management.

- Aging Workforce: A significant portion of experienced energy sector workers are nearing retirement, creating a knowledge transfer challenge.

- Talent Competition: Increased competition for specialized skills from other energy companies and related industries.

- Impact on Costs: Higher wages and benefit packages are often necessary to attract and retain essential talent, increasing operational expenses.

Financing and Capital Providers

EDP's reliance on external financing for its capital-intensive operations, particularly its €5.4 billion investment in green projects during 2024, grants significant bargaining power to capital providers. Lenders and investors, especially those specializing in sustainable finance, hold considerable sway due to the substantial capital requirements for grid upgrades and renewable energy expansion. EDP actively manages this power by focusing on strong financial performance and maintaining a favorable credit rating. This ensures continued access to necessary funding at competitive terms.

- Capital Requirements: EDP's significant investments, such as the €5.4 billion in green projects in 2024, create a strong demand for capital.

- Investor Focus: A growing emphasis on green financing empowers investors with specific mandates for renewable energy projects.

- Financial Health: Maintaining robust financial metrics and a good credit rating is crucial for EDP to mitigate the bargaining power of lenders.

- Access to Funds: The ability to secure large volumes of capital is directly linked to EDP's relationships with financing institutions.

Suppliers of specialized renewable energy components, like wind turbines and solar panels, hold significant bargaining power due to high entry barriers and the technical expertise required. EDP's 2024 investments highlight this, as major players like Vestas and Siemens Gamesa dominate the market, influencing pricing and contract terms.

EDP's substantial global purchasing volume provides some leverage, enabling them to negotiate better terms by diversifying suppliers and geographies. This strategy is crucial for managing costs and ensuring supply chain reliability for their extensive renewable energy projects.

While EDP has reduced reliance on fossil fuel suppliers, critical raw materials for solar panels and batteries remain a point of supplier influence. Supply chain disruptions for these minerals can directly impact project costs and timelines for EDP's renewable infrastructure development.

| Supplier Type | Key Components/Services | Impact on EDP | 2024 Data/Trend |

|---|---|---|---|

| Equipment Manufacturers | Wind Turbines, Solar Panels | Price negotiation, supply availability | Market dominated by Vestas, Siemens Gamesa; high concentration |

| Raw Material Suppliers | Minerals for batteries (lithium, cobalt), silicon | Cost of renewable components, project timelines | Global supply chain volatility impacting mineral prices |

| Specialized Service Providers | Grid modernization, digitalization, maintenance | Access to critical expertise, project execution | EDP's €930M network investment requires these specialized skills |

What is included in the product

This analysis of Edp-energias De Portugal's competitive environment details the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, providing strategic insights for Edp-energias De Portugal.

Instantly assess EDP's competitive landscape with a visual, easy-to-understand breakdown of Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

EDP's customer base spans residential, commercial, and industrial sectors across continents, presenting varied bargaining power. For many residential and small business clients in competitive markets, switching providers can be straightforward, potentially involving minimal costs and thus enhancing their leverage.

Conversely, large industrial customers or those operating in heavily regulated territories often face higher switching costs. These can stem from long-term contracts, the need for specialized infrastructure integration, or simply a lack of readily available alternative suppliers, which naturally diminishes their bargaining power.

In Portugal and Spain, key markets for EDP, electricity and gas prices are heavily regulated. This means regulators often set tariffs and implement price controls, directly impacting how much EDP can charge. For instance, in 2024, the Portuguese energy regulator (ERSE) continued to manage regulated tariffs, influencing the final price consumers paid.

These price controls can significantly amplify customer bargaining power. When EDP faces rising operational costs, its ability to simply pass those increases onto consumers is limited by regulatory caps. This situation effectively empowers customers, particularly those on regulated tariffs, as their prices are shielded from immediate market fluctuations.

The bargaining power of EDP's customers is amplified by the growing accessibility of alternative energy sources. Rooftop solar, advanced energy storage systems, and more efficient energy consumption technologies are giving consumers more control and options. This is particularly true as the cost of solar photovoltaic (PV) installations continues its downward trend, making self-generation a more attractive proposition.

While these alternatives may not completely replace the grid for major industrial users, they significantly reduce dependence on traditional energy providers for many. For instance, residential solar adoption has seen robust growth, with installations in many European countries, including Portugal, increasing year-over-year. This shift empowers customers to negotiate better terms or switch providers more readily if current offerings are not competitive.

Demand Fluctuation and Market Dynamics

Variations in electricity demand significantly shape customer bargaining power for EDP. For instance, mild weather in Portugal during 2024, leading to lower heating and cooling needs, could translate into periods of reduced demand. In such scenarios, with potentially more electricity available than needed, customers might find themselves in a stronger position to negotiate more favorable rates or terms.

Conversely, when demand surges, such as during heatwaves or periods of robust economic activity, EDP's leverage increases. The growing appetite for electricity from sectors like data centers and the burgeoning AI industry in Europe, with Portugal aiming to be a hub, can create tighter markets. In 2023, for example, electricity consumption in Portugal saw an increase, which can shift the balance back towards the supplier.

- Demand Sensitivity: Residential customers often have less flexibility to switch providers compared to large industrial consumers, limiting their immediate bargaining power.

- Economic Impact: During economic downturns, reduced industrial output can lower overall electricity demand, giving large industrial customers more leverage to seek price concessions.

- Renewable Integration: The increasing penetration of renewable energy sources, which can sometimes lead to price volatility, may create opportunities for customers to negotiate based on market fluctuations.

- Regulatory Environment: Government regulations and energy market structures play a crucial role in defining customer rights and influencing their ability to bargain for better prices.

Customer Information and Transparency

Customers now have unprecedented access to information about energy pricing and their own consumption patterns. This is largely thanks to smart meters and digital platforms becoming more widespread. For instance, by the end of 2023, Portugal had installed over 3 million smart meters, providing real-time data to consumers. This transparency allows individuals to easily compare different energy providers and their offerings, significantly boosting their bargaining power.

This increased awareness of alternatives and competitive pricing directly pressures energy companies like EDP. They are compelled to offer more attractive rates and improve their service quality to retain customers. In 2024, the average electricity price in Portugal saw fluctuations, with wholesale market prices impacting retail offers, making customer comparison even more critical.

- Smart Meter Penetration: Over 3 million smart meters installed in Portugal by end-2023, providing real-time consumption data.

- Price Transparency: Facilitates easy comparison of energy tariffs across different providers.

- Informed Decision-Making: Empowers customers to switch suppliers based on price and service.

- Competitive Pressure: Drives utilities to offer better rates and services to maintain market share.

The bargaining power of EDP's customers is significant due to increased price transparency and the availability of alternative energy sources. Smart meter penetration, with over 3 million installed in Portugal by the end of 2023, provides real-time data, empowering consumers to compare tariffs and make informed switching decisions. This competitive pressure forces utilities to offer better rates and services to retain their customer base.

| Factor | Impact on Bargaining Power | Example/Data Point |

| Price Transparency | Increases | Over 3 million smart meters in Portugal by end-2023. |

| Alternative Energy Sources | Increases | Declining costs of solar PV installations. |

| Regulatory Environment | Varies (Increases under price controls) | ERSE managing regulated tariffs in Portugal in 2024. |

| Switching Costs | Generally Low for Residential | Minimal costs for residential clients in competitive markets. |

Preview Before You Purchase

Edp-energias De Portugal Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis of EDP-Energias de Portugal you'll receive immediately after purchase. You'll gain detailed insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector. This document is ready for your immediate use and strategic planning, offering a complete and professionally formatted assessment of EDP's market position. No placeholders or sample content; what you see is precisely what you get.

Rivalry Among Competitors

The energy sector where EDP operates, particularly in Europe and North America, features a robust and varied competitive environment. This includes not only traditional utility giants but also a growing number of agile, specialized firms focusing on renewable energy development.

Major players like Iberdrola and Enel are significant competitors, directly challenging EDP for market share and access to new projects. This concentration of large, well-capitalized entities, alongside a multitude of smaller, innovative companies, fuels intense rivalry across the board.

For instance, in the offshore wind sector alone, numerous developers are actively pursuing projects. Companies like Ørsted and RWE are major forces, but many other regional and specialized players are also emerging, creating a dynamic and often crowded marketplace for asset acquisition and development.

The energy sector is experiencing robust growth, fueled by increasing electrification and the burgeoning demand from data centers. This expansion presents significant opportunities, but it also intensifies competition, especially in the crucial area of renewable energy development.

Global renewable capacity additions surged to an estimated 700 GW in 2024, highlighting a dynamic market where new entrants are readily attracted. This rapid expansion means companies like EDP are vying for a slice of a growing pie, leading to aggressive bidding and a heightened rivalry for securing new projects and resources.

In the electricity sector, a market often perceived as commoditized, EDP differentiates itself through a strong emphasis on renewable energy. By the end of 2023, EDP had achieved 95% of its generation from renewable sources, a significant factor in attracting environmentally conscious customers and securing long-term Power Purchase Agreements (PPAs).

Beyond its renewable portfolio, EDP is actively investing in innovative client solutions and energy efficiency services. Their commitment to digitalization, including smart grid technologies, further enhances customer experience and operational efficiency. These initiatives aim to move beyond basic energy provision, offering added value and fostering customer loyalty in a competitive landscape.

Exit Barriers and Asset Specificity

EDP - Energias de Portugal faces intense competitive rivalry, partly due to high exit barriers. The energy sector is incredibly capital-intensive, requiring massive investments in infrastructure like power plants and transmission networks. These assets are highly specific; they cannot easily be repurposed or sold for alternative uses, locking companies like EDP into the market.

This asset specificity and substantial capital outlay mean that companies must continue operating to recoup their investments, even when market conditions are unfavorable. This persistence fuels ongoing competition for market share. For instance, in 2024, significant investments in renewable energy projects by various players, including EDP, highlight the long-term commitment and the difficulty of divesting such specialized assets.

- High Capital Intensity: The energy sector demands enormous upfront capital for infrastructure development.

- Asset Specificity: Power plants and transmission lines are specialized and difficult to redeploy, creating a commitment to the existing market.

- Sustained Competitive Pressure: Companies are compelled to compete to recover substantial fixed costs, even in periods of low profitability.

- Recouping Investments: The inability to easily exit forces firms to remain active competitors, intensifying rivalry.

Geographic Diversification and Market Liberalization

EDP's expansive geographic footprint, spanning Europe, North America, South America, and Asia-Pacific, significantly mitigates risk by spreading operations across diverse economic cycles and regulatory environments. This global presence also enables EDP to tap into varied growth opportunities. For instance, as of the first quarter of 2024, EDP Renewables reported a substantial increase in installed capacity across these regions, underscoring its active engagement in key markets.

However, the trend of market liberalization, particularly in emerging economies and even within more mature European markets, is intensifying competitive rivalry. As these energy sectors open up, both established utilities and new entrants, often with specialized renewable technologies, are vying for market share. This liberalization means that EDP faces a more dynamic competitive landscape where agility and innovation are paramount for maintaining its position.

- Geographic Spread: EDP operates in over 20 countries across Europe, North America, South America, and Asia-Pacific.

- Risk Diversification: Global presence reduces reliance on any single market's economic performance.

- Market Liberalization Impact: Increased competition from new and existing players entering newly liberalized energy markets.

- Competitive Pressure: Liberalization fosters a more aggressive environment, demanding continuous adaptation and investment.

EDP faces intense rivalry from established utilities and emerging renewable specialists, a situation exacerbated by high exit barriers due to the capital-intensive nature of the energy sector. Companies like Iberdrola and Enel are direct competitors, pushing EDP to differentiate through its strong renewable focus, evidenced by 95% renewable generation by end-2023.

The global surge in renewable capacity additions, estimated at 700 GW in 2024, attracts numerous developers, intensifying competition for projects. This dynamic market requires constant adaptation and investment, especially as market liberalization in various regions opens doors for new and existing players alike.

EDP's global footprint in over 20 countries aids risk diversification but also exposes it to varied competitive pressures across different economic cycles and regulatory landscapes.

| Competitor | Primary Focus | Geographic Overlap with EDP |

|---|---|---|

| Iberdrola | Renewables, Grids | Europe, North America, South America |

| Enel | Renewables, Utilities | Europe, North America, South America |

| Ørsted | Offshore Wind | Europe, North America |

| RWE | Renewables, Conventional Power | Europe, North America |

SSubstitutes Threaten

The rise of distributed generation, especially rooftop solar, presents a notable threat to EDP Energias de Portugal. Consumers can now generate their own electricity, lessening dependence on traditional grid providers. This trend is fueled by increasingly affordable solar technology.

By 2024, the global installed capacity of solar PV is projected to reach over 1,600 GW, demonstrating the significant scale of this shift. This growing availability of self-generated power directly competes with the electricity sales of established utilities.

Improvements in energy efficiency are a significant threat to EDP. For instance, in 2024, residential energy efficiency upgrades in the EU were projected to save billions of kilowatt-hours, directly reducing the demand for grid-supplied electricity. This trend means that conserved energy acts as a substitute for energy that EDP would otherwise supply.

Demand-side management technologies, such as smart grids and smart home devices, further empower consumers to manage their energy usage, often reducing peak demand. By 2025, it's anticipated that a substantial portion of European households will be equipped with smart meters, enabling more granular control and further substitution of traditional energy consumption patterns with optimized usage.

The threat of substitutes for traditional energy provision is escalating significantly due to advancements in energy storage. Battery energy storage systems (BESS), in particular, are becoming more accessible and affordable. For instance, global BESS installations are projected to reach hundreds of gigawatts by 2030, a substantial increase from the tens of gigawatts installed in 2023. This trend allows consumers and businesses to store electricity generated from solar panels or during off-peak hours, thereby decreasing their dependence on conventional utility supply, especially during peak demand periods.

Alternative Fuels and Heating/Cooling Technologies

The threat of substitutes for EDP's natural gas business is growing, particularly from electrification in the residential and commercial sectors. Heat pumps, which utilize electricity often sourced from renewables, are becoming a viable alternative for heating and cooling. For instance, in 2024, European governments continued to incentivize the adoption of electric heating systems, with subsidies supporting the installation of heat pumps. This trend directly reduces demand for natural gas used in traditional boilers.

In industrial applications, the long-term substitution threat comes from the transition to cleaner energy sources. The development and increasing adoption of green hydrogen as a fuel for industrial processes could eventually displace natural gas. While still in early stages for widespread industrial use, significant investment in green hydrogen production facilities, with projections indicating substantial capacity increases by the late 2020s, signals a potential shift away from natural gas in the future.

- Heat pumps offer an electric alternative for heating and cooling, reducing reliance on natural gas.

- Government incentives in Europe are accelerating heat pump adoption in 2024.

- Green hydrogen presents a long-term substitution threat for industrial natural gas consumption.

- Investments in green hydrogen production capacity are expected to grow significantly.

Technological Advancements and Innovation

Technological advancements are rapidly reshaping the energy landscape, presenting a significant threat of substitutes for traditional power generation. Breakthroughs in areas like small modular reactors (SMRs) and advanced geothermal technologies are on the horizon, potentially offering entirely new and more efficient energy sources. The rapid evolution of these technologies means that established infrastructure could quickly become less competitive or even obsolete.

The potential for fusion energy, while still in development, also represents a long-term substitute. EDP's proactive strategy, including substantial investments in green hydrogen production and energy storage solutions, demonstrates a clear understanding of this evolving threat. For instance, EDP has committed billions of euros to renewable energy projects, aiming to diversify its generation portfolio and mitigate risks associated with disruptive technologies.

- Emerging Energy Technologies: SMRs, advanced geothermal, and future fusion power offer alternatives to conventional large-scale energy production.

- Pace of Innovation: The rapid development of these technologies can quickly alter market dynamics and the competitiveness of existing energy sources.

- EDP's Response: Investments in green hydrogen and storage showcase EDP's strategic effort to counter substitute threats by embracing new energy solutions.

- Investment Scale: EDP's significant capital allocation towards renewables underscores the seriousness with which it views potential technological disruptions.

The threat of substitutes for EDP's traditional electricity generation is substantial, driven by distributed solar PV and enhanced energy efficiency measures. By 2024, global solar PV capacity is expected to exceed 1,600 GW, with EU residential energy efficiency upgrades projected to save billions of kilowatt-hours annually. Furthermore, advancements in energy storage, like battery systems, are enabling greater consumer independence from the grid, with global BESS installations anticipated to reach hundreds of gigawatts by 2030.

For its natural gas segment, EDP faces substitution from electrification, particularly heat pumps, which are seeing increased adoption supported by European government incentives in 2024. Looking ahead, green hydrogen poses a significant long-term threat to industrial natural gas use, with substantial investments planned for its production capacity. Emerging technologies like small modular reactors and advanced geothermal also represent future substitutes.

| Substitute Category | Key Technologies/Trends | Impact on EDP | Relevant Data/Projections (as of 2024/2025) |

|---|---|---|---|

| Renewable Distributed Generation | Rooftop Solar PV | Reduced demand for grid-supplied electricity | Global solar PV capacity projected > 1,600 GW (2024) |

| Energy Efficiency | Improved building insulation, smart home devices | Lower overall electricity consumption | EU residential efficiency saving billions of kWh annually (2024) |

| Energy Storage | Battery Energy Storage Systems (BESS) | Increased consumer self-sufficiency, reduced reliance on utility supply | Global BESS installations projected hundreds of GW by 2030 (up from tens of GW in 2023) |

| Electrification (Heating/Cooling) | Heat Pumps | Displacement of natural gas in residential/commercial sectors | Increased government incentives for heat pump adoption in Europe (2024) |

| Industrial Fuel Alternatives | Green Hydrogen | Long-term substitution for natural gas in industrial processes | Significant investment in green hydrogen production capacity expected |

| Emerging Energy Technologies | Small Modular Reactors (SMRs), Advanced Geothermal, Fusion Energy | Potential for entirely new, more efficient energy sources | Ongoing development and investment |

Entrants Threaten

The energy sector, especially power generation and distribution, demands enormous upfront capital. EDP, like other established players, has invested billions in infrastructure such as power plants and extensive grid networks. For instance, in 2024, significant investments continue to pour into renewable energy projects and grid modernization across Europe, with projects often running into hundreds of millions or even billions of euros, creating a substantial barrier to entry for new companies.

The energy sector, including EDP – Energias de Portugal, is heavily regulated. This means new companies wanting to enter the market face significant hurdles. Think complex licensing processes, stringent environmental compliance rules, and the need for numerous permits, all varying by region. For instance, in 2024, the European Union continued to emphasize stringent environmental standards for energy generation, requiring substantial upfront investment in compliance technologies and expertise.

These regulatory and licensing requirements are not just bureaucratic hurdles; they demand considerable time, specialized knowledge, and deep pockets. Companies must invest heavily in legal teams, environmental consultants, and administrative processes just to get a foot in the door. The sheer cost and complexity of navigating these entry barriers effectively deter many potential new competitors from even attempting to enter the market, thereby protecting incumbent firms like EDP.

Established players like EDP benefit from significant economies of scale across their operations, from generation to transmission and distribution. This allows them to achieve lower per-unit costs, making it challenging for new entrants to compete on price. For instance, in 2023, EDP's total operating revenue reached €23.5 billion, reflecting its vast infrastructure and market presence.

The substantial capital investment required to build new power plants, transmission lines, and distribution networks creates a high barrier to entry. Potential new entrants would struggle to match the cost efficiencies and operational expertise that EDP has cultivated over decades, further solidifying the position of incumbents.

Access to Distribution Channels and Grid Connectivity

New entrants into the energy sector, particularly those seeking to compete with established players like EDP Energias de Portugal, encounter significant hurdles in accessing essential distribution channels and securing grid connectivity. Incumbent utilities often control these vital infrastructures, creating a substantial barrier to entry.

The process of obtaining grid connection and allocating transmission capacity is frequently protracted and administratively complex. This can significantly delay or even prevent new companies from bringing their energy services to market, especially in a landscape where grid capacity is a finite and valuable resource.

- High Capital Investment: Building new distribution infrastructure requires massive upfront capital, often in the billions, which new entrants may struggle to secure compared to established firms with existing assets.

- Regulatory Hurdles: Navigating the complex web of energy regulations and obtaining the necessary permits for grid access can be a lengthy and costly undertaking for newcomers.

- Limited Existing Capacity: In many regions, the existing grid infrastructure may have limited spare capacity, making it difficult for new, large-scale energy producers to connect without significant upgrades.

- Control by Incumbents: EDP and similar companies often hold exclusive or dominant rights to operate and manage distribution networks, effectively limiting access for potential competitors.

Brand Loyalty and Customer Relationships

Established utilities like EDP Energias de Portugal (EDP) possess a significant advantage due to decades of cultivated brand loyalty and strong customer relationships. This deep-seated trust makes it difficult for new players to gain traction. For instance, in 2024, customer retention rates for incumbent energy providers often exceed 90%, a testament to these enduring connections.

New entrants face the daunting task of overcoming this loyalty, requiring substantial investments in marketing campaigns and customer acquisition strategies. The cost to acquire a new energy customer can range from €100 to €300, depending on the market and the intensity of competition. This high barrier to entry significantly dampens the threat from new competitors.

- Customer Retention Rates: Incumbent utilities in 2024 often boast retention rates above 90%.

- Customer Acquisition Cost (CAC): New entrants may face CACs between €100 and €300.

- Brand Equity: Decades of service build strong brand recognition and trust, a difficult asset for newcomers to replicate.

The threat of new entrants for EDP Energias de Portugal is significantly mitigated by the immense capital requirements for infrastructure development and the complexities of regulatory frameworks. For instance, the European Union's continued push for stringent environmental standards in 2024 necessitates substantial investments in compliance technologies, creating a formidable entry barrier.

Moreover, established economies of scale, as evidenced by EDP's €23.5 billion operating revenue in 2023, allow incumbents to offer competitive pricing that new entrants struggle to match. Access to and control over existing grid infrastructure also presents a considerable challenge for newcomers seeking market entry.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Investment | Building new power generation and distribution networks requires billions in upfront capital. | Significantly limits the number of potential new entrants. | Renewable energy projects often cost hundreds of millions to billions of euros. |

| Regulation & Licensing | Complex licensing, environmental compliance, and permits are mandatory. | Increases time-to-market and operational costs for newcomers. | Stringent EU environmental standards demand significant compliance investment. |

| Economies of Scale | Established players benefit from lower per-unit costs due to large-scale operations. | Makes it difficult for new entrants to compete on price. | EDP's 2023 operating revenue of €23.5 billion highlights its scale advantage. |

| Grid Access | Control over transmission and distribution networks limits newcomer connectivity. | Can delay or prevent new energy providers from reaching customers. | Limited spare grid capacity exacerbates this issue for new large-scale producers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EDP-Energias De Portugal is built upon a foundation of official company disclosures, including annual reports and investor presentations. We supplement this with data from reputable industry analysis firms and government energy sector reports to provide a comprehensive view of the competitive landscape.