Edp-energias De Portugal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edp-energias De Portugal Bundle

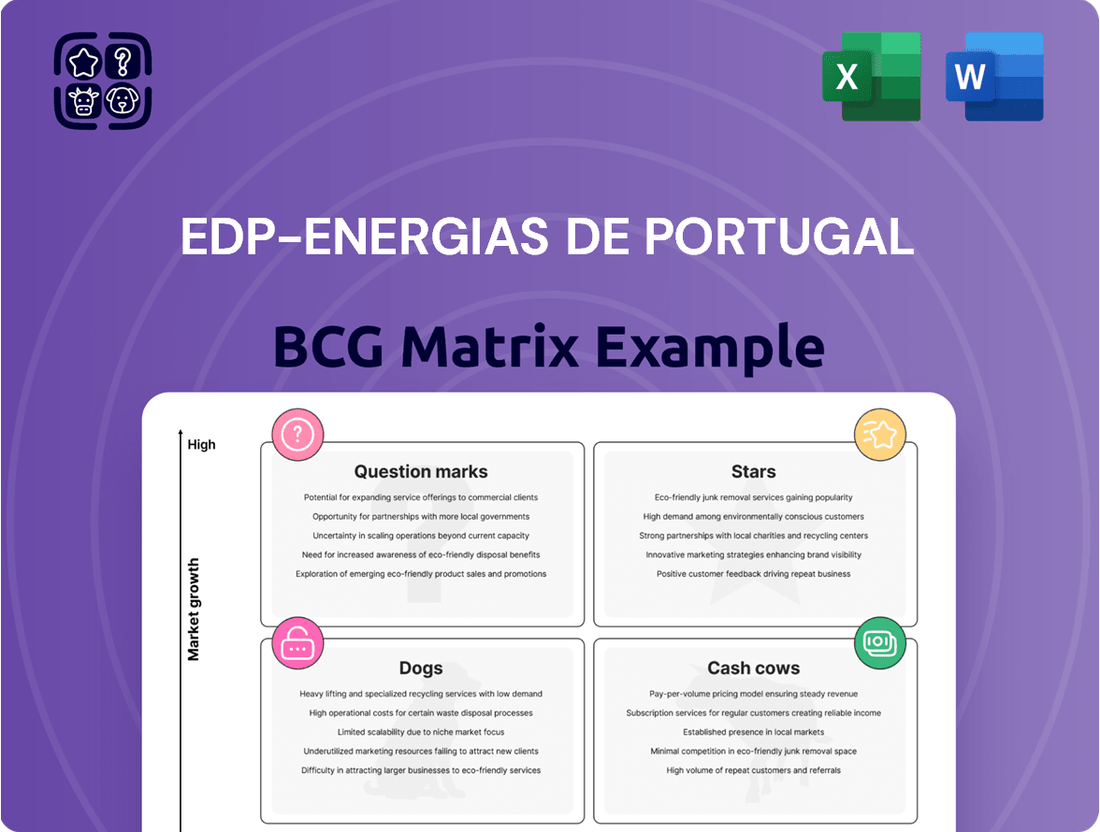

Unlocking the strategic potential of EDP-Energias de Portugal hinges on understanding its product portfolio's market standing. While this glimpse reveals key product placements within the BCG Matrix, the true power lies in the complete analysis.

This comprehensive report provides a detailed quadrant-by-quadrant breakdown, illuminating which of EDP's ventures are Stars, Cash Cows, Dogs, or Question Marks. Gain the clarity needed to make informed decisions about resource allocation and future investments.

Don't just guess at EDP's market dynamics; know them. Purchasing the full BCG Matrix empowers you with actionable insights and a clear roadmap for optimizing EDP's diverse business units for sustained growth and profitability.

Get the full BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

EDP is making significant strides in offshore wind, a key growth area. Their focus on floating offshore wind is particularly noteworthy, as this technology unlocks opportunities in deeper waters. This strategic investment positions them well for future capacity expansions.

The WindFloat Atlantic project in Portugal and the Mayflower Wind project in the US are prime examples of EDP's commitment and leadership in this sector. These initiatives are expected to contribute substantially to their offshore wind capacity by 2030.

Furthermore, EDP's involvement in the Arven Offshore Wind Farm in Scotland reinforces their strong presence in this expanding market segment. This diversification of projects underscores their dedication to building a robust offshore wind portfolio.

EDP is aggressively growing its large-scale solar photovoltaic (PV) installations. Major projects are actively being developed across Europe and the United States, significantly boosting their renewable energy portfolio.

The Cerca Solar Park in Portugal is a prime example of this expansion. Furthermore, EDP is securing new solar parks in California, underscoring a strategic focus on increasing solar generation capacity.

These developments are often supported by long-term power purchase agreements (PPAs) with major technology firms. For instance, in 2024, EDP Renewables announced a PPA with Amazon for a 200 MW solar project in Spain, highlighting the demand from major corporations for clean energy.

EDP is aggressively expanding its battery energy storage systems (BESS) both as standalone units and alongside renewable energy projects. This strategic move is driven by the critical need for grid stability and the efficient integration of variable solar and wind power. By 2026, EDP aims to surpass 500 MW of global storage capacity, a significant leap forward.

Real-world examples highlight this commitment. The Harrington Franklin storage project in England is a prime example of their development efforts, demonstrating the practical application of BESS technology. Furthermore, substantial BESS investments in the United States underscore EDP's global approach to building a more resilient and flexible energy infrastructure.

Green Hydrogen Initiatives

EDP is actively positioning itself in the burgeoning green hydrogen market through strategic early-stage investments. The company's vision includes repurposing existing thermal power plants into hubs for green energy production, a move that leverages existing infrastructure for a sustainable future.

These initiatives are geared towards capturing significant growth in a sector critical for decarbonizing challenging industries. The establishment of green hydrogen valleys in Spain, specifically in Cadiz and Asturias, alongside pilot projects in Portugal, underscores EDP's commitment to this high-potential area.

Green hydrogen is poised to play a pivotal role in electrifying sectors that are difficult to convert to renewable electricity, such as heavy industry and long-haul transport. As of early 2024, the global green hydrogen market is experiencing rapid expansion, with projections indicating substantial growth in the coming decade, driven by policy support and technological advancements.

- Strategic Investment: EDP is investing early in green hydrogen production capabilities.

- Infrastructure Repurposing: Plans to convert thermal power plants into green energy centers.

- Geographic Focus: Development of green hydrogen valleys in Cadiz and Asturias (Spain).

- Pilot Projects: Implementation of pilot green hydrogen plants in Portugal.

- Market Potential: Targeting hard-to-electrify sectors like industry and transport for decarbonization.

Expansion in Emerging APAC Markets

EDP's strategic focus on emerging APAC markets, particularly those with stable economic conditions and strong currencies like Singapore, Japan, and Australia, positions these ventures as potential stars in its portfolio. The company's commitment to these regions is underscored by substantial investments and partnerships aimed at capturing significant market share.

A prime example of this strategy is EDP's recent power purchase agreements for solar distributed generation in Singapore. This move into a high-growth renewable energy market demonstrates EDP's proactive approach to capitalizing on the burgeoning demand for sustainable energy solutions in the Asia-Pacific region.

By securing these agreements, EDP is not only expanding its operational footprint but also solidifying its presence in markets with favorable regulatory environments and increasing energy needs.

- Emerging APAC Markets: EDP targets Singapore, Japan, and Australia for expansion due to their low-risk profiles and strong currencies.

- Singapore Solar DG: Significant power purchase agreements signed for solar distributed generation in Singapore highlight a key growth area.

- Renewable Energy Focus: The strategy emphasizes capturing opportunities in high-growth emerging renewable markets within the APAC region.

- Strategic Investment: EDP's actions reflect a deliberate move to invest in and benefit from the expanding renewable energy sector in Asia.

EDP's ventures in emerging Asia-Pacific markets, particularly Singapore, Japan, and Australia, are demonstrating strong growth potential. These regions offer stable economic conditions and favorable regulatory environments for renewable energy. Significant investments, such as power purchase agreements for solar distributed generation in Singapore, highlight EDP's strategic focus on these high-potential areas.

| Venture Area | Key Markets | Growth Drivers | Recent Activity (2024 examples) | Star Potential Indicators |

|---|---|---|---|---|

| Emerging APAC Renewables | Singapore, Japan, Australia | Stable economies, strong currencies, increasing demand for clean energy | Solar distributed generation PPAs in Singapore | High market growth, strategic investments, favorable regulatory frameworks |

What is included in the product

This BCG Matrix overview highlights EDP's strategic positioning, identifying growth opportunities and areas for resource allocation.

The EDP-Energias De Portugal BCG Matrix offers a clear, one-page overview, relieving the pain of strategic uncertainty by placing each business unit in its appropriate quadrant.

Cash Cows

EDP's regulated electricity distribution networks in Portugal, Spain, and Brazil are considered cash cows. These operations generate consistent and predictable revenue streams because their pricing and operations are overseen by regulatory bodies. For instance, in 2023, EDP Distribuição, now E-Redes, continued its investment in grid modernization, contributing to a stable performance.

Significant capital is being deployed to upgrade and digitize these essential grids. These investments aim to enhance efficiency, improve reliability, and build greater resilience against potential disruptions, solidifying their role as a dependable source of income for EDP. The company has been actively investing in smart grid technologies to improve operational performance.

EDP's established hydroelectric power plants are prime examples of cash cows within its portfolio. These mature, large-scale assets, with a significant presence in Portugal and Brazil, represent a highly efficient and consistent source of renewable energy. Their operational costs are considerably lower than those for new developments, allowing them to reliably generate substantial cash flow. In 2024, EDP's hydroelectric capacity contributed a significant portion to its overall renewable energy output, demonstrating their enduring profitability and stability.

EDP's mature onshore wind farms in stable markets are clear cash cows. These established assets benefit from long-term power purchase agreements and predictable regulatory environments, ensuring a steady stream of revenue. For instance, as of the first quarter of 2024, EDP Renováveis reported a significant operational capacity in mature markets, contributing robustly to the company's earnings.

These wind farms have cultivated strong competitive advantages and substantial market shares, minimizing the need for costly promotional activities or extensive market penetration efforts. Their consistent revenue generation, coupled with lower operating and capital expenditure compared to newer ventures, solidifies their position as dependable cash generators for EDP.

Retail Electricity and Gas Supply in Core Markets

EDP's retail electricity and gas supply in core European markets like Portugal and Spain represents a classic cash cow. These mature markets offer a stable, predictable customer base, generating consistent recurring revenue. Despite potentially low growth rates, EDP's established market share in these regions ensures a reliable inflow of cash. This financial strength allows EDP to fund investments in higher-growth areas or emerging technologies.

- Market Share: EDP maintained a significant presence in its core Iberian markets, with retail electricity customer numbers around 3.5 million in Portugal and Spain as of early 2024.

- Revenue Stability: The regulated nature of some retail supply segments and the essential service aspect contribute to predictable revenue streams, less susceptible to economic downturns.

- Profitability: While growth is modest, the operational efficiency and scale in these established markets contribute positively to overall profitability, acting as a key financial pillar for the group.

- Investment Support: The consistent cash generated from these retail operations has been instrumental in funding EDP's substantial investments in renewable energy projects and grid modernization.

Long-Term Contracted Renewable Generation

Edp-energias De Portugal's long-term contracted renewable generation assets function as powerful cash cows within its business portfolio. A substantial part of its renewable energy output is locked in via long-term Power Purchase Agreements (PPAs) with reliable customers, notably major technology firms. This extensive contracted volume, with an average remaining duration of 12 years, ensures highly predictable and consistent cash flows. Consequently, it significantly minimizes exposure to the unpredictable fluctuations of market electricity prices.

These stable cash flows are crucial for funding other business segments and investments. For instance, in 2023, EDP's renewable energy segment generated a significant portion of its EBITDA. The predictable nature of these PPAs allows for more accurate financial planning and supports a lower cost of capital for these assets.

- Predictable Revenue Streams: Long-term PPAs provide a stable revenue base, insulating EDP from short-term market price volatility.

- Reduced Risk Profile: Securing off-take agreements with creditworthy entities like tech giants lowers the financial risk associated with renewable energy generation.

- Financial Stability: The consistent cash flow from these contracted assets supports dividend payments and reinvestment in growth areas.

- Asset Longevity: With an average contract maturity of 12 years, these assets offer a reliable income stream for an extended period.

EDP's regulated electricity distribution networks in Portugal, Spain, and Brazil are prime cash cows. These operations, managed under regulatory oversight, provide consistent and predictable revenue streams. In 2023, E-Redes (formerly EDP Distribuição) continued its grid modernization efforts, contributing to stable financial performance and ensuring these essential assets remain dependable income generators.

What You See Is What You Get

Edp-energias De Portugal BCG Matrix

The preview you're seeing is the exact, fully formatted EDP-Energias de Portugal BCG Matrix report you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be immediately available for your use without any watermarks or demo content. You can confidently download this professional document, ready to inform your business planning and decision-making processes.

Dogs

Legacy coal-fired thermal power plants within EDP's portfolio, though slated for phase-out by 2025, represent the Dogs in the BCG matrix. These assets are in a declining market with minimal growth potential, characterized by increasing operational expenses and significant environmental compliance costs.

These power plants are essentially cash traps, demanding ongoing investment for maintenance and environmental mitigation without offering substantial returns. For instance, the operational costs associated with maintaining older coal facilities can outweigh their energy generation revenue, especially as renewable energy sources become more competitive.

EDP's strategic direction clearly indicates a move away from coal, making these assets non-core and candidates for divestiture or managed decommissioning. The company's commitment to a coal-free future by 2025 underscores the low strategic value and limited future of these legacy operations.

Some older, smaller hydroelectric power plants within EDP Energias de Portugal's portfolio might be classified as Dogs. These assets often face challenges such as needing substantial maintenance or being situated in areas with less reliable water flow, impacting their profitability and overall market share.

These older hydro assets can be less efficient when compared to more modern, larger-scale hydroelectric facilities or other advanced renewable energy technologies. This inefficiency can lead to underperformance relative to their operational expenditures, making them a drag on overall profitability.

For instance, many older small hydro assets might operate at a capacity factor below 40%, significantly lower than newer plants that can exceed 60%. This lower operational efficiency directly translates to reduced revenue generation against fixed maintenance costs.

In 2024, it's estimated that a significant portion of smaller, older hydro assets globally are struggling to compete on cost per megawatt-hour, often exceeding 100 EUR/MWh for generation, whereas newer renewables can achieve much lower costs.

EDP has strategically divested certain non-core business units, aligning with its commitment to a future centered on renewable energy and grids. These divested assets typically represent operations with lower growth potential or those not central to EDP's long-term strategic vision. For instance, in 2023, EDP completed the sale of its stake in the Brazilian energy company EDP Energias de Portugal SA for approximately €2.4 billion, a move that sharpened its focus on core European markets and renewable development.

Outdated or Inefficient Distribution Infrastructure in Rural Areas

In 2024, EDP faced challenges with its distribution infrastructure in rural Portugal. Portions of the network in remote areas, characterized by low population density, incurred higher operational costs. These segments often struggled with low growth potential, meaning the revenue generated didn't justify the investment needed to maintain and upgrade the aging infrastructure.

This situation presents a classic case for a BCG Matrix analysis, where these rural distribution assets could be categorized as potential 'Dogs'. They require continuous investment to ensure service delivery, yet their low profitability and limited growth prospects make them less attractive from a strategic investment standpoint.

For instance, in 2023, the cost to serve customers in the most remote regions was estimated to be up to 25% higher than in urban centers. This disparity directly impacts the efficiency of the distribution network.

- High operational costs: Rural networks often feature longer lines and fewer customers per mile, increasing maintenance and operational expenses.

- Low revenue generation: Sparsely populated areas typically have lower electricity consumption and fewer high-demand users, limiting revenue potential.

- Inefficient investment: Continued investment in these segments, while necessary for universal service, yields lower returns compared to investments in high-growth areas.

- Limited future growth: Demographic trends in many rural areas show stagnation or decline, further dimming the prospects for significant future revenue increases.

Abandoned or Challenged International Projects

Projects that have been abandoned, like EDP's past wind ventures in Colombia, signify investments that didn't deliver anticipated returns and have ceased contributing to growth or market presence. These situations highlight initiatives that became financial burdens and were divested to streamline the company's overall portfolio.

These abandoned projects, often categorized as Dogs in a BCG matrix, indicate strategic missteps or unforeseen market challenges. For example, in 2023, EDP reported impairments related to certain international assets, demonstrating the tangible impact of such ventures turning into cash traps.

- Colombia Wind Projects: These represent past capital outlays that did not achieve the projected financial performance or market penetration, leading to their discontinuation.

- Cash Traps: Such ventures consumed resources without generating sufficient returns, negatively impacting overall profitability and cash flow.

- Portfolio Optimization: The decision to exit these challenged projects reflects a strategic move to reallocate capital towards more promising opportunities.

- Impairment Charges: Financial reporting often includes charges for assets that have lost value, such as those associated with exited international projects.

EDP's legacy coal-fired plants, despite their phase-out by 2025, exemplify the 'Dogs' in the BCG matrix. These assets operate in a declining market with minimal growth and face escalating operational and environmental costs.

Similarly, some older, less efficient hydroelectric plants within EDP's portfolio can be classified as Dogs. Their lower operational efficiency, with capacity factors sometimes below 40% compared to newer plants exceeding 60%, makes them less profitable, especially when generation costs can exceed 100 EUR/MWh in 2024.

Rural distribution infrastructure in Portugal, characterized by low population density and high operational costs, also presents 'Dog' characteristics. These segments, with limited revenue potential and demographic stagnation, require continuous investment but yield lower returns.

Abandoned projects, such as past wind ventures in Colombia, represent past capital outlays that failed to deliver projected returns, becoming cash traps and leading to portfolio exits, often resulting in impairment charges as seen in 2023.

| Asset Category | Market Growth | Relative Market Share | BCG Classification | Key Challenges |

| Legacy Coal Plants | Declining | Low | Dog | High operational/environmental costs, phase-out by 2025 |

| Older Hydro Plants | Low/Stagnant | Low | Dog | Lower efficiency, higher maintenance costs, low capacity factors (<40%) |

| Rural Distribution Networks | Low | Low | Dog | High operational costs, low revenue, limited future growth |

| Abandoned Projects (e.g., Colombia Wind) | N/A (Exited) | N/A | Dog | Failed to meet ROI, cash traps, impairment charges |

Question Marks

Early-stage green hydrogen production technologies, like novel electrolysis methods or advanced biological processes, often fall into the 'Star' category within a BCG matrix for companies like EDP. These represent high-growth potential areas but are currently characterized by low market share due to their nascent development and limited commercial deployment.

These technologies require substantial upfront capital investment for research, development, and pilot projects, with uncertain near-term financial returns. For instance, projects exploring photoelectrochemical water splitting are still in laboratory or early demonstration phases, demanding significant R&D funding before reaching commercial scale.

The capital intensity is a major hurdle; establishing even a small-scale pilot plant for a new green hydrogen production method can cost tens or hundreds of millions of dollars. This investment is crucial to prove technical feasibility and economic viability in a market still dominated by established, albeit less sustainable, production methods.

While global investment in green hydrogen is surging, with projections suggesting the market could reach over $100 billion by 2030, the specific funding for these cutting-edge, early-stage technologies is often channeled through government grants, venture capital, and strategic partnerships, reflecting their high-risk, high-reward profile.

EDP's ventures into emerging renewable energy markets, particularly in less developed regions of Asia-Pacific beyond established hubs, align with the characteristics of question marks in the BCG matrix. These markets present significant growth opportunities, but EDP is still in the process of establishing its presence and understanding the local regulatory frameworks and competitive dynamics.

For instance, EDP's recent investments in countries like Vietnam, which aims to increase its renewable energy capacity significantly by 2030, represent a strategic push into a question mark market. While Vietnam's solar and wind potential is vast, the market is still maturing, with evolving policies and a developing supply chain, requiring substantial upfront investment and risk for EDP.

In 2024, the Asia-Pacific renewable energy sector saw substantial growth, with investments reaching hundreds of billions of dollars. However, specific markets within this region, like those EDP is exploring, often present a higher risk-reward profile due to less predictable regulatory environments compared to more developed markets.

EDP's strategy in these nascent markets involves building local partnerships and adapting its technology to local conditions, a typical approach for question mark assets. Success in these regions will be crucial for EDP to diversify its portfolio and tap into future high-growth areas, though the immediate return on investment may be uncertain.

EDP's advanced digital energy services and platforms, encompassing areas like smart home integration and specialized energy management solutions, represent a potential star in the BCG matrix. These offerings operate in rapidly evolving and competitive markets, signaling high growth potential. However, their current market penetration is likely low, reflecting the nascent stage of many of these innovative services.

Significant investment in technology development and robust customer acquisition strategies are crucial for these digital ventures to capture substantial market share. For instance, investments in AI-driven energy optimization platforms and IoT-enabled smart home ecosystems are key. The global smart home market alone was projected to reach over $150 billion in 2024, indicating a substantial opportunity for scalable digital energy services.

Innovative E-mobility Charging Infrastructure Pilots

EDP's innovative e-mobility charging infrastructure pilots, particularly in urban settings and for commercial fleets, are positioned as potential stars in its BCG matrix. These ventures require significant upfront investment for infrastructure development and market penetration, reflecting their high-growth potential. By 2024, EDP had initiated numerous pilot programs, aiming to capture market share in this rapidly expanding sector.

These initiatives demand substantial capital expenditure, consuming cash to establish a strong market presence and develop new charging technologies. The success of these pilots hinges on achieving rapid customer adoption and scaling operations efficiently. For example, a significant portion of EDP's 2024 capital expenditure was allocated to these forward-looking e-mobility projects.

- High Investment: Significant cash outlay for infrastructure and market entry in competitive urban e-mobility markets.

- Growth Potential: Targeting high-growth segments like urban charging and commercial fleet solutions.

- Scale Dependency: Future profitability relies heavily on rapid adoption and achieving economies of scale.

- 2024 Focus: EDP dedicated substantial resources in 2024 to testing and deploying these advanced charging solutions.

Research & Development in Novel Energy Technologies

EDP's ventures into novel energy technologies, such as next-generation energy storage beyond traditional battery systems and emerging renewable generation methods, represent significant investments in areas with high future potential but considerable commercialization uncertainty. These are inherently speculative endeavors, akin to placing bets on future market leaders.

These R&D efforts are crucial for EDP's long-term competitive positioning. They are designed to identify and cultivate future "Stars" in the BCG matrix – technologies that, if successful, could dominate emerging markets. However, the substantial risk involved means some projects may not achieve viability and could be discontinued.

For instance, EDP has been exploring advancements in green hydrogen production and advanced offshore wind turbine designs. These areas, while promising, are still in relatively early stages of development and widespread adoption. The capital expenditure for such research, while significant, is balanced against the potential for disruptive market entry.

- High Risk, High Reward: R&D in novel energy technologies carries substantial risk, with no guarantee of commercial success, but offers the potential for significant future market leadership.

- Long-Term Strategy: These investments are integral to EDP's strategy of staying ahead of energy market evolution and securing a competitive advantage in the future energy landscape.

- Uncertain Commercialization: Technologies like advanced energy storage and new renewable generation forms face hurdles in scaling, cost reduction, and market acceptance, making their commercial viability uncertain.

- Potential for Stars: Successful development of these technologies could transform them into future market leaders, mirroring the "Star" quadrant in the BCG matrix.

EDP's early-stage green hydrogen production technologies, like novel electrolysis methods or advanced biological processes, are classic examples of "Question Marks" in the BCG matrix. These represent high-growth potential areas but currently have low market share due to their nascent development and limited commercial deployment, demanding significant capital for R&D and pilot projects.

These ventures require substantial upfront capital investment for research, development, and pilot projects, with uncertain near-term financial returns. For instance, projects exploring photoelectrochemical water splitting are still in laboratory or early demonstration phases, demanding significant R&D funding before reaching commercial scale, with capital intensity being a major hurdle.

While global investment in green hydrogen is surging, with projections suggesting the market could reach over $100 billion by 2030, the specific funding for these cutting-edge, early-stage technologies is often channeled through government grants, venture capital, and strategic partnerships, reflecting their high-risk, high-reward profile.

EDP's ventures into emerging renewable energy markets, particularly in less developed regions of Asia-Pacific beyond established hubs, align with the characteristics of question marks. These markets present significant growth opportunities, but EDP is still in the process of establishing its presence and understanding the local regulatory frameworks and competitive dynamics, requiring substantial upfront investment and risk.

| BCG Category | EDP Venture Example | Market Growth | Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|---|

| Question Mark | Early-stage Green Hydrogen Tech | High | Low | High | Star or Dog |

| Question Mark | Emerging Asia-Pacific Renewables | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our EDP-Energias De Portugal BCG Matrix leverages official company filings, market share data, and industry growth projections. This ensures a robust analysis of each business unit's market position and potential.