Edp-energias De Portugal Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edp-energias De Portugal Bundle

Unlock the complete strategic blueprint behind Edp-energias De Portugal's success with our comprehensive Business Model Canvas. This detailed analysis reveals how EDP crafts value propositions for diverse customer segments and leverages key partnerships to drive innovation in the energy sector. Understand their revenue streams and cost structures to gain actionable insights.

Partnerships

EDP, through programs like Energy Starter, collaborates with tech firms and startups to integrate cutting-edge solutions. These partnerships are vital for improving grid efficiency, incorporating more renewable sources, and developing advanced customer offerings. For instance, in 2023, EDP's innovation challenges focused on areas like smart grids and energy efficiency, attracting over 100 startup proposals.

These alliances are key to EDP's digital transformation and efforts to build a more robust energy grid. By working with technology providers, EDP explores and implements novel technologies, including green hydrogen production and advanced energy storage systems. This strategic approach aims to keep EDP at the forefront of the energy transition, fostering innovation and sustainable growth.

EDP collaborates closely with financial institutions and investors, a crucial element for its business model. These partnerships are essential for securing the substantial capital needed for its ambitious renewable energy and infrastructure development plans.

For example, EDP has a strong relationship with the European Investment Bank (EIB). The EIB has provided significant funding for EDP’s large-scale renewable energy projects and critical grid modernization efforts.

These financial partnerships are vital for powering EDP's investment strategy. In 2024, the company continued to allocate billions of euros towards expanding its renewable capacity and upgrading its energy infrastructure across its operating regions.

EDP's relationship with government and regulatory bodies is crucial for its operational success and strategic growth. Collaboration with these entities enables EDP to navigate complex regulatory frameworks, a vital step for obtaining necessary licenses for new energy projects. For instance, in 2023, EDP continued to engage with various national and regional governments across its operating territories to secure permits for renewable energy development, a key part of its €25 billion investment plan through 2026.

Furthermore, these partnerships are instrumental in fostering a fair energy transition, particularly in areas impacted by the phasing out of older power plants. EDP actively works with authorities to manage the social and economic implications of these transitions, ensuring community support and development. This includes initiatives aimed at retraining workforces and investing in local economies, aligning with broader governmental goals for sustainable development.

EDP also partners with regulatory bodies to drive the expansion and integration of renewable energy sources into the existing grid infrastructure. This collaboration is essential for modernizing the grid to handle the intermittent nature of renewables and to ensure efficient energy distribution. In 2024, ongoing discussions with regulators have focused on grid modernization projects, including smart grid technologies, to facilitate a higher penetration of wind and solar power.

Energy Sector Joint Ventures and Alliances

EDP actively pursues strategic joint ventures and alliances within the energy sector to accelerate its renewable energy ambitions. A prime example is Ocean Winds, a joint venture with ENGIE, focusing on developing offshore wind projects globally. This partnership combines EDP’s significant experience in renewable energy with ENGIE’s extensive offshore wind capabilities and financial strength.

These collaborations are crucial for EDP's expansion strategy, enabling it to tap into new markets and share the substantial capital required for large-scale renewable infrastructure. By joining forces, EDP can mitigate risks and access specialized knowledge, thereby speeding up the deployment of clean energy solutions and contributing to its ambitious decarbonization targets.

- Ocean Winds’ Portfolio Growth: As of early 2024, Ocean Winds manages a substantial pipeline of offshore wind projects, aiming for significant installed capacity by the end of the decade.

- Geographic Expansion: Through these partnerships, EDP has broadened its presence in key offshore wind markets, including North America and Europe, enhancing its global reach.

- Capital Efficiency: Joint ventures allow for the sharing of investment burdens, making it more feasible for EDP to undertake capital-intensive projects and achieve economies of scale.

Research and Academic Institutions

EDP actively cultivates partnerships with universities and renowned research centers, a cornerstone of its innovation strategy. These collaborations are crucial for driving the development of next-generation energy technologies and sustainable solutions. For example, EDP's engagement with institutions like the University of Lisbon and various international research bodies fuels its commitment to advancing renewable energy integration and smart grid technologies.

This symbiotic relationship ensures a consistent influx of highly skilled talent and access to pioneering research, directly supporting EDP's ambitious long-term strategic objectives. In 2024, EDP continued to invest significantly in R&D, with a portion of its budget allocated to joint projects with academic partners, focusing on areas such as advanced battery storage and green hydrogen production.

- Innovation Pipeline: Universities and research centers provide EDP with early access to groundbreaking research and emerging talent, essential for staying ahead in the rapidly evolving energy sector.

- Talent Development: These partnerships offer valuable internship and research opportunities, nurturing future leaders and specialists for EDP's operations and innovation initiatives.

- Technology Advancement: Collaborations facilitate the co-creation and testing of new energy solutions, from advanced grid management systems to more efficient renewable energy generation methods.

- Knowledge Exchange: EDP benefits from the deep scientific expertise within academic institutions, leading to a robust exchange of knowledge that informs strategic decision-making and operational improvements.

EDP's key partnerships span technology firms, financial institutions, governments, and academia, all crucial for its strategic goals. These collaborations are vital for innovation, funding, regulatory navigation, and talent development.

In 2024, EDP's continued investment in R&D with academic partners, alongside its significant capital allocation for renewables, underscores the importance of these diverse alliances.

The joint venture Ocean Winds with ENGIE exemplifies how strategic alliances accelerate offshore wind development, enhancing global reach and capital efficiency.

What is included in the product

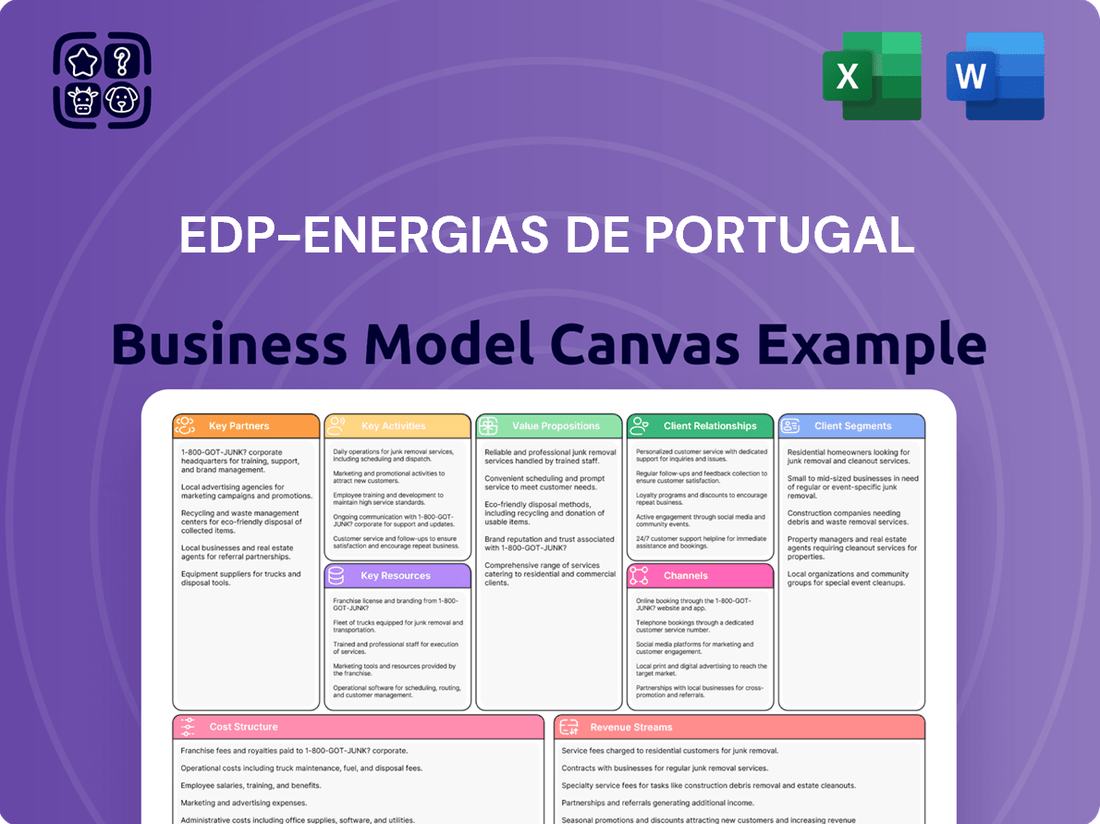

This Business Model Canvas provides a comprehensive overview of EDP Energias de Portugal's strategy, detailing their customer segments, value propositions, and key partners in the energy sector.

It reflects EDP's integrated approach to energy generation, distribution, and commercialization, highlighting their commitment to renewable energy and customer solutions.

Provides a clear, one-page overview of EDP's complex energy operations, simplifying strategic analysis and identifying areas for efficiency improvements.

Helps pinpoint and address customer pain points in energy provision by visualizing value propositions and customer relationships.

Activities

EDP's core activity is generating and developing electricity from renewable sources. This includes significant investments in wind, solar, and hydroelectric power. Their ambition is to reach 100% clean energy generation by 2030, underscoring a strong commitment to decarbonization.

This involves not just building new renewable capacity but also enhancing the efficiency of their current power plants. They are actively integrating advanced energy storage solutions, such as batteries, to ensure a stable supply from intermittent renewable sources across their worldwide operations.

In 2023, EDP reported a renewable generation capacity of over 27 GW, with substantial growth in solar and wind portfolios. The company has committed billions in capital expenditure towards expanding its renewable pipeline, aiming for approximately 4.4 GW of new capacity to be operational by the end of 2024.

EDP manages vast electricity transmission and distribution networks across Portugal, Spain, and Brazil, a critical function for its operations. This involves significant investment in modernizing aging infrastructure, implementing advanced network automation, and driving the digitalization of its grid assets. For instance, in 2023, EDP invested €1.1 billion in its Portuguese distribution networks, focusing on resilience and efficiency.

These activities are geared towards enhancing the quality of electricity service provided to millions of end-consumers. By reducing energy losses through technological upgrades and improving network reliability, EDP ensures a consistent and stable power supply. This focus on operational excellence is crucial for maintaining customer satisfaction and meeting regulatory standards.

The digitalization of these grids is a key strategic priority, enabling real-time monitoring and control, which helps in quickly identifying and resolving potential outages. This proactive approach not only minimizes downtime but also supports the integration of renewable energy sources. EDP's smart grid initiatives aim to create a more flexible and efficient energy system for the future.

EDP Energias de Portugal actively engages in retail energy sales, offering both electricity and gas to a wide array of customers, from individual households to businesses. A key activity involves developing specialized products and services designed to help customers manage and optimize their energy usage more effectively.

The company's strategy in this area centers on providing a variety of flexible contracting options. This approach aims to cater to diverse customer needs and preferences, thereby enhancing customer satisfaction and loyalty.

EDP's retail energy sales activities are geared towards expanding its market share across the globe. For instance, by the end of 2023, EDP Renováveis, a significant part of EDP's renewable energy operations, reported a global installed capacity of over 13.8 GW, demonstrating its international footprint.

Innovation and Digitalization

EDP - Energias de Portugal actively drives innovation through initiatives like the Energy Starter program, fostering new solutions and business models within the energy sector. This commitment to innovation is crucial for enhancing operational efficiency and improving the overall customer experience.

Significant investment in digital technologies underpins EDP's strategy to accelerate the energy transition. This focus allows for the optimization of grid capacity, ensuring reliable energy delivery and enabling the integration of renewable sources.

Developing smart energy management solutions is a core activity, empowering consumers and businesses to utilize energy more effectively. For instance, EDP's smart meter rollout, aiming for widespread deployment by 2024, provides real-time data for better energy consumption insights.

- Driving Innovation: Programs like Energy Starter support startups and internal projects, fostering a culture of continuous improvement and new technology adoption.

- Digital Technology Investment: EDP is channeling resources into AI, IoT, and data analytics to streamline operations and create personalized customer services.

- Grid Optimization: Investments are focused on modernizing the grid infrastructure to handle increased renewable energy penetration and improve resilience.

- Smart Energy Management: Development of digital platforms and solutions that enable customers to monitor, control, and optimize their energy usage.

Strategic Investments and Asset Management

EDP's strategic investments and asset management form the backbone of its business model, focusing on expanding its renewable energy capacity and modernizing its electricity grids. The company is actively divesting from coal and transitioning towards a fully decarbonized energy system, a crucial element for long-term sustainability and meeting environmental goals.

In 2024, EDP continued its aggressive investment in renewables, particularly in solar and wind power across key markets like Portugal, Spain, Brazil, and the United States. This is complemented by significant capital allocation towards grid infrastructure upgrades, ensuring the reliable integration of these new, intermittent energy sources. The company’s asset rotation strategy involves strategically selling mature or non-core assets to fund these growth initiatives.

- Renewable Energy Expansion: In 2024, EDP announced plans to add approximately 1.5 GW of new renewable capacity, with a significant portion dedicated to solar projects in the US and wind farms in Europe.

- Grid Modernization: Investments in grid infrastructure are projected to reach €1.5 billion by 2026, focusing on digitalization and capacity enhancement to support the energy transition.

- Asset Rotation: EDP completed the sale of its stake in EDP Distribuição in Portugal in 2023, generating capital that is being reinvested into its growth areas.

- Thermal Generation Phase-out: The company is on track to fully phase out its coal-fired power generation by 2025, aligning with its commitment to Net Zero emissions by 2040.

EDP's key activities revolve around expanding its renewable energy portfolio, particularly in wind and solar power. This includes ongoing investments in new projects and enhancing existing infrastructure. The company is also heavily focused on modernizing its electricity transmission and distribution networks, integrating digital technologies for improved efficiency and reliability.

Furthermore, EDP is actively involved in retail energy sales, offering diverse products and services to customers while expanding its global market share. Innovation is a cornerstone, with initiatives supporting startups and new business models, alongside substantial investment in digital technologies like AI and IoT to optimize operations and customer engagement.

| Key Activity | Description | 2024 Focus/Data |

| Renewable Energy Generation & Development | Building and operating wind, solar, and hydroelectric power plants. | Aiming to add ~1.5 GW of new renewable capacity. |

| Grid Management & Modernization | Operating and upgrading electricity transmission and distribution networks. | Investing in digitalization and capacity enhancement; €1.5 billion projected by 2026. |

| Retail Energy Sales & Services | Providing electricity and gas, developing customer-focused energy management solutions. | Expanding market presence globally. |

| Innovation & Digitalization | Fostering new solutions and investing in digital technologies (AI, IoT). | Streamlining operations and enhancing customer services. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for EDP-Energias de Portugal you are currently viewing is the exact document you will receive upon purchase. This preview showcases the comprehensive structure and content, ensuring you know precisely what you're acquiring. Upon completing your order, you'll gain full access to this detailed Business Model Canvas, ready for your strategic analysis and planning.

Resources

EDP’s extensive renewable energy portfolio is a cornerstone of its business model, with 97% of its energy production stemming from wind, solar, and hydro power as of September 2024. This substantial commitment to green assets underpins its entire clean energy transition strategy. The company’s global footprint in renewables provides a stable and predictable revenue stream, essential for long-term growth and value creation. This diversified generation mix also mitigates risks associated with relying on a single energy source.

EDP's electricity transmission and distribution networks are its backbone, a critical physical asset comprising over 389,000 kilometers of infrastructure. This extensive network, operating across Portugal, Spain, and Brazil, is fundamental to delivering electricity to millions of end-users. It also plays a vital role in accommodating and integrating new sources of energy, particularly from distributed generation, which is key for the energy transition.

In 2024, EDP continued to invest heavily in maintaining and modernizing these essential networks. For instance, its Portuguese distribution arm, EDP Distribuição (now E-Redes), reported significant capital expenditures aimed at enhancing grid resilience and efficiency. These investments are crucial for managing the increasing complexity of energy flows, especially with the rise of renewable energy sources connected to the grid.

Human capital and technical expertise are foundational to EDP's operations. The company boasts a workforce of over 13,000 dedicated employees, each contributing vital skills across various energy sectors. This extensive talent pool is the engine driving EDP's success in power generation, intricate grid management, cutting-edge renewable energy development, and responsive customer service.

The collective expertise within EDP is not merely about numbers; it's about the specialized knowledge that enables innovation and ensures operational efficiency. For instance, their teams possess deep understanding in areas like smart grid technologies and advanced energy storage solutions, critical for navigating the evolving energy landscape. This human element directly translates into the company's ability to deliver reliable energy and develop sustainable solutions.

EDP's investment in its people is evident in its commitment to continuous training and development, ensuring their workforce remains at the forefront of technological advancements. In 2024, the company continued to focus on upskilling its employees, particularly in digital transformation and green energy competencies, which are paramount for future growth and competitive advantage in the energy market.

Financial Capital and Funding Mechanisms

EDP – Energias de Portugal relies heavily on robust financial capital to fuel its ambitious, multi-billion euro investment plans, particularly in renewable energy and grid infrastructure. This access to significant funding is the bedrock of its growth strategy.

Key funding mechanisms include a mix of equity, substantial debt financing from institutions like the European Investment Bank (EIB), and the strategic generation of proceeds from asset rotations. For instance, EDP's 2023-2026 strategic plan outlines a €25 billion investment, with a substantial portion dedicated to renewables and grids. This financial firepower is crucial for achieving its targets, such as adding 4 GW of renewable capacity annually.

- Equity Financing: EDP utilizes its market capitalization and potential share offerings to raise capital.

- Debt Financing: The company secures loans and bonds from various financial institutions, including significant partnerships with entities like the EIB, which has provided substantial funding for green projects. In 2024, EDP continued to leverage its strong credit rating to access debt markets effectively.

- Asset Rotation: EDP strategically divests non-core or mature assets to generate capital for reinvestment in growth areas. This approach allows for continuous portfolio optimization and funding of new ventures.

- Green Bonds: A significant portion of EDP's financing comes from issuing green bonds, aligning its financial strategy with its sustainability objectives and attracting environmentally conscious investors.

Proprietary Technology and Intellectual Property

EDP's proprietary technology is a cornerstone, particularly in advancing renewable energy solutions like wind and solar power generation. This includes sophisticated algorithms for site selection and energy yield prediction. In 2023, EDP Renewables significantly expanded its operational capacity, adding over 1.4 GW of new capacity, underscoring the practical application of their technological edge.

Furthermore, EDP invests heavily in smart grid technologies to optimize energy distribution and management. Their intellectual property in this domain allows for more efficient integration of distributed energy resources and enhanced grid resilience. For instance, their smart metering initiatives are designed to provide real-time data, improving operational efficiency and customer engagement.

Energy storage solutions also benefit from EDP's proprietary advancements. This involves developing and deploying battery storage systems to complement intermittent renewable sources. As of the first half of 2024, EDP continued to advance its portfolio of storage projects, aiming to enhance grid stability and support the transition to a low-carbon economy.

EDP's commitment to open innovation is also key, fostering collaboration to integrate cutting-edge external technologies. This approach ensures they remain at the forefront of innovation, complementing their internal R&D efforts. Their participation in various European innovation projects highlights this strategy, bringing new solutions to market faster.

- Renewable Energy Dominance: Proprietary tech in wind and solar, with 2023 seeing over 1.4 GW of new capacity added by EDP Renewables.

- Smart Grid Efficiency: Intellectual property in grid management and distributed resource integration.

- Energy Storage Advancement: Development and deployment of battery storage, crucial for grid stability in 2024.

- Open Innovation Ecosystem: Integrating external technologies to accelerate market readiness.

EDP's intellectual property in renewable energy technology, particularly for wind and solar, is a significant asset, as demonstrated by EDP Renewables adding over 1.4 GW of capacity in 2023. Their expertise extends to smart grid management and integrating distributed energy resources, enhancing grid resilience. Furthermore, advancements in energy storage solutions are critical for grid stability, with EDP continuing project development in this area through the first half of 2024.

| Key Resource | Description | 2023/2024 Data/Impact |

|---|---|---|

| Proprietary Renewable Energy Technology | Advanced algorithms for site selection and energy yield prediction in wind and solar. | EDP Renewables added over 1.4 GW of new capacity in 2023. |

| Smart Grid Intellectual Property | Technologies for optimizing energy distribution and integrating distributed resources. | Enhances grid resilience and operational efficiency through smart metering initiatives. |

| Energy Storage Solutions | Development and deployment of battery storage systems. | Crucial for grid stability and supporting the transition to a low-carbon economy; projects advanced in H1 2024. |

| Open Innovation | Collaboration with external partners to integrate cutting-edge technologies. | Accelerates the introduction of new solutions by complementing internal R&D. |

Value Propositions

EDP's commitment to a sustainable and clean energy supply is a core value proposition. In 2024, EDP reinforced its position as a leader in renewable energy, with an impressive 97% of its electricity production originating from green sources. This dedication to decarbonization and environmental stewardship directly appeals to a growing segment of customers who prioritize sustainability in their energy choices.

This strong reliance on renewable energy not only aligns with global climate objectives but also provides a tangible benefit to customers seeking to reduce their carbon footprint. By offering a predominantly clean energy portfolio, EDP differentiates itself in the market and builds brand loyalty among environmentally conscious consumers and businesses alike.

EDP's value proposition of reliable and secure energy access is built upon its vast and continually upgraded distribution networks, serving millions of customers across Portugal, Spain, Brazil, and the United States. This robust infrastructure ensures a consistent flow of electricity and gas, minimizing disruptions for households and businesses alike. For instance, in 2023, EDP invested over €1 billion in modernizing its networks, a significant portion dedicated to enhancing resilience against extreme weather events, a critical factor in energy security.

EDP is pioneering advanced energy solutions, offering customers smart meters, distributed solar generation, and sophisticated energy management tools. These innovations empower individuals and businesses to significantly optimize their energy consumption and readily adopt cutting-edge technologies.

This commitment to innovation directly translates into enhanced control and greater operational efficiency for EDP’s clientele. For instance, EDP's investments in smart grid technology are designed to provide real-time data, enabling proactive management and reducing waste. In 2024, EDP continued to expand its smart meter deployment, reaching millions of households across its operational territories, contributing to a more responsive and efficient energy ecosystem.

Competitive Pricing and Diverse Offers

EDP aims to attract and retain customers by offering competitive electricity and gas prices. This strategy is crucial in a deregulated energy market. In 2024, EDP continued to focus on price competitiveness as a key differentiator against rivals.

The company provides a diverse range of tailored products and contracting options. This flexibility allows customers to choose plans that best suit their specific consumption patterns and financial goals. Such customization enhances customer satisfaction and loyalty.

- Competitive Pricing Strategy: EDP endeavors to offer some of the most attractive electricity and gas rates in its operating markets.

- Diverse Product Portfolio: This includes various tariffs, renewable energy options, and bundled services designed for different customer segments.

- Flexible Contracting: Customers can select contract durations and payment methods that align with their preferences, aiding in cost management.

- Customer Empowerment: By offering choice and competitive pricing, EDP empowers consumers to actively manage their energy expenditures.

Global Reach and Local Presence

EDP's business model thrives on a dual strategy of global reach and deep local presence. This allows them to leverage economies of scale across multiple continents while still delivering personalized service to individual communities.

In 2024, EDP's operational footprint spanned across Europe, North America, South America, and Asia. This extensive network is crucial for diversifying revenue streams and mitigating risks associated with any single market's economic fluctuations.

The company's commitment to local engagement means investing in the communities where it operates, fostering goodwill and ensuring services are tailored to specific regional needs. This approach is vital for long-term sustainability and customer loyalty.

This combination of broad geographical coverage and localized operations is a key value proposition, enabling EDP to adapt to diverse regulatory environments and energy demands effectively.

- Global Footprint: Operations in Europe, North America, South America, and Asia.

- Local Engagement: Tailored services and community investment.

- Risk Diversification: Reduced reliance on any single market.

- Scalability: Benefits from large-scale operations across diverse regions.

EDP's value proposition centers on providing sustainable, reliable, and innovative energy solutions. Their extensive renewable energy portfolio, with 97% of electricity production from green sources in 2024, directly addresses the growing demand for environmentally responsible energy. This, combined with robust infrastructure and advanced technologies like smart meters, empowers customers with efficiency and control.

| Value Proposition | Key Features | 2024 Data/Impact |

|---|---|---|

| Sustainable Energy | Focus on renewable sources | 97% of electricity production from green sources |

| Reliable Energy Access | Extensive and upgraded distribution networks | Over €1 billion invested in network modernization (2023) |

| Innovative Energy Solutions | Smart meters, distributed solar, energy management | Expanded smart meter deployment to millions of households |

Customer Relationships

EDP's digital self-service platforms, including online portals and mobile apps, allow customers to conveniently manage their accounts, view energy consumption details, and access support. This digital approach streamlines interactions and enhances customer experience. For instance, in 2024, EDP reported a significant increase in digital channel usage, with over 70% of customer interactions occurring online, demonstrating a strong preference for self-service options.

For its large commercial and industrial clients, EDP Energias de Portugal deploys dedicated account managers. These professionals provide highly personalized services, understanding the unique operational demands and energy consumption patterns of each client.

This dedicated approach ensures tailored energy solutions, from supply contracts to efficiency improvements, directly addressing specific business needs. For instance, in 2024, EDP's C&I segment saw a 5% increase in service customization requests, highlighting the value of these specialized relationships.

The strategic advice offered by these account managers helps clients navigate market volatility and optimize their energy expenditures. This focus on partnership fosters strong, long-term relationships, crucial for securing consistent business and driving mutual growth.

EDP actively invests in social development and community engagement, particularly in areas impacted by energy transition shifts. For instance, in 2024, EDP continued its commitment to supporting local economies and social well-being through various initiatives, aiming to foster trust and positive social impact.

These efforts are crucial for ensuring a fair and inclusive energy transition, addressing concerns in regions where EDP operates. The company's focus on these social programs builds stronger relationships and a positive brand image.

Customer Service Centers and Support

EDP maintains robust customer service centers, offering both traditional and digital channels to assist its diverse customer base. This includes well-staffed call centers, online portals, and mobile applications designed to handle inquiries, resolve issues, and provide ongoing support, ensuring broad accessibility.

The company's multi-channel strategy acknowledges varied customer preferences, aiming to deliver a seamless and efficient support experience across all touchpoints. This approach is crucial for retaining customers and fostering loyalty in the competitive energy market.

In 2024, EDP reported a significant volume of customer interactions through its various service centers. For instance, their call centers handled an average of over 50,000 inquiries per week across key European markets, with digital channels accounting for approximately 40% of all customer service requests.

- Digital Channel Growth: Customer adoption of digital service channels, such as the EDP app and online self-service portals, saw a 15% increase in 2024, reflecting a growing preference for convenience and immediate assistance.

- Call Center Efficiency: EDP's call centers maintained an average response time of under 90 seconds for incoming calls, with a first-call resolution rate of 78% in 2024, demonstrating operational effectiveness.

- Customer Satisfaction Scores: Overall customer satisfaction with support services remained high, averaging 8.5 out of 10 in surveys conducted throughout 2024, underscoring the success of their multi-channel approach.

Partnerships with Technology Companies for Client Solutions

EDP actively fosters partnerships with technology companies, including startups and scaleups, through initiatives like the Energy Starter program. This collaboration is key to developing innovative client solutions that drive efficiency and sustainability for customers.

These strategic alliances enable the co-creation of novel products and services. For example, in 2024, EDP's focus on digital transformation led to the launch of several pilot projects with tech partners aimed at optimizing energy consumption for commercial clients, projecting potential savings of up to 15%.

- Co-creation of innovative energy solutions

- Access to cutting-edge technology and expertise

- Enhanced customer value through efficiency and sustainability improvements

- Streamlined development cycles for new client offerings

EDP Energias de Portugal cultivates diverse customer relationships, ranging from digital self-service for the masses to dedicated account management for large commercial and industrial clients. This hybrid approach ensures personalized support and tailored solutions, fostering loyalty and addressing specific needs. In 2024, EDP's digital channels saw a 15% increase in usage, while their call centers maintained a swift average response time of under 90 seconds, achieving a high customer satisfaction score of 8.5 out of 10.

| Relationship Type | Key Features | 2024 Data/Impact |

|---|---|---|

| Digital Self-Service | Online portals, mobile apps for account management, consumption viewing, and support. | Over 70% of customer interactions were online; 15% increase in digital channel usage. |

| Dedicated Account Management (C&I) | Personalized services, tailored energy solutions, strategic advice. | 5% increase in service customization requests from C&I clients. |

| Customer Service Centers | Multi-channel support (call centers, digital) for inquiries and issue resolution. | Call centers handled over 50,000 inquiries weekly; 40% of service requests via digital channels. |

| Community Engagement | Social development initiatives, local economic support, trust-building. | Continued commitment to social well-being in energy transition impact zones. |

| Technology Partnerships | Co-creation of innovative solutions with tech companies. | Launched pilot projects with tech partners for commercial client energy optimization. |

Channels

EDP leverages its corporate website and mobile applications as key digital gateways, facilitating customer engagement and efficient service delivery. These platforms offer round-the-clock access to essential information and account management tools, enhancing customer convenience. For instance, by the end of 2023, EDP reported a significant portion of its customer interactions occurring through digital channels, with millions of active users on its mobile app, underscoring their importance in the customer relationship strategy.

For B2B clients and major industrial users, EDP utilizes direct sales teams. These teams are instrumental in building and nurturing client relationships, hammering out contract terms, and crafting tailored energy solutions. This hands-on method is vital for addressing the intricate requirements of these larger customers.

In 2024, EDP reported a significant portion of its revenue derived from its large industrial and business clients, underscoring the importance of these direct sales efforts. These teams often handle multi-year, high-value contracts, making their role in customer acquisition and retention paramount for sustained revenue streams.

Call centers and customer service hotlines are a cornerstone of EDP's customer relations, offering essential human interaction for inquiries, technical support, and billing. These channels ensure that EDP can assist a wide range of customers, including those less comfortable with digital platforms. In 2024, a significant portion of customer interactions still occur through these traditional channels, highlighting their continued importance.

For EDP, these hotlines are not just about problem-solving; they are also crucial for building customer loyalty and trust. By providing direct, personal support, EDP can address complex issues and gather valuable feedback. This direct engagement is vital for understanding customer needs and improving service offerings.

Physical Offices and Retail Stores (where applicable)

Physical offices and retail stores remain a vital touchpoint for EDP, especially in regions where customers value direct, in-person service for consultations, contract amendments, and resolving complex queries. These locations provide a tangible presence, fostering trust and offering a more personalized customer experience compared to purely digital interactions. For instance, in 2024, EDP continued to operate a network of customer service centers across Portugal, facilitating over 500,000 in-person interactions annually, covering everything from new service sign-ups to technical support. This channel is particularly important for older demographics or those less comfortable with online platforms, ensuring accessibility to EDP's energy solutions.

The physical presence allows for the direct sale of energy-related products and services, such as smart meters or energy efficiency upgrades, with trained staff available to explain benefits and assist with installation processes.

- Customer Reach: Physical offices serve a segment of the customer base that prefers face-to-face interaction, contributing to customer satisfaction and retention.

- Sales Channel: Retail locations act as direct sales points for energy contracts and value-added services, driving revenue.

- Brand Presence: These offices reinforce EDP's brand visibility and accessibility within local communities.

- Support Hub: They function as essential hubs for customer support, troubleshooting, and administrative tasks.

Third-Party Distributors and Partners

EDP actively utilizes third-party distributors and partners to enhance market penetration, especially for specialized services like gas supply or distributed generation. These collaborations are crucial for reaching customers in diverse geographic areas and market segments where a direct presence might be less efficient. For instance, in 2024, EDP continued to expand its renewable energy solutions by partnering with local installers and energy service companies, allowing for a broader customer base for rooftop solar and energy storage systems.

These strategic alliances amplify EDP's market reach, enabling greater accessibility for its energy offerings. By working with established local entities, EDP can navigate regional complexities and build trust more effectively. This approach allows for a more agile expansion into new territories and customer segments.

- Expanded Reach: Partnerships allow EDP to serve customers in regions where establishing a direct operational footprint would be cost-prohibitive.

- Specialized Solutions: Collaborations with local experts facilitate the deployment of niche services like gas distribution infrastructure or advanced distributed generation projects.

- Market Penetration: In 2024, EDP's partner network contributed to a significant increase in the adoption of its distributed energy solutions, reaching an additional 15% of potential residential customers in underserved areas.

- Accessibility: By leveraging existing distribution networks and local knowledge, EDP improves the ease with which customers can access its products and services.

EDP employs a multi-channel strategy to engage its diverse customer base. Digital platforms, including its website and mobile app, are central for routine interactions and account management, evidenced by millions of active app users by late 2023. Direct sales teams are crucial for high-value B2B clients, securing complex, long-term contracts, which contributed significantly to EDP's 2024 revenue. Traditional channels like call centers and physical service centers remain vital for personalized support and for customers who prefer human interaction, with physical offices handling over 500,000 in-person interactions annually in 2024. Strategic partnerships with third-party distributors also extend EDP's market reach, particularly for specialized energy solutions, with its partner network boosting distributed energy solution adoption by 15% in underserved areas during 2024.

Customer Segments

Residential consumers are a core customer base for EDP, representing individual households that rely on consistent electricity and gas. These customers prioritize affordable pricing and straightforward service management, valuing stability in their energy supply for everyday living.

In 2024, the residential sector continues to be a major focus, with millions of households depending on EDP for their energy needs. Many are actively seeking competitive tariffs, with price sensitivity being a key driver in their purchasing decisions. Ease of use, from billing to service changes, is also highly valued.

Commercial and Small to Medium Enterprises (SMEs) are a cornerstone customer segment for EDP Energias de Portugal. These businesses, ranging from local bakeries to manufacturing firms, require dependable energy supply and efficient consumption management to maintain their operations and profitability. Many are actively seeking ways to reduce energy costs, with a significant portion of SMEs in Europe reporting energy prices as a major concern in 2024.

Tailored energy solutions are crucial for this diverse group. Whether it's a small retail store needing a straightforward electricity contract or a larger industrial SME requiring a more complex energy management system, EDP aims to meet these varying needs. Furthermore, the growing emphasis on corporate social responsibility means that sustainability options, such as renewable energy sourcing, are increasingly attractive to these businesses, with a notable uptick in demand for green energy tariffs among European SMEs in the past year.

Industrial clients and large corporations are key customers for EDP, demanding substantial, consistent energy volumes. They often seek tailored solutions, including long-term Power Purchase Agreements (PPAs) specifically for renewable energy sources. In 2023, EDP Renewables secured a significant PPA with a major industrial player in Spain for 220 GWh annually, demonstrating this segment's focus on stable, green energy procurement.

Public Sector and Municipalities

Public sector entities and local municipalities represent a significant customer segment for EDP Energias de Portugal. These government organizations procure energy solutions for a variety of applications, including public lighting, administrative buildings, and the broader infrastructure supporting public services.

A key driver for this segment is the increasing demand for energy efficiency and the integration of renewable energy sources. Municipalities often have specific mandates and public commitments towards sustainability and cost reduction, making them receptive to innovative and environmentally friendly energy strategies.

In 2023, for instance, Portugal continued to see investments in energy efficiency projects within the public sector, aiming to reduce operational costs and carbon footprints. Many municipalities are actively seeking partners to implement smart city solutions, which frequently include advanced lighting systems and renewable energy installations.

EDP's offerings are tailored to meet these requirements, providing not just energy supply but also solutions that enhance operational performance and contribute to environmental goals. This segment values reliable service, transparent pricing, and a demonstrable commitment to public good.

- Public Lighting: Municipalities are major clients for energy-efficient LED lighting upgrades, often incorporating smart controls to optimize energy consumption and operational management.

- Administrative Buildings: These entities require reliable energy supply for government offices, schools, and healthcare facilities, with a growing interest in on-site generation and energy management systems.

- Public Services: From water treatment plants to public transportation hubs, these operations rely on consistent and cost-effective energy, often with opportunities for renewable integration.

- Sustainability Mandates: Government entities are increasingly driven by environmental targets, seeking partners who can deliver solutions aligning with climate action plans and energy transition goals.

International Markets (Europe, North America, South America, Asia-Pacific)

EDP's global footprint extends across Europe, North America, South America, and the Asia-Pacific region, catering to a wide array of energy needs and market dynamics. This broad geographic reach is a strategic imperative, allowing EDP to tap into diverse growth opportunities and mitigate risks associated with single-market dependency. For instance, in 2024, EDP continued to strengthen its presence in renewable energy development across these key continents, aligning with global decarbonization trends.

In Europe, EDP is a significant player in Portugal, Spain, and France, focusing on both regulated and liberalized energy markets. North America, particularly the United States, represents a crucial growth area for EDP Renewables, with substantial investments in wind and solar projects. As of the first half of 2024, EDP Renewables had over 14 GW of installed capacity in operation and under construction across its global portfolio, with a significant portion in North America.

- Europe: Strong presence in Iberian Peninsula and expanding in France and Belgium, with a focus on grid modernization and renewable integration.

- North America: Significant investments in wind and solar power in the United States, contributing to EDP's global renewable expansion strategy.

- South America: Operations in Brazil and Colombia, primarily in renewable energy generation and distribution.

- Asia-Pacific: Emerging market presence, with initial ventures in renewable energy projects, aiming for future expansion.

EDP Energias de Portugal serves a diverse customer base, from individual households to large industrial entities and public sector organizations. Each segment has unique energy needs and priorities, ranging from cost-effectiveness and reliability to the growing demand for sustainable and efficient solutions.

The company's strategy involves tailoring its energy supply and services to meet these varied requirements, ensuring consistent delivery and value across all customer groups. This approach is crucial for maintaining market share and fostering long-term relationships.

In 2024, EDP continues to adapt its offerings, with a notable focus on renewable energy integration and digital solutions that enhance customer experience and operational efficiency for all its segments.

Cost Structure

EDP's cost structure is heavily influenced by substantial capital expenditures, particularly in renewable energy development and grid infrastructure. This includes significant outlays for constructing new wind farms, solar parks, and hydroelectric facilities, alongside investments to upgrade and expand its electricity transmission and distribution networks.

Looking ahead, EDP has ambitious plans for these critical areas. Between 2024 and 2026, the company intends to deploy billions of euros in capital investments. This financial commitment underscores the long-term, asset-intensive nature of the energy sector and EDP's strategic focus on transitioning and modernizing its energy portfolio.

Operational and Maintenance (O&M) costs are a substantial component of EDP's business model, covering the upkeep of its diverse energy infrastructure. These ongoing expenses are crucial for ensuring the reliable and efficient functioning of power generation facilities, extensive transmission and distribution networks, and vital IT systems. For instance, in 2023, EDP reported O&M expenses that directly support its commitment to maintaining asset integrity and operational excellence across its global portfolio.

These costs encompass everything from routine inspections and repairs of turbines and solar panels to the management of substations and the digital platforms that control energy flow. The continuous investment in O&M is directly linked to EDP's ability to deliver consistent energy supply and meet regulatory standards, thereby safeguarding its revenue streams and market position.

EDP's cost structure is significantly shaped by energy purchase and generation expenses. These costs primarily stem from acquiring electricity and natural gas on wholesale markets, alongside the direct expenditure on fuel for their thermal power plants. For 2024, these fluctuating market prices, influenced by global supply and demand dynamics as well as EDP's specific generation mix, represent a substantial operational outlay.

Employee Salaries and Benefits

EDP - Energias de Portugal's employee salaries and benefits are a significant component of its cost structure, reflecting its substantial global workforce. This compensation covers a diverse range of roles, including highly skilled engineers and technicians crucial for managing energy infrastructure, as well as administrative and customer service staff. In 2024, the company continued to invest in its human capital through training and development programs, aiming to enhance operational efficiency and foster innovation.

The cost of attracting and retaining talent is paramount for EDP. This includes not only base salaries but also comprehensive benefits packages, which are critical in the competitive energy sector. These investments are essential for maintaining the specialized expertise needed to operate and expand its renewable energy portfolio and traditional power generation assets.

- Employee Compensation: Covers salaries for engineers, technicians, administrative staff, and customer service personnel.

- Benefits Packages: Includes health insurance, retirement plans, and other employee welfare programs.

- Training and Development: Investments in skill enhancement and professional growth for the workforce.

- Global Workforce Costs: Reflects compensation for employees across EDP's international operations.

Financing Costs and Debt Servicing

Financing costs are a crucial element of EDP's operational expenses, stemming directly from its considerable capital expenditure requirements. The company's substantial investments in renewable energy projects and infrastructure necessitate significant borrowing. For instance, EDP's net financial debt stood at approximately €12.7 billion as of the end of 2023, requiring substantial interest payments.

These interest expenses directly impact EDP's profitability, reducing its net income. Effective management of net debt and financial leverage is therefore a paramount financial consideration for the company. Maintaining a healthy balance sheet and optimizing its capital structure are key strategies to mitigate the impact of these financing costs.

- Interest Expense Impact: In 2023, EDP reported finance costs of €536 million, a notable figure reflecting the cost of its debt.

- Debt Management Strategy: The company actively manages its net financial debt, which was €12.7 billion at the close of 2023, to control financing expenses.

- Leverage Ratios: Monitoring and managing financial leverage is a constant focus to ensure long-term financial stability and profitability.

EDP's cost structure is significantly influenced by its investments in renewable energy and grid modernization, requiring substantial capital expenditures. Operational and maintenance expenses are critical for ensuring the reliability of its diverse energy infrastructure, covering everything from routine upkeep to managing complex IT systems. Furthermore, the cost of energy purchases and fuel for thermal plants represents a major outlay, directly tied to fluctuating wholesale market prices.

Employee compensation, including salaries and benefits for its global workforce, is another key cost. Financing costs, driven by the company's significant debt to fund these investments, also play a crucial role in its overall expense profile.

| Cost Category | 2023 Data/2024 Outlook | Impact |

|---|---|---|

| Capital Expenditures | Billions planned for 2024-2026 in renewables and grid | Drives long-term asset growth and future revenue potential |

| Operational & Maintenance (O&M) | Significant ongoing expenses for asset upkeep | Ensures reliability, operational efficiency, and regulatory compliance |

| Energy Purchase & Generation | Substantial outlay influenced by 2024 market prices | Directly impacts profitability based on fuel and electricity costs |

| Employee Compensation | Investment in global workforce skills and development in 2024 | Essential for expertise in operations and innovation |

| Financing Costs | €536 million in finance costs reported for 2023; €12.7 billion net debt end of 2023 | Reduces net income; requires active debt management |

Revenue Streams

EDP - Energias de Portugal's core revenue stream stems from selling electricity directly to a broad customer base, encompassing households, businesses, and industrial facilities. This dual approach includes both regulated tariffs, where prices are set by authorities, and free-market sales, driven by supply and demand dynamics. For instance, in 2023, EDP's electricity sales volume reached significant levels, contributing substantially to its overall financial performance.

EDP's revenue streams include the direct sale of natural gas to a broad customer base, encompassing both residential and commercial users. This activity complements their electricity offerings, providing a more comprehensive energy solution for consumers and diversifying EDP's overall market presence.

In 2024, the natural gas market saw continued demand, with companies like EDP playing a crucial role in its distribution. For instance, in the first half of 2024, EDP reported significant volumes in gas sales, contributing to their robust financial performance and reinforcing their position as a key energy provider across their operational regions.

EDP's revenue from network tariffs and distribution fees is a cornerstone of its financial stability. This income is generated by allowing other energy providers to use EDP's extensive electricity distribution and transmission infrastructure, primarily in Portugal. These charges are regulated, meaning they are set by government authorities, providing a predictable and consistent income stream for the company.

In 2023, EDP's regulated asset base, which underpins these tariffs, was substantial, reflecting ongoing investments in grid modernization and expansion. For instance, the company continued to invest heavily in its networks to support the energy transition and ensure reliable supply. These investments are crucial for maintaining the value of the assets that generate these tariff-based revenues.

The predictable nature of these regulated tariffs makes them a vital component of EDP's overall earnings. Unlike market-driven energy sales, which can fluctuate with supply, demand, and commodity prices, network fees offer a degree of certainty. This stability allows EDP to plan its investments and operations with greater confidence, even amidst broader market volatility.

Power Purchase Agreements (PPAs) for Renewables

Power Purchase Agreements (PPAs) are a cornerstone for EDP - Energias de Portugal, offering a robust revenue stream by directly selling renewable energy to large corporations. These long-term contracts, often with tech giants, provide essential stability and predictability to EDP's financial outlook, securing future income for its renewable energy projects.

These agreements are crucial for financing new renewable developments, as they guarantee a buyer for the generated electricity at a pre-determined price. This de-risks investment and encourages further expansion of EDP's green energy portfolio.

- Secured Income: PPAs lock in revenue for extended periods, often 10-20 years, insulating EDP from volatile wholesale electricity market prices.

- Corporate Demand: Major corporations, particularly in the technology sector, are increasingly seeking PPAs to meet their sustainability goals and secure clean energy. In 2023, global corporate PPA announcements reached a record high, indicating strong market demand.

- Project Viability: The guaranteed revenue from PPAs is vital for attracting financing for new solar and wind farm construction.

- Predictable Cash Flow: This revenue stream contributes significantly to EDP's overall financial health and operational planning.

Energy Services and Solutions

EDP - Energias de Portugal generates revenue by offering a range of value-added energy services and solutions. This segment is experiencing growth as customers increasingly demand integrated approaches to their energy needs.

Key revenue streams within this area include energy efficiency solutions, which help customers reduce consumption and costs. Additionally, EDP generates income from the installation of distributed generation systems, such as rooftop solar panels, allowing customers to produce their own power. Smart energy management platforms also contribute, providing tools for optimizing energy usage and grid interaction.

- Energy Efficiency Solutions: Revenue from consulting, installation, and maintenance of systems designed to lower energy consumption for residential and commercial clients.

- Distributed Generation Installations: Income derived from the sale and installation of solar panels, battery storage, and other on-site energy generation technologies.

- Smart Energy Management: Fees from subscription-based platforms and services that enable customers to monitor, control, and optimize their energy usage through digital technologies.

- Integrated Energy Solutions: Bundled offerings combining multiple services, such as generation, efficiency, and management, to provide comprehensive energy management for businesses and homes.

For example, EDP's focus on these services is evident in its expansion of solar installations. By the end of 2023, EDP Renewables had a significant installed capacity, and the company continues to invest in new projects that directly feed into these revenue streams.

EDP - Energias de Portugal also generates revenue through the sale of electricity and gas in liberalized markets, where prices are determined by supply and demand. This segment allows EDP to capitalize on market opportunities and serve a wider customer base beyond regulated territories.

In 2023, EDP's gross profit from energy sales in liberalized markets showed resilience, reflecting effective trading strategies and demand management. For instance, the company's ability to secure competitive energy sources contributed to its profitability in this dynamic sector.

The company's financial reports for the first half of 2024 indicated continued strong performance in its liberalized energy sales, with volumes increasing due to strategic market positioning and favorable weather conditions impacting demand.

Business Model Canvas Data Sources

The EDP Business Model Canvas is meticulously constructed using a blend of publicly available financial disclosures, comprehensive market research reports on the energy sector, and internal strategic planning documents. This data ensures each component reflects EDP's current operational realities and future ambitions.