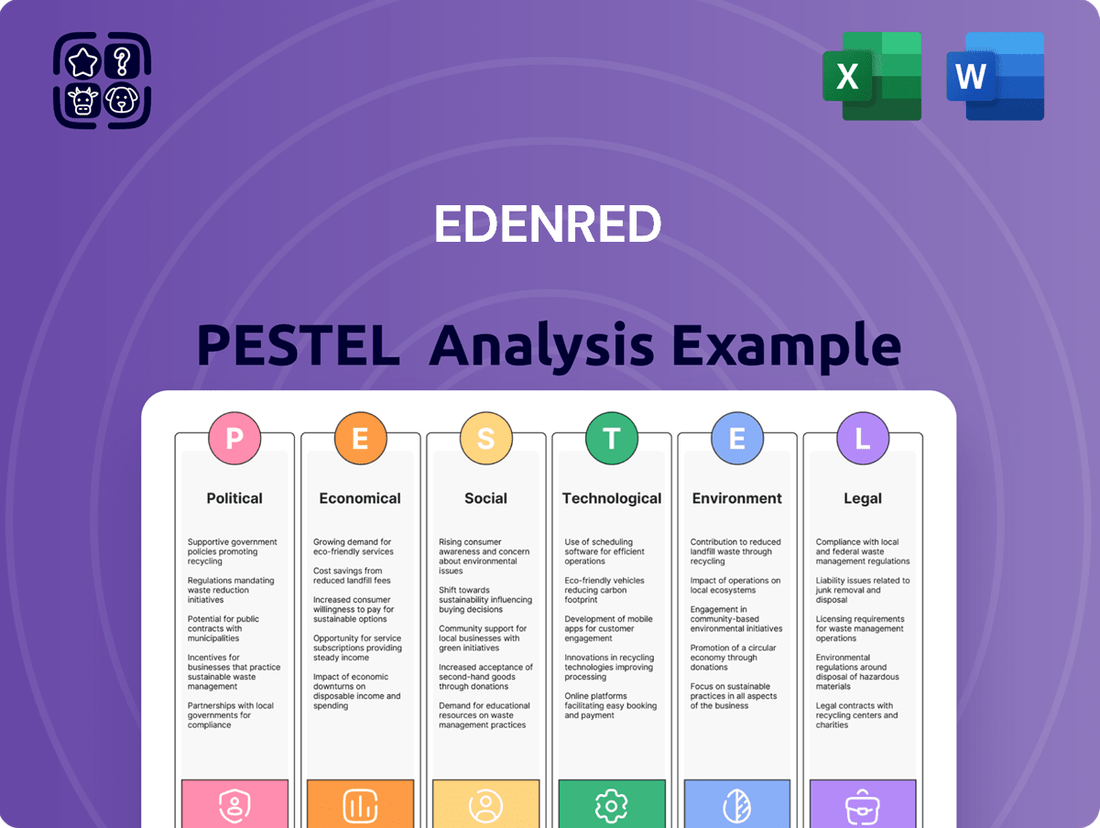

Edenred PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edenred Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Edenred's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to navigate this dynamic landscape. Download the full report to gain actionable intelligence and secure your competitive advantage.

Political factors

Government policies and regulations are a big deal for Edenred, shaping how they operate their core business of things like meal vouchers and fuel cards. These rules can really make or break their business model.

For instance, a new rule in Italy set for 2025 that puts a limit on what merchants can be charged for commissions is projected to affect Edenred's earnings before interest, taxes, depreciation, and amortization (EBITDA) significantly. This shows just how much national regulatory shifts can impact their financial performance.

Furthermore, changes and ongoing debates around employee benefits, like meal vouchers in France, present both potential upsides and downsides for Edenred, requiring them to stay adaptable.

Antitrust and competition policies are a significant consideration for Edenred, particularly in its dominant segments like employee benefits and mobility solutions. Regulatory bodies globally, including the French Antitrust Authority, actively scrutinize market concentration and business practices. For instance, in 2023, the French authority imposed a fine on Edenred for anti-competitive practices in the meal voucher market, highlighting the direct impact of these regulations.

Data privacy and security legislation is a critical political factor for Edenred. The company's operations, which involve managing sensitive personal and financial data for millions of users across various services like employee benefits and mobility solutions, are heavily impacted by stringent regulations. For instance, the General Data Protection Regulation (GDPR) in the European Union sets a high bar for data protection, and Edenred's commitment to compliance is non-negotiable to prevent hefty fines and maintain user confidence.

Edenred's adherence to these evolving data security standards is paramount. In 2023, the EU continued to emphasize data sovereignty and cross-border data transfer regulations, impacting how companies like Edenred process and store information. The company's proactive approach includes obtaining certifications such as SOC 2 Type II, demonstrating its commitment to robust data security practices and regulatory alignment, which is crucial for its reputation and operational integrity in the 2024-2025 period.

Government Support for Digital Transformation

Governments globally are increasingly championing digital transformation, particularly in the payments sector. For instance, the European Union's PSD2 directive, fully implemented by 2021, has spurred innovation in open banking and digital payment solutions, directly benefiting companies like Edenred. This political backing creates a fertile ground for Edenred's digital platforms, encouraging a faster transition away from traditional payment methods.

This governmental push for digitalization directly supports Edenred's strategic focus on expanding its digital infrastructure and user base. By fostering cashless societies and promoting fintech adoption, governments are effectively accelerating the growth of digital transaction volumes, which are crucial for Edenred's business model. For example, many countries are setting targets for digital payment penetration; in India, the Unified Payments Interface (UPI) has seen exponential growth, with over 100 billion transactions recorded in 2023, demonstrating the impact of government initiatives.

- Accelerated Adoption: Government incentives for digital payments boost user acquisition and transaction frequency on platforms like Edenred's.

- Regulatory Frameworks: Supportive regulations, such as those promoting open banking, enable Edenred to integrate new digital services and expand its offerings.

- Reduced Cash Dependency: Political efforts to minimize cash usage directly increase the reliance on digital payment solutions, benefiting Edenred's market share.

Geopolitical Stability and International Relations

Edenred's extensive global footprint, spanning operations in 45 countries as of late 2024, makes it inherently sensitive to shifts in geopolitical stability and international relations. For instance, political instability or changes in trade policies within key operational regions, especially in Latin America where Edenred has significant investments, can directly impact currency valuations and business volumes. In 2023, Edenred reported that its revenue in Latin America represented a substantial portion of its overall performance, highlighting the financial impact of regional political climates.

The company's ability to navigate these external pressures is crucial for maintaining its growth trajectory and strategic expansion plans. A strong financial foundation, evidenced by its solid liquidity and manageable debt levels reported in its 2024 financial statements, provides Edenred with the resilience needed to absorb the effects of fluctuating international trade agreements and potential economic disruptions stemming from geopolitical events.

- Global Reach: Edenred operates in 45 countries, exposing it to diverse geopolitical landscapes.

- Latin American Exposure: Key markets in Latin America are particularly susceptible to political shifts and currency fluctuations impacting revenue.

- Financial Resilience: A robust financial position is essential for Edenred to manage the uncertainties arising from international relations and trade policies.

- Impact on Strategy: Geopolitical factors directly influence business volumes, revenue streams, and the feasibility of expansion initiatives.

Government policies heavily influence Edenred's operations, from employee benefits to payment processing. For example, a 2025 Italian regulation capping merchant commissions could significantly impact Edenred's EBITDA. France's ongoing discussions on employee benefits also present evolving market dynamics.

Antitrust scrutiny, as seen with a 2023 French fine for anti-competitive practices, directly affects Edenred's market position. Furthermore, stringent data privacy laws like GDPR are critical, with ongoing EU emphasis on data sovereignty impacting cross-border operations in 2023-2024.

Government support for digital transformation, exemplified by the EU's PSD2 directive, benefits Edenred by fostering cashless societies and fintech adoption. This push accelerates digital transaction growth, aligning with Edenred's strategic expansion of its digital infrastructure.

Edenred's presence in 45 countries makes it vulnerable to geopolitical shifts; Latin America, a key revenue driver in 2023, is particularly sensitive to political instability and currency fluctuations.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Edenred, examining how Political, Economic, Social, Technological, Environmental, and Legal forces shape its operational landscape and strategic opportunities.

The Edenred PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thereby alleviating the pain point of information overload.

Economic factors

Inflation directly impacts the real value of the employee benefits Edenred facilitates, potentially affecting client demand for its services and the purchasing power of the benefits themselves. For instance, if inflation outpaces benefit adjustments, employees might perceive less value.

The interest rate environment is a crucial driver for Edenred's 'other revenue,' which is generated from the float on unspent funds. In 2024, as many central banks maintained or increased interest rates to combat inflation, this revenue stream saw a positive impact. For example, Brazil's Selic rate, which remained elevated through much of 2023 and into 2024, would have provided a significant boost to Edenred's float income in that market.

Overall economic growth and employment rates are critical drivers for Edenred. In a strong economy with low unemployment, businesses are more likely to expand their workforce and offer attractive employee benefits, directly boosting demand for Edenred's services. For instance, if a country experiences a GDP growth of 3% and its unemployment rate falls to 4% in 2024, this signals increased corporate spending and a larger pool of potential Edenred users.

Conversely, economic downturns or rising unemployment can dampen demand. A projected economic slowdown in Europe for 2025, potentially leading to a 0.5% contraction in GDP and a rise in unemployment to 6%, could mean fewer companies offering new benefits programs and reduced transaction volumes on Edenred's payment solutions as companies tighten their budgets.

As a global player with operations in many countries, Edenred is significantly exposed to the ups and downs of currency exchange rates. These fluctuations can really affect how their financial results look when reported in their home currency.

For instance, unfavorable currency movements, especially from key markets like Brazil, Mexico, and Argentina, have historically impacted Edenred's reported operating revenue and net debt figures. In 2023, for example, currency headwinds presented a challenge, though the company actively works to mitigate these effects.

Effectively managing these currency risks is therefore a critical component of Edenred's strategy to ensure stable and predictable financial performance across its diverse international operations.

Consumer Spending and Market Penetration

Consumer spending habits are a major driver for Edenred, particularly as more people embrace digital payment solutions. This shift directly boosts the volume of transactions the company processes. For instance, in 2023, global consumer spending on digital payments continued its upward trajectory, with projections indicating further growth through 2025.

Edenred is strategically targeting markets where its services have lower adoption rates, especially among small and medium-sized enterprises (SMEs). Their business model relies on building strong customer loyalty and offering subscription-based services, which creates a predictable and recurring revenue stream. This focus on market penetration is key to their revenue expansion strategy.

- Digital payment adoption: Global digital payment transaction volumes are projected to reach trillions of dollars by 2025, a significant increase from previous years.

- SME segment focus: Edenred aims to capture a larger share of the SME market, which often represents a significant portion of economic activity in many countries.

- Recurring revenue: Subscription-based models contribute to a stable revenue base, with Edenred's customer retention rates often exceeding 90% in mature markets.

- Market penetration: Expanding into underpenetrated geographies is a core growth lever, with some emerging markets showing potential for double-digit growth in employee benefits and payment solutions.

Acquisition and Investment Strategy

Edenred leverages its robust financial position to execute a proactive acquisition and investment strategy, aiming to broaden its service portfolio and expand its geographical footprint. This approach is central to its long-term growth and diversification objectives.

In 2024, Edenred demonstrated this commitment through substantial acquisitions totaling €510 million. Key investments included the acquisition of Spirii, a player in electric vehicle recharging solutions, and IP's energy card business in Italy. These moves are strategically designed to bolster its Beyond Food and Beyond Fuel segments.

These strategic acquisitions are crucial for Edenred's future trajectory:

- Expansion of Service Offerings: Integrating new services like EV recharging and energy card management diversifies Edenred's value proposition.

- Market Reach Enhancement: Acquisitions in new markets or complementary sectors solidify Edenred's presence and competitive standing.

- Strategic Diversification: The company actively pursues investments that align with its vision of becoming a leader in employee benefits and corporate payment solutions, moving beyond traditional offerings.

- Future Growth Driver: These targeted investments are foundational for driving sustained revenue growth and profitability in the evolving landscape of employee services and mobility solutions.

Economic factors significantly shape Edenred's operating environment, influencing both revenue generation and operational costs. Inflation directly affects the real value of employee benefits, potentially impacting client demand and employee perception of value. Interest rates, particularly in markets like Brazil, have a notable impact on Edenred's 'other revenue' derived from the float on unspent funds.

Strong economic growth and low unemployment generally boost demand for Edenred's services as companies expand and offer more benefits. Conversely, economic slowdowns or rising unemployment can lead to reduced corporate spending on benefits and lower transaction volumes. Currency exchange rate fluctuations also pose a risk, impacting reported financial results across Edenred's diverse international operations.

| Economic Factor | Impact on Edenred | 2024/2025 Data/Projection |

| Inflation | Reduces real value of benefits, potentially impacting demand. | Global inflation rates remained a concern in 2024, with varying impacts across regions. |

| Interest Rates | Boosts 'other revenue' from float on unspent funds. | Elevated interest rates in many economies in 2024 positively impacted float income. Brazil's Selic rate remained high. |

| Economic Growth/Unemployment | Strong growth/low unemployment increases demand; downturns decrease demand. | Projected 0.5% GDP contraction and 6% unemployment in Europe for 2025 could dampen demand. |

| Currency Exchange Rates | Fluctuations affect reported financial results. | Currency headwinds impacted results in 2023, with ongoing vigilance required for markets like Brazil and Mexico. |

Same Document Delivered

Edenred PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Edenred PESTLE analysis provides a comprehensive overview of the external factors influencing the company's strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape impacting Edenred.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis is designed to equip you with the knowledge needed to understand Edenred's market position and future opportunities.

Sociological factors

There's a significant shift in how companies view employee welfare, with a strong emphasis now placed on improving overall well-being, boosting purchasing power, and fostering a better work-life balance. This trend perfectly matches Edenred's core purpose of enriching lives through specialized employee benefit solutions.

Businesses are actively looking for benefit programs that are not only flexible but also tailored to individual employee needs, recognizing this as a key strategy for attracting and keeping top talent in a competitive job market.

Edenred's comprehensive suite of employee benefits, covering areas like meal vouchers, transportation, and incentive programs, directly addresses these changing demands. By offering these personalized solutions, Edenred helps companies enhance their appeal to potential hires and improve their operational efficiency.

The increasing reliance on digital tools and smartphones is reshaping how people manage their daily lives, including how they access and utilize employee benefits. This societal shift means that companies like Edenred must prioritize user-friendly digital platforms and mobile applications to cater to these evolving expectations. For instance, in 2024, mobile payment transactions are projected to exceed 2.5 trillion globally, underscoring the widespread consumer preference for digital convenience.

Edenred's investment in its digital ecosystem, including its mobile app, directly addresses this trend. By offering intuitive online solutions and facilitating seamless mobile transactions, Edenred aligns with the growing demand for instant access and ease of use. This digital focus is crucial as mobile-first lifestyles become the norm, particularly among younger demographics entering the workforce.

Societal awareness regarding sustainability is a powerful driver, pushing businesses like Edenred to integrate corporate social responsibility (CSR) deeply into their operations. This growing consciousness means consumers and employees alike are actively seeking out companies that demonstrate a commitment to ethical and environmentally sound practices.

There's a clear trend towards healthier eating, more sustainable transportation, and minimizing waste, creating a market demand for solutions that address these concerns. Edenred's 'Ideal' CSR policy directly responds to this by focusing on fostering healthier lifestyles and reducing environmental impact, aligning with consumer values.

Edenred's strategic partnerships, such as those with organizations dedicated to combating food waste, exemplify this commitment. For instance, their involvement in initiatives that redistribute surplus food directly tackles waste, a key concern for environmentally conscious consumers and a significant area of focus in ESG (Environmental, Social, and Governance) reporting for 2024 and beyond.

Demographic Shifts and Workforce Diversity

The global workforce is becoming increasingly diverse, with significant shifts in age, ethnicity, gender, and work styles. This evolving demographic landscape demands flexible and inclusive employee benefit programs. For instance, the rise of remote and hybrid work models, accelerated by events in 2020 and beyond, requires solutions that support a distributed workforce. In 2024, companies are increasingly looking at benefits that cater to individual employee needs rather than one-size-fits-all approaches.

Edenred recognizes these demographic changes and is actively adapting its offerings. Their commitment to diversity is evident in targets like achieving 40% of executive positions held by women by 2030, reflecting a broader societal push for gender parity in leadership. This focus on diversity extends to their benefit solutions, aiming to be relevant and accessible to all employees, regardless of their background or role.

To address the varied needs arising from workforce diversity, Edenred offers tailored benefit solutions. Lifestyle Spending Accounts (LSAs), for example, allow employees to choose benefits that best suit their personal circumstances, whether it's for wellness, education, or family support. This approach empowers employees and enhances their overall well-being, aligning with the growing expectation for personalized employee experiences in the modern workplace.

- Workforce Diversity: Global workforce demographics are shifting, with greater representation across age, background, and work arrangements.

- Edenred's Diversity Goal: The company aims for 40% of its executive positions to be held by women by 2030, highlighting a commitment to gender diversity.

- Adaptable Benefit Solutions: The need for flexible benefits like Lifestyle Spending Accounts (LSAs) is growing to meet diverse employee needs in 2024.

Influence of ESG Factors in Corporate Culture

Societal expectations increasingly place Environmental, Social, and Governance (ESG) factors at the core of corporate culture and strategic decisions. This shift impacts how companies operate and how employees engage with their employers. Edenred's robust extra-financial performance, evidenced by its inclusion in prominent ESG indices such as the Dow Jones Sustainability Indices (DJSI) Europe and World, highlights its alignment with these evolving societal priorities.

The growing societal emphasis on ESG principles directly influences corporate clients' selection of benefit providers. Businesses are more likely to partner with organizations that demonstrate a strong commitment to sustainability and ethical practices. For instance, a 2024 survey indicated that 65% of corporate buyers consider ESG performance a key factor when choosing service providers.

- Societal Demand: Growing public and investor pressure for responsible business practices.

- Corporate Client Preferences: Businesses are prioritizing ESG-aligned partners for their employee benefits and services.

- Edenred's ESG Standing: Inclusion in DJSI Europe and World signifies strong performance in sustainability and governance.

- Employee Engagement: ESG commitment can attract and retain talent who value ethical corporate behavior.

Societal expectations are increasingly prioritizing employee well-being and work-life balance, aligning perfectly with Edenred's mission to enhance lives through specialized benefits. Companies are actively seeking flexible, personalized benefit programs to attract and retain top talent in 2024, a trend Edenred addresses with its diverse offerings.

The digital transformation is profoundly impacting how benefits are accessed, with mobile solutions becoming paramount; global mobile payment transactions are projected to surpass 2.5 trillion in 2024. Edenred's investment in its digital platform ensures it meets this demand for convenience and instant access, particularly crucial for younger demographics.

Growing awareness of sustainability and health is shaping consumer and employee preferences, driving demand for ethically and environmentally conscious companies. Edenred's CSR initiatives, like combating food waste, directly cater to these values, with ESG performance becoming a key factor for 65% of corporate buyers selecting service providers in 2024.

Workforce diversity is a significant sociological factor, necessitating adaptable and inclusive benefit programs. Edenred's commitment to gender diversity, aiming for 40% of executive positions held by women by 2030, and its provision of tailored solutions like Lifestyle Spending Accounts reflect this evolving landscape.

Technological factors

Edenred's core business thrives on sophisticated digital payment technologies, encompassing mobile apps, web portals, and payment cards. The company's ongoing commitment to enhancing its platform ensures the secure and efficient processing of billions of transactions annually, a critical factor in its operational success.

The global push towards digital transactions, particularly in the employee benefits and mobility sectors, is a significant technological driver for Edenred. Innovations like Near Field Communication (NFC) and QR code scanning are instrumental in broadening the acceptance and usability of mobile payments worldwide, directly impacting Edenred's market reach and service delivery.

Artificial Intelligence (AI) and Machine Learning (ML) are pivotal technological drivers for Edenred, significantly boosting operational efficiency, bolstering fraud prevention measures, and elevating customer service capabilities. For instance, in 2024, Edenred continued to invest in AI-powered solutions to streamline its business processes.

AI-driven tools are instrumental in automating routine tasks, accelerating software development cycles, powering sophisticated chatbots for customer interactions, and enhancing the quality of generated content. This technological integration allows Edenred to allocate human resources to more strategic initiatives.

The application of AI within Edenred's invoice-to-pay workflows is particularly impactful, enabling the detection and prevention of fraudulent activities. This advancement cultivates a more secure and intelligent accounts payable ecosystem, a critical area for financial transaction integrity.

Edenred's digital platform thrives on cloud computing and serverless architectures, ensuring a remarkable 99.99% availability for its critical services in 2024. This robust infrastructure is the backbone for handling the millions of daily transactions processed by their various solutions.

The company's commitment to continuously enhancing its cloud infrastructure is key to its ability to rapidly deploy new services and manage its growing user base efficiently. This focus on scalability and reduced latency directly translates to a more reliable and responsive user experience.

Cybersecurity and Data Protection

Cybersecurity and data protection are absolutely critical for Edenred, especially since they handle so much sensitive customer information. Think about all the employee benefit accounts and payment details they manage. This isn't just a nice-to-have; it's fundamental to their operation.

Edenred places a huge emphasis on keeping data safe. They actively work to meet stringent data protection rules and have achieved certifications like SOC 2 Type II, which shows they're serious about security controls. For instance, in 2023, the global spending on cybersecurity solutions was projected to reach over $200 billion, highlighting the industry's focus on this area.

The stakes are incredibly high. A major cyberattack or data breach could lead to massive financial losses from fines and recovery efforts, not to mention the severe damage to their reputation and customer trust. Recent reports indicate that the average cost of a data breach in 2024 is expected to climb, further underscoring the need for robust defenses.

- Cybersecurity is paramount due to the sensitive customer data Edenred processes.

- Edenred prioritizes data security, adhering to strict regulations and holding certifications like SOC 2 Type II.

- Protecting against cyber threats is vital for maintaining customer trust and avoiding significant financial and reputational damage.

- Global cybersecurity spending is expected to exceed $200 billion in 2023, reflecting the critical importance of these measures across industries.

Development of APIs and Ecosystem Integration

The increasing demand for integrated payment solutions is a significant technological driver for Edenred. This trend pushes the company to actively develop and enhance its Application Programming Interfaces (APIs). These APIs are key to allowing Edenred's payment and benefits services to be smoothly incorporated into a wide array of third-party platforms and Enterprise Resource Planning (ERP) systems.

By facilitating these API integrations, Edenred creates a more connected and user-friendly ecosystem. This open innovation strategy is vital for broadening the accessibility of their offerings and improving the overall customer experience, making it easier for businesses and employees to manage their benefits and payments.

For instance, in 2024, the global API management market was valued at approximately $5.1 billion and is projected to grow substantially. This growth underscores the critical role APIs play in digital transformation and ecosystem building, directly benefiting companies like Edenred that leverage them for service integration.

- API Growth: The global API management market is expected to reach over $15 billion by 2029, highlighting the increasing reliance on interconnected digital services.

- Ecosystem Value: Companies with strong API strategies report higher revenue growth, with some studies indicating up to 30% higher growth compared to peers.

- Platform Integration: Edenred's focus on API development allows its solutions to be embedded within over 50,000 partner platforms, enhancing utility and user adoption.

- Digital Payments Adoption: In 2024, over 70% of consumer transactions globally involved digital payment methods, reinforcing the need for seamless integration of payment solutions.

Edenred's technological advancement is heavily influenced by the rapid evolution of digital payment methods, including mobile and contactless solutions. The company's continued investment in AI and machine learning is crucial for enhancing fraud detection and streamlining operations, as evidenced by their 2024 focus on AI-powered process optimization.

Cloud infrastructure is fundamental to Edenred's service availability, with their critical services achieving 99.99% uptime in 2024, supporting millions of daily transactions. Furthermore, robust cybersecurity measures, underscored by their SOC 2 Type II certification and adherence to data protection regulations, are paramount to safeguarding sensitive customer data and maintaining trust in an era where data breach costs are escalating.

| Technological Factor | Impact on Edenred | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Digital Payment Evolution | Drives adoption of mobile and contactless solutions. | Over 70% of global consumer transactions were digital in 2024. |

| AI & Machine Learning | Enhances fraud detection, operational efficiency, and customer service. | Continued investment in AI for process optimization in 2024. |

| Cloud Infrastructure | Ensures high service availability and scalability. | 99.99% uptime for critical services in 2024. |

| Cybersecurity & Data Protection | Critical for trust and compliance; mitigates financial/reputational risk. | Global cybersecurity spending projected over $200 billion in 2023; average data breach cost increasing in 2024. |

| API Integration | Facilitates seamless integration into third-party platforms and ERP systems. | Global API management market valued at ~$5.1 billion in 2024, growing substantially. |

Legal factors

Edenred's global operations necessitate strict adherence to diverse data protection regulations, notably the General Data Protection Regulation (GDPR). The company's commitment to secure personal data processing is clearly outlined in its privacy policy, reflecting compliance with GDPR and other regional data privacy laws.

Failure to comply with these stringent regulations, such as GDPR, can result in significant financial penalties. For instance, GDPR fines can reach up to €20 million or 4% of a company's annual global turnover, whichever is higher, posing a substantial risk to Edenred's financial health and market standing.

The regulatory landscape for employee benefits and payment services is highly fragmented globally, with each nation imposing its own set of rules. This means Edenred must navigate a complex web of compliance, impacting how it operates and generates revenue in different regions.

A significant development is Italy's planned introduction of a merchant fee cap, set to take effect in 2025. This cap is expected to reduce Edenred's EBITDA by an estimated €20 million in 2025, highlighting the direct financial consequences of such regulatory changes.

These specific industry regulations, like fee caps, directly affect the financial viability and operational strategies of companies like Edenred. Consequently, ongoing vigilance and strategic adjustments are crucial to mitigate risks and capitalize on opportunities within these evolving legal frameworks.

Labor laws globally are increasingly shaping employee benefit landscapes, directly impacting companies like Edenred. For instance, in 2024, many European Union countries are seeing discussions around strengthening worker protections and expanding mandatory benefits, such as enhanced parental leave or mental health support. This means Edenred must continually adapt its platform to ensure compliance with varying national mandates, which can range from statutory sick pay to mandatory pension contributions, potentially creating demand for new, compliant benefit solutions.

Anti-Money Laundering (AML) and KYC Requirements

As a significant player in the financial services sector, Edenred faces rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are vital to combat financial crime and ensure continued operation. Compliance necessitates strong internal processes and vigilant monitoring.

Failure to comply can lead to substantial penalties. For instance, in 2023, financial institutions globally faced billions in AML-related fines, highlighting the financial risks of non-adherence.

- Regulatory Scrutiny: Edenred must maintain robust systems to verify customer identities and monitor transactions for suspicious activity, a standard practice across the fintech industry.

- Operational Costs: Implementing and maintaining effective AML/KYC programs involves significant investment in technology and personnel, impacting operational expenses.

- Reputational Risk: Non-compliance can severely damage Edenred's reputation, affecting customer trust and business partnerships.

Intellectual Property Rights

Intellectual property rights are crucial for Edenred's sustained competitive edge. Protecting its proprietary technologies, digital platforms, and innovative solutions through patents, trademarks, and copyrights for its software and payment systems is paramount. Safeguarding these valuable assets deters unauthorized use and fosters an environment conducive to continuous innovation, particularly in areas like digital payment solutions and employee benefits platforms.

Edenred actively leverages its intellectual property portfolio to maintain market leadership. For instance, as of early 2024, the company continued to invest in patent applications for its evolving digital payment technologies and data analytics capabilities, aiming to secure its position in the rapidly digitizing employee benefits and corporate services sectors. This focus on IP protection is essential for preventing competitors from replicating its unique service offerings and for ensuring the long-term value of its technological investments.

The company's commitment to intellectual property is reflected in its ongoing efforts to secure and defend its brand and technological innovations. This includes vigilance against infringement of its trademarks, which are vital for brand recognition and trust among employers and employees. By maintaining robust IP protection, Edenred ensures that its investments in research and development translate into tangible, defensible market advantages.

Edenred must navigate a complex and evolving legal landscape, particularly concerning data protection and financial regulations. For example, the company's adherence to GDPR, with potential fines up to 4% of global turnover, underscores the financial risks of non-compliance. Furthermore, Italy's planned 2025 merchant fee cap is projected to reduce Edenred's EBITDA by €20 million, illustrating the direct impact of specific regulatory changes on its profitability.

Environmental factors

Edenred has committed to significant carbon emission reductions, targeting a 51.4% cut in absolute Scope 1 and 2 greenhouse gas emissions by 2030. This ambitious goal, validated by the Science Based Targets initiative (SBTi) in 2024, underscores the company's dedication to environmental stewardship.

Furthermore, Edenred has pledged to reach net-zero emissions across its entire value chain by 2050. This long-term vision aligns with global efforts to combat climate change and positions Edenred as a forward-thinking organization in sustainability.

Edenred is significantly investing in eco-friendly solutions, notably expanding its Beyond Fuel offerings to include electric vehicle (EV) charging, exemplified by its acquisition of Spirii. This strategic move addresses the increasing demand for sustainable mobility options.

The company is also tackling food waste through various partnerships, aligning with a broader environmental consciousness. For instance, in 2023, Edenred's Ticket Restaurant solution in France saw a 15% increase in digital usage, indicating a shift towards more sustainable service delivery methods.

Environmental factors are increasingly shaping investment strategies, with a growing emphasis on Environmental, Social, and Governance (ESG) criteria. Edenred demonstrates a strong commitment to these principles, as evidenced by its consistent inclusion in prestigious ESG indices such as the Dow Jones Sustainability Indices (DJSI) Europe and World. This recognition, coupled with high ratings from agencies like S&P Global, underscores the company's robust ESG performance and its alignment with evolving investor expectations for transparency and sustainability.

Edenred's proactive approach to ESG reporting is further highlighted by its 2024 double materiality assessment. This assessment is crucial for complying with the new European Sustainability Reporting Standards (ESRS), which mandate a comprehensive evaluation of a company's impacts and how sustainability issues affect its business. By undertaking this assessment, Edenred is positioning itself to meet stringent regulatory requirements and to provide investors with detailed, reliable information on its sustainability performance.

Resource Consumption and Waste Management

Edenred is actively working to minimize its environmental impact by focusing on resource consumption and waste management. A key initiative is reducing their carbon footprint and optimizing resource use across all operations. This commitment is evident in their data centers, where they aim for greater energy efficiency and have already achieved 60% of their electricity from renewable sources.

Their Green IT strategy promotes practices like eco-coding and extending the useful life of IT equipment, further contributing to sustainability efforts. These actions align with growing global expectations for corporate environmental responsibility.

- Energy Efficiency: Edenred is optimizing energy consumption in its data centers.

- Renewable Energy: 60% of electricity used in their data centers comes from renewable sources.

- Green IT: Initiatives include eco-coding and extending equipment lifespan.

- Waste Reduction: The company aims to reduce overall waste across its operations.

Sustainable Mobility and Food Initiatives

Edenred is actively driving sustainable mobility by offering multi-energy fuel cards that now encompass electric vehicle charging. This strategic move supports the growing demand for cleaner transportation options. The company also invests in developing sustainable transport ecosystems, recognizing the broader shift towards environmentally conscious commuting and logistics.

In the food sector, Edenred champions initiatives to combat food waste and encourage healthier eating. For instance, their 'NutriCOOLtura' campaign in Romania directly promotes nutritious and sustainable food choices among consumers. This focus aligns with increasing consumer awareness and regulatory pressures regarding environmental impact and well-being.

- EV Charging Integration: Edenred's fuel cards now include EV charging capabilities, reflecting the 2024 surge in electric vehicle adoption, which saw a significant percentage increase in new EV registrations across Europe compared to 2023.

- Food Waste Reduction Partnerships: Collaborations with anti-waste organizations highlight Edenred's commitment to sustainability in the food industry, a sector facing growing scrutiny over its environmental footprint.

- Healthy Eating Campaigns: Initiatives like 'NutriCOOLtura' directly address consumer trends towards healthier lifestyles and sustainable consumption patterns, a key focus for 2024-2025.

Edenred's environmental strategy centers on ambitious emission reductions, targeting a 51.4% cut in Scope 1 and 2 greenhouse gas emissions by 2030, a goal validated by the SBTi in 2024. They are also committed to net-zero emissions across their value chain by 2050, demonstrating a long-term dedication to climate action.

The company is actively investing in sustainable mobility, integrating electric vehicle charging into its multi-energy fuel cards, a move that aligns with the significant growth in EV adoption observed in 2024. Edenred also addresses food waste and promotes healthy eating through initiatives like its 'NutriCOOLtura' campaign in Romania.

Edenred's commitment to ESG is recognized through its inclusion in indices like the DJSI Europe and World, and high ratings from S&P Global. Their 2024 double materiality assessment ensures compliance with ESRS, providing investors with transparent sustainability data.

Furthermore, Edenred's Green IT strategy, including eco-coding and extending equipment lifespans, alongside a focus on energy efficiency in data centers, where 60% of electricity is renewable, showcases a holistic approach to minimizing their environmental footprint.

| Environmental Target | Metric | Status/Year | Initiative |

| GHG Emission Reduction (Scope 1 & 2) | 51.4% absolute reduction | By 2030 (SBTi validated 2024) | Operational efficiency, renewable energy sourcing |

| Net-Zero Emissions | Across value chain | By 2050 | Supply chain engagement, sustainable product development |

| Renewable Energy Use (Data Centers) | 60% | Achieved | Green IT strategy, energy efficiency measures |

| Sustainable Mobility | EV Charging Integration | Ongoing (2024 focus) | Multi-energy fuel cards, partnerships |

PESTLE Analysis Data Sources

Our Edenred PESTLE Analysis is built upon a robust foundation of data from reputable sources including government publications, international financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Edenred.