Edenred Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edenred Bundle

Unlock the strategic genius behind Edenred's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap for their market dominance. Perfect for anyone seeking to understand or replicate their winning formula.

Dive deep into Edenred's operational blueprint with the full Business Model Canvas. Discover their key partners, activities, and cost structure that fuel their growth and innovation. This actionable insight is invaluable for strategists and aspiring entrepreneurs.

Want to know what makes Edenred tick? Our complete Business Model Canvas provides an in-depth look at their customer relationships, channels, and competitive advantages. Download the full version to gain a strategic edge and accelerate your own business planning.

Partnerships

Edenred's success hinges on its extensive global network of over 2 million partner merchants, encompassing restaurants, fuel stations, and retailers. This vast ecosystem is fundamental to the usability of Edenred's specialized payment solutions, allowing employees to access a wide range of services.

The strategic management and continuous growth of this merchant network are paramount. In 2024, Edenred continued to focus on onboarding new partners and strengthening existing relationships to ensure its solutions remain convenient and valuable for both corporate clients and end-users.

Companies and employers are the bedrock of Edenred's business, acting as the main buyers and distributors of its employee benefit and engagement solutions. In 2024, Edenred continued to solidify these B2B relationships, recognizing them as crucial for sustained growth and predictable revenue. These partnerships are long-term, often involving multi-year contracts that ensure a steady income for Edenred.

Edenred’s success hinges on its ability to deeply integrate with its corporate clients, understanding their unique needs to customize offerings that boost employee satisfaction and operational effectiveness. This collaborative approach allows Edenred to deliver tailored programs that resonate with both the employer and their workforce.

Edenred's success hinges on strong ties with financial institutions and payment processors. These collaborations are vital for the secure and efficient handling of transactions, which is the bedrock of their service offerings.

By partnering with banks and payment networks, Edenred facilitates card issuing and payment automation. This allows them to effectively manage their float, ensuring a smooth digital payment experience for their users. In 2023, Edenred reported a significant increase in digital payment transactions, underscoring the importance of these financial partnerships.

These strategic alliances are instrumental in supporting Edenred's comprehensive invoice-to-pay solutions and corporate travel payment services. For instance, their integration with major payment gateways enables businesses to streamline expense management and employee benefits distribution, a critical function for companies of all sizes.

Technology and Software Providers

Edenred collaborates with key technology and software providers to bolster its digital offerings. These partnerships, encompassing cloud services, AI specialists, and ERP/accounting software firms, are fundamental to creating advanced solutions and ensuring seamless integration. For instance, in 2024, Edenred continued to leverage partnerships for its eMobility solutions, aiming to simplify corporate fleet management and employee benefits. These alliances are crucial for maintaining the security, scalability, and operational efficiency of its transaction processing systems.

These strategic alliances enable Edenred to integrate cutting-edge technologies, such as artificial intelligence for fraud detection and enhanced user experiences, and cloud computing for robust data management. The company's focus on embedded payment solutions also relies heavily on partnerships with financial technology providers to offer seamless payment experiences within client workflows. In 2024, the ongoing digital transformation within the employee benefits and mobility sectors underscored the importance of these technological collaborations for maintaining a competitive edge and delivering innovative services.

- Cloud Computing Providers: Essential for hosting and scaling Edenred's digital platforms, ensuring high availability and data security.

- AI Developers: Crucial for enhancing services through intelligent automation, personalized recommendations, and advanced analytics.

- ERP/Accounting Software Firms: Vital for seamless integration with clients' existing financial systems, simplifying expense management and reporting.

- Fintech Specialists: Key partners for developing and implementing embedded payment solutions and innovative transaction methods.

Acquisition and Integration Partners

Edenred actively pursues strategic acquisitions to bolster its business model, integrating new capabilities and market access. For instance, the acquisition of Reward Gateway in 2022, a significant move, aimed to enhance its employee benefits and engagement solutions. This partnership, alongside others like Spirii for EV charging solutions and RB for corporate payment services, illustrates Edenred's commitment to expanding its service portfolio and geographic reach.

These integrations are crucial for accelerating Edenred's strategic objectives, particularly its Beyond Food and Beyond Fuel initiatives. By bringing in new technologies and customer segments, these partnerships directly contribute to diversifying the company's revenue streams and strengthening its global presence. For example, Reward Gateway brought a substantial customer base in the UK and US, aligning with Edenred's goal of becoming a leading platform for employee engagement.

The impact of these partnerships is evident in Edenred's financial performance and market positioning. In 2023, Edenred reported strong growth, partly driven by the successful integration of its acquired businesses. The company continues to scout for opportunities that align with its long-term vision, ensuring that its key partnerships are drivers of innovation and sustainable growth across its diverse business lines.

Key partnership highlights include:

- Reward Gateway Acquisition: Strengthened employee engagement and benefits offerings, expanding into new markets.

- Spirii Integration: Enabled entry into the electric vehicle charging solutions market, supporting the Beyond Fuel strategy.

- RB Partnership: Enhanced corporate payment solutions, broadening the scope of its business services.

- Global Footprint Expansion: Acquisitions and partnerships have been instrumental in increasing Edenred's presence in key international markets.

Edenred's key partnerships extend to financial institutions and payment processors, which are critical for enabling secure and efficient transactions, the core of its service delivery. These collaborations facilitate card issuance and payment automation, allowing Edenred to manage its float effectively and ensure a seamless digital payment experience for users. In 2023, a notable increase in digital payment transactions highlighted the indispensable role of these financial alliances.

Furthermore, Edenred collaborates with a wide array of technology and software providers, including cloud services, AI specialists, and ERP/accounting software firms. These partnerships are vital for developing advanced digital solutions and ensuring smooth integration with clients' existing systems. For example, in 2024, Edenred continued to leverage these alliances for its eMobility solutions, aiming to simplify corporate fleet management and employee benefits.

| Partner Type | Role | Impact/Example |

| Financial Institutions & Payment Processors | Transaction processing, card issuance, payment automation | Ensures secure and efficient digital payments; managed float effectively. |

| Technology & Software Providers | Platform hosting, AI enhancement, system integration | Enables advanced solutions like eMobility; ensures scalability and security. |

| Merchants | Service provision to end-users | Vast network (over 2 million) critical for usability of Edenred's solutions. |

| Corporate Clients | Primary customers and distributors | Long-term contracts ensure predictable revenue and tailored program delivery. |

What is included in the product

A detailed breakdown of Edenred's strategy, outlining its customer segments, value propositions, and revenue streams in the employee benefits and payment solutions market.

Edenred's Business Model Canvas acts as a pain point reliver by providing a clear, structured overview of how they solve employee needs for meal and benefits, streamlining complex HR processes for businesses.

Activities

Edenred's core operations revolve around building and upkeep of its digital ecosystems, including user-friendly mobile apps and robust online platforms. These are the engines that power their employee benefits and payment solutions.

Significant investment is funneled into advanced technologies like artificial intelligence, cloud infrastructure, and cybersecurity. For instance, in 2023, Edenred reported a substantial increase in its IT spending, aiming to bolster the security and efficiency of its platforms, which process billions of transactions annually.

This commitment to technological advancement is not just about maintaining current services; it's a strategic imperative. By staying at the forefront of digital innovation, Edenred aims to enhance user experience, expand service offerings, and solidify its competitive edge in the rapidly evolving digital payments and employee benefits landscape.

Edenred's core activity involves aggressively growing its global merchant network, ensuring users have extensive options for spending their benefits. This means constantly bringing new businesses onboard, from local eateries to large retail chains.

The company actively manages these merchant relationships, which includes negotiating favorable terms and providing the necessary technology for seamless integration of Edenred's payment systems. In 2023, Edenred reported a network of over 2 million merchants across its various solutions, a testament to its ongoing expansion efforts.

Edenred's key activities center on acquiring new corporate and public sector clients through targeted sales and marketing. This is crucial for expanding their reach and driving revenue growth.

Managing these relationships is equally vital. Edenred focuses on understanding unique client needs to offer customized solutions, fostering loyalty and ensuring consistent recurring revenue streams.

By deepening engagement with its existing base of 1 million corporate clients, Edenred aims to maximize customer lifetime value and solidify its market position.

Solution Design and Product Innovation

Edenred's core activities revolve around the meticulous design and continuous innovation of specialized payment solutions. This spans critical areas like employee benefits, corporate mobility, and efficient payment processing for businesses. By actively identifying unmet market needs and developing novel features, Edenred ensures its offerings remain relevant and competitive. A key aspect is the strategic integration of technologies acquired through mergers and acquisitions, bolstering its comprehensive service portfolio.

The company's forward-thinking approach is exemplified by its strategic pillars: 'Beyond Food,' 'Beyond Fuel,' and 'Beyond Payment.' These initiatives underscore a commitment to expanding its service ecosystem beyond traditional offerings. For instance, their 'Beyond Fuel' strategy aims to broaden mobility solutions beyond simple fuel payments, incorporating electric vehicle charging and fleet management services. In 2024, Edenred continued to invest heavily in R&D, with a significant portion of its innovation budget dedicated to these strategic growth areas, aiming to capture emerging market trends and solidify its position as a leader in specialized payment solutions.

- Solution Design: Developing tailored payment platforms for employee benefits, mobility, and corporate expenses.

- Product Innovation: Creating new features and services to address evolving market demands and customer needs.

- Technology Integration: Seamlessly incorporating acquired technologies to enhance existing and new product offerings.

- Strategic Expansion: Pursuing 'Beyond Food,' 'Beyond Fuel,' and 'Beyond Payment' initiatives to broaden service scope.

Transaction Processing and Security

Edenred's core operations revolve around the secure and efficient processing of a massive volume of transactions. This underpins the entire ecosystem, ensuring seamless exchanges between employers, employees, and merchants.

The company's infrastructure is designed for high throughput and unwavering security, handling billions of transactions annually. This focus on operational excellence is paramount for maintaining trust and reliability across its diverse service offerings.

- Secure Transaction Handling: Processing billions of transactions securely and efficiently is a critical operational activity for Edenred.

- Robust Infrastructure: This involves a robust payment infrastructure, fraud prevention measures, and strict adherence to financial regulations.

- System Resilience: Edenred emphasizes the safety and resilience of its systems to ensure uninterrupted service.

- 2024 Volume: In 2024, Edenred processed over €45 billion in business volume through its digital assets, highlighting the scale of its transaction processing capabilities.

Edenred's key activities focus on developing and maintaining its digital platforms, including user-friendly apps and robust online systems that power its employee benefits and payment solutions. Significant investments are made in advanced technologies like AI and cloud infrastructure to enhance user experience and maintain a competitive edge. In 2023, Edenred reported a notable increase in IT spending to fortify platform security and efficiency.

A crucial activity involves expanding its global merchant network, onboarding new businesses to provide users with a wide array of spending options. Edenred actively manages these merchant relationships, negotiating terms and facilitating seamless integration of its payment systems. By the end of 2023, Edenred boasted a network of over 2 million merchants worldwide.

Acquiring new corporate and public sector clients through targeted sales and marketing is vital for Edenred's growth. Simultaneously, the company prioritizes managing these client relationships by offering customized solutions to foster loyalty and ensure recurring revenue. Edenred aims to maximize customer lifetime value by deepening engagement with its existing base of 1 million corporate clients.

Edenred continuously designs and innovates specialized payment solutions for employee benefits, corporate mobility, and business payment processing. This includes integrating acquired technologies to broaden its service portfolio, exemplified by its strategic 'Beyond Food,' 'Beyond Fuel,' and 'Beyond Payment' initiatives. In 2024, substantial R&D investment continued in these growth areas.

The secure and efficient processing of billions of transactions annually is fundamental to Edenred's operations, ensuring seamless exchanges between employers, employees, and merchants. The company maintains a robust infrastructure designed for high throughput and security, with a focus on operational excellence to build trust and reliability. In 2024, Edenred processed over €45 billion in business volume through its digital assets.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Digital Ecosystem Development | Building and maintaining user-friendly apps and online platforms. | Increased IT spending in 2023. |

| Merchant Network Expansion | Onboarding new businesses to increase user spending options. | Over 2 million merchants by end of 2023. |

| Client Acquisition & Management | Gaining new clients and fostering loyalty through customized solutions. | 1 million corporate clients. |

| Solution Innovation | Designing and improving payment solutions, including strategic expansions. | Investments in 'Beyond Food,' 'Beyond Fuel,' 'Beyond Payment' in 2024. |

| Transaction Processing | Securely handling a high volume of financial transactions. | Processed over €45 billion in business volume in 2024. |

Full Document Unlocks After Purchase

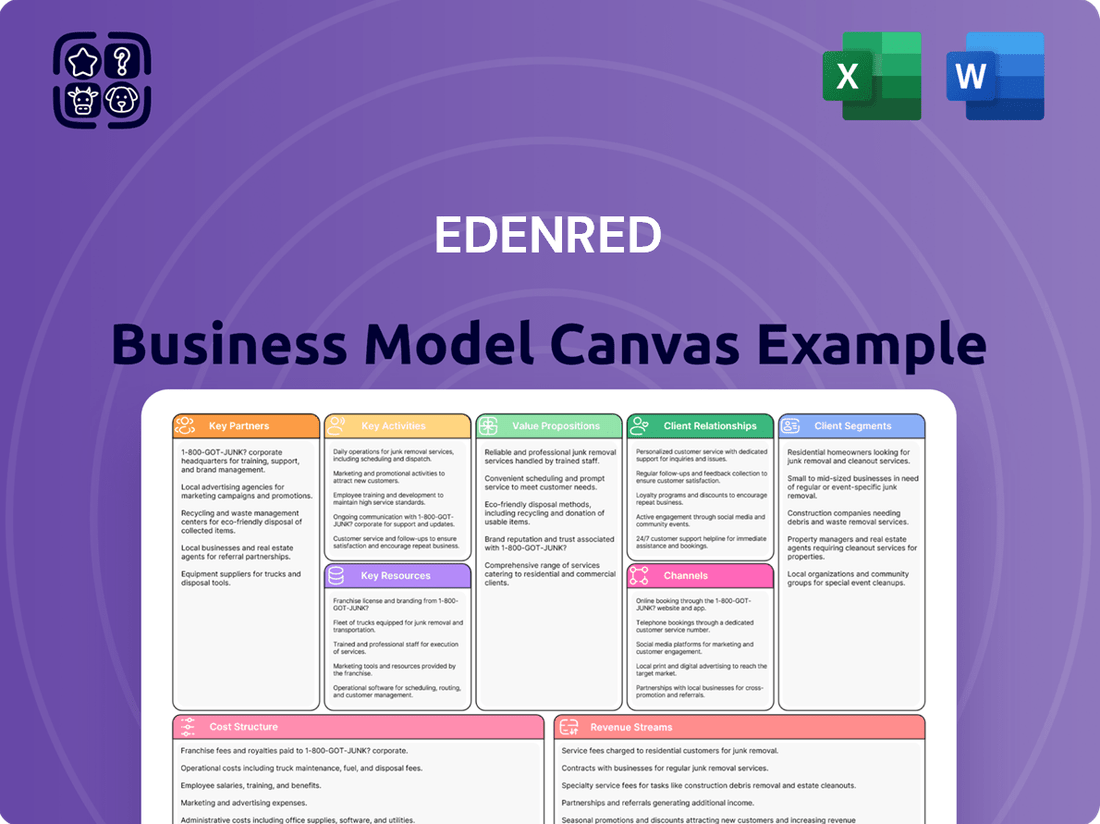

Business Model Canvas

The Edenred Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you get a direct, unedited look at the complete, ready-to-use analysis. Once your order is complete, you’ll have full access to this same professionally structured and formatted document, ensuring no surprises and immediate usability.

Resources

Edenred's proprietary digital platforms, including its mobile apps and online portals, are the backbone of its operations, handling millions of transactions daily. These advanced systems are powered by significant investments in artificial intelligence, cloud computing, and robust cybersecurity measures, ensuring efficiency, security, and the ability to scale operations smoothly.

The company's commitment to technological leadership is further underscored by its team of 3,500 dedicated tech employees. This substantial workforce is instrumental in developing and maintaining the sophisticated infrastructure that processes a vast volume of employee benefits and engagement solutions.

Edenred's extensive global merchant network, boasting over 2 million partners across 45 countries, is a foundational asset. This vast reach ensures broad acceptance for their employee benefits and engagement solutions, directly serving 60 million users.

This network is not just large; it's a critical differentiator that fuels Edenred's value proposition. It provides unparalleled convenience and choice for users, which in turn drives significant transaction volume and strengthens the ecosystem.

Edenred's extensive network of roughly 1 million corporate clients worldwide is a cornerstone of its business model, ensuring a consistent stream of recurring revenue. This vast client base provides a solid platform for introducing and upselling additional services, fostering deeper client engagement.

These established, often long-term, relationships are critical for Edenred's ongoing success. The company's demonstrated ability to not only retain these clients but also to consistently acquire new ones is fundamental to its sustained growth trajectory and market position.

Brand Reputation and Trust

Edenred’s brand reputation is a cornerstone of its business model, built on decades of providing reliable and secure payment solutions. This strong reputation translates directly into trust from its diverse customer base, including employers, employees, and a vast network of merchants. In 2024, this trust is crucial as the company continues to expand its digital offerings and maintain its leadership in employee benefits and payment solutions.

This cultivated trust enhances Edenred's competitive advantage by making it easier to attract and retain clients, as well as onboard new merchants to its platform. The company's commitment to simplifying daily life for employees and improving the world of work underpins this trust, fostering loyalty and encouraging deeper engagement with its services. For instance, Edenred’s consistent delivery of value supports its ability to forge strategic partnerships, further solidifying its market position.

The company's global presence, with operations in 42 countries, further amplifies its brand recognition and the trust associated with it. This extensive network allows Edenred to leverage its reputation to enter new markets and adapt its solutions to local needs, reinforcing its image as a dependable partner. In 2024, this global trust is a significant asset as businesses increasingly seek established and reliable partners for their employee welfare and payment processing needs.

Key aspects of Edenred's brand reputation and trust include:

- Global Leadership: Recognized worldwide for specialized payment solutions, fostering confidence among stakeholders.

- Reliability and Security: A proven track record in secure transaction processing and dependable service delivery.

- Commitment to Work-Life Improvement: A core value that resonates with employers and employees, building strong relationships.

- Facilitation of Partnerships: Trust acts as a catalyst for new collaborations and business growth.

Human Capital and Expertise

Edenred's 12,000 employees represent a vital asset, with significant expertise concentrated in technology, sales, and operations. This skilled workforce is fundamental to the company's ability to innovate and deliver its comprehensive suite of employee benefits and engagement solutions.

The team's proficiency in developing and managing intricate client and partner relationships is a cornerstone of Edenred's success. Their operational excellence ensures the smooth functioning of services, directly impacting customer satisfaction and loyalty.

- Technological Prowess: Employees driving innovation in digital platforms and payment solutions.

- Sales Acumen: A dedicated sales force adept at expanding market reach and client acquisition.

- Operational Excellence: Teams ensuring the seamless delivery and management of services across diverse markets.

- Client Relationship Management: Expertise in fostering strong, long-term partnerships with businesses and service providers.

Edenred's key resources are its robust digital platforms, a vast global merchant network, a substantial corporate client base, a strong brand reputation built on trust, and its skilled workforce. These elements collectively enable Edenred to deliver its specialized payment solutions and employee engagement services effectively across its international operations.

The company's technological infrastructure, including AI and cloud computing, supports millions of daily transactions, managed by 3,500 tech employees. Its merchant network spans over 2 million partners in 45 countries, serving 60 million users, while its 1 million corporate clients provide recurring revenue. In 2024, Edenred's global presence and commitment to reliability continue to bolster its brand trust and competitive edge.

| Resource | Description | Impact |

|---|---|---|

| Digital Platforms | Proprietary, AI-powered mobile apps and online portals | Handle millions of transactions daily, ensuring efficiency and security |

| Merchant Network | Over 2 million partners in 45 countries | Provides broad acceptance and choice for 60 million users |

| Corporate Clients | Approximately 1 million worldwide | Ensures recurring revenue and platform for upselling services |

| Brand Reputation | Built on decades of reliable and secure payment solutions | Fosters trust, attracts clients and merchants, and enhances partnerships |

| Workforce | 12,000 employees with expertise in tech, sales, and operations | Drives innovation, client relationship management, and operational excellence |

Value Propositions

Edenred provides businesses with streamlined tools for managing employee benefits and corporate expenses, directly boosting operational efficiency and offering better cost control. For instance, in 2024, companies using Edenred's expense management solutions reported an average reduction of 15% in processing time for expense reports.

These solutions also significantly contribute to employee engagement and well-being. By offering flexible benefits and simplifying access, Edenred helps companies create a more attractive workplace, improving talent retention. Surveys from late 2023 indicated that organizations offering comprehensive digital benefits platforms, like those from Edenred, saw a 10% higher employee satisfaction rate.

Furthermore, Edenred's offerings facilitate tax optimization for employers and simplify complex administrative tasks. This allows businesses to focus more on strategic growth rather than getting bogged down in paperwork, ultimately providing a tangible competitive advantage in the labor market.

Employees gain significant purchasing power, allowing them to stretch their budgets further. This increased financial flexibility translates directly into an improved quality of life.

Access to a diverse array of services, from meals to transportation and special incentives, enhances daily convenience. Edenred's digital platforms make managing and using these benefits incredibly simple.

These solutions empower employees with greater choice and flexibility in how they leverage their benefits, directly contributing to their overall well-being and daily satisfaction. For instance, in 2023, Edenred's solutions facilitated over 2.7 billion employee transactions across its platforms.

Partner merchants benefit from a significant influx of new customers through Edenred's extensive network, translating into a notable boost in sales volume and increased foot traffic. For instance, in 2024, Edenred's platforms facilitated billions of transactions, directly driving revenue for its merchant partners.

Edenred simplifies payment processes, offering merchants guaranteed and timely settlements, which significantly reduces their administrative workload and financial uncertainty. This streamlined approach supports local economies by ensuring consistent cash flow for businesses.

For Fleet Managers: Optimized Mobility and Cost Control

Edenred offers fleet managers comprehensive solutions for managing fuel, electric vehicle charging, maintenance, and tolls. These services are designed to provide enhanced control over expenses and boost operational efficiency. For instance, in 2024, companies utilizing integrated fleet management platforms reported an average of 15% reduction in fuel costs.

These mobility solutions actively support the shift towards greener transportation and provide intelligent data for optimizing fleet performance. By leveraging smart insights, fleet managers can make informed decisions to reduce their carbon footprint and improve overall fleet utilization. The adoption of EV charging management, a key component, saw a 25% increase among European fleets in the first half of 2024.

- Optimized Cost Control: Reduced fuel, maintenance, and toll expenses through integrated management.

- Enhanced Operational Efficiency: Streamlined processes for charging, refueling, and repairs.

- Support for Energy Transition: Facilitates the adoption and management of electric vehicles.

- Smart Fleet Insights: Data-driven recommendations for improved fleet performance and optimization.

For Public Sector: Efficient Social Program Distribution

Edenred provides secure and efficient digital platforms for public sector entities to distribute social programs. These solutions ensure that funds are used for intended purposes, reaching the correct beneficiaries with enhanced transparency and accountability. For instance, in 2024, Edenred's solutions facilitated the distribution of billions in social benefits across various European countries, directly impacting local economies by stimulating consumption within designated sectors.

This approach significantly boosts the effectiveness of public spending, offering a clear audit trail for every transaction. By digitizing the distribution process, public administrations can reduce administrative overhead and improve the speed at which aid reaches citizens. This, in turn, vitalizes local economies through targeted spending. For example, a 2024 report indicated that regions utilizing Edenred's welfare distribution systems saw a 15% increase in local retail spending compared to traditional methods.

- Enhanced Transparency: Digital platforms provide real-time tracking of fund allocation and usage, reducing opportunities for misuse.

- Targeted Distribution: Ensures social program funds are directed to specific needs and intended recipients.

- Economic Stimulation: Facilitates spending within local economies, supporting small businesses and communities.

- Improved Accountability: Offers robust reporting and audit capabilities for public fund management.

Edenred's value proposition centers on simplifying and enhancing employee benefits and corporate expense management for businesses. This translates to improved operational efficiency and better cost control, with companies reporting an average 15% reduction in expense report processing time in 2024. Furthermore, it boosts employee engagement and well-being by offering flexible benefits, leading to a 10% higher employee satisfaction rate in organizations with comprehensive digital benefit platforms.

Employees benefit from increased purchasing power and greater flexibility in how they use their benefits, improving their quality of life and daily satisfaction. Edenred's digital platforms simplify access to a wide range of services, facilitating over 2.7 billion employee transactions in 2023 alone.

Merchants gain access to a broad customer base, driving sales volume and foot traffic, with Edenred platforms facilitating billions of transactions in 2024. They also benefit from simplified, guaranteed, and timely settlements, reducing administrative burdens and financial uncertainty.

For fleet managers, Edenred offers solutions for fuel, EV charging, maintenance, and tolls, providing enhanced expense control and operational efficiency. Companies using these platforms saw an average 15% reduction in fuel costs in 2024, and EV charging management adoption grew by 25% in early 2024.

Public sector entities leverage Edenred's secure digital platforms for transparent and efficient distribution of social programs. This enhances public spending effectiveness, with a 15% increase in local retail spending observed in regions using these systems in 2024.

| Customer Segment | Value Proposition | Key Metrics (2023-2024 Data) |

|---|---|---|

| Businesses | Streamlined employee benefits & expense management, operational efficiency, cost control, improved employee engagement & retention. | 15% reduction in expense report processing time (2024); 10% higher employee satisfaction (late 2023). |

| Employees | Increased purchasing power, greater flexibility in benefit usage, improved quality of life, enhanced daily convenience. | 2.7 billion+ employee transactions facilitated (2023). |

| Merchants | Access to new customers, increased sales volume, simplified payment processes, guaranteed settlements. | Billions of transactions facilitated (2024). |

| Fleet Managers | Enhanced expense control, operational efficiency, support for EV transition, smart fleet performance insights. | 15% reduction in fuel costs (2024); 25% increase in EV charging management adoption (early 2024). |

| Public Sector | Transparent & efficient social program distribution, enhanced public spending effectiveness, improved accountability. | Billions in social benefits distributed (2024); 15% increase in local retail spending (2024). |

Customer Relationships

Edenred cultivates customer relationships through robust automated digital self-service channels, featuring user-friendly web portals and mobile apps. These platforms empower clients, merchants, and end-users to independently manage accounts and conduct transactions, enhancing convenience and operational efficiency for their extensive user base.

Edenred assigns dedicated account managers and sales teams, particularly for its large corporate clients. This ensures a high level of personalized support and strategic guidance.

These dedicated teams work closely with clients to understand their unique needs, offering tailored solutions that foster deep integration with Edenred's services. This approach is crucial for maintaining strong client relationships and ensuring high satisfaction rates.

In 2024, Edenred reported continued growth in its B2B services, with a significant portion of this driven by the retention and expansion of key corporate accounts, underscoring the value of its dedicated relationship management model.

Edenred prioritizes customer relationships through a comprehensive support system. This includes readily available hotlines, live chat, and increasingly, AI-driven virtual assistants. These channels are designed to provide swift resolutions for users, merchants, and corporate clients, fostering a sense of reliability.

In 2024, Edenred continued to invest in its customer service infrastructure. For instance, their digital platforms are equipped with self-service options and extensive FAQs, aiming to reduce resolution times. This focus on efficient and accessible support is crucial for maintaining high levels of trust and encouraging repeat engagement with their services.

Community and Engagement Initiatives

Edenred actively cultivates its ecosystem through a range of community and engagement initiatives. These efforts are designed to create a stronger sense of belonging for both its users and the merchants on its platform.

- Loyalty Programs: Edenred offers robust loyalty programs for its merchant partners, incentivizing continued participation and rewarding their commitment. For example, in 2023, their digital solutions saw significant adoption, with a substantial portion of their merchant network actively utilizing engagement features.

- Employee Well-being: For employees, Edenred promotes well-being programs, fostering a positive and supportive environment. These initiatives contribute to increased user satisfaction and retention across their various benefit solutions.

- Digital Community Building: The company leverages digital platforms to connect users and merchants, facilitating feedback and fostering a collaborative community. This digital engagement is crucial for understanding evolving needs and driving innovation within the Edenred network.

Data-Driven Insights and Optimization

Edenred significantly strengthens customer relationships by offering data-driven insights that go beyond simple transaction processing. For corporate clients, this means providing actionable analytics to optimize their operations. For example, fleet managers utilizing Edenred's solutions gain access to detailed data on fuel consumption and vehicle maintenance patterns, enabling them to make informed decisions that reduce costs and improve efficiency.

- Data Analytics for Fleet Optimization: Providing fleet managers with insights into fuel usage and maintenance schedules.

- Merchant Performance Insights: Offering merchants data to understand customer spending habits and optimize their offerings.

- Personalized Offers: Leveraging data to present tailored benefits and rewards to end-users, enhancing engagement.

- Client Retention through Value-Added Services: Demonstrating ongoing commitment to client success by providing tools for operational improvement.

Edenred fosters strong customer connections through a blend of digital self-service, personalized account management, and robust community engagement. Their approach prioritizes accessibility and tailored support, ensuring both corporate clients and individual users feel valued and efficiently served. This multifaceted strategy is key to their sustained success and high retention rates.

Channels

Edenred employs a dedicated direct sales force to connect with a broad range of businesses, from burgeoning SMEs to established large corporations. This team is instrumental in onboarding new clients and fostering deeper engagement.

This direct channel is vital for identifying and securing new business opportunities, as well as for expanding the services offered to existing clients. It allows for tailored solutions and personalized relationship management.

In 2024, Edenred's direct sales efforts were a significant driver of growth, contributing to a substantial portion of new client acquisition. This hands-on approach ensures that client needs are thoroughly understood and met effectively.

Edenred's proprietary web platforms and mobile applications serve as the core channels for delivering its services and engaging with both users and merchants. These digital touchpoints are crucial for facilitating transactions, allowing for easy account management, and providing convenient access to employee benefits. For instance, in 2023, Edenred reported that its digital solutions accounted for a significant portion of its total transaction volume, reflecting the growing reliance on these platforms.

Edenred strategically partners with financial institutions, ERP providers, and travel management companies. These collaborations allow Edenred to embed its solutions within existing business workflows, significantly broadening its market access and distribution channels. For instance, in 2024, Edenred continued to expand its integrations with major ERP systems, aiming to simplify expense management for businesses of all sizes.

Integrated APIs and Embedded Solutions

Integrated APIs and embedded solutions are crucial for Edenred's corporate payment and specialized services. These offerings allow clients to seamlessly integrate Edenred's functionalities directly into their existing Enterprise Resource Planning (ERP) and accounting systems. This creates a highly automated and efficient channel for Business-to-Business (B2B) transactions, reducing manual input and potential errors.

By embedding Edenred's payment and service platforms, businesses can streamline their financial operations. For example, in 2023, Edenred reported significant growth in its digital solutions, with over 90% of its business volume processed digitally, highlighting the importance of these integrated channels. This approach fosters a frictionless experience for managing employee benefits, business expenses, and other corporate services.

- API Integrations: Facilitate direct connection between Edenred's platform and client ERP/accounting software.

- Embedded Solutions: Allow clients to utilize Edenred's services within their own existing workflows and systems.

- Automated B2B Transactions: Drive efficiency and reduce administrative burden for corporate clients.

- Enhanced User Experience: Provide a seamless and integrated approach to managing payments and services.

Marketing and Communication Campaigns

Edenred leverages a multi-faceted approach to marketing and communication, ensuring its brand and innovative solutions reach key stakeholders. Digital marketing, including targeted online advertising and content marketing, plays a significant role in reaching potential corporate clients and employees. Public relations efforts focus on building brand credibility and highlighting Edenred's impact on employee well-being and business efficiency.

Corporate events and sponsorships further enhance brand visibility and provide platforms for direct engagement with clients and partners. In 2023, Edenred reported a 10.5% like-for-like increase in revenue, demonstrating the effectiveness of its outreach strategies in driving business growth.

- Digital Marketing: Targeted campaigns across social media, search engines, and industry-specific platforms to attract new corporate clients and users.

- Public Relations: Media outreach, press releases, and thought leadership content to showcase Edenred's value proposition and industry expertise.

- Corporate Events: Participation in and hosting of industry conferences, webinars, and client appreciation events to foster relationships and generate leads.

- Partnership Marketing: Collaborative campaigns with merchants and employers to promote the benefits of Edenred's platform to a wider audience.

Edenred utilizes a direct sales force to engage businesses, from small to large enterprises, ensuring tailored solutions and strong client relationships. This channel was a key driver for new client acquisition in 2024. Furthermore, Edenred's digital platforms, including web and mobile apps, are central to service delivery and user/merchant interaction, handling a significant portion of transaction volume as seen in 2023.

Strategic partnerships with financial institutions and ERP providers embed Edenred's solutions into existing business workflows, expanding market reach. API integrations and embedded solutions streamline B2B transactions by connecting directly with client ERP systems, enhancing efficiency. In 2023, over 90% of Edenred's business volume was processed digitally, underscoring the importance of these integrated channels.

Edenred's marketing efforts encompass digital campaigns, public relations, and corporate events to build brand awareness and attract clients. In 2023, these outreach strategies contributed to a 10.5% like-for-like revenue increase.

| Channel Type | Description | Key Activities | 2023/2024 Impact |

|---|---|---|---|

| Direct Sales | Dedicated sales team for client acquisition and engagement. | Onboarding, relationship management, upselling services. | Significant driver of new client acquisition in 2024. |

| Digital Platforms (Web/Mobile) | Proprietary platforms for service delivery and user interaction. | Transaction processing, account management, benefit access. | Handled a significant portion of total transaction volume in 2023. |

| Partnerships | Collaborations with financial institutions, ERP providers, etc. | Embedding solutions into existing business workflows. | Expanded market access and distribution in 2024 through ERP integrations. |

| API Integrations & Embedded Solutions | Seamless integration with client ERP/accounting systems. | Automated B2B transactions, streamlined financial operations. | Over 90% of business volume processed digitally in 2023. |

| Marketing & Communications | Digital marketing, PR, events, and sponsorships. | Brand building, lead generation, client engagement. | Contributed to 10.5% like-for-like revenue increase in 2023. |

Customer Segments

Corporate clients, encompassing both small and medium-sized enterprises (SMEs) and large multinational corporations, are a cornerstone of Edenred's business model. These employers procure Edenred's comprehensive suite of solutions to streamline the administration of employee benefits, manage corporate expenses, and optimize employee mobility programs.

These businesses are driven by a need for enhanced operational efficiency, significant cost savings, and robust compliance with evolving regulations. Furthermore, they leverage Edenred's offerings as strategic tools to attract top talent and foster employee loyalty, recognizing the impact of well-managed benefits on workforce engagement and retention.

In 2024, the demand for integrated expense management solutions saw a notable uptick. For instance, a significant portion of European businesses reported that digitalizing expense reporting reduced processing times by an average of 30%, a key driver for adopting platforms like Edenred's.

Employees, numbering over 60 million globally, are the direct beneficiaries of Edenred's comprehensive suite of solutions. They utilize these benefits, ranging from meal vouchers and fuel cards to gift cards, which are provided by their employers to enhance their daily lives.

These end-users prioritize convenience and seek to maximize their purchasing power. Edenred's offerings are designed to provide a better quality of life by ensuring the easy and secure management and utilization of these valuable employee benefits.

Partner Merchants are the backbone of Edenred's ecosystem, representing over 2 million businesses globally. This diverse group includes everything from local restaurants and supermarkets to larger retail chains and essential service providers like fuel stations. In 2024, these merchants were actively seeking solutions to drive customer footfall and streamline their payment processes.

These businesses leverage Edenred's payment solutions primarily to attract a wider customer base, as millions of consumers use Edenred cards and platforms. They value the guaranteed payment aspect, which reduces administrative burden and financial risk. Furthermore, the ease of transaction processing offered by Edenred's technology contributes to operational efficiency, allowing them to focus more on serving their customers.

Public Sector Organizations

Public sector organizations, including government bodies and public institutions, are key customers for Edenred. They leverage Edenred's platforms to efficiently distribute social welfare programs and manage specific public expenditures. These entities prioritize secure, transparent, and highly efficient fund disbursement mechanisms to ensure accountability and reach beneficiaries effectively. For instance, in 2024, governments worldwide continued to explore digital solutions for social aid, with Edenred's services facilitating payments for initiatives like meal assistance or employee benefits for public sector workers.

These organizations seek robust solutions that offer:

- Enhanced security and fraud prevention in the disbursement of public funds.

- Streamlined administrative processes for managing large-scale welfare or benefit programs.

- Transparent tracking and reporting capabilities to ensure compliance and operational oversight.

- Scalable platforms capable of handling diverse beneficiary groups and program requirements.

Fleet Managers and Mobility Professionals

Fleet managers and mobility professionals represent a key customer segment for Edenred, specifically those responsible for overseeing company vehicle fleets. Their primary concerns revolve around optimizing operational efficiency and reducing costs associated with fleet management.

These professionals are actively seeking integrated solutions that address critical areas such as fuel management, predictive maintenance scheduling, toll processing, and the increasingly important transition to electric vehicle (EV) fleets. For instance, as of 2024, the global fleet management market is projected to reach over $30 billion, highlighting the significant demand for such services.

- Fuel Optimization: Solutions that monitor and analyze fuel consumption to identify and reduce waste, potentially saving companies 5-10% on fuel costs annually.

- Maintenance Tracking: Tools to schedule and manage vehicle maintenance, minimizing downtime and extending asset life, which can reduce repair costs by up to 15%.

- Toll Management: Streamlined processing of toll payments and recovery, simplifying administration and ensuring compliance.

- EV Transition Support: Features to manage charging infrastructure, track EV battery health, and optimize charging schedules, crucial as EV adoption accelerates with many companies setting ambitious EV targets by 2030.

Edenred serves a broad customer base, from large corporations seeking efficient employee benefit administration to small businesses aiming to attract talent. These corporate clients are focused on cost savings and regulatory compliance, with a growing emphasis on digital expense management solutions, which saw a 30% reduction in processing times in 2024 for many European firms.

Employees, numbering over 60 million globally, are the direct users of Edenred's services, valuing convenience and enhanced purchasing power. Partner merchants, exceeding 2 million worldwide, benefit from increased customer traffic and simplified payment processes, a key driver for their engagement in 2024.

Public sector organizations utilize Edenred for secure and transparent distribution of social welfare programs, a trend that continued to grow in 2024 as governments sought digital aid solutions. Fleet managers also represent a significant segment, focused on optimizing fuel, maintenance, and the transition to electric vehicles, a market projected to exceed $30 billion in 2024.

Cost Structure

Edenred heavily invests in R&D to enhance its digital offerings. This includes significant spending on artificial intelligence, cloud infrastructure, robust cybersecurity measures, and the creation of entirely new solutions. This focus ensures they remain at the forefront of technological advancement in their sector.

In 2024, the company allocated €217 million in capital expenditure specifically for technology. This substantial investment underscores Edenred's dedication to maintaining a competitive edge through continuous technological innovation and platform upgrades.

Edenred incurs significant costs in acquiring and retaining its corporate clients. These include expenses for its sales force, extensive marketing campaigns, advertising, and various promotional activities designed to reach and engage businesses.

The company's strategic focus on penetrating the Small and Medium-sized Enterprise (SME) market, a key growth driver, directly contributes to these sales, marketing, and client acquisition expenses. For instance, in 2023, Edenred's operating expenses, which encompass these costs, were €1,761.5 million.

Edenred incurs significant operational and transaction processing costs to maintain its digital payment platforms. These include fees for processing a high volume of transactions, which are essential for its core business of providing employee benefits and services. For instance, in 2023, Edenred reported operating expenses of €1,781 million, a substantial portion of which is tied to these ongoing platform management activities.

Customer support centers and robust data management are also key cost drivers, ensuring the reliability and security of its services. The company invests in network infrastructure to support its extensive digital ecosystem, which facilitates seamless transactions for millions of users and thousands of merchants. These expenditures are critical for upholding service quality and user trust.

Merchant Commissions and Incentives

Edenred incurs costs through commissions paid to its extensive network of partner merchants. These commissions are a direct expense for facilitating transactions when businesses and their employees use Edenred's meal, gift, or employee benefit solutions. For instance, in 2023, Edenred continued to manage these commission structures across its diverse markets, balancing merchant acquisition with profitability.

Incentives are also a significant cost component, aimed at both retaining existing merchants and attracting new ones to broaden the acceptance network. These can include performance-based bonuses or preferential commission rates. The company actively works to optimize these incentives to ensure a robust and appealing merchant ecosystem. For example, efforts in 2024 focus on digital onboarding and support to streamline merchant engagement and reduce associated costs while maintaining network growth.

Regulatory environments can directly influence these costs. A notable example is Italy, where caps on merchant commissions for certain types of services have been implemented. Such regulations require Edenred to adapt its commission strategies and potentially absorb some of the cost difference or adjust service offerings. This highlights the dynamic nature of managing merchant relationships and the associated financial outlays.

- Merchant Commissions: Payments to partner merchants for accepting Edenred solutions.

- Merchant Incentives: Costs incurred to maintain and expand the merchant network.

- Regulatory Impact: Changes like commission caps (e.g., Italy) can affect these expenses.

- Network Growth: Costs associated with attracting and retaining merchants are crucial for service accessibility.

Human Resources and Administrative Costs

Edenred's human resources and administrative costs are substantial, reflecting its global footprint and employee base. In 2024, the company continued to invest heavily in its approximately 12,000 employees worldwide, covering salaries, comprehensive benefits packages, and ongoing training programs designed to foster talent development and operational efficiency. These investments are crucial for maintaining a skilled workforce capable of navigating the complexities of the digital payments and employee benefits sectors.

Beyond personnel expenses, a significant portion of these costs is allocated to general administrative functions. This includes essential support services, legal counsel, and robust compliance measures necessary to operate effectively and ethically across its 45 diverse operating countries. Ensuring adherence to local regulations and maintaining high standards of corporate governance are paramount to Edenred's long-term success and reputation.

- Employee Compensation: Salaries and benefits for a global workforce of around 12,000 individuals.

- Talent Development: Investment in training and development programs to enhance employee skills.

- Global Operations Support: General administrative expenses supporting business functions across 45 countries.

- Legal and Compliance: Costs associated with legal services and regulatory adherence in all operating regions.

Edenred's cost structure is significantly impacted by its substantial investments in technology and R&D, aiming to bolster its digital platforms and introduce innovative solutions. These expenditures are critical for maintaining a competitive edge in the evolving fintech landscape.

The company also incurs considerable costs related to client acquisition and retention, particularly within the SME segment, which involves extensive sales, marketing, and advertising efforts. Furthermore, operational and transaction processing fees for its digital payment systems represent a core expense, alongside customer support and data management.

Merchant commissions and incentives are another major cost driver, essential for building and maintaining a widespread acceptance network. These costs are managed to balance merchant engagement with profitability, with regulatory changes, such as commission caps in certain markets, also influencing these expenses.

Finally, human resources and administrative costs, including employee compensation, benefits, training, and global operational support across 45 countries, form a substantial part of Edenred's overall cost base.

| Cost Category | Description | 2023/2024 Data Point |

|---|---|---|

| Technology & R&D | Investment in AI, cloud, cybersecurity, new solutions | €217 million in capital expenditure for technology (2024) |

| Sales & Marketing | Client acquisition and retention, especially SMEs | €1,761.5 million in operating expenses (2023) |

| Operations & Transaction Processing | Maintaining digital platforms, processing high transaction volumes | €1,781 million in operating expenses (2023) |

| Merchant Network Costs | Commissions and incentives for partner merchants | Ongoing management of commission structures, adapting to regulations (e.g., Italy) |

| Human Resources & Administration | Employee compensation, benefits, training, global support | Approx. 12,000 employees globally; costs supporting operations in 45 countries |

Revenue Streams

Edenred's core revenue generation stems from service fees levied on corporate clients. These fees are tied to the provision, oversight, and administration of specialized payment solutions designed for employee benefits and incentives.

These fees are typically recurring, calculated either as a percentage of the total funds issued or on a per-employee basis. For instance, in 2024, Edenred continued to leverage this model, with a significant portion of its revenue derived from these corporate partnerships.

Edenred generates revenue by taking a commission or interchange fee from merchants for every transaction processed through its employee benefits and engagement solutions. This fee is typically a percentage of the transaction value. For example, in 2023, Edenred's total revenue reached €2,533 million, with a significant portion stemming from these merchant-based fees.

Edenred generates revenue from the interest earned on the float, which are funds preloaded by corporate clients and held by Edenred before users redeem them. This financial income stream is directly tied to prevailing interest rates and the overall volume of business transactions processed.

In 2024, the company's financial income, largely driven by this float, contributed significantly to its 'other revenue' category. For instance, during the first half of 2024, Edenred reported a notable increase in its financial income, reflecting both higher interest rate environments and robust transaction volumes across its platforms.

Subscription and Platform Fees

Edenred generates revenue through subscription and platform fees for its specialized services. These fees apply to clients and merchants accessing enhanced functionalities beyond the basic offerings. For instance, advanced employee engagement platforms and sophisticated fleet management tools typically fall under these fee structures.

These premium services are designed to provide additional value, such as deeper analytics, customized reporting, or integrated HR solutions. For example, the Edenred group's acquisition of Reward Gateway in 2021 bolstered its employee engagement capabilities, likely contributing to subscription-based revenue streams for those advanced features.

- Subscription Fees: Charged for access to value-added services like advanced employee engagement or specialized fleet management solutions.

- Platform Fees: Levied for the use of enhanced platform features and functionalities that go beyond core benefits.

- Ancillary Services: Revenue derived from optional, premium services that complement the main offerings, providing deeper insights or operational efficiencies.

Data Monetization (Aggregated Insights)

Edenred's extensive network generates a wealth of anonymized transaction data. This data, when aggregated and analyzed, provides valuable market insights that can be leveraged to enhance existing services or develop new offerings for clients, aligning with their 'Beyond' strategies.

- Data Insights: Aggregated transaction data offers clients insights into consumer spending patterns and market trends.

- Enhanced Value: These insights can be integrated into Edenred's existing platforms, increasing their value proposition.

- New Opportunities: The potential exists to develop specialized data-driven services for businesses seeking market intelligence.

For instance, in 2023, Edenred processed over 2.5 billion transactions, highlighting the sheer volume of data available for monetization through aggregated insights. This capability allows Edenred to offer clients a deeper understanding of their markets, potentially driving efficiency and strategic decision-making.

Edenred's revenue streams are diverse, primarily driven by service fees from corporate clients for managing employee benefits and incentives. These fees are often recurring, based on the volume of funds or the number of employees served.

Additionally, Edenred earns commissions from merchants for transactions processed through its platforms, contributing a significant portion of its income. The company also benefits from interest earned on pre-funded employee accounts, a stream that fluctuates with interest rates and transaction volumes.

Subscription and platform fees for premium services, along with the monetization of anonymized transaction data for market insights, further diversify Edenred's revenue generation, supporting its strategic growth initiatives.

| Revenue Stream | Description | Example/Data Point |

|---|---|---|

| Service Fees (Corporate Clients) | Fees for providing and managing employee benefit and incentive solutions. | Recurring fees based on funds issued or per employee. |

| Merchant Commissions | Interchange fees from merchants for transactions via Edenred solutions. | In 2023, Edenred's total revenue was €2,533 million, with merchant fees being a key component. |

| Float Interest Income | Interest earned on funds held before redemption by employees. | First half of 2024 saw increased financial income due to higher interest rates and transaction volumes. |

| Subscription & Platform Fees | Fees for enhanced functionalities and premium services. | Revenue from advanced employee engagement or fleet management tools. |

| Data Insights | Monetization of anonymized transaction data for market intelligence. | Over 2.5 billion transactions processed in 2023 provide rich data for insights. |

Business Model Canvas Data Sources

The Edenred Business Model Canvas is informed by a comprehensive analysis of internal financial data, customer transaction records, and operational performance metrics. This ensures a data-driven foundation for all strategic decisions.