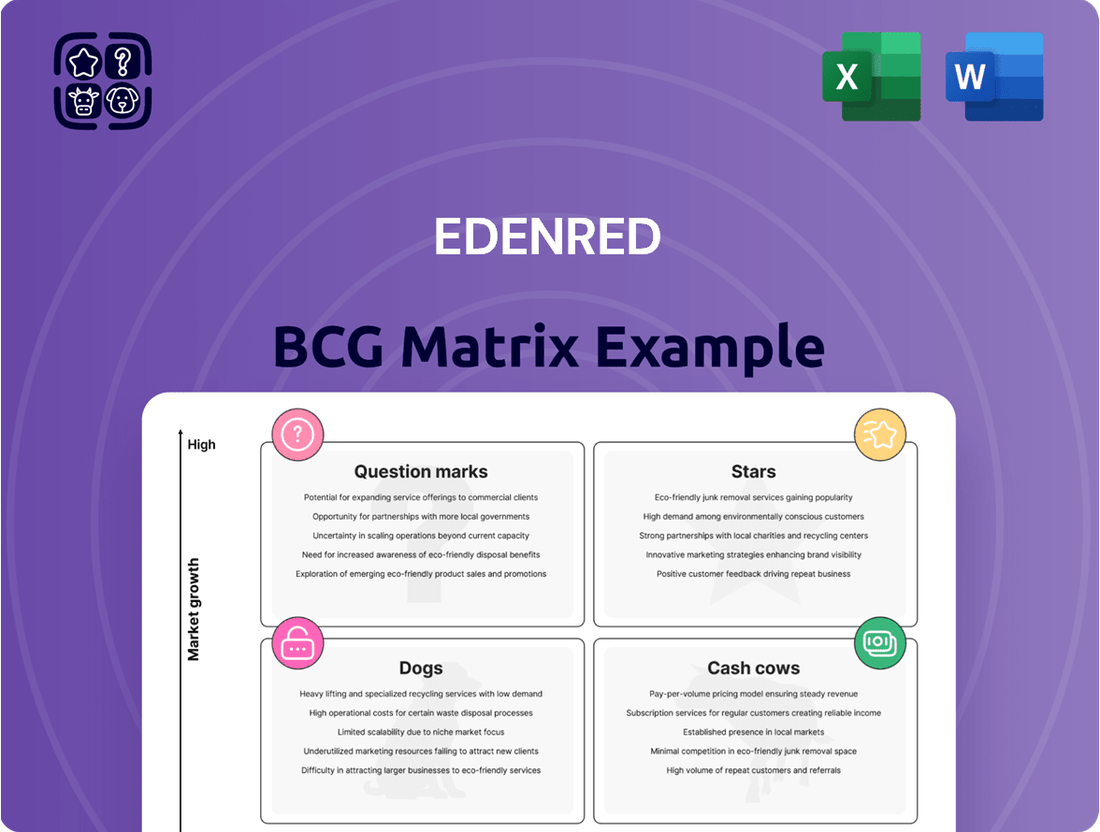

Edenred Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edenred Bundle

Uncover the strategic power of Edenred's product portfolio with a glance at their BCG Matrix. See which offerings are fueling growth and which might need a closer look.

Don't just see the quadrants; understand the implications. Purchase the full Edenred BCG Matrix for detailed analysis and actionable strategies to optimize your investments and drive future success.

Stars

Edenred's Beyond Food solutions, encompassing employee engagement platforms and expanded benefits such as wellness, health, and gift programs, are showing robust growth. These digital platforms offer flexible, personalized benefits that meet today's employees' demand for holistic well-being support.

The company's strategic acquisitions, including Reward Gateway and GOintegro, underscore its commitment to this high-growth, high-potential market. For instance, Reward Gateway reported a significant increase in client adoption of its engagement platform in 2024, highlighting the market's positive reception.

Edenred's strategic move into electric vehicle (EV) charging solutions, particularly with the acquisition of Spirii, firmly places this segment as a Star in their portfolio. This expansion aligns with their 'Beyond Fuel' initiative, tapping into the booming e-mobility sector. The global EV charging infrastructure market was valued at approximately $25 billion in 2023 and is projected to reach over $100 billion by 2030, demonstrating substantial growth potential.

Digital Corporate Payment Solutions, branded as Edenred Pay, represent a significant growth driver for Edenred. This segment, focusing on invoice-to-pay and B2B payment automation, is experiencing robust expansion due to the accelerating digital transformation of corporate finance and the increasing need for operational efficiency. By 2024, the global B2B payments market was projected to reach trillions, with digital solutions capturing an ever-larger share.

Edenred Pay leverages cutting-edge technologies like AI for enhanced fraud detection and predictive cash flow management, alongside seamless integration with enterprise resource planning (ERP) systems. This technological edge positions Edenred Pay as a leader in a market segment that is rapidly evolving. Companies are increasingly prioritizing solutions that streamline their financial operations, making Edenred Pay a highly attractive offering.

Geographic Expansion in Underpenetrated Markets

Edenred is actively pursuing geographic expansion into underpenetrated markets, with a significant focus on the Asia-Pacific and North American regions. This strategy leverages its proven digital solutions and strategic acquisitions to establish a strong foothold in these high-growth areas.

The company aims to replicate its success in mature markets by tailoring its offerings to local preferences and capturing new customer segments. For instance, in 2024, Edenred continued its expansion in Asia, aiming to capture a larger share of the burgeoning employee benefits market, which is estimated to grow significantly in the coming years.

- Targeted Expansion: Edenred's strategic focus on Asia-Pacific and North America capitalizes on their underpenetrated status.

- Digital Solutions & Acquisitions: The company utilizes its established digital platforms and makes targeted acquisitions to enter these new markets.

- Market Replicaton: Edenred seeks to adapt its successful models from mature markets to local conditions in emerging geographies.

- Growth Opportunity: In 2024, the company identified significant growth potential in these regions, projecting increased adoption of digital employee benefits solutions.

AI-Powered and Data-Driven Solutions

Edenred's strategic investment in AI and data analytics is a key driver for its platform and service enhancements. This focus is evident in their efforts to automate processes, elevate customer interactions with AI-powered chatbots, and optimize operational efficiency, such as in fleet management through predictive analytics.

These technological advancements are not just about improving existing offerings; they are about forging a competitive advantage. By leveraging AI, Edenred is positioned to develop innovative, high-value services that cater to the dynamic demands of the digital marketplace.

- AI-driven automation streamlines internal operations and client-facing services.

- Predictive analytics optimize fleet management, reducing costs and improving delivery times.

- AI-powered customer service enhances user experience through intelligent chatbots.

- Data analytics inform new service development and personalized offerings.

Stars in Edenred's portfolio represent high-growth, high-market-share segments. These are areas where Edenred has a strong competitive position and sees significant potential for future expansion and profitability. The company's strategic focus and investments are often directed towards nurturing these Star businesses.

Edenred's Beyond Food solutions, including employee engagement and expanded benefits like wellness and gift programs, are a prime example of a Star. The company's acquisition of Reward Gateway in 2023 further solidified this segment's position, with Reward Gateway reporting strong client growth in 2024. Similarly, Edenred Pay, their digital corporate payment solution, is experiencing robust expansion driven by the digital transformation of B2B payments, a market projected to reach trillions globally by 2024.

| Segment | Growth Rate | Market Share | Key Drivers |

|---|---|---|---|

| Beyond Food (Employee Engagement & Benefits) | High | Strong | Digitalization, demand for holistic well-being, strategic acquisitions (Reward Gateway) |

| Edenred Pay (Digital Corporate Payments) | High | Growing | B2B payment automation, digital transformation, AI integration |

| EV Charging Solutions (Spirii) | Very High | Emerging | E-mobility growth, government incentives, 'Beyond Fuel' strategy |

What is included in the product

The Edenred BCG Matrix analyzes its business units based on market share and growth, guiding strategic decisions for investment and divestment.

Clear visualization of Edenred's business units, identifying Stars and Cash Cows to optimize resource allocation and relieve portfolio management pain.

Cash Cows

Edenred's traditional meal voucher business, prominently featuring Ticket Restaurant, is a prime example of a Cash Cow within the BCG matrix. This segment thrives in mature markets where Edenred has cultivated a dominant market share, ensuring a stable and substantial inflow of cash.

These established solutions benefit from high brand recognition and extensive merchant acceptance, minimizing the need for significant promotional spending. This allows them to generate consistent, strong profits with relatively low ongoing investment.

Although the market for traditional meal vouchers experiences low growth, the sheer volume of recurring transactions and the strength of Edenred's merchant network guarantee sustained profitability. For instance, in 2023, Edenred reported a 7.4% increase in its Total Revenue, driven significantly by its Employee Benefits segment, which includes meal vouchers, demonstrating the enduring strength of these offerings.

Edenred's traditional fuel card business, under Core Fuel Solutions, stands as a robust cash cow. This segment commands a significant market share within a mature yet stable industry, benefiting from extensive infrastructure and a dedicated customer base, especially among small and medium-sized enterprises (SMEs).

Despite the ongoing transition to electric vehicles, the core fuel card operations consistently deliver substantial and dependable cash flow. For instance, in 2023, Edenred reported its fleet and mobility solutions, which include fuel cards, as a key driver of its performance, contributing to the group's overall financial strength.

Edenred's Benefits & Engagement segment in established European markets, including France and Germany, acts as a significant cash cow. These mature offerings benefit from high market penetration and strong customer loyalty, ensuring consistent revenue streams.

For instance, in 2023, Edenred reported a 10.6% organic growth in its Employer Benefits business, with Europe being a core contributor. This segment's profitability is driven by its established client base and efficient operational models, allowing for steady cash generation.

Existing Digital Platform Infrastructure

Edenred's existing digital platform infrastructure is a prime example of a cash cow within its BCG Matrix. This robust technological backbone, developed through substantial, sustained investment, underpins all of Edenred's service offerings. Its high availability, consistently at 99.99%, and its capacity to process a massive volume of API messages demonstrate its maturity and reliability, allowing for efficient transaction processing and scalable growth with minimal additional expenditure.

This established digital foundation is critical for Edenred's operations, enabling seamless and secure transactions for millions of users and businesses. The platform's inherent efficiency means that as transaction volumes increase, the incremental cost of processing each transaction remains low, directly contributing to strong profitability.

- Foundation of Services: Supports all Edenred offerings, from employee benefits to fleet management.

- High Availability: Achieves 99.99% uptime, ensuring continuous service delivery.

- Scalability & Efficiency: Handles high API message volumes with low incremental costs.

- Maturity & Reliability: Built over years of investment, providing a stable and dependable technological base.

Float Management and Interest Income

Edenred's management of its float, the money held between client payments and merchant disbursements, is a significant driver of its cash flow. This practice, particularly lucrative in periods of higher interest rates, generates substantial interest income. For example, in 2024, with interest rates remaining elevated, Edenred likely saw a notable boost in this revenue stream, underscoring the financial efficiency of its operational model.

This interest income acts as a reliable cash cow for Edenred, supplementing its core business operations. It's a testament to how effective financial management can create value. The company's ability to hold and invest these funds before they are paid out provides a consistent and dependable source of earnings, reinforcing its financial stability.

- Float Management: Edenred holds funds from clients before paying merchants.

- Interest Income Generation: This float generates significant interest, especially in high-rate environments.

- 2024 Impact: Elevated interest rates likely boosted this income stream in 2024.

- Cash Flow Contribution: A substantial and reliable source of cash flow for the company.

Edenred's established digital platform is a key cash cow, underpinning all its services with high availability and efficient transaction processing. This mature technological base, built over years of investment, ensures reliable service delivery and scalability with minimal additional expenditure.

The company's float management also acts as a significant cash cow, generating substantial interest income, particularly in the current environment of elevated interest rates. This financial strategy provides a consistent and dependable source of earnings, enhancing Edenred's overall financial stability.

| Business Segment | BCG Category | Key Characteristics | 2023 Performance Indicator |

| Traditional Meal Vouchers (e.g., Ticket Restaurant) | Cash Cow | Dominant market share in mature markets, high brand recognition, extensive merchant acceptance, low growth but stable cash flow. | 7.4% Total Revenue growth (driven by Employee Benefits) |

| Core Fuel Solutions (Fuel Cards) | Cash Cow | Significant market share in a stable industry, dedicated customer base, dependable cash flow despite EV transition. | Key driver of performance in Fleet and Mobility Solutions |

| Benefits & Engagement (Established European Markets) | Cash Cow | High market penetration, strong customer loyalty, efficient operations, consistent revenue streams. | 10.6% organic growth in Employer Benefits (Europe as core contributor) |

| Digital Platform Infrastructure | Cash Cow | High availability (99.99%), efficient processing of high API volumes, scalable with low incremental costs, mature and reliable. | Supports millions of users and businesses, enabling seamless transactions. |

| Float Management | Cash Cow | Generates substantial interest income from funds held between client payments and merchant disbursements. | Likely boosted by elevated interest rates in 2024. |

Delivered as Shown

Edenred BCG Matrix

The Edenred BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report is fully formatted and ready for immediate strategic application, offering a clear breakdown of Edenred's business units according to the BCG growth-share matrix. You can confidently use this preview as a representation of the high-quality, analysis-ready file that will be yours to download and implement in your business planning.

Dogs

Remaining legacy paper-based voucher systems within Edenred's portfolio would likely be categorized as Dogs in the BCG Matrix. These systems operate in markets experiencing a decline, with minimal growth potential and a shrinking user base due to the widespread adoption of digital alternatives. For instance, while Edenred has heavily invested in digital solutions, any lingering paper systems represent an outdated technology facing obsolescence.

Underperforming regional operations, often stemming from smaller acquisitions that haven't captured substantial market share, represent the Dogs in Edenred's portfolio. These units may be situated in slow-growing geographical areas or contend with formidable local rivals, lacking a clear strategy to become market leaders.

For instance, if a specific European country operation within Edenred's portfolio reported a market share of only 3% in 2024, while the average market share for its competitors in that region was 15%, it would likely be classified as a Dog. Continued financial commitment to such segments is unlikely to generate significant returns, as the investment required to shift market dynamics would outweigh potential gains.

Some complementary solutions within the employee benefits space might fall into the category of outdated or niche offerings with limited scalability. These are services that, perhaps due to their specialized nature or a lack of broader market appeal, haven't achieved significant traction. For instance, a very specific type of voucher for a single, small retail chain might represent such a solution.

These offerings are characterized by a low market share, meaning they are not widely used by Edenred's client base. Furthermore, their growth potential is minimal, as they are unlikely to attract new users or expand into new market segments. An example could be a legacy system for managing a particular type of fringe benefit that has been superseded by more modern, integrated platforms.

Consider a scenario where a company offered a highly localized, paper-based meal voucher system in a region that has since shifted entirely to digital payment solutions. This would represent an outdated complementary solution with very limited scalability, likely holding a negligible market share and facing a future of decline rather than growth.

Services Highly Dependent on Declining Industries

Services deeply embedded in industries facing irreversible decline would fall into the Dogs category within the Edenred BCG Matrix. For instance, if Edenred offered specialized payment solutions for sectors like print media advertising, which has seen a significant downturn, the market for such services would be contracting. This low growth environment, coupled with potential competition from more modern alternatives, would likely lead to diminishing market share and profitability for those specific offerings.

Consider the impact on businesses reliant on traditional retail foot traffic; services facilitating in-store payments or loyalty programs for brick-and-mortar stores that are struggling against e-commerce growth would be prime examples of Dogs. In 2024, the ongoing shift to digital platforms continues to challenge many legacy industries.

- Services for declining print media: Solutions tied to the shrinking advertising budgets of newspapers and magazines.

- Traditional retail payment processing: Offerings for physical stores facing significant competition from online retailers.

- Employee benefits for industries in structural decline: For example, services tailored to workforce needs in sectors like coal mining or certain types of manufacturing that are experiencing long-term contraction.

Non-Renewed Public Social Programs

The non-renewal of public social program contracts, like the one in Belgium reported in Q1 2025, or a reduced participation in programs such as in Chile, signals a product facing declining market share within a slow-growth or contracting segment for Edenred. These specific contract situations function similarly to a Question Mark in the Edenred BCG Matrix, where their contribution to revenue diminishes significantly.

These situations highlight a strategic challenge, as these programs, while not a formal product line, represent revenue streams that are no longer performing optimally. For instance, the Belgian contract's non-renewal in early 2025 means a direct loss of revenue from that specific public service. Similarly, a reduced share in Chile's program implies a shrinking revenue base from that market.

- Contract Non-Renewal: The cessation of specific public social program contracts, such as the Belgian example in Q1 2025, directly impacts Edenred's revenue streams.

- Reduced Market Share: A diminished role in programs like the one in Chile indicates a product in a low-growth or declining market segment for Edenred.

- Question Mark Analogy: These non-renewed or reduced programs, though not formal product lines, exhibit characteristics of Question Marks due to their declining revenue contribution.

- Strategic Impact: Such events necessitate a review of Edenred's public sector strategy and resource allocation to address underperforming segments.

Legacy paper-based voucher systems are prime examples of Dogs within Edenred's portfolio. These systems operate in shrinking markets with minimal growth potential, largely due to the widespread adoption of digital alternatives. For instance, while Edenred has prioritized digital solutions, any remaining paper systems represent an outdated technology facing obsolescence.

Underperforming regional operations, often acquired but failing to gain significant market share, also fall into the Dog category. These units might be in slow-growing areas or face strong local competition without a clear path to market leadership. For example, a 2024 report might show a specific European operation holding only a 3% market share against competitors averaging 15% in that region.

Outdated or niche complementary solutions, such as highly specialized or localized paper vouchers with limited scalability, are also classified as Dogs. These offerings have low market share and minimal growth potential, unlikely to attract new users or expand into new segments. A prime example would be a legacy system for a fringe benefit superseded by integrated platforms.

| Category | Description | Example | Market Share (Illustrative 2024) | Growth Potential |

|---|---|---|---|---|

| Dogs | Low market share, low growth | Legacy paper voucher systems | < 5% | Declining |

| Dogs | Low market share, low growth | Underperforming regional operations | 3% (in specific markets) | Low |

| Dogs | Low market share, low growth | Outdated niche solutions | Negligible | None |

Question Marks

Edenred actively pursues new digital ventures in underserved markets, often beginning as pilot programs or experimental platforms. These initiatives target emerging demands or leverage their existing infrastructure in novel industries. For instance, in 2024, Edenred launched a pilot program for a specialized digital platform catering to the gig economy's unique payment and benefit needs, an area previously less explored by the company.

These ventures are positioned in markets with significant growth potential but currently hold a minimal market share. The focus is on building brand recognition, acquiring users, and refining the service offering to capture a substantial portion of these nascent sectors. By 2024, similar digital ventures in the employee wellbeing space saw substantial investment, indicating a broader market trend Edenred aims to capitalize on.

Early-stage employee wellbeing and engagement tools, while part of the broader employee engagement platform category (Stars), can be considered Question Marks. These are often pilot programs or nascent features still being refined for market fit and scalability. For instance, a new AI-driven mental health check-in tool, launched in late 2023, is being tested with a limited user base, demonstrating high growth potential if it proves effective but currently holding low market penetration.

Expanding into new territories, especially those with established competitors or intricate regulatory landscapes, can be a significant drain on resources. While Edenred's overall geographic expansion might be a Star in the BCG Matrix, specific market entries demand substantial upfront capital. These ventures are high-growth prospects, but their initial returns are uncertain, requiring patient investment and strategic development.

AI-Driven Solutions in Nascent Applications

Edenred is likely exploring AI for entirely new, experimental applications within its business. These are areas where AI's impact is still theoretical, carrying high risk but also the potential for significant future rewards. Think of AI helping to predict entirely new employee benefit trends or optimizing complex, multi-stakeholder payment networks in novel ways.

These nascent AI applications would reside in the Question Marks quadrant of the Edenred BCG Matrix. They require substantial research and development investment to prove their concept and market fit. Success here could lead to entirely new service lines or a substantial competitive advantage.

- Exploring AI for personalized employee well-being programs: This could involve AI analyzing anonymized data to suggest tailored benefits and wellness activities, aiming to boost employee engagement and retention.

- Developing AI for predictive fraud detection in emerging payment channels: As new digital payment methods gain traction, AI could be crucial in identifying and mitigating novel fraud patterns.

- Investigating AI for optimizing supply chain logistics in the gig economy: For Edenred's partners, AI could streamline the delivery and management of services within flexible work environments.

Targeted Acquisitions in Emerging Payment Technologies

Targeted acquisitions in emerging payment technologies represent strategic plays for Edenred, aiming to capture future growth. These ventures, while potentially high-growth, typically start with a low market share within the company’s existing offerings. For instance, an acquisition of a company specializing in instant cross-border B2B payments, a sector projected for significant expansion, would initially be classified as a Question Mark. This is because its current contribution to Edenred's overall revenue and market presence would be minimal, despite its promising future trajectory.

These acquisitions are essentially bets on nascent technologies that are not yet widely adopted but show strong potential to disrupt established payment methods. The success of these ventures hinges on their ability to scale and integrate effectively into Edenred's broader ecosystem. For example, if Edenred were to acquire a startup focused on decentralized payment solutions leveraging blockchain technology, it would likely be a Question Mark. While the long-term potential is substantial, the current market penetration and revenue generation would be limited, making it a strategic investment in future market share.

- Acquisition of a novel digital wallet provider with limited user adoption but high growth potential in a specific niche market.

- Investment in a startup developing AI-powered fraud detection for contactless payments, aiming to capture a growing segment of the security market.

- Acquiring a company specializing in embedded finance solutions for small businesses, a sector experiencing rapid digital transformation.

Question Marks in Edenred's BCG Matrix represent new ventures with high growth potential but low market share. These are often pilot programs or early-stage technologies requiring significant investment to prove their viability and scale. For example, Edenred's 2024 pilot for a gig economy payment platform exemplifies this, aiming to capture a nascent market. These initiatives are crucial for future diversification, but their success is uncertain, necessitating careful resource allocation and strategic development to transition them into Stars or Cash Cows.

| Venture Type | Market Growth Potential | Current Market Share | Investment Required (Est.) | Potential Outcome |

|---|---|---|---|---|

| Gig Economy Payment Platform (2024 Pilot) | High | Low | Significant R&D and marketing | Star or Dog |

| AI-driven Mental Health Tool (Late 2023 Launch) | High | Very Low | Ongoing development and user acquisition | Star or Dog |

| Acquisition of Blockchain Payment Startup | Very High | Negligible | Substantial acquisition cost and integration | Star or Cash Cow |

BCG Matrix Data Sources

Our Edenred BCG Matrix leverages comprehensive market data, including financial performance, customer adoption rates, and competitor analysis, to accurately position each business unit.