Eaton SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eaton Bundle

Eaton's impressive market position is built on strong brand recognition and a diverse product portfolio, but understanding the full scope of its challenges and opportunities requires a deeper dive. Our comprehensive SWOT analysis reveals the critical factors driving its success and potential vulnerabilities.

Want the full story behind Eaton's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Eaton Corporation commands significant market leadership across its key business segments, including electrical, aerospace, hydraulics, and vehicle components. This diversified portfolio, serving over 160 countries, shields the company from over-reliance on any single industry, fostering revenue stability.

In 2023, Eaton reported approximately $23.7 billion in sales, with its Electrical Americas segment alone generating around $9.1 billion, underscoring its dominant presence in critical markets. The company's consistent ability to lead in multiple product categories highlights a robust competitive advantage.

Eaton showcased impressive financial strength throughout 2024 and into Q1 2025, achieving record earnings and sales. The company reported robust segment margins, reflecting strong operational execution. This consistent financial outperformance, including significant organic sales growth, highlights Eaton's ability to generate value and meet its financial objectives.

Eaton is demonstrating strong commitment to its sustainability objectives, having already achieved a 35% reduction in greenhouse gas emissions compared to 2018 levels. This progress is a significant step towards their ambitious goal of reaching net-zero emissions by 2050.

The company's substantial investments in R&D for sustainable solutions directly address growing global environmental concerns, simultaneously bolstering Eaton's brand image and market appeal.

This proactive stance on Environmental, Social, and Governance (ESG) principles not only resonates with investors and customers but also positions Eaton as a leader in responsible corporate citizenship.

Innovation in Electrification and Digitalization

Eaton is strongly positioned to capitalize on global megatrends like electrification, the energy transition, and digitalization. The company's significant investments in cutting-edge technologies are a major strength, allowing it to address the growing demand for sustainable power solutions.

These investments are directly translating into market opportunities. For instance, Eaton's focus on advanced electric vehicle (EV) charging infrastructure and intelligent power management systems is crucial for facilitating the shift to renewable energy sources. In 2023, Eaton reported a 12% increase in its Electrical Americas segment revenue, partly driven by demand in data centers and electrification projects, highlighting the tangible impact of these innovations.

- Focus on Megatrends: Eaton strategically aligns its R&D and product development with electrification, energy transition, and digitalization.

- EV Charging Solutions: The company is a key player in developing and deploying advanced EV charging infrastructure.

- Intelligent Power Management: Eaton's expertise in smart grid integration and intelligent power systems addresses critical energy management needs.

- Market Responsiveness: These technological advancements enable Eaton to effectively meet evolving customer and market demands in the clean energy sector.

Strong Backlog and Order Growth

Eaton's backlog reached a record $23.4 billion by the end of the first quarter of 2024, demonstrating robust demand and providing significant revenue visibility. This growth is particularly strong in the Electrical Americas segment, which saw orders increase by 14% year-over-year, and the Aerospace segment, up 11%. The company's Electrical Services and Products division also experienced robust order growth, reflecting broad-based demand.

This substantial backlog is a direct result of increasing demand from key growth areas. Data centers, driven by AI and cloud computing, are a major contributor, alongside significant investments in grid modernization and renewable energy infrastructure projects. These trends are expected to continue fueling order growth throughout 2024 and into 2025.

- Record Backlog: Eaton's backlog exceeded $23 billion in early 2024, up from $21.9 billion at the end of 2023.

- Segment Strength: Electrical Americas orders grew 14% and Aerospace orders increased 11% in Q1 2024.

- Key Demand Drivers: Data centers and infrastructure projects are primary catalysts for sustained order growth.

- Future Revenue Visibility: The strong backlog provides a clear line of sight for future revenue performance.

Eaton's diversified business model, spanning electrical, aerospace, hydraulics, and vehicle components, provides significant resilience against industry-specific downturns. This broad market presence, serving over 160 countries, ensures a stable revenue stream. The company's leadership in key segments, such as Electrical Americas which generated approximately $9.1 billion in sales in 2023, underscores its competitive strength.

Financially, Eaton has demonstrated robust performance, achieving record earnings and sales through Q1 2025, driven by strong organic growth and operational efficiency. This consistent financial outperformance, coupled with a commitment to sustainability, positions Eaton favorably for continued value creation.

Eaton's strategic alignment with megatrends like electrification and digitalization, backed by substantial R&D investments, fuels its market responsiveness. For example, a 12% revenue increase in Electrical Americas in 2023 was partly attributed to demand in electrification projects, highlighting the impact of these innovations.

The company's record backlog of $23.4 billion by early 2024, with strong order growth in Electrical Americas (14%) and Aerospace (11%), provides excellent future revenue visibility, primarily driven by data centers and infrastructure upgrades.

| Strength | Description | Supporting Data (2023/Q1 2024) |

| Diversified Portfolio | Broad market presence across multiple segments reduces risk. | Sales of ~$23.7 billion in 2023; Electrical Americas segment ~$9.1 billion. |

| Financial Strength & Growth | Consistent record earnings and sales, strong margins. | Record earnings and sales through Q1 2025; strong segment margins. |

| Innovation & Megatrend Alignment | Focus on electrification, energy transition, and digitalization. | 12% revenue growth in Electrical Americas driven by electrification; record backlog. |

| Strong Order Pipeline | Substantial backlog indicates robust future demand. | Record backlog of $23.4 billion by Q1 2024; 14% order growth in Electrical Americas. |

What is included in the product

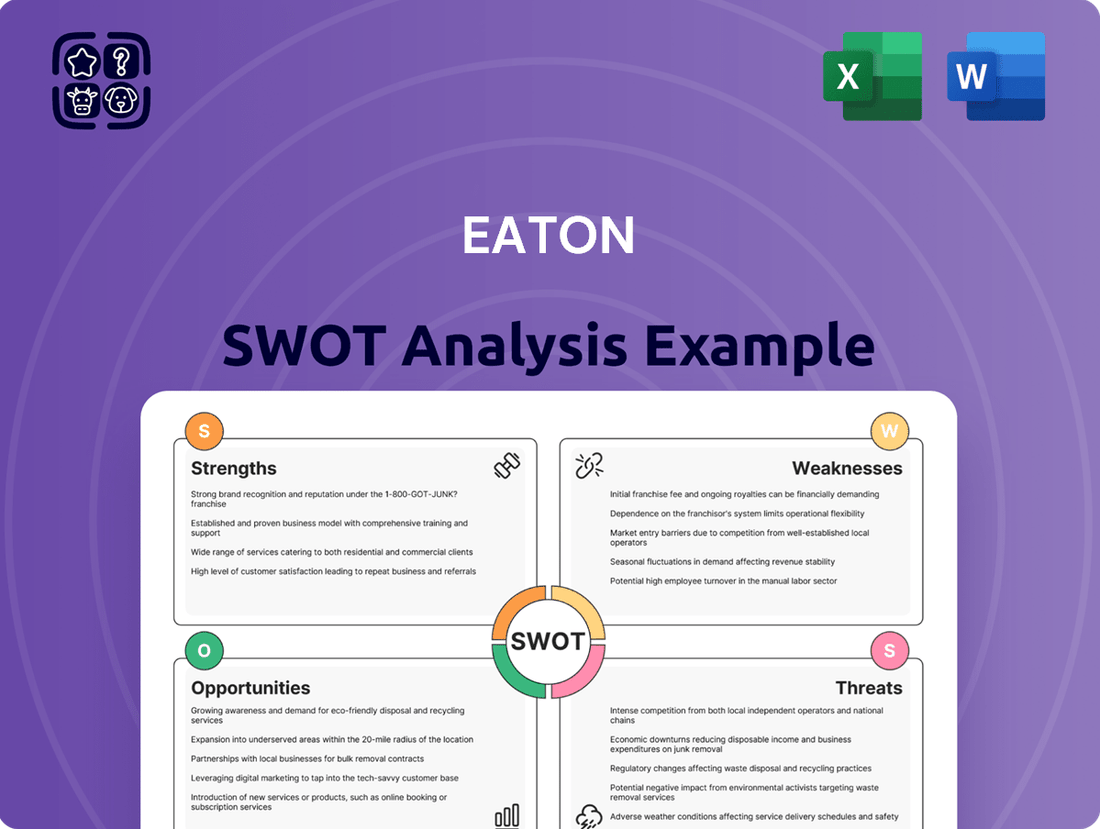

Delivers a strategic overview of Eaton’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, alleviating the pain of uncertainty.

Weaknesses

Despite ongoing efforts to strengthen its operations, Eaton still contends with supply chain vulnerabilities. The availability of critical components, particularly electronics, remains a concern, alongside persistent logistical hurdles. These disruptions can drive up the cost of essential raw materials, including copper and steel, potentially impacting the company's profitability.

Eaton's significant reliance on the data center segment for growth, while a strength, also introduces a concentration risk. A downturn in this specific market, perhaps due to oversupply or reduced tech spending, could disproportionately affect Eaton's overall financial results. For instance, while data centers were a key driver in 2023, any slowdown in capital expenditures by major cloud providers could present headwinds for Eaton's performance in this area.

Eaton's eMobility and Vehicle segments have faced notable headwinds, with weakening demand and sales declines impacting performance. For instance, the company has pointed to a slowdown in light vehicle production as a key contributor to this softness.

Delays in securing crucial contracts, particularly for high-voltage charging systems within the eMobility division, have further exacerbated these challenges. These specific segment-level issues can act as a drag on Eaton's overall revenue expansion and profitability.

Exposure to Macroeconomic Volatility

Eaton's extensive global footprint and varied business segments mean it's susceptible to economic ups and downs across different geographies. For instance, a slowdown in key markets like the United States or Europe, which are significant for industrial sectors, could directly impact Eaton's sales and earnings.

The company's performance is closely tied to the health of its end markets, which can experience unexpected shifts. A downturn in construction, data centers, or aerospace, for example, could reduce demand for Eaton's products. This exposure necessitates ongoing strategic adjustments to navigate these economic uncertainties.

- Global Economic Sensitivity: Eaton’s diversified operations, spanning electrical, aerospace, hydraulic, and vehicle segments, mean that regional economic downturns can collectively impact its revenue streams.

- Impact of Recessions: A potential U.S. recession or a significant slowdown in European industrial activity, both of which were concerns in late 2023 and early 2024, could lead to reduced capital expenditure by customers, directly affecting Eaton's order volumes.

- Demand Fluctuations: Unforeseen changes in customer spending patterns, driven by economic sentiment or specific industry challenges, can create volatility in demand for Eaton's electrical components, power management solutions, and other offerings.

Elevated Valuation Metrics

Eaton's valuation metrics, particularly its price-to-earnings (P/E) ratio, are viewed by some market observers as elevated. For instance, as of early 2024, Eaton's P/E ratio has traded at a premium compared to some industry peers, suggesting that the market has high growth expectations baked into its stock price.

This premium valuation presents a potential risk; if Eaton's future earnings growth falters or fails to meet these elevated expectations, the stock could face downward pressure. Investors are closely watching for continued strong operational performance to justify the current market valuation.

- Elevated P/E Ratio: Eaton's P/E ratio has historically traded at a premium, indicating high market expectations.

- Growth Dependency: Sustained stock performance is contingent on meeting these ambitious growth forecasts.

- Investor Confidence: Maintaining investor confidence requires demonstrating consistent operational excellence and strategic execution.

Eaton's reliance on a few key markets, such as data centers, creates a concentration risk. A slowdown in this sector, perhaps due to reduced tech spending, could disproportionately impact the company's financial results. For example, while data centers fueled growth in 2023, any decrease in capital expenditures by major cloud providers could pose challenges.

The company's eMobility and Vehicle segments have experienced weaker demand and sales declines, partly due to a slowdown in light vehicle production. Delays in securing crucial contracts for high-voltage charging systems in the eMobility division further hinder revenue growth and profitability.

Eaton's global operations make it vulnerable to economic downturns in various regions. A recession in the U.S. or a slowdown in Europe, significant markets for industrial sectors, could directly reduce sales and earnings. This sensitivity to macroeconomic shifts necessitates continuous strategic adaptation.

Eaton's stock valuation, particularly its price-to-earnings (P/E) ratio, is considered high by some market observers. As of early 2024, its P/E ratio trades at a premium compared to industry peers, implying high market growth expectations. If Eaton fails to meet these expectations, its stock price could face downward pressure.

| Segment | 2023 Performance Highlight | Potential Weakness Driver |

|---|---|---|

| Data Centers | Key growth driver | Concentration risk; reduced tech spending |

| eMobility/Vehicle | Weakening demand, sales declines | Slowdown in light vehicle production; contract delays |

| Global Operations | Diversified revenue streams | Sensitivity to regional economic downturns (e.g., US/Europe) |

| Valuation | Premium P/E ratio | High market growth expectations; risk of underperformance |

Preview the Actual Deliverable

Eaton SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual segment of the complete Eaton SWOT analysis, ensuring you know exactly what quality and detail to expect. Purchase unlocks the full, comprehensive report.

Opportunities

Eaton is strategically positioned to benefit from the ongoing global shift towards electrification and renewable energy sources. This transition, driven by environmental concerns and technological advancements, creates substantial opportunities for the company.

The increasing demand for energy-efficient products and services, coupled with government initiatives promoting clean energy, directly supports Eaton's growth. For instance, in 2023, Eaton reported a significant increase in its Electrical Americas segment, reflecting strong demand for its power management solutions in a rapidly electrifying market.

Eaton's commitment to accelerating the planet's transition to renewable energy aligns perfectly with these market trends. The company's investments in areas like grid modernization and energy storage solutions, expected to see continued robust growth through 2025, further solidify its advantage in this expanding sector.

The surge in AI development is fueling unprecedented demand for data centers, a trend expected to continue through 2025. This growth, coupled with significant government initiatives for infrastructure upgrades, particularly in North America and Europe, presents a major opportunity for Eaton. For example, the U.S. government's infrastructure bill, passed in 2021 and with significant spending allocated through 2025, is a key driver.

Eaton's essential electrical components and advanced power management systems are vital for constructing and operating these large-scale projects. This critical role translates directly into strong order books and a growing backlog for the company. In Q1 2024, Eaton reported a 14% increase in backlog for its Electrical Americas segment, largely attributed to these infrastructure and data center demands.

Eaton's strategic acquisition approach is a key opportunity for growth, allowing the company to broaden its product range and penetrate new markets. The acquisition of Fibrebond Corporation in early 2024, for instance, is set to strengthen Eaton's electrical and aerospace segments, adding an estimated $100 million to $150 million in annual revenue by 2025. This inorganic expansion strategy enables Eaton to swiftly align with evolving market demands and bolster its overall capabilities.

Advancements in Electric Vehicle (EV) Technology and Infrastructure

The accelerating global adoption of electric vehicles (EVs) represents a substantial growth opportunity for Eaton's eMobility segment. The company's focus on innovative EV safety solutions, high-voltage components, and robust charging infrastructure technologies positions it to capitalize on this expanding market. As the EV ecosystem matures, Eaton is well-placed to offer integrated power management solutions that cater to both individual vehicles and the broader charging networks.

Eaton's contributions are vital to the electrification trend. For instance, the company's power distribution units and contactors are essential for the safe and efficient operation of EVs. The global EV market is projected to reach over $800 billion by 2027, with charging infrastructure being a critical enabler of this growth. Eaton's expertise in power management directly addresses the needs of this expanding sector.

- EV Market Growth: The worldwide market for electric vehicles is experiencing rapid expansion, creating a significant demand for the components and solutions Eaton provides.

- Charging Infrastructure: Eaton's involvement in developing and supplying technology for EV charging stations directly addresses a key bottleneck in EV adoption, offering a substantial revenue stream.

- Integrated Solutions: The company's ability to offer comprehensive power management for both vehicles and charging networks provides a competitive advantage in a complex and evolving market.

Digitalization and Smart Grid Solutions

Eaton's commitment to digitalization, exemplified by its Brightlayer digital platform, presents a significant opportunity. This focus allows for the optimization of energy management systems and the development of more adaptable infrastructure, crucial for ensuring power security in an increasingly complex energy landscape.

The 'Factories as a Grid' concept, a key component of Eaton's digital strategy, unlocks further potential. By treating industrial facilities as microgrids, Eaton can drive enhanced efficiency, implement real-time monitoring capabilities, and facilitate the seamless integration of renewable energy sources. This is particularly relevant given the global trend of rising electricity costs and the persistent challenge of grid instability.

- Enhanced Efficiency: Smart grid solutions can reduce energy waste by up to 10-15% in industrial settings.

- Renewable Integration: Digital platforms enable smoother incorporation of intermittent renewables, potentially increasing their share in the energy mix by 20% in the medium term.

- Grid Stability: Real-time monitoring and predictive analytics offered by smart grids can improve grid reliability by reducing outages by an estimated 25%.

- Cost Savings: Optimized energy usage and reduced downtime contribute to significant operational cost reductions for businesses.

Eaton is poised to capitalize on the burgeoning demand for data centers, driven by the rapid advancement of AI technologies, a trend expected to persist through 2025. This, coupled with substantial government investments in infrastructure upgrades, particularly in North America and Europe, presents a significant growth avenue. For instance, the U.S. infrastructure bill, with substantial funding allocated through 2025, is a key catalyst.

Eaton's core electrical components and sophisticated power management systems are indispensable for the construction and operation of these large-scale projects, directly contributing to a growing order backlog. In the first quarter of 2024, Eaton observed a notable 14% increase in backlog for its Electrical Americas segment, largely attributable to these infrastructure and data center demands.

The company's strategic approach to acquisitions offers a compelling avenue for expansion, enabling broader product portfolios and deeper market penetration. The acquisition of Fibrebond Corporation in early 2024, for example, is projected to enhance Eaton's electrical and aerospace divisions, adding an estimated $100 million to $150 million in annual revenue by 2025, thereby aligning the company with evolving market needs.

The accelerating global adoption of electric vehicles (EVs) presents a substantial growth opportunity for Eaton's eMobility segment. The company's focus on innovative EV safety solutions, high-voltage components, and robust charging infrastructure technologies positions it to capitalize on this expanding market. For example, Eaton's power distribution units and contactors are critical for the safe operation of EVs, a market projected to exceed $800 billion by 2027.

| Opportunity Area | Key Drivers | Eaton's Role/Impact | Projected Growth (2024-2025) |

|---|---|---|---|

| Data Centers & AI Infrastructure | AI development, cloud computing growth | Provides essential electrical components and power management solutions | High growth, driven by increasing compute demand |

| Electrification & Renewable Energy | Environmental concerns, government incentives | Grid modernization, energy storage, power distribution | Continued robust growth in energy transition solutions |

| Electric Vehicle (EV) Ecosystem | EV adoption, charging infrastructure needs | EV safety components, charging technologies, eMobility solutions | Significant expansion in the eMobility segment |

| Digitalization & Smart Grids | Energy efficiency demands, grid stability concerns | Brightlayer digital platform, 'Factories as a Grid' concept | Enhanced operational efficiency and renewable integration |

Threats

Eaton faces a fierce competitive environment across its core electrical, hydraulic, and mechanical power management sectors. Major players like Cummins, Emerson Electric, ABB, Schneider Electric, and Parker Hannifin constantly vie for market share. This pressure often translates into pricing challenges and necessitates ongoing investment in research and development to stay ahead.

Persistent supply chain disruptions and skilled labor shortages continue to pose significant threats to Eaton's operations. These ongoing challenges can directly impact the company's ability to fulfill demand, particularly for complex, large-scale projects, potentially leading to production bottlenecks and increased operational expenses.

Unanticipated fluctuations in the cost of raw materials and labor add another layer of risk, potentially squeezing profit margins. For instance, in the electrical equipment sector, material costs saw significant increases throughout 2023 and early 2024, impacting companies like Eaton.

These constraints not only risk production delays but could also cap Eaton's capacity for rapid market expansion, as securing necessary components and qualified personnel becomes a more arduous and costly endeavor.

Eaton's global operations mean it's susceptible to shifting tariff landscapes and evolving regulations worldwide. For instance, in 2024, ongoing trade tensions could lead to increased import duties on key components, directly impacting Eaton's cost of goods sold and potentially squeezing profit margins in affected regions. Navigating these complex and often unpredictable regulatory changes across multiple countries requires significant resources and a proactive approach to compliance.

Market Volatility and Economic Downturns

Economic downturns and shifts in consumer spending present a significant threat to Eaton's financial performance. Broader macroeconomic uncertainties, including the potential for recessions or slowing industrial activity, directly impact demand for Eaton's products and services across its diverse end markets. For instance, a slowdown in construction or manufacturing, key sectors for Eaton, could lead to reduced order volumes and pressure on pricing.

Eaton's broad portfolio, while a strategic advantage, also means it's susceptible to downturns in multiple sectors simultaneously. This requires the company to maintain agile business strategies to effectively navigate and mitigate risks associated with these fluctuations.

- Economic Uncertainty: Global economic growth forecasts for 2024 and 2025 indicate continued volatility, with potential impacts on industrial production and infrastructure spending, key drivers for Eaton.

- Sectoral Slowdowns: A projected slowdown in key end markets such as non-residential construction in North America for 2024 could dampen demand for electrical components and systems.

- Inflationary Pressures: Persistent inflation in 2024 continues to pose a threat by increasing input costs and potentially impacting consumer and business spending power, affecting demand for Eaton’s solutions.

Emergence of Disruptive Technologies and Business Models

The rapid evolution of technology, particularly in areas like artificial intelligence and energy efficiency, presents a significant threat. For instance, advancements in AI could lead to more optimized power consumption, potentially reducing demand for traditional power management solutions. Eaton's market position could be challenged by new entrants leveraging these disruptive technologies or by shifts in customer needs towards more integrated, intelligent energy systems.

The increasing sophistication of competing technologies, especially those offering greater efficiency or novel functionalities, could render Eaton's current product portfolio less competitive. A prime example is the growing interest in decentralized energy solutions and microgrids, which could alter the traditional utility-scale power infrastructure Eaton has long served. The company must remain vigilant, as failure to adapt could lead to market share erosion and a decline in revenue from established product lines.

To counter these threats, Eaton's commitment to research and development is paramount. In 2023, Eaton invested $1.7 billion in R&D, a figure that will likely need to grow to keep pace with technological acceleration. This investment is crucial for developing next-generation products and services that align with emerging market trends and customer expectations. Staying ahead of innovation is key to avoiding obsolescence and maintaining a competitive edge in the dynamic energy sector.

Key areas of technological disruption impacting Eaton include:

- Advancements in AI for energy management: More efficient AI models can optimize power usage, potentially reducing the need for certain types of hardware.

- Growth of distributed energy resources (DERs): The rise of solar, battery storage, and microgrids challenges traditional centralized power models.

- Electrification of transportation: While an opportunity, it also necessitates new infrastructure and power solutions that competitors might address differently.

- Digitalization of grid operations: Smart grid technologies require continuous innovation in software and control systems to integrate effectively.

Eaton faces significant threats from intense competition, with rivals like Schneider Electric and ABB constantly innovating and competing on price. Supply chain volatility and skilled labor shortages continue to disrupt operations, potentially delaying projects and increasing costs. Fluctuations in raw material prices, such as the reported increases in electrical components during 2023 and early 2024, can also squeeze profit margins.

Economic uncertainty and potential sectoral slowdowns, like a projected dip in North American non-residential construction for 2024, pose risks to demand. Persistent inflation in 2024 further exacerbates these concerns by raising input costs and impacting spending power. Eaton's global footprint also exposes it to evolving regulations and trade tensions, which could increase duties on key components.

Technological disruption is another major threat, with advancements in AI for energy management and the growth of distributed energy resources potentially altering demand for traditional power solutions. The electrification of transportation and the digitalization of grid operations also require continuous innovation to remain competitive.

Here's a snapshot of key financial and market data relevant to these threats:

| Metric | 2023/2024 Data | Implication for Threats |

|---|---|---|

| Eaton's R&D Investment | $1.7 billion (2023) | Crucial for countering technological obsolescence and competitive pressure. |

| Global Economic Growth Forecast (2024) | Varied, with some forecasts indicating slowdowns. | Heightens risk of reduced demand and sectoral slowdowns. |

| Inflationary Pressures | Persistent throughout 2023 and into 2024. | Increases input costs and can dampen customer spending. |

SWOT Analysis Data Sources

This Eaton SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable perspective.