Eaton PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eaton Bundle

Unlock the strategic forces shaping Eaton's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are influencing its operations and market position. This expert-crafted report provides the critical intelligence you need to anticipate challenges and seize opportunities. Download the full version now and gain a decisive competitive advantage.

Political factors

Government investments in infrastructure, particularly in areas like smart grids and electric vehicle charging networks, directly benefit Eaton. For instance, the United States' Bipartisan Infrastructure Law, enacted in 2021 and with substantial funding continuing through 2025, allocates billions towards grid modernization and EV infrastructure, creating a robust demand for Eaton's power management solutions.

Favorable policies and consistent funding for renewable energy integration, such as tax credits and grid upgrade initiatives, are crucial for Eaton's growth. The Inflation Reduction Act in the US, for example, provides significant incentives that are expected to drive demand for grid-edge solutions and energy storage through 2030, positively impacting Eaton's electrical segment.

Conversely, any slowdown in government infrastructure spending or unfavorable policy shifts, such as reduced subsidies for renewables or EVs, could temper market opportunities for Eaton. A decrease in public funding for grid modernization projects, for example, could lead to slower adoption rates for advanced electrical components and systems.

Changes in international trade policies significantly impact Eaton's global business. For instance, the renegotiation of trade agreements like the United States-Mexico-Canada Agreement (USMCA) in 2020, which replaced NAFTA, has reshaped trade dynamics in North America, potentially affecting Eaton's sourcing and sales channels.

Tariffs and customs regulations are also critical. A hypothetical increase in tariffs on electrical components imported into the European Union could raise Eaton's manufacturing costs in its European facilities, impacting its competitive pricing. Conversely, a reduction in tariffs on finished goods exported from the EU could enhance market access and sales volume for Eaton's products in 2024-2025.

Protectionist measures, such as those seen in various trade disputes in recent years, add complexity. These can lead to supply chain disruptions and increased compliance burdens, potentially affecting Eaton's profitability. A stable and predictable global trade environment, however, remains crucial for Eaton's ability to efficiently manage its international operations and serve its diverse customer base across continents.

Geopolitical stability significantly shapes Eaton's strategic landscape. For instance, ongoing geopolitical tensions in Eastern Europe and the Middle East, as observed throughout 2024, directly impact global energy markets and supply chains, areas critical to Eaton's electrical and aerospace segments. This instability can lead to increased operational costs and a more cautious approach to new market entries, affecting investment decisions.

Eaton’s supply chain resilience is tested by regional conflicts and trade disputes, which can disrupt the flow of components and finished goods. For example, trade tariffs imposed or threatened by major economies in 2024 can increase the cost of materials and affect pricing strategies. This volatility necessitates robust risk management and diversification of sourcing to mitigate potential disruptions and maintain customer confidence.

Conversely, a stable global political environment, characterized by predictable trade policies and reduced conflict, fosters a more favorable climate for Eaton's long-term investments and market expansion. Periods of enhanced geopolitical calm, such as the resolution of certain trade agreements in late 2024, can unlock new market opportunities and boost demand for Eaton's power management solutions.

Energy policy and regulations

Government policies actively promoting energy efficiency and the adoption of renewable energy sources directly influence the demand for Eaton's power management solutions. For instance, the Inflation Reduction Act in the United States, enacted in 2022, provides significant tax credits for clean energy and energy-efficient technologies, which is expected to bolster the market for products like Eaton's energy storage systems and smart grid technologies through 2025 and beyond. Stricter environmental regulations, such as those targeting carbon emissions, can further accelerate market growth for Eaton's green technologies by creating a greater need for efficient power distribution and backup solutions.

Conversely, a relaxation of environmental regulations or a reduction in incentives for green technologies could potentially slow the perceived urgency for energy-efficient upgrades, impacting the pace of adoption for some of Eaton's offerings. However, the global push towards net-zero emissions, with many countries setting ambitious targets through 2030 and 2050, provides a strong underlying tailwind. For example, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly supporting demand for advanced energy management systems.

- Government incentives for renewable energy integration, such as solar and wind power, increase the need for grid stabilization and energy storage solutions, areas where Eaton excels.

- Stricter building codes mandating higher energy efficiency standards can drive demand for Eaton's electrical components and power distribution equipment.

- The global commitment to decarbonization, evidenced by international agreements and national policies, creates a sustained long-term demand for energy-efficient and sustainable power management technologies.

- Changes in energy policy, such as the phasing out of fossil fuel subsidies, can create a more favorable competitive landscape for renewable energy solutions offered by companies like Eaton.

Industrial policy and subsidies

Government initiatives like the Inflation Reduction Act (IRA) in the United States, enacted in 2022, offer significant tax credits and incentives for clean energy manufacturing and deployment. This directly impacts companies like Eaton, which are heavily involved in electrical components and renewable energy solutions. These policies can encourage domestic production and create a more favorable environment for Eaton's investments in areas like battery storage and grid modernization, potentially boosting its competitive edge in these growing markets.

The European Union's Green Deal and its associated industrial strategy also aim to bolster domestic manufacturing in strategic sectors, including energy and digital technologies. For Eaton, this could translate into increased demand for its energy-efficient products and smart grid solutions. However, the effectiveness of these subsidies and the potential for them to favor specific competitors or technologies will be crucial factors to monitor for Eaton's strategic planning.

- IRA Incentives: The IRA provides over $369 billion in funding for climate and energy security, including tax credits for renewable energy manufacturing and electric vehicle production, directly benefiting Eaton's clean energy portfolio.

- EU Green Deal Impact: The EU aims to invest heavily in green technologies, potentially increasing demand for Eaton's energy management and grid infrastructure solutions within the bloc.

- Reshoring Trends: Policies encouraging reshoring could lead to shifts in global supply chains, impacting Eaton's manufacturing locations and operational costs.

Government investments in infrastructure, particularly in smart grids and electric vehicle charging networks, directly benefit Eaton. The United States' Bipartisan Infrastructure Law, with substantial funding continuing through 2025, allocates billions towards grid modernization, creating robust demand for Eaton's power management solutions.

Favorable policies and consistent funding for renewable energy integration, such as tax credits, are crucial for Eaton's growth. The Inflation Reduction Act in the US provides significant incentives expected to drive demand for grid-edge solutions and energy storage through 2030, positively impacting Eaton's electrical segment.

Conversely, any slowdown in government infrastructure spending or unfavorable policy shifts could temper market opportunities. A decrease in public funding for grid modernization projects, for example, could lead to slower adoption rates for advanced electrical components.

Changes in international trade policies significantly impact Eaton's global business. Tariffs and customs regulations are critical; for instance, a hypothetical increase in EU tariffs on electrical components could raise Eaton's manufacturing costs, impacting competitive pricing.

What is included in the product

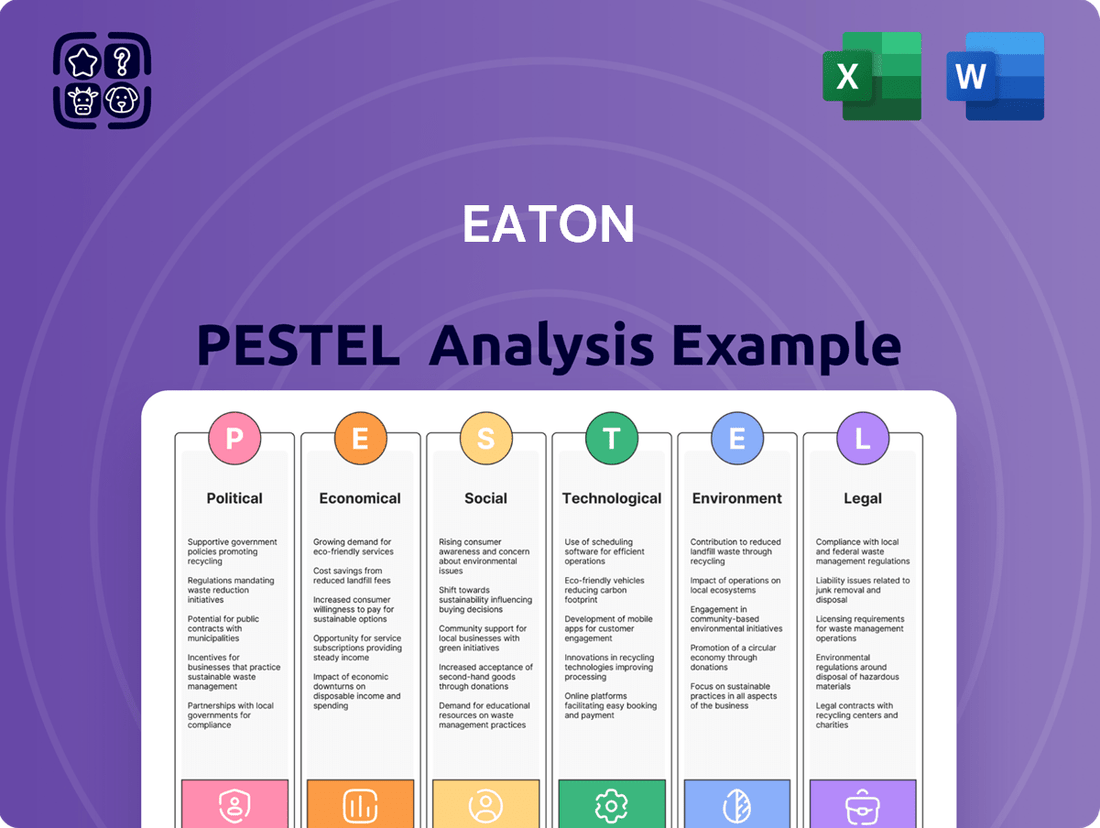

This Eaton PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the company's operating landscape.

It provides a comprehensive understanding of external influences to inform strategic decision-making and identify growth opportunities.

The Eaton PESTLE Analysis offers a structured framework that alleviates the pain of navigating complex external environments by providing clear, actionable insights into political, economic, social, technological, environmental, and legal factors impacting business strategy.

Economic factors

Global economic growth is a critical driver for Eaton, influencing demand across its electrical, aerospace, and industrial segments. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicative of a generally expanding economy. This growth directly translates to higher industrial output and infrastructure development, areas where Eaton's solutions are vital.

Rising inflation in 2024 and projected into 2025 presents a significant challenge for Eaton. Increased costs for raw materials, energy, and labor directly impact its manufacturing operations. For instance, the Producer Price Index (PPI) in the US, a key indicator of inflation for manufacturers, saw a notable increase in late 2023 and early 2024, suggesting higher input costs for Eaton's electrical components and aerospace materials.

Higher interest rates, a common response to inflation, also affect Eaton. Increased borrowing costs can deter capital expenditures for Eaton itself and for its customers who finance large projects utilizing Eaton's products, potentially slowing demand. The Federal Reserve's monetary policy decisions throughout 2024, including any adjustments to the federal funds rate, will be crucial in determining the cost of capital for Eaton and its clients.

As a global entity, Eaton's financial performance is directly influenced by currency exchange rate fluctuations. When Eaton converts earnings from its international operations into its reporting currency, unexpected shifts in exchange rates can significantly alter reported revenues, costs, and ultimately, profitability. For instance, a strengthening US dollar against other currencies could reduce the dollar value of foreign sales.

The significant volatility observed in currency markets, particularly in 2024 and early 2025, introduces considerable uncertainty for businesses like Eaton. This unpredictability can complicate pricing strategies for products sold in different regions, making it challenging to maintain consistent profit margins. Companies must carefully consider these currency movements when setting prices to remain competitive while ensuring profitability.

To manage these inherent risks, Eaton, like many multinational corporations, likely employs hedging strategies. These financial instruments, such as forward contracts or options, are designed to lock in exchange rates for future transactions, thereby mitigating the impact of adverse currency movements. For example, if Eaton anticipates significant revenue in Euros in the coming months, it might use a forward contract to sell Euros at a predetermined rate, protecting against a potential depreciation of the Euro against the US dollar.

Supply chain stability and costs

Eaton faces ongoing challenges with supply chain stability and costs, which directly affect its production and bottom line. Disruptions, like those seen in 2023 and continuing into 2024, involving raw material shortages and elevated freight expenses, can significantly hinder manufacturing schedules and profitability. For instance, the semiconductor shortage, while easing, still presented hurdles for electronic component availability throughout much of 2023, impacting lead times for certain electrical products.

The company's ability to procure essential components and manage its logistics network effectively is paramount to satisfying customer demand. Eaton's operational efficiency hinges on securing a consistent flow of goods at predictable prices. In 2024, while some supply chain pressures have abated compared to the peak of the pandemic, geopolitical events and fluctuating energy costs continue to create an unpredictable cost environment for transportation and raw materials.

- Semiconductor Shortages: While improving, these continued to impact lead times for electronic components in 2023, affecting production schedules for various Eaton products.

- Freight Costs: Global shipping rates, though volatile, remained a significant cost factor in 2023 and early 2024, influencing overall manufacturing expenses.

- Raw Material Volatility: Prices for key materials like copper and steel experienced fluctuations in 2023-2024, impacting Eaton's cost of goods sold.

- Geopolitical Impact: Ongoing global tensions continue to pose risks to supply chain reliability and cost predictability.

Customer industry spending

Eaton's performance is closely tied to the economic health and investment cycles of its major customer industries. For instance, the commercial construction sector, a significant market for Eaton's electrical and building solutions, experienced a projected 4.1% growth in U.S. nonresidential construction spending for 2024, according to Dodge Construction Network. However, a slowdown in these areas, like a decrease in data center build-outs or reduced capital expenditures in the automotive sector, directly impacts Eaton's revenue. The aerospace industry's recovery post-pandemic, with a projected 9% increase in global air travel demand by 2025 compared to 2023 levels, offers a positive outlook for Eaton's aerospace segment.

Eaton's diversification strategy across various sectors like utilities, industrial automation, and transportation helps to buffer against downturns in any single industry. For example, while residential construction might face headwinds, increased investment in grid modernization by utilities, driven by renewable energy integration, can provide a stable revenue stream. The automotive industry's transition to electric vehicles (EVs) presents both challenges and opportunities, with demand for EV charging infrastructure and advanced electrical systems growing. Eaton reported that its Electrical Americas segment saw a 14% increase in sales in the first quarter of 2024, partly driven by strong demand in data centers and utilities.

- Commercial Construction: Projected 4.1% growth in U.S. nonresidential construction spending for 2024.

- Aerospace: Global air travel demand expected to increase by 9% by 2025 compared to 2023.

- Electrical Americas Segment: Achieved 14% sales increase in Q1 2024, boosted by data centers and utilities.

- Automotive: Growing demand for EV charging infrastructure and advanced electrical systems.

The global economic landscape in 2024 and projected into 2025 presents a mixed but generally expanding picture for Eaton. While global growth is anticipated to moderate slightly, it remains robust enough to support demand across Eaton's diverse segments. However, persistent inflation and the associated higher interest rates pose challenges by increasing input costs and potentially dampening capital expenditures for both Eaton and its clients.

| Economic Factor | 2024 Projection/Status | Impact on Eaton |

|---|---|---|

| Global GDP Growth | IMF projected 3.2% for 2024 | Supports demand across segments |

| Inflation (e.g., US PPI) | Notable increase in late 2023/early 2024 | Increases raw material, energy, and labor costs |

| Interest Rates | Monitored closely by central banks (e.g., Federal Reserve) | Raises borrowing costs, potentially slowing investment |

| Currency Exchange Rates | Significant volatility observed in 2024/early 2025 | Affects reported revenues and profitability of international operations |

Same Document Delivered

Eaton PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Eaton PESTLE analysis offers a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the insights and structure you see are precisely what you'll be working with.

Sociological factors

Eaton faces evolving workforce demographics, with an aging global population potentially reducing the pool of experienced engineers. For instance, in 2024, many developed nations continue to see a rise in the average age of their workforce, impacting the availability of specialized technical skills crucial for Eaton's operations.

To counter this, Eaton's investment in training and development is paramount. By 2025, companies like Eaton are expected to increase spending on reskilling and upskilling programs to bridge potential talent gaps and ensure employees remain proficient with new technologies.

Furthermore, diversity and inclusion initiatives are increasingly vital for talent acquisition. Eaton's commitment to these areas by 2024-2025 helps broaden its appeal to a wider talent pool, ensuring a more innovative and adaptable workforce.

Consumer and societal demand for sustainability is a major driver for companies like Eaton. There's a growing expectation for businesses to be environmentally conscious and socially responsible, pushing Eaton to develop products and strategies that align with these values. For instance, in 2024, the global market for sustainable products saw continued robust growth, with consumers increasingly willing to pay a premium for eco-friendly options.

This trend directly influences Eaton's product development, encouraging innovation in areas like energy efficiency and renewable energy solutions. Companies demonstrating strong Environmental, Social, and Governance (ESG) performance are also seeing increased investor interest and customer loyalty. Eaton's focus on intelligent power management aligns well with this demand, as seen in its continued investment in technologies that reduce carbon footprints.

The relentless global march towards urbanization, with an estimated 68% of the world's population projected to live in urban areas by 2050 according to the UN, directly fuels demand for Eaton's power management solutions. This trend necessitates significant investment in new and upgraded electrical infrastructure, commercial buildings, and transportation systems, all critical sectors for Eaton's product and service offerings.

Rapid urban growth, particularly in emerging economies where cities are expanding at an unprecedented rate, creates fertile ground for smart city technologies and the implementation of more efficient energy distribution systems. For instance, the global smart city market was valued at over $400 billion in 2023 and is expected to grow substantially, presenting direct opportunities for Eaton's integrated power solutions.

Health and safety standards

Eaton's commitment to health and safety is paramount, influencing everything from manufacturing processes to the very design of its electrical and aerospace components. This societal trend toward prioritizing well-being for both workers and consumers directly shapes how Eaton operates, ensuring its products meet rigorous safety benchmarks.

Adherence to these evolving safety standards is not just a matter of compliance; it's crucial for maintaining Eaton's reputation and avoiding costly regulatory penalties. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) reported that workplace injuries and illnesses cost U.S. businesses an estimated $174 billion annually, underscoring the financial implications of safety lapses.

Eaton actively invests in enhancing its safety protocols and product reliability, recognizing that continuous improvement in these areas is a key differentiator. This focus is evident in their ongoing efforts to minimize workplace incidents and ensure the safe performance of their technologies in diverse applications.

- Workplace Safety Investment: Eaton's dedication to a safe work environment is reflected in its operational expenditures, aiming to reduce incident rates and foster a culture of safety.

- Product Safety Compliance: The company ensures its electrical and aerospace products meet or exceed global safety certifications, vital for market access and customer trust.

- Regulatory Alignment: Eaton continuously monitors and adapts to changing health and safety regulations worldwide, a critical aspect of its global business strategy.

- Employee Well-being Programs: Beyond compliance, Eaton implements programs focused on employee health and safety, recognizing their importance for productivity and morale.

Corporate social responsibility expectations

Stakeholders, including investors, customers, and employees, are increasingly scrutinizing corporate social responsibility (CSR) efforts. For instance, in 2023, over 70% of consumers stated they would switch to brands that align with their values, highlighting the impact of ethical practices and community engagement on purchasing decisions. Eaton’s commitment to sustainability, evidenced by its 2023 ESG report detailing a 30% reduction in absolute Scope 1 and 2 greenhouse gas emissions since 2018, directly addresses these expectations.

A robust CSR reputation is no longer just a feel-good initiative; it's a strategic imperative that influences financial performance. In 2024, socially responsible investing (SRI) funds are projected to reach $50 trillion globally, demonstrating a significant shift in capital allocation towards companies with strong ESG credentials. This trend directly benefits companies like Eaton that prioritize transparent reporting and responsible business conduct, enhancing brand image and attracting socially conscious investors.

Employee expectations also play a crucial role in shaping CSR. A 2024 survey indicated that 85% of millennials consider a company's social and environmental impact when deciding where to work. Eaton’s initiatives, such as its 2023 global volunteer program that engaged over 15,000 employees, contribute to improved employee morale and retention, further solidifying its commitment to responsible business practices.

- Investor Demand: Growing SRI funds signal investor preference for companies demonstrating strong ESG performance, like Eaton's 2023 emissions reduction targets.

- Consumer Loyalty: Over 70% of consumers in 2023 indicated willingness to switch brands based on values, making CSR a key differentiator.

- Talent Acquisition: 85% of millennials in 2024 prioritize a company's social and environmental impact, influencing employer choice.

- Reputational Enhancement: Transparent CSR reporting and community engagement, such as Eaton's 2023 volunteer program, bolster brand image and trust.

Societal attitudes toward health and safety significantly influence Eaton's operational standards and product development. The increasing global emphasis on worker well-being and consumer safety means companies must adhere to stringent protocols. For instance, in 2023, workplace safety regulations continued to tighten, with a particular focus on electrical safety in industrial settings, directly impacting Eaton's manufacturing and product design.

Eaton’s proactive approach to safety, including investments in advanced safety training and robust product testing, is crucial for maintaining its reputation and market access. This commitment is underscored by the fact that in 2024, companies with strong safety records often experience lower insurance premiums and fewer production disruptions.

Furthermore, the growing awareness of public health and environmental safety drives demand for Eaton's solutions that promote cleaner energy and safer infrastructure. The company's focus on developing energy-efficient technologies and reliable power systems aligns directly with these societal priorities, positioning it favorably in the market.

Technological factors

Continuous innovation in power electronics, particularly in semiconductors, inverters, and converters, directly influences the efficiency, size, and overall cost of Eaton's electrical products. For instance, advancements in wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) are enabling higher power density and reduced energy losses in power conversion systems, a key area for Eaton's offerings.

By integrating these cutting-edge advancements, Eaton can develop and market more compact, powerful, and energy-efficient solutions, appealing to a market increasingly focused on sustainability and performance. This technological edge is crucial for maintaining a competitive advantage in the rapidly evolving electrical infrastructure sector.

Staying ahead in power electronics is paramount for Eaton's long-term success, as demonstrated by the growing demand for efficient power management in data centers and renewable energy integration. The global power electronics market was valued at approximately $25 billion in 2023 and is projected to grow significantly, underscoring the importance of technological leadership.

The increasing integration of digital technologies, including the Internet of Things (IoT) and artificial intelligence (AI), into power management systems presents significant opportunities for Eaton. These advancements allow for the development of smart, connected solutions that can transform how businesses manage their energy. For instance, predictive maintenance, enabled by IoT sensors, can reduce downtime and operational costs, a key benefit for industrial clients.

Eaton's strategic focus on intelligent power solutions directly leverages these technological shifts. By incorporating IoT and AI, Eaton can offer enhanced capabilities such as remote monitoring of critical infrastructure and optimized energy usage across facilities. This not only improves efficiency for their customers but also strengthens Eaton's competitive position in a rapidly evolving market.

For example, Eaton's 2023 revenue from its Digital Solutions segment, which encompasses many of these smart technologies, saw substantial growth, indicating strong customer adoption. The company's ongoing investments in R&D for AI-driven grid management and smart building technologies are expected to further bolster its market share in the coming years, with projections suggesting continued double-digit growth in this area through 2025.

The accelerating adoption of solar and wind power, which saw global renewable capacity additions reach a record 510 gigawatts (GW) in 2023 according to the International Energy Agency (IEA), demands sophisticated technologies for seamless grid integration. Eaton's advanced power management solutions are vital for stabilizing grids with intermittent renewables, facilitating energy storage deployment, and enabling the efficient operation of microgrids, thereby supporting the global energy transition.

Eaton's focus on developing innovative solutions for grid modernization is a key growth catalyst. For instance, the company's smart grid technologies, including advanced distribution automation and grid-edge intelligence, are essential for utilities seeking to enhance grid resilience and accommodate distributed energy resources. This technological advancement directly addresses the challenges posed by the increasing complexity of modern power systems.

Electric vehicle (EV) technology evolution

The rapid advancement in electric vehicle (EV) technology, particularly in battery energy density and charging speeds, directly impacts Eaton's core businesses. Innovations in power electronics, crucial for EV drivetrains and battery management systems, represent a significant growth avenue. As of early 2025, the global EV market is projected to reach over 30 million units sold annually, a substantial increase from previous years, highlighting the scale of this technological shift.

Eaton's expertise in power distribution, management, and protection is highly relevant to the expanding EV charging infrastructure. This includes solutions for high-power charging stations and grid integration, ensuring reliable and efficient power delivery. The demand for robust charging solutions is escalating, with investments in charging networks worldwide accelerating to meet consumer needs.

- Battery Advancements: Continued improvements in lithium-ion battery technology are reducing costs and increasing range, making EVs more accessible and practical.

- Charging Infrastructure Growth: The global charging infrastructure market is expected to grow at a CAGR of over 30% through 2030, creating substantial opportunities for component suppliers.

- Power Electronics Integration: Eaton's power electronics, such as inverters and converters, are essential for optimizing EV performance and charging efficiency, a critical area for market penetration.

Automation and advanced manufacturing

Eaton's integration of automation and advanced manufacturing, including robotics and smart factory initiatives, is crucial for enhancing operational efficiency and product quality. For instance, in 2024, the manufacturing sector globally saw a significant push towards Industry 4.0, with investments in AI-driven quality control and predictive maintenance systems increasing by an estimated 15-20% year-over-year, according to industry reports.

These technological advancements directly impact Eaton's cost structure and competitiveness. By optimizing production lines and reducing manual labor dependencies, the company can achieve substantial cost savings, estimated to be between 10-15% in areas where automation is fully deployed. This also bolsters the reliability and consistency of its global supply chain.

- Increased Efficiency: Automation reduces cycle times and minimizes errors in manufacturing processes.

- Cost Reduction: Lower labor costs and reduced material waste contribute to significant operational savings.

- Enhanced Quality: Advanced manufacturing techniques ensure greater precision and consistency in product output.

- Competitive Edge: Investment in Industry 4.0 keeps Eaton at the forefront of technological innovation in its industry.

Eaton's technological advancements in power electronics, particularly with wide-bandgap semiconductors like SiC and GaN, are driving higher power density and reduced energy loss in its electrical products, enhancing efficiency and competitiveness. The global power electronics market, valued at around $25 billion in 2023, highlights the importance of this innovation for Eaton's growth.

The integration of IoT and AI into power management systems allows Eaton to offer smart, connected solutions, boosting operational efficiency and customer value, as evidenced by the strong growth in its Digital Solutions segment in 2023. Investments in AI-driven grid management are projected for continued double-digit growth through 2025.

Eaton's solutions are crucial for integrating renewable energy sources, with global renewable capacity additions reaching a record 510 GW in 2023. Its smart grid technologies aid utilities in modernizing infrastructure and managing distributed energy resources, essential for grid resilience.

The burgeoning electric vehicle (EV) market, projected to exceed 30 million units sold annually by early 2025, presents significant opportunities for Eaton's power distribution and management expertise, especially in charging infrastructure and power electronics for EVs.

| Technological Factor | Impact on Eaton | Supporting Data/Trend |

|---|---|---|

| Power Electronics Advancements (SiC, GaN) | Increased efficiency, reduced energy loss, higher power density in electrical products. | Global power electronics market ~ $25B (2023), growing demand for efficient solutions. |

| IoT and AI Integration | Development of smart, connected power management solutions; enhanced predictive maintenance and remote monitoring. | Strong growth in Eaton's Digital Solutions segment (2023); projected double-digit growth in AI-driven grid management through 2025. |

| Renewable Energy Grid Integration | Enabling stable integration of intermittent renewables, supporting microgrids and energy storage. | Record 510 GW renewable capacity additions globally in 2023; demand for grid modernization technologies. |

| Electric Vehicle (EV) Technology | Opportunities in EV charging infrastructure and power electronics for EV drivetrains and battery management. | Global EV market projected > 30M units annually by early 2025; increasing investments in charging networks. |

Legal factors

Eaton navigates a complex web of product liability and safety regulations worldwide, impacting everything from electrical components to aerospace systems. For instance, in 2024, the automotive sector faced increased scrutiny on advanced driver-assistance systems (ADAS) safety, a segment where Eaton is active. Failure to adhere to these stringent standards, such as those set by the U.S. Consumer Product Safety Commission (CPSC) or European Union directives, can lead to costly recalls and significant legal battles.

Eaton operates under stringent environmental protection laws that govern emissions, waste management, and the handling of hazardous substances. These regulations necessitate significant capital expenditure for sustainable manufacturing practices and the innovation of greener product lines. For instance, the EU's Emissions Trading System (ETS) and similar initiatives globally put a price on carbon, directly affecting operational costs for energy-intensive sectors where Eaton is active.

Compliance with these evolving environmental standards, such as those related to energy efficiency in electrical equipment and vehicle emissions, requires continuous investment in research and development. Eaton's commitment to sustainability, evident in its 2023 sustainability report detailing progress in reducing greenhouse gas emissions by 37% against a 2018 baseline, demonstrates this focus. Failure to adhere to these legal frameworks can result in substantial financial penalties and reputational damage, impacting market access and investor confidence.

Eaton faces a complex web of data privacy and cybersecurity laws, with regulations like GDPR and CCPA significantly impacting its operations. As of early 2024, the global cost of data breaches was estimated to be around $4.51 million on average, highlighting the financial risks. Compliance with these evolving mandates is crucial for safeguarding customer information and operational integrity, especially with Eaton's increasing reliance on connected products and digital services.

Intellectual property rights

Protecting Eaton's vast array of patents, trademarks, and trade secrets is fundamental to preserving its market leadership and deterring unauthorized use. The company actively manages its intellectual property portfolio, which is a significant asset in its competitive landscape. For instance, in 2023, Eaton reported spending $2.1 billion on research and development, a testament to its continuous innovation pipeline that requires robust IP protection.

Legal frameworks governing intellectual property differ significantly across the globe, necessitating a sophisticated and adaptable strategy for enforcement and defense. Eaton's global operations mean it must navigate these varied legal systems to safeguard its innovations from infringement. This proactive legal stance ensures that Eaton's technological advancements remain exclusive and provide a sustained competitive advantage.

- Global IP Enforcement: Eaton's strategy includes monitoring and enforcing its intellectual property rights in key markets worldwide.

- R&D Investment: The company's substantial R&D spending, exceeding $2 billion annually, underscores the importance of protecting its innovations.

- Legal Compliance: Navigating diverse international IP laws is critical for preventing infringement and defending its technological assets.

- Competitive Advantage: Strong IP protection safeguards Eaton's innovations, directly contributing to its sustained market position.

Labor and employment laws

Eaton navigates a complex web of global labor and employment laws, impacting everything from minimum wage requirements to workplace safety standards. For instance, in 2024, the International Labour Organization (ILO) continued to advocate for stronger protections against discrimination and harassment in the workplace across its member states, which includes many countries where Eaton operates. Failure to adhere to these varied regulations, such as those concerning overtime pay or unionization rights, can result in significant financial penalties and damage to Eaton's brand reputation.

Ensuring compliance is an ongoing challenge, requiring constant monitoring of legislative changes and robust internal policies. For example, in the European Union, the upcoming implementation of directives aimed at improving work-life balance and transparency in working conditions will necessitate adjustments to employment contracts and operational practices. Eaton's commitment to fair labor practices is therefore not just a legal obligation but a strategic imperative for sustainable operations.

- Global Compliance Burden: Eaton must adhere to labor laws in over 175 countries, each with unique regulations on wages, working hours, and employee rights.

- Risk of Non-Compliance: Fines for labor law violations can be substantial; for example, in 2024, several multinational corporations faced multi-million dollar penalties for wage and hour violations in the United States.

- Reputational Impact: Negative publicity stemming from labor disputes can deter customers and talent, impacting market share and employee morale.

- Evolving Legal Landscape: New legislation, such as the push for increased parental leave in several Asian nations in 2024-2025, requires continuous adaptation of HR policies.

Eaton is subject to a broad range of trade regulations, including export controls and tariffs, which directly influence its global supply chain and market access. For instance, in 2024, ongoing geopolitical tensions led to adjustments in trade policies affecting critical components, impacting companies like Eaton. Navigating these complex international trade laws, such as those enforced by the World Trade Organization (WTO) or national customs agencies, is crucial for maintaining operational efficiency and profitability.

Compliance with competition laws, or antitrust regulations, is paramount to prevent monopolistic practices and ensure fair market competition. Eaton must continually assess its market position and business practices to avoid anti-competitive behavior, which can lead to severe penalties and legal challenges. For example, regulatory bodies worldwide, including the European Commission and the U.S. Federal Trade Commission (FTC), actively investigate and prosecute anti-competitive conduct, with significant fines levied against non-compliant entities.

The company's commitment to ethical business practices and corporate governance is reinforced by various legal frameworks designed to ensure transparency and accountability. Adherence to regulations like the Sarbanes-Oxley Act (SOX) in the United States, which mandates robust internal controls over financial reporting, is critical. Eaton's 2023 annual report details its ongoing efforts to strengthen these governance structures, reflecting the importance of legal compliance in maintaining investor trust and corporate reputation.

| Legal Area | Key Regulations/Considerations | Impact on Eaton | 2024/2025 Relevance |

|---|---|---|---|

| Product Liability & Safety | CPSC, EU Directives | Costly recalls, legal battles | Increased scrutiny on ADAS safety |

| Environmental Law | EU ETS, Carbon Pricing | Capital expenditure for sustainability | Driving investment in greener product lines |

| Data Privacy & Cybersecurity | GDPR, CCPA | Financial risks from data breaches | Protecting customer data in connected products |

| Intellectual Property | Global IP Laws | Safeguarding innovations, competitive advantage | Protecting $2.1 billion R&D investment (2023) |

| Labor & Employment | ILO standards, Work-life balance directives | Financial penalties, reputational damage | Adapting to new parental leave policies |

| Trade Regulations | Export Controls, Tariffs, WTO | Supply chain disruption, market access | Navigating geopolitical trade policy shifts |

| Competition Law | Antitrust, FTC, EU Commission | Fines, legal challenges | Ensuring fair market practices |

| Corporate Governance | SOX, Ethical conduct | Investor trust, corporate reputation | Strengthening internal financial controls |

Environmental factors

Global climate change mitigation efforts, such as the Paris Agreement's commitment to limit warming to well below 2 degrees Celsius, and increasing renewable energy mandates worldwide, significantly boost demand for Eaton's energy-efficient technologies. For instance, the European Union's target to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels directly fuels the need for solutions like Eaton's power distribution and management systems that enable greater grid flexibility and renewable energy integration.

Eaton's business model is inherently aligned with helping its customers achieve their own carbon reduction goals. Its products, like advanced uninterruptible power supplies (UPS) and energy storage systems, are crucial for businesses looking to minimize their environmental impact and operational costs. As of 2024, many corporations are setting ambitious net-zero targets, creating a substantial market for these sustainable solutions.

Simultaneously, Eaton itself faces mounting pressure from investors and regulators to decarbonize its own operations. The company is actively pursuing initiatives to reduce its Scope 1 and Scope 2 emissions, aiming for science-based targets. This internal focus on sustainability not only enhances its corporate reputation but also drives innovation in developing even more efficient products and processes.

Growing concerns about resource scarcity, particularly for critical materials like copper and rare earth elements essential for electrical components, are pushing Eaton to integrate more sustainable manufacturing. This includes exploring alternative materials and actively pursuing circular economy models. For instance, the company is focusing on designing products with enhanced durability and recyclability, directly impacting its product lifecycle management strategies.

Eaton faces increasing scrutiny over its environmental impact, with stringent regulations on waste management and pollution control directly affecting its global manufacturing operations. For instance, in 2024, the European Union continued to tighten its grip on industrial emissions, pushing companies like Eaton to invest heavily in advanced pollution abatement technologies. Failure to comply can result in significant fines and reputational damage, making proactive environmental stewardship a critical business imperative.

The company's commitment to reducing its environmental footprint is demonstrated through initiatives aimed at waste minimization and enhanced recycling programs across its facilities. Eaton reported a 5% reduction in hazardous waste generation in its 2023 sustainability report, a trend it aims to continue through 2025 by optimizing production processes and exploring circular economy principles in its supply chain. These efforts are not just about compliance but also about meeting growing public and investor expectations for corporate environmental responsibility.

Renewable energy adoption trends

The global shift towards renewable energy is rapidly accelerating, presenting substantial growth avenues for Eaton. As countries worldwide push for decarbonization, the demand for robust grid infrastructure, advanced energy storage systems, and efficient power distribution solutions, all areas of Eaton's expertise, is set to surge. Eaton's technologies are crucial for seamlessly integrating and managing the inherent variability of sources like solar and wind power, making this a foundational growth sector for the company.

Real-world data underscores this trend. For instance, the International Energy Agency (IEA) reported that renewable energy sources accounted for over 80% of new global power capacity additions in 2023. Furthermore, projections indicate that solar PV capacity alone could more than triple by 2030, reaching over 3,000 GW globally. This expansion necessitates significant upgrades and new installations in grid modernization and management, directly benefiting companies like Eaton.

- Global renewable energy capacity additions in 2023 exceeded 500 GW, a record high.

- The global energy storage market is projected to grow from approximately $20 billion in 2023 to over $100 billion by 2030.

- Eaton's Powering Business Networks report highlights that 70% of businesses are increasing their investment in grid resilience and renewable energy integration.

ESG reporting and transparency

Eaton's commitment to ESG reporting is increasingly critical as investors and stakeholders demand greater transparency regarding its environmental impact. This scrutiny is driving a need for comprehensive data on emissions, resource usage, and sustainability initiatives.

Strong ESG performance directly correlates with attracting responsible investment capital and bolstering the company's reputation. For instance, in 2023, sustainable investment funds saw significant inflows, highlighting this trend. Eaton's transparent reporting on its 2024 environmental targets and progress is therefore essential for maintaining investor confidence and accessing a broader pool of capital.

- Enhanced Investor Appeal: Companies with robust ESG reporting, like Eaton, are better positioned to attract capital from the growing number of ESG-focused investment funds. In 2024, sustainable investing assets under management are projected to reach new highs.

- Reputational Capital: Transparent reporting builds trust and enhances brand image, which can translate into stronger customer loyalty and a more attractive employer brand.

- Regulatory Preparedness: Proactive and transparent ESG reporting helps Eaton stay ahead of evolving environmental regulations and disclosure requirements globally.

- Operational Accountability: The process of reporting fosters internal accountability, driving continuous improvement in environmental performance and sustainability efforts.

The global push for decarbonization significantly benefits Eaton, as demand for its energy-efficient technologies and grid modernization solutions surges. For example, the International Energy Agency reported that renewable energy capacity additions exceeded 500 GW in 2023, a record. This trend is projected to continue, with solar PV capacity expected to more than triple by 2030, creating substantial opportunities for Eaton's power management systems.

Eaton's focus on sustainability aligns with corporate net-zero targets, driving demand for its energy storage and UPS systems. As of 2024, many businesses are increasing investments in grid resilience and renewable energy integration, with 70% of businesses reporting higher spending in this area, according to Eaton's own research.

The company is also actively reducing its own environmental footprint, with initiatives like waste minimization showing results, such as a 5% reduction in hazardous waste generation in 2023. This commitment is crucial for meeting investor expectations and preparing for evolving environmental regulations.

| Environmental Factor | Impact on Eaton | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Climate Change Mitigation & Renewables | Increased demand for energy-efficient technologies and grid solutions. | Global renewable energy capacity additions exceeded 500 GW in 2023. Solar PV capacity projected to triple by 2030. |

| Corporate Sustainability Goals | Growth in demand for energy storage and UPS systems. | 70% of businesses increasing investment in grid resilience and renewables (Eaton report). |

| Resource Scarcity & Circular Economy | Focus on sustainable materials and product durability/recyclability. | Ongoing efforts to integrate circular economy principles in supply chains. |

| Environmental Regulations & Compliance | Need for investment in pollution abatement and waste management. | Continued tightening of industrial emission regulations globally (e.g., EU). 5% reduction in hazardous waste generation reported in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Eaton is meticulously constructed using a blend of official government reports, reputable industry publications, and leading economic forecasting agencies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscapes impacting Eaton.