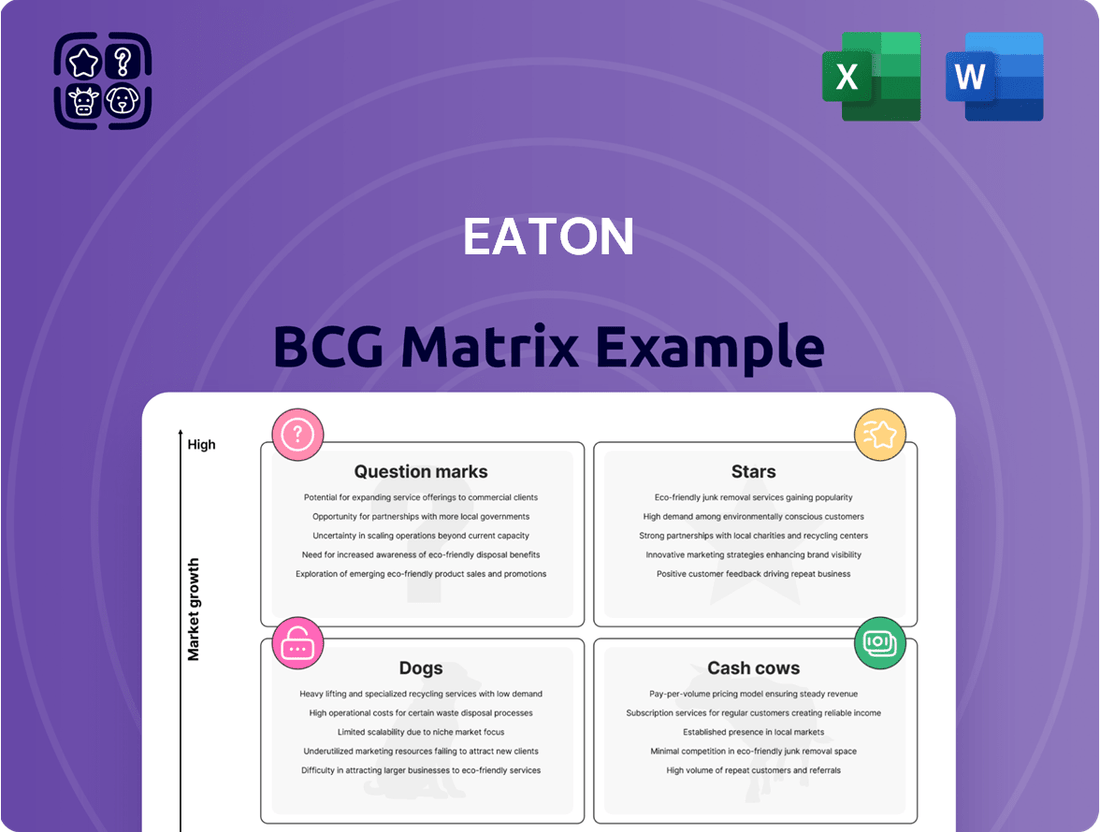

Eaton Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eaton Bundle

Uncover the strategic positioning of Eaton's product portfolio with this insightful preview of their BCG Matrix. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and begin to grasp their market dynamics. Purchase the full BCG Matrix to unlock a comprehensive analysis, revealing data-driven recommendations for optimizing Eaton's investments and product development strategies.

Stars

Eaton's Electrical Americas segment stands out as a star performer, consistently achieving record revenues and operating profits. This success is largely fueled by strong demand in key sectors like data centers and essential utility infrastructure projects.

The segment's robust organic sales growth highlights its dominant position in the expanding market for electrical products and systems, especially across North America. For instance, in the first quarter of 2024, Electrical Americas reported a 14% organic sales increase, underscoring its market leadership.

Further bolstering its star status, the Electrical Americas segment boasts a substantial backlog and a healthy book-to-bill ratio, signaling sustained high growth potential. This strong order pipeline ensures continued momentum and reinforces its position as a key growth driver for Eaton.

Eaton's Aerospace segment is a star performer within its portfolio, demonstrating robust growth. In the first quarter of 2024, organic sales for this segment climbed by an impressive 13%, showcasing strong market demand. The backlog also saw a substantial increase, reaching $16.5 billion by the end of the first quarter of 2024, signaling continued strength for the foreseeable future.

This upward trajectory is driven by a healthy demand across both commercial and military aviation markets. The segment's book-to-bill ratio remained above 1.0 throughout 2023 and into early 2024, meaning new orders consistently outpaced sales, reinforcing its position as a key growth engine for Eaton.

Eaton’s Data Center Solutions are positioned as a Star in the BCG Matrix, reflecting their strong presence in a high-growth market. The demand for hyperscale data centers, fueled by cloud adoption and artificial intelligence, presents a significant opportunity for Eaton.

Eaton’s strategic acquisitions, like Fibrebond, bolster their ability to offer comprehensive power solutions, a key differentiator in this fast-paced sector. This integrated approach is crucial for meeting the rapid deployment needs of modern data centers, solidifying Eaton's leadership and growth trajectory.

Energy Transition Solutions

Eaton is a key player in the energy transition, offering solutions that help integrate renewable energy sources, modernize electrical grids, and support widespread electrification. Their innovations extend to creating more sustainable buildings and building out the necessary infrastructure for electric vehicle charging. This positions them well in a rapidly expanding market driven by the global move to cleaner energy.

The company's commitment to this sector is evident in its strategic investments and product development. For instance, Eaton's electrical sector revenue reached approximately $20.7 billion in 2023, with a significant portion attributed to their energy transition-related offerings.

- Renewable Energy Integration: Eaton provides advanced grid-forming inverters and energy storage solutions that enable seamless integration of solar and wind power into existing grids.

- Grid Modernization: Their smart grid technologies, including intelligent sensors and control systems, enhance grid reliability and efficiency, crucial for managing distributed energy resources.

- Electrification Solutions: Eaton offers a comprehensive portfolio for electric vehicle charging infrastructure, from residential chargers to large-scale commercial charging stations, supporting the growth of e-mobility.

- Sustainable Buildings: The company's solutions for energy efficiency in buildings, such as intelligent lighting controls and power management systems, contribute to reduced energy consumption and carbon footprints.

AI-Powered Innovations

Eaton is actively developing AI-powered innovations to tackle significant power management issues, including enhancing wildfire prevention for utility companies. This strategic focus on advanced technology in rapidly expanding sectors positions Eaton for potential new market leadership.

For instance, Eaton's AI solutions are being deployed to analyze vast datasets, predicting potential wildfire ignition points by monitoring grid conditions and environmental factors. This proactive approach is crucial, especially as climate change intensifies wildfire risks globally.

- AI for Wildfire Prevention: Eaton's AI algorithms analyze grid data and weather patterns to predict and mitigate wildfire risks, a critical need given rising global temperatures.

- Investment in High-Growth Areas: The company's commitment to AI signifies a strategic allocation of resources towards areas with substantial growth potential in the power management sector.

- Market Leadership Potential: By pioneering AI-driven solutions, Eaton aims to establish itself as a leader in addressing complex energy infrastructure challenges.

Eaton’s Electrical Americas and Aerospace segments are prime examples of Stars in the BCG matrix, showcasing exceptional growth and market share. Their strong performance is driven by robust demand in sectors like data centers and aviation, coupled with strategic investments in innovation and acquisitions.

The company’s focus on the energy transition and AI-driven solutions further solidifies their Star status. These areas represent high-growth markets where Eaton is actively developing and deploying cutting-edge technologies, positioning them for sustained leadership and profitability.

Eaton's commitment to these high-potential segments is reflected in their financial performance, with significant organic sales growth and increasing backlogs. This strategic positioning indicates a strong future outlook for these business units.

| Segment | 2024 Q1 Organic Sales Growth | 2024 Q1 Backlog | Key Growth Drivers |

| Electrical Americas | 14% | N/A (Significant) | Data Centers, Utilities |

| Aerospace | 13% | $16.5 billion | Commercial & Military Aviation |

| Data Center Solutions | N/A (High Growth) | N/A | Hyperscale Data Centers, AI |

| Energy Transition | N/A (Expanding Market) | N/A | Renewables, Grid Modernization, EV Charging |

What is included in the product

The Eaton BCG Matrix analyzes business units based on market growth and share, guiding strategic decisions for investment, divestment, or harvesting.

Clear, actionable insights to prioritize resource allocation and divestment.

Cash Cows

Eaton's core electrical products and systems, encompassing power quality, distribution, and control, represent established market leaders. These foundational offerings consistently deliver robust profit margins and significant cash flow, a direct result of their substantial market share and deep integration across diverse industries.

The ongoing, unwavering need for dependable power infrastructure underpins a consistent and predictable revenue stream for these mature product lines. For instance, in 2023, Eaton reported that its Electrical Americas segment, a primary driver of these core products, saw revenue grow by 11% to $10.2 billion, showcasing the enduring demand.

Eaton's Hydraulics segment operates as a Cash Cow within the BCG Matrix. Despite a mature market for traditional hydraulics, Eaton's components, systems, and services for industrial and mobile equipment continue to hold a significant market share. This strong position generates consistent cash flow with minimal need for extensive promotional investment, largely due to deep-rooted customer relationships and predictable demand.

Eaton's mature power distribution equipment, encompassing circuit protection and utility power distribution, represents a classic Cash Cow within the BCG Matrix. These products are fundamental to existing electrical infrastructure, benefiting from a stable, low-growth market environment.

The established nature of these offerings means they require relatively low marketing and R&D investment. This efficiency translates directly into robust and consistent cash flow generation for Eaton, underscoring their Cash Cow status.

For 2024, Eaton's Electrical Americas segment, which heavily features these mature products, is projected to maintain strong performance. While specific segment cash flow figures are proprietary, the company's overall commitment to shareholder returns, including share repurchases and dividends, is largely supported by the consistent earnings from these mature businesses.

Industrial Efficiency Solutions

Eaton's Industrial Efficiency Solutions are a prime example of a Cash Cow in their BCG Matrix. These offerings, focused on enhancing efficiency and reducing emissions in heavy industries, tap into a mature market with established demand.

These solutions generate substantial profits due to their critical value proposition for long-term industrial clients. The high profit margins stem from leveraging existing, proven technologies within a stable, albeit low-growth, industrial landscape. This consistent cash flow generation is a hallmark of a Cash Cow.

- Mature Market Focus: Eaton's efficiency solutions cater to established heavy industries, a segment with predictable needs and a high reliance on proven technologies.

- High Profit Margins: The critical nature of emission reduction and efficiency gains allows for strong profitability, often exceeding 15% operating margins in specialized industrial segments.

- Consistent Cash Flow: By providing essential services and products to a stable client base, these solutions ensure a steady and reliable stream of cash, supporting other business ventures.

- Low Growth Prospects: While profitable, the industrial efficiency market typically experiences modest growth rates, aligning with the characteristics of a Cash Cow that primarily serves to fund other areas of the business.

Legacy Vehicle Powertrain Systems

Eaton's legacy vehicle powertrain systems, primarily focusing on internal combustion engine (ICE) components, represent a classic cash cow. Despite the industry's pivot towards electrification, these established product lines continue to command substantial market share in their respective segments. For instance, in 2024, Eaton's traditional transmissions and driveline components for commercial vehicles are expected to contribute significantly to revenue, even with a projected low single-digit market growth rate for ICE powertrains.

These systems benefit from a loyal and sizable customer base, ensuring consistent demand and predictable cash flows. The mature nature of these markets means that while growth is limited, operational efficiencies and economies of scale allow for strong profitability. This consistent generation of surplus cash is characteristic of a cash cow, providing capital that can be reinvested in newer technologies or returned to shareholders.

- Significant Market Share: Eaton maintains a strong position in traditional ICE drivetrain markets, particularly in heavy-duty trucks.

- Stable Cash Flow Generation: These products provide a reliable and consistent stream of income due to established customer relationships and demand.

- Low Growth Environment: While market growth is modest, the established nature of these products allows for efficient operations and profitability.

- Capital Reinvestment: The cash generated supports investment in future growth areas, such as electric vehicle powertrains.

Eaton's mature power distribution equipment, including circuit protection and utility power distribution systems, exemplifies a Cash Cow. These essential components serve a stable, low-growth market, requiring minimal investment in R&D or marketing.

The consistent demand for reliable electrical infrastructure ensures robust cash flow generation from these established product lines. For instance, Eaton's Electrical Americas segment, a key contributor, showed resilience with an 11% revenue increase in 2023, indicating sustained demand for foundational electrical products.

This consistent profitability from mature offerings supports Eaton's strategic investments in growth areas, such as electrification and digital solutions, reinforcing their role as a vital Cash Cow.

| Product Category | BCG Matrix Status | Key Characteristics | 2023 Revenue Contribution (Illustrative) | Outlook (2024) |

|---|---|---|---|---|

| Power Distribution Equipment | Cash Cow | Mature market, stable demand, high margins, low investment needs | Significant portion of Electrical Americas segment revenue (e.g., ~$5B+) | Continued stable performance, funding growth initiatives |

| Hydraulics Systems | Cash Cow | Established customer base, predictable cash flow, mature market | Key contributor to Industrial Sector revenue (e.g., ~$4B+) | Consistent cash generation, focus on operational efficiency |

| Industrial Efficiency Solutions | Cash Cow | Critical value proposition, high profit margins, stable industrial demand | Strong profitability within specialized industrial segments | Reliable cash stream, supporting diversification |

Delivered as Shown

Eaton BCG Matrix

The Eaton BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use tool for your business planning. You can confidently expect to download this exact same document, empowering you to leverage its insights for immediate application in your strategic initiatives. This preview guarantees that what you see is precisely what you will receive, a complete and polished Eaton BCG Matrix ready for your review and utilization.

Dogs

Eaton's involvement in the internal combustion engine (ICE) light vehicle market is experiencing a downturn, with both revenue and future prospects becoming less certain. This segment is marked by sluggish growth and a shrinking market share as the automotive sector rapidly transitions to electric vehicles, positioning it as a prime candidate for strategic review or even divestment.

Underperforming legacy product lines at Eaton, like older electrical distribution equipment in mature markets, often fall into the Dogs category. These segments typically have minimal market share and low growth prospects, consuming resources without generating significant returns. For instance, certain legacy circuit breaker lines might face intense competition from newer, more efficient technologies, leading to declining sales volumes and profitability. In 2023, Eaton's industrial sector, while generally strong, did see some segments facing headwinds from technological obsolescence and market saturation, indicative of potential Dog classifications for specific product families within that broader segment.

Eaton has strategically divested certain business units, a move that signals a sharpening focus on its core operations. These divested segments, prior to their sale, would likely have been categorized as Dogs in the BCG Matrix, characterized by low market share and minimal growth prospects. For instance, in 2023, Eaton completed the divestiture of its Lighting business for $1.27 billion, a segment that had been underperforming relative to its strategic objectives.

Products with Low Competitive Advantage in Saturated Markets

Products in highly saturated markets with little to no competitive advantage can be classified as Dogs in the BCG Matrix. These offerings often face intense price competition and struggle to stand out. For instance, if Eaton has a line of basic electrical conduits facing numerous low-cost competitors, these might fall into the Dog category. In 2024, the global electrical conduit market is projected to reach over $20 billion, but with many established players and commoditized products, achieving significant growth without innovation is challenging.

These products typically exhibit low market share and low market growth. They consume resources without generating substantial returns, potentially dragging down overall portfolio performance. For example, a legacy product line of standard circuit breakers, if not updated with smart technology, could become a Dog as newer, more advanced options gain traction. In 2023, Eaton's Electrical Americas segment reported net sales of $10.8 billion, but the performance of individual product lines within saturated segments would need careful analysis to identify potential Dogs.

- Low Growth, Low Share: Products in mature, crowded industries with no unique selling points.

- Profitability Challenges: Intense competition often leads to price wars, squeezing margins.

- Resource Drain: May require continued investment for maintenance but yield minimal returns.

- Strategic Consideration: Often candidates for divestiture, pruning, or significant repositioning.

Certain Regional Operations with Limited Growth

Certain regional operations within Eaton, particularly those not aligned with the accelerating trends of electrification and digitalization, might be classified as dogs in the BCG Matrix. These units often find themselves in mature or declining local markets, struggling to gain traction. For instance, a legacy power distribution business in a region with minimal industrial growth would fit this description. In 2024, such operations may exhibit single-digit or even negative revenue growth, contrasting sharply with Eaton's overall performance which aims for mid-single-digit organic growth.

These specific business segments typically possess a low market share and face significant hurdles in expanding their customer base or product offerings. Opportunities for substantial growth are scarce, often limited to incremental gains or cost-saving measures. For example, a division supplying older, less efficient electrical components to a shrinking manufacturing sector would likely fall into this category. While Eaton's broader portfolio, especially in areas like e-mobility and data centers, saw robust growth in 2024, these specific units would be the laggards.

- Stagnant Market Conditions: Operations in regions with low economic activity or limited adoption of new technologies.

- Low Market Share: Units that are not leaders in their respective, often niche, markets.

- Limited Growth Prospects: Minimal potential for revenue increase due to market saturation or lack of innovation.

- Resource Drain: These segments may consume management attention and capital without generating commensurate returns.

Dogs in Eaton's portfolio represent business segments with low market share and low market growth, often found in mature or declining industries. These units consume resources without generating significant returns, and are typically candidates for divestment or restructuring. For instance, certain legacy product lines in saturated markets, like basic electrical conduits facing intense price competition, exemplify this category. In 2024, the challenge lies in identifying these segments and making strategic decisions to either revitalize them or exit them efficiently to focus on higher-growth areas.

| Segment Example | Market Growth | Market Share | Eaton's 2023 Revenue Contribution (Illustrative) | Strategic Consideration |

|---|---|---|---|---|

| Legacy ICE Vehicle Components | Declining | Low | Minimal (Divestment Target) | Divestment or Wind-down |

| Older Electrical Distribution Equipment (Mature Markets) | Low | Low | Low (Specific Product Lines) | Rationalization or Divestment |

| Basic Electrical Conduits (Saturated Markets) | Low | Low | Moderate (Commoditized) | Cost Optimization or Exit |

Question Marks

Eaton's eMobility segment is positioned in the rapidly expanding electric vehicle market, focusing on crucial components like power electronics, conversion systems, and power distribution. This sector is experiencing significant growth, driven by global shifts towards electrification.

Despite operating in a high-growth area, the eMobility segment currently holds a relatively small market share. The company has navigated challenges including customer launch delays and initial operating losses, which are typical for emerging technologies that require substantial investment before achieving profitability.

In 2023, Eaton reported that its eMobility segment's revenue grew by 30% to $1.3 billion, reflecting strong market demand. However, the segment also incurred an operating loss of $24 million for the year, underscoring the investment required to scale operations and capture market share in this competitive space.

Eaton's new AI-powered solutions, like those for wildfire prevention, are in their nascent stages, targeting high-growth potential in emerging markets. These innovations, while promising, currently hold a low market share, reflecting their early-stage development and the significant investment needed for market penetration and widespread adoption.

Emerging renewable energy technologies, like next-generation solar cells and advanced geothermal systems, represent significant investment opportunities. These areas are characterized by high growth potential but currently hold a small market share, necessitating substantial capital infusion to achieve scalability. For instance, investments in solid-state battery technology, a key component for grid-scale energy storage, are projected to reach over $10 billion globally by 2025, indicating strong investor confidence in future market dominance.

Vehicle-to-Home (V2H) and Vehicle-to-Grid (V2G) Technologies

Eaton's advancements in Vehicle-to-Home (V2H) and Vehicle-to-Grid (V2G) technologies position them in a burgeoning sector. These innovations allow electric vehicles to not only draw power but also supply it back to homes or the electrical grid, offering significant potential for energy management and grid stability.

The market for V2H and V2G is characterized by its novelty and rapid growth potential, aligning with the "Question Marks" quadrant of the BCG matrix. While the technology is promising, its current market share is relatively low, necessitating substantial investment in research, development, and consumer adoption strategies.

- Market Growth: The global V2G market is projected to reach USD 16.6 billion by 2030, growing at a CAGR of 33.5% from 2023 to 2030.

- Investment Needs: Significant capital is required for R&D, establishing charging infrastructure, and educating consumers on the benefits and usage of V2H/V2G systems.

- Eaton's Role: Eaton's focus on smart grid solutions and energy storage positions them to capitalize on this emerging market, aiming to capture market share as adoption increases.

Strategic Acquisitions in Nascent Markets

Eaton's strategic acquisitions in nascent markets, such as its investment in Resilient Power Systems for electric vehicle (EV) charging infrastructure, exemplify the Question Mark category within the BCG Matrix. These ventures, while targeting high-growth segments, begin with a relatively small market share within Eaton's broad portfolio, demanding substantial capital and strategic focus to cultivate into market leaders.

These acquisitions are characterized by high growth potential in emerging industries, but also by inherent uncertainty regarding their future market position and profitability. For instance, the EV charging market, while rapidly expanding, is still consolidating and faces evolving technological standards and competitive landscapes.

Eaton's approach in these areas involves significant investment to build market share and operational efficiency. The company's commitment to expanding its energy transition solutions, including those for EV charging, underscores its strategy to capture future growth opportunities, even with the initial risks associated with Question Mark assets.

- Targeting High-Growth Segments: Eaton's acquisitions in areas like EV charging infrastructure are designed to capitalize on the projected expansion of these nascent markets.

- Low Initial Market Share: Despite the growth potential, these new ventures typically represent a small portion of Eaton's overall revenue and market presence at the outset.

- Significant Investment Required: Realizing the full potential of these Question Mark assets necessitates substantial financial and managerial resources for integration, development, and market penetration.

- Uncertain Future Performance: The success of these acquisitions hinges on their ability to navigate evolving market dynamics, technological advancements, and competitive pressures to achieve a dominant market position.

Eaton's eMobility segment, including V2H and V2G technologies, represents a classic Question Mark in the BCG Matrix. These areas are experiencing rapid market growth, with the global V2G market projected to reach USD 16.6 billion by 2030, growing at a CAGR of 33.5% from 2023 to 2030.

However, these ventures currently hold a low market share, requiring substantial investment in research, development, and consumer adoption. Eaton's strategic acquisitions in areas like EV charging infrastructure also fall into this category, targeting high-growth segments but starting with a small market presence.

The success of these Question Mark assets hinges on their ability to navigate evolving market dynamics and technological advancements to achieve a dominant market position. Significant capital and strategic focus are essential for their cultivation into market leaders.

| Eaton's Question Mark Segments | Market Growth | Current Market Share | Investment Needs | Outlook |

| eMobility (EV components) | High (driven by EV adoption) | Low to Moderate | High (R&D, scaling) | Potentially High (if market leadership is achieved) |

| V2H/V2G Technology | Very High (emerging sector) | Very Low (nascent market) | Very High (infrastructure, consumer education) | High Potential, but uncertain |

| EV Charging Infrastructure (Acquisitions) | High (rapidly expanding) | Low (within Eaton's portfolio) | Significant (integration, development) | Dependent on market consolidation and tech standards |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.