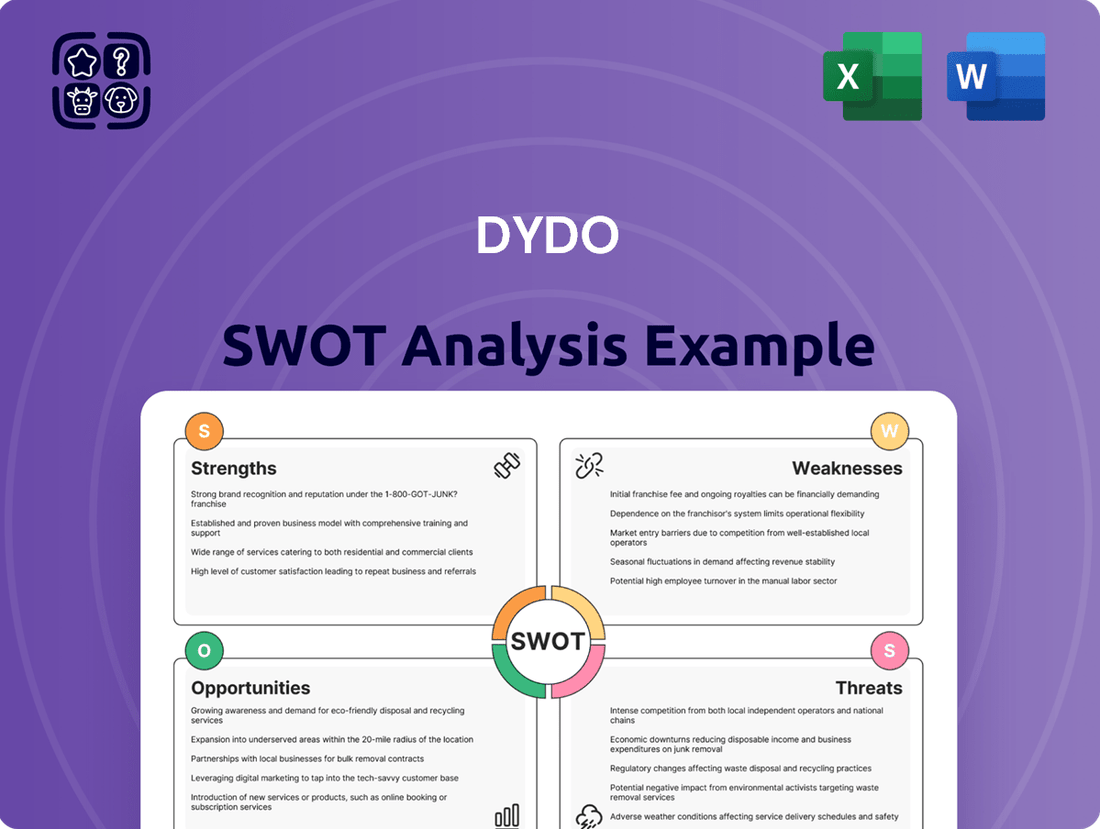

DyDo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DyDo Bundle

DyDo's market position is shaped by its strong brand recognition and diverse product portfolio, but also faces challenges from intense competition and evolving consumer preferences. Understanding these internal capabilities and external market dynamics is crucial for strategic decision-making.

Want the full story behind DyDo's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

DyDo Group Holdings leverages an extensive vending machine network, a cornerstone of its operations, generating roughly 80% of its domestic beverage revenue. This widespread presence ensures products are readily available to consumers nationwide, acting as a robust distribution channel and a consistent source of income.

DyDo Group Holdings' strength lies in its diversified business portfolio, extending beyond its well-known beverage operations. The company has strategically expanded into health foods and supplements, tapping into the growing wellness market. This diversification is a key advantage, reducing reliance on any single sector and creating multiple growth engines.

Further bolstering its portfolio is a pharmaceutical-related business, which includes contract manufacturing for drinkable preparations and a focus on orphan drugs. This segment is not just a niche play; it's showing tangible progress. For instance, early 2025 saw the company achieve new drug approvals and generate sales within this area, demonstrating its growing capabilities and market penetration.

DyDo Group Holdings boasts a robust international beverage segment, highlighted by significant growth in Turkey. Strategic price adjustments and marketing efforts there led to a notable increase in local currency sales, demonstrating effective market penetration.

The acquisition of a Polish beverage company in February 2024 was a key move, enhancing DyDo's global reach and positively impacting its operating profit from the outset. This expansion underscores a commitment to solidifying its international standing.

To further cultivate global brands and stabilize international operations, DyDo established DyDo DRINCO International, Inc. This initiative signals a strategic focus on building a stronger, more cohesive worldwide presence for its beverage portfolio.

Commitment to Innovation and Technology

DyDo's commitment to innovation is evident in its proactive adoption of technology, especially within its vending machine network. The company is deploying AI-powered 'Smart Operations' to boost efficiency and address labor challenges, a critical move given the evolving workforce landscape. This focus on technological integration is designed to streamline operations and enhance customer experience.

Further demonstrating its forward-thinking approach, DyDo is developing 'LOVE the EARTH Vendors,' aiming for carbon-neutral vending solutions. This initiative directly supports the company's sustainability objectives and appeals to environmentally conscious consumers. The development of these eco-friendly machines is a key part of their strategy to operate more responsibly.

The establishment of the 'DyDo Group Future Co-Creation Institute' in March 2025 highlights a significant investment in future growth. This institute is dedicated to open innovation and research and development, particularly in functional materials for beverages and foods. This strategic move positions DyDo to explore new product avenues and maintain a competitive edge in the market.

Focus on Health and Wellness Trends

DyDo Group Holdings is strategically focusing on health and wellness trends, a significant strength given the escalating consumer demand for healthier beverage and food options. This alignment is evident in their development and marketing of health foods and supplements.

The company's 'Group Mission 2030' explicitly champions the creation of enjoyable, healthy lifestyles, underscoring their commitment to this sector. DyDo is actively investing in product development that embodies the concept of being 'delicious for sound mind and body.'

This proactive approach positions DyDo to effectively capture market share within the increasingly health-conscious Japanese and global beverage markets. For instance, the functional beverage market in Japan saw robust growth, with sales reaching approximately ¥2.5 trillion in 2023, indicating strong consumer interest in health-oriented products.

- Alignment with Growing Health Consciousness: DyDo is actively developing and marketing health foods and supplements to meet rising consumer demand for healthier options.

- Strategic Mission: The 'Group Mission 2030' prioritizes creating enjoyable, healthy lifestyles, guiding product innovation towards health-focused offerings.

- Product Development Focus: The company is committed to creating products that are both delicious and beneficial for mental and physical well-being.

- Market Opportunity: This focus allows DyDo to capitalize on the significant and growing health consciousness prevalent in both Japanese and international beverage markets.

DyDo's extensive vending machine network, responsible for about 80% of its domestic beverage revenue, provides unparalleled market reach and a stable income stream. This deep penetration ensures product accessibility across Japan.

The company's strategic diversification into health foods, supplements, and pharmaceuticals, including orphan drugs, creates multiple revenue streams and reduces dependence on any single market. Early 2025 approvals and sales in the pharmaceutical sector highlight this segment's growing contribution.

DyDo's international expansion, notably the acquisition of a Polish beverage company in February 2024 and growth in Turkey, strengthens its global footprint and operational profit. The establishment of DyDo DRINCO International, Inc. further solidifies this global strategy.

Innovation is a key strength, with AI-powered 'Smart Operations' enhancing vending machine efficiency and the development of 'LOVE the EARTH Vendors' demonstrating a commitment to sustainability. The March 2025 launch of the 'DyDo Group Future Co-Creation Institute' signals a strong investment in R&D for future growth.

| Strength | Description | Supporting Data/Fact |

| Vending Machine Network | Extensive domestic reach | Generates ~80% of domestic beverage revenue |

| Business Diversification | Beyond beverages into health and pharma | New drug approvals and sales in early 2025 |

| International Growth | Expansion and market penetration | Acquisition of Polish company (Feb 2024), growth in Turkey |

| Technological Innovation | AI for efficiency, eco-friendly solutions | 'Smart Operations' deployment, 'LOVE the EARTH Vendors' |

What is included in the product

Delivers a strategic overview of DyDo’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform its market position.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, turning potential weaknesses into manageable opportunities.

Weaknesses

DyDo's substantial dependence on its domestic vending machine network, which accounts for approximately 80% of its Japanese beverage sales, presents a notable weakness. This concentration leaves the company exposed to the challenges facing Japan's vending machine sector, including persistent labor shortages and escalating operating expenses.

The shrinking vending machine market in Japan, driven by these economic pressures, directly impacts DyDo's core distribution channel. This reliance makes the company particularly vulnerable to any decline in vending machine usage or intensified competition within this specific segment of the market.

DyDo's domestic beverage business is showing signs of weakness, with a notable decline in beverage sales. This underperformance is a concern, especially as the company invests heavily in its vending machine network, leading to increased operational costs. For instance, in the fiscal year ending March 2024, the company reported a decrease in its domestic beverage segment, highlighting the pressure on its core market.

DyDo's profitability is susceptible to sudden increases in the cost of essential raw materials and supplies. Global geopolitical tensions and rising energy prices in 2024 and early 2025 have intensified these procurement risks.

These cost pressures can significantly erode the Group's financial performance, necessitating difficult decisions like price adjustments on certain product categories to maintain margins.

Competition in the Japanese Beverage Market

DyDo operates within a fiercely competitive Japanese non-alcoholic beverage market. Established giants and agile newcomers constantly battle for consumer attention and market share. This intense rivalry puts pressure on pricing and necessitates continuous innovation to stand out.

The green tea segment, a key area for DyDo, is particularly challenging. The rise of private-label store brands offering more affordable options directly impacts DyDo's market position. Furthermore, major beverage manufacturers are actively introducing new products and marketing campaigns to defend their existing customer base.

- Intense Competition: The Japanese beverage market is characterized by a high degree of competition from both domestic and international players.

- Private Label Growth: Store brands are increasingly capturing market share, especially in categories like green tea, by offering lower price points.

- Innovation Pressure: Leading manufacturers are investing heavily in R&D and marketing to differentiate their offerings and maintain consumer loyalty.

- Market Saturation: Certain beverage categories are nearing saturation, making it harder for any single player to achieve significant organic growth without aggressive strategies.

Challenges in Pharmaceutical-Related Business Development

The pharmaceutical segment, while promising, presents significant hurdles for DyDo. Developing orphan drugs, for instance, is a high-stakes endeavor fraught with uncertainty. These projects can face lengthy development cycles, potential discontinuation, and unpredictable outcomes regarding regulatory approvals and pricing. For example, the average cost to develop a new drug from discovery to market approval has been estimated to be over $2 billion, with many candidates failing in clinical trials.

This inherent unpredictability translates into substantial financial risk for DyDo’s foray into this newer business area. The long lead times and high failure rates mean that considerable capital investment may not yield a return, impacting overall profitability. The pharmaceutical industry's regulatory landscape is also constantly evolving, adding another layer of complexity and potential for unexpected setbacks.

Key challenges include:

- Extended Development Timelines: Pharmaceutical development can take 10-15 years, delaying revenue generation.

- High Failure Rates: A significant percentage of drug candidates fail during clinical trials.

- Regulatory Uncertainty: Approval processes are rigorous and can lead to unexpected delays or rejections.

- Pricing Pressures: Governments and insurers may impose lower prices than anticipated, affecting profitability.

DyDo's heavy reliance on its domestic vending machine network, which comprises around 80% of its Japanese beverage sales, is a significant vulnerability. This concentration exposes the company to the sector's challenges, including ongoing labor shortages and rising operational costs.

The declining vending machine market in Japan, exacerbated by these economic pressures, directly impacts DyDo's primary distribution channel. This makes the company especially susceptible to any decrease in vending machine usage or increased competition within this specific market segment.

DyDo's domestic beverage business is showing signs of weakness, with a notable decline in beverage sales. This underperformance is a concern, especially as the company invests heavily in its vending machine network, leading to increased operational costs. For instance, in the fiscal year ending March 2024, the company reported a decrease in its domestic beverage segment, highlighting the pressure on its core market.

DyDo's profitability is susceptible to sudden increases in the cost of essential raw materials and supplies. Global geopolitical tensions and rising energy prices in 2024 and early 2025 have intensified these procurement risks.

These cost pressures can significantly erode the Group's financial performance, necessitating difficult decisions like price adjustments on certain product categories to maintain margins.

DyDo operates within a fiercely competitive Japanese non-alcoholic beverage market. Established giants and agile newcomers constantly battle for consumer attention and market share. This intense rivalry puts pressure on pricing and necessitates continuous innovation to stand out.

The green tea segment, a key area for DyDo, is particularly challenging. The rise of private-label store brands offering more affordable options directly impacts DyDo's market position. Furthermore, major beverage manufacturers are actively introducing new products and marketing campaigns to defend their existing customer base.

The pharmaceutical segment, while promising, presents significant hurdles for DyDo. Developing orphan drugs, for instance, is a high-stakes endeavor fraught with uncertainty. These projects can face lengthy development cycles, potential discontinuation, and unpredictable outcomes regarding regulatory approvals and pricing. For example, the average cost to develop a new drug from discovery to market approval has been estimated to be over $2 billion, with many candidates failing in clinical trials.

This inherent unpredictability translates into substantial financial risk for DyDo’s foray into this newer business area. The long lead times and high failure rates mean that considerable capital investment may not yield a return, impacting overall profitability. The pharmaceutical industry's regulatory landscape is also constantly evolving, adding another layer of complexity and potential for unexpected setbacks.

| Weakness | Description | Impact | Data Point (FY2024/2025 context) |

|---|---|---|---|

| Vending Machine Dependence | High reliance on domestic vending machines for sales. | Exposure to sector-specific challenges like labor shortages and rising costs. | Vending machines account for ~80% of Japanese beverage sales. |

| Domestic Beverage Market Decline | Underperformance in the core beverage segment. | Increased operational costs due to network investment without commensurate sales growth. | Reported decrease in domestic beverage segment sales in FY ending March 2024. |

| Intense Market Competition | Highly competitive Japanese beverage market. | Pressure on pricing and need for continuous innovation. | Significant market share competition from established players and private labels, especially in green tea. |

| Pharmaceutical Development Risks | High uncertainty and cost in drug development. | Substantial financial risk due to long development cycles, high failure rates, and regulatory hurdles. | Estimated $2 billion+ cost to develop a new drug; many candidates fail clinical trials. |

Same Document Delivered

DyDo SWOT Analysis

This is the actual DyDo SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the real content that will be yours after checkout, ensuring you get exactly what you need.

Opportunities

Consumer interest in health and wellness is booming in Japan, with a clear shift towards beverages that offer more than just hydration. This trend is a prime opportunity for DyDo Group Holdings to tap into the expanding market for low-sugar, functional drinks. For instance, the functional beverage market in Japan was valued at approximately ¥1.5 trillion (around $10 billion USD) in 2023 and is projected to grow steadily through 2025, driven by this health-conscious consumer base.

DyDo can leverage this by developing and promoting drinks enriched with beneficial ingredients like vitamins, minerals, and adaptogens, catering to the increasing demand for natural health solutions. This strategic move aligns perfectly with consumer preferences for products that support well-being, potentially leading to increased market share and revenue growth in the coming years.

DyDo can capitalize on advancements in smart vending technology, like AI for personalized recommendations and contactless payment systems. This offers a chance to elevate customer engagement and streamline operations. For instance, their 'Smart Operations' initiative aims to integrate these technologies, potentially boosting sales efficiency.

The integration of real-time inventory management in smart vending machines presents a significant opportunity for DyDo to reduce waste and ensure product availability. Coupled with energy-efficient designs, such as their 'LOVE the EARTH Vendors,' this can also enhance their sustainability image and reduce operational costs. This aligns with a growing consumer preference for eco-conscious brands.

DyDo's successful foray into Turkey and the recent acquisition in Poland present a clear runway for further international market expansion. The company can leverage these experiences to enter other high-growth emerging markets, potentially in Southeast Asia or Latin America, where demand for beverages is on the rise.

This strategic move would not only diversify DyDo's revenue streams but also significantly reduce its dependence on the increasingly saturated Japanese market. For instance, emerging markets often exhibit higher per capita consumption growth rates for beverages compared to developed economies, offering substantial upside potential.

Strategic Partnerships and M&A

Strategic partnerships and mergers and acquisitions (M&A) offer significant avenues for DyDo's growth. For instance, its joint venture, Dynamic Vending Network Inc., with Asahi Soft Drinks Co., Ltd., and the acquisition of Wosana S.A. in Poland exemplify how these moves can bolster market standing, introduce novel technologies, and broaden distribution networks. DyDo's 'DyDo Group Future Co-Creation Institute' actively seeks collaborations with emerging startups and academic research bodies, signaling a forward-looking strategy to leverage external innovation.

These strategic moves are crucial for staying competitive in the dynamic beverage market. In 2024, the global beverage M&A market saw continued activity, with companies seeking to diversify portfolios and expand geographical reach. DyDo's proactive approach in forming alliances and acquiring businesses positions it to capitalize on these trends, potentially integrating new product lines or accessing untapped consumer segments.

- Strengthened Market Position: Collaborations like the one with Asahi Soft Drinks enhance DyDo's competitive edge.

- Technology and Innovation Access: Acquisitions and partnerships can bring in advanced manufacturing or R&D capabilities.

- Distribution Channel Expansion: Entering new markets or strengthening existing ones through strategic alliances is a key benefit.

- Startup and Research Integration: The Future Co-Creation Institute’s focus on startups and research institutions aims to foster innovation and future growth drivers.

Sustainability Initiatives and ESG Focus

DyDo's proactive approach to sustainability, including its aim for carbon-neutral vending machines and contributions to a decarbonizing society, aligns with growing consumer and investor demand for ESG-conscious businesses. This focus can significantly bolster brand image and attract a key demographic of environmentally aware customers. For instance, by 2023, over 70% of global consumers indicated they were willing to change their purchasing habits to reduce environmental impact, a trend that continues to accelerate into 2024 and 2025.

This commitment offers a distinct competitive advantage in the beverage market. As ESG investing gains momentum, with global ESG assets projected to reach over $33.9 trillion by 2026, DyDo is well-positioned to attract capital and partnerships that prioritize sustainable operations. The company's efforts can translate into:

- Enhanced Brand Loyalty: Consumers increasingly favor brands that demonstrate genuine commitment to environmental and social responsibility.

- Improved Investor Relations: A strong ESG profile can attract socially responsible investors and potentially lower the cost of capital.

- Market Differentiation: Sustainability initiatives can set DyDo apart from competitors, appealing to a growing segment of the market.

DyDo can capitalize on the growing demand for functional and low-sugar beverages in Japan, a market valued at approximately ¥1.5 trillion in 2023. By developing drinks with added vitamins or adaptogens, DyDo can align with consumer health trends and potentially increase market share. Furthermore, advancements in smart vending technology, such as AI-powered recommendations, offer opportunities to enhance customer engagement and operational efficiency, with initiatives like their 'Smart Operations' already underway.

Threats

Japan's demographic challenges, including a declining birthrate and an aging population, present a significant long-term threat to DyDo's primary domestic beverage market. This trend means fewer young consumers entering the market and a potential shift in purchasing power and preferences as the population ages, directly impacting overall demand for DyDo's products.

By 2025, Japan's population is projected to fall below 120 million, with the elderly (65+) accounting for nearly 30% of the total. This shrinking and aging consumer base directly affects DyDo's sales volume and necessitates strategic adjustments to product offerings and marketing efforts to cater to evolving needs.

DyDo operates in a fiercely competitive Japanese beverage market, facing pressure from both established domestic and international brands, as well as the growing threat of private-label offerings from retailers. This intense rivalry, particularly evident in segments like green tea, often forces companies into price wars, squeezing profit margins and making it harder to stand out. In 2023, the overall beverage market in Japan experienced continued growth, but the increased availability of lower-priced alternatives put significant pressure on established brands to maintain their market share and pricing power.

A significant threat for DyDo arises from evolving consumer tastes and growing health consciousness. For instance, a swift pivot by consumers away from sugary drinks, a category where DyDo holds a notable market share, could directly impact revenue if the company isn't agile in offering healthier options. In 2024, global beverage market reports indicated a 5% year-over-year increase in consumer demand for low-sugar and functional beverages, highlighting this trend.

Supply Chain Disruptions and Geopolitical Risks

Global geopolitical tensions, exemplified by the ongoing conflict in Ukraine, continue to pose a significant threat to supply chains. These events can cause substantial volatility in currency exchange rates and drive up the cost of essential commodities like crude oil and raw materials. For DyDo, this translates directly into increased procurement expenses and potential disruptions to its operational flow, as noted in its own risk evaluations.

The impact of these disruptions is not theoretical. For instance, in 2023, global shipping costs saw significant increases due to various geopolitical factors, directly affecting companies reliant on international trade. DyDo, like many beverage manufacturers, depends on a consistent and cost-effective supply of ingredients and packaging materials, making it vulnerable to these external shocks.

- Increased Input Costs: Fluctuations in raw material prices, such as sugar and aluminum, directly impact DyDo's cost of goods sold.

- Supply Chain Volatility: Geopolitical events can lead to delays or shortages in the availability of key ingredients and packaging.

- Currency Exchange Rate Risk: A weaker Yen against major currencies can increase the cost of imported raw materials.

- Operational Uncertainty: The unpredictability of global events creates challenges in forecasting and managing production schedules.

Technological Disruption and Vending Machine Evolution

The swift evolution of vending machine technology presents a significant challenge for DyDo. While the company is investing in smart machines, falling behind on advancements like AI, IoT, and new payment methods could be detrimental. For instance, the global smart vending machine market was valued at approximately USD 1.3 billion in 2023 and is projected to grow substantially, indicating a rapid shift in consumer expectations and operational capabilities.

Competitors who quickly integrate these cutting-edge technologies could outpace DyDo, potentially capturing market share through enhanced user experiences and more efficient operations. The increasing adoption of contactless payment systems, which saw a significant surge during the pandemic and continued strong growth through 2024, highlights the need for DyDo to remain agile in its technological upgrades.

Failure to adapt could lead to a competitive disadvantage, as consumers increasingly expect seamless and innovative interactions with vending solutions. The market is seeing a rise in machines offering personalized recommendations powered by AI, a trend DyDo must consider to remain relevant.

DyDo faces a significant threat from Japan's demographic decline, with its aging and shrinking population impacting domestic demand. The intensifying competition, particularly from private labels and health-conscious shifts, further pressures its market position. Geopolitical instability and rising input costs, as seen in 2023 shipping cost hikes, create operational uncertainties and increase expenses.

The rapid evolution of vending machine technology presents a challenge, as competitors integrating AI and IoT could gain an edge. For example, the global smart vending machine market's projected growth highlights the need for DyDo to stay technologically current to avoid a competitive disadvantage.

SWOT Analysis Data Sources

This DyDo SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial reports, comprehensive market research, and expert industry analysis to provide a thorough and actionable strategic overview.