DyDo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DyDo Bundle

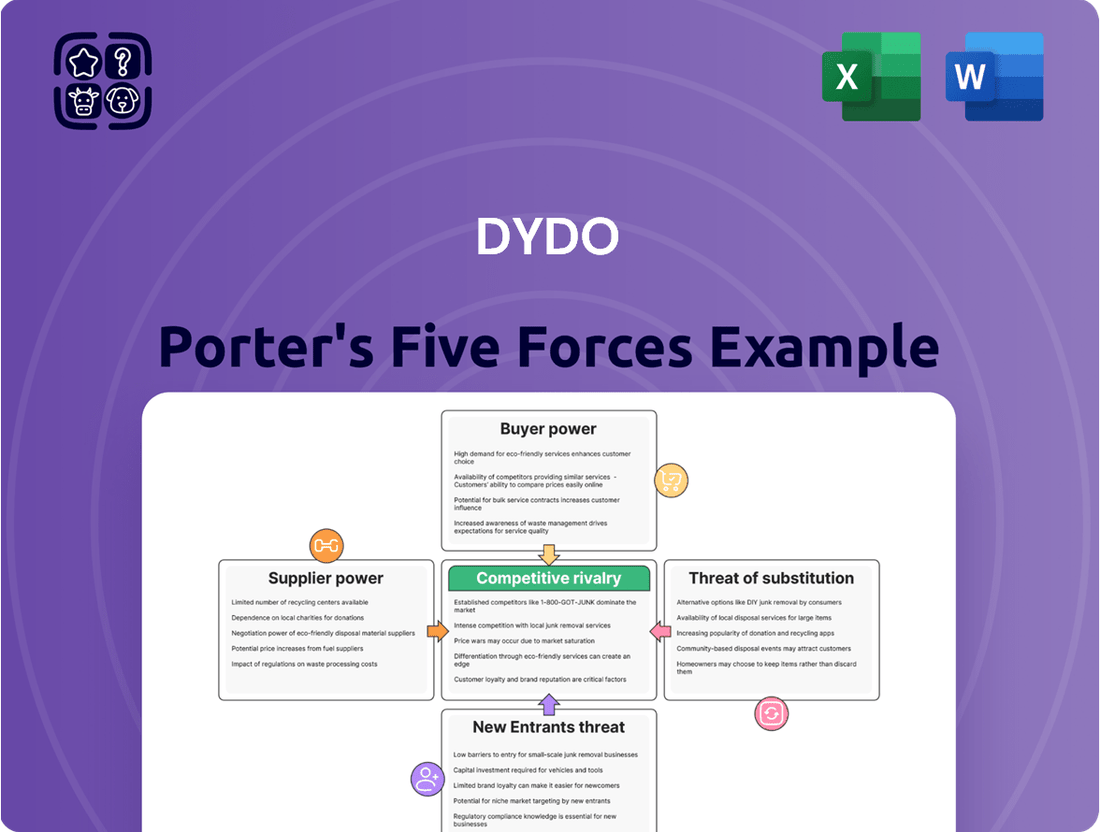

DyDo's competitive landscape is shaped by several key forces, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for navigating the beverage market.

The complete report reveals the real forces shaping DyDo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DyDo's bargaining power of suppliers is significantly influenced by the concentration of its supplier base. If DyDo depends on a limited number of suppliers for critical inputs like premium coffee beans, unique tea blends, or specialized beverage packaging, those suppliers gain considerable influence. This is particularly true if the cost or effort to switch to a different supplier is substantial, perhaps due to unique product specifications or existing long-term agreements. For instance, in 2024, the global coffee bean market saw price volatility, with certain specialty Arabica beans experiencing a 15% price increase due to adverse weather conditions in key producing regions, highlighting the potential leverage of concentrated suppliers of such premium ingredients.

Suppliers offering unique or highly differentiated inputs hold significant leverage. For DyDo, this could translate to specialized flavors for its diverse beverage lineup or advanced components for its vending machine operations. For instance, a supplier of a novel functional ingredient for a new health drink could dictate terms, impacting DyDo's cost of goods sold.

If DyDo's suppliers, particularly those providing specialized ingredients or packaging, were to integrate forward into beverage production or vending operations, their leverage over DyDo would significantly grow. This scenario would transform them from suppliers into potential direct competitors.

While the likelihood of basic commodity suppliers like sugar or water producers engaging in forward integration is low, the threat is more pronounced for suppliers of unique flavors, advanced dispensing technology, or proprietary packaging solutions. For instance, a company that developed a novel, shelf-stable fruit puree could potentially enter the beverage market itself.

Importance of Supplier's Input to DyDo's Cost Structure

The bargaining power of suppliers for DyDo is significantly influenced by how crucial their inputs are to DyDo's overall cost structure. If a particular raw material or component constitutes a large percentage of DyDo's production expenses, the supplier of that item gains considerable leverage.

For instance, if the price of a key ingredient, such as a specific type of tea leaf or sweetener, experiences substantial volatility, it directly impacts DyDo's profitability. This price fluctuation empowers the supplier, as DyDo becomes more reliant on their pricing decisions and less able to absorb cost increases without affecting their own margins.

- Input Cost Significance: The proportion of a supplier's input in DyDo's total cost directly correlates with supplier power.

- Price Volatility Impact: Fluctuations in the price of essential ingredients grant suppliers greater negotiation leverage.

- Profitability Dependence: DyDo's profitability is sensitive to the cost of key inputs, increasing supplier influence.

- Supplier Leverage: When DyDo heavily relies on a specific supplier for a critical component, that supplier's ability to dictate terms and prices increases.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts DyDo's bargaining power with its suppliers. If DyDo can easily switch to alternative ingredients or components that perform a similar function, suppliers have less leverage. For instance, if DyDo relies on a specific type of sweetener, and numerous other sweeteners are readily available and cost-effective, the supplier of that original sweetener cannot command excessive prices or dictate unfavorable terms.

Conversely, DyDo's bargaining power diminishes when its inputs are highly specialized and lack viable substitutes. In such scenarios, suppliers recognize their unique position and can exert greater influence over pricing and supply conditions. This is particularly relevant for DyDo if they require proprietary flavorings or unique packaging materials that are not easily replicated by other manufacturers.

- Reduced Supplier Power: The existence of comparable substitute ingredients, such as various natural and artificial sweeteners, allows DyDo to negotiate better terms by threatening to switch.

- Increased Supplier Power: If DyDo requires a unique, patented flavoring extract for a popular beverage line, the supplier of that extract holds considerable power due to the lack of alternatives.

- Market Dynamics: In 2024, the beverage industry saw continued innovation in ingredient sourcing, with a growing emphasis on plant-based alternatives, potentially increasing DyDo's options for certain inputs.

- Cost Implications: The cost differential between substitute inputs directly influences DyDo's ability to leverage this factor; a small price difference might not justify switching, thus preserving supplier power.

DyDo's supplier bargaining power is amplified when suppliers are highly concentrated or when their products are critical to DyDo's cost structure. For example, in 2024, the global supply of specific high-grade tea leaves, essential for some of DyDo's premium products, was dominated by a few key agricultural cooperatives. This concentration, coupled with the significant portion these leaves represent in the final product's cost, grants these suppliers considerable leverage in price negotiations.

The threat of forward integration by suppliers also heightens their bargaining power. If a supplier of specialized vending machine components were to consider entering the beverage market directly, DyDo would face increased pressure to meet their terms. Furthermore, the availability of substitutes plays a crucial role; a lack of viable alternatives for unique flavorings or packaging materials significantly strengthens a supplier's negotiating position.

| Factor | Impact on DyDo's Supplier Bargaining Power | Example (2024 Data) |

| Supplier Concentration | High | Limited number of key suppliers for premium coffee beans |

| Input Cost Significance | High | Specialized tea leaves constitute a large portion of production costs |

| Availability of Substitutes | Low for unique inputs | Proprietary flavorings lack readily available alternatives |

| Threat of Forward Integration | Moderate to High for specialized suppliers | Vending machine component suppliers potentially entering beverage market |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to DyDo's beverage and healthcare product markets.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

DyDo's vast vending machine network serves millions of individual consumers. These customers face minimal barriers to switching to a competitor's beverage or even a different vending machine provider. While each customer's individual impact is small, shifts in collective consumer preferences can significantly influence DyDo's sales volume.

Japanese consumers, particularly for frequently purchased items like beverages, demonstrate a notable degree of price sensitivity. This means that while they appreciate convenience and quality, the cost of products significantly influences their purchasing decisions. For DyDo, this translates into a need to carefully manage pricing strategies.

The competitive landscape in Japan's beverage market is densely populated with numerous companies offering similar products. This abundance of choice empowers consumers, as they can easily switch to a competitor if DyDo's prices are perceived as too high. Consequently, DyDo faces limitations in its ability to absorb rising production costs by simply increasing prices, as this could lead to a substantial loss of market share.

With readily available information about various beverage brands, consumers can easily compare prices and features across similar products. This transparency, especially in categories like coffee, tea, and juices, significantly enhances their bargaining power. For instance, in 2024, online price comparison tools and extensive product reviews empower consumers to find the best deals, putting pressure on companies like DyDo to maintain competitive pricing.

Distribution Channel Influence (Retailers and Vending Machine Locations)

DyDo's bargaining power of customers is significantly influenced by its distribution channels. While individual consumers typically have limited individual power, large retailers like supermarkets and convenience stores wield considerable influence. These entities can leverage the substantial volume of DyDo products they stock, giving them leverage to negotiate terms, pricing, and promotional support. Similarly, owners of high-traffic vending machine locations, such as major train stations or corporate offices, can also exert bargaining power. Their ability to grant or deny access to prime selling spots means they can negotiate favorable agreements with DyDo, potentially impacting its market reach and sales volume.

- Retailer Concentration: The concentration of major retail chains in Japan, such as Aeon and Seven & i Holdings, means a few key players control a large portion of the beverage market shelf space, increasing their bargaining power over DyDo.

- Vending Machine Location Value: Prime vending machine locations are scarce and highly sought after. For instance, a vending machine in a busy Shinjuku Station platform can generate significantly higher sales than one in a less frequented area, allowing location owners to negotiate better terms.

- Brand Choice and Competition: Retailers and location owners can easily switch to competing beverage brands if DyDo's terms are not met, further amplifying their bargaining power.

Growing Demand for Healthy and Functional Beverages

The growing consumer demand for healthier, low-sugar, and functional beverages significantly enhances customer bargaining power. This trend forces companies like DyDo to innovate and diversify their product lines to align with evolving preferences, giving consumers more sway in the market.

In 2024, the functional beverage market continued its robust expansion, with consumers actively seeking products offering benefits beyond basic hydration, such as improved immunity, energy, or cognitive function. This heightened consumer awareness and desire for specialized products means they can more easily switch to competitors offering the desired attributes.

- Increased Choice: Consumers now have a wider array of healthy and functional beverage options from various brands, reducing reliance on any single provider.

- Price Sensitivity: As more brands enter the healthy beverage space, consumers can compare prices and seek out the best value for products meeting their health criteria.

- Demand for Transparency: Customers are increasingly scrutinizing ingredient lists and nutritional information, demanding transparency from manufacturers.

- Influence of Trends: Health and wellness trends, often amplified by social media, quickly shape consumer preferences, pushing companies to adapt product development cycles.

DyDo's customers, particularly individual consumers, hold significant bargaining power due to low switching costs and a highly competitive market in Japan. Price sensitivity is a key factor, with consumers readily comparing prices and features, especially with the aid of online tools in 2024. This forces DyDo to maintain competitive pricing to avoid losing market share.

The bargaining power of customers is amplified by the concentration of major retailers and the value of prime vending machine locations. Large retail chains can negotiate favorable terms, and owners of high-traffic vending spots can leverage their prime access to secure better agreements with DyDo. This dynamic means DyDo must carefully manage relationships with these powerful intermediaries.

Evolving consumer preferences towards healthier and functional beverages further empower customers. The demand for low-sugar and specialized drinks means consumers can easily switch to competitors offering these attributes, pressuring DyDo to innovate its product portfolio. In 2024, the functional beverage market saw continued growth, with consumers actively seeking products with added health benefits.

| Factor | Impact on DyDo | 2024 Data/Trend |

|---|---|---|

| Low Switching Costs for Consumers | Easy to shift to competitors | Minimal barriers for everyday beverage purchases. |

| Price Sensitivity | Limits ability to raise prices | Consumers actively use online comparison tools. |

| Retailer Concentration | Increased leverage for large chains | Major retailers like Aeon control significant shelf space. |

| Vending Machine Location Value | Negotiating power for prime spots | High-traffic locations (e.g., train stations) command better terms. |

| Demand for Healthier Options | Drives product innovation | Functional beverage market expanded significantly in 2024. |

Preview Before You Purchase

DyDo Porter's Five Forces Analysis

The document you see here is the complete, professionally written DyDo Porter's Five Forces Analysis that you will receive immediately after purchase, ensuring no surprises or placeholders. This detailed analysis thoroughly examines the competitive landscape of DyDo, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying, ready for your strategic decision-making.

Rivalry Among Competitors

The Japanese beverage market is incredibly crowded, with a vast number of both domestic giants and global brands vying for consumer attention. This saturation means companies like Asahi, Kirin, Suntory, Coca-Cola, and PepsiCo are constantly battling for market share, making it tough for any single player to dominate.

Competitors in the beverage market showcase a broad spectrum of products, spanning coffee, tea, juices, sports drinks, and functional beverages. This extensive range, coupled with continuous innovation in flavors, packaging, and health-focused formulations, significantly heightens competitive intensity.

DyDo's substantial presence in the vending machine sector places it in direct competition with numerous players vying for prime locations and customer attention. This rivalry extends to the adoption of new technologies, such as the integration of cashless payment systems, which saw a significant increase in adoption across Japan in 2024, with over 70% of vending machine transactions reportedly utilizing them by the end of the year.

Competitors are also locked in a race to offer innovative vending experiences, including smart features for personalized recommendations and enhanced user interfaces. The battle for shelf space within these machines is fierce, with companies constantly adjusting their product assortments to meet evolving consumer preferences and capture market share, as evidenced by the growing demand for healthier beverage options in 2024.

Marketing and Distribution Strength

DyDo faces intense competition from larger rivals with considerable financial muscle for marketing. For instance, in 2024, major beverage companies in Japan, like Suntory and Kirin, allocated billions of yen to advertising and promotional activities, significantly outspending smaller players. This disparity makes it difficult for DyDo to capture consumer attention and build brand loyalty without substantial marketing investment.

Established distribution networks are another hurdle. Large competitors have long-standing relationships with retailers and extensive logistical capabilities, ensuring their products are readily available across numerous outlets. DyDo must invest heavily in expanding its own distribution channels to compete effectively, a challenge given the saturation of the market.

- Marketing Spend Disparity: Major beverage competitors in Japan reportedly increased their marketing budgets by an average of 8% in 2024 compared to the previous year, a significant challenge for DyDo's market penetration efforts.

- Distribution Network Reach: Competitors often boast distribution coverage in over 90% of convenience stores and supermarkets nationwide, a benchmark DyDo strives to match.

- Brand Recognition: Extensive marketing by rivals contributes to higher brand recall, with top competitors consistently ranking in the top 5 for beverage brand awareness in consumer surveys.

Industry Maturity and Slow Growth in Some Segments

The Japanese soft drink market, while featuring dynamic growth in niche areas like functional beverages, generally exhibits characteristics of maturity. This maturity, particularly in traditional segments, translates to slower overall volume expansion. For instance, the carbonated soft drink market in Japan has seen relatively stable but not explosive growth in recent years. This environment intensifies competition as companies vie for a larger slice of a market that isn't rapidly expanding, leading to more aggressive strategies to capture existing demand.

The maturity of certain segments within the Japanese soft drink industry directly fuels heightened competitive rivalry. When overall market growth decelerates, companies often resort to more aggressive tactics to gain or maintain market share. This can manifest as increased promotional activities, price competition, and a greater emphasis on product differentiation and innovation to attract consumers away from rivals. The struggle for market dominance becomes more pronounced when the pie is not growing substantially.

- Market Maturity: The overall Japanese soft drink market is considered mature, with growth rates moderating in many established categories.

- Segmental Variations: While functional drinks and certain other categories show robust growth, traditional segments like standard carbonated beverages may experience slower expansion or even contraction.

- Aggressive Competition: This mature market landscape compels companies to compete more fiercely for existing consumer demand, often through price wars, enhanced marketing, and product innovation.

- Share Gains: Companies are incentivized to steal market share from competitors rather than relying solely on overall market expansion for revenue growth.

The competitive rivalry in the Japanese beverage sector is intense, driven by a saturated market and numerous established players. Companies like Asahi, Kirin, and Suntory, alongside global giants such as Coca-Cola and PepsiCo, constantly battle for consumer attention and market share across diverse product categories. This fierce competition is further amplified by aggressive marketing spend, with major players reportedly increasing their budgets by an average of 8% in 2024, making it challenging for DyDo to gain traction without substantial investment.

| Competitor | 2024 Marketing Spend (Estimated Billions JPY) | Distribution Reach (%) | Brand Awareness Rank (Top 5) |

|---|---|---|---|

| Asahi | 15-20 | 95+ | 1-2 |

| Kirin | 12-18 | 90-95 | 2-3 |

| Suntory | 18-25 | 95+ | 1-3 |

| Coca-Cola | 20-30 | 98+ | 1-2 |

| PepsiCo | 10-15 | 90-95 | 3-4 |

SSubstitutes Threaten

The threat of substitutes for DyDo's beverage products is significant due to the sheer volume and variety of alternative options available to consumers. Beyond DyDo's core tea and coffee offerings, consumers can easily opt for tap water, which is essentially free, or easily prepared homemade beverages. The bottled water market itself is vast, with numerous competitors offering alternatives to DyDo's own bottled water lines.

Furthermore, the ready-to-drink (RTD) beverage market is flooded with choices. In 2024, the global RTD coffee market alone was valued at over $38 billion, showcasing the intense competition from brands offering similar convenience and flavor profiles. This broad spectrum of readily available and often lower-cost alternatives directly challenges DyDo's market share and pricing power.

Consumers increasingly seek healthier options, leading to a rise in functional beverages and health supplements as substitutes for traditional drinks. DyDo's own health supplement business, for instance, directly competes with its beverage offerings for consumer wellness spending. This trend is significant, with the global functional food and beverage market projected to reach over $220 billion by 2025, indicating a substantial threat from these alternative product categories.

The threat of substitutes for DyDo’s beverage products in vending machines is significant, particularly from other food and snack options. As vending machines increasingly offer diverse food items, consumers might opt for a snack or light meal instead of a beverage, especially if they are looking for a more substantial offering.

In 2024, the convenience food sector continued its robust growth, with many vending machine operators expanding their snack and ready-to-eat meal selections to cater to evolving consumer preferences. This diversification directly competes with traditional beverage offerings, potentially diverting sales from DyDo's core products.

Cost and Convenience of Alternatives

The availability of lower-cost alternatives presents a significant threat. For instance, tap water, or even generic beverages purchased from supermarkets, can often be procured at a fraction of the price of a vending machine product. In 2024, the average price of a 500ml bottled water from a vending machine could range from $1.50 to $2.50, whereas a similar volume of tap water is virtually free, and a multi-pack of supermarket-brand beverages might cost less than $0.50 per serving.

While vending machines offer undeniable convenience, this advantage is eroded when other readily accessible options provide superior value. The rise of convenience stores, many of which are also strategically located and offer a wider variety of beverages at competitive prices, directly challenges vending machine dominance. Furthermore, the increasing prevalence of rapid online grocery and beverage delivery services means consumers can often have drinks delivered to their homes or offices with minimal delay, sometimes at a lower overall cost when considering bulk purchases or subscription models.

The threat of substitutes is amplified by consumer price sensitivity and evolving purchasing habits. As of late 2024, economic pressures have led many consumers to re-evaluate discretionary spending, making cheaper alternatives more attractive.

- Price Disparity: Vending machine beverages can be 2-3 times more expensive than comparable supermarket options.

- Convenience Trade-off: While vending machines offer instant access, the growing efficiency of online delivery and the ubiquity of convenience stores diminish this unique selling proposition.

- Consumer Behavior Shift: Increased focus on value for money in 2024 makes consumers more likely to seek out and utilize cheaper substitutes.

Shift Towards At-Home Consumption and Home Brewing

The increasing trend of at-home consumption presents a significant threat of substitution for DyDo. With more people working remotely or simply preferring to enjoy beverages in the comfort of their homes, the appeal of brewing personal coffee or tea, or preparing other drinks, grows. This shift directly competes with DyDo's ready-to-drink offerings found in vending machines and retail outlets.

This substitution is fueled by convenience and cost-effectiveness. For example, the global home brewing equipment market was valued at approximately USD 2.5 billion in 2023 and is projected to grow, indicating a substantial consumer interest in DIY beverage preparation. In 2024, this trend is expected to continue its upward trajectory as consumers seek personalized and economical alternatives to purchased drinks.

- Home Brewing Growth: The market for home coffee and tea brewing equipment is expanding, reflecting a consumer preference for at-home preparation.

- Cost Savings: Consumers can often prepare multiple servings at home for less than the cost of a single ready-to-drink beverage.

- Personalization: At-home preparation allows for greater customization of taste and ingredients, appealing to individual preferences.

The threat of substitutes for DyDo's beverage portfolio is substantial, encompassing everything from basic hydration to specialized health drinks. Consumers can easily turn to tap water, homemade beverages, or a vast array of bottled water brands, all of which represent direct alternatives to DyDo's offerings. The sheer volume and accessibility of these substitutes significantly pressure DyDo's market position and pricing strategies.

The ready-to-drink (RTD) market is particularly saturated, with the global RTD coffee segment alone exceeding $38 billion in value in 2024. This highlights the intense competition from numerous brands providing similar convenience and flavor profiles. Furthermore, the growing demand for healthier options has propelled functional beverages and supplements, which compete for consumer wellness spending and directly challenge traditional drink categories.

Vending machines, a key distribution channel for DyDo, face substitution threats from other food and snack items as machine offerings diversify. In 2024, the convenience food sector's growth meant vending machines increasingly stocked more substantial options, potentially diverting consumers from beverages. Price sensitivity is a major factor, with vending machine drinks often costing 2-3 times more than supermarket alternatives, and tap water remaining a virtually free substitute.

| Substitute Category | Estimated Market Size (2024) | Key Competitive Factors |

| Bottled Water | >$50 Billion (Global) | Brand variety, price, perceived purity |

| Homemade Beverages | N/A (Highly Fragmented) | Cost savings, personalization, perceived health benefits |

| Functional Beverages | >$220 Billion (Global Market Projection by 2025) | Health benefits, specific ingredients, wellness trends |

| Convenience Foods (Vending) | N/A (Sector Growth) | Variety, satiety, impulse purchase |

Entrants Threaten

The threat of new entrants for DyDo's vending machine business is significantly mitigated by the high capital investment required. Establishing a nationwide network, similar to DyDo's, involves substantial upfront costs for purchasing and deploying numerous vending machines, which can run into millions of dollars. For instance, a single modern vending machine can cost anywhere from $3,000 to $10,000 or more, and scaling this to thousands of units represents a formidable financial hurdle.

Beyond the initial machine purchase, new entrants must also account for ongoing expenses such as maintenance, servicing, and the complex logistics of stocking and managing a dispersed network. Securing prime real estate locations for optimal placement also adds to the capital burden. These combined financial demands create a substantial barrier, making it difficult for smaller players to challenge DyDo's established market presence.

Established brand loyalty and extensive distribution networks pose a significant barrier to new entrants in the beverage market. DyDo, for instance, has cultivated strong brand recognition over decades, fostering customer preference and repeat purchases. In 2023, DyDo's domestic beverage sales reached approximately ¥210 billion, underscoring its market penetration.

Securing prime shelf space and vending machine placements is a considerable hurdle. DyDo's long-standing relationships with retailers and its widespread network of vending machines, a key channel for its products, make it challenging for newcomers to gain visibility and access to consumers. This entrenched distribution infrastructure effectively limits the reach of potential competitors.

The threat of new entrants in the Japanese beverage and health food sectors is significantly mitigated by stringent regulatory hurdles and quality standards. Navigating these complex requirements, including food safety certifications and labeling regulations, can demand substantial investment and expertise, creating a high barrier for newcomers. For instance, adherence to the Food Sanitation Act and specific labeling laws for health claims requires meticulous compliance and can be costly to implement, deterring many potential entrants.

Economies of Scale in Production and Distribution

Existing players in the beverage industry, like DyDo, leverage significant economies of scale in production and distribution. This means they can manufacture products more cheaply and get them to market more efficiently than a newcomer could. For instance, large-scale bottling operations and optimized logistics networks allow established companies to achieve lower per-unit costs.

New entrants face a substantial hurdle in matching these cost advantages. Without the volume of production and established distribution channels, a new company would likely incur higher per-unit expenses. In 2024, major beverage manufacturers continued to benefit from these scale efficiencies, with companies reporting substantial cost savings through bulk purchasing of raw materials and high-volume production runs.

- Lower Per-Unit Costs: Established companies benefit from bulk purchasing of ingredients and packaging, reducing their input costs.

- Efficient Manufacturing: Large-scale production facilities operate at higher capacities, spreading fixed costs over more units.

- Optimized Supply Chains: Extensive distribution networks allow for lower transportation costs per item delivered.

- Pricing Power: These cost advantages enable incumbents to offer more competitive pricing, deterring new entrants.

Innovation and Niche Market Opportunities

While the beverage industry generally presents high entry barriers due to established brands and distribution networks, innovative newcomers can still find avenues for entry. These new entrants often focus on specialized niche markets, differentiating themselves through unique product offerings or novel business approaches. For instance, a company might introduce functional beverages with novel ingredients or explore entirely new flavor combinations that appeal to specific consumer segments.

The threat of new entrants is further shaped by evolving consumer preferences and technological advancements. Companies that can identify and capitalize on emerging trends, such as the growing demand for plant-based or low-sugar options, can carve out a space for themselves.

- Niche Market Entry: New players can bypass high capital requirements by targeting specific consumer segments with specialized products, like artisanal sodas or adaptogen-infused drinks.

- Distribution Innovation: Online-only sales models or direct-to-consumer subscriptions can reduce reliance on traditional, costly distribution channels.

- Product Differentiation: Unique flavor profiles, functional benefits, or sustainable packaging can attract customers away from established brands.

- Example: In 2024, the functional beverage market continued its robust growth, with several smaller brands gaining traction through innovative formulations and targeted digital marketing, demonstrating the viability of niche entry strategies.

The threat of new entrants for DyDo is considerably low due to substantial capital requirements for establishing a nationwide vending machine network, estimated to be in the millions of dollars. This financial barrier is compounded by ongoing costs for maintenance, servicing, and logistics, making it difficult for smaller competitors to gain a foothold.

Established brand loyalty, with DyDo's domestic beverage sales reaching approximately ¥210 billion in 2023, and entrenched distribution networks present significant challenges. Securing prime locations and consumer attention is difficult for newcomers against DyDo's widespread presence and long-standing retail relationships.

Regulatory compliance and quality standards in Japan's beverage sector add another layer of difficulty for new entrants. Navigating food safety certifications and specific labeling laws requires significant investment and expertise, further deterring potential competitors.

DyDo benefits from economies of scale in production and distribution, allowing for lower per-unit costs. In 2024, major beverage manufacturers continued to leverage these efficiencies through bulk purchasing and high-volume production, making it hard for new companies to match these cost advantages and offer competitive pricing.

Porter's Five Forces Analysis Data Sources

Our DyDo Porter's Five Forces analysis is built upon a robust foundation of data, including DyDo's official investor relations website, annual reports, and financial statements. We also incorporate industry-specific market research reports and competitor analysis from reputable sources to provide a comprehensive view of the competitive landscape.