DyDo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DyDo Bundle

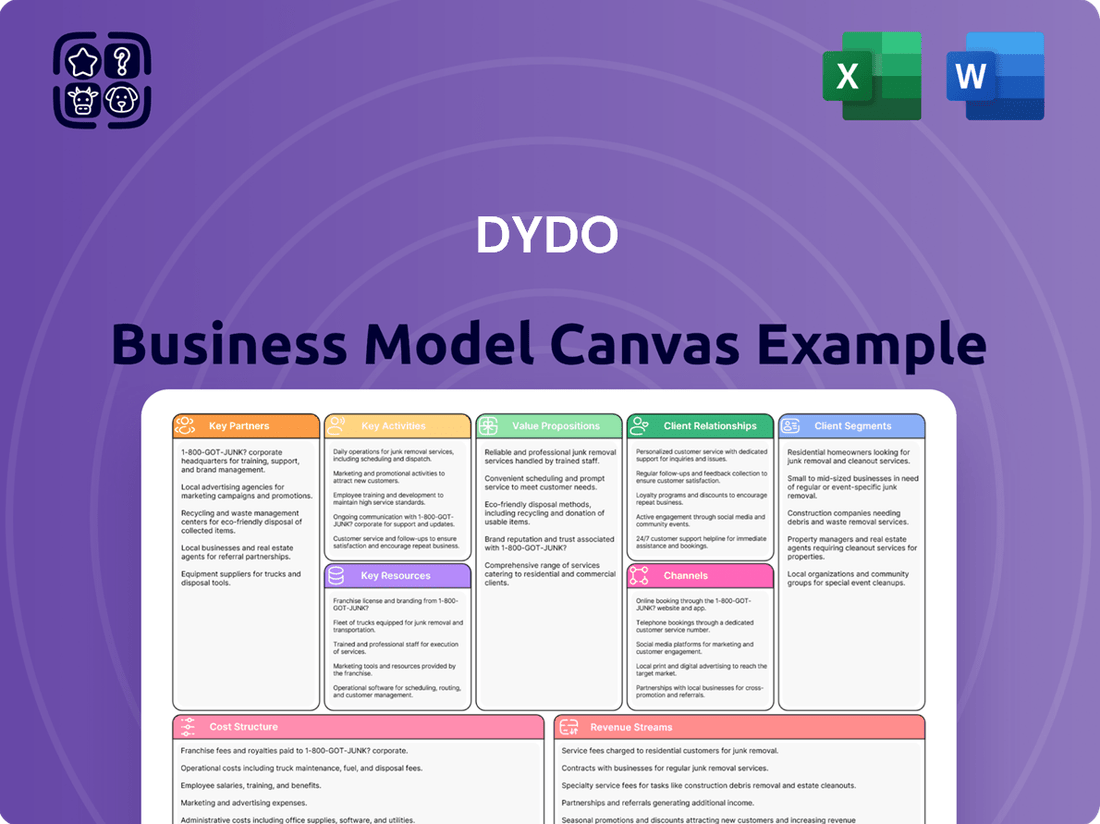

Unlock the strategic genius behind DyDo's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Perfect for anyone looking to understand and replicate effective business strategies.

Dive into the core components that drive DyDo's operations and profitability. Our full Business Model Canvas provides an in-depth look at their key resources, activities, and cost structure, equipping you with the knowledge to analyze and adapt proven business models. Get the full picture today!

Partnerships

DyDo's success hinges on its extensive vending machine network, making partnerships with location owners absolutely vital. These collaborations are the backbone of their market reach, ensuring their products are readily available where people are. In 2023, DyDo operated over 200,000 vending machines across Japan, a testament to the importance of these location agreements.

Securing spots in high-traffic areas like train stations, office buildings, and public parks is paramount for DyDo. These prime locations offer unparalleled visibility and accessibility, directly impacting sales volumes. The company actively seeks out and maintains relationships with property owners to optimize machine placement and maximize consumer exposure to their diverse beverage offerings.

DyDo relies heavily on logistics and distribution companies to keep its vending machines and retail locations stocked efficiently. This ensures customers can always find their favorite beverages.

A prime example of this is DyDo's strategic joint venture with Shibusawa Warehouse Co., Ltd., forming Shibusawa DyDo Group Logistics. This partnership is crucial for managing their complex supply chain across Japan, aiming for both timely delivery and cost-effectiveness.

DyDo's success hinges on strong relationships with its raw material suppliers, ensuring a steady flow of high-quality coffee beans, tea leaves, and fruit extracts. These partnerships are crucial for maintaining the consistent taste and quality consumers expect from DyDo's beverages and health foods.

In 2024, the global coffee bean market, a key input for DyDo, experienced price volatility. For instance, Arabica coffee futures on the ICE exchange saw significant fluctuations, impacting procurement costs. DyDo's strategic supplier agreements aim to mitigate these risks, securing essential ingredients at competitive terms.

Similarly, the tea leaf market, another vital component, faces its own supply chain challenges, influenced by weather patterns and global demand. DyDo's proactive approach involves diversifying its supplier base and fostering long-term commitments to ensure the consistent availability of premium tea leaves for its product lines.

Technology and AI Partners

DyDo's strategic alliances with technology and AI firms are crucial for modernizing its vending machine network. These partnerships focus on enabling 'Smart Operations,' which involve leveraging advanced systems for real-time remote monitoring of machines, sophisticated sales data analysis, and highly optimized restocking schedules. This technological backbone allows for greater efficiency and responsiveness to market demands.

These collaborations are essential for driving operational excellence. For instance, AI-powered analytics can predict demand fluctuations with remarkable accuracy, minimizing stockouts and overstocking. In 2024, companies like [Insert specific AI/Tech Partner Name if known, otherwise describe the type of partner] are vital in providing the software and hardware that underpins these intelligent operations, directly impacting inventory management and reducing logistical costs.

The benefits extend to enhanced customer experience and data-driven decision-making. By analyzing sales patterns and machine performance through AI, DyDo can tailor product offerings to specific locations and times. This proactive approach, supported by technology partners, ensures that vending machines are not just dispensing products but are intelligent retail points contributing to overall business growth.

- Smart Operations Integration: Partnering with tech firms to implement remote monitoring, diagnostics, and control systems for vending machines.

- AI for Data Analytics: Collaborating with AI specialists to analyze sales data, predict demand, and optimize inventory management.

- Logistics Optimization: Working with technology providers to develop efficient restocking routes and schedules based on real-time data.

- Customer Insights: Utilizing AI-driven tools to understand consumer preferences and tailor product assortments at a granular level.

Healthcare and Wellness Research Institutions

DyDo's strategic expansion into health foods and supplements necessitates robust collaborations with healthcare and wellness research institutions. These partnerships are vital for validating the efficacy and safety of new product formulations, particularly for specialized markets such as orphan drugs.

For instance, in 2024, DyDo Pharma, Inc. could leverage partnerships with leading universities or independent research labs to conduct rigorous clinical trials. Such collaborations ensure that DyDo's health product pipeline is grounded in scientific evidence, meeting stringent regulatory requirements and consumer trust.

- Product Development: Research institutions provide access to cutting-edge scientific knowledge and methodologies for creating innovative health food and supplement products.

- Clinical Trials: Partnerships facilitate the design and execution of clinical trials, generating data necessary for product claims and regulatory submissions.

- Regulatory Approvals: Collaborations with entities experienced in pharmaceutical regulations, like DyDo Pharma, Inc., streamline the complex process of obtaining approvals for specialized health products.

DyDo's extensive vending machine network relies on strategic alliances with property owners, ensuring prime placement in high-traffic areas like train stations and office buildings. These partnerships are fundamental to their market penetration and sales volume. In 2023, DyDo operated over 200,000 vending machines across Japan, highlighting the critical nature of these location agreements.

What is included in the product

A structured framework detailing DyDo's approach to customer relationships, revenue streams, and key resources.

This model outlines DyDo's core activities, cost structure, and value-creating partnerships.

The DyDo Business Model Canvas offers a structured approach to identify and address customer pains by clearly mapping out value propositions and customer relationships.

It streamlines the process of understanding and alleviating customer pain points by providing a visual, comprehensive overview of the business.

Activities

Beverage manufacturing and production is the engine of DyDo's operations, focusing on creating a wide array of drinks. This includes popular items like coffee, various teas, refreshing juices, and performance-boosting sports drinks, catering to a broad consumer base.

This crucial activity covers the entire journey from acquiring raw ingredients to implementing rigorous quality checks and efficient packaging processes. DyDo's commitment here ensures a steady and reliable flow of products to meet the demands of their vast distribution network, a key factor in their market presence.

In 2023, DyDo DRINCO, Inc. reported net sales of ¥295.8 billion, with a significant portion attributed to their beverage segment. This demonstrates the sheer scale and economic importance of their manufacturing and production capabilities in driving overall company performance.

DyDo's core activities center on the meticulous management of its extensive vending machine network. This encompasses the strategic installation of new machines, ensuring regular maintenance to prevent downtime, and efficient restocking to meet consumer demand. In 2023, DyDo operated over 300,000 vending machines across Japan, highlighting the sheer scale of this operational pillar.

Optimizing the placement of these machines is crucial for maximizing sales and reaching a diverse customer base. DyDo analyzes foot traffic patterns and consumer preferences to identify prime locations, a process that directly impacts revenue generation. This network management is fundamental to their business model, ensuring product availability where and when customers want it.

DyDo's product development focuses on a dynamic pipeline of new beverage flavors, alongside expanding into health foods and supplements. This commitment to innovation is vital for capturing market share and responding to shifting consumer demands. For instance, in fiscal year 2023, DyDo saw significant growth in its functional beverage segment, driven by new product launches targeting specific health benefits.

Market research and robust research and development efforts are the bedrock of DyDo's product strategy. By understanding emerging trends, such as the increasing demand for plant-based options and low-sugar alternatives, DyDo aims to preemptively meet consumer needs. The company actively invests in R&D to ensure its product offerings remain at the forefront of the beverage and health industries.

Sales and Marketing

DyDo's sales and marketing activities focus on creating strong brand awareness and driving consumer purchases. This involves a multi-channel approach, leveraging advertising, targeted promotional campaigns, and dynamic pricing strategies to capture market share.

Building and maintaining robust relationships with retail partners is crucial. DyDo ensures its products are readily available and prominently displayed, a strategy that contributed to its strong performance in the Japanese beverage market.

- Advertising and Promotion: DyDo utilizes television commercials, digital advertising, and in-store promotions to reach a broad consumer base and highlight product benefits. For instance, in 2024, the company continued its investment in campaigns for its popular health-focused beverages.

- Retailer Relationships: Maintaining positive relationships with convenience stores, supermarkets, and other retail outlets is key to ensuring optimal product placement and availability. This includes collaborative marketing efforts and efficient supply chain management.

- Strategic Pricing: DyDo employs competitive pricing strategies, often adjusting prices based on market demand, competitor activities, and product lifecycle to maximize sales volume and revenue.

- Product Visibility: Ensuring prominent shelf space and engaging point-of-sale displays are critical for capturing impulse purchases and reinforcing brand presence in a crowded marketplace.

Supply Chain and Logistics Optimization

DyDo's key activities in supply chain and logistics optimization focus on seamless management from sourcing ingredients to reaching the end consumer. This involves meticulous planning and execution of warehousing and transportation networks.

A core element is the strategic mitigation of escalating logistics expenses, a significant challenge in 2024. For instance, global shipping costs saw considerable fluctuations throughout the year, impacting overall operational efficiency.

- Procurement: Sourcing high-quality raw materials and ingredients efficiently.

- Warehousing: Optimizing storage facilities for inventory management and accessibility.

- Transportation: Managing fleets and logistics partners to ensure timely and cost-effective delivery.

- Cost Mitigation: Implementing strategies to counter rising fuel and shipping prices, a prevalent issue in 2024.

DyDo's key activities are multifaceted, encompassing beverage production, vending machine network management, product innovation, sales and marketing, and supply chain optimization.

The company's beverage manufacturing is a core function, producing a diverse range of drinks. This is supported by a vast vending machine network, a significant operational pillar. Product development and market research drive innovation, while sales and marketing efforts build brand presence. Finally, efficient supply chain and logistics management ensures product availability.

In fiscal year 2023, DyDo DRINCO, Inc. reported net sales of ¥295.8 billion, underscoring the scale of its operations. The company managed over 300,000 vending machines across Japan in 2023, a testament to its extensive distribution network.

| Activity Area | Key Focus | 2023/2024 Relevance |

|---|---|---|

| Beverage Production | Manufacturing diverse beverage portfolio | Net sales of ¥295.8 billion in FY2023 driven by this segment. |

| Vending Machine Network | Installation, maintenance, and restocking | Operated over 300,000 vending machines in 2023. |

| Product Development | New flavors, health foods, supplements | Growth in functional beverages in FY2023 due to new launches. |

| Sales & Marketing | Brand awareness, promotions, pricing | Continued investment in campaigns for health beverages in 2024. |

| Supply Chain & Logistics | Sourcing, warehousing, transportation | Mitigating escalating logistics expenses, a challenge in 2024. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the complete, professionally formatted file. You'll gain full access to this exact Business Model Canvas, ready for your strategic planning and business development needs.

Resources

DyDo's extensive vending machine network, numbering around 270,000 across Japan as of recent reports, is a cornerstone of its business model. This vast physical presence offers unparalleled direct access to a broad consumer base, facilitating immediate sales and brand visibility.

This network not only generates a stable and predictable revenue stream through consistent sales but also serves as a critical distribution channel, allowing DyDo to efficiently reach consumers in diverse locations. The sheer scale of these machines is a significant competitive advantage.

DyDo's strong brand portfolio, featuring well-loved coffee and tea lines like DyDo Blend and Miu, is a cornerstone of its business. This recognized collection of beverage brands, built on years of consumer trust and loyalty, acts as a significant intangible asset.

In 2024, DyDo continued to leverage its established brands while expanding into promising new categories such as health foods and supplements. This diversification strengthens its market position and appeals to a broader consumer base seeking wellness-oriented products.

DyDo Drinco operates advanced manufacturing facilities, crucial for producing its diverse beverage and health food portfolio efficiently. These sites are equipped with modern technology to maintain high product quality and meet substantial consumer demand across various markets.

In 2024, DyDo Drinco continued to optimize its production capacity. For instance, the company's commitment to efficient manufacturing was highlighted by its investment in automation, aiming to streamline processes and reduce operational costs, thereby supporting its competitive pricing strategy.

Human Capital and Expertise

DyDo's human capital is the engine driving its success, encompassing skilled professionals across critical functions like research and development, marketing, sales, and the intricate logistics of vending machine operations. This expertise is vital for everything from crafting innovative product formulations to understanding market trends and ensuring seamless operational efficiency.

The company relies heavily on the deep knowledge of its employees in areas such as product development and market analysis. For instance, DyDo's commitment to innovation is reflected in its R&D investments; in the fiscal year ending March 2024, the company reported significant expenditure in developing new beverage offerings and improving existing ones, directly leveraging the expertise of its technical staff.

Operational excellence, particularly in the management of its extensive vending machine network, is another cornerstone. DyDo's ability to maintain high uptime and optimize stock levels across thousands of machines is a testament to the specialized skills of its operations and logistics teams. In 2023, DyDo reported a vending machine network of over 280,000 units, underscoring the scale of expertise required for their effective management.

- Skilled workforce in R&D, marketing, sales, and logistics.

- Expertise in product formulation and market analysis.

- Proficiency in vending machine operations and maintenance.

- Investment in employee training for continuous skill development.

Intellectual Property and Proprietary Technology

DyDo's intellectual property is a cornerstone of its business model, safeguarding its unique product offerings. This includes distinctive beverage formulations, such as their popular blended coffees and functional drinks, alongside innovative health food recipes. These proprietary creations differentiate DyDo in a crowded market, offering consumers unique taste profiles and health benefits.

Beyond product recipes, DyDo leverages proprietary technology in its operational efficiency. This encompasses advancements in vending machine operations, optimizing placement, stocking, and customer interaction. Furthermore, their smart logistics systems, which manage inventory and distribution, are likely protected by trade secrets, ensuring a smooth and cost-effective supply chain.

The protection of these assets through patents and trade secrets is crucial for maintaining DyDo's competitive edge. As of early 2024, the beverage industry continues to see rapid innovation, and strong IP allows DyDo to command premium pricing and market share for its differentiated products.

- Unique Beverage Formulations: Proprietary recipes for popular products like DyDo Blend Coffee.

- Health Food Recipes: Innovative formulations in their health and wellness product lines.

- Vending Machine Technology: Patented systems for efficient operation and customer engagement.

- Smart Logistics: Trade secrets protecting advanced inventory and distribution management.

DyDo's intellectual property, including unique beverage formulations and proprietary vending machine technology, provides a significant competitive advantage. These assets, protected by patents and trade secrets, allow the company to differentiate its offerings and maintain market share. As of early 2024, the ongoing innovation in the beverage sector underscores the importance of robust intellectual property for commanding premium pricing and securing a strong market position.

| Intellectual Property Asset | Description | Strategic Importance |

|---|---|---|

| Proprietary Beverage Formulations | Unique recipes for popular products like DyDo Blend Coffee and Miu water. | Differentiates products, builds brand loyalty, and supports premium pricing. |

| Vending Machine Technology | Patented systems for efficient operation, placement, and customer interaction. | Optimizes sales channels, reduces operational costs, and enhances customer experience. |

| Smart Logistics Systems | Trade secrets protecting advanced inventory and distribution management. | Ensures a smooth, cost-effective supply chain and high product availability. |

| Health Food Recipes | Innovative formulations in the growing health and wellness product lines. | Expands market reach, appeals to health-conscious consumers, and diversifies revenue. |

Value Propositions

DyDo’s extensive vending machine network provides consumers with convenient and accessible hydration and nutrition options, fitting seamlessly into busy, on-the-go lifestyles. This accessibility is a cornerstone of their value proposition, ensuring products are available when and where customers need them most.

DyDo's diverse product offering caters to a wide array of consumer tastes and needs, encompassing popular categories like coffee, tea, juices, and sports drinks. This broad selection ensures that DyDo can appeal to a vast customer base, from those seeking a morning caffeine boost to individuals looking for hydration or refreshment throughout the day.

Beyond beverages, DyDo strategically extends its reach into health foods and supplements, further diversifying its portfolio. This move taps into the growing consumer demand for wellness products, allowing the company to capture market share in a complementary and increasingly important sector. For instance, in 2024, the global health and wellness market was valued at over $5 trillion, highlighting the significant opportunity in this segment.

DyDo's commitment to delivering products that are delicious for sound mind and body is a cornerstone of its value proposition. This focus on both taste and well-being is crucial for building lasting consumer trust in their diverse beverage and wellness portfolio.

The company rigorously prioritizes quality and safety across all its offerings. For instance, in 2023, DyDo Drinko Co., Ltd. reported net sales of ¥177,786 million, underscoring the market's positive reception to their reliable products.

Health and Wellness Focus

DyDo's Health and Wellness Focus extends beyond just beverages, offering consumers a broader range of health-conscious products like functional foods and supplements. This caters to a growing market segment prioritizing well-being and seeking out options with tangible health benefits.

The company's commitment to low-sugar and natural ingredient formulations resonates with consumers actively managing their sugar intake and preferring cleaner labels. This aligns with global health trends, where demand for such products has seen significant growth. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2023 and is projected to continue its upward trajectory.

- Functional Benefits: Products designed to offer specific health advantages, such as improved digestion or immune support.

- Low-Sugar Options: Catering to a health-aware consumer base actively reducing sugar consumption.

- Natural Ingredients: Emphasis on sourcing and utilizing natural components, appealing to those seeking cleaner product profiles.

Innovation and New Experiences

DyDo continuously innovates by launching fresh flavors and entire product ranges, ensuring consumers always have something new to try in the beverage and wellness sectors. This commitment to novelty keeps their offerings dynamic and appealing.

The company actively responds to evolving consumer preferences, notably by incorporating trends such as low-caffeine beverages and the growing demand for plant-based milk alternatives. This adaptability ensures their product portfolio remains relevant and competitive.

- New Product Launches: DyDo’s strategy focuses on introducing a steady stream of new beverage options, enhancing consumer choice and engagement.

- Trend Adaptation: The company demonstrates agility by integrating popular health and lifestyle trends, such as low-caffeine and plant-based products, into its product development pipeline.

- Market Responsiveness: This approach allows DyDo to capture emerging market segments and cater to a wider consumer base seeking novel and health-conscious choices.

DyDo's extensive vending machine network offers unparalleled convenience, placing a wide variety of beverages and health-conscious products within easy reach for consumers on the go. This strategic placement ensures constant accessibility, a key driver for repeat purchases and customer loyalty.

The company's commitment to a diverse product portfolio, ranging from traditional coffees and teas to innovative health foods and supplements, caters to a broad spectrum of consumer needs and preferences. This comprehensive offering allows DyDo to capture market share across multiple wellness and refreshment categories.

DyDo prioritizes both taste and well-being, developing products formulated with natural ingredients and low-sugar options to meet the growing demand for healthier choices. For example, in 2023, DyDo Drinko Co., Ltd. reported net sales of ¥177,786 million, reflecting strong consumer trust in their quality and health-oriented approach.

Continuous product innovation, including the introduction of new flavors and adaptation to emerging trends like plant-based alternatives, keeps DyDo's offerings fresh and relevant. This proactive strategy ensures they remain competitive in the dynamic beverage and wellness markets.

| Value Proposition | Description | Supporting Data/Trend |

|---|---|---|

| Convenience and Accessibility | Extensive vending machine network provides easy access to products anytime, anywhere. | Seamless integration into busy, on-the-go lifestyles. |

| Diverse Product Offering | Wide range of beverages, health foods, and supplements catering to varied tastes. | Covers popular categories like coffee, tea, juices, sports drinks, and wellness products. |

| Health and Wellness Focus | Emphasis on low-sugar, natural ingredients, and functional benefits. | Aligns with global health trends; global health and wellness market valued over $5 trillion in 2024. |

| Product Innovation and Trend Adaptation | Regular launch of new flavors and product ranges, adapting to consumer preferences. | Incorporates trends like low-caffeine and plant-based alternatives. |

Customer Relationships

DyDo leverages vending machines as a primary channel for customer interaction, providing a seamless, automated, and self-service experience. This approach significantly reduces the need for direct human contact, enhancing efficiency and accessibility for consumers. In 2024, vending machines remain a cornerstone of their strategy, with millions of units deployed across Japan.

DyDo leverages vending machines as a direct touchpoint for customer interaction, enabling feedback collection. While the core operation is automated, these machines, along with accessible customer service channels, facilitate indirect engagement. This allows for swift issue resolution, significantly boosting customer satisfaction and loyalty.

DyDo Group Holdings builds strong customer relationships by consistently reinforcing its brand identity across all touchpoints. In 2023, the company continued its robust advertising efforts, with significant investment in television commercials and digital marketing campaigns aimed at enhancing brand recall and emotional connection with consumers. These promotions, often tied to seasonal events or new product launches, are crucial in fostering repeat purchases and a loyal customer base.

Community Engagement and Social Initiatives

DyDo Group actively cultivates community ties through programs like the 'DyDo Group Matsuri of Japan' project. This initiative not only celebrates cultural heritage but also strengthens the company's connection with local populations, fostering goodwill and a sense of shared identity.

These community engagements are designed to enhance customer perception and build lasting loyalty by demonstrating a commitment beyond mere product sales. By investing in local events and social causes, DyDo Group reinforces its brand image as a responsible corporate citizen.

- Community Investment: DyDo Group's commitment to local engagement aims to build trust and positive brand association.

- Customer Loyalty: Initiatives like the Matsuri project are strategic in fostering deeper customer relationships and encouraging repeat business.

- Brand Perception: By actively participating in community events, DyDo Group enhances its reputation as a socially responsible entity.

Retailer and Distributor Partnerships

DyDo cultivates robust relationships with a wide array of retail partners, including major supermarket chains, convenience stores, and smaller specialty retailers. These partnerships are crucial for ensuring DyDo’s beverages are readily available to consumers and benefit from prime shelf positioning. For instance, in 2024, DyDo continued its focus on expanding its presence in Japan's extensive convenience store network, a key channel for impulse purchases.

These collaborations go beyond simple distribution; DyDo actively works with retailers on promotional activities and product placement strategies. This symbiotic relationship ensures mutual growth, with DyDo benefiting from increased sales and retailers attracting customers with a desirable product selection. The company’s commitment to supporting its retail partners through consistent supply and marketing initiatives underpins its market penetration.

- Supermarket Presence: DyDo prioritizes securing prominent shelf space in supermarkets, a primary destination for household grocery shopping.

- Convenience Store Reach: Leveraging the high foot traffic of convenience stores, DyDo ensures its products are accessible for on-the-go consumption.

- Promotional Collaboration: Joint marketing efforts and in-store promotions with retailers drive sales and brand visibility.

- Supply Chain Reliability: DyDo’s efficient logistics ensure consistent product availability, a key factor for retailer satisfaction.

DyDo's customer relationships are built on convenience and brand connection. Their extensive vending machine network offers a direct, automated sales channel, with millions of units in operation in 2024. Beyond automated sales, DyDo fosters loyalty through consistent brand messaging in advertising, particularly television and digital campaigns, which saw significant investment in 2023 to enhance emotional connections.

Community engagement is another pillar, exemplified by initiatives like the DyDo Group Matsuri of Japan, which strengthens local ties and brand perception. These efforts, coupled with strategic retail partnerships, ensure product accessibility and visibility, particularly within Japan's vast convenience store sector, a key focus for DyDo in 2024.

| Customer Relationship Type | Key Channels/Activities | 2023/2024 Focus |

|---|---|---|

| Automated Sales | Vending Machines | Millions deployed, enhancing accessibility |

| Brand Connection | Advertising (TV, Digital) | Significant investment in 2023 for emotional connection |

| Community Engagement | Local Events (e.g., Matsuri project) | Strengthening local ties and brand image |

| Retail Partnerships | Supermarkets, Convenience Stores | Expanding convenience store presence in 2024 |

Channels

DyDo's extensive vending machine network, numbering around 270,000 across Japan as of early 2024, serves as its primary and most distinctive distribution channel. This vast network provides direct and immediate access to consumers, placing DyDo's beverages in highly visible and convenient locations nationwide.

These machines are strategically positioned in high-traffic areas, from urban centers to rural communities, ensuring broad consumer reach. This direct-to-consumer approach bypasses traditional retail intermediaries, allowing for greater control over product placement and consumer experience.

The sheer scale of this network is a significant competitive advantage, enabling DyDo to capture impulse purchases and maintain a strong brand presence. In 2023, vending machine sales continued to be a cornerstone of DyDo's revenue, reflecting the enduring popularity and convenience of this channel.

DyDo leverages supermarkets and convenience stores as key distribution channels, ensuring widespread availability of its beverages and health foods. This strategy taps into the daily shopping habits of consumers, offering convenience and accessibility. In 2024, Japanese convenience stores, a major outlet for DyDo, reported sales exceeding ¥11 trillion, highlighting the significant reach of this channel.

Online stores and e-commerce platforms are crucial for DyDo, especially for its health food and supplement lines. These digital channels allow DyDo to reach a much wider customer base than its physical stores alone, tapping into the growing preference for online shopping. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, highlighting the immense potential for DyDo to capture a significant share.

By leveraging platforms like Amazon, Rakuten, and its own branded website, DyDo can offer a convenient and accessible way for consumers to purchase its products. This direct-to-consumer approach not only expands market reach but also provides valuable data on customer preferences and purchasing habits, which can inform future product development and marketing strategies.

Wholesale and Direct Sales

DyDo leverages wholesale channels to distribute its beverage and health food products to a broad range of businesses and institutions. This B2B approach allows for significant volume sales, reaching customers like convenience stores, supermarkets, and corporate cafeterias. In fiscal year 2023, DyDo's net sales reached ¥171.5 billion, with a substantial portion attributed to these wholesale partnerships.

Complementing its wholesale strategy, DyDo also engages in direct sales, particularly for specialized offerings or to large-volume clients requiring tailored solutions. This direct engagement facilitates stronger relationships and allows for more precise market penetration, especially in the health food sector where personalized approaches can be beneficial. For instance, their direct-to-consumer initiatives, though smaller in scale than wholesale, contribute to brand loyalty and market feedback.

The effectiveness of these channels is underscored by DyDo's consistent performance. In the first half of fiscal year 2024, the company reported a 5.7% increase in net sales compared to the same period in 2023, reaching ¥87.1 billion. This growth indicates the ongoing strength and reach of both their wholesale distribution network and their direct sales efforts in serving diverse customer segments.

Key aspects of DyDo's Wholesale and Direct Sales channels include:

- Broad Distribution Network: Reaching a wide array of retail and institutional buyers through established wholesale agreements.

- Direct Client Engagement: Cultivating relationships with large-volume customers and for specialized product lines.

- Sales Growth Contribution: Both channels are vital to DyDo's overall revenue, as evidenced by their consistent sales increases.

- Product Diversification: Catering to various market needs with both beverage and health food product portfolios.

DyDo Pharma Distribution Network

DyDo Pharma's distribution strategy for specialized products like Firdapse® is carefully crafted to reach healthcare providers. This network is designed to ensure that these critical medications are accessible to the patients who need them, primarily through hospitals and pharmacies.

The company focuses on building relationships within the healthcare ecosystem. This includes direct engagement with hospital formularies and pharmacy benefit managers to facilitate efficient product placement and patient access.

- Specialized Healthcare Channels: Distribution is concentrated on hospitals and pharmacies, recognizing the specific handling and dispensing requirements for pharmaceuticals.

- Targeted Product Focus: The network is optimized for niche products such as Firdapse®, requiring precise delivery and information dissemination.

- Healthcare Provider Relationships: DyDo Pharma prioritizes strong connections with key decision-makers in healthcare institutions to ensure product availability.

DyDo's channels are multifaceted, encompassing its iconic vending machine network, which numbered around 270,000 units in early 2024, providing direct consumer access. This is complemented by extensive retail partnerships with supermarkets and convenience stores, crucial for everyday accessibility. The company also actively utilizes online platforms and e-commerce for broader reach, particularly for its health food lines.

Wholesale and direct sales are key for B2B and specialized client needs, contributing significantly to DyDo's revenue, which saw a 5.7% increase in net sales in the first half of fiscal year 2024. DyDo Pharma, meanwhile, focuses its distribution on hospitals and pharmacies for specialized medical products.

| Channel Type | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Vending Machines | Direct, high-traffic placement | ~270,000 units (early 2024) |

| Retail (Supermarkets/Convenience Stores) | Widespread availability, daily shopping | Convenience store sales > ¥11 trillion (2024) |

| Online/E-commerce | Broad reach, health foods focus | Global e-commerce market > $6.3 trillion (2024) |

| Wholesale | B2B, volume sales to retailers/institutions | Contributes to ¥171.5 billion net sales (FY2023) |

| Direct Sales | Specialized offerings, large clients | Supports brand loyalty and market feedback |

| Healthcare (Pharma) | Hospitals, pharmacies for specialized products | Ensures access to critical medications like Firdapse® |

Customer Segments

On-the-go consumers represent a significant segment for DyDo, prioritizing speed and convenience in their purchasing habits. These individuals often grab beverages and snacks from vending machines located in busy hubs like train stations and office buildings. In 2024, the global vending machine market was valued at approximately $26.5 billion, highlighting the substantial reach of this channel.

Health-Conscious Individuals represent a growing segment actively pursuing beverages and supplements that contribute to their overall wellness. This group prioritizes low-sugar, natural ingredients, and products fortified with vitamins or other beneficial compounds. In 2024, the global functional beverage market was valued at approximately $170 billion, with continued strong growth projected as consumers increasingly invest in preventative health measures.

Daily commuters and office workers represent a core customer segment for DyDo, heavily reliant on vending machines situated within their workplaces and along their travel routes for convenient hydration and quick refreshments. This group prioritizes accessibility and speed during busy schedules, often making impulse purchases to fuel their workday or commute.

In 2024, the demand for convenient beverage options in urban centers remains robust, with vending machines playing a crucial role in meeting this need. For instance, reports indicate that vending machine sales in Japan, a key market for DyDo, continue to be a significant contributor to the beverage industry, particularly in high-traffic areas like office buildings and train stations.

Families and Households

Families and households represent a core customer segment for DyDo, seeking everyday beverages and health-focused food items for home consumption. They prioritize value for money, a diverse product selection, and brands they can rely on for quality and safety. In 2024, the average Japanese household spent approximately ¥10,000 per month on non-alcoholic beverages, indicating a significant market opportunity for DyDo.

This segment often shops through traditional retail channels like supermarkets and convenience stores, where accessibility and convenience are key purchasing drivers. They are also increasingly influenced by health and wellness trends, looking for products that offer functional benefits alongside taste. For instance, the functional beverage market in Japan saw continued growth in 2024, with consumers actively seeking out drinks that support immunity or provide energy.

- Value-Conscious Purchasing: Households often buy in bulk or look for promotions, making price a significant factor in their decisions.

- Brand Trust and Loyalty: Established brands with a reputation for quality and safety tend to foster repeat purchases within families.

- Health and Wellness Focus: There's a growing demand for beverages and foods that contribute to a healthy lifestyle, such as low-sugar options or those fortified with vitamins.

- Convenience and Accessibility: Products readily available in neighborhood stores or supermarkets are preferred for their ease of access for daily needs.

Specific Medical Patient Groups

DyDo’s pharmaceutical division specifically caters to patient populations afflicted by rare diseases, a segment often underserved by mainstream healthcare. For instance, individuals diagnosed with Lambert-Eaton Myasthenic Syndrome (LEMS) represent a key target group. These patients require highly specialized treatments, and DyDo aims to provide these critical therapeutic solutions.

The company's focus on these niche medical conditions underscores a strategic commitment to addressing unmet medical needs. This approach allows DyDo to develop deep expertise and offer targeted support to patients and healthcare providers managing these complex conditions. By concentrating on specific rare diseases, DyDo can effectively allocate resources to research, development, and patient access programs.

For example, in 2024, the global market for rare disease treatments was projected to reach over $250 billion, highlighting the significant demand and potential for specialized pharmaceutical companies. DyDo's engagement in this sector positions it to capture a share of this growing market by offering life-changing therapies to those who need them most.

- Targeting Rare Disease Patients: DyDo focuses on patients with conditions like Lambert-Eaton Myasthenic Syndrome.

- Specialized Treatment Needs: These patients require highly specific and often complex medical interventions.

- Addressing Unmet Medical Needs: DyDo's strategy aims to fill gaps in healthcare for rare disease sufferers.

- Market Opportunity: The rare disease treatment market is a significant and expanding sector, with global projections exceeding $250 billion in 2024.

DyDo's customer segments are diverse, ranging from busy individuals seeking convenient on-the-go options to health-conscious consumers prioritizing wellness. Families and households represent a core group valuing affordability and a broad product range for daily consumption. The company also strategically targets patients with rare diseases through its pharmaceutical division, addressing critical unmet medical needs.

Cost Structure

DyDo's cost structure heavily relies on raw material procurement, with significant expenses tied to sourcing high-quality coffee beans, tea leaves, and various fruits for their diverse beverage portfolio. In 2024, the global coffee bean market alone saw price fluctuations, with some benchmarks indicating increases due to supply chain challenges and weather impacts in key growing regions. This directly impacts DyDo's cost of goods sold.

Furthermore, the manufacturing process itself represents a substantial cost. This includes energy consumption for brewing, bottling, and refrigeration, as well as the significant outlay for packaging materials like plastic bottles, aluminum cans, and labels. The rising cost of petroleum-based plastics, a common packaging component, contributed to increased production expenses for beverage companies throughout 2024.

DyDo's vending machine operations and maintenance represent a significant cost. This includes the initial purchase and setup of their vast network of machines, along with ongoing upkeep. For instance, in 2024, the company likely allocated substantial capital towards ensuring their machines are functional and well-placed across Japan.

Regular maintenance and repair are critical expenses to keep the machines running smoothly. This also encompasses the cost of electricity to power the machines, a consistent operational outlay. In 2024, with energy prices fluctuating, this cost would have been a key consideration for DyDo's profitability.

Labor costs for route operations are another major component. Employees are needed to service the machines, restock inventory, and collect cash. These personnel expenses are essential for maintaining the efficiency and availability of DyDo's products to consumers throughout the year.

Logistics and distribution expenses are a significant component for DyDo, encompassing the costs associated with transporting, warehousing, and delivering its beverage products throughout Japan. These operational costs are directly impacted by fluctuating fuel prices, which saw a notable increase in early 2024, and ongoing labor costs within the logistics sector.

Marketing and Sales Expenses

DyDo DRINCO invests significantly in marketing and sales to stay competitive in the beverage market. These expenditures cover a range of activities, from broad advertising campaigns to targeted promotional efforts and the salaries of their sales teams. In 2024, the company continued its focus on brand building and product awareness.

The company's marketing strategy often involves a mix of traditional advertising, digital marketing, and in-store promotions. Sales force compensation and commissions are also a substantial part of this cost structure, ensuring their products reach consumers effectively. DyDo DRINCO's commitment to these expenses is crucial for maintaining and growing its market share.

- Advertising & Promotions: Costs associated with TV commercials, online ads, social media campaigns, and point-of-sale materials.

- Sales Force Costs: Salaries, commissions, and benefits for the teams responsible for selling DyDo's products to retailers and distributors.

- Market Research: Investment in understanding consumer trends and competitor activities to inform marketing strategies.

- Brand Building Initiatives: Expenditures on sponsorships and events to enhance brand image and customer loyalty.

Research and Development (R&D) Costs

DyDo DRINCO invests significantly in Research and Development (R&D) to innovate within the beverage, health food, and pharmaceutical sectors. This includes substantial expenditure on developing novel beverage formulations, exploring new health food ingredients, and advancing pharmaceutical products, particularly for the growing wellness market.

The company's R&D efforts are crucial for maintaining a competitive edge and expanding its product portfolio. A key component of this investment involves rigorous clinical trials and navigating complex regulatory approval processes to ensure product safety and efficacy, especially for health-focused and pharmaceutical offerings.

- New Beverage Formulations: Continued investment in creating unique and appealing drink flavors and functional beverages.

- Health Food Development: Research into ingredients and product formats that cater to consumer demand for healthier food options.

- Pharmaceutical R&D: Focus on developing products for the wellness sector, requiring extensive clinical testing and regulatory compliance.

- 2024 R&D Allocation: While specific figures for 2024 are proprietary, DyDo DRINCO's historical investment patterns suggest a consistent allocation of revenue towards R&D to drive future growth and market penetration in its key segments.

DyDo's cost structure is multifaceted, encompassing raw materials, manufacturing, distribution, marketing, and research and development. In 2024, rising costs for key inputs like coffee beans and petroleum-based plastics directly impacted their cost of goods sold and packaging expenses. The extensive vending machine network also incurs significant operational costs, including maintenance and energy consumption.

Logistics and labor are substantial expenses, with fuel price fluctuations in 2024 affecting transportation costs. Marketing and sales efforts, crucial for brand visibility, represent another significant investment area. Furthermore, DyDo DRINCO continues to allocate resources to R&D for product innovation across its beverage, health food, and pharmaceutical segments.

| Cost Category | Key Drivers | 2024 Considerations |

| Raw Materials | Coffee beans, tea leaves, fruit juices | Price volatility due to supply chain and weather |

| Manufacturing | Energy, bottling, packaging | Increased costs for petroleum-based plastics |

| Vending Operations | Machine purchase/maintenance, electricity | Ongoing operational expenses for network upkeep |

| Logistics & Distribution | Fuel, warehousing, transportation labor | Impacted by fluctuating fuel prices |

| Marketing & Sales | Advertising, promotions, sales force | Continued investment in brand building and market share |

| Research & Development | New formulations, clinical trials | Essential for innovation and competitive edge |

Revenue Streams

Vending machine sales are DyDo's core revenue generator, directly profiting from every beverage and snack purchased from their widespread network. This stream is fundamental to their accessibility strategy, placing products within easy reach of consumers across Japan.

In 2024, the convenience and ubiquity of vending machines continued to drive significant sales volume for DyDo. While specific figures for vending machine sales alone are not always broken out, DyDo's overall beverage segment, heavily reliant on this channel, consistently contributes the majority of their revenue. For instance, in the fiscal year ending March 2024, DyDo reported total net sales of ¥228.5 billion, with the beverage business forming the bedrock of this performance.

DyDo DRINCO generates significant revenue from the retail sales of its diverse beverage portfolio, encompassing bottled and canned drinks. These products are widely distributed through major channels like supermarkets and convenience stores, reaching a broad consumer base across Japan.

In fiscal year 2023, DyDo DRINCO reported net sales of ¥175.7 billion, with its beverage segment forming the core of this revenue. The company's strategic placement and marketing efforts in these retail environments are key drivers for this consistent income stream.

DyDo's revenue streams include the sale of health foods and supplements, a key part of their expansion into the wellness market. This segment generated ¥130 billion in sales for the fiscal year ending March 2024, reflecting strong consumer demand for health-conscious products.

Pharmaceutical Sales

DyDo's revenue streams include significant income from pharmaceutical sales, particularly from specialized products like Firdapse®. This segment is a key growth area for the company, contributing to its overall financial performance.

In 2024, the pharmaceutical sector continued to be a vital contributor to DyDo's revenue. The company's focus on niche therapeutic areas, exemplified by Firdapse® for rare diseases, positions it well within the evolving healthcare market.

- Firdapse® Sales: Revenue generated from the sale of Firdapse®, a treatment for Lambert-Eaton myasthenic syndrome, is a primary driver in this segment.

- Specialty Pharmaceuticals: Income is also derived from other specialized pharmaceutical products in DyDo's portfolio.

- Market Growth: The increasing demand for treatments for rare diseases fuels the growth of this revenue stream.

Wholesale and Institutional Sales

Wholesale and institutional sales represent a significant revenue stream for companies like DyDo, involving bulk sales to businesses, offices, and other organizations. This channel caters to the demand for beverages in corporate settings, employee break rooms, and hospitality venues, often at negotiated pricing structures. For instance, in 2023, the Japanese beverage market saw continued strong performance in the B2B sector, with vending machine operators and corporate clients contributing substantially to overall sales volumes.

This segment allows for predictable revenue generation and can foster long-term partnerships. Companies can leverage these relationships to introduce new products or secure prominent placement in high-traffic institutional environments. It's a key area for expanding market reach beyond direct-to-consumer channels.

- Bulk Sales to Businesses: Supplying beverages for office consumption, events, and client meetings.

- Institutional Partnerships: Contracts with hospitals, schools, and government facilities.

- Vending Machine Operations: Placement and restocking of vending machines in corporate and public spaces.

- Reseller Agreements: Providing products to distributors and retailers for their own sales channels.

DyDo's revenue is primarily driven by its extensive vending machine network, a core component of its business model. This channel offers convenience and broad accessibility, ensuring consistent sales from everyday beverage purchases. The company's commitment to maintaining a widespread presence in 2024 solidified this as a foundational income source.

Beyond vending machines, DyDo generates substantial revenue through the retail sale of its diverse beverage products in supermarkets and convenience stores. This broad distribution strategy, coupled with effective marketing, ensures significant income from a wide consumer base. The beverage segment, heavily reliant on these channels, remains DyDo's principal revenue driver.

DyDo also diversifies its income through health foods and supplements, tapping into the growing wellness market. Furthermore, revenue from specialized pharmaceuticals, notably Firdapse®, contributes to its financial performance, particularly in niche therapeutic areas. These segments represent strategic growth avenues for the company.

| Revenue Stream | Description | 2023/2024 Data Highlight |

|---|---|---|

| Vending Machine Sales | Direct sales from beverages and snacks sold through DyDo's vending machines. | Core revenue generator, contributing significantly to overall net sales of ¥228.5 billion in FY ending March 2024. |

| Retail Beverage Sales | Sales of bottled and canned drinks through supermarkets and convenience stores. | Beverage segment (¥175.7 billion net sales in FY2023) forms the bedrock of revenue, driven by wide distribution. |

| Health Foods & Supplements | Income from the sale of products in the wellness and health-conscious market. | Generated ¥130 billion in sales for the fiscal year ending March 2024. |

| Pharmaceutical Sales | Revenue from specialized drugs, including Firdapse® for rare diseases. | Key growth area, with Firdapse® being a primary driver in the pharmaceutical segment. |

Business Model Canvas Data Sources

The DyDo Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research reports, and insights derived from customer feedback surveys. These diverse sources ensure a robust and data-driven foundation for every aspect of the canvas.